Every year, as the festive season knocks at the door, each household prepares for new beginnings, for generations, bringing home gold on auspicious days like Dhanteras and Diwali has been seen as a symbol of prosperity and good fortune. People often head to their trusted jeweller to purchase a coin, a small bar, or an ornament, believing it will invite wealth and blessings for the year ahead.

However, gold has also become a crucial investment choice, offering certainty in fluctuating markets. While our parents and grandparents used to rely on jewellery or coins, the younger generation prefers to invest in Gold ETFs, sovereign gold bonds, digital gold, and gold mutual funds.

In this article, we will guide you through the best ways to invest in gold this festive season, helping you decide which option suits your needs, whether you’re buying for tradition, investment, or a bit of both.

Why Should Gold Be Part of Your Investment Portfolio?

Key Things to Keep in Mind Before Investing in Gold

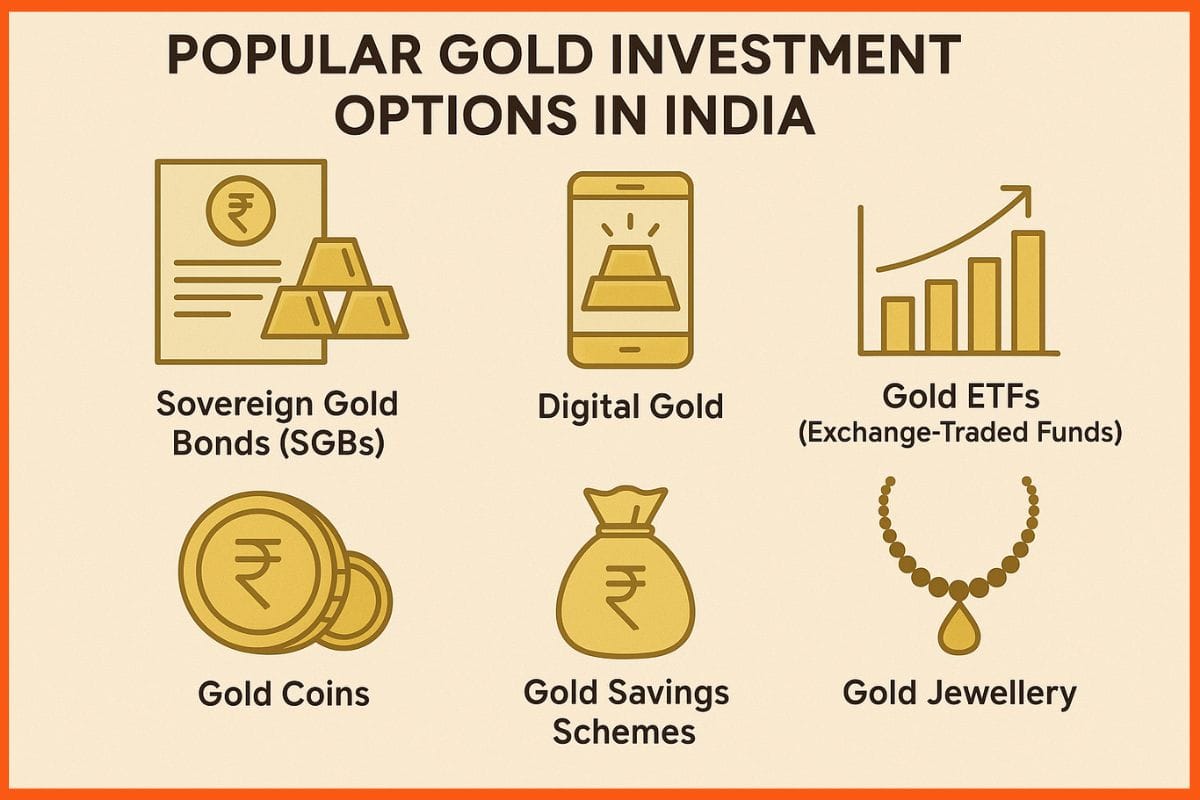

Popular Gold Investment Options in India

Which Gold Option is Best for You?

How to Create a Balanced Gold Investment Plan?

Why Should Gold Be Part of Your Investment Portfolio?

In today’s unpredictable economic climate, where stock markets swing wildly and inflation remains high, gold stands out as a safe and reliable investment. Beyond protecting your capital, it provides stability during global financial uncertainties, making it a trusted choice for investors.

Experts also suggest that gold prices could continue to rise, as central banks around the world keep adding gold to their reserves. In India, investing has become easier than ever, thanks to options like digital gold and Sovereign Gold Bonds, allowing both beginners and seasoned investors to enter the market conveniently.

With its high liquidity and long-term value retention, gold is more than just a safe haven; it’s a strategic asset that can bring balance and security to your investment portfolio. A thoughtfully designed gold investment plan can be a cornerstone of financial stability in your overall wealth strategy.

Key Things to Keep in Mind Before Investing in Gold

- Know Exactly What You’re Buying: If you’re saving for a wedding or planning to purchase a specific item, say, a 10-gram gold necklace, make sure the savings agreement clearly mentions the design, weight, and total price. Having these details in writing will protect you from sudden price hikes or last-minute surprises when you finally redeem your gold.

- Check Credibility and Trustworthiness: Always research the jeweller or platform you’re dealing with. Go through customer reviews, ratings, and social media feedback. If you find repeated complaints about delayed delivery, poor product quality, or lack of transparency, it’s best to walk away. A reliable jeweller or platform will always provide clear, upfront information about their products and services.

- Stay Updated with Market Prices: Gold prices fluctuate daily, and even small changes can make a big difference in your investment. Keep track of prices using financial news portals or apps. If you notice an upward trend, consider buying sooner rather than later to lock in a better rate. Timing your investment wisely ensures you get maximum value.

- Watch Out for Hidden Charges: Before signing any agreement or plan, carefully read the terms and conditions. Some schemes may include hidden fees or additional charges that can eat into your returns. Cross-check all details with your understanding so you don’t get caught off guard later.

Popular Gold Investment Options in India

Sovereign Gold Bonds (SGBs)

Sovereign Gold Bonds are one of the most trusted and secure ways to invest in gold since they are issued by the Government of India. However, they’re not available year-round. Instead, the government opens subscription windows a few times a year, usually for about a week. If you miss this window, the only way to invest is by buying previously issued SGBs through the secondary market. Each bond not only tracks the gold price but also pays 2.5% annual interest, making it a strong choice for long-term investors. For 2025, investors are still waiting for the government to announce the next tranche.

Digital Gold

For those who prefer convenience, digital gold is a modern alternative. Through apps like Paytm, PhonePe, and Google Pay, you can start buying gold with as little as INR 1. The gold you purchase is stored securely by trusted partners such as SafeGold or MMTC-PAMP (a joint venture of India’s MMTC and Switzerland’s PAMP SA). Digital gold is especially popular among young investors and those who want flexibility without worrying about storage.

Gold Coins

If you want something tangible but still easy to store, gold coins are a great option. They are available through jewellers, banks, NBFCs, and even e-commerce platforms. All coins come hallmarked under BIS (Bureau of Indian Standards) guidelines to ensure purity. Ideally, buy them in tamper-proof packaging, which helps prevent damage, fraud, and counterfeiting. Coins typically range from 0.5 grams to 50 grams, making them suitable for gifting as well as investment.

Gold ETFs (Exchange-Traded Funds)

A Gold ETF is essentially a mutual fund that invests in 99.5% pure gold. These ETFs trade on the stock exchange, just like company shares. This means you can buy or sell units anytime during market hours. The biggest advantage is liquidity, you get the benefit of gold price appreciation without worrying about storage. However, you’ll need a Demat account to invest in them.

Gold Savings Schemes

Many jewellers now offer gold savings plans, where you deposit a fixed sum of money every month for a chosen duration. At the end of the term, you can buy gold or jewellery worth the accumulated amount, often with an added bonus or discount from the jeweller. These schemes are particularly attractive to families planning to buy jewellery for weddings or festivals.

Gold Jewellery

Buying gold jewellery remains the most traditional and sentimental form of investment. However, it comes with added costs, mainly making charges, which can go up significantly for intricate designs. There’s also the concern of safety and styles becoming outdated over time. While jewellery is not the most efficient investment, it continues to hold cultural value and remains a festive favourite.

Which Gold Option is Best for You?

| Investor Type | Best Option | Why? |

|---|---|---|

| Traditional Buyers | Physical Gold | & gifting value |

| Tech-Savvy Millennials | Digital Gold / Gold ETFs | Small-ticket & easy to trade |

| Long-Term Investors | Sovereign Gold Bonds | Govt-backed, safe, interest + appreciation |

| First-Time Investors | Gold Mutual Funds | No Demat needed, SIP-friendly |

How to Create a Balanced Gold Investment Plan?

Before investing in gold, it’s essential to clarify your financial objectives. Are you seeking security and capital protection, or are you aiming for long-term wealth creation? Depending on your goal, financial experts often suggest allocating 10–15% of your overall portfolio to gold.

Choose the type of gold investment that aligns with your risk tolerance and investment horizon. Options include physical gold, digital gold, Gold ETFs, and Sovereign Gold Bonds. For long-term growth, setting up a Systematic Investment Plan (SIP) in gold mutual funds can help you invest consistently and benefit from market fluctuations over time.

A well-thought-out gold plan not only provides stability to your portfolio but also ensures financial security, combining the cultural value of gold with smart investment practices.

Conclusion

Investing in gold has always been more than a financial decision in India; it is a time-honoured tradition, especially during festivals like Dhanteras and Diwali. By choosing reputable and organized players, understanding the specifics of your purchase, and exploring modern options such as digital gold, Gold ETFs, and Sovereign Gold Bonds, you can make your investment both safe and rewarding.

Gold not only helps preserve wealth but also adds stability and balance to your overall investment portfolio. With the right strategy, it can serve as a hedge against market volatility and inflation, while offering long-term growth potential. Whether you invest in physical gold for tradition or digital instruments for convenience, a well-planned gold investment can be a valuable pillar of your financial future, blending culture, security, and smart wealth management.

FAQs

Why do people buy gold on Dhanteras and Diwali?

Buying gold on Dhanteras and Diwali is considered auspicious in India. It symbolizes wealth, prosperity, and good fortune for the year ahead. Families often purchase gold coins, jewellery, or bars as part of festive traditions.

What are Sovereign Gold Bonds and why should I invest in them?

Sovereign Gold Bonds (SGBs) are government-issued securities linked to gold prices. They not only give price appreciation benefits but also pay 2.5% annual interest, making them safer and more rewarding than physical gold.

Is digital gold safe to buy during Diwali?

Yes, digital gold is safe if purchased through trusted platforms like Paytm, PhonePe, or Google Pay. The gold is stored securely by partners such as MMTC-PAMP or SafeGold, ensuring purity and safety.

Is buying gold jewellery a good investment option?

While jewellery holds cultural and emotional value, it is not the most efficient investment due to high making charges and design depreciation. Coins, ETFs, or SGBs offer better returns for pure investment purposes.

Leave a Reply