The way we save, invest, and exchange money is changing as a result of technological advancements in today’s lightning-fast financial industry. The pioneering force behind this transformation is fintech, an abbreviation for financial technology. When it comes to the stock market and online broking, Zerodha is what comes to the mind of an Indian. Zerodha is the most prominent and the leading discount brokerage company, founded in 2010. The company is the first-ever stock brokerage company that gave rise to discount brokerage options for investors as well as traders.

Today, Zerodha is the biggest brokerage company in India with a client count above 5 million. It is also known as the Robinhood of India.

The company contributes over 15% to every retail order volume in India on a daily basis through trading and investing in various stocks, Commodities, F&O, IPOs, and others. In this article, we have briefly discussed the business model and revenue model of Zerodha. Let’s get started!

About Zerodha

Zerodha is an Indian fintech startup that has been shaking up the conventional brokerage sector since its founding in 2010 by brothers Nithin Kamath and Nikhil Kamath. The company’s name represents its objective to remove hurdles and democratize finance. It is a mix of “Zero” and “Rodha,” the Sanskrit words for obstacles.

The largest online brokerage firm in India, Zerodha is widely famous for its discount brokerage option. Zerodha offers financial services with the main motive of providing low-cost services to customers. Zerodha is a significant member of BSE, MCX-SX, and NSE, which provides broking services to the traders of the stock market.

Zerodha is headquartered in Bengaluru and has a huge customer base. Zerodha is the first discount broker in India because of this, it gained huge support from the audience.

An essential part of Zerodha’s success has been its dedication to offering traders and investors products that are affordable, easy to use, and driven by technology. Belief in creating a world without brokers is Zerodha’s motto. The financial market players will benefit greatly from this ideology. In addition to meeting the unique demands of each client, the organization strives to offer cheap trade services and first-rate customer service. Using cutting-edge innovation, innovative ideas, and unparalleled customer service, Zerodha aims to build a world without brokerages.

Besides, the most intriguing thing about Zerodha is that it always comes up with brilliantly innovative ideas supported by several strategic and definite efforts. Zerodha runs with the tagline of “The Free Trade Zone“.

Moreover, Zerodha offers tons of open online education and community programs that uphold retail traders as well as investors.

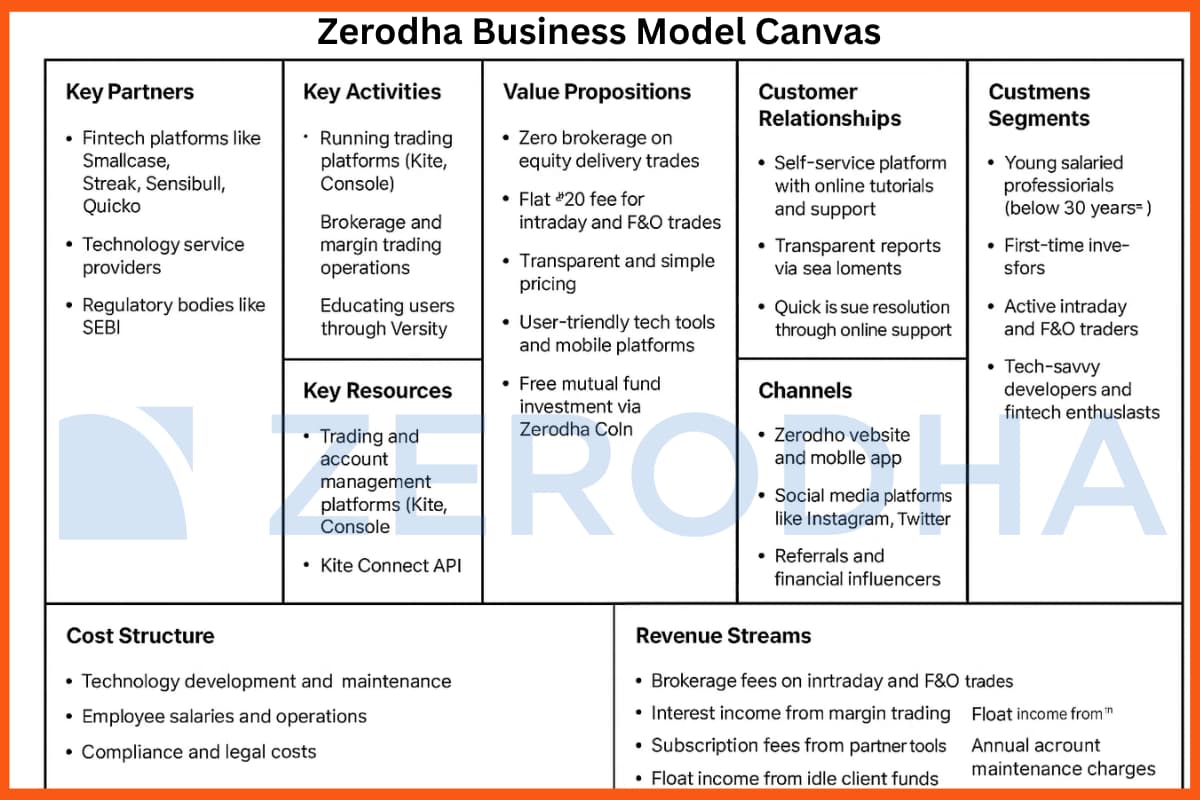

Zerodha Business Model Canvas

Key Partners

- Fintech platforms like Smallcase, Streak, Sensibull, Quicko

- Technology service providers

- Regulatory bodies like SEBI

Key Activities

- Running trading platforms (Kite, Console)

- Brokerage and margin trading operations

- Developing fintech tools and APIs

- Educating users through Varsity

Value Propositions

- Zero brokerage on equity delivery trades

- Flat ₹20 fee for intraday and F&O trades

- Transparent and simple pricing

- User-friendly tech tools and mobile platforms

- Free mutual fund investment via Zerodha Coin

Customer Relationships

- Self-service platform with online tutorials and support

- Transparent reports and statements

- Community building via social media and Varsity

- Quick issue resolution through online support

Customer Segments

- Young salaried professionals (below 30 years)

- First-time investors

- Active intraday and F&O traders

- Tech-savvy developers and fintech enthusiasts

Key Resources

- Trading and account management platforms (Kite, Console)

- Kite Connect API

- Skilled technology and support teams

- Regulatory licenses and compliance systems

Channels

- Zerodha website and mobile app

- Social media platforms like Instagram, Twitter

- Referrals and financial influencers

- Educational platform Varsity

Cost Structure

- Technology development and maintenance

- Employee salaries and operations

- Compliance and legal costs

- Customer acquisition and marketing

Revenue Streams

- Brokerage fees on intraday and F&O trades (up to ₹20/order)

- Interest income from margin trading

- Demat account DP charges

- Subscription fees from partner tools (e.g., Streak, Smallcase)

- Float income from idle client funds

- Annual account maintenance charges (₹300/year)

Where does Zerodha operate?

Zerodha is a financial service company that offers various retail and institutional-based brokerage, bonds, mutual funds, and currency & commodities trades. Zerodha operates in various states of India, including Hyderabad, Bengaluru, and Pune.

Key Products and Services of Zerodha

The broking limited company, Zerodha, offers tons of key products to its customers. These products include Console for account management, Kite for trading platforms, Varsity for financial education, Quicko for the traders in Tax stems, Coin for Free Mutual Fund, Kite Connect API for the developers, Kill Switch for the risk management for retail traders, and Sentinel for the cloud-based market alert tool.

Target Audience of Zerodha

Zerodha majorly targets its potential audience in Pune, Bengaluru, and Hyderabad based on the average age group of people below 30 years. It focuses on those below 30 people who are new to their jobs and have already started saving from their salaries and are searching for better saving and investing methods to increase their money effectively. With its incredible services and products, it has gained over a million active users.

Zerodha Business Model

The most significant thing about the business model of Zerodha is the success and popularity it gained among the audience. Zerodha offers a very convenient service to its customers, because of which it gained absolute success in the strenuous market as well.

Zero Brokerage Model

When it comes to equity delivery deals, Zerodha stands out due to its zero brokerage strategy. This is a great alternative for long-term investors since it allows investors to purchase and hold equities without paying brokerage fees. They make money from many categories, including intraday trading, futures, and options, and others, by collecting a flat fee on each deal.

Transparent Pricing

Another important part of Zerodha’s business model is transparency. Importantly, being a fintech company they offer a straightforward pricing system. To prevent unpleasant unexpected events, traders can determine their trading costs in advance. Customers trust them more because of this openness, and they distinguish themselves from more conventional brokerages that have convoluted pricing structures.

Zerodha USP

The entire business model of Zerodha is very transparent and has no hidden costs later on. It lets you know all your transactions and also provides a quick tutorial on online trading.

It keeps all the information transparent and open to the customers. These facets help the company more vibrantly and gain more significant clients for trading.

The USP of Zerodha is its zero brokerage concept. Traders don’t need to pay to trade stocks if they plan to keep them for longer than a day. There is no brokerage fee; all the trader has to do is pay their taxes. Brokerage fees from intraday and derivatives trading are Zerodha’s main source of revenue. For FNO trading, Zerodha has a fixed brokerage fee of INR 20 per order.

How Zerodha Makes Money | Zerodha Revenue Model

Zerodha is the biggest trading network with the highest number of active users in India. People across India use Zerodha for investing and trading. Zerodha revenue sources include brokerage fees, interest on margin funding, and income from partner platforms and technology services. The company charges only Rs. 20 (or 0.03%) for every F&O and intraday capital trade.

Although its charge is pretty low, as a huge number of transactions take place, the company gains enough profit. Besides the account maintenance, it charges Rs. 300 annually.

From the records of the past few years, Zerodha experienced rapid growth. This results in the 2% contribution of investors in the stock exchange. This, later on, boosts the revenue of the company. With this revenue source, Zerodha raised its valuation worth $1 billion. The valuation of Zerodha is around $3.6 billion (2023).

Along with stock trading, Zerodha also provides a platform called Zerodha Coin where users may invest in mutual funds without paying a commission. Numerous clients seeking an easy method to put their money into mutual funds have taken advantage of this service. The larger movement towards digital wealth management and the use of the term “hire a fintech developer” to describe the process of creating and managing such systems is congruent with this.

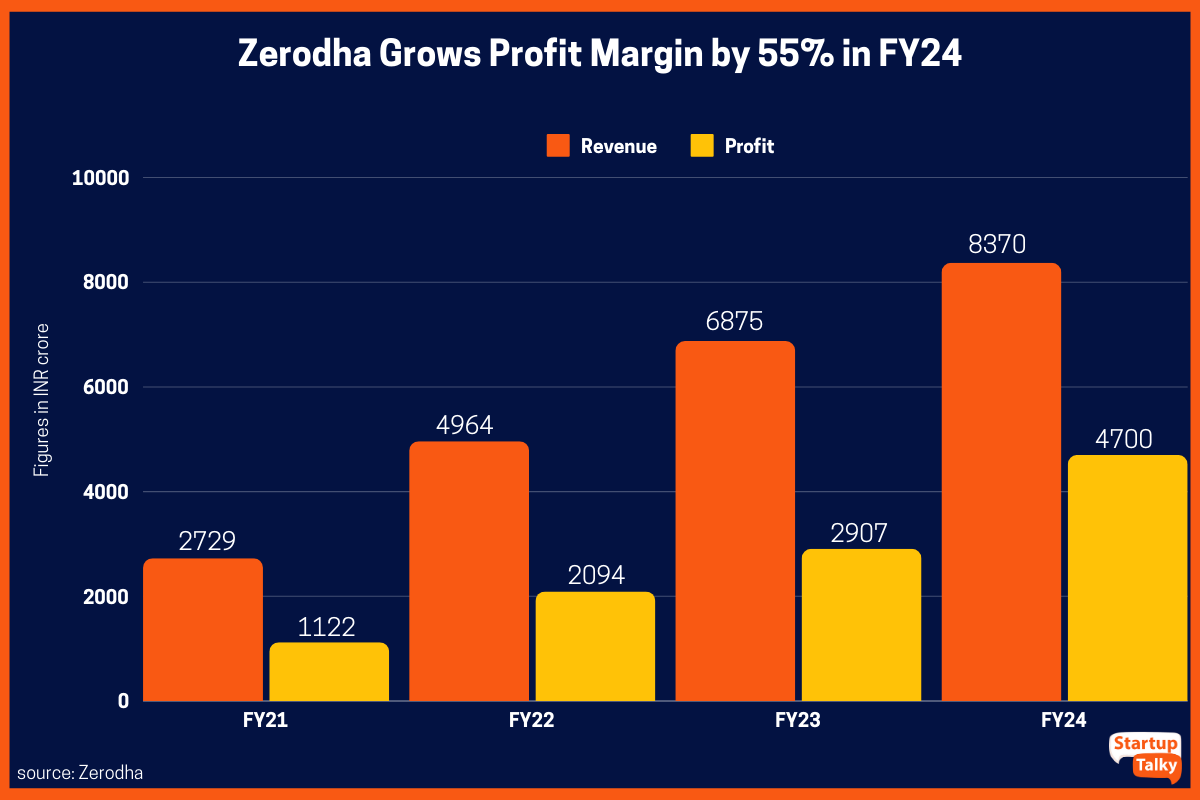

Zerodha Financials

| Particulars | FY24 | FY23 | FY22 | FY21 |

|---|---|---|---|---|

| Revenue | INR 9,994.5 Cr | INR 6,877.1 Cr | INR 4,964 Cr | INR 2,729.6 Cr |

| Expenses | INR 3,119.3 Cr | INR 2,992.7 Cr | INR 2,165.1 Cr | INR 1,260.2 Cr |

| Profit after Tax | INR 1,122 Cr | INR 2,094 Cr | INR 2,907 Cr | INR 4,700 Cr |

Zerodha has shown consistent growth in revenue and profit over the last few years. In FY24, the company saw significant growth in revenue and profit, continuing its upward trajectory from FY23.

Zerodha Revenue Breakdown:

| Particulars | FY24 | FY23 |

|---|---|---|

| Revenue from operations | INR 9,372.2 crore | INR 6,832.8 crore |

| Other income | INR 622.3 crore | INR 44.3 crore |

| Total revenue | INR 9,994.5 crore | INR 6,877.1 crore |

Zerodha’s revenue has consistently increased over the last few years, with a notable spike in FY24. Revenue from operations saw substantial growth, and other income showed a significant rise in FY24 compared to FY23.

Zerodha SWOT Analysis

Zerodha Strengths

- Zerodha has shaken up India’s traditional brokerage market with its novel approach to trading, providing clients with commission-free trading.

- Customers can rely on quick and dependable trading because of Zerodha’s powerful technological infrastructure.

- To meet the demands of traders with varying skill sets, the firm has created several trading platforms and tools.

- Thanks to its user-centric strategy and great customer service, Zerodha has a high customer satisfaction rating.

- To meet the varied investing needs of its clients, Zerodha provides a comprehensive suite of financial products, including stocks, bonds, mutual funds, and derivatives.

Zerodha Weakness

- The potential for growth and expansion is limited for Zerodha because its operations are limited to India.

- Zerodha is at risk of cyber threats and system breakdowns because its business model is highly reliant on technology.

- Brokerage fees and commissions are Zerodha’s only sources of income, which may lead to difficulties for the company down the road.

Zerodha Opportunities

- Zerodha has a great chance for growth due to the continuously expanding population of retail investors and traders in India.

- Zerodha has a golden opportunity to grow its business by taking advantage of the growing popularity of online shopping in India.

- If Zerodha wants to diversify its revenue streams and access new markets, it might look into foreign expansion prospects.

Zerodha Threats

- There is a lot of competition for Zerodha’s products and services from both well-established brokerage businesses and emerging startups.

- Business operations and profitability at Zerodha are susceptible to changes in regulatory policies and guidelines.

- Investor sentiment and trade volumes are influenced by economic uncertainty and market volatility, which in turn affect Zerodha’s revenue sources.

Conclusion

Even after this huge customer base, Zerodha is still working on expanding the company on a broad scale with a more significant client base. Nithin Kamath, the CEO of Zerodha, mentioned in an interview that he is aiming to take the company to a client base of 5-10 million in the upcoming years.

Zerodha believes in promoting its services, as the company hardly spends any money on advertising channels. The company holds a great reputation in the market because of its incredible services and customer interactions. This has resulted in the comprehensive and impeccable growth of the company.

Within the context of the Indian brokerage industry, Zerodha’s commission-free trading business model is characterized by an effective technological infrastructure, a high level of customer satisfaction, and diversified product offerings that offer significant value. These offerings are relatively uncommon and difficult to imitate, and a robust organizational culture supports them. This helps the company maintain its significant competitive advantage.

In the upcoming years, Zerodha is expected to grow even more and expand more promptly. Stay tuned for more updates!

FAQ

What does Zerodha do?

Zerodha Broking Ltd. is an Indian stock broker and financial services company. The company provides institutional and retail brokerage services, as well as currency and commodity trading. Additionally, Zerodha offers investment options in mutual funds and bonds.

Is Zerodha free?

Traders don’t need to pay to trade stocks if they plan to keep them for longer than a day. There is no brokerage fee; all the trader has to do is pay his taxes. For FNO trading, Zerodha has a fixed brokerage fee of INR 20 per order.

What are the strengths of Zerodha?

The strengths of Zerodha include commission-free trading, its technological infrastructure, versatile trading platform, high customer satisfaction, and its comprehensive financial products.

What is Zerodha business model?

Zerodha follows a discount brokerage business model, offering low-cost trading services in stocks, commodities, and currencies. It charges zero brokerage on equity delivery trades and a flat fee of ₹20 per order for intraday and F&O trades. The company earns revenue from brokerage fees, interest on margin funding, and its tech platforms like Kite and Coin. By focusing on technology and low costs, Zerodha has attracted a large base of retail investors.

How Zerodha earns money?

Zerodha earns money through brokerage fees on intraday and F&O trades, charging up to INR 20 per order. It also makes money from interest on margin funding, DP charges when clients sell shares, and subscription fees for premium tools like smallcase and Streak. Additionally, it earns float income from idle client funds.

What is Zerodha valuation?

Zerodha valuation is $3.6 billion.

What is Zerodha tagline?

Zerodha tagline is “The Free Trade Zone”.