We believe that every startup has a unique journey to pursue, which is based on the idea that requires a right push in the right way. Regardless of the stage, your startup is in, it requires significant guidance to move forward and have successful accomplishments. We have attempted to make a List of Incubators and Accelerators in Mumbai that would help you in making the right choices for your business.

Mumbai isn’t just the well-off city, but the Economic Hub of India, that has various Industrialists, CEOs, Entrepreneurs, Well-known companies, Directors, Producers, Artists, and what not! The place ‘Mumbai’ has its own culture and architecture that makes it the spot of tourist attraction. Well, a place that is full of life and energetic minds, requires a mentor and a financial supporter for building up the initial base of the dreams.

List of top 21 Incubators & Accelerators in Mumbai

- Rise Accelerator

- UnLtd India

- Espark Viridian

- Venture Catalysts

- Society for Innovation and Entrepreneurship (SINE)

- Amplifi Asia

- ISDI Creative Accelerator – Microsoft Ventures

- Zone Startups India

- Z Nation Lab

- Startupbootcamp FinTech

- ScaleMinds

- MITCON Technology Business Incubator Centre

- NASSCOM 10000 startups

- Science and Technology Park (Scitech Park)

- ISME ACE Accelerator

- JioGenNext

- YES Fintech

- ThinQbate

- Incubation Center, S.P. Jain Institute of Management and Research (SPJIMR)

- Centre for Incubation and Business Acceleration (CIBA)

- Venture Nursery

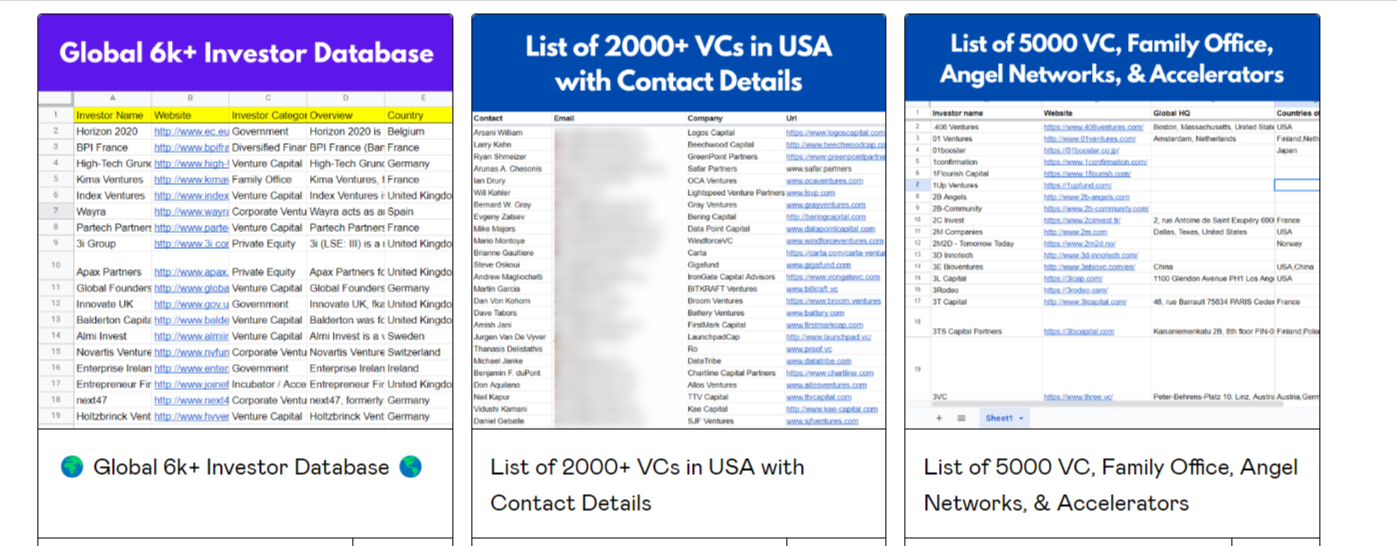

Unlock Your Startup’s Potential with Our Exclusive Investor Lists and Resources

Supercharge your startup’s success with our comprehensive resources. Access investor lists, pitch decks, KPIs, and fundraising guides. Connect with pre-seed investors, angel networks, and family offices, while mastering VC pitches. Ignite your entrepreneurial dreams today!

Rise Accelerator

Being India’s first FinTech Accelerator Program, Rise was created by Barclays in partnership with the Zone Startups. It has an intensive 18-week cohort-based program that offers a wide community to interact and collaborate with. It assists companies to gain major milestones throughout the journey. If you are working on building an amazing solution based on finance, cyber security, data analytics, cryptocurrency, wealth management, insurance and digital banking then this is the place you can consider looking into.

Rise Accelerator offers:

- Mentorship.

- Introduction to key industry experts.

- Access to Barclays technology, insight and expertise.

- Access to Global Community.

- Industry Connections.

- Investors Access.

UnLtd India

With a view as to how the socio-economic problems hinder the growth of the country and the economy at large, UnLtd India acts as a launchpad for zealous individuals whose potential ideas can be a solution to the prevailing socio-economic problems. Their major focus is on early-stage social entrepreneurs to help them with providing opportunities and accelerate the growth of their organisation that can have a huge impact on society. If you are an Individual with an innovative Idea that can have a positive and sustained Impact at a large scale, therein open to feedback and Incubation, then this is the right place for you to pitch in.

UnLtd India offers:

- Piloting and building the idea.

- Personalized Coaching.

- Workshops & Training.

- Networking & Impact measurement.

Also Read: 21 Amazing Startup Incubators & Accelerators in Bangalore

Espark Viridian

Espark Viridian Ventures supports early-stage as well as growth-seeking startups as a business accelerator across India. Their main idea is based on how they shape the mindsets that in turn shape the entrepreneur in you. With accelerating more than 340 startups, they are playing a major role in the Indian Startup ecosystem. The most unique feature in their program, that sets them apart from others is ‘Enablement’, wherein an Enabler (Startup Coach) is assigned to each startup throughout the journey of the startup in the course.

Frequip, Oranjtag, Carpiko, Garam Box, Findmedz, etc. are some of the startups that gained support from Viridian Ventures in their journey.

Espark Viridian offers:

- Infrastructural Support.

- Workshops and Events.

- Networking opportunities in global markets.

- Mentors & Trainers.

Venture Catalysts

It is one of India’s Top Startup Incubator which is widely known for its integrated approach. The approach offers mentorship, funding, networks of successful founders, product experts and unicorns. It invests in the range of $500 to $1 million, with its wider presence across India, Dubai, UAE and Hongkong. Some of its Incubated Startups – Lenden, Purple Style Labs, Inc42, Supr, Flickstree, Cleardekho, Beardo, Chai Break among many.

Venture Catalysts offers:

- Workspace.

- Conference Rooms.

- Funding & Mentoring.

- Investor Community.

- Industry Connections.

- Events & Conferences.

Also Read: Top Angel Investors in Mumbai [With Contact]

Society for Innovation and Entrepreneurship (SINE)

To encourage and develop tech startups, SINE was established as an umbrella organization at IIT Bombay to provide support to tech-based entrepreneurs and ventures. It acts as an incubator and accelerator to startups and helps them in their journey to scale up their business.

Their portfolio comprises various startups with sectors Cleantech, Fintech, IoT, IT/ICT, Medtech, and others. Acuradyne Systems, Ayati Devices, Bellatrix, Ayu Devices, Connect Plus, Chainworks Digital, Inphlox Water Systems, Navork Innovations, etc. are some of the startups showcasing in their portfolio.

SINE offers:

- Government collaboration.

- Industry-level training from experts.

- Product development & Manufacturing.

- Up to 3 years incubation support.

- Electronics & Prototyping.

- Access to SINE Labs.

- Infrastructural & Tech support.

- Business Network.

Amplifi Asia

Being positioned as Asia’s leading enterprise tech, SaaS dedicated venture accelerator, Amplifi Asia provides a holistic and magnificent ecosystem for tech startups in Asia. With a hands-on team of successful leaders and experienced entrepreneurs, it tends to provide support to the early-stage ventures in their journey of establishment and Growth. Regions that are mainly focused on them are India, Singapore, Hong Kong, Taiwan and Israel. Being dedicated to tech-based startups with the main highlights of AI, Blockchain, IoT, AR and VR are of major concern. They have a wide range of partner networks including Google cloud platform and AWS. The alumni startups of Amplifi Asia are Tellofy, Travdots, Varsito, Keito, Dave.ai, Superwise among many others.

Amplifi Asia offers:

- Mentoring & Guidance.

- Access to global entrepreneurs, advisors, and investors.

- Social media and offline promotions.

- Workshops and Training.

- Networking events.

Also Read: 5 Factors to Consider while choosing a Startup Incubator

ISDI Creative Accelerator – Microsoft Ventures

An interdisciplinary accelerator program designed by the Indian School of Design and Innovation (ISDI) and powered by Microsoft Ventures. Their main aim is to create a collated environment of academics, entrepreneurship, industry and capital with an understanding of design thinking. It will provide an opportunity for budding entrepreneurs to launch/restructure their business with an intensive 6-month program. It would mainly comprise technology, design and business innovation.

ISDI Creative Accelerator offers:

- Access to business support partners.

- Mentoring & Guidance.

- Support in design strategy and branding.

- Capacity building.

- Funding support.

- Investors’ Connection.

Zone Startups India

Zone Startups, a Startup accelerator spread across the world, offers strategic guidance to accelerate the market validation of the startups. In addition to providing seed capital and post-funding support, Zone Startups also focuses on networking, customer acquisition, and consulting practices. With a wide range of business experts and mentors, startups can gain in-hand knowledge on various aspects of the business. The focus on sectors is widely spread to Data Analytics, Education, Enterprise, Financial, Health, IoT, Media, and Social.

Its portfolio includes- Actofit, Advenio, Aasaanpay, Difin, Dive, Genecorp, Plackal, Sherelt, Uberlit, Zybra and many more.

Zone Startups India offers:

- Workspace.

- Access to cloud credits.

- Marketing and promotional opportunities.

- Funding.

- Meeting sessions.

- Networking opportunities.

- Business development counselling.

Also Read: Top 10 Startup Incubation Centers in India

Z Nation Lab

The Z Nation Lab recognizes all that is needed to run a startup and tends to achieve success with its strong value proposition to lead the startups to reach the growth stage. With a foothold in the Indian market and presence in Silicon Valley USA, Z Nation lab provides access to global markets and the community. They do not only help in making strategic decisions, scaling up technology, structuring a team, market analysis but also gear up to aid in raising the next round of funding. They are not particular about the kind of sector or industry that the startups focus on, but it is more of being innovative and providing technological solutions to solve real-world problems.

The portfolio includes Hiotify, GetParking, Knight Fintech, Office Pulse, ONN among many.

Z Nation Lab offers:

- Access to the global community and global market.

- Helps in raising the next round of funding.

- Business and Tech support.

Startupbootcamp FinTech

With more than 870 startups accelerated, Startupbootcamp provides invaluable support and guidance in the journey of early-stage tech ventures. They have accelerator programs spread across Amsterdam, London, New York, Singapore, Australia, and many others, thus providing access to the global community and market. They work with many leading brands like Intel, Cisco, Mastercard, Deutsche Bank, Airbus Group, Google Cloud, and many others.

Startupbootcamp offers:

- International Networking to mentors, investors, and partners.

- Business & Tech Support.

- Funding.

- Events & Conferences globally.

Also Read: 16 Fascinating Coworking Spaces in Mumbai

ScaleMinds

It is a business development driven accelerator for high growth startups. With a major focus on seed funding, it offers an on-site accelerator program for about 16weeks. They invest up to INR 10 Lakhs along with other benefits like server credits, workspace etc.,

ScaleMinds offers:

- Mentoring.

- Seed Funding.

- Monitoring outcome.

- Assists in building necessary skills.

- Access to a wider community.

MITCON Technology Business Incubator Centre

Being promoted by MITCON Consultancy & Engineering Services Ltd., MITCON TBI is sponsored by the Department of Science and Technology, Government of India. It is concentrated on various disciplines in Biotechnology, Agriculture, Food Processing, and Pharmaceutical. As a TBI, the incubator centre focuses on rural entrepreneurship that would lead to boosting the economy of the country.

MITCON Technology Business Incubator Centre offers:

- Consultancy & Training.

- Tech and Business support.

- Specialized services to Biotechnology & Agriculture SMEs.

- Workspace & Information centre.

- Computing facilities.

NASSCOM 10000 startups

NASSCOM aspires to build and nurture the Indian Startup Ecosystem via various programs under them. They have programs relating to Incubate, Virtual Incubate, NIPP (NASSCOM Industry Partnership Program), and Integrate (Global Acceleration). It is associated with esteemed funding partners which include CrunchBase, Nexus, Indian Angel Network, etc.

Some of their startups include Asksid, Headway.ai, Bigtrade, Bombay Play and many more.

NASSCOM 10000 startups offer:

- Community connect.

- Challenges and Hackathons.

- Mentors and Evaluators.

- Consulting sessions.

- Startup Kits.

Also Read: Top Startups & Entrepreneurs in Mumbai

Science and Technology Park (Scitech Park)

Being one of the leading Entrepreneurship parks, Scitech is supported jointly by the NSTEDB, Department of Science and Technology, Government of India, and Savitribai Phule Pune University. The primary aim of this park is to provide aid to innovative and tech-based startups in various areas which include Pharma, Biotechnology, Foodtech, Agriculture, Cyber Security, IT, Cleantech, etc. It had established an independent Business Incubator “Growth Lab” to support startups in their journey of growth.

Some of the incubated companies include – GisDox, Toshvi, Relationware, iZone Technologies, VB Infotech among many.

Scitech Park offers:

- Incubator management.

- Mentoring.

- Access to a wider network.

- Legal & accounting assistance.

ISME ACE Accelerator

It is one of India’s largest Fintech Accelerator, with a major focus on early-stage ventures. It assists startups in developing a scalable business with real customer data. It is part of India’s largest Innovation & Entrepreneurship Ecosystem which is designed for developing India’s financial services sector.

ISME ACE Accelerator offers:

- Seed Funding.

- Media Exposure.

- Investor network support.

- Mentorship support.

- Access to financial services partner firms.

- CFO & Legal support.

JioGenNext

Reliance Industries backed accelerator, JioGenNext provides an extraordinary platform for startups to flourish in the Jio ecosystem. It aims to help the young-minded and enthusiastic technopreneurs with a spark to achieve growth with speed, scale, and sustainability that is incomparable.

Apiria, Ayasta, Fingage, Payeasy, Zoapi, Puzzelo, Pioctave, Mozzo, etc. are some of the startups that accelerated.

JioGenNext offers:

- Mentoring & Guidance.

- Networking.

- Business & Tech assistance.

Centre for Incubation and Business Acceleration (CIBA)

Being supported by the Department of Science & Technology under the Startup India Action plan, CIBA acts as a support system for startups in their journey of establishment. From consultation to seed funding and growth acceleration, CIBA aims to provide a collaborative environment to the entrepreneurs and build the startup ecosystem.

CIBA offers:

- Workspace facilities.

- Prototyping lab.

- Management and Networking support.

- Business plan assistance.

- Seed funding.

- Mentoring & Training programs.

- Professional support services (CS, CA, Legal, Branding).

YES Fintech

A platform comprising of YES Bank and Fintech startups that aims to create and develop innovative solutions for the market. Their major focus areas include Digital Payments, Cybersecurity, Big data & Analytics, Digital Banking, Lending, Wealth tech and process automation.

YES Fintech offers:

- Funding Access & Mentorship.

- Digital Banking Tools.

- Customer Access.

- Global Market.

ThinQbate

ThinQbate, a startup incubator, provides an ecosystem to entrepreneurs filled with knowledge sharing, infrastructure, vast community, and capital adding value to the business. With the partnership with Hatcher+, a data-driven venture firm that uses machine learning and AI to identify early-stage opportunities, Thinqbate will be helped by them as a significant role in the funding process. Startups include- Calamus, NapNap, Redesyn, Loyalty, Taleho, SuperFan, Physiz, etc.

ThinQbate offers:

- Training & Mentoring.

- Access to a vast community.

- Infrastructural support.

- Backend operations.

- Legal & tax assistance.

- Follow on investment opportunities.

- Business development support.

Incubation Center, S.P. Jain Institute of Management and Research (SPJIMR)

SPJIMR plays an important role in promoting entrepreneurship and thereby setting up an Incubation centre that helps startups in venturing in the right direction. It is envied for providing opportunities to SPJIMR students, alumni, and faculty. The assistance provided by this centre will help startups achieve various milestones in their journey.

SPJIMR offers:

- Mentoring & Training.

- Business-related assistance.

- Access to potential investors & VCs.

Venture Nursery

Venture Nursery, India’s first angel-backed startup accelerator, is based on the belief that the success of noteworthy startups plays an important role in the ecosystem. It tends to undertake various mentoring roles and training that would help the entrepreneurs with all the needed support like infrastructural, learning, etc.

Its portfolio includes Talview, Oyo rooms among many.

Venture Nursery offers:

- Connect to various Angel investors and Industry experts.

- Access to business support partners.

- Assistance in building a business plan.

- Infrastructural support like working space.

- Helps with legal compliances.

- Intellectual property management.

But this accelerator is not active anymore.

Conclusion

This was our list of Incubators & Accelerators in Mumbai. If you are not among them, then connect with us at shubham@startuptalky.com to get featured in the list.

FAQs

What are Startup Incubators?

Startup Incubators are the organization that help newly found and early-stage startups to scale their business.

What does a startup incubator do?

Startup incubators help entrepreneurs grow their business by providing workspace, seed funding, mentoring, and training.

What is Startup Accelerator?

Startup Accelerator is the combination of two words – Startup and Accelerator. A startup is a newly established business whereas an accelerator is either a person or an organization that causes something to happen or develop more quickly.

So when combined together, startup accelerators are the organizations that support early-stage, growth-driven companies through education, mentorship, and financing.

What is the difference between an incubator and an accelerator?

In simple words, Accelerators focus on scaling a business while incubators focus on innovation.

Should you join a Startup Incubator or Accelerator?

Startup Incubator or Accelerator helps the startup at the initial stage to take their business to a higher level. They provide guidance, mentoring, funding, infrastructure, coworking space, investors, etc. to startups in order to scale their business. They can be a good source of advice for early-stage startups.

Which are the top startup incubators and accelerators in Mumbai?

Here’s the list of top startup incubators and accelerators in Mumbai.

- Rise Accelerator

- UnLtd India

- Espark Viridian

- Venture Catalysts

- Society for Innovation and Entrepreneurship (SINE)

- Amplifi Asia

- ISDI Creative Accelerator – Microsoft Ventures

- Zone Startups India

- Z Nation Lab

- Startupbootcamp FinTech

- ScaleMinds

- MITCON Technology Business Incubator Centre

- NASSCOM 10000 startups

- Science and Technology Park (Scitech Park)

- ISME ACE Accelerator

- JioGenNext

- YES Fintech

- ThinQbate

- Incubation Center, S.P. Jain Institute of Management and Research (SPJIMR)

- Centre for Incubation and Business Acceleration (CIBA)

- Venture Nursery