This article has been contributed by Shreya Sharma, Founder and CEO, Rest The Case

If you’ve ever utilized a legal services platform, chances are you adore just how convenient it is to deal with legal matters without all the headaches that typically come along. But behind the scenes, what’s really going on? Surprisingly, it’s not always smooth sailing. Platforms are facing some stiff challenges, both ones that are rather obvious and ones that aren’t. Let’s break the biggest struggles down and the genius ways these platforms manage to keep thriving.

The Legal Maze Nobody Warned Them About

Imagine going through a maze blindfolded. The regulations surrounding who can provide legal advice vary geographically and are extremely stringent. Most locales only want lawyers who have cleared the bar to really provide legal advice, so these websites can’t simply hurl legal pointers at you without lawyers in the mix.

So, legal websites play it clever. They provide tons of useful information and convenient forms that practically anyone can fill out, but when the case requires something more bespoke or complicated, they call in the experts the real lawyers. It’s a clever trick for being on the right side of the law while still assisting tons of people with what they require.

Clients Want It Fast, Cheap, and Clear—No Fuss

Today, patience is not a virtue when it comes to legal assistance. Individuals demand speedy responses, concise directions, and fees that don’t cause their wallet to weep. That’s an uphill task for something as slow and fiddly as the law.

Platforms rise to this challenge by making the mundane tasks automated. Completions of forms? Automated. Scheduling a call? Clicking away. Which leaves the actual legal minds to handle more difficult matters that require their personal touch, which means everyone receives assistance, quickly and with efficiency.

Old-School Law Meets New-School Tech

You understand how some law firms still resemble they’re from the previous century with stacks of paper and file cabinets? Well, transitioning from that to completely digital mediums is like turning a huge ship. It requires coordination, patience, and time.

The good platforms all use all-in-one software where it all links your case information, communication, billing, you get the picture. This simplifies life for both clients and attorneys, and since it’s all online, the managers of the platform can identify and correct issues quickly.

Keeping Your Secrets More Secure Than Fort Knox

When it comes to legal business, your information is sacrosanct. If this information gets out, it’s not only humiliating, it can destroy people’s lives. Which is why legal sites are really serious about security.

They deploy every type of trick such as encryption, two-step verification, and ongoing system scanning to keep the hackers away. And they also train everyone to catch scams before they reach. Because if customers can’t trust them with their secrets, the entire platform collapses.

The Personal Touch Without the Robot Feel

A complaint about online law services is that it often seems like you’re conversing with a robot. You complete the same dull forms, navigate through menus, and wait for a scripted response.

To do that, most platforms offer you two choices: easy tasks you can finish yourself or the option to talk to a real person if things get confusing. It’s like building Ikea shelves with your own two hands, but having a pro on speed dial for the hard stuff.

Managing the Crowd Without Losing Their Mind

Popular legal sites get overwhelmed with users. If there are too many requests with no system to filter them, things come to a standstill and people become frustrated.

So, sites employ intelligent tech that sorts and ranks cases themselves and forward them to lawyers specializing in the same area. Thus, everyone receives the proper assistance faster and the lawyers aren’t bogged down.

Teaching Old Dogs New Tricks

Lawyers are traditional; they’ve done their job a specific way for years. Prying them from doing things the old way and onto new technology isn’t easy. Some lawyers resist it in point-blank fashion.

Legal platforms solve this by gradually introducing lawyers to the new tools. They give training and demonstrate how technology reduces the time taken and minimizes mistakes. Once lawyers witness that it makes life easier for them, they’re on board.

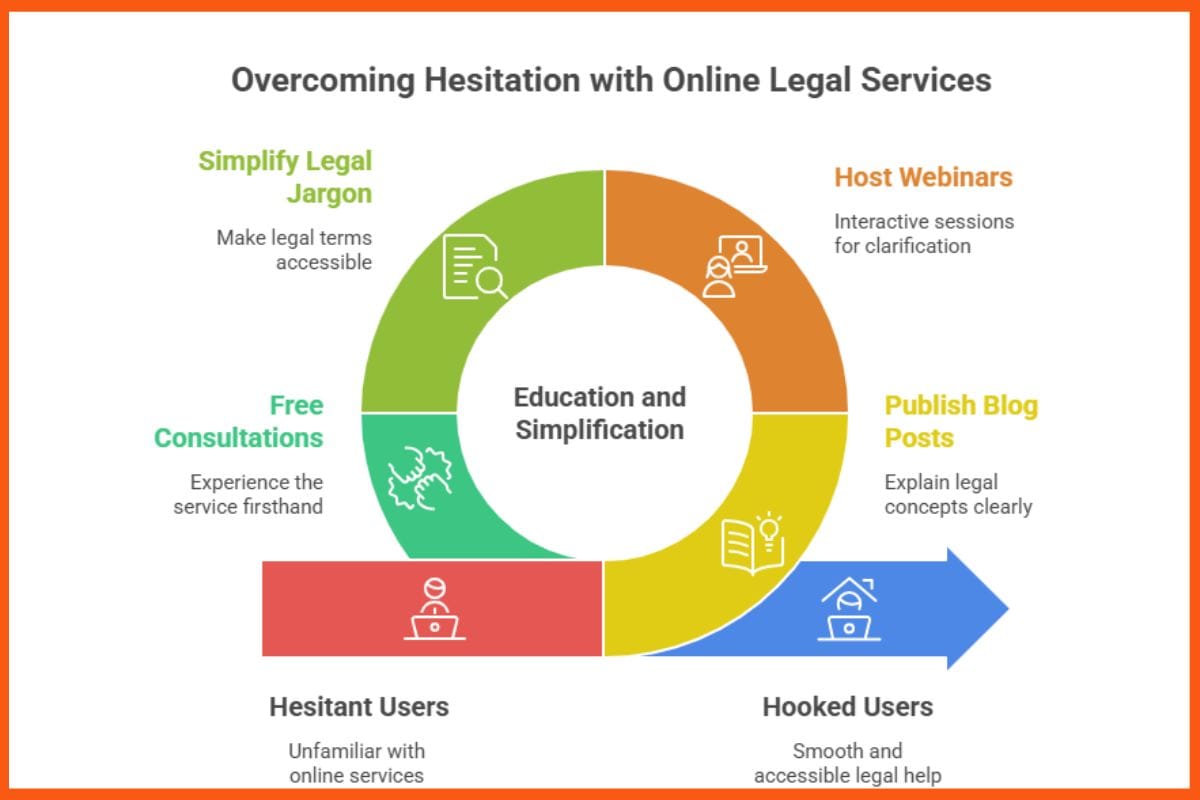

Teaching People It’s Not a Scam

Even today, plenty of people hesitate to use online legal services because they don’t quite get how they work. The idea of getting legal help through a website feels… risky.

That’s why education has become a core strategy. Platforms publish blog posts, host webinars, and simplify legal jargon so it feels less intimidating. Some even offer free first consultations to let people “try before they buy.” Once someone sees how smooth the process is, they’re usually hooked.

Custom Fits Instead of One-Size-Fits-All

All law firms are unique. What works beautifully for one won’t necessarily work for another. But creating unique software for everyone is complicated and costly.

That’s why leading platforms create editable tools. They provide a good foundation everyone employs but allow firms to customize details to suit their own requirements. This combination provides flexibility without the hassle and cost of building something new.

So, What’s the Takeaway?

Although legal service websites appear to be a walk in the park, they’re playing a delicate balancing act. They must comply with stringent laws, live up to high client expectations, keep data sealed tight, and get legal experts to adopt change while leveraging next-generation technology wisely. Their secret to success? Treating technology as a tool, not a replacement. Automate the trivial, preserve human touch where possible, gain user trust, and maintain the system’s flexibility.

Ultimately, these platforms are making legal assistance simpler and more accessible to all and that’s something to get fired up about.