The digital revolution in India has touched upon all aspects of business and entrepreneurship, so much so that technology has become an integral part of how human beings conduct themselves and related activities.

Insurance services in the subcontinent have, over this time, integrated their policies with technology to create unique digital products. It has paved the way for a new branch of startups called InsurTech companies.

The technological integration has helped improve various processes, like insurance agency onboarding and selling, to such an extent that these companies have been able to curate insurance policies based on the behavioral patterns of their clients.

They have grown to become a significant part of the larger fintech industry, where InsurTech companies constitute 8.18% of the $22 billion worth of capital in the fintech industry. This article examines some of the top Insurtech startups in India.

What is an Insurtech Company?

Insurtech is a mix of two words – Insurance and Technology. It means using technology like data analytics and machine learning in the insurance industry. This helps in underwriting, claims processing, and managing group insurance.

In India, insurtech companies provide digital platforms and mobile apps to buy policies and raise health insurance claims. Everything can be done online with no paperwork.

These companies are changing the old way of insurance by using new technologies to solve problems and meet customer needs.

Insurtech startups are making insurance:

- Easy to access

- Clear and transparent

- Paperless

- Customer-friendly

- Fast and digital

This article looks at the top 10 insurtech companies in India in 2025 that are changing how insurance works.

Top InsurTech Companies In India

| S.No | Company | Products | Key Features |

|---|---|---|---|

| 1 | Digit Insurance | Health, Motor, Travel, Home Insurance | Paperless claims, smartphone-enabled self-inspection, wide coverage options |

| 2 | Acko | Car, Bike, Health, Mobile Protection | Instant policy issuance, low-cost premiums, digital-only platform |

| 3 | PolicyBazaar | Insurance Comparison & Aggregation | Compares multiple insurers, easy online policy purchase, large user base |

| 4 | SecureNow | Employee Benefits, Liability, Property Insurance | Focus on SMEs, customized corporate policies, digital risk management |

| 5 | Toffee Insurance | Bite-sized Health, Accident & Lifestyle Covers | Micro-premium plans, lifestyle-oriented insurance, quick online claims |

| 6 | Coverfox | Car, Health, Term Life Insurance Aggregator | Seamless policy comparison, digital claim assistance, quick policy issuance |

| 7 | OneAssist | Mobile, Wallet, Appliance Protection Plans | 24×7 assistance, device replacement, theft and damage coverage |

| 8 | InsuranceDekho | Motor, Health, Life, Term Insurance Marketplace | Agent-assisted selling, multiple insurer tie-ups, quick claim settlement |

| 9 | Turtlemint Insurance | Life, Health, Motor, Investment-linked Insurance | Advisor network, financial literacy tools, simplified policy recommendations |

| 10 | Symbo Insurance | Embedded Insurance for Businesses | API-based integration, custom coverage for partners, scalable solutions |

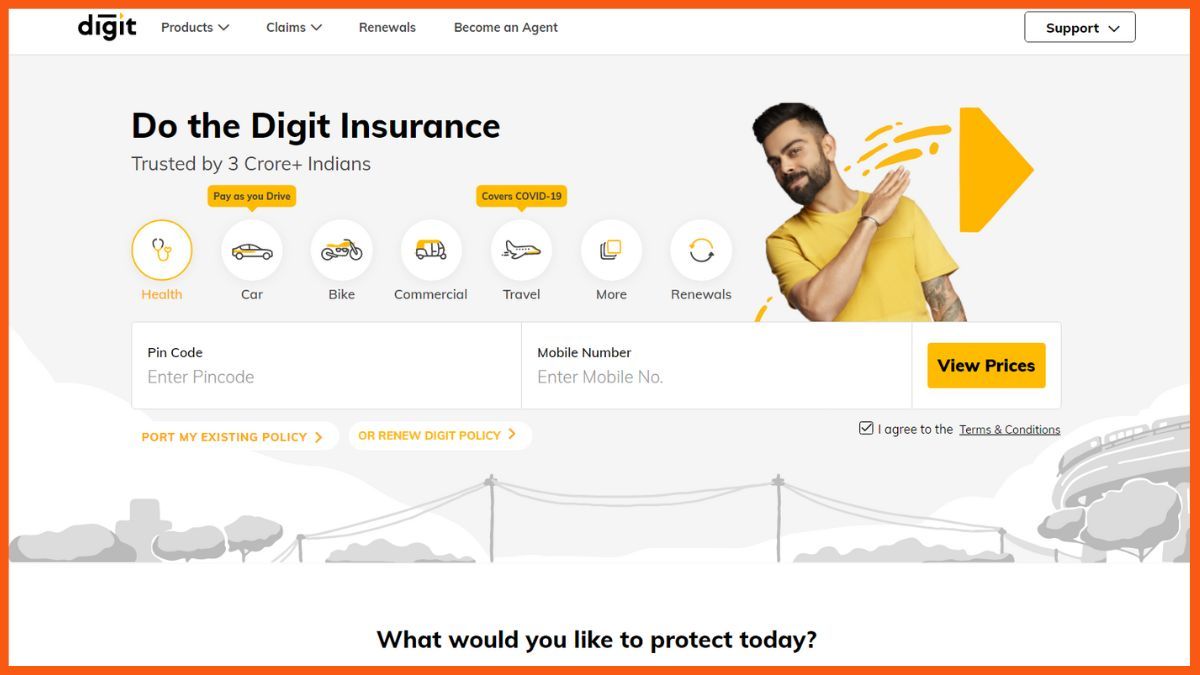

Digit Insurance

| Startup Name | Digit Insurance |

|---|---|

| Founders | Kamesh Goyal, Sriram Shankar, Philip Varghese, Vijay Kumar |

| Founded In | 2016 |

| Headquarters | Bengaluru |

| Website | www.godigit.com |

This Bangalore-based startup provides various products like car insurance, travel insurance, house insurance, commercial vehicle insurance, shop insurance, trip insurance, fire insurance, and other small-ticket insurance. Till 2022, Digit Insurance has received more than $585.6 million through various funding rounds.

Some of the famous investors in the firm are TVS Capital Funds, Sequoia Capital India, and Wellington Management. They aim to simplify the entire process of insurance with the aim of helping even a 15-year-old kid comprehend the procedures involved. They stand out from other similar companies through their client-friendly policies.

For example, their insurance covers flight delays of 75 minutes and more, unlike the standard travel insurance that covers delays of 6 hours and more. Similarly, their “Pay as you Drive” (PAYD) facility will ensure that those who drive less will have to pay less.

Through their simple procedures and fewer T&Cs, and excellent customer service, they have earned the trust of their valuable clients, which has been fuelling their growth since the beginning.

Acko

| Startup Name | Acko |

|---|---|

| Founders | Varun Dua |

| Founded In | 2016 |

| Headquarters | Mumbai |

| Website | www.acko.com |

They are the first digital general insurance in India. Launched in 2016, they have grown to cater to more than 50 million customers today. They have taken most of their operations online, reducing much of the offline paperwork.

They have partnered with reputed firms like Ola, redBus, Zomato, Amazon, and OYO, to name a few.

Their journey has to be credited to their attention to detail and focus on quality over quantity. Their unique micro-insurance product called “Ola Trip Insurance,” which insured the passengers using the app, had been awarded the Golden Peacock Innovative Product. Amping up with data and tech, they further aspire to improve every aspect of insurance technology.

PolicyBazaar

| Startup Name | PolicyBazaar |

|---|---|

| Founders | Yashish Dahiya, Alok Bansal, Avaneesh Nirjar |

| Founded In | 2008 |

| Headquarters | Gurgaon |

| Website | www.policybazaar.com |

Catering to more than 9 million customers since its inception in 2008, they have been one of the most popular insurtech companies in the subcontinent. With an aim to reimagine insurance, Policybazaar has brought transparency into it by simplifying the entire procedure and putting an end to rampant misselling and policy breaches.

So far, they have sold more than 19 million policies by winning the trust of the people making it one of the best insurtech solutions provider in India. They aspire to bring in better coverage of health and financial policies in households in India. Reputed investing organizations like SoftBank, Temasek, Tencent Alpha Wave, PremjiInvest, etc, have invested in Policy Bazaar, vouching for its trust and quality.

SecureNow

| Startup Name | SecureNow |

|---|---|

| Founders | Kapil Mehta, Abhishek Bondia |

| Founded In | 2011 |

| Headquarters | Gurgaon |

| Website | www.securenow.in |

Founded by Abhishek Bondia and Kapil Mehta in 2011, they provide insurance solutions to small and medium-sized businesses. Through end-to-end InsurTech systems and a CRM software platform called PAM, they streamline various procedures, including right from issuing insurance and claiming.

They also have a mobile app for insurance services. They cater to more than 30,000 commercial establishments and settle over 1000 claims on a yearly basis.

Toffee Insurance

| Startup Name | Toffee Insurance |

|---|---|

| Founders | Rohan Kumar, Nishant Jain |

| Founded In | 2017 |

| Headquarters | Gurgaon |

| Website | www.toffeeinsurance.com |

Realizing the importance of accessibility and availability of insurance, Toffee Insurance has ventured into the sector with the goal of curating insurance policies that suit the needs of its customers. They specifically focus on millennials by developing bite-sized insurance policies that cover the immediate lifestyle requirements of the fast-paced world.

They make use of the facilities offered by artificial intelligence and machine learning to make sense of behavioral and consumption data so as to provide better services to customers.

These insurance innovators further focus on transparency and fast services that will help realize their aim to create a novel world of insurance that thrives on innovative products woven to fit the client’s needs. With more than 99.1% of the claims approved, Toffee Insurance serves over 2 lack customers across more than 600 cities.

Coverfox

| Startup Name | Coverfox |

|---|---|

| CEO | Sanjib Jha |

| Founded In | 2013 |

| Headquarters | Mumbai |

| Website | www.coverfox.com |

Launched in 2011, Coverfox is an InsurTech company that sells more than 360 products, including medical, automobile, bike, term, and travel insurance coverage across the subcontinent. Quickening the selling procedures, one of the major highlights of Coverfox is that they provide quotations to their customers instantly.

Further, their easy renewal, digitalized policy updates, and quick claims procedure further make the entire process hassle-free and attractive as far as the customers are concerned.

At a time when data privacy and security are greatly valued and are a matter of concern, Coverfox offers highly safe transactions and assures that the data is not sold to anybody, for that matter. They have won many accolades over the years for their commendable service over the Yeats including the best Insurtech startup award for the year 2022.

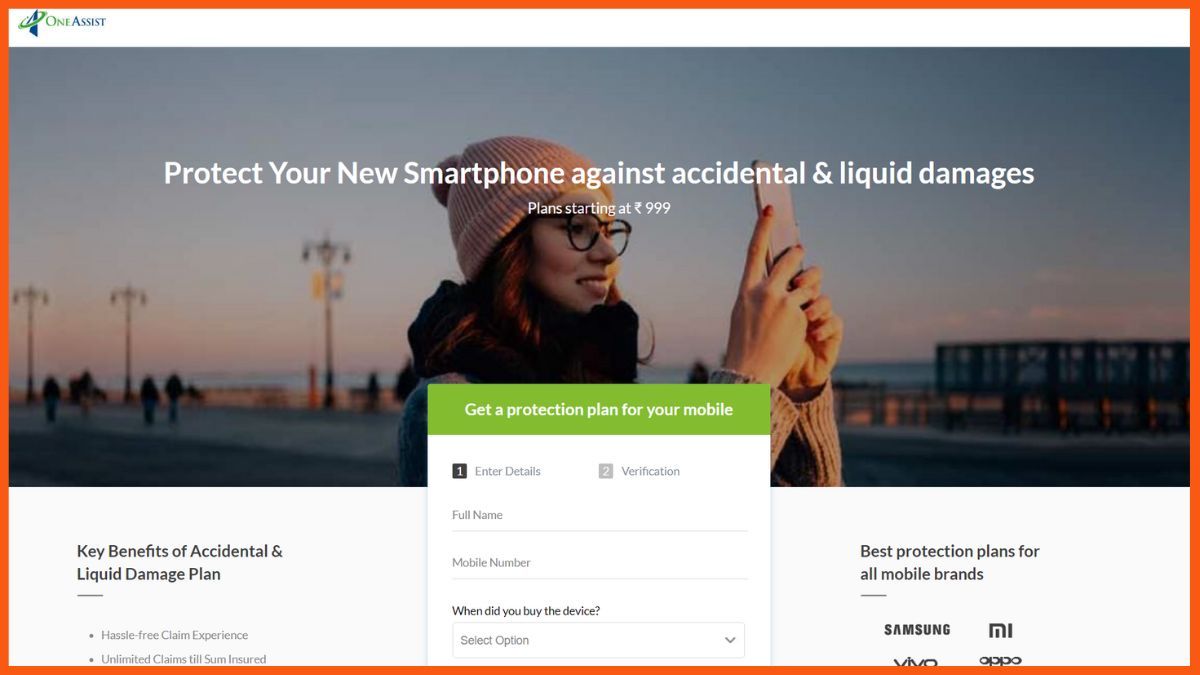

OneAssist

| Startup Name | OneAssist |

|---|---|

| Founders | Gagan Maini · Subrat Pani |

| Founded In | 2011 |

| Headquarters | Mumbai |

| Website | www.oneassist.in |

OneAssist is headquartered in Mumbai and is known to provide services related to the consumer-focused program. It has gained a good reputation in the last few years by providing coverage for data security and protection for electronics.

It has a partnership with many well-reputed firms like Amazon.com, Yes Bank, Axis Bank, etc. The primary goal of the firm is to provide a universal platform for customers to access and get their support and protection solutions from.

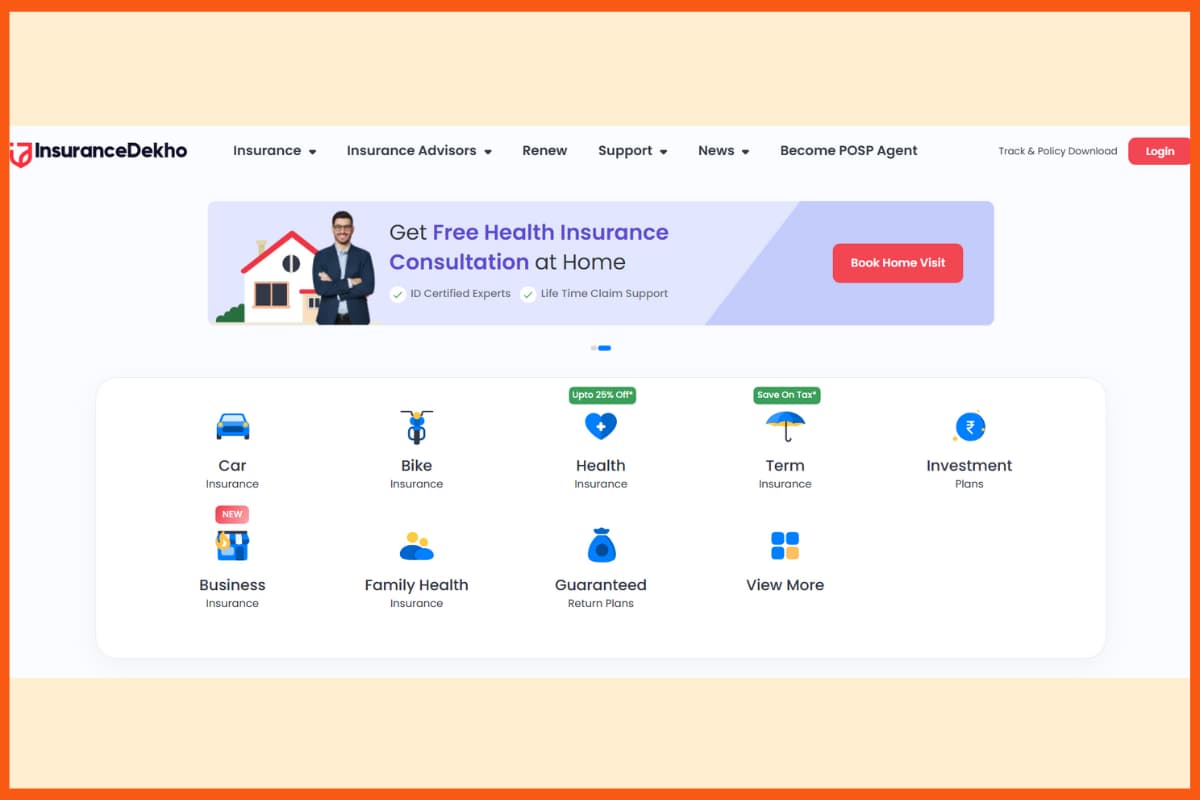

InsuranceDekho

| Startup Name | InsuranceDekho |

|---|---|

| Founders | Ankit Agrawal · Amit Bhatia |

| Founded In | 2016 |

| Headquarters | Gurugram |

| Website | www.insurancedekho.com |

InsuranceDekho is supported by CarDekho and is growing fast by combining both physical and digital ways to sell insurance. It is an online platform where people can compare and buy different insurance policies. They offer many types of insurance, like motor, health, and travel insurance. InsuranceDekho is popular because it is easy to use and makes buying insurance simple for customers.

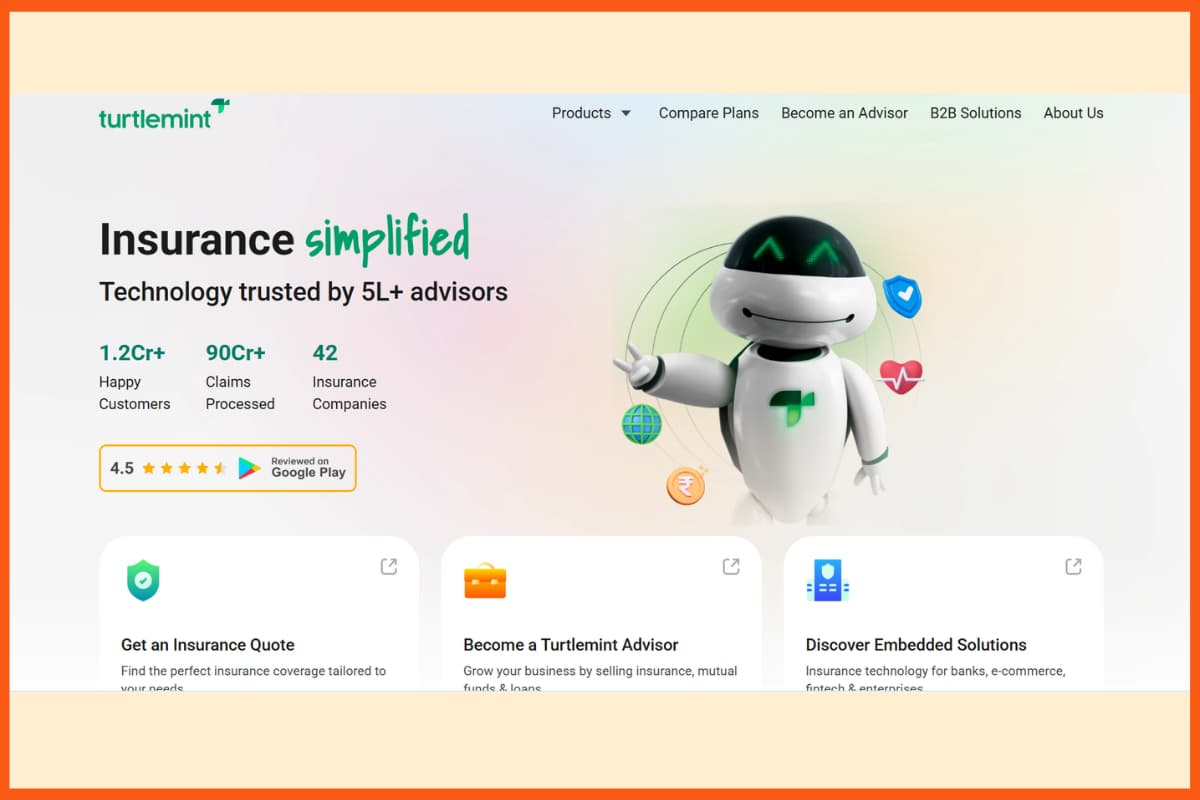

Turtlemint Insurance

| Startup Name | Turtlemint Insurance |

|---|---|

| Founders | Dhirendra Mahyavanshi · Anand Prabhudesai |

| Founded In | 2015 |

| Headquarters | Mumbai |

| Website | www.turtlemint.com |

Turtlemint is a top insurance company in India that offers many types of insurance, like life, health, car, and bike insurance.

They also provide other financial services like loans and savings accounts. Turtlemint has a Financial Advisory Service to help you plan and reach your money goals.

The company is based in Mumbai and works in more than 20 cities in India. They offer different services to help people and families with their insurance and financial needs.

Symbo Insurance

| Startup Name | Symbo Insurance |

|---|---|

| Founders | Anik Jain · Rahul Aggarwal · Abhishek Bondia |

| Founded In | 2017 |

| Headquarters | Mumbai |

| Website | www.symboinsurance.com |

Symbo focuses on embedded insurance, which means they help retailers, direct-to-consumer brands, and online platforms offer insurance right when customers are buying something.

Symbo is a registered insurance broker and a tech company that works closely with retail and eCommerce businesses to add insurance options during the checkout process.

Their product easily fits into any brand’s sales flow, making it simple for brands to sell insurance to their customers.

Symbo has teamed up with many brands and insurance companies, and they have over 100 different product integrations.

Conclusion

The InsurTech industry in India is still at its nascent stage. With the digital community still coming to terms with the possibilities and issues with regard to technology and digitalization, it is likely that it might take some more time for the industry to boom.

However, there is no doubt about the fact that the future of the insurance industry in India is heavily anchored upon the foundations laid by technology. Despite being in its initial stages, the industry in India has thrived like no other. Companies aspire to be more client-friendly, custom-made, and paperless. How the industry has evolved over the years is indeed interesting, and it makes its future worth observing.

FAQs

How many InsurTech companies are there in India?

The total count of InsurTech companies in India is a highly debatable topic. As per the report published by Inc24, there are 300+ active InsurTech companies in India for the year 2022.

What is the difference between Insurtech and FinTech?

FinTech and InsurTech are the units of the same field. The major difference between them is that InsurTech mainly deals with insurance-related things and is on a smaller scale than FinTech which basically deals with financial-related concepts including topics like banks, financial planners, banks, etc.

How many unicorns are InsurTech?

According to the report published by Inc24, India has around 3 unicorns in the field of InsurTech named Acko, Digit Insurance, and PolicyBazaar.

How big is the InsurTech market?

The global InsurTech market was valued at USD 3.85 billion in 2021 and is estimated to reach USD 5.45 billion in 2022.

Leave a Reply