How many times have you broken your pot to withdraw your savings from the piggy bank? If you’ve also done this, then you know the temptation to break the pot and take the money out. But this was a traditional method of saving. In this era, you can save whenever you spend. Want to know how? Then stay tuned with this article.

So many tactics we adopt in order to save our money for our future needs. Traditionally, we used to save our money in piggy banks. Whenever we have some extra pennies, we put that money in a piggy bank and wait until it is full. This way, we accumulate a handsome amount of money through small savings.

As mentioned, this is a traditional method, but today we have the privilege to use digital technology for saving as well. Now we can automate our savings without any extra hustle by leveraging the benefits of digital savings apps. These apps are designed to boost savings by contributing a small chunk of daily spending into gold or investing it into different portfolios, which, with large returns, yields a handsome profit.

What Are Digital Saving Apps?

Digital saving apps facilitate saving by leveraging AI and technology. These apps help you to save every single penny, and in addition to that, provide interest on it. You can create your goal for future spending and start saving for that goal now. Each day, when you see yourself going toward your goal will create a habit of saving in you and motivate you to continue further.

Top 12 Digital Saving Apps

There are many digital savings apps in the market, but the following are the best digital apps that you must try to make a profit.

| S.No. | App | Key Benefit for Users | Best For |

|---|---|---|---|

| 1 | Gullak | Automates small savings from daily expenses | Users who want micro-savings without effort |

| 2 | Spenny | Invests spare change into digital gold | Beginners looking to save + invest |

| 3 | Fello | Gamified savings with rewards | Gen Z/Millennials who like gamification |

| 4 | Wizely | Goal-based savings with rewards | People who like setting & tracking goals |

| 5 | Fi money | Smart savings, spending insights, and rewards | Salaried professionals managing money |

| 6 | Jar | Saves spare change in digital gold | First-time investors & savers |

| 7 | Jupiter | Smart banking with budgeting & tracking tools | Tech-savvy users wanting a neobank |

| 8 | Deciml | Invests spare change in mutual funds | Young adults wanting passive investing |

| 9 | Cred | Rewards for paying credit card bills on time | Credit card users seeking rewards |

| 10 | YNAB | Powerful budgeting tool based on zero-based method | Serious budgeters seeking control |

| 11 | Digit | Automatically saves based on spending patterns | Busy individuals who want hands-off saving |

| 12 | Cash Karo | Earns cashback and coupons on online shopping | Shoppers who want to save while spending |

Gullak

| Rating | 4.3/5 |

|---|---|

| Best For | Micro-saving and auto-investing |

Many of you are very much familiar with the word “Gullak”, as it is widely used by us for saving pennies and small amounts. Gullak is a goal-based saving app that helps to maintain consistency in saving and also to move towards your goal of saving. The amount we save in Gullak is invested in digital gold, which is 24k pure gold. This way, you can earn some interest on your savings through appreciation in the gold price.

Set your goal with as low as Rs 10 per day and automate the whole process of saving via the autopay facility. Currently, this app supports autopay from three UPI platforms like PhonePe, BHIM, and PayTM. You can adjust the contribution, pause, or revoke the autopay anytime.

The most influential feature of this app is saving on your spending. Whenever you spend your money digitally, it automatically rounds off the amount spent and invests in digital gold. For example, if you make a payment of Rs194, it rounds off the figure to the nearest 10 and invests the remaining amount of Rs6. This way, it accumulates a handsome amount of money by aggregating these small savings.

Features of Gullak

- It invests in digital Gold provided by Augmont, where the buying and selling price is based on the wholesale market price.

- Flexibility to change the duration of your goal, the amount of autopay, and the multiplier.

- No KYC is needed for Gold investment below 30gm.

Spenny

| Rating | 4.5/5 |

|---|---|

| Best For | Newbie Investors |

Automate your saving habit with Spenny, which is a spare change investment platform. The working of this app is similar to Gullak, but it has certain advantages. Whenever you spend money digitally, it accumulates your transaction data, and based on your transaction, it rounds up the figure to the nearest 10.

It holds all your rounded-up money in a cart and invests the whole amount into your desired investment option. There is a minimum threshold limit in the cart set by you, which means it invests your money when this threshold is met.

Let me clear one most common doubts, it doesn’t deduct the money to round up whenever you make any transaction. It accumulates the spare change in the cart and only deducts the money via autopay when it reaches the threshold limit decided by you.

Features of Spenny

- There is no lock-in period, which means you can withdraw your money whenever you want.

- It provides multiple investment options like Pennywise, mutual funds, and digital gold.

Fello

| Rating | 3.7/5 |

|---|---|

| Best For | Gaming Enthusiast |

Fello is a game-based digital saving app that enriches the saving experience with the fun and joy of built-in games. It offers two investment options to save money: fellow flo and digital gold. Users can opt for any of these two options to grow their savings and earn some interest. Digital gold of Fello is provided by Augmont, which is a government, BIS, and NABL-accredited Gold provider.

Apart from saving and investing in Gold and Fello Flo, Users can play exciting games and win rewards. This app provides a token for every single rupee you save, and you can use those tokens to play games. Also, every Rs500 of weekly savings makes you eligible to win a tombola ticket.

A Tambola ticket is like a lucky draw coupon where you win a reward if your ticket number matches the leaderboard number. Every Friday at 6 PM, they announce the draw number.

Features of Fello

- 10% fixed return if you choose Fello Flo, which is a decent return compared to other fixed investment options available. This return may change anytime.

- Along with the Fello Flo, the Digital Gold investment option is also available from a trusted provider, Augmont.

- Win a Fello token every time you save some bucks, and use these tokens to play games.

Money Saving Apps

Wizely

| Rating | 4.2/5 |

|---|---|

| Best For | Saving and future Plans |

Wizely is a savings app to improve your financial discipline and make sure you never run out of money at the end of the month. This app comes with many exciting features and gives a reward whenever you take one step forward toward your goal. There are some saving plans already created, like an emergency plan, safety plan, and growth plan, or you can create your custom plan and start saving.

The funds are automatically saved in the form of digital gold to earn some interest. Whenever you save some money and fulfil the challenges, it will provide you with a wellness score and a scratch card. The reward earned through scratch cards can easily be transferred directly to the bank account through UPI. Wizely Wednesday is another exciting reward contest to win rewards up to Rs 25 lakh.

Your savings are in autopilot mode with Wizely, and it will also track your spending and all the transactions in one place.

Features of wisely

- Budget creation and monitoring of the expenditure to build financial discipline.

- Save more and take on challenges to win scratch cards and earn monetary rewards.

- Expense categorization to prevent you from overspending.

Fi money

| Rating | 4.5/5 |

|---|---|

| Best For | Working professionals |

Fi Money is a one-stop solution for accounts, savings, investment, UPI, and lending. It is a neobank with a partnership with a federal bank that provides an enhanced banking experience to its customers. It is loaded with all the basic facilities of a traditional bank, with no minimum balance requirements and zero forex charges. RBI-approved Fi money insures your money up to Rs 5 lakh. Smart deposit is the piggy bank of this app to save money for your goals.

It allows you to save money for your vacations, a new house, a car, and many more. With the benefit of saving, it gives an interest of 5.45% on the amount you save. If you want to earn some extra interest of 5.95%, then you can simply switch to fixed deposits with the convenience of your smartphone.

For better convenience and transparency, it connects all your bank accounts to its platform so that you can view all your transactions and bank balances in one place.

Features of Fi money

- Multiple saving and investment options are available to choose from, based on your saving goal.

- The Fi jump feature to earn a fixed interest of 9% every year and see your investment grow every day. Also, withdraw your investment anytime to your account.

- Have a collection of direct and commission-free mutual funds to invest in.

Jar

| Rating | 4.3/5 |

|---|---|

| Best For | Micro saving and gold investment |

Jar is a digital Gullak to save your hard-earned money into 24K digital gold. Just like you put pennies into your traditional Gullak, you can put spare change into a jar. This spare change is automatically debited from your account via UPI mandate. Jar is the best app for saving money in India digitally.

Whenever you make any digital transaction, Jar rounds up the value to the nearest 10 and invests the remaining spare change into your digital goal. SafeGold is the digital gold provider of Jar, which enables investing in digital gold to be feasible. One can easily withdraw the investment at any time with a single click.

Jar also provides real-time updates on Gold prices through the chart. Also, there is a spin reward awarded to you whenever you save some money in it.

Features of Jar

- You can choose to withdraw your savings either into a bank account or in the form of physical gold, which will be directly delivered to your home.

- There is no lock-in period and minimum amount for withdrawal.

- Seamlessly automate your savings via autopay and pause or revoke it anytime.

Jupiter

| Rating | 4.4/5 |

|---|---|

| Best For | Expense tracking and management |

Jupiter is a federal bank-backed digital asset management platform that is loaded with banking facilities, investments, debit and credit card management, savings, and transaction tracking. Jupiter offers savings pots to save for future purchases. This pot lets you be aware of your savings for your goal and keeps you disciplined.

Apart from saving, you can also make investments in direct mutual funds with no commission. These are no-penalty mutual funds, which means you don’t need to pay any penalty for SIP default.

A zero balance account with no forex charge is another notable feature of this app. Just like Fi money, you can configure your bank accounts and see all your transactions and bank balances at one single interface. It provides a Jupiter debit card with no annual maintenance charge. Earn a reward of 1% whenever you make a purchase using this card, also freeze and sleep the card with a single tap.

Features of Jupiter

- Categorized insight into all the expenditures made through any of your bank accounts.

- Intuitive interface to manage everything at a glance.

- Get a 1% reward not only on debit card transactions but also on purchases through UPI.

Deciml

| Rating | 4/5 |

|---|---|

| Best For | Daily basis investment into different portfolios |

Deciml is the next app on our list of digital portfolios. Like other saving apps we discussed so far, this also has the functionality to save your spare change and invest in a fixed return instrument. This supports all debit cards, credit cards, UPI, net banking, and ATM transactions to accumulate spare change.

While other apps invest your spare change in digital gold or mutual funds, this app invests your money into Lendbox. Lendbox is a P2P investment platform certified by the RBI. It invests your money into a diversified portfolio to earn interest on your savings. Deciml is currently working on implementing mutual funds and crypto in its investment portfolio. It’s a piggy bank app in India that supports all credit cards and helps you save money.

Features of Deciml

- The main feature of Deciml, which differentiates it from Jar and Gulllak, is that it invests your spare change on a daily basis. It doesn’t wait to reach a certain amount to invest.

- Offers return up to 10%, which is approximately 3X the savings account return, and 2.5X the FD return.

Cred

| Rating | 4.7/5 |

|---|---|

| Best For | Credit card users |

Cred is a credit card management app that delivers amazing credit card-related services that eventually help you save a lot of money. The use of Credit cards is now very common among people, also most people tend to hold more than one credit card at a time. Credit cards come with a lot of benefits, only if you use them in a disciplined manner, and here Cred plays an exceptional role.

It helps in the timely payment of your credit card dues by reminding you of the due date. You can monitor all your credit cards in one place, their spending, EMIs, outstanding amount, and many more things. Apart from making you disciplined in credit card use, it also showcases the hidden charges associated with these cards.

It offers free credit scores to you from top credit rating agencies like Experian and CRIF. Cred allows you to become a member if you fulfil certain eligibility criteria. It checks your credit score when you apply for membership and approves you as a member if your credit score falls above the eligible score.

Features of Cred

- Whenever you make a credit card bill payment through this app, it will reward you the Cred coins by which you can use to unlock exclusive rewards.

- Since your Credit score depends on your credit behaviour, this app uses AI to provide you with the statistics of your spending patterns and usage.

- Multiple credit card management facilities in one app, now there is no need to download separate apps for all your cards.

YNAB

| Rating | 3.7/5 |

|---|---|

| Best For | Creating and Tracking Budget |

YNAB (You Need a Budget) is an app that acts as your personal finance manager that taking care of all your finances. It helps to manage all your finances in one place and also to make smart financial decisions. Integrate all your bank accounts in one place and see all your finances.

The goal-tracking feature will help you to track your progress at a glance. This app doesn’t allow you to save money on it, but it helps in different aspects of saving. Smart categorization of your expenses will help you monitor your expenses at the top.

Features of YNAB

- Target setting for your goal to achieve it even faster.

- Adjust your spending and move the money from one category to another seamlessly.

- Easy monitoring of spending, goal progress, and budget.

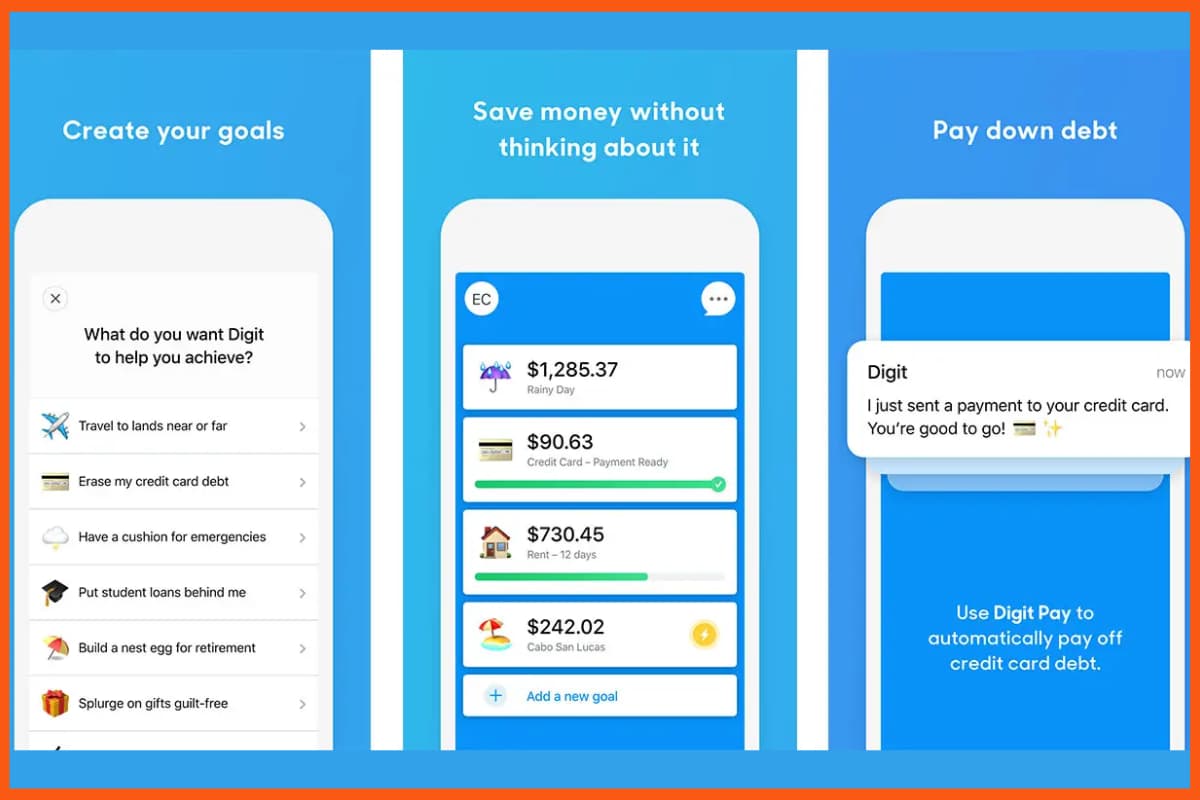

Digit

| Rating | 4.4/5 |

|---|---|

| Best For | Automated, Hands-Off Savings |

Digit is an AI-powered savings app that automatically analyzes your spending habits and moves small amounts of money into savings without you noticing. It helps you save for multiple goals like emergency funds, vacations, or debt repayment. The app removes the need for manual budgeting or transfers, making it ideal for people who want a hands-off approach to saving. Digit also offers features like overdraft prevention and investment options. It’s especially useful for users who struggle with consistent saving habits.

Features of Digit

- Digit analyzes your income and spending habits to save small, safe amounts daily without manual input.

- You can create multiple savings goals like travel, emergency funds, or debt repayment, and Digit allocates funds accordingly.

- Digit monitors your bank balance and transfers money back if needed to help you avoid overdraft fees.

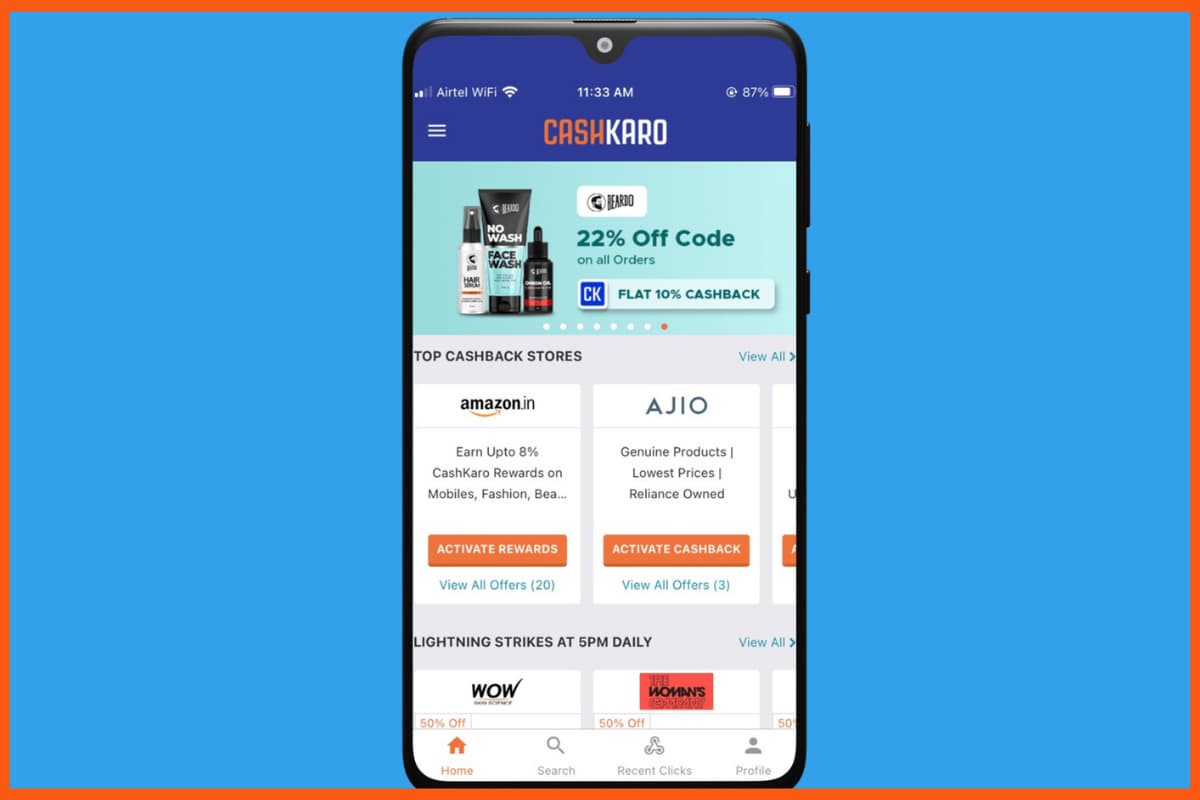

Cash Karo

| Rating | 4.2/5 |

|---|---|

| Best For | Cashback and Coupons on Shopping |

CashKaro is a cashback and coupons platform that helps users save money on online shopping. When you shop through CashKaro’s partner links, you earn real cashback on purchases from sites like Amazon, Flipkart, Myntra, and more. The cashback can be transferred to your bank account or redeemed as gift cards. It also offers exclusive deals and coupons to boost your savings. Ideal for regular online shoppers who want extra value on every purchase.

Features of CashKaro

- You earn cashback when you shop on popular sites like Amazon and Flipkart through CashKaro.

- It gives you exclusive coupon codes to save more money.

- You can refer friends and earn extra cashback from their purchases.

Conclusion

Saving and investing for a future goal is the best thing you can start today, and these digital savings apps will help you in your journey. Today, we have a plethora of investment and saving options to choose from. You need to choose the right option that best suits your goals and requirements. Don’t think too much, just create your goal and start saving by choosing the best-saving App from the list we have provided.

FAQs

What are the benefits of Digital savings apps?

Digital savings apps can make the process of saving money easier over time. You can fill your piggy bank automatically so that savings goals can be met without stress, and it also helps you on tough days by automatically saving for you as you are spending. Some apps are programmed to make payments rounded off to the nearest whole number and save away the “change” you would receive if the transaction were done in cash.

Why is saving important?

Saving provides a financial “backstop” and provides financial security and freedom, and it also secures you in case any financial emergency arises. One can avoid debt, pay off loans, live their dream life, and avoid further debt if they have saved a sufficient amount.

Which are the apps like Jar?

Some of the apps like Jar

- Gullak

- Cred

- Spenny

- Fello

- Wizely

- Fi Money

- Jupiter

- YNAB

- Deciml

Which is better in Gullak vs Jar?

Gullak and Jar are both digital savings apps that help you save money easily, but they work a bit differently. Gullak focuses on automating small savings by rounding off your daily expenses and putting the extra change aside, making saving effortless. Jar, on the other hand, also saves your spare change but invests it directly into digital gold, helping your savings grow with potential returns. So, if you want simple, automatic saving, Gullak is great. But if you want to invest your small savings in gold, Jar is a better choice.