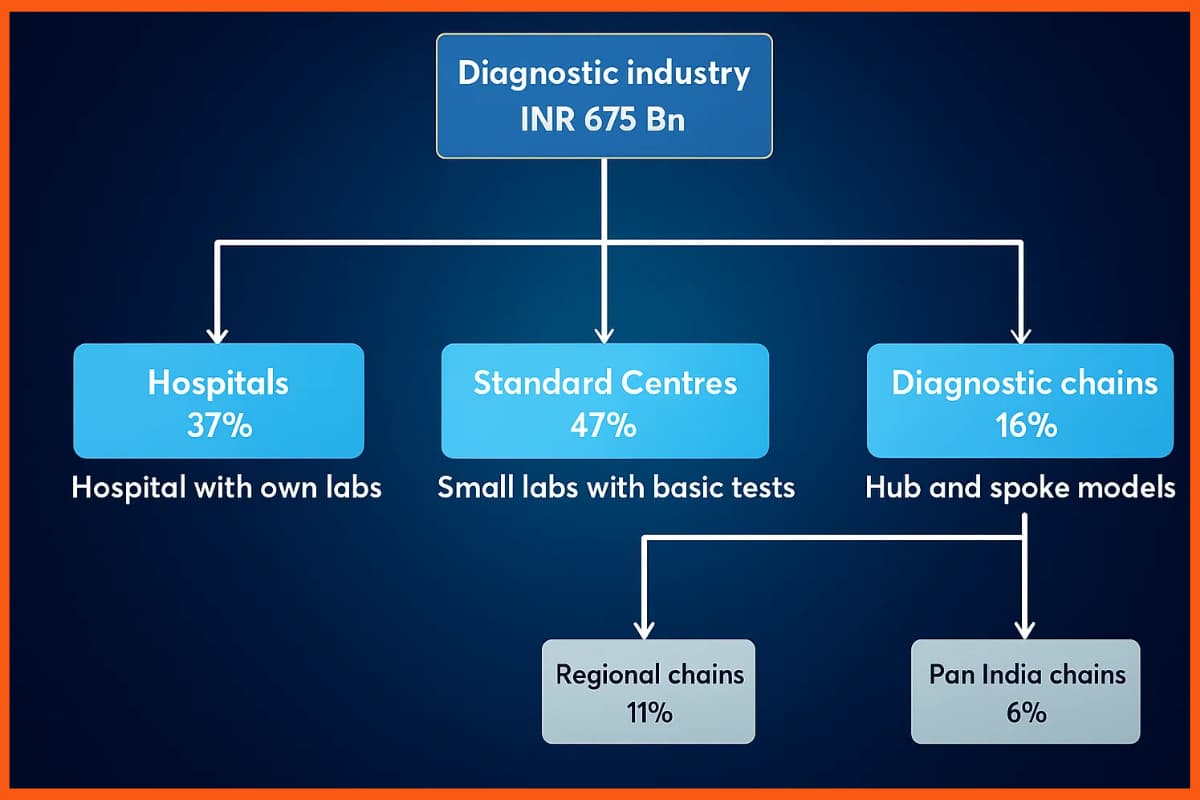

Accurate treatment needs accurate diagnosis. Diagnosis is the first step towards curing disease or disorder. The need for labs is increasing day by day as the number of patients and life-threatening diseases are increasing. The availability of medical diagnostic centers in all parts of the nation is very important. This is a great opportunity for someone who wants to start a medical diagnostic center.

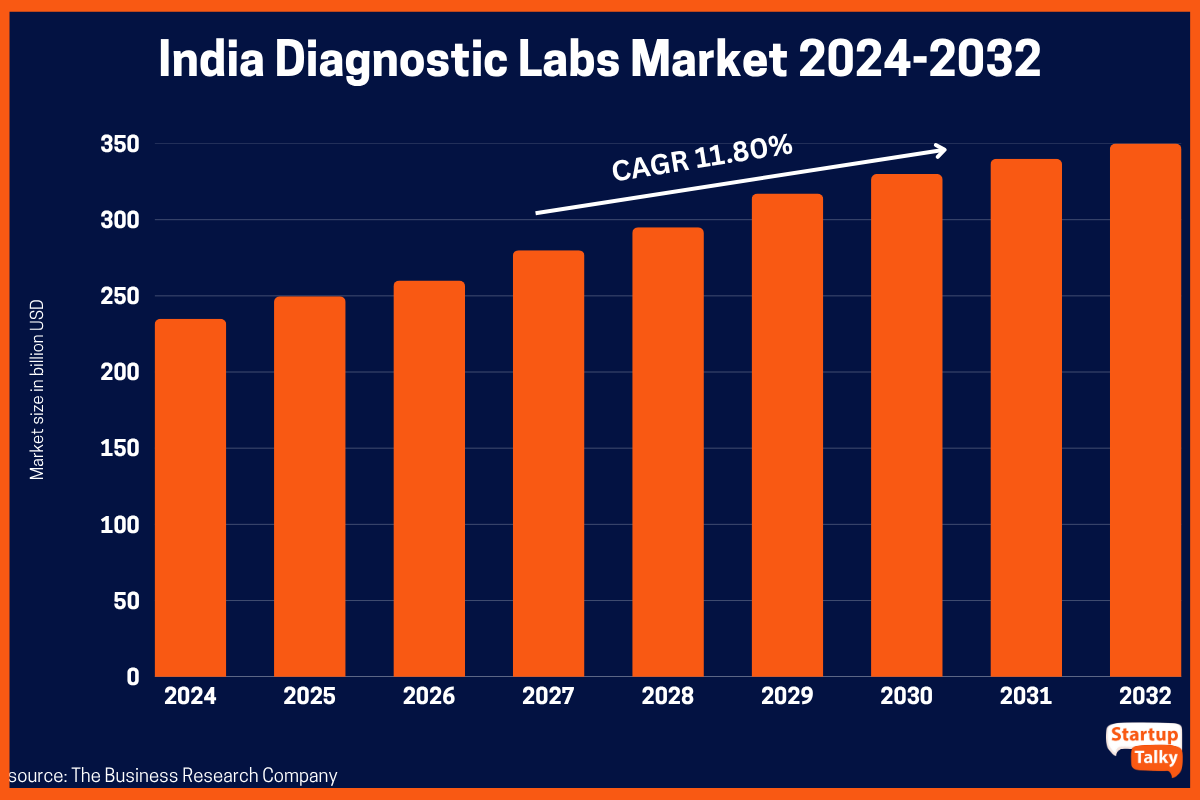

The global medical diagnostic centre business services market is big and growing fast. In 2023, it was worth $211.27 billion and is expected to reach $449.78 billion by 2033. This means it could more than double in the next 10 years. The market is growing at an average rate of 7.9% each year from 2024 to 2033. This shows that more people are using medical tests and services around the world. Starting a diagnostic center business requires proper planning, investment in equipment, and meeting all regulatory requirements. Before starting operations, it’s important to understand all diagnostic centre requirements, including licenses, equipment, trained staff, and proper infrastructure.

Facts and Details about Diagnostic Centers

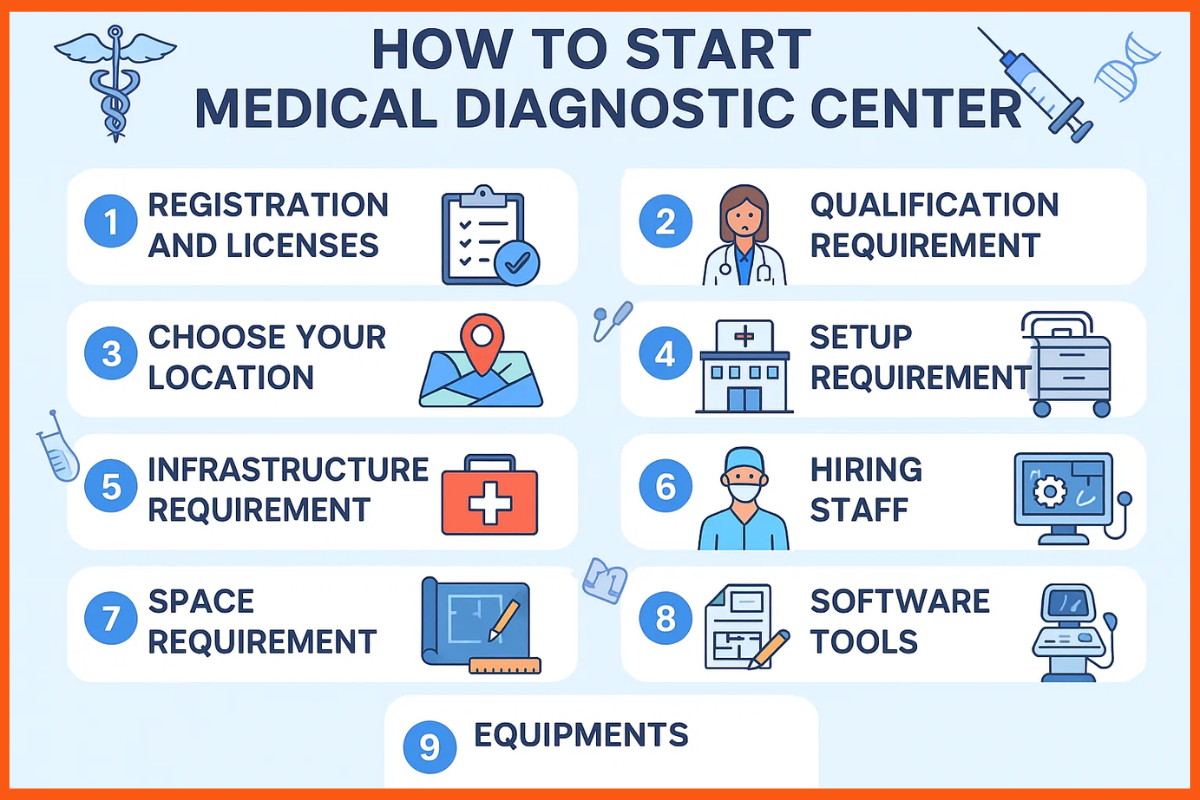

Steps Involved in Starting Diagnostic Centers

- Registration and Licenses

- Qualification Requirement

- Choose Your Location

- Setup Requirement

- Infrastructure Requirement

- Hiring Staff

- Space Requirement

- Software Tools

- Equipments

Facts and Details about Diagnostic Centers

India Diagnostic Labs Market Trends and Drivers

- Growing Demand: More people now focus on preventive care due to rising cases of cancer, diabetes, and heart disease.

- Health Awareness: Early detection and regular health checkups are becoming a priority, leading to higher use of diagnostic services.

- Stronger Economy: With more middle-class families and higher incomes, spending on health is increasing.

- Better Insurance: Wider health insurance coverage is making diagnostics more accessible to the public.

- COVID-19 Effect: The pandemic showed how important testing is, pushing more demand and lab expansion.

- Tech Upgrades: New tools like molecular diagnostics and genetic testing are making tests faster and more accurate.

- AI and Automation: Labs are now using automation and AI to speed up processes and improve results.

- Home Testing Trend: The rise of telemedicine and home care has boosted demand for at-home test kits and mobile labs.

- Improved Standards: Big diagnostic chains are bringing better quality, consistency, and trust to the industry.

- What’s Ahead: With growing focus on health and wellness, the diagnostic market in India will continue to grow in the coming years.

Types of medical tests performed in diagnostic center

- Clinical pathology – Tests are performed on blood to identify the presence of disease-causing organisms.

- Bio-Chemist – a laboratory that analyses body fluids such as urine and blood

- Radiology – Medical tests using imaging techniques such as CT scan, x-rays, MRI, PET, and ultrasound.

Steps Involved in Starting Diagnostic Centers

Registration and Licenses

Creating a strong diagnostic centre business plan is essential for setting up a successful and profitable healthcare venture. The first step towards starting your medical diagnostic center is to get your business registered and acquire licenses in order to earn credibility. The medical industry is all about safety and hygiene. There are many rules and regulations to ensure the same. Following those rules will increase credibility, gain customer trust and satisfaction. To get your test reports accepted at hospitals and nursing homes, a license is required.

Getting registered:

- Trade license (Shop Establishment Act) – At nearest Municipality or Panchayat office

- Clinical Establishment Act

- Biomedical waste disposal body

For clinical establishment act Biomedical waste disposal body you can apply online on their respective websites.

The license required for diagnostic centre are as follows:

- Accreditation from National Accreditation Board for Testing and Calibration Laboratories (NABL) – This license is optional, it is applicable or large center only.

- Accreditation from Good Clinical Practices (GCP)

- Waste generation approval from the pollution board in your state

- Fire Department NOC

- Municipality NOC

Qualification Requirement

You must be a qualified pathologist and must have the required license to practice from the Medical Council of India. You will require a biochemist, pathologist, and microbiologist. Lab technicians must have a Diploma or Bachelors’s in medical lab technology.

Setup Requirement

The setup cost of the lab purely depends on the service offered and the investment you make. A good business plan is necessary to grow your business. As normal lesser investment then lesser will be the number of patients for whom the service offered. If there is more investment and most importantly that spend adequately on infrastructure, staff, machinery, and software tools the higher will be serviced, and the higher will be the incoming and outgoing of patients from your lab. Here we understand that the most important five parameters like infrastructure, space. staff, equipment, and software tools which decide the total entire setup planning and organization.

Choose Your Location

After planning your setup, the next important thing when starting a diagnostic clinic in the Philippines is choosing the right location. If you’re the only clinic in the area with complete services, many people will come to you. But it’s also a good idea to open your clinic near a hospital or other clinics. This way, you can attract patients who are looking for better services than what others offer. Your location can help bring in more customers.

Infrastructure Requirement

The setup was due to give focus on the infrastructure of the lab because it may help staff work efficiently without any disruption. There should be a very clear layout planned for various rooms and treatment areas so that all the planned activities of each department are done smoothly. There must be the availability or accessibility of various services of the lab should be well communicated to the patients who visit the lab for tests.

The other most important thing is that the level of cleanliness should be always kept high. As this relates to the medical activities, there may be some minor deviation from healthy surroundings which will lead to serious problems for both the patients and the staff working there.

Some facilities are necessary:

- Clean restrooms

- Waiting area

- Blood collection lab

- Lab equipment

- Processing

- Examination

- Storage and waste disposal

- Wheelchairs

- Other basis elements of hospital

Hiring Staff

Any organization is nothing but a reflection of its staff. You will need a highly-skilled team of professionals. Doctors, nurses, technicians, pathologists for the success of your pathological center. The staff who is selected to work in the lab must have standard qualifications for respective designations. The recruiting process must go with various rounds if screening and the final resulting staff are efficient enough o handle the complex problems in the medical field.

The lab technicians who are appointed must have enough control and knowledge over the machines used in the lab. They should be provided with training and induction programs during the initial stages of their appointment.

The work and other operations of the lab will be achieved well if the training is given properly. The staff who are regularly working in the lab must be vaccinated with necessary medicines to protect them from the communicable diseases of the patients.

The staff who are appointed must be assisted by a medical representative who will perform the activation of updating the staff with changing techniques. The medical representative will be informing you and the staff regularly about the dynamic conditions in the medical field. Innovations, new medicines, and new techniques will be informed so that you make necessary changes in the methods of finding results.

Space Requirement

Space should be able to accommodate at least 100 patients. Patients should not be left to merge and sit together or have a congested environment due to insufficient space. Space planning is necessary to place things right at their place. Clubbing to two or more departments performing various activities should not happen possibly that may give misplaced results or any undesirable condition.

Software Tools

To set up a modern and hi-tech lab everything becomes computerized. This helps in working in an organized manner. This will eliminate errors in results and will be an efficient time-saving opportunity. Having a record of their medical history will be possible with strong software tools and staff with adequate knowledge in this field. Diagnosis will also require efficient systems and programming to arrive at the results.

Here is a list of modern software that helps in lab management:

- Thinklab – it is an easy-to-use software that keeps a track of medical records, scheduling & appointments, specialization based EMR, prescription management, case-based tracking, billing, inventory, analytics & MIS, alerts and notification, private chat, etc.

- ThinkWide– A fully automated laboratory solution that helps in the supervision of nursing homes, polyclinics, medical shops, pathology, and radiology labs.

Equipments

The equipment required for the pathology lab has a different range of items. The smartest way to purchase them all by having a checklist otherwise you might miss one or two important items. If your lab is short of necessary equipment then it will be rated as low. Having a various range of testing tools is the only way to make your lab more productive for the patients coming. We all know that the basic expectation of any patient will be the availability of all the required services in one place. From this, the most important part is the safety aspect of the purchased equipment. It is a better option to carry out preventive maintenance, than breakdown maintenance.

Some of the most important equipment needed in a pathology lab are as follows:

- Full auto analyzer

- Semi-auto analyzer

- Elisa washer

- Elisa reader

- Blood cell counter

- Microscope

- Centrifuge

- Regent and chemicals

- Deep fridge

- Dispensing scale

- Blood gas analyzer

- Colorimeter

Marketing Plans

Making locals aware of your services is another big task. A good marketing plan ensure an increase in awareness about services provided by your lab. By implementing a good strategy, you can attract more patients to your lab. In today’s modern world everything and everyone is connected to the internet. Generally, people rate the medical sector on the basis of services provided.

- Having tie-ups with hospitals will be a very effective method of marketing.

- Tie up with hospital or organization for mass checkup of locals provided at little lower costs.

- A Functional Website

- Facebook and Other Social Media

- Search Engine Optimization of your website

- Word of Mouth and Internal Marketing

- Automate your Operations

FAQs

How to open diagnostic centre in India?

For starting a diagnostic center, you will first need to register your business and get required licenses. There are many rules and regulations in India for starting diagnostic center. You will need to follow all the rules and laws to gain credibility, customer loyalty, satisfaction, and results acceptance at hospitals and nursing homes. Hire qualified staff and find a right location for your business. Plan and design space to keep patients comfortable and at a safe distance. Make a good plan and you are all set to launch your diagnostic center.

License required for diagnostic center

- Accreditation from National Accreditation Board for Testing and Calibration Laboratories (NABL) – This license is optional, it is applicable or large center only.

- Accreditation from Good Clinical Practices (GCP)

- Waste generation approval from the pollution board in your state

- Fire Department NOC

- Municipality NOC

Marketing plan for Diagnostic center

Your product should speak for itself. Keep your customers satisfied with good services and they will be spreading word of mouth for your business. Also technology will be very helpful in this context. You can increase your reach using SEO and digital media.

- Having tie-ups with hospitals will be a very effective method of marketing.

- Tie up with hospital or organization for mass checkup of locals provided at little lower costs.

- A Functional Website

- Facebook and Other Social Media

- Word of Mouth and Internal Marketing

What are the requirements to open a diagnostic centre?

To open a diagnostic centre, you need medical licenses, certified staff, quality equipment, proper space, and government approvals.

What are the documents required for diagnostic centre?

Documents required for a diagnostic centre in India include a trade license, pollution control certificate, lab registration, NOC from the fire department, and approval from local health authorities.

What is diagnostic center setup cost in India?

The diagnostic center setup cost in India can range from INR 15 lakhs to INR 1 crore or more, depending on the size, location, and type of services offered. Basic pathology labs cost less, while centers with advanced imaging like MRI or CT scans require higher investment.

What is the qualification required to open a pathology lab?

To open a pathology lab in India, you typically need a pathologist with an MD or DNB in Pathology. Additionally, you must have qualified lab technicians (DMLT/BMLT) and appropriate licenses from health authorities like the Clinical Establishment Act and local municipal bodies.