Kingfisher Airlines, once known as the “King of Good Times,” was launched to provide top-notch service, transforming air travel in India. In 2011, Kingfisher Airlines had the second-largest domestic market share in India, and its international network reached as far as London (LHR) and Hong Kong (HKG).

Yet, just a few years after its promising debut, it came crashing down, grounded, bankrupt and labelled one of the biggest failures in Indian aviation history. So, what happened to Kingfisher Airlines? Why did such a well-funded, high-profile airline collapse despite massive brand value and market visibility?

In this article, we will break down the full story and the biggest lessons entrepreneurs and investors can learn from it.

Kingfisher Airlines – How It All Began?

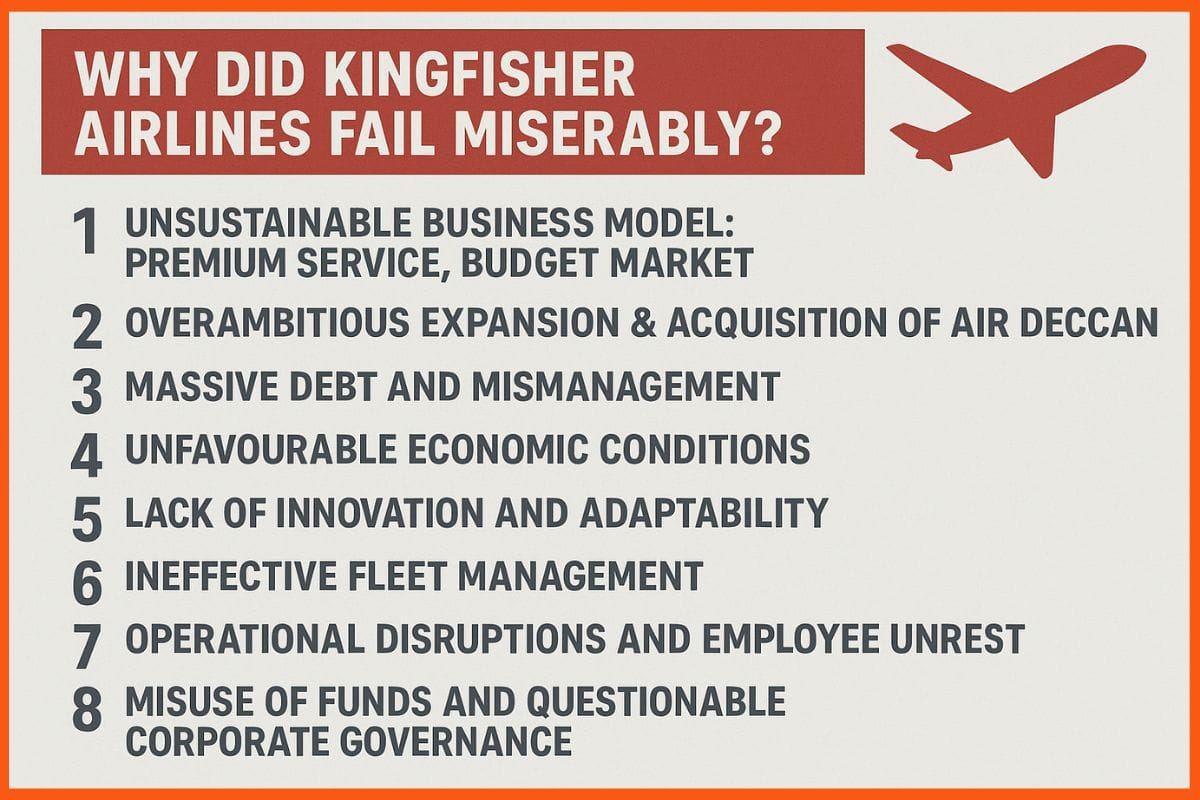

Why Did Kingfisher Airlines Fail Miserably?

How Kingfisher Airlines Crashed – A Chronological Breakdown?

Kingfisher Airlines – How It All Began?

Kingfisher Airlines was launched in May 2005 by well-known industrialist Vijay Mallya, head of the UB Group Vijay Mallya, chairman of the UB Group, which is best known for Kingfisher Beer. The airline aimed to redefine Indian aviation by offering a blend of luxury, glamour, and high-end service, which was uncommon in the domestic sector at that time.

Kingfisher’s Airbus A320s featured 20 “First” seats and 114 “Kingfisher Class” seats. First-class offered a 48‑inch pitch with a 126° recline, while the economy had 32–34 inches of pitch. All seats had personal in‑flight entertainment, and First even included an onboard steam ironing service.

By 2007, the airline’s fleet had swelled to around 20 A320s, operating across 26 destinations. In September 2008, Kingfisher launched its first long‑haul route between Bengaluru (BLR) and London (LHR), deploying Airbus A330‑200s configured in two classes with full‑flat seats in “Kingfisher First.”

Why Did Kingfisher Airlines Fail Miserably?

Unsustainable Business Model: Premium Service, Budget Market

Kingfisher’s high-cost model clashed with the Indian aviation market, which is dominated by low-cost carriers (LCCs) like IndiGo, SpiceJet, and GoAir.

- High operational costs due to in-flight entertainment, meals, and premium services.

- Low-cost competitors were growing fast, attracting budget travellers.

- Kingfisher couldn’t justify the price difference for most middle-class passengers.

Overambitious Expansion & Acquisition of Air Deccan

In 2007, Kingfisher Airlines acquired a controlling stake in Air Deccan, India’s first budget airline, founded by Captain G.R. Gopinath.

- Intent: Enter the fast-growing low-cost segment to tap into India’s price-sensitive flyers.

- Reality: The move blurred Kingfisher’s premium brand image, known for luxury, with Deccan’s low-cost positioning. Brand confusion diluted customer perception and eroded the identity Kingfisher had built.

- Integration Woes

- Operationally, the merger was messy and expensive; different aircraft types (ATR and Airbus), team cultures, and customer bases made the integration inefficient.

- Air Deccan was later rebranded as Kingfisher Red, but it never truly aligned with the core luxury offering.

- The merger created conflicting strategies, serving high-end and low-end customers simultaneously, which led to cost overruns and poor resource allocation.

- It failed to produce the expected financial synergy and ultimately weakened both arms of the airline.

Massive Debt and Mismanagement

By 2011, Kingfisher Airlines had racked up over INR 9,000 crore in debt, with little to show in profit. The airline was borrowing just to repay existing loans, a red flag in financial management.

Key reasons for the downfall:

- Over-leveraging: Kingfisher expanded aggressively and took on massive loans without a clear repayment strategy.

- Defaulting on dues: Payments to oil companies, airports, aircraft lessors, and even employee salaries were regularly delayed or skipped.

- Low return on luxury investments: While the airline spent heavily to offer a premium flying experience, the business model of Kingfisher Airlines failed to deliver sustainable returns.

By 2012, major lenders, including SBI, IDBI, PNB, Bank of Baroda, Bank of India, and United Bank of India, officially classified Kingfisher as a Non-Performing Asset (NPA), triggering legal and financial proceedings.

Unfavourable Economic Conditions

The global economic slowdown and surging fuel prices only made matters worse for Kingfisher Airlines. While these external challenges were beyond the airline’s control, the lack of a solid backup plan exposed how unprepared the business was to weather financial storms. Companies must build strong contingency strategies to survive such downturns.

Lack of Innovation and Adaptability

Kingfisher Airlines struggled to evolve its business model in response to shifting market dynamics. While the aviation industry demanded cost-efficiency and operational flexibility, Kingfisher remained rigid in its premium-heavy approach. In a highly competitive market, the failure to innovate and adapt ultimately made the airline irrelevant and unsustainable.

Ineffective Fleet Management

Kingfisher Airlines operated a mixed fleet of aircraft, which significantly increased maintenance complexity and operational expenses. Instead of streamlining its resources, the airline’s diverse fleet led to higher training, fuel, and servicing costs, ultimately straining profitability. In aviation, uniformity in fleet management is crucial for cost optimization and long-term sustainability.

Operational Disruptions and Employee Unrest

By late 2011, signs of Kingfisher Airlines’ collapse were increasingly visible:

- Flights were frequently delayed or cancelled, disrupting operations nationwide.

- Pilots, engineers, and ground staff staged protests and strikes due to months of unpaid salaries.

- A large number of aircraft were grounded because of unpaid fuel bills, maintenance dues, and lease defaults.

- Employee attrition surged, and remaining staff morale was extremely low.

- Customer trust eroded, and passenger load factors (i.e., seat occupancy rates) dropped significantly.

Eventually, after continued operational disruptions and failure to provide a recovery plan, the DGCA (Directorate General of Civil Aviation) suspended Kingfisher Airlines’ flying license on October 20, 2012, citing safety and financial viability concerns.

Misuse of Funds and Questionable Corporate Governance

- As Kingfisher Airlines failed, multiple investigations were launched into allegations of financial mismanagement and fund diversion.

- Vijay Mallya, the airline’s promoter, was accused of diverting bank loans meant for Kingfisher Airlines to fund other ventures, including his IPL cricket team, Royal Challengers Bangalore, luxury properties, and an extravagant lifestyle.

- India’s Enforcement Directorate (ED) and the Central Bureau of Investigation (CBI) filed cases against him under the Prevention of Money Laundering Act (PMLA) and bank fraud laws. The Kingfisher airline had a bankruptcy of INR 9,000 crore from a consortium of public sector banks.

- In March 2016, Mallya left India and moved to the United Kingdom, just as banks were closing in on recovering dues. He was later declared a Fugitive Economic Offender by an Indian court under the Fugitive Economic Offenders Act of 2018, the first person to be labelled so under this law.

How Kingfisher Airlines Crashed – A Chronological Breakdown?

Conclusion

In a nutshell, Kingfisher Airlines failed because it tried to be everything for everyone, without grounding itself in economic reality. Its luxurious vision clashed with India’s price-sensitive travellers.

Poor financial decisions, brand confusion, mismanagement, and unchecked ambition turned a promising airline into an airline failure tale. Kingfisher’s failure is a reminder that in aviation and business, style can never outweigh substance, from an investor’s dream to a bankruptcy nightmare.

FAQs

What was Kingfisher Airlines and who founded it?

Kingfisher Airlines was a premium Indian airline founded in May 2005 by Vijay Mallya, the chairman of UB Group. It aimed to revolutionize Indian aviation by offering luxury service and onboard amenities rarely seen in the domestic sector

How much debt did Kingfisher Airlines accumulate?

By 2011, Kingfisher Airlines had accumulated over INR 9,000 crore in debt.

When was Kingfisher Airlines’ flying license suspended?

Kingfisher Airlines had its flying license suspended on October 20, 2012, by the DGCA due to serious concerns over safety, financial viability, and failure to provide a credible revival plan.