If one word could define the 21st century, it would be ‘Speed’. In a world moving faster than ever, technology has become the driving force, shrinking distances, transforming lives, and accelerating everything around us. Speed isn’t just a preference anymore; it’s a way of life.

And when it comes to the thrill of speed, few things capture it better than the high-octane world of Formula 1 (F1) racing. With roaring engines, global fanfare, and jaw-dropping precision, F1 isn’t just a sport, it’s a billion-dollar spectacle.

But behind the glamour, fast cars, and famous drivers lies a fascinating business model. So, how exactly does F1 make its money? In this article, we take you into the fast lane of Formula One’s revenue engine, unpacking how the sport sustains its enormous operations and still drives impressive profits.

Formula One – The Racing Sport

The First World Formula One championship

The Popularisation of Formula One

F1 Business Model

How Does Formula One Make Money?

Formula One Administration

The Formula One Management

Where do the F1 Teams Spend their Money?

FAQ

How do Formula 1 Teams Make Money?

Formula One – The Racing Sport

Even if you are not a diehard fan, you must have heard it somewhere around the world. Maybe in a film or just when you tinker with the television. Formula one is one of the most popular sports in the whole world. It is a racing sport, where players (the drivers) try to win the race by being the fastest. It is the finest and highest class of international racing with single-seated cars. It has an official federation of boards that looks after the events and also the sportsmanship. Formula One is sanctioned by an international federation known as the Fédération Internationale de l’Automobile (FIA) which was established on 20 June 1904.

F1 is owned by Liberty Media, a large American media company that also owns SiriusXM and has shares in Live Nation and the Atlanta Braves. Formula 1 is managed by Liberty Media through its company called the Formula One Group. This group has been in charge of F1’s business and commercial side since Liberty Media bought it in 2017.

Formula one was inaugurated on 13 May 1950, under the name ‘World Drivers championship’. The inauguration was hosted at Silverstone in the United Kingdom. The inaugurated name was changed to FIA Formula One World Championship in the year 1981. Although it was formally organised and inaugurated in 1950, the inception can be traced much back to that.

The origins of Formula One begin from the European Championship of the 1920s and the 30s. Then came World war II, which stopped the racing fad. Once it was over, motor racing enthusiasts came back to the track, challenging the wheels. Thus, even after the big shaky war, the sport stood firm in people’s hearts.

Later in the year 1946, Formula one was agreed on the set of rules that the players have to comply with. The 1946 Turin Grand Prix was the first Formula One Grand Prix event held.

The races happen on tracks that are specifically built for that purpose. The tracks are checked and certified by the FIA. Most of these tracks are located in Off-sites of cities, that are connected to cities and disconnected at the same time.

Within the sport, there are many divisions like the British Grand Prix and the Singapore Grand Prix, which can also be seen be happening in closed public areas. As mentioned before, formula one is the most premium form of racing sport in the world. Having said that, it also draws huge attention and audiences.

The First World Formula One championship

Guiseppe Farina, an Italian driver won the first-ever world championship. Driving an Alfa Romeo, narrowly defeated Juan Manuel Fangio, the Argentine and his teammate and walked away with the first Driver Crown, of the most premium racing sport ever. Fangio did not lose hope and tried again to get better, eventually winning the 1951 championship.

The Popularisation of Formula One

After the technology that was brought to the table, Formula One stood off as an effective and profitable sport. It had all the ingredients that make someone fall in love with the sport.

In the year 1971, Bernie Eccelstone brought the Brabham team, thus racing a seat on the association of boards (Formula One Constructors’ Association or FOCA). With the inclusion of Eccelstone in the association, the circuit owners negotiated with individual teams. Which in return persuaded the FOCA to offer circuit owners a collective deal, which was more beneficial for them.

FISA was formed in 1979 which asserted rights over the revenues that came from the television. When FOCA had a dispute with FISA over technical regulations, FOCA boycotted a Grand Prix. FISA later gave up the administration of television rights to FOCA. There were further disputes.

Out of the blues of conflicts, Formula One emerged as a big business when sponsors came in and poured money. The FIA earned good money along with the teams. Participating Teams in turn started to spend millions on technology and ways that can make the car run faster. All these events grew a nice demand for a thrilling sport that Formula One promised.

F1 Business Model

Formula 1 operates a unique business model that combines global sports entertainment with strong commercial management. Owned by Liberty Media, F1 is run through the Formula One Group, which oversees the sport’s commercial rights, partnerships, and promotion. The model focuses on hosting races worldwide, building long-term partnerships with sponsors and cities, and growing a loyal global fanbase through media and digital engagement. By managing the sport’s image, events, and distribution, F1 turns high-speed racing into a profitable, global business empire.

How Does Formula One Make Money?

If this is such a big and premium sport then how does it run itself, or how does it sustain itself? These questions are normal to have and that is the reason why we are here in this article. Let us not beat around the bush then and find out how it earns money.

It is here to be importantly noted that Formula One has not just a single source of revenue, but it has multiple sources. We will discuss each and every source in a brief and in detailed manner. Let us get to it.

As mentioned before, F1 makes its money in many ways. There’s prize money, the management, sponsorships and sponsors, partnerships and investments from the car manufacturers and other arrangements of the financial sort.

There may be more than just these heads of income, but primarily the whole source is built upon the basic boundaries of these heads of income. Let us first discuss the first and by far the foremost and most popular source of revenue in the 21st century, the Sponsorships.

Sponsorships

Sponsorships are the most common source of revenue for any popular entity. The entity can be a product, a sport and it can even be a person. This most obvious source is a big contributor to the speedy and premium sports business of formula one. The most common brands that we always witness in these leagues are Petronas, HP, DHL, Red Bull to name just a few of them.

The Introduction of Sponsorships

Over the next two decades of the sport, the participating teams saw a need for specially made cars. That was the only possible way to take the sport ahead in line. As the cars changed shape from being front-engined to mid-engined, the need grew stronger. The Ferguson P99 was the last front-engined car to compete in the World Championships.

In 1962, came the greatest technological breakthrough. They introduced an aluminium monocoque chassis for making cars. This marked the time when brands started to advertise on racing cars. The first was probably the Cigarette manufacturers “Imperial Tobacco” sponsoring in 1968. This technological breakthrough made the norm of advertising in this sport normal for the world.

It is not to mention that sponsorships are completely based on the performance of the underlying entity. It will cost more depending on how well or how good the team does in the game.

As we all know that a Mercedes sponsorship will surely cost more than Haas. The reason behind this is that these cars (the most noted and the luxury) have more exposure and more goodwill among the fan bases. This also results in more sales of merchandise of the brand and thus sponsors display logos a lot.

The story of sponsorships started with the first brand of tobacco that tried to display their product to the prospective public. In the year 1968 when Team Lotus F1 took to the circuit with flying colours of tobacco’s products.

Since that time, the sport was not the same and it emerged as a hotspot (rather hot sport) for the world of sponsorships. Now sponsorships and the thrilling sport of Formula One go hand in hand and are inseparable.

Let us see how the sponsors fit into the game. So, the game has teamed with players or teammates, each team in the formula one can hold up about 25 sponsors who fit into various categories. According to the various categories of sponsors, they pay the fee for sponsoring the event. Title sponsor is the highest form of sponsorship or is considered the highest of all and thus, comes with the highest fees for a sponsor.

Here’s a look at sponsorship deals of the top 3 F1 teams in 2020.

Mercedes Petronas F1 Top Sponsors

| Sponsor | Sponsorship Cost |

|---|---|

| Mercedes-Benz | $75M |

| Petronas | $57M |

| Ineos | $24M |

| UBS | $6M |

| EPSON | $4M |

Red Bull Racing F1 Top Sponsors

| Sponsor | Sponsorship Cost |

|---|---|

| Red Bull | $200M |

| Aston Martin | $30M |

| Honda | $25M |

| Mobil 1 | $15M |

| Tag Heuer | $5M |

McLaren F1 Top Sponsors

| Sponsor | Sponsorship Cost |

|---|---|

| Bat | $40M |

| Dell | $12M |

| Darktrace | $10M |

| Huski Chocolate | $6M |

| Arrow | $6M |

Sports like these tend to have a huge rate of title sponsorships. The reason is that it is the most visible sponsorship of all.

Technology Partners

After the highest pitch of sponsorship partners, then comes the land of technology partners. These are the partners or sponsors that supply teams with essentials that they will be needing during the course of the sport. Examples in this domain include Pirelli which is a tyre supplier and DHL as the official logistics partner.

These companies however are called sponsors supply the essentials. Essentials that are supplied by these companies cut costs on the participating teams.

Corporate Partners

Corporate partners are those partners who can be seen working on the sidelines of sporting events. Like for example, Mercedes has 12 Sponsors, some notables include, HP Enterprises, Monster Energy, IWC Watches, AMD and Tommy Hilfiger. Corporate partners come to the picture when there is a team event, a product launch, a party or a charitable occasion.

If you are a fan of this sport then you must have seen Lewis clicking with his IWC watch. You might think that he likes the brand but it turns out that he has signed a contract with the watchmaker.

According to the signed pact, Lewis has to be wearing his watch when he is on the podium or at any other public event. Sponsorship deals like these are worth between £10 million to £15 million every season.

Then there are some sponsors that can be laid on the category of minor sponsors. They usually get a small logo positioned over the car. These small promotional logos can cost a brand about £1 million to £3 million.

The Sales of Merchandise

The second big fat source of revenue is the merchandise. They offer a huge stream of revenue. Merchandise can be defined as the official signature products of an entity. However, there are no figures that are published yet but we know how fans of some brand or sport can go to places for buying merchandise of their favourite player.

Ferrari is said to be in a report to have generated around £8 million in 2006. These numbers are rookie numbers when compared to the Schumacher era when sales were bombed in Germany, he was really famous.

Every Formula one team sells merchandise to its fans all over the world. It has become easier to reach out to everyone, with a simple website. Some small teams also have specially made tents for selling this merchandise at the racing events. People come in huge numbers at these events and it offers a big market for the team’s merchandise. However, merchandise sales are solely based on the popularity of teams among fans, the popularity has a direct relation to these sales revenue.

Media Rights (Around 30% of Revenue)

F1 earns a big part of its money by selling the rights to show races on TV and online. TV channels and streaming platforms like Netflix pay a lot to show these exciting events. F1 also has its own service called F1 TV. These deals are usually made for different countries or regions, and the strong demand helps F1 grow and earn more.

F1 Growth

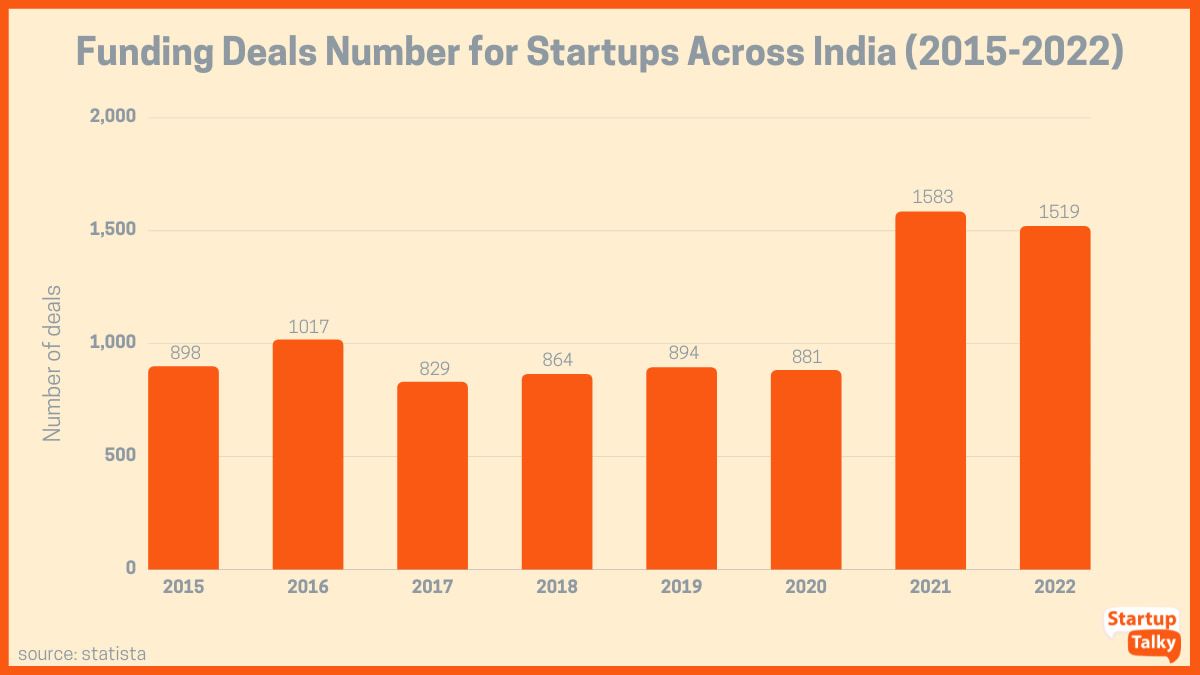

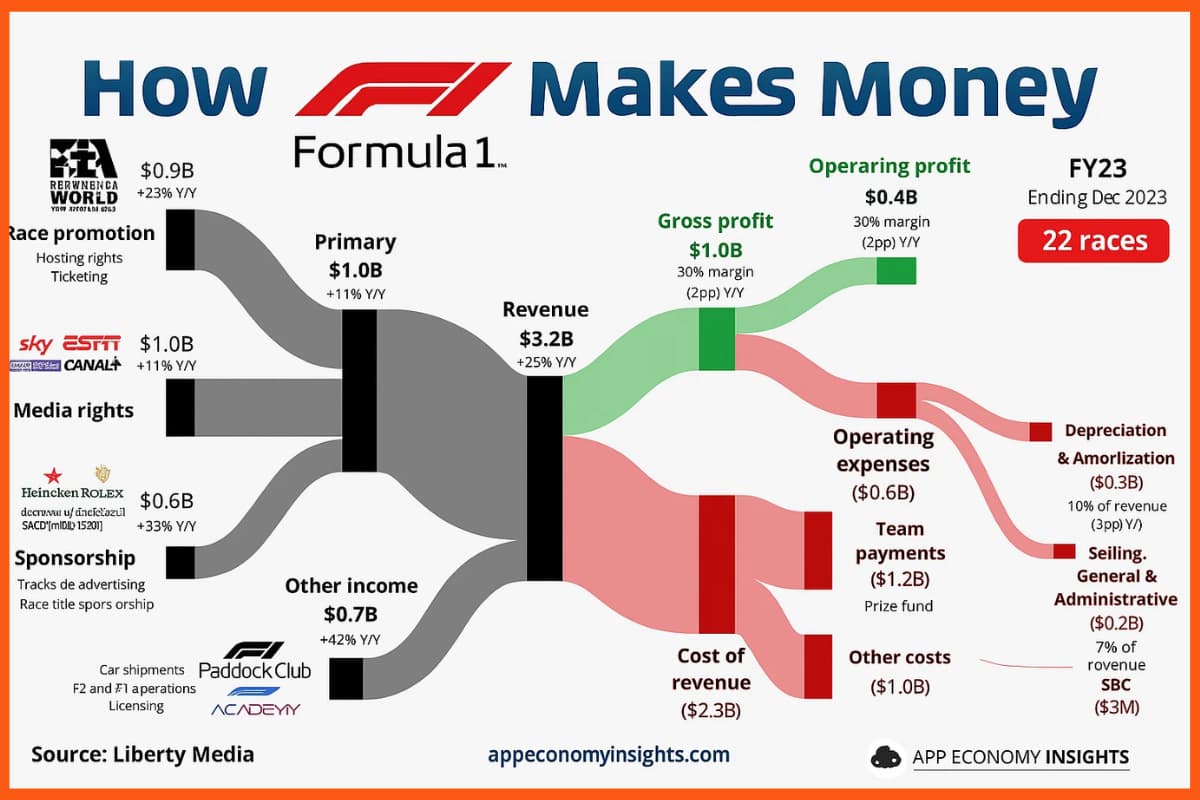

For FY23, total revenue increased by 25% year-over-year, reaching $3.2 billion. Here’s a breakdown of the key areas:

- Race Promotion: Revenue grew by 28% Y/Y to $0.9 billion.

- Media Rights: Revenue grew by 11% Y/Y to $1.0 billion.

- Sponsorship: Revenue increased by 33% Y/Y, amounting to $0.6 billion.

- Other Income: This category saw a 42% Y/Y increase, reaching $0.7 billion.

The company achieved a gross margin of 30%. Key costs included:

- Team Payments: $1.2 billion.

- Other Costs (such as hospitality, FIA annual fees, and commissions): $1.0 billion.

- Selling, General, and Administrative Expenses: $0.7 billion.

- Depreciation and Amortization: $0.2 billion.

These expenses contributed to an operating margin of 12%.

Formula One Administration

The whole sport of Formula One is maintained and managed by the Administering body. It is responsible for organising each and every event that happens in the sport. It can be either casual types of events or racing events. They get all the access to the track fees, Commercial Rights on T.V. (which cost broadcasters huge amounts.), driver super licences and etcetera.

According to the reports, all these sales and revenue sources add up to a revenue of one billion Euros to the association. In addition to that, broadcasters always try to eye this opportunity of getting special rights in the association. For example, the BBC(British Broadcasting Channel) has paid over 240 million euros for a three-year contract in the racing sport. This is multiplied all over the globe, in over 200 countries, and 40 individual broadcasters. Sky Sports won the broadcasting rights in 2019 which was reported to be worth around £1bn.

The Formula One Administration also awards the participating teams with a prize fund. Out of about 2 billion euros that they were able to raise through various sources is shared among the teams, the basis of which is qualifying race results. The number is hypothetical that can be assumed to be near the actual figure.

Due to the nature and secretive attitude of the FIA, an exact number cannot be published but it is seen in reports and evidently.

Speaking of money, ever wondered how much the steering wheel of a racing car costs?

The Formula One Management

FOM payments or Formula One management is another part of the process of revenue distribution and direction. There are mainly five divisions of payments in Formula One management.

In the First division is 36 million dollars paid to every team and the time of which is two seasons straight. The division one payment and every single team receive this.

The second division of payments is the prize money based on the number to which the team finished. For example, the luxury car brand Mercedes received sixty-one million dollars for winning the title while Williams just received thirteen, for finishing at last. This feels right and pleasant but there’s more to it.

The third division goes to the long-standing team. As the name suggests, it is for the longest standing team, and not to mention the division name is synonymous with Ferrari. Hence, the division is also known as the Ferrari budget, as they are the ones who always get that. The sum of money is 68 Million Dollars.

Next is the constructor’s championship bonus which is 35 million dollars to Ferrari and Mercedes, Red Bull and McLaren for winning some titles that can be called miscellaneous in layman terms. Lastly, there are payments like Heritage payment to Williams ($10 Million), Ferrari ($35 Million), Red Bull ($35 Million), for signing the Concord Agreement first.

Where do the F1 Teams Spend their Money?

The above discussed all the primary sources of revenue for the Formula One management but it is not the whole story. Running a successful team in this speedy game is hard and as well as expensive. The cost of running a Formula One Team is humongous just because they have to work at the pinnacle of their efficiency. A little here and there and their team can lose all credibility. So they have to be cautious and active on all ends of effectiveness. They mainly spend on these four heads, namely –

Salaries

This head of income does not really need an introduction. Salaries are the most basic form of expense in any sort of business. In this domain of Formula One, teams have all sorts of labour available for their work. It has engineering people and marketing people to make team’s working a full-fledged operation. It also can include the payments to drivers of these supercars.

Research and Development

R and D, or simple research and development is not as easy as it sounds. It consists of all the scientific terms that you can think of in driving a car faster than light. It includes wind tunnel testing, race track testing and all sorts of testing that can make the racing a smooth sail. It is important that everything is perfect, to improve the performance of the game and the safety of drivers.

Production

Production means that part of the team is responsible for producing the car for the event. It starts with the manufacturing or procurements of new components. It can include reversing the engine and just that part can cost about 10 million pounds by itself. Thus, the production is what makes the car fit for racing at the speed of light.

Operations

Operations are all things that come in a business routine. It can include things like client entertainment, logistics for the car and the team, technology costs that are incurred to run the website and the marketing end of things. Operation costs can also include things like the fuel cost of the racing car. These are miscellaneous but when added, can become big

Conclusion

Above, we all read about the beginning of the sport of Formula One. What is shinier is the money transactions that it brings to the table. For speed lovers, Formula One is their favourite refuge. The sport has managed to get to the hearts of people from all over the world. This trend not only shows the success of Formula One but also provides testimony of the tendency in challenging the science of speeds.

The business aspect of the sport is as interesting as the sport itself, if not more than that. One may think and admire these sports as nothing but a leisure activity but they sure are way more than just that. The money-making capacities of such ventures almost never fail to surprise us.

FAQ

How much does it cost to run an F1 team?

It requires F1 teams approximately $150 to $200 million.

How much is F1 prize money?

In 2023, the total F1 prize money pool was estimated at around $1.2 billion, distributed among the 10 teams based on their performance in the Constructors’ Championship. The top team (1st place) typically earns over $140 million, while lower-ranked teams receive smaller amounts. Some teams also receive special bonuses like the Ferrari heritage bonus or long-standing team payments.

How much does Rolex pay to sponsor F1?

Rolex paid approximately $45 million annually.

How do F1 teams make money?

F1 teams make money mainly through prize money, sponsorships, merchandise sales, and partnerships. Top teams also earn from brand deals, investor funding, and selling technology or engineering services.

What is Formula 1 business model?

Formula 1’s business model is based on organizing global races, selling media rights, securing sponsorships, and offering premium fan experiences. It’s managed by Liberty Media through the Formula One Group, turning racing into a global entertainment business.

Which country has hosted the most grands prix since its first in 1950?

Italy has hosted the most Formula 1 Grands Prix since the championship began in 1950. The Italian Grand Prix at Monza is the only race that has been held every year without interruption since F1’s inaugural season, making Italy the country with the longest and most consistent presence in F1 history.

Are F1 teams profitable?

Some F1 teams are profitable, but not all. Top teams like Mercedes, Red Bull, and Ferrari often earn profits due to strong sponsorships, prize money, and commercial deals. However, smaller teams may struggle to break even because of high costs (around $135 million per season, even with the cost cap). Profitability depends on performance, brand value, sponsors, and how well a team manages expenses.