In this exclusive interaction with Neha Patil, Founder of ProGen Ventures, she shares her journey from working with startups in the UK to becoming an early-stage investor in India. She discusses ProGen’s focus on providing smart capital to innovative startups, emphasising the role of technology and sustainability. Patil also talks about how she identifies investment opportunities in India’s growing startup ecosystem. Additionally, she touches on the challenges she’s faced as a young woman in venture investing and how she is overcoming them.

StartupTalky: What motivated you to establish ProGen Ventures, and how did your background contribute to its foundation?

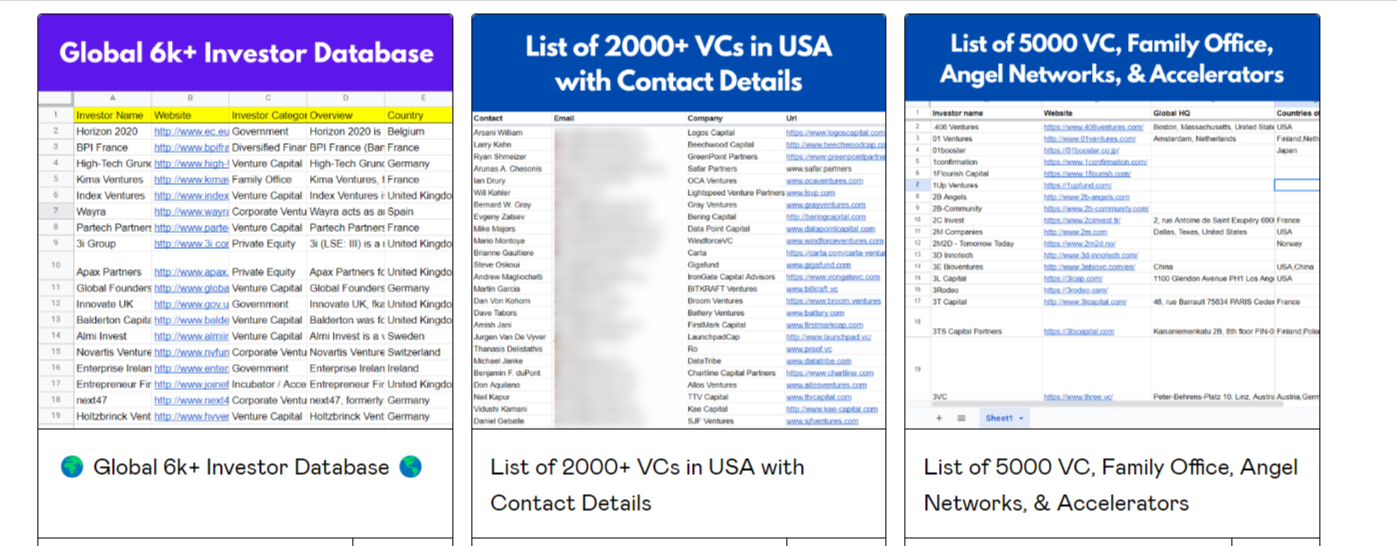

Ms. Patil: India is the 3rd largest startup ecosystem in the world. We are home to 100+ unicorns, 5000+ angel investors, 1400+ venture capitalists, and 1100+ private equity firms.

Since childhood, I have been an avid reader and have an innate curiosity about how things work. Coming from a business background, there was always a certain inquisitiveness around businesses, founders, growth, and capital. I spent 5 years in the UK, studying and working. I went to Imperial College London for my masters and Imperial has one of the finest startup incubators in the world. That’s where I started working closely with startups. That led to working at Mishipay (a global startup).

After coming back to India, I was impressed by the thriving ecosystem and started consulting startups. Soon, started investing in them and created a portfolio of 25 companies as an angel investor.

Having co-invested with some of the finest funds like Matrix Partners, Chiratae, Accel, and Angels like Deepinder Goyal, Kunal Bahl, and Kunal Shah, I have built a portfolio of 25 category creators across consumer, enterprise saas, fintech, and climate tech startups.

ProGen was incepted in 2024 January and we are working towards building an early-stage venture firm that provides smart capital to champion teams disrupting the status quo. There are plenty of venture firms in the country. The idea is to provide smart capital that goes beyond writing a cheque. Today, founders have access to capital but lack hands-on help to help them hire better, make smarter financial decisions, and build sustainable long-term businesses. We enable them by connecting them to domain experts in our network who help them create a faster growth engine in the process.

ProGen focuses on new-age startups that resonate with India’s 65% population that falls below the age of 35. We are investing in products, services, and technologies that enable this generation to shop better, live healthier and sustainably, work smarter, invest more, travel easier, and get access to know-how faster than ever before.

As an early-stage venture investor, I only invest in category creators that have the ability to own significant market share in the future and create smarter solutions for the new-age economy.

StartupTalky: What unique opportunities do you see in the Indian startup ecosystem that excite you?

Ms. Patil: India is at the cusp of incredible innovation not in one, two, or three sectors but in almost every single sector across the economy. Every space is ripe for disruption- From lending and wealth management for retail investors to kids’ products, wellness, and healthcare, logistics, healthcare, infrastructure, proptech, etc.

This allows for a wide array of opportunities to invest in. I am excited about the future of climate, retail, and commerce in the country.

StartupTalky: What are the key strategies and factors ProGen Ventures uses to identify and evaluate startups for investment?

Ms. Patil: We evaluate anywhere between 300-400 startups a year. Most of these are across sectors. We take a macroeconomic perspective to identify startups. A lot of research usually goes into identifying evolving consumer trends and needs across sectors.

For example, FirstCry is a phenomenal success story because India is one of the youngest economies in the world. Disposable income in each household has increased significantly. With both working parents, there is a growing awareness in terms of educational toys, conscious clothing for kids, nutrition for kids, etc. This has enabled FirstCry to scale and capture a significant market share.

ProGen’s investment thesis largely focuses on investing in solutions that are being built for an agile tomorrow.

StartupTalky: What is the typical process and timeline for a startup to secure investment from ProGen Ventures, and how can founders best prepare for it?

Ms. Patil: We take 2 weeks once founders share the necessary data to make a final decision.

At an early stage, we have limited data so the conviction is largely around founders, their authenticity, domain expertise, and ability to scale their startup.

StartupTalky: How does ProGen Ventures support its portfolio companies beyond just providing financial investment?

Ms. Patil: To reinstate, at ProGen we are staunch believers in smart capital. We have an expert network that consists of CXOs, founders, and business operators that help founders with real-time insights into the challenges they face in day-to-day operations.

For example, Adonmo Technologies wanted to expand to newer cities and we helped them acquire those cities 3 quarters earlier than planned. Zomato came in as their largest shareholder post our investment and they have been scaling up since then.

A food tech startup was having a tough time choosing their lead for the next round and we stepped in to help them get a term sheet that resonates with their core values and growth plans.

StartupTalky: Can you share some success stories of startups that ProGen Ventures has invested in and how they have evolved?

Ms. Patil: Most portfolio companies like Cureskin, Beco, OTO capital, Skye Air, BluSmart, and Boba Bhai have raised uprounds within 12-18 months of investing from some of the largest global and Indian funds like Qatar Insurance Authority, Matrix Partners, Temasek, Chiratae Ventures.

StartupTalky: How important is technology in the startups you invest in and what technological trends excite you the most?

Ms. Patil: All portfolio companies use technology as an enabler in everything that they do. I am really looking forward to startups building vertical tools and software using LLMs to enable seamless education, healthcare, commerce, and smart working solutions.

StartupTalky: ProGen Ventures emphasises sustainability. How do you ensure that the startups you invest in align with this value?

Ms. Patil: We are investing in climate-forward ideas and actively supporting startups in that space. Sustainable startups in the current portfolio are Beco, Infinity box, and BluSmart. All three are category leaders in their space and we are looking for more startups disrupting the status quo to enable a more sustainable future.

StartupTalky: What are ProGen Ventures’ plans for future expansion?

Ms. Patil: We are looking to invest in 12-15 startups this year, with an average ticket size of $100-150K. We focus on seed-stage investments.

StartupTalky: What unique challenges have you faced as one of the youngest venture investors, and how have you overcome them?

Ms. Patil: Venture investors historically have been associated with bald men, grey hair, seasoned entrepreneurs, and finance professionals. (Mostly men, 99% of the time).

I don’t fit those stereotypes. I have not exited a startup, I have not worked in finance for the past 15 years, and neither do I come from the investment banking space, and most distinctly, I am a woman. But I let the performance speak for itself.

I started venture investing at 27. At 30, I have a portfolio of 25 startups, most of these names have made it to top startups of the country and have some of the finest backers/investors like Zypp, BluSmart, OTO Capital, Beco, Cureskin, and Adonmo.

If you are bringing value to the table, that’s all that matters.

StartupTalky: What advice would you give to aspiring entrepreneurs seeking investment?

Advice is a very strong term. I am still learning every day from founders and investors, but I think what has worked well for successful founders is more substance and less noise. Focus on building, and rest everything falls into place.