Welcome to StartupTalky’s 2025 Indian startup funding updates! As we move into the New Year, we’re here to provide you with a clear and simple overview of the latest funding news. Our monthly tables, updated weekly, will track the amount each company has raised, the sectors they operate in, the key investors involved, and more.

Whether you’re an investor, entrepreneur, or just curious about the startup scene, this article will keep you informed on the funding trends shaping the industry. Be sure to check back regularly for the latest funding updates and insights!

Indian Startup Funding – October 2025 [6 October – 27 October]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Banana Club | Consumer > Fashion Tech | Karnataka | $1.39M | Seed | – |

| Neulife | HealthTech > Fitness & Wellness Tech | Maharashtra | $1M | Unattributed | Subhkam Ventures |

| Dhobi G | Consumer > Local Services | Tamil Nadu | $171K | Conventional Debt | Indian Overseas Bank |

| Helex | Life Sciences > Genomics | Telangana | Undisclosed | Seed | Bluehill Capital Trust |

| Michezo Sports | Consumer > Sports Services | Karnataka | $2.5M | Seed | Centre Court Capital |

| Celewish | Consumer > Communication Apps | Maharashtra | $750K | Angel | – |

| Megaliter Varunaa | Environment > Waste & Water Management | Telangana | $1.71M | Seed | – |

| The Eye Foundation | Healthcare > Hospital Chains | Tamil Nadu | $75M | Series C | Verlinvest |

| Wonderland Foods | Food & Agriculture > Food & Beverage Products | Delhi | $16M | Series B | Asha |

| CapitalXB Finance | Financial Services > Consumer and SME Loans | Maharashtra | Undisclosed | Conventional Debt | Nicolas Walewski |

| CapitalXB Finance | Financial Services > Consumer and SME Loans | Maharashtra | $15M | Seed | Nicolas Walewski |

| Berar Finance | Financial Services > Consumer and SME Loans | Maharashtra | $17M | PE | Abler Nordic |

| Uniphore | High Tech > Generative AI | California / Tamil Nadu | $260M | Series F | New Enterprise Associates |

| Umagine | Environment > Environment Consultancy Services | Delhi | $850K | Seed | Venture Catalysts |

| Stylox | Consumer Goods > Apparel Brands | Haryana | $340K | Seed | thefef.net |

| Fundamento | Enterprise Applications > Customer Service Software | California / Delhi | $1.9M | Seed | The Players Fund |

| Imagimake | Retail > Mom & Baby Care | Maharashtra | Undisclosed | Series B | Pidilite Ventures |

| EKA | Energy Tech > Electric Vehicles | Maharashtra | $57M | Series A | NIIF |

| HooLiv | Consumer > Residential Real Estate Tech | Delhi | $2.73M | Seed | Negen Capital PMS |

| Healing Hands Clinic | Healthcare > Clinic Chains | Maharashtra | Undisclosed | PE | L Catterton |

| Kraya | Enterprise Applications > SCM Software | Maharashtra | $113K | Seed | AID |

| Zepto | Food and Agriculture Tech > Online Grocery | Karnataka | $300M | Series G | Goodwater Capital |

| DashamLabs | High Tech > Advanced Materials | Haryana | $1.36M | Seed | Speciale Invest |

| Kuku FM | Consumer > Vernacular Platforms | Maharashtra | $50M | Series C | Granite Asia |

| CoreStack | Enterprise Infrastructure > IT Operations | Washington / Tamil Nadu | $50M | Convertible Debt | Post Road Group |

| Thefragaria | Food and Agriculture Tech > Crop Tech | Tamil Nadu | $2M | Seed | WEH Ventures |

| Flowatt Batt | Energy Tech > Energy Storage Tech | Karnataka | $248K | Seed | PedalStart |

| CoinDCX | FinTech > Cryptocurrencies | Maharashtra | Undisclosed | Series D | Coinbase |

| Matters | Enterprise Infrastructure > Cybersecurity | Karnataka | $4.75M | Seed | Kalaari Capital |

| Airoclip | Mobile > Mobile Gaming | Karnataka | $2.75M | Seed | TAC |

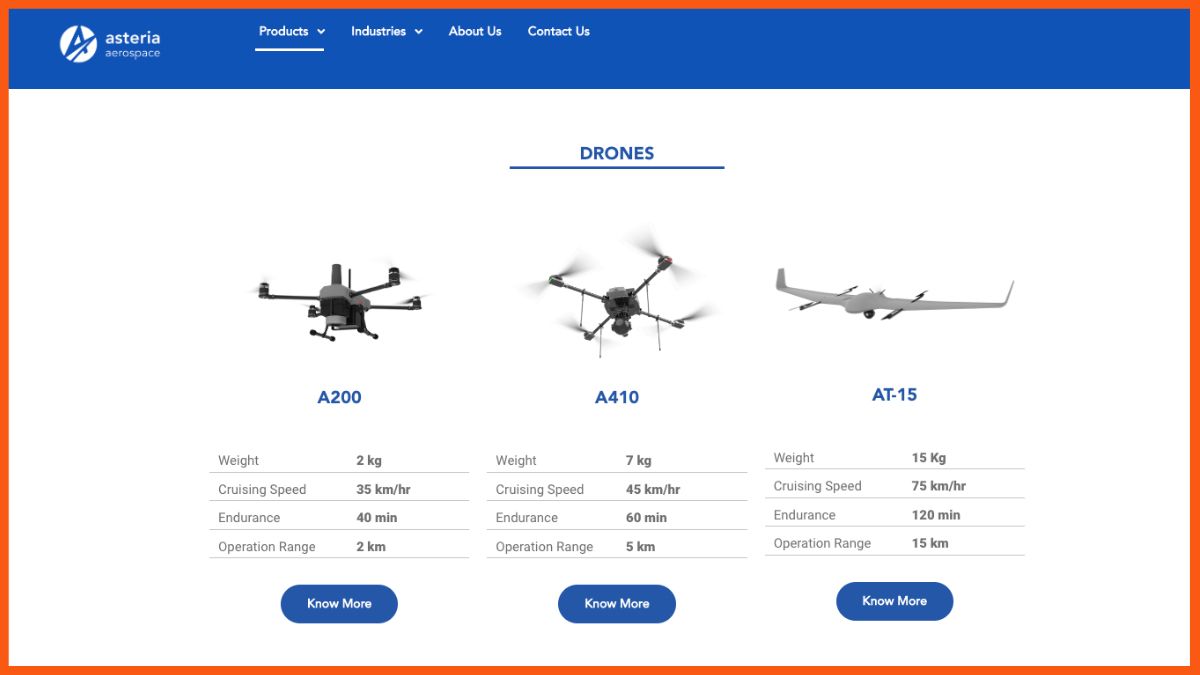

| Airbound | High Tech > Drones | Karnataka | $8.65M | Seed | Humba Ventures |

| CIMCON | Energy > Oilfield Services | Gujarat | $5.86M | Series A | Niveshaay |

| HouseEazy | Consumer > Residential Real Estate Tech | Uttar Pradesh | $17M | Series B | Accel |

| SpeakX | EdTech > Continued Learning | Haryana | $16M | Series B | WestBridge Capital |

| Reia Diamonds | Consumer Goods > Fashion Accessories | Karnataka | $225K | Seed | Venture Catalysts |

| MyWonder | Real Estate & Construction > Construction Management Services | Karnataka | $300K | Seed | Antler |

| Ramkrishna Forgings | Auto > Auto Components | West Bengal | $23.1M | Post IPO | – |

| Exposome | Chemicals & Materials Tech > Chemicals Tech | Maharashtra | $2.59M | Seed | Colossa Ventures |

| GoodScore | FinTech > Alternative Lending | Karnataka | $13M | Series A | Peak XV Partners |

| Onida | Consumer Goods > TV & Audiovisual Products | Maharashtra | $14.8M | Post IPO | Authum |

| FS Life | Consumer > Fashion Tech | Haryana | $5.6M | Series B | Colossa Ventures |

| Hunger | Food & Agriculture > Food Service Chains | Maharashtra | Undisclosed | Series A | Lighthouse |

| Hala Mobility | Consumer > Auto E-Commerce & Content | Telangana | $3.38M | Series A | Magnifiq Capital Trust |

| Qapita | FinTech > Investment Tech | Singapore / Telangana | $26.5M | Series B | MassMutual Ventures |

| Pantherun | Enterprise Infrastructure > Enterprise Networking | Karnataka | $12M | Series A | Info Edge Ventures |

| We360.ai | Enterprise Applications > HRTech | Madhya Pradesh | $2M | Seed | GSF |

| Ask My Guru | Consumer > Religion Tech | Karnataka | $500K | Seed | Matrimony.com |

| Rusk Media | Media & Entertainment > Film & TV Studios | Maharashtra | Undisclosed | Series B | IvyCap Ventures Advisors |

| FasTest | HealthTech > Healthcare Booking Platforms | Maharashtra | $135K | Seed | Inflection Point Ventures |

| Ekkaa | Semiconductors > Display Technology | Haryana | $12.2M | Series A | – |

| Eternz | Consumer > Fashion Tech | Karnataka | Undisclosed | Seed | Multiply Ventures |

| GH2 Solar | Energy > Solar Energy | Uttar Pradesh | $6.5M | Series A | GrowMo360 |

| Jaagruk Bharat | Media & Entertainment > Internet First Media | Delhi | $169K | Seed | ajvc |

| Meolaa | Retail > Beauty Tech | Karnataka | $6M | Seed | General Catalyst |

| Rusk Media | Media & Entertainment > Film & TV Studios | Maharashtra | $169K | Angel | Ramesh Gandhi |

| TrusTerra | Auto > Auto Retail & Aftersales | Haryana | $1.01M | Seed | Finvolve |

| Battwheelz | Energy Tech > Electric Vehicles | Haryana | $225K | Seed | Finvolve |

| Intangles | Consumer > Road Transport Tech | Maharashtra | $30M | Series B | Avataar Ventures |

| August AI | HealthTech > Disease Self Management | Karnataka | $3M | Seed | Accel |

| Consuma | Enterprise Applications > MarketingTech | Karnataka | $1.3M | Seed | Equirus Wealth |

| Goodmelts | Retail > Home Care E-Commerce | Karnataka | Undisclosed | Seed | Anicut Capital |

| H2 Carbon Zero | Energy Tech > Energy Storage Tech | Delhi | $850K | Seed | Venture Catalysts |

| ZillOut | Food and Agriculture Tech > Food Tech | Karnataka | $310K | Seed | Jindagilive Angel Network |

| Dezerv | FinTech > Investment Tech | Maharashtra | $40M | Series C | Premji Invest |

| Vipul Organics | Chemicals & Materials > Dyes Pigments and Inks | Maharashtra | $3.97M | Post IPO | – |

| OZi | Retail > Mom & Baby Care | Haryana | $3.3M | Seed | Blume Venture |

| Lucio | High Tech > Chatbots | Karnataka | $5M | Series A | DeVC |

| Finarkein Analytics | FinTech > Banking Tech | Maharashtra | Undisclosed | Seed | DSP Group Family Office |

| PRYM Aerospace | High Tech > Drones | Maharashtra | $2.41M | Seed | Lloyds steel |

| Ecoex | Environment Tech > Solid Waste Management Tech | Delhi | $4M | Seed | – |

| Navata Supply Chain Solutions | Business Services > Supply Chain Services | Telangana | $1.52M | Series A | Abyro Capital |

| AltMat | High Tech > Advanced Materials | Gujarat | Undisclosed | Seed | Rainmatter |

| Exsure | Life Sciences > Oncology | Odisha | $11.3K | Seed | AIC-Nalanda Institute Of Technology Foundation |

| DecorTwist | Consumer Goods > Home Furnishing Products | Uttar Pradesh | $200K | Seed | Tejas Paresh Lodaya |

| GreyLabs | High Tech > Natural Language Processing | Maharashtra | $9.6M | Series A | Elevation Capital |

| Raise | FinTech > Investment Tech | Maharashtra | $120M | Series B | Beenext |

| JSW One MSME | Enterprise Applications > Manufacturing Tech | Maharashtra | $26.5M | Series B | Oneup Financial Consultants |

| ThrustWorks Dynetics | Aerospace, Maritime & Defense Tech > Space Tech | Maharashtra | $789K | Seed | Jamwant Ventures |

Indian Startup Funding – October 2025 [28 September – 5 October]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Art Of Time | Consumer Goods > Retailers | Maharashtra | Undisclosed | Series B | Plutus Wealth Management |

| Sammaan Capital | Financial Services > Consumer and SME Loans | Delhi | $1B | Post IPO | IHC / Marshall Wace |

| Freight Tiger | Consumer > Logistics Tech | Maharashtra | $13.5M | Series C | Tata Motors / Lightspeed India |

| Recyclaro.com | Environment Tech > Solid Waste Management Tech | Uttar Pradesh | $1M | Seed | CapitalOven |

| GrowXCD | Financial Services > Consumer and SME Loans | Tamil Nadu | $22.5M | Series B | Blue Earth Capital / Lok Capital |

| Assesslim | High Tech > AI Infrastructure | West Bengal | $5M | Seed | Foxhog Ventures / IDEAS TIH |

| UNMANND | Aerospace, Maritime and Defense Tech > Military Tech | Karnataka | $2M | Seed | Speciale Invest |

| VAMAm | Consumer > Local Services | Delhi | $2.5M | Seed | Wavemaker Partners / 7Square Ventures |

| Climaty AI | Enterprise Applications > AdTech | Dubai, Karnataka | $2M | Seed | Turbostart |

| Ignosis | FinTech > Banking Tech | Gujarat | $4M | Seed | Peak XV Partners |

| Fyno | Enterprise Applications > Customer Success Management | Karnataka | $4M | Seed | Arkam Ventures / 3one4 Capital |

| Recur Club | FinTech > Alternative Lending | Delhi | $42M | Conventional Debt | InCred / Info Edge Ventures |

| Recur Club | FinTech > Alternative Lending | Delhi | $8M | Series A | Info Edge Ventures |

| Wit And Chai Group | Business Services > Marketing Services | Maharashtra | Undisclosed | Seed | Sanjay Katkar |

| Hocco | Food and Agriculture > Food Service Chains | Gujarat | $13M | Series B | Sauce |

| Petpoojam | Food and Agriculture Tech > Food Tech | Gujarat | Undisclosed | Series C | Dharana / Gujarat Venture Finance |

| Kapivas | Life Sciences > Nutraceuticals Tech | Karnataka | $28M | Series D | Vertex Growth / Jetty Ventures |

| Vaani Research Labs | High Tech > Chatbots | Karnataka | $400K | Seed | Venture Catalysts |

| EF Polymer | Chemicals and Materials > Polymers | Rajasthan | Undisclosed | Series B | Toyoda Gosei / Beyond Next Ventures |

| RUGR | FinTech > Banking Tech | Karnataka | $5M | Seed | Vikasa India EIF Fund |

| IGowise | Energy Tech > Electric Vehicles | Karnataka | – | – | – |

Indian Startup Funding – September 2025 [22 September – 27 September]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| PharmEasy | Health Tech | Mumbai | $191.7 Mn | Debt | – |

| Emergent | AI | Gurugram | $23 Mn | Series A | Lightspeed Ventures |

| Chakr Innovation | Clean Tech | Gurugram | $23 Mn | Series C | Iron Pillar |

| Curefoods | Foodtech | Bengaluru | $18 Mn | – | 3State Ventures |

| Handpickd | Consumer Services | Gurugram | $15 Mn | Series A | Bertelsmann India Investments |

| Rocket | AI | Bengaluru | $15 Mn | Seed | Salesforce Ventures, Accel |

| Vedantu | Edtech | Bengaluru | $11 Mn | – | – |

| Simple Energy | Clean Tech | Bengaluru | $10 Mn | – | Dr Arokiaswamy Velumani (founder, Thyrocare) |

| KisanKonnect | Agritech | Ahmednagar | $8.1 Mn | Pre-Series A | Bajaj Finserv Group |

| Distil | Ecommerce | Mumbai | $7.7 Mn | Series A | Jungle Ventures, CE-Ventures |

| Gullak | Fintech | Bengaluru | $7.5 Mn | Series A | Chiratae Ventures |

| Oolka | Fintech | Bengaluru | $7 Mn | Seed | Lightspeed India, Z47 |

| PRISM | Travel Tech | Mumbai | $5.6 Mn | – | InCred, Analah Capital |

| OnFinance | AI | Bengaluru | $4.2 Mn | Pre-Series A | Peak XV (Surge) |

| Amwoodo | Ecommerce | Kolkata | $4 Mn | Pre-Series A | Rainmatter |

| Cosmoserve Space | Advanced Hardware & Technology | Hyderabad | $3.2 Mn | Pre-Seed | AVCF |

| P-TAL | Ecommerce | New Delhi | $3 Mn | Series A | Venture Catalysts, Rainmatter |

| Xbattery | Clean Tech | Hyderabad | $2.3 Mn | Seed | Bipin Patel Family Office |

| Grest | Ecommerce | Cuttack | $1.8 Mn | – | Equentis |

| VyomIC | Advanced Hardware & Technology | Bengaluru | $1.6 Mn | Pre-Seed | Speciale Invest |

| Akashalabdhi | Advanced Hardware & Technology | Roorkee | $1.2 Mn | Pre-Seed | – |

| Navo | Ecommerce | Gurugram | $902K | Seed | IndiaQuotient |

| Bharat Intelligence | Agritech | Mumbai | $790K | Pre-Seed | Sahyadri Farms |

| Recove | Clean Tech | Bengaluru | $598K | – | Momentum Capital |

| Paar Autonomy | Advanced Hardware & Technology | Bengaluru | $500K | Seed | Venture Catalysts |

| Samaaro | Enterprise Tech | Bengaluru | $500K | Pre-Series A | Inflection Point Ventures |

| Gaadimech | Consumer Services | Jaipur | $169K | – | AJVC |

| Gabit | Ecommerce | Gurugram | – | – | – |

Indian Startup Funding – September 2025 [15 September – 20 September]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Infra.Market | Real Estate Tech | Thane | $83 Mn | Series G | – |

| EvoluteIQ | Enterprise Tech | Bengaluru | $53 Mn | – | Baird Capital |

| FinBox | Fintech | Bengaluru | $40 Mn | Series B | WestBridge Capital |

| Blue Energy Motors | Clean Tech | Pune | $30 Mn | – | Nikhil Kamath, Omnitex Industries |

| InCred Money | Fintech | Mumbai | $30 Mn | – | – |

| EcoSoul | Ecommerce | Noida | $20 Mn | Series B | Accel, Bajaj Financial Securities |

| Indkal | Ecommerce | Bengaluru | $20 Mn | – | – |

| Scalekit | AI | Bengaluru | $5.5 Mn | Seed | Together Fund, Z47 |

| Lucira | Ecommerce | Mumbai | $5.5 Mn | Seed | Blume Ventures |

| SpaceFields | Advanced Hardware & Technology | Bengaluru | $5 Mn | Pre-Series A | Globaz Technologies |

| Pelocal | Fintech | Chennai | $5 Mn | Series A | UNLEASH Capital Partners, Unicorn India Ventures |

| iDO Devices | Ecommerce | Noida | $4 Mn | – | Blume Ventures, Merak Ventures |

| Pascal AI Labs | AI | Bengaluru | $3.1 Mn | Seed | Kalaari Capital |

| Equilibrium | Clean Tech | Noida | $3 Mn | Seed | – |

| INCLUD | Ecommerce | Gurugram | $2.9 Mn | Pre-Series A | 3one4 Capital |

| Blinkit-AI | AI | Gurugram | $1.2 Mn | Seed | Foliflex Cables |

| Supply6 | Ecommerce | Bengaluru | $1.1 Mn | Seed | Zeropearl VC |

| UGX.ai | AI | Gurugram | $1 Mn | Seed | Blue Ocean Venture Partners |

| PlaySuper | Media & Entertainment | Gurugram | $1 Mn | Seed | Chimera |

| Wankel Energy Systems | Clean Tech | Chennai | $1 Mn | Pre-Seed | Shastra VC |

| MyNaksh | Consumer Services | Bengaluru | $852K | Pre-Seed | Eximius Ventures |

| uKnowva | Enterprise Tech | Mumbai | $500K | Pre-Series A | – |

| Raptee.HV | Clean Tech | Chennai | – | – | Technology Development Board (Ministry of Science & Technology) |

Indian Startup Funding – September 2025 [08 September – 13 September]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Flipspaces | Real Estate Tech | Mumbai | $9 Mn | Series C | — |

| Indrajaal | Advanced Hardware & Technology | Hyderabad | $5.5 Mn | Pre-Series A | India Accelerator, Finvolve |

| Presolv360 | Enterprise Services | Mumbai | $4.7 Mn | Series A | Elevation Capital, MGA Ventures |

| Indigrid Technology | Enterprise Services | Gurugram | $4 Mn | — | Cactus Partners |

| Ember | Ecommerce | US | $3.2 Mn | Seed | — |

| Asaya | Ecommerce | Bengaluru | $3.2 Mn | Pre-Series A | RPSG Capital |

| Inamo | Enterprise Services | Mumbai | $3 Mn | Seed | Shastra VC |

| WeHouse | Real Estate Tech | Hyderabad | $2.8 Mn | Series A | — |

| EndureAir Systems | Advanced Hardware & Technology | Noida | $2.8 Mn | — | Indian Angel Network |

| Snap-E-Cabs | Travel Tech | Kolkata | $2.5 Mn | — | Inflection Point Ventures |

| Aurva | Enterprise Tech | New Delhi | $2.2 Mn | Seed | Nexus Venture Partners |

| BacAlt Biosciences | Health Tech | Bengaluru | $2 Mn | Pre-Seed | Avaana Capital |

| PeakAmp | Clean Tech | Gurugram | $1.4 Mn | Seed | Caret Capital |

| FarmDidi | Ecommerce | Mumbai | $793K | Seed | Samved Ventures |

| Prowrrap | Enterprise Services | Delhi | $453K | Pre-Series A | Calance Software; Amit Govil (chairman, Calance Corporation) |

| Biokraft Foods | Clean Tech | Mumbai | $227K | Seed | GVFL |

| Misfits | Ecommerce | Gurugram | — | Seed | Nu Ventures |

| TraqCheck | AI | New Delhi | — | — | Alok Oberoi (chairman, Everstone Capital); Siddharth Mehta (founder, Bay Capital) |

Indian Startup Funding – September 2025 [01 September – 06 September]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| CityMall | Ecommerce | Gurugram | $47 Mn | Series D | Accel |

| Seekho | Media & Entertainment | Bengaluru | $28 Mn | Series B | Bessemer Venture Partners |

| Blue Tokai Coffee Roasters | Ecommerce | Gurugram | $25 Mn | – | – |

| FirstClub | Consumer Services | Bengaluru | $23 Mn | Series A | Accel, RTP Global |

| Colive | Real Estate Tech | Bengaluru | $20 Mn | Series B | Bain Capital |

| Offgrid Energy | Clean Tech | Gurugram | $15 Mn | Series A | Archean Chemicals Industries |

| Reveal Healthtech | AI | US | $7.2 Mn | Series A | Leo Capital |

| PlatinumRx | Health Tech | Bengaluru | $6 Mn | Series A | Stellaris Venture Partners |

| LeafyBus | Travel Tech | Delhi | $4.1 Mn | Pre-Series A | Enetra India |

| Tuco Kids | Ecommerce | Bengaluru | $4 Mn | Series A | RTP Global |

| FlexifyMe | Health Tech | Pune | $2.3 Mn | Pre-Series A | IvyCap Ventures |

| AutoDukan | Ecommerce | Pune | $1 Mn | Pre-Series A | – |

| House of Zelena | Ecommerce | New Delhi | $793K | Seed | Sprout Venture Partners, M Venture Partners |

| Cuzor | Ecommerce | Bengaluru | $566K | Seed | Ramesh Kannan (MD, Kaynes Technology) |

| RxMen | Health Tech | New Delhi | $566K | Seed | Inflection Point Ventures |

| QuantE Energy | Clean Tech | Noida | $500K | Seed | Trillion Dollar Venture Partners |

| Dectrocel | Health Tech | Lucknow | $453K | – | BioAngels (IAN Group) |

| Zanskar | Ecommerce | Bengaluru | $317K | Seed | Zeropearl VC |

| Waterscience | Ecommerce | Bengaluru | $159K | – | Valar Ventures |

| Edgehax | Advanced Hardware & Technology | Bengaluru | $158K | Seed | Inflection Point Ventures |

Indian Startup Funding – August 2025 [25 August – 30 August]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| TransBnk | Fintech | Mumbai | $25 Mn | Series B | Bessemer Venture Partners |

| Altum Credo | Fintech | Pune | $19.4 Mn | – | British International Investment |

| CredRight | Fintech | Bengaluru | $10 Mn | Series B | Abler Nordic |

| WizCommerce | Enteprise Tech | Bengaluru | $8 Mn | Series A | Peak XV Partners |

| Vutto | Ecommerce | Bengaluru | $7 Mn | Series A | RTP Global |

| Palmonas | Ecommerce | Pune | $6.2 Mn | Series A | Vertex Ventures Southeast Asia & India |

| Enmovil | Logistics | Hyderabad | $6 Mn | Series A | Sorin Investments |

| Peeko | Consumer Services | Bengaluru | $3.2 Mn | Seed | Stellaris Venture Partners |

| Matiks | Media & Entertainment | Haveri | $3.1 Mn | Pre-Series A | Tanglin Ventures |

| Wastelink | Cleantech | New Delhi | $3 Mn | Series A | Avaana Capital |

| Harajuku Tokyo Cafe | Fooddtech | New Delhi | $2 Mn | Seed | Indian Angel Network |

| Cumin Co | Ecommerce | Gurugram | $1.5 Mn | – | Fireside Ventures |

| Anmasa | Ecommerce | Gurugram | $1.1 Mn | Pre-Seed | – |

| Nugen | Artificial Intelligence | Ahmedabad | $1 Mn | Pre-Seed | Antler |

| Vaave | Enteprise Tech | Hyderabad | $748K | – | VCMint |

| Hexafun | Ecommerce | Delhi | $510K | Seed | Prajay Advisors |

| Nuyug | Ecommerce | New Delhi | $283K | Pre-Seed | AJVC |

| BhaoBhao | Consumer Services | Mumbai | $200K | – | – |

Indian Startup Funding – August 2025 [18 August – 23 August]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| R For Rabbit | Ecommerce | Ahmedabad | $27 Mn | Series B | Filter Capital, 3one4 Capital |

| Kiwi | Fintech | Bengaluru | $24 Mn | Series B | Vertex Ventures |

| Beyond Appliances | Ecommerce | Bengaluru | $4 Mn | Series A | Fireside Ventures |

| House Of Biryani | Consumer Services | Mumbai | $3.6 Mn | – | – |

| Mitra | Ecommerce | Gurugram | $1.6 Mn | – | Bestvantage Investments |

| PeelON | Enterprise Services | Vishakhapatnam | $1 Mn | Seed | growX ventures |

| Hexafun | Ecommerce | Delhi | $512K | Seed | Prajay Advisors |

| Famyo | Ecommerce | Bengaluru | $457K | Seed | I’n Angel Fund |

| ZenZebra | Consumer Services | Delhi | – | Seed | Rukam Capital |

Indian Startup Funding – August 2025 [11 August – 16 August]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Truemeds | Healthtech | Mumbai | $65 Mn | Series C | — |

| Zepto | Consumer Services | Bengaluru | $45.7 Mn | — | Motilal Oswal Financial Services Ltd |

| Darwinbox | Enterprise Tech | Hyderabad | $40 Mn | — | Ontario Teachers’ Pension Plan |

| Ultraviolette | Cleantech | Bengaluru | $21 Mn | — | TDK Ventures |

| Arintra | Enterprise Tech | US | $21 Mn | Series A | Peak XV Partners |

| Dashverse | Media & Entertainment | Bengaluru | $13 Mn | Series A | Peak XV Partners |

| Lifelong Online | Ecommerce | New Delhi | $13 Mn | — | — |

| Pronto | Consumer Services | Gurugram | $11 Mn | Series A | General Catalyst, Glade Brook Capital |

| Elivaas | Travel Tech | Gurugram | $10 Mn | Series B | Vertex Ventures |

| Graas.ai | Artificial Intelligence (AI) | Singapore | $9 Mn | Series B | Tin Men Capital |

| Refold AI | Artificial Intelligence (AI) | Bengaluru | $6.5 Mn | Seed | Eniac Ventures, Tidal Ventures |

| Olee Space | Advanced Hardware & IoT | Pune | $3 Mn | Seed | — |

| Holiday Tribe | Travel Tech | Gurugram | $3 Mn | Pre-Series A | Powerhouse Ventures |

| Fairdeal.Market | Ecommerce | Gurugram | $3 Mn | Pre-Series A | Incubate Fund Asia |

| Manastu Space Technologies | Advanced Hardware & IoT | Mumbai | $3 Mn | Series A | Capital-A |

| Comminent | Advanced Hardware & IoT | Bengaluru | $2 Mn | — | Transition VC |

| Spike AI | Artificial Intelligence (AI) | Bengaluru | $1.9 Mn | Pre-Seed | Sorin Investments |

| Trackk | Fintech | New Delhi | $1 Mn | Seed | — |

Indian Startup Funding – August 2025 [04 August – 09 August]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| The Sleep Company | Ecommerce | Mumbai | $54.6 Mn | Series D | — |

| RENEE Cosmetics | Ecommerce | Ahmedabad | $30 Mn | Series C | Playbook Partners |

| Fibe | Fintech | Pune | $25 Mn | Debt | Franklin Templeton Alternative Investments Fund |

| SuperGaming | Media & Entertainment | Pune | $15 Mn | Series A | Skycatcher, Steadview Capital |

| Jeh Aerospace | Advanced Hardware & Technology | Hyderabad | $11 Mn | Series A | Elevation Capital |

| Zype | Fintech | Mumbai | $10.3 Mn | — | Unleash Capital Partners |

| DPDPZero | Fintech | Bangalore | $7 Mn | Series A | GMO Venture Partners |

| TurboHire | Artificial intelligence (AI) | Hyderabad | $6 Mn | Series A | IvyCap Ventures |

| Mitigata | Fintech | Delhi | $5.9 Mn | Series A | Nexus Venture Partners |

| TPlusA India | Ecommerce | Bangalore | $5.8 Mn | Seed | Livspace |

| Cautio | Advanced Hardware & Technology | Bangalore | $3 Mn | Seed | — |

| OUTZIDR | Ecommerce | Bangalore | $3 Mn | Pre-Series A | RTP Global |

| HYLENR | Clean Tech | Hyderabad | $3 Mn | Pre-Series A | Valour Capital, Chhattisgarh Investments |

| Zepto | Consumer Services | Bangalore | $2.9 Mn | — | MapmyIndia |

| CodeKarma | Artificial intelligence (AI) | Bangalore | $2.5 Mn | Pre-Seed | Prosus, Accel, Xeed Ventures |

| Xovian Aerospace | Advanced Hardware & Technology | Bangalore | $2.5 Mn | Pre-Seed | Piper Serica, Turbostart |

| Nuuk | Ecommerce | Gurugram | $2 Mn | Series A | — |

| DesignX | Enterprise Tech | Noida | $2 Mn | — | — |

| EON Space Labs | Advanced Hardware & Technology | Hyderabad | $1.2 Mn | Pre-Series A | MGF Kavachh |

| MangoPoint | Ecommerce | Chennai | $1 Mn | Pre-Series A | Inflection Point Ventures |

| Fraganote | Ecommerce | New Delhi | $1 Mn | Pre-Series A | Rukam Capital |

| Shotgun Games | Media & Entertainment | Mumbai | $1 Mn | Seed | — |

| Gladful | Ecommerce | Jaipur | $913K | — | Eternal Capital |

| Terafac | Advanced Hardware & Technology | Chandigarh | $800K | Pre-Seed | Inuka Capital |

| Prozo | Logistics | Gurugram | — | — | Ranbir Kapoor |

Indian Startup Funding – July 2025 [28 July – 02 August]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Safe Security | Enterprise Tech | New Delhi | $70 Mn | Series C | Avataar Venture Partners |

| Metaforms | AI | Bengaluru | $9 Mn | Series A | Peak XV Partners |

| STAN | Media & Entertainment | Chennai | $8.5 Mn | Series A | – |

| Arivihan | Edtech | Indore | $4.2 Mn | Pre-Series A | Prosus, Accel |

| Sharpsell.ai | Enterprise Tech | Mumbai | $3.4 Mn | Series A | Equentis Angel Fund |

| Drizz | AI | Bengaluru | $2.7 Mn | Seed | Stellaris Venture Partners |

| Littlebox | Ecommerce | Noida | $2.1 Mn | Seed | Huddle Ventures, Prath Ventures |

| Snooplay | Ecommerce | New Delhi | $916K | Pre-Series A | Pravek Family Office |

| Zepto | Consumer Services | Bengaluru | $857K | – | Elcid Investments |

| Heizen | Enterprise Services | New Delhi | $500K | Pre-Seed | Titan Capital |

| Passport Trips | Travel Tech | Mumbai | $500K | Pre-Seed | Aroa Venture Partners |

| ILine | Logistics | Noida | $500K | – | – |

| Genexis Biotech | Health Tech | Vadodara | $457K | Seed | GVFL |

| Vahan.ai | AI | Bengaluru | – | – | Temasek |

Indian Startup Funding – July 2025 [21 July – 26 July]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Gupshup | Enterprise Tech | Mumbai | $60 Mn | – | – |

| Netrasemi | Advanced Hardware & Technology | Thiruvananthapuram | $12.4 Mn | Series A | Zoho Corporation |

| SuperK | Consumer Services | Bengaluru | $11.5 Mn | Series B | 3STATE Ventures |

| Kluisz.ai | Artificial Intelligence (AI) | Bengaluru | $9.6 Mn | Seed | RTP Global |

| EduFund | Fintech | Ahmedabad | $6 Mn | Series A | Cercano Management |

| EVeez | Travel Tech | Gurugram | $5.4 Mn | Series A | Michael & Susan Dell Foundation |

| Enlite Research | Enterprise Tech | Mumbai | $5.3 Mn | Series A | Avaana Capital |

| iTuring.AI | Artificial Intelligence (AI) | Bengaluru | $5 Mn | Series A | Dallas Venture Capital, Mela Ventures |

| Sugar Cosmetics | Ecommerce | Mumbai | $5 Mn | – | Anicut Capital |

| Escape Plan | Ecommerce | Bengaluru | $5 Mn | Seed | Jungle Ventures, Fireside Ventures |

| Hudle | Enterprise Tech | Delhi | $2.5 Mn | Series A | Sky Impact Capital |

| Grexa AI | Artificial Intelligence (AI) | Thane | $1.8 Mn | Seed | Utsav Somani |

| ANNY | Ecommerce | Gurugram | $1.2 Mn | Pre-Series A | Atomic Capital |

| Ammunic Systems | Advanced Hardware & Technology | Bengaluru | $1.1 Mn | Seed | India Accelerator, Finvolve |

| Inbound Aerospace | Advanced Hardware & Technology | Chennai | $1 Mn | Pre-Seed | Speciale Invest |

| Plenome Technologies | Enterprise Tech | Chennai | $752K | Seed | Ovington Capital Partners |

| Bharatsure | Fintech | Mumbai | $694K | – | Inflection Point Ventures |

| ApClub | Consumer Services | Bengaluru | $231K | Pre-Seed | Curefit |

| Coluxe | Ecommerce | New Delhi | – | – | – |

| Magma | Enterprise Services | Ahmedabad | – | – | GVFL Limited |

| Roast Foods | Ecommerce | Pune | – | – | Pagariya Exports Pvt Ltd |

| KlugKlug | Enterprise Services | New Delhi | – | – | – |

Indian Startup Funding – July 2025 [14 July – 19 July]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| QpiAI | Advanced Hardware & Technology | Bengaluru | $32 Mn | Series A | Avataar Ventures, National Quantum Mission |

| Truemeds | Healthtech | Mumbai | $20 Mn | Series C | Peak XV Partners |

| Phi Commerce | Fintech | Pune | $5.9 Mn | Series B | BEENEXT |

| KNOT | Consumer Services | Bengaluru | $3 Mn | Pre-Series A | Kae Capital |

| Trupeer.AI | Artificial intelligence (AI) | Bengaluru | $3 Mn | Seed | RTP Global |

| Omspace Rocket & Exploration | Advanced Hardware & Technology | Ahmedabad | $3 Mn | Pre-Seed | – |

| Vaaree | Ecommerce | Bengaluru | $2.1 Mn | Pre-Series A | PeerCapital, Peak XV Surge |

| CureFit | Health Tech | Bengaluru | $2 Mn | – | First Luxembourg SCA |

| DCG Tech | Ecommerce | Gurugram | $1.7 Mn | Pre-Series A | GVFL |

| Zuppa | Advanced Hardware & Technology | Chennai | $1.5 Mn | – | Rahul Dewan |

| Deep Algorithm | Enterprise Tech | Hyderabad | $1.3 Mn | – | Unicorn India Ventures |

| Dial4242 | Health Tech | Gurugram | $1.1 Mn | Pre-Series A | IAN Group |

| The Wedding Company | Consumer Services | Bengaluru | $1 Mn | Pre-Seed | LVX |

| Navana.ai | Artificial intelligence (AI) | Mumbai | $812K | Pre-Series A | Antler India |

| Unibose | Advanced Hardware & Technology | Chennai | $639K | Pre-Series A | O2 Angels |

| Zulu Club | Consumer Services | Gurugram | $250K | Pre-Seed | TDV Partners |

| Parkobot | Advanced Hardware & Technology | Kolkata | $243K | Seed | Inflection Point Ventures |

| Enercomp | Advanced Hardware & Technology | Ahmedabad | $232K | – | – |

| CosMoss | Ecommerce | Gurugram | – | Seed | Malika Sadani |

| Onetab.ai | Artificial intelligence (AI) | Bengaluru | – | – | Hyperscope, Elrise |

| Fire AI | Artificial intelligence (AI) | Mumbai | – | Pre-Seed | Venture Catalysts |

Indian Startup Funding – July 2025 [07 July – 12 July]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Infinity Fincorp | Fintech | Mumbai | $70 Mn | – | Partners Group |

| Varthana | Fintech | Bengaluru | $18.6 Mn | Debt | – |

| Khetika | Ecommerce | Bengaluru | $18 Mn | Series B | Narotam Sekhsaria Family Office, Anicut Capital |

| InPrime Finserv | Fintech | Bengaluru | $6 Mn | Series A | Pravega Ventures |

| Chai Bisket | Media & Entertainment | Hyderabad | $5 Mn | Seed | InfoEdge Ventures, General Catalyst |

| Belong | Fintech | Bengaluru | $5 Mn | Seed | Elevation Capital |

| Clean Fanatics | Consumer Services | Bengaluru | $2 Mn | Seed | Inflection Point Ventures |

| Cookd | Ecommerce | Chennai | $2 Mn | Pre-Series A | Spring Marketing Capital |

| Gramik | Agritech | Lucknow | $2 Mn | – | – |

| Green Aero | Advanced Hardware & Technology | New Delhi | $1.6 Mn | Seed | pi Ventures |

| AMAMA | Ecommerce | New Delhi | $1 Mn | – | Mistry Ventures |

| WiseLife | Ecommerce | Gurugram | $932K | Seed | Rukam Capital |

| Linkrunner | AI | Bengaluru | $560K | – | Titan Capital |

| Divine Hindu | Ecommerce | Gurugram | $181K | Seed | – |

| Jeh Aerospace | Advanced Hardware & Technology | Hyderabad | – | – | Indigo Ventures |

| LdotR | Enterprise Services | New Delhi | – | – | Basil Moftah, Mark Garlinghouse |

| Qoruz | Media & Entertainment | Bengaluru | – | Pre-Series A | Chennai Angels |

Indian Startup Funding – July 2025 [30 June – 05 July]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Jumbotail | Ecommerce | Bengaluru | $120 Mn | Series D | SC Ventures, Artal Asia |

| Infra.Market | Real Estate Tech | Thane | $50 Mn | Debt | Mars Growth Capital |

| InCred Finance | Fintech | Mumbai | $46.8 Mn | Debt | Morgan Stanley, Nippon Life India |

| Eggoz | Ecommerce | Gurugram | $20 Mn | Series C | Gaja Capital, IvyCap Ventures, Rebright Partners, Avaana Capital, NABVENTURES, Merisis Opportunities Fund, Arvind Thakur, S Ramadorai, Artek Chemicals, Blue Dot Capital |

| AppsForBharat | Consumer Services | Bengaluru | $20 Mn | Series C | Susquehanna Asia VC, Fundamentum, Elevation Capital, Peak XV Partners |

| Aukera | Ecommerce | Bengaluru | $15 Mn | Series B | Peak XV Partners, Fireside Ventures, Sparrow Capital, Prath Ventures, Alteria Capital |

| Bambrew | Enterprise Services | Bengaluru | $10.5 Mn | Series B | Ashok Goel, Enrission India Capital |

| Eeki | Agritech | Kota | $7 Mn | Series A | Sixth Sense Ventures |

| Zango AI | Artificial Intelligence (AI) | Indore | $4.8 Mn | Seed | Nexus Venture Partners, South Park Commons, Notion Capital, No Label Ventures, Start Ventures |

| Maieutic Semiconductor | Advanced Hardware & Technology | Bengaluru | $4.2 Mn | Seed | Endiya Partners, Exfinity Venture Partners |

| Luma Fertility | Health Tech | Mumbai | $4 Mn | Seed | Peak XV, Ameera Shah, Vijay Taparia |

| GobbleCube | Artificial Intelligence (AI) | Gurugram | $3.5 Mn | Pre-Series A | InfoEdge Ventures, Kae Capital |

| Loopworm | Health Tech | Bengaluru | $3.3 Mn | Pre-Series A | WaterBridge Ventures, Enrission India Capital |

| CIMware | Advanced Hardware & Technology | Bengaluru | $2.3 Mn | Pre-Series A | Transition VC |

| Sthyr Energy | Cleantech | Chennai | $1 Mn | Seed | Speciale Invest, Antares Ventures |

| Astrophel Aerospace | Advanced Hardware & Technology | Pune | $800K | Pre-Seed | – |

| Lamark Biotech | Health Tech | Bengaluru | $767K | Pre-Series A | IAN Alpha Fund, Vinayender Tulla, Nita Roy, Venkataraman KNK |

| FitFeast | Ecommerce | New Delhi | $644K | Seed | Inflection Point Ventures, Raghav Singhal, Santosh Govindaraju, Abhishek Chopra, Aabhas Khanna |

| Garaaz | Enteprise Tech | Jaipur | $531K | Seed | GVFL |

| FES Cafe | Foodtech | Gurugram | $351K | Seed | Wolfpack Labs |

| AjnaLens | Advanced Hardware & Technology | Thane | – | – | Lenskart |

Indian Startup Funding – June 2025 [23 June – 28 June]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Raphe mPhibr | Advanced Hardware & Technology | Noida | $100 Mn | – | General Catalyst, Think Investments, Amal Parikh |

| GIVA | Ecommerce | Bengaluru | $62 Mn | – | Creaegis, Premji Invest, Epiq Capital, Edelweiss Discovery Fund |

| EKA Mobility | Cleantech | Pune | $23 Mn | – | Enam Holdings |

| ShopOS | Artificial Intelligence (AI) | Ahmedabad | $20 Mn | Seed Round | 3STATE Ventures |

| GoKwik | Fintech | New Delhi | $13 Mn | – | RTP Global, Z47, Peak XV Partners, Think Investments |

| Sahi | Fintech | Mumbai | $10.5 Mn | Series A | Accel, Elevation Capital |

| Fabheads | Advanced Hardware & Technology | Chennai | $10 Mn | Series A | Accel, Trifecta Capital |

| Kazam | Cleantech | Bengaluru | $6.2 Mn | Series B | International Finance Corporation, Vertex Ventures SEA & India, Avaana Capital |

| Flipspaces | Real Estate Tech | Mumbai | $5.9 Mn | – | Asiana Fund |

| StayVista | Travel Tech | Mumbai | $5 Mn | Series B | JSW Ventures, DSG Consumer Partners, Capri Global Family Office |

| Rabitat | Ecommerce | New Delhi | $4.6 Mn | Series A | RPSG Capital, DSG Consumer Partners, Capital A, Accurize Syndicate, Flair Writing Family Office, Eagle Venture Fund, AG Ventures, Vedang Patel, Harsh Lal, Rohin Samtaney, Ramakant Sharma, Sourabh Jain, Ankit Nagori |

| ZILO | Consumer Services | Mumbai | $4.5 Mn | Seed Round | Info Edge Ventures, Chiratae Ventures |

| Evera Cabs | Travel Tech | New Delhi | $4 Mn | Debt Round | Mufin Green Finance |

| Coratia Technologies | Advanced Hardware & Technology | Rourkela | $2 Mn | Pre-Series A | MGF-Kavachh |

| Fantail | Enterprise Services | Surat | $1.6 Mn | Seed Round | Riverwalk Holdings, Incubate Fund Asia, All in Capital |

| Armory | Advanced Hardware & Technology | Gurugram | $1.5 Mn | – | growX Ventures, Industrial 47, Antler, AC Ventures, Dexter Ventures |

| Jobizo | Enterprise Tech | Gurugram | $1.4 Mn | Pre-Series A | Inflection Point Ventures, Alkemi Ventures |

| Skippi | Ecommerce | Hyderabad | $1.4 Mn | Pre-Series A | – |

| AuraML | Artificial Intelligence (AI) | Bengaluru | $1 Mn | Pre-Seed | Turbostart, DeVC, GSF Accelerator, Indian Angel Network |

| Innovodigm | Health Tech | Kolkata | $643K | Seed | IAN Group |

| Truliv | Real Estate Tech | Chennai | – | – | Bennett, Coleman & Co |

Indian Startup Funding – June 2025 [16 June – 21 June]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| WIOM | Consumer Services/ Enterprise Services | New Delhi | $35 Mn | – | Bertelsmann India Investments, Accel, Prosus, Promaft Partners, RTP global |

| POP | Fintech | Bengaluru | $30 Mn | – | Razorpay |

| Oben Electric | Cleantech | Bengaluru | $11.5 Mn | Series A | Helios Holdings, Sharda family office, Kay family |

| Techfino | Fintech | Bengaluru | $7.5 Mn | – | Stellaris Venture Partners, Saison Capital |

| Saswat Finance | Fintech | Mumbai | $2.6 Mn | Pre-Series A | Ankur Capital, Incubate Fund Asia |

| illumine | Enterprise Tech | Chennai | $2.5 Mn | Seed | Prime Venture Partners |

| Darwix AI | Artificial Intelligence | Gurugram | $1.5 Mn | – | Rebalance, IPV, JITO Incubation and Innovation Foundation, Growth Sense, Growth91, Ankit Nagori, Sanjay Suri, Amit Lakhotia, Mekin Maheshwari |

| 7 Ring | Ecommerce | Mumbai | $462K | Pre-Series A | Venture Catalysts, Anchorage Capital Partners, Sheth family office |

| Nuvie | Ecommerce | Bengaluru | $450K | Pre-Seed | PedalStart |

| Xportel | Logistics | Delhi | – | Seed | Rukam Sitara, Flipkart Ventures |

Indian Startup Funding – June 2025 [09 June – 13 June]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Decentro | Fintech | Bengaluru | Rs 30 Crore | Series B | InfoEdge Ventures |

| Sanlayan Technologies | Defence Electronics | Bengaluru | Rs 186 crore | Series A | Gemba Capital, Singularity Ventures, and Shastra VC |

| Roomstory.ai | AI | Gurugram | Rs 3 crore | Pre-seed | Rukam Sitara Fund |

| Vecmocon Technologies | Deep-tech | New Delhi | $18 Mn | Series A | EIF |

| CRED | Fintech | Bengaluru | Rs 617 crore | Down Round | GIC’s Lathe Investment |

| Flick TV | OTT platform | Noida | $2.3 Mn | Seed round | Stellaris Venture Partners |

| Kazam | Electric mobility | Bengaluru | $6 Mn | Series B | Vertex Ventures |

| Wow! Momo | QSR | Kolkata | Rs 85 Cr | Debt Round | Stride Ventures |

| PowerUp Money | Wealthtech | Bengaluru | $7.1M | Seed round | Accel |

| FlexiLoans | NBFC | Mumbai | Rs 375 Cr | Series C | BII |

| Garuda Aerospace | Drone startup | Chennai | $1 million | Funding round | Narotam Sekhsaria Family Office |

| Piston | Digital payment | Chennai | $6.1M | Seed round | Spark Capital, Pear VC and BOND |

| Leumas | Deeptech | Bengaluru | $2.2 Mn | Seed round | Capital 2B |

| Machaxi | Sportstech | Bengaluru | $1.5 Mn | Funding Round | Rainmatter, Prakash Padukone |

| Knest | Construction-tech | Pune | Rs 300 crore | Funding Round | Lighthouse |

| MetaShot | Gaming | Bengaluru | Rs 2 crore | Covertible Debt | Karnataka Govt’s Venture Fund |

| Repello AI | AI security | Bengaluru | $1.2 million | Seed Funding | Venture Highway |

| GIVA | D2C Jewellery | Bengaluru | Rs 450 Cr | Series C | Creaegis |

| Kisah | Men’s ethnicwear | Kolkata | Rs 13 crore | Funding Round | Wow Momo |

| Iom Bioworks | Deep science | Bengaluru | Rs 4 Cr | Seed Funding | Inflection Point Ventures |

| PlutoPe | Decentralized finance (DeFi) | Gurugram | Rs 5 Cr | Pre-seed Round | Manit Gupta |

| Spinny | Used car platform | Gurugram | $30 million | Series F | WestBridge Capital |

Indian Startup Funding – June 2025 [02 June – 06 June]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Qubeats | Quantum Computing | Telangana | $2.91M | Grant (Prize Money) | Corporate: iDEX |

| Nxt Meal | Food Tech | Karnataka | $750K | Seed | – |

| The Tarzan Way | Online Travel | Delhi | $233K | Seed | Inflection Point Ventures |

| LoanTap | Alternative Lending | Maharashtra | $6.29M | Series B | July Ventures |

| LoanTap | Alternative Lending | Maharashtra | $2.33M | Venture Debt | – |

| Plush | Personal Care Products | Tamil Nadu | $4.66M | Series B | Blume Ventures |

| Naagin Sauce | Food & Beverage | Maharashtra | $2.1M | Seed | 8i Ventures |

| Khari Foods | Online Grocery | Delhi | $350K | Seed | Meri Punji |

| Stride Green | Green SME Loans | Haryana | $3.5M | Seed | Micelio Tech Fund, Incubate Fund India |

| Handpickd | Online Grocery | Delhi | $2.53M | Seed | Genesia Ventures, Beenext |

| Gully Labs | Fashion Tech | Uttar Pradesh | $129K | Venture Debt | Stride Ventures |

| Manipal Group | Education, Healthcare | Karnataka | $600M | Conventional Debt | KKR |

| GyanDhan | Higher Education Tech | Delhi | $5.85M | Series A | Pravega Ventures, Gray Matters Capital |

| Shapoorji Pallonji | Real Estate | Maharashtra | $75M | Conventional Debt | Synergy, Cerberus Capital Management |

| Udaan | B2B E-Commerce | Karnataka | $114M | Series G | M&G, Samena Capital |

| Pepperfry | Home Improvements | Maharashtra | $5.06M | Series F | Norwest Venture Partners |

| Spense | Investment Tech | Karnataka | $1.85M | Seed | GrowthCap Ventures |

| Samunnati | Agri-financing | Tamil Nadu | $5.84M | Conventional Debt | Elevar Equity |

| Samunnati | Agri-financing | Tamil Nadu | ₹50 Cr (~$6M) | Strategic Investment | – |

| Farmako | HealthTech | Uttarakhand | Undisclosed | Seed | Genesia Ventures, Y Combinator |

| Snitch | D2C Menswear Brand | – | $40M | Growth | 360 One Asset, IvyCap, SWC Global, Ravi Modi Office |

| Stable Money | FinTech | – | $20M | Series A | Fundamentum, Aditya Birla Ventures, Lightspeed |

| Decentro | API Banking / Fintech | – | ₹30 Cr (~$3.6M) | Series B | InfoEdge Ventures, Y Combinator |

| Biopeak | Wellness & Longevity | – | $3M | Seed | Claypond Capital, Rainmatter |

| Kosmc AI | Social-Commerce Infrastructure | – | Undisclosed | Pre-Seed | – |

| Atlanture Sports | Sports & Media | – | ₹21 Cr (~$2.5M) | Strategic Investment | Rannvijay Singha |

| True Diamond | Lab-Grown Diamond Jewellery | – | ₹26 Cr (~$3.1M) | Pre-Series A | – |

| Upurfit | Sports Wellness | – | Undisclosed | Strategic Investment | Jonty Rhodes (Angel Investor) |

Indian Startup Funding – May 2025 [26 May – 30 May]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors | |

|---|---|---|---|---|---|---|

| Stable Money | Wealthtech | Bengaluru | $20 million | Series B | The Fundamentum Partnership Fund | |

| Mufin Green | EV Financier | New Delhi | $18 million | Debt Funding | US-based institution | |

| Slikk | Fashion Delivery | Bengaluru | $10 million | Series A | Nexus Venture Partners | |

| Citykart | Value fashion retailer | Gurugram | Rs 538 crore | Series B | TPG NewQuest, A91 | |

| EUME | Premium Travel Luggage Brand | Mumbai | Rs 25 crore | Series A | Ashish Kacholia | |

| Fleetx.io | SaaS | Gurugram | Rs 113 Crore | Series C | Indiamart Intermesh and BEENEXT’s Accelerate Fund | |

| Frinks AI | Manufacturing AI | Bengaluru | $5.4 million | Pre-Series A | Prime Ventures Partners | |

| Contineu | Deeptech | US | $1.2 million | Seed Funding | SenseAI Ventures | |

| Orbitt Space | Spacetech | Ahmedabad | $1 million | Pre-seed funding | Pi Ventures, IIMA Ventures | |

| Myntra | Fashion ecommerce | Bengaluru | $124 million | – | FK Myntra Holdings | |

| GROWiT | Agritech | Surat | $3 million | Series A | GVFL | |

| Saarathi Finance | NBFC | Mumbai | Rs 475 Crore | Funding round | Equity Capital | |

| ILIOS 72 Alternative Capital | Wealth Management | Gurugram | Rs 1 crore | Seed Funding | Group of family offices | |

| Snabbit | Quick service app | Mumbai | $19 million | Series B | Lightspeed | |

| Simply Nam | Beauty brand | Mumbai | – | – | Bhaane Group | |

| Cleevo | Home hygiene | Nashik | $1 million | Seed Round | Eternal Capital | |

| Ziniosa | Luxury Fashion Brand | Bengaluru | Undisclosed | – | Inflection Point Ventures (IPV) | |

| KhiladiPro | Sporttech | Bengaluru | $1 million | Pre-seed | Shastra VC and | MGA Ventures |

| Snitch | Fashion | Bengaluru | Rs 280 crore | Series B | 360 Asset Management Fund | |

| Unbound | Enterprise AI security and governance | Pune | $4 million | Seed Funding | Race Capital | |

| Battery Smart | Battery swapping | New Delhi | $29 million | Series B | Rising Tide Energy |

Indian Startup Funding – May 2025 [19 May – 23 May]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Euler Motors | EV | New Delhi | Rs 638 crore | Series D | Hero MotoCorp |

| Cloudsek | Cybersecurity | Bengaluru | $19 million | Fresh Funding | Tenacity Ventures and Commvault |

| CureBay | Healthtech | Bhubaneshwar | $21 Mn | Series B | Series B |

| Miraggio | Fashion | Gurugram | $6.5 million | Institutional Round | RPSG Capital Ventures |

| Tan90 | Deep-tech | Chennai | Rs 20 Cr | Series A | NABVENTURES |

| Misfits | Community Platform | Gurugram | Rs 5 Crore | Seed Round | Info Edge Ventures and Better Capital |

| Mythik | Media Technology | Mumbai | $15 million | Seed Round | Sakal Media Group |

| Biostate AI | Biotech | US | $12 million | Series A | Accel |

| Data Sutram | Fintech | Mumbai | $9 Mn | Series A | B Capital, Lightspeed |

| Zoca | Agentic AI | Gurugram | $6 million | Funding Round | Accel |

| Promethean Energy | Cleantech | Mumbai | $2 Mn | Pre-Series A | Transition VC |

| Shuru | Social media | Gurugram | Undisclosed | Series A | Krafton India |

| ALT CARBON | Deeptech | Kolkata | $12 Mn | Seed Round | Lachy Groom |

| BlackCarrot | D2C dinnerware | Mumbai | Undisclosed | Pre-seed funding | Venture Catalysts |

| OpenFX | FX infrastructure | US | $23Mn | Seed Round | Accel |

| KSKT | Agri-commerce | Gurugram | $1.3 Mn | Equity and Debt Round | Keiretsu Forum and Favcy’s 1stCheque Angel Network |

Indian Startup Funding – May 2025 [12 May – 16 May]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Farmley | Snacking | Noida | $40 million | Series C | L Catterton |

| Avammune Therapeutics | Healthtech | Bengaluru | $12 million | Series A | Capital 2B |

| Celebal Tech | IT services provider | Jaipur | $15 million | Series B | InCred Growth Partners Fund-I and Norwest Capital, LLC |

| Citrus Freight | Shipping | Bengaluru | Rs 2.5 Cr | Bridge Round | Caret Capital, Indigram Labs Foundation |

| M1xchange | Supply Chain Financing | Gurugram | $10Mn | secondary deal | Filter Capital |

| Hyperbots | AI | Mumbai | $6.5Mn | Seed Funding | Arkam Ventures and Athera Venture Partners |

| Biryani Blues | QSR | Gurugram | $5 Mn | Pre-series C | Yugadi Capital |

| Be Clinical | Skincare | Mumbai | Rs 2 Cr | Seed Round | Titan Capital |

| JSW One | B2B e-commerce | Mumbai | Rs 340 Cr | – | Principal Asset Management, OneUp, JSW Steel |

| TIEA Connectors | B2B ESDM (Electronic System Design and Manufacturing) | Bengaluru | Rs 22 Cr | Funding Round | Jamwant Ventures And Valour Capital |

| Flam | Mixed Reality Content | Bengaluru | $14Mn | Series A | RTP Global |

| Adopt AI | Agentic AI | Bengaluru | $6 Mn | Seed Round | Elevation Capital |

| ReelSaga | Mobile-first entertainment | Mumbai | $2.1 Mn | $2.1 Mn | Picus Capital |

| BlueStone | Omnichannel jewellery | Bengaluru | Rs 40 Cr | Debt Funding | BlackSoil and Caspian Impact Investments |

| VFlowTech | Vanadium redox flow battery | Kolkata | $20.5 Mn | Funding Round | Granite Asia |

| ContraVault AI | Tender and RFP management | Delhi | Rs 5.1 Cr | Seed Funding | Titan Capital |

| Third Bracket | Hiring Platform | Bengaluru | Rs 5 Cr | Seed Round | HNIs |

| LUZO | Marketplace for salons, spas, and wellness clinics | Mumbai | $550K | Seed Funding | Enrission India Capital |

| Complement1 | Healthtech | US | $16 million | Seed Funding | Owl Ventures and Blume Ventures |

| Hocco | Ice Cream Brand | Ahmedabad | $10 Mn | Series B | Chona family office and Sauce.vc |

| NapTapGo | Pod Hotel | Noida | Rs 2 Cr | Pre-Seed Round | IPV |

| MedVital | MedTech | New Delhi | Rs 8.4 crore | Pre-seed funding | 4point0 Health Ventures |

| 1-India Family Mart | Value retail chain | Delhi | $12 Mn | Series D | Gulf Islamic Investments |

| Zenergize | EV | Gurugram | $2 Mn | Seed Funding | Mohit Tandon, Himanshu Aggarwal |

| Nobel Hygiene | Disposable hygiene | Mumbai | $20 Mn | Funding Round | Neo Asset Management |

| Fyn Mobility | EVaaS | Chennai | $2.5Mn | Funding Round | Vijay Kedia, Lloyd Balajadia, Rahul Bothra |

Indian Startup Funding – May 2025 [05 May – 09 May]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Volt14 | Battery Tech | Bengaluru | $1.87 Mn | Pre-Series A | Blume Ventures |

| Store My Goods | Storage Solutions | Noida | Rs 4 Cr | Growth Funding Round | JITO Incubation and Innovation Foundation (JIIF) and family offices |

| Alt DRX | Digital Real Estate | Bengaluru | Rs 23 Cr | Funding Round | Qatar Development Bank |

| Lifechart | Gut Wellness | Gurugram | $360K | Seed Funding | Prajay Advisors, Prakash Mody, and Jayendra Shah |

| Celcius Logistics | Cold chain aggregator | Mumbai | Rs 250 Cr | Series B | Eurazeo, Omnivore |

| 91trucks | Commercial vehicle marketplace | Delhi | Rs 43 Cr | Funding Round | Arkam Ventures |

| Troovy | Kids-focused nutrition food brand | Gurugram | Rs 20 Cr | Pre-Series A | Fireside Ventures |

| Nawgati | Fuel aggregator | Noida | $2.5 Mn | Pre-Series A | Ajay Upadhyaya |

| KorinMi | Korean skin clinic | Gurugram | Rs 3 Cr | Pre-Seed | Vikas Agarwal |

| The Good Bug | Gut health-focused | Mumbai | Rs 100 Cr | Series B | Susquehanna Asia |

| InspeCity | Spacetech | Mumbai | $5.6Mn | Seed Funding | Lucky Investment Managers |

| Insurance Samadhan | Insurance | Noida | Rs 8.5 Cr | Strategic Funding Round | Innovito Ventures |

| Flipspaces | Interior design and contracting | Mumbai | $35Mn | Series C | Iron Pillar |

| Routematic | Transport-as-a-service | Bengaluru | $40 Mn | Series C | Fullerton Carbon Action Fund and Shift4Good |

| Shiplog | Logistics-Tech | Gurugram | Rs 6.5 Cr | Seed Round | Deepak Bhagnani Family Office |

| BlissClub | Women-focused direct-to-consumer | Bengaluru | Rs 33 Cr | Pre-Series B | Elevation Capital |

| Posha | Kitchen Robotics | Posha | $8Mn | Series A | Accel |

| PB Healthcare | Healthtech | Gurugram | $218 Mn | Equity funding round | General Catalyst, PB Fintech |

| Vaya | AI | New Delhi | $1.5 Mn | Funding Round | Accel, Arkam Ventures |

| High Time Foods | Food-tech | Bengaluru | $1.2 Mn | Funding Round | Avaana Capital |

| Zebu | Defense Tech | Hyderabad | $1 Mn | Pre-Series A | Bluehill VC |

| Feline Spirits | Craft alcoholic beverage | New Delhi | Rs 5.2 Cr | Pre-Series A | IPV |

| GoTrust | Privacy compliance | Noida | $400K | Pre-Seed | Aevitas Capital |

| Footprints Preschool & Daycare | Early childhood education and daycare | Noida | $7.5Mn | Series A | Tanglin |

| Porter | Logistics | Bengaluru | $200 Mn | Series F | Kedaara Capital and Wellington Management |

Indian Startup Funding – April 2025 [28 April – 02 May]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Uni Seoul | Lifestyle | Pune | Rs 5 crore | Seed Funding | Sauce VC |

| Malaki | Beverage | Mumbai | Rs 5.7 Cr | Seed Funding | Venture Catalysts |

| Care.fi | Healthcare Fintech | Gurugram | Rs 6 Cr | Debt Round | RevX |

| Metafin | NBFC | Mumbai | $10Mn | Series A | Vertex Ventures SEAI |

| Mugafi | AI | Gurugram | $3 Mn | Seed Round | StartupXseed |

| CollegeDekho | Edtech | Gurugram | Rs 40 Cr | Debt Funding | Recur Club |

| Primebook | Android Laptop | Delhi | $2 Mn | Pre-Series A | Inflection Point Ventures |

| Scandalous Foods | B2B Indian sweets | Nashik | Rs 2 Cr | Seed Round | New Age India Fund |

| Kult | Beauty Tech | Mumbai | $20 Mn | Series A | M3M Family Office |

| Stimuler | Edtech | Bengaluru | $3.75 Mn | Pre-Series A | Lightspeed, SWC Global |

| QNu | Cyber Security | Bengaluru | Rs 60 Cr | Series A | NQM |

| Vividobots | Robotics | Chennai | Rs 1.47 Cr | Seed Round | Inflection Point Ventures |

| HexaHealth | Healthtech | Gurugram | $12 Million | Series A | Orios Venture Partners and 3one4 Capital |

| SatLeo Labs | Space Tech | Ahmedabad | $3.3 Mn | Pre-seed Round | Merak Ventures |

| Sadhav Offshore | Maritime Service | Mumbai | Rs 25 Cr | Equity Round | Negen Capital |

| Anveshan | D2C Food | Gurugram | Rs 48 Cr | Series A | Wipro Consumer Care |

| Salt Oral Care | Pre-Series A | Mumbai | $1 Mn | Pre-Series A | Lotus Holdings |

| Ivana Jewels | Lab-grown Diamonds | Surat | Rs 2 Cr | Seed Round | Avinya Ventures |

| Fuze | Digital Assets Infrastructure | Abu Dhabi | $12.2 Mn | Series A | Galaxy and e& Capital |

| Kaleidofin | Fintech | Chennai | $5.3 Mn | Funding Round | IDH Farmfit Fund |

Indian Startup Funding – April 2025 [21 April – 25 April]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Finodaya Capital | Non-banking financial company | Indore | $2.5 million | Seed Funding | White Venture Capital |

| Ivory | Healthcare | New Delhi | $1 million | Funding Round | IIM-A Ventures, Capital-A |

| MatBook | Construction Tech | Gurugram | $750K | Pre-Seed Round | Seedstars International Ventures, Fluent Ventures and Everywhere Ventures |

| Rebel Foods | Cloud Kitchen | Mumbai | $25 million | Series G | Qatar Investment Authority |

| DevAssure | SaaS | Chennai | Undisclosed | Pre‑Seed Funding | Eximius Ventures |

| Poshs Metal | Steel Processing | Pune | Rs 43 crore | Funding Round | Aavishkaar Capital |

| MyDesignation | D2C Fashion | Thiruvananthapuram | $1.25 million | Seed Funding | Multiply Ventures |

| Emversity | Edtech | Bengaluru | $5 million | Pre-Series A Round | Z47 and Lightspeed |

| Vayudh | Drone Startup | New Delhi | $10 million | Funding Round | Dharana Capital |

| BankBazaar | Loan Sourcing | Chennai | Rs 55 crore | Funding Round | Muthoot Fincorp, Walden International |

| SaveIN | Fintech | New Delhi | Rs 37 crore | Funding Round | 10X Founders, Oliver Jung, Leblon Capital, Stem AI |

| Intellicar | Fabric | Bengaluru | $13.5 million | Series A | Nuveen |

| GreenGrahi | Agri-biotech | New Delhi | Rs 32 crore | Funding Round | Avaana Capital |

| Rimigo | Travel Tech | Bengaluru | $550K | Pre-Seed Round | Reazon Capital |

Indian Startup Funding – April 2025 [14 April – 18 April]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Optimized Electrotech | Deeptech | Ahmedabad | $6 million | Series A | Blume Ventures and Mela Ventures |

| V SAFE | IoT | Thanjavur | $300K | Seed Funding | Priya Parthasarathy |

| SportsSkill | Sports Technology | Pune | Undisclosed | Pre-Seed Funding | Waimea Bay Investments |

| Jupiter International | Solar solutions | Kolkata | Rs 500 Cr | – | ValueQuest SCALE Fund |

| Cura Care | Oral Care | Bengaluru | Rs 5 Cr | Pre-Seed | Zeropearl VC |

| Noto | Ice Cream Brand | Mumbai | Rs 21 Cr | Angel Fund | Equentis |

| BeastLife | Nutrition Brand | Gurugram | Rs 1.9 crore | – | Rinku Singh |

| CENTA | Education | Bengaluru | Rs 20 Cr | Series A1 | Colossa Ventures |

| Jewelbox | D2C lab-grown diamond jewellery | Kolkata | $3.2Mn | pre-Series A | V3 Ventures |

| Rio Innobev | Beverage Startup | Pune | Rs 10 Cr | Pre-Series A | Atomic Capital |

| OfBusiness | B2B commerce | Gurugram | Rs 100 Cr | – | Cornerstone Ventures |

| Nothing Before Coffee | QSR coffee chain | Jaipur | $2.3 Mn | Pre-Series A | Prath Ventures |

| Peppermint Robotics | Robotics | Pune | $4 Mn | Series A | Indian Angel Network |

| Garuda Aerospace | Aerospace | Chennai | Rs 100 Cr | Series B | Venture Catalysts |

| Magma | B2B manufacturing | Ahmedabad | $5Mn | Series A | Capria Ventures |

| IPEC | EV charging | Mumbai | $3 Mn | – | Gruhas |

| JetSynthesys | Digital entertainment and technology | Pune | Undisclosed | – | Krafton |

Indian Startup Funding – April 2025 [07 April – 11 April]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Easebuzz | B2B Fintech | Pune | $30 Mn | Funding Round | Bessemer |

| Asha Ventures | Venture Capitalist | Mumbai | $10 million | Funding Round | British International Investment (BII) |

| Vimano | Nanotech | Bengaluru | Rs 25 Cr | Seed Round | Ankur Capital |

| Innovist | Beauty Products | Gurugram | Rs 136 Cr | Series B | ICICI Venture |

| CalligoTech | AI | Bengaluru | $1.1 Mn | Pre-Series A | Seafund and Artha Venture Fund |

| Juspay | Fintech | Bengaluru | $60 Mn | Series D | Kedaara Capital |

| Sadbhav Future Tech | Agri-Renewable | Gurugram | Rs 36 Cr | Pre-IPO Round | Chanakya Opportunities Fund |

| SiglQ.ai | Edtech | – | $9.5 Mn | Seed Round | The House Fund and GSV Ventures |

| OUTZIDR | D2C Apparel | Bengaluru | Rs 30 Cr | Seed Round | Stellaris Venture Partners |

| DaveAI | AI | Bengaluru | Undisclosed | Pre-Series A | Inflection Point Ventures |

| Cautio | Visual Telematics | Bengaluru | Rs 11 Cr | Seed Round | 9Unicorns, Venture Catalysts, Antler India, Infinyte Club, Ministry of Electronics and IT (MeitY) |

| AgroStar | Agritech | Pune | $6.7 Mn | Funding Round | Accel India |

| Eat Better | D2C Snacking | Jaipur | Rs 17 Cr | Pre-Series A | Prath Ventures and Spring Marketing Capital |

| Amicco | B2B marketplace | Gurugram | $1 Mn | Seed Funding | Eximius |

| Let’s Try | D2C Snack Brand | Delhi | $2.5 Mn | Funding Round | SWC Global |

| PARÉ Innovations | building material segment | Mumbai | $8.5Mn | Funding Round | Advenza Global Limited |

| Bhagva | Digital Spirituality | Delhi | $1 Mn | Pre-Series A | Pradeep Nain |

| Noise | Wearables | Gurugram | $20 Mn | Funding Round | Bose Corporation |

| Xindus | Cross-border Logistics | Gurugram | $10 Mn | Pre-Series A | 3one4 Capital and Orios Venture Partners |

| Eloelo | Live Social Entertainment | Bengaluru | $13.5 Mn | Series B | Play Ventures |

| AskMyGuru | Spiritual-tech | Bengaluru | $1.2 Mn | Seed Round | Lumikai |

| Bower | Edtech | Hyderabad | Rs 11.5 Crore | Seed Funding | High-Net-Worth Individuals (HNIs) and Astir Ventures |

| Mosaic Wellness | Health and wellness | Mumbai | $20 Mn | – | Think Investment |

| GreenLine Mobility Solutions Ltd. | Green Logistics | Surat | $20Mn | – | Nikhil Kamath |

Indian Startup Funding – April 2025 [31 March – 04 April]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Koparo | D2C | New Delhi | $1.7 million | Pre-Series A | Saama Capital |

| Lehlah | Influencer Commerce | Mumbai | INR 12.5 crore | Seed Funding | Gruhas |

| Spinny | Used-car sales | Gurugram | $131 million | Funding Round | Accel Leaders Fund |

| Tvaster Genkalp | Healthtech | Chennai | $1.25 million | Pre-Series A | Ideaspring Capital |

| Evenflow | Multi-brand | Mumbai | $5 million | Series A | Venture Catalysts, Sunder Ramachandran |

| Wendor | Smart Vending | Delhi | $2.5 million | Seed Funding | Elanpro |

| Stance Health | Healthtech | Bengaluru | $1 million | Pre-Seed | General Catalyst |

| The Bear House | D2C Menswear | Bengaluru | INR 50 crore | Series A | JM Financial Private Equity |

| DeCharge | EV Charging Solutions | Hyderabad | $2.5 million | Seed Funding | Lemniscap |

| YatriKart | Transit Retail | Indore | Undisclosed | Series A | MMG Group |

| Argos Watches | Luxury watch brand | Surat | INR 6.5 crore | Angel Funding Round | Group of high-net-worth Indian investors |

| Better Nutrition | Biofortified food brand | Lucknow | INR 10 crore | Seed Funding | Family offices and high-net-worth individuals (HNIs) |

| InnerGize | D2C mental health tech | Mumbai | INR 4.5 crore | Pre-Seed | Antler |

| Infinity Fincorp | NBFC | Mumbai | $40 million | Series A | Beams Fintech Fund |

| Fur Jaden | Luggage and lifestyle brand | Mumbai | $1.1 million | Pre-Series A | Gruhas Collective Consumer Fund |

| Flipkart Internet | Marketplace | Bengaluru | INR 3,249 crore | – | Flipkart Marketplace Private Limited in Singapore |

| Pratilipi | Storytelling App | Bengaluru | $20 million | Series E Round | Jungle Ventures |

| RapidClaims | AI Revenue Cycle Management | Akola | $11 million ($8 million and $3 million) | Series A, Seed Round | Accel, Together Fund |

| FurtherAI | AI Assistants | US | $5 million | Funding Round | Nexus Venture Partners |

| Sweet Karam Coffee | Foods and Beverages | Chennai | $8 million | Series A | Peak XV Partners |

| Scapia | Travel fintech | Bengaluru | $40 million | Series B | Peak XV Partners |

| Perkant Tech | Healthtech | Vishakhapatnam | INR 6.6 crore | Seed Funding | YourNest Venture Capital |

| DriverShaab | B2B mobility solutions provider | Patna | INR 2.8 crore | Pre-Series A | Inflection Point Ventures |

| Tonbo Imaging | Defence tech | Bengaluru | INR 175 crore | Series D pre-IPO funding round | Florintree Advisors, Tenacity Ventures and the Export-Import Bank of India |

| Aerem Solutions Private Limited | Solartech | Mumbai | INR 100 crore | Funding Round | UTEC |

| Alienkind | Juice Brand | Bengaluru | $1.2 million | Seed Funding | Prakash Sikaria, Ravi Iyer, Arpan Sheth |

Indian Startup Funding – March 2025 [24 – 28 Mar]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Nexthop AI | AI | US | $110 million | Funding Round | Lightspeed Venture Partners |

| Abound | Finance | US | $14 million | Seed Funding | NEAR Foundation |

| smallcase | Online investment platform | Bengaluru | $50 million | Series D | Elev8 |

| Country Delight | Dairy products brand | Gurugram | $25 million | Equity Round | Temasek, V-Sciences Investments |

| Apna Mart | FMCG Chain | Bengaluru | INR 214 crore | Equity and Funding Round | Accel and Fundamentum |

| DCDC Kidney Care | Health Service | New Delhi | INR 150 crore | – | ABC Impact |

| Curefoods | Cloud Kitchen | Bengaluru | $6.6 million | – | BlackSoil, Binny Bansal and Caspian Investments |

Indian Startup Funding – March 2025 [17 – 21 Mar]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| SHOEGR | Shoe care | Chandigarh | $100K | Pre-Seed Round | PedalStart |

| Otipy | Agritech | Gurgaon | $2 million | Venture Debt | Nuvama |

| Slikk Club | Fashion Delivery | Bengaluru | $3.2 million | Seed Round | Lightspeed |

| Protectt.ai | Mobile App Security | Gurgaon | Rs 76 Cr ($8.7 million) | Series A | Bessemer Venture Partners |

| Nivara Home Finance | Housing loan | Bengaluru | Rs 245 Cr | Series B | True North |

| Pilgrim | D2C Beauty Brand | Bengaluru | Rs 200 Cr | Mix of Primary and Secondary Funding | NSFO |

| Chai Kings | Chai Retail | Chennai | $3 million | Series A | A.V. Thomas and Co |

| Qila Games | Gaming | Bengaluru | $1 million | Pre-seed Funding | Chimera VC |

| Lighthouse PropTech | PropTech | Mumbai | $2.5 million | Funding Round | Turbostart |

| Iyaso | Speech Therapy | Pune | $500k | Pre-Seed Funding | Malpani Ventures |

| My Pahadi Dukan | D2C Wellness | Jalandhar | Undisclosed | Pre-Seed Funding | Inflection Point Ventures |

| Navadhan | Fintech | Mumbai | Rs 111 crore | Series A | NabVentures |

| Asper.ai | AI-powered supply chain | Bengaluru | $20 million | – | Fractal |

| Everhope Oncology | Healthcare | Delhi and Mumbai | $10 million | Seed Funding | – |

| Harvested Robotics | AI | Hyderabad | Rs 5 crore | Seed Round | Arali Ventures |

| Broadway | D2C | Mumbai | – | Strategic Investment | Gruhas |

| Nourish You | Plant-based Nutrition | Hyderabad | Rs 16 crore | Series A | Sidbi Venture Capital |

| iHub Robotics | Humanoid robotics | Ernakulam | Rs 4.3 crore | Pre-Seed Funding | U.S. investors |

| Hypergro.ai | AI | Bengaluru | Rs 7 crore | Pre-Series A | Eternal Capital |

| GoOAT | D2C nutrition | Gurugram | undisclosed | Pre-Seed Round | Sirona |

| Go Zero | Ice Cream | Mumbai | Rs 30 crore | Series A | DSG Consumer Partners, Saama Capital and V3 Ventures |

| Yummy Bee | Café chain | Hyderabad | Rs 18 crore | Funding | Mile Deep Capital |

Indian Startup Funding – March 2025 [10 – 14 Mar]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Zolve | Cross-border NeoBank | Bengaluru | $251 million | Series B | Creaegis, HSBC, SBI Investment, GMO Venture Partners |

| Scimplify | Chemicals Startup | Bengaluru | $40 million | Series B | Accel, Bertelsmann India, UMI, Omnivore and 3one4 Capital |

| Purple Style Labs | Omnichannel Luxury Fashion | Mumbai | $40 million | Series E | SageOne Flagship Growth OE Fund, Alchemy Long Term Ventures Fund, Bajaj Holdings and Investment, and Minerva Ventures Fund |

| AmpereHour Energy | Energy Storage | Pune | $5 million | Series A | Avaana Capital |

| goSTOPS | Backpacker Hostel | New Delhi | $4.2 million | Series A | Blume Ventures |

Indian Startup Funding – March 2025 [03 – 08 Mar]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| indē wild | Ayurvedic Skincare | Mumbai | $5 million | Seed Round | Unilever Ventures, SoGal Ventures, The Global Ventures |

| Zuppa | Drone Manufacturing | Chennai | – | Strategic Investment | Garuda Aerospace |

| Swish | Food Delivery | Bengaluru | $14 Mn | Series A | Hara Global Capital, Accel India |

| Gainhub.Ai | Haryana | $100K | Pre-Series | Growth Strategy Ventures | |

| MapMyCrop | Agritech | Pune | Rs 15.7 Cr | Seed Funding | YourNest Venture Capital, Eaglewings Venture |

| MaxIQ (formerly Gyaan AI) | AI | Bengaluru | $7.8 million | Seed Funding | Dell Technologies Capital, Intel Capital |

| Phot.AI | AI | Gurugram | $2.7Mn | Seed Funding | Info Edge Ventures, Together Fund, AC Ventures |

| InsuranceDekho | Insurtech | Gurugram | $70Mn | Funding Round | Beams Fintech Fund, Japan’s Mitsubishi UFJ Financial Group (MUFG), and insurer BNP Paribas Cardif |

| Beacon.li | AI | San Fracisco | $7 Mn | Series A | Sorin Investments |

| Darwinbox | HR technology | Mumbai | $140 Mn | Undisclosed Round | Partners Group and KKR |

| Nuuk | D2C home appliances | Gurugram | $5 Mn | Series A | Vertex Ventures SEAI, Good Capital |

Indian Startup Funding – February 2025 [24 – 01 Mar]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Geniemode | B2B Cross-Border E-commerce | Gurugram | $50 million | Series C | Multiples Alternate Asset Management, Fundamentum, Paramark Ventures, Info Edge Ventures |

| Bridgetown Research | SaaS – Research Analytics | Bengaluru | $19 million | Funding Round | Lightspeed, Accel |

| Oxyzo | Fintech – NBFC Lending | Gurugram | Rs 100 crore ($12M) | Debt Funding | AK Capital Finance |

| Quick Clean | Linen Management – SaaS | Gurugram | Rs 50 crore ($5.7M) | Series A + Debt Funding | Alkemi Growth Capital, Blue Ashva Capital, Rs 10 crore ($1.15M) credit line from Venture Debt Cos |

| Dr. Reddy’s Laboratories | Pharmaceutical Company | Hyderabad | Rs 30 crore | Strategic Investment | Acquired a 0.32% stake by Go Digit (Insurtech – Investments) |

| FanTV | Content – Blockchain/Sui Network | Noida | $3 million | Strategic Investment | Mysten Labs, Cypher Capital, CoinSwitch Ventures, Illuminati Capital |

| Vidyut | EV Full-Stack Platform | Bengaluru | $2.5 million | Funding Round | Flourish Ventures |

| HiWiPay | Fintech – Cross-border Payments | Mumbai | $2 million | Seed Round | Unicorn India Ventures, Dewang Neralla’s Family Office, Jupiter Metaverse LLP, Ritesh Malik, Mitesh Shah, Nilesh Doshi |

| Technodysis | IT – Cloud & DevOps Solutions | Bengaluru | Rs 10 crore | Debt Funding | Recur Club |

| Sisir Radar | Spacetech – SAR Satellite Imaging | Kolkata | $1.5 million | Seed Round | Shastra VC, Riverwalk Holdings, INVSTT |

| Jobizo | HRTech – Healthcare Staffing Solutions | Gurugram | $1.4 million | Pre-Series Funding | Alkemi Growth Capital |

| Astrogate Labs | Spacetech – Satellite Communications | Bengaluru | $1.3 million | Pre-Series Funding | Piper Serica Angel Fund |

| Triple Tap Games | Gaming – Game Development | Mumbai | $1.2 million | Pre-Seed Round | Eximius Ventures, Kalaari Capital, Angel Investors from Entertainment & Gaming Community |

| Dodo Payments | Fintech – Payments Infrastructure | Bengaluru | $1.1 million | Pre-Seed Round | Antler, 9Unicorns, Venture Catalysts, Nitin Gupta, Maninder Gulati, Raymond Russell, Preethi Kasireddy, Nishant Verman |

| Ritualistic | Home Decor – D2C Brand | Gurugram | $1 million | Secondary + Primary Funding | Deep Bajaj, Mohit Bajaj |

| Earthful | Plant-Based Nutrition – D2C Wellness | Hyderabad | Rs 5 crore ($600K) | Seed Round | Srinivasan Namala |

| Pickkup | Logistics – Hyperlocal Deliveries | Gurugram | $500K | Seed Round | We Founder Circle (WFC), Angel Investors |

| Make in Box | Deeptech – Engineering Solutions | Gurugram | $260K | Pre-Series Funding | Mile Deep Works, Mile Deep Capital |

Indian Startup Funding – February 2025 [17 – 22 Feb]

| Company | Sector | Headquarters | Amount | Founding Round Type | Lead Investors |

|---|---|---|---|---|---|

| Lightstorm | Cloud & Data Centre Networking | Gurugram | Rs 700 crore ($80.5M) | Funding Round | NIIF Infrastructure Finance Limited (NIIF IFL) |

| Udaan | B2B E-commerce | Bengaluru | $75 million | Series G | Series G Equity Funding |

| Waterfield Advisors | Wealth Advisory – Fintech | Mumbai | $18 million | Funding Round | Jungle Ventures (Primary & Secondary Investment) |

| Spyne | AI-Powered Visual Merchandising – AutoTech | Gurugram | $16 million | Series A | Vertex Ventures, Accel, Storm Ventures, Alteria Capital |

| The Whole Truth | Clean Label Health Food – D2C | Mumbai | $15 million | Series C | Sofina, Z47, Peak XV Partners, Sauce.VC |

| Singulr AI | Enterprise AI Solutions | Bengaluru | $10 million | Seed Round | Nexus Venture Partners, Dell Technologies Capital |

| Dogsee Chew | D2C Pet Treats | Bengaluru | $8 million | Series B | Ektha.com, Shivanssh Holdings, Poddar Family Office |

| Rare Rabbit | Omnichannel Fashion Retailer | Bengaluru | Rs 50 crore ($6M) | Growth Funding | A91 Partners |

| Ikonz Studios | Digital Avatars & Holography – AI/VR | Hyderabad | $5 million | Pre-Series A | Marc Jordan, Ramana Thummu, Madhusudan Kela, Akash Bhanshali |

| Probus Smart Things | IoT & Data Analytics | Noida | $5 million | Series A1 | Unicorn India Ventures, US-based & Indian Family Offices |

| Swish Club | Devices-as-a-Service – DaaS | Bengaluru | $4.5 million | Pre-Series A | Powerhouse Ventures, Blume Ventures, Founders Fund, Touchstone Ventures, Eternal Capital, Atrium Ventures |

| OneTab AI | Workplace SaaS – AI Solutions | Indore | $3.3 million (Rs 28.6Cr) | Seed Round | LIT Fund, Orbit, Singapore Family Office, SOSV, Sunil Kumar Singhvi, Founders |

| Almonds Ai | Loyalty & Rewards Platform – SaaS | Gurugram | Rs 16 crore ($1.9M) | Seed Round | Promoters of Haldiram’s, JITO Incubation & Innovation Foundation (JIIF), Venture Catalysts, Ever Grow Capital, Nine ALPS |

| NOTO Ice Cream | D2C – Health Foods | Mumbai | Rs 15 crore ($1.75M) | Growth Funding | Inflection Point Ventures (IPV), JITO Incubation & Innovation Foundation, LetsVenture |

| Dynolt Technologies | Deeptech – AI & Analytics | Bengaluru | $1.7 million | Seed Round | Transition VC, Yashowardhan Shah |

| You Care Lifestyle | Independent Verification – E-commerce | Mumbai | $1 million | Funding Round | Luke Coutinho, Narendra Firodia |

| Healthfab | D2C – Reusable Period Panties | Bengaluru | $1 million | Pre-Series A | Mistry Ventures, BeyondSeed, Thrive Ventures, Anupam Mittal, Aman Gupta, Vineeta Singh, Peyush Bansal |

| BYTES | AI-Powered ADAS for Two-Wheelers – MobilityTech | Pune | ₹20 lakh (Non-Dilutive) | Grant | Nikhil Kamath’s WTFund (2024 Cohort) |

Indian Startup Funding – February 2025 [10 – 15 Feb]

| Company | Sector | Headquarters | Amount | Funding Round Type | Lead Investors |

|---|---|---|---|---|---|

| EnCharge AI | AI Chips – Semiconductor | California | $100 million+ | Series B | Tiger Global |

| ToneTag | Digital Payments – Fintech | Bengaluru | $78 million | Funding Round | ValueQuest Scale Fund, Iron Pillar |

| SpotDraft | Contract Lifecycle Management – CLM SaaS | Bengaluru | $54 million | Series B | Vertex Growth Singapore, Trident Partners, Xeed VC, Arkam Ventures, Prosus Ventures, Premji Invest |

| Zeta | Banking Tech – Fintech SaaS | Hyderabad | $50 million | Investment Round (Valued at $2B) | Strategic Investor |

| 75F | Commercial HVAC Automation – IoT & AI | Bengaluru | $45 million | Series B | Accurant International’s Net Zero Alliance, Carrier Global Corporation, Climate Investment, Breakthrough Energy Ventures, Next47, WIND Ventures |

| Rapido | Mobility – Bike Taxi Services | Bengaluru | Rs 250 crore ($29.7M) | Series E | Prosus |

| JQR | Affordable Footwear – D2C | Bahadurgarh | $25 million | VC Funding (First Institutional) | Venturi Partners |

| Lucidity | Multi-Cloud Storage – SaaS | Bengaluru | $21 million | Series A | WestBridge Capital, Alpha Wave |

| The Whole Truth | D2C Protein Bars – Foodtech | Mumbai | Rs 133 crore ($16M) | Series C | Sofina Ventures, Peak XV Partners, Matrix Partners, Sauce.vc |

| Nirmata | SaaS – Cloud Security | Bengaluru | $9.6 million | Funding Round | Peak XV’s Surge, Dallas Venture Capital, Dreamit, Z5 Capital, Uncorrelated Ventures |

| BorderPlus | Global Workforce Mobility | Mumbai | $7 million | Institutional Investment Round | Owl Ventures |

| Bold Care | D2C Sexual Wellness – Healthtech | Mumbai | $5 million (Rs 43 Cr) | Series A | Zerodha’s Rainmatter, Mithun Sacheti (CaratLane), Siddhartha Sacheti (Jaipur Diamond), Gruhas Collective Consumer Fund, Claris Capital |

| CapGrid Solutions | B2B Manufacturing – Supply Chain SaaS | Gurugram | $5 million | Funding Round | Anicut Growth Fund, Nexus Venture Partners, Axilor Ventures |

| Nivaan Care | Chronic Pain Management – Healthtech | Delhi | $4.25 million | Seed Round | Endiya Partners, W Health Ventures |

| Toonsutra | Webtoon & Comics – MediaTech | Bengaluru | $3.2 million | Seed Round | Holtzbrinck Publishing Group, GMJP, T-Accelerate, Google, Graphic India |

| Mysa | Unified Finance – Fintech SaaS | Bengaluru | $2.8 million | Seed Round | Blume Ventures, EMVC, Antler, Neon Fund, CIIIE, Sriharsha Majety (Swiggy), Mohit Kumar (Ultrahuman), Naiyaa Saagi (MyGlamm), Nitin Gupta (Uni) |

| Eduvanz | Education Loan – Fintech | Mumbai | Rs 25.52 crore | Bridge Funding Round | Juvo Ventures, Capria Fund, Peak XV, Unitus Ventures |

| ArthAlpha | Investment Tech – Wealthtech | Bengaluru | $2 million+ | Seed Round | DSP, Family Offices, Wealth Managers |

| Anscer Robotics | Deeptech – Robotics | Bengaluru | $2 million | Seed Round | Info Edge Ventures |

| The Energy Company | EV Battery Solutions | Bengaluru | $2 million | Pre-Series A | Siana Capital, Callapina Capital, Z21 Ventures, 1Crowd, LetsVenture, other investors |

| Future AGI | AI Infrastructure | Bengaluru | $1.6 million | Pre-Seed Round | Powerhouse Ventures, Snow Leopard Ventures, AngelList Quant Fund, Saka Ventures, Swadharma Source Ventures, 30+ industry stalwarts |