Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations.

BlueStone is a renowned online jewelry brand that has revolutionized the way consumers shop for fine jewelry in India. With a focus on quality and design, BlueStone ensures that each piece is crafted with precision, using ethically sourced materials. The brand’s user-friendly platform allows customers to customize designs, making the jewelry shopping experience personal and engaging.

This StartupTalky article explores BlueStone’s journey, innovative business model, and its impact on the Indian jewelry market.

BlueStone – Company Highlights

| Name | Bluestone |

|---|---|

| Headquarters | Bangalore |

| Sector | E-commerce |

| Founder | Gaurav Singh Kushwaha |

| Founded | 2011 |

| Valuation | $970 million (March 2025) |

| Website | Bluestone.com |

BlueStone – About

BlueStone – Industry

BlueStone – Founders and Team

BlueStone – Startup Story

BlueStone – Mission and Vision

BlueStone – Name, Tagline and Logo

BlueStone – Business Model

BlueStone – Revenue Model

BlueStone – Challenges Faced

BlueStone – Funding and Investors

BlueStone – Growth

BlueStone – Financials

BlueStone – IPO

BlueStone – Online and Social Media Presence

BlueStone – Awards and Achievements

BlueStone – Competitors

BlueStone – Future Plans

BlueStone – About

Since its launch in 2011, BlueStone has grown into one of India’s go-to destinations for elegant, high-quality jewelry. Whether you’re looking for something timeless or trendy, they’re here to elevate your jewelry experience with a blend of creativity, quality, and personalized service.

They offer a dazzling collection of over 8,000 unique designs—each one crafted with meticulous care and attention to detail. What makes them stand out? You have the freedom to tailor your jewelry exactly to your liking. Adjust the gold purity, color, or diamond clarity to fit your style and occasion with a motto of ‘Your vision, your jewelry!’

Their stores are more than just a place to shop—they’re designed to offer an immersive experience. With a welcoming atmosphere, knowledgeable staff, and the sparkle of their stunning collections, each visit is a memorable one. Team BlueStone strives to make every customer feel at home while exploring the brilliance of their jewelry.

Behind each piece is their award-winning design team, ensuring that every product you pick up is a masterpiece. Leveraging cutting-edge technology and innovative craftsmanship, they bring you jewelry that shines as bright as your special moments. Whether you’re buying for yourself or a loved one, BlueStone promises excellence in every detail.

BlueStone – Industry

India’s jewelry industry plays a vital role in the nation’s economy, contributing around 7% to its GDP as of early 2022, and employing approximately 5 million people. The sector, especially known for its gold and diamond trade, has immense growth potential, making it a key focus for export promotion. Recent initiatives by the government, such as allowing 100% Foreign Direct Investment (FDI) and signing the Comprehensive Economic Partnership Agreement (CEPA) with the UAE, have further boosted this potential by enhancing global market access and encouraging investment.

Despite a slight decline in exports in FY24, India’s gems and jewelry industry remains strong, with its market size expected to reach $100 billion by 2027. The future growth will likely be driven by the rise of organized retail brands, which bring innovation, diverse products, and expanded market reach. Additionally, relaxed gold import restrictions, stabilizing gold prices, and low-cost gold loans are set to fuel further expansion in the sector. India’s status as a hub for jewelry manufacturing, with over 450 organized players, ensures it will continue to play a significant role in global markets.

BlueStone – Founders and Team

Gaurav Singh Kushwaha

CEO and Founder

Gaurav Singh Kushwaha, the visionary founder and CEO of BlueStone, has reshaped India’s fine jewelry market with his innovative approach to blending the digital and physical shopping experience. An IIT Delhi alumnus, Gaurav’s entrepreneurial journey spans over two decades, during which he pioneered India’s first Web 2.0 portal, tapping into the early wave of social media and carving out a name as a forward-thinking leader.

Before launching BlueStone, Gaurav Singh Kushwaha co-founded Chakpak, an online entertainment portal, in 2007. Under his leadership, Chakpak secured two rounds of funding, marking his first entrepreneurial success. Before his ventures, Gaurav gained valuable experience working at Amazon, both in the USA and India, where he honed his skills in tech and business strategy. These experiences laid the foundation for his entrepreneurial journey, ultimately leading him to establish BlueStone and revolutionize the fine jewelry industry.

Sudeep Nagar

Sudeep Nagar, the COO of BlueStone, has been a driving force behind the company’s evolution into a leading omnichannel fine jewelry brand in India. A graduate of IIM Ahmedabad, Sudeep brings a wealth of experience from his work in tech, sales, and luxury real estate, skills he has skillfully applied to BlueStone over the past decade. Before his pivotal role at BlueStone, Sudeep Nagar served as the Deputy General Manager of Sales Strategy and Planning at the Lodha Group. He has also worked at Computer Sciences Corporation (CSC) and HCL Technologies. His strategic insights and experience in this position helped shape his understanding of market dynamics and customer needs.

BlueStone – Startup Story

Gaurav Kushwaha is more than just the founder and CEO of BlueStone Jewellery; he’s a trailblazer who identified the immense potential within the online jewelry sector. A daring entrepreneur at heart, Gaurav excels in creating businesses that challenge the norm while achieving profitability.

His entrepreneurial path began at the young age of 27 when he launched his first website in 2006 – Chakpak. It was a popular movie review platform where users could engage, debate, and share their views on films. Within just three years, it rose to become one of the top 50 websites in India, showcasing its widespread appeal.

Building on this success, founder Gaurav Kushwaha, along with Vidya Nataraj, ventured into the world of fine jewelry by starting BlueStone in 2011. BlueStone quickly gained recognition as a leading online destination for exquisite jewelry, offering customers high-quality, customizable pieces with a seamless shopping experience.

One of its remarkable achievements includes securing a personal investment from Ratan Tata, a distinguished figure in Indian business.

The first meeting with Tata in Mumbai was a noteworthy moment in Gaurav’s journey. Rather than simply pursuing financial support, Gaurav sought to learn from the respected entrepreneur. Tata’s guidance was straightforward yet impactful: prioritize creating value for customers and strive to build an outstanding product, service, and workplace culture. This mantra has been instrumental for Gaurav and his team at BlueStone.

BlueStone – Mission and Vision

Mission Statement: At BlueStone, the mission is to deliver exquisite jewelry that resonates with every individual’s unique style and occasion. Each piece is individually crafted and undergoes rigorous quality checks to ensure that it meets the highest standards of purity and authenticity before it reaches your doorstep. Whether you’re looking for plain gold, dazzling diamonds, or vibrant gemstone jewelry, BlueStone offers a design to suit every mood and budget.

Vision: The vision of BlueStone revolves around building trust and transparency in the jewelry industry. They are committed to maintaining ethical practices across social, environmental, and business dimensions, ensuring no compromise on integrity. By allowing customers to personalize their jewelry choices, BlueStone fosters a lifelong relationship, offering a seamless exchange experience and a commitment to customer satisfaction that extends far beyond the initial purchase.

BlueStone – Name, Tagline and Logo

The BlueStone logo is a stunning embodiment of luxury and elegance, featuring a harmonious blend of blue and white hues. The glossy finish of the logo reflects sophistication, instantly capturing the eye and conveying a sense of refined quality. The deep blue symbolizes trust and reliability, while the crisp white accentuates purity and clarity, echoing the brand’s commitment to authenticity in every piece of jewelry. This striking logo not only represents the essence of BlueStone but also resonates with customers seeking exquisite craftsmanship and a touch of elegance in their jewelry choices.

BlueStone – Business Model

BlueStone has carved a niche for itself in the online jewelry retail industry with a forward-thinking eCommerce business model. By integrating technology, craftsmanship, and customer engagement, the brand has become a dominant player in this competitive space. Here’s a closer look at how BlueStone operates:

- Online Retail Focus: Customers can easily browse, customize, and purchase jewelry from the comfort of their homes.

- B2C Model: Eliminates the need for middlemen, enhancing cost efficiencies and providing a personalized shopping experience.

- Extensive Product Range: Offers over 8,000 unique designs, including rings, bracelets, and everyday accessories, catering to diverse customer preferences.

- Money Return Guarantee: Provides a 30-day money-back guarantee to build trust and confidence in purchases.

- Customization Options: Customers can tailor their jewelry to their liking, enhancing engagement and satisfaction.

- Quality Assurance: Ensures that every piece meets high-quality standards with full transparency in pricing and materials.

- Physical Retail Presence: Maintains physical stores alongside the online platform to offer a comprehensive shopping experience.

- Quick Delivery Options: Includes next-day delivery to enhance customer convenience.

- Try-at-Home Service: Allows customers to try jewelry from home, avoiding crowded retail environments.

- Customer Incentives: Offers Blue Cash, discounts, and subscription plans to foster customer loyalty and engagement.

BlueStone – Revenue Model

The revenue model of BlueStone is strategically designed to maximize earnings through multiple streams. By focusing on product sales, customization, and innovative subscription plans, BlueStone ensures a sustainable and profitable business. Here’s how BlueStone generates revenue:

- Product Sales: The primary source of income comes from the sale of jewelry items via both online and physical stores.

- Customization Fees: Additional charges apply to customers who choose to personalize their jewelry, contributing to revenue growth.

- Subscription Plans: Offers programs like the Gold Mine 10+1 Plan, providing members with exclusive discounts and offers, and encouraging repeat business.

- Strong Customer Service: Committed to exceptional customer experience, which drives repeat purchases and increases overall sales.

- User-Friendly Interface: An easy-to-navigate platform that enhances customer satisfaction and boosts conversion rates.

- Quality and Authenticity: The brand’s commitment to high standards ensures customer trust, leading to increased sales and referrals.

BlueStone – Challenges Faced

The jewelry industry has traditionally lacked the incentive to embrace technological advancements due to its fundamentally different business model, as noted by Gaurav Singh Kushwaha, founder and CEO of BlueStone. While the Indian eCommerce market has rapidly expanded, creating an illusion of permanence in online shopping, many consumers were still in college when Flipkart launched just a decade ago. The evolution of Indian eCommerce began with commoditized products like books and electronics, eventually branching out into more personal categories such as apparel and jewelry.

In contrast to conventional jewelers, who maintain substantial inventories for customers to explore in-store, BlueStone operates with a vast catalog of over 6,000 designs that are made to order. To address this unique challenge, BlueStone invested significantly in technology and logistics—not merely for website functionality like most eCommerce platforms but specifically for the manufacturing processes of the jewelry they sell. By establishing its manufacturing facility that is closely integrated with its website, BlueStone has innovated across the entire production chain, enabling it to create products within a three to five-day timeframe. This operational model aligns more closely with companies like Lenskart, which manufactures glasses on demand, rather than traditional marketplaces such as Flipkart or Amazon.

BlueStone – Funding and Investors

Since its founding, BlueStone has reached impressive milestones. The company attracted a substantial investment of INR 100 crore from Nikhil Kamath, co-founder of Zerodha. With manufacturing facilities in Mumbai and Jaipur, BlueStone has successfully enhanced its production capabilities.

Following several funding rounds from both emerging and established investors, the company’s valuation skyrocketed to around $970 million.

| Date of Funding | Funding Amount | Round Name | Investors |

|---|---|---|---|

| August 22, 2024 | INR 900 crore | Series F | Peak XV Partners, Prosus, Think, Pratithi Investments Steadview |

| June 24, 2024 | $12 million | Conventional Debt | Neo Markets Services |

| March 11, 2024 | $9 million | Venture Debt | Trifecta Capital |

| September 28, 2023 | $70.6 million | Series F | Info Edge Ventures,, IvyCap Ventures, NV Holdings, Twin & Bull, Stride Ventures, Alteria Capital, Ohm Enterprises, Pratithi Investments, Innoven Capital, Kalaari Capital, Iron Pillar360 One, NKSquared Global, Kamath Associates, Girnar Growth Ventures, Nezone Enterprises, Prabhushree Trading.Angel Investors: Raveen Sastry, Ashwin Kedia, Deepinder Goyal, Sakar Bora |

| March 15, 2022 | $30 million | Angel | Sunil Kant Munjal, GrowthStory |

| July 06, 2021 | $6.5 million | Series E | Innoven Capital, Accel, AT Capital Group, Saama Capital Brainstorm Force, Ashoka.Angel Investors: Esha Parnami, Nitin Rajput, Saurabh Mehta |

| May 29, 2020 | $2.0 million | Series D | Accel, Kalaari Capital, Iron Pillar, IvyCap Ventures, Saama Capital, 360 One |

| April 26, 2019 | $5.0 million | Series D | Accel, IvyCap Ventures, Dragoneer Investment Group, Kalaari Capital, Iron Pillar, RB investments, Saama Capital, 360 One, Avanz Capital. Angel Investors: Raveen Sastry |

| February 21, 2018 | $8.1 million | Series D | OBOR Capital, Kalaari Capital, Accel, Iron Pillar,IvyCap Ventures,RB investments, Fairmont Capital, Saama Capital, IIFL Finance, 360 OneAngel Investor: Gaurav Deepak |

| July 01, 2016 | $76.4 million | Series D | Accel, Iron Pillar,Kalaari Capital,IvyCap Ventures,RB investments,Saama Capital, Dragoneer Investment Group, Innoven Capital, IIFL Finance |

| July 10, 2015 | $16.0 million | Series C | Accel,IvyCap Ventures,Kalaari Capital,Dragoneer Investment Group, Saama Capital. |

| March 18, 2014 | $10 million | Series B | Kalaari Capital,Accel,Saama Capital, RNT Associates |

| January 24, 2012 | $5.3 million | Series A | Accel, Saama Capital,SVB.Angel Investor: K Ganesh |

| October 16, 2011 | $200K | Angel | Angel Investor: Manjusha Anumola, Ganesh Narayan |

BlueStone – Growth

BlueStone is positioning itself as a key player in India’s jewelry market, competing with major brands like Titan’s Tanishq, Kalyan Jewellers, and Senco Gold. Founded by Gaurav Singh Kushwaha and Vidya Nataraj in 2011, BlueStone has expanded its operations to include over 203 physical stores across 86 cities in 26 states and union territories in India as of June 30, 2024.

The company offers a catalog of over 7,000 unique jewelry designs. BlueStone manufactures its jewelry in Mumbai, Jaipur, and other locations. Initially an e-commerce brand, BlueStone ventured into offline retail with its first store in Delhi’s Pacific Mall in 2018 and has since expanded to multiple locations across the country.

BlueStone – Financials

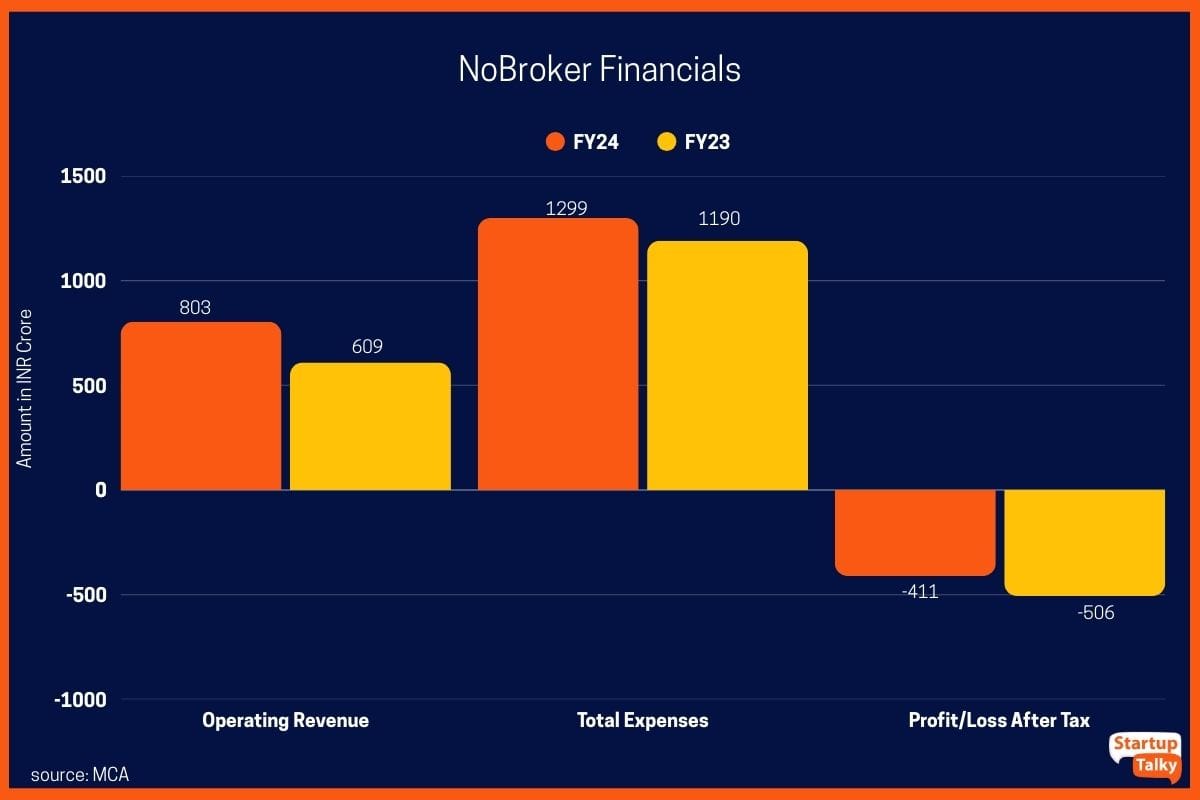

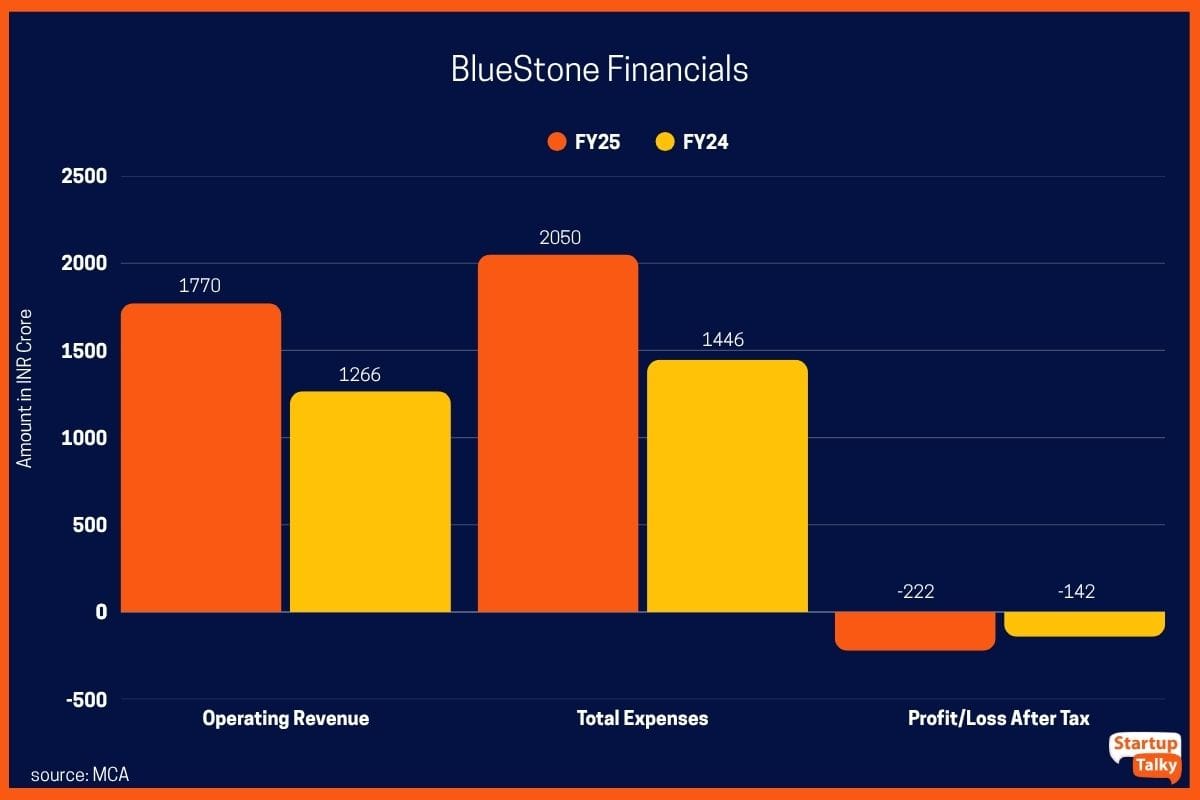

| BlueStone Financials | FY25 | FY24 |

|---|---|---|

| Operating Revenue | INR 1770 crore | INR 1266 crore |

| Total Expenses | INR 2050 crore | INR 1446 crore |

| Profit/Loss | Loss of INR 222 crore | Loss of INR 142 crore |

The company’s sole revenue stream was the sale of diamond, gold, platinum, gemstone, and pearl jewelry, with an average order value (AOV) of INR 47,671 in FY25. This growth was steered by increasing store maturity and a broader product portfolio. The Bengaluru-based company operated 275 stores across 117 cities in 26 states and union territories by March 2025.

Meanwhile, online sales contributed only 6.66% of the total sales, while the rest of the income came from stores and other channels.

On the expense side, Bluestone’s cost of materials remained its largest expense head, which increased by 46% to INR 1,098 crore and accounted for 54% of total expenses. Employee benefit expenses rose 47% to INR 203 crore, while advertising costs stood at INR 159 crore, up 28% from FY24.

Other operational expenses and finance costs contributed another INR 643 crore. Overall, total expenses rose 42% to INR 2,050 crore in the last fiscal year (FY25) from INR 1,446 crore in FY24.

BlueStone – IPO

BlueStone has received approval from the Securities and Exchange Board of India (SEBI) for its upcoming Initial Public Offering (IPO). The IPO will include a fresh issue of shares worth INR 1,000 crore and an Offer For Sale (OFS) of up to 23,986,883 equity shares by existing shareholders.

The company intends to allocate INR 750 crore from the fresh issue to fund working capital requirements and for general corporate purposes. The offering will follow a book-building process, with at least 75% of the net offer reserved for Qualified Institutional Buyers (QIBs), up to 15% for Non-Institutional Investors (NIIs), and up to 10% for Retail Individual Investors (RIIs).

BlueStone – Online and Social Media Presence

BlueStone employs a multifaceted digital marketing strategy that leverages the strengths of both online marketing and social media to craft a comprehensive promotional plan. By collaborating with well-known actresses, celebrities, and influencers, the brand effectively targets its desired audience, creating a direct connection that resonates with potential customers. Their commitment to cultivating a robust following across various social media platforms has significantly enhanced engagement and bolstered brand visibility. Campaigns featuring prominent Indian figures, like Alia Bhatt, exemplify their approach, further solidifying their allure among consumers.

Recognizing the importance of deeper engagement with their audience, BlueStone has strategically focused on the modern Indian woman, whose interest in jewelry is driven more by fashion and aspiration than by investment value. To address this, the brand has developed captivating social media campaigns tailored to resonate with its audience, successfully capturing attention and igniting interest in its diverse jewelry offerings.

To maximize the effectiveness of its messaging, BlueStone has seamlessly integrated its campaigns across email communications and below-the-line (BTL) initiatives, ensuring a consistent and cohesive brand narrative throughout all channels. Additionally, the company has produced engaging web film scripts to raise awareness about its services, demonstrating its commitment to enhancing customer interaction. Through these innovative digital marketing approaches, BlueStone continues to solidify its position as a trendsetter in the jewelry industry.

BlueStone – Awards and Achievements

- Outstanding e-Retail Performance: BlueStone’s excellence in the online retail space.

- Best Online Jewellery Portal: Awarded by the India Bullion and Jewellers Association.

- Luxury e-Retailer of the Year: Awarded at the 4th Indian Retail & e-Retail Awards in 2015.

- Fortune India’s “40 Under 40”: Gaurav Kushwaha, CEO of BlueStone, was featured in this list, recognizing him as one of India’s top young entrepreneurs driving innovation and growth in the jewelry sector.

BlueStone – Competitors

Bluestone’s close competitor, CaratLane, which is owned by Titan, reported impressive financial results for FY24, with INR 3,081 crore in revenue and a INR 79 crore profit. Other competitors:

- Tanishq

- Joyalukkas

- Kalyan Jewellers

- Melorra

BlueStone – Future Plans

Bluestone is focusing on aggressive expansion, both online and offline, to solidify its position in the jewelry market. They plan to grow their store network, enhance their omnichannel presence, and leverage technology for a seamless customer experience. The company also plans to launch an IPO to raise capital for these expansion plans and for general corporate purposes.

FAQs

What is BlueStone?

Established in 2011, BlueStone is India’s leading destination for high-quality fine jewelry with strikingly exquisite designs. It is one of India’s largest eCommerce portals for fine jewelry.

Who is the founder of BlueStone?

Gaurav Singh Kushwaha is the founder of BlueStone.

When was BlueStone founded?

BlueStone was founded in 2011.

Who are the main competitors of BlueStone?

The main competitors of BlueStone include CaratLane, Tanishq, Joyalukkas, Kalyan Jewellers, Mellora, and more.