This article has been contributed by Rajmohan Krishnan, Principal Founder and Managing Director, Entrust Family Office

The ringing of the bell on listing day is one of the most significant moments in the life of a founder. All the sweat, toil and tears over the years have finally paid off, and the vision they started their entrepreneurial journey with is vindicated to a great extent. But here’s the big question: What comes next after the Initial Public Offering (IPO)?

For many Indian founders today, going public isn’t just about making money, but about establishing a legacy that will endure beyond them. Hence at this time, founders need to shift their focus from building and scaling the business to ensuring that their hard-earned success translates into lasting wealth and impact. This article explores what founders should prioritize around an IPO, in order to achieve this end.

Before the IPO: Set the Stage for What’s to Come

Wealth & Liquidity Planning

After a significant liquidity event like an IPO, the founder’s personal financial landscape changes overnight. However, the risk lies in viewing this liquidity as a final destination. Meticulous planning is needed at this stage, in order to ensure that the wealth is protected and grown.

Founders need to thoughtfully structure their holdings: how much equity to keep, when and how to exit, and how to diversify across different asset classes. A solid tax strategy is also important, to avoid unexpected tax liabilities.

Building the Family Governance Framework

An IPO is also a significant moment for the founder’s family – each family member has expectations from the newly gained wealth. With increased expectations and potential for conflicts, family governance becomes important.

Founders need to consider setting up a family constitution, along with structures to ensure that their wealth is protected in alignment with their values. Governance frameworks can help in preparing family members for their responsibilities and avoid misunderstandings in the future.

Setting the house in order

Before the company goes public, founders need to take the time out to assess their financial landscape. The focus areas at this time need to be capital structuring, strategy for using the IPO proceeds and identifying risks to be addressed early on.

After the IPO: Liquidity to Legacy

Crafting a Smart Portfolio

Liquidity can result in unnecessary risk taking and opportunistic investments. But founders need to exercise discipline and build a professionally managed, well diversified portfolio that is aligned to their values and risk tolerance. This will enable their wealth to grow across generations, in accordance with their belief systems.

Giving with Intention

Philanthropy is often seen as something to think about later in life. But this is a good time to plan for meaningful giving. Founders can look at charitable trusts, foundations or impact funds that are aligned to their values.

This will also set an example for future generations, making philanthropy a part of the family’s legacy.

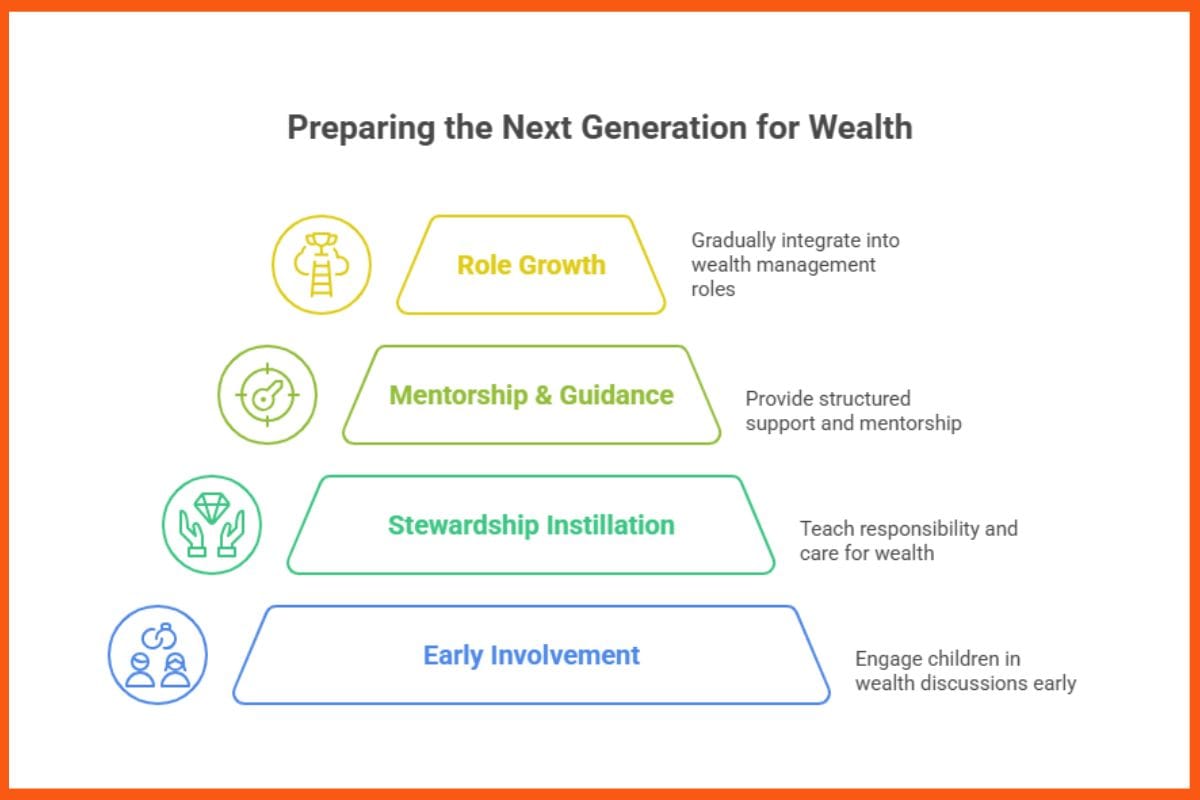

Preparing the Next Generation

A significant challenge after an IPO involves getting the next generation ready to inherit. Sudden wealth can lead to a sense of being weighed down or of feeling entitled, both of which are avoidable. What is required is to instil a sense of stewardship, with the help of mentorship and structured guidance.

Children need to be involved early on in conversations that make them understand the responsibilities related to wealth, so that they slowly grow into their roles rather than feeling overwhelmed.

Planning for the Future

At this stage, estate and succession planning become very important. These are difficult topics to deal with in harmonious times, but avoiding them can lead to significant confusion and conflict in the future.

Founders need to establish clear plans for inheritance and business succession and ensure that tax efficient structures are in place. This will help ensure a peaceful transition of wealth across generations, ensuring continuity and family harmony.

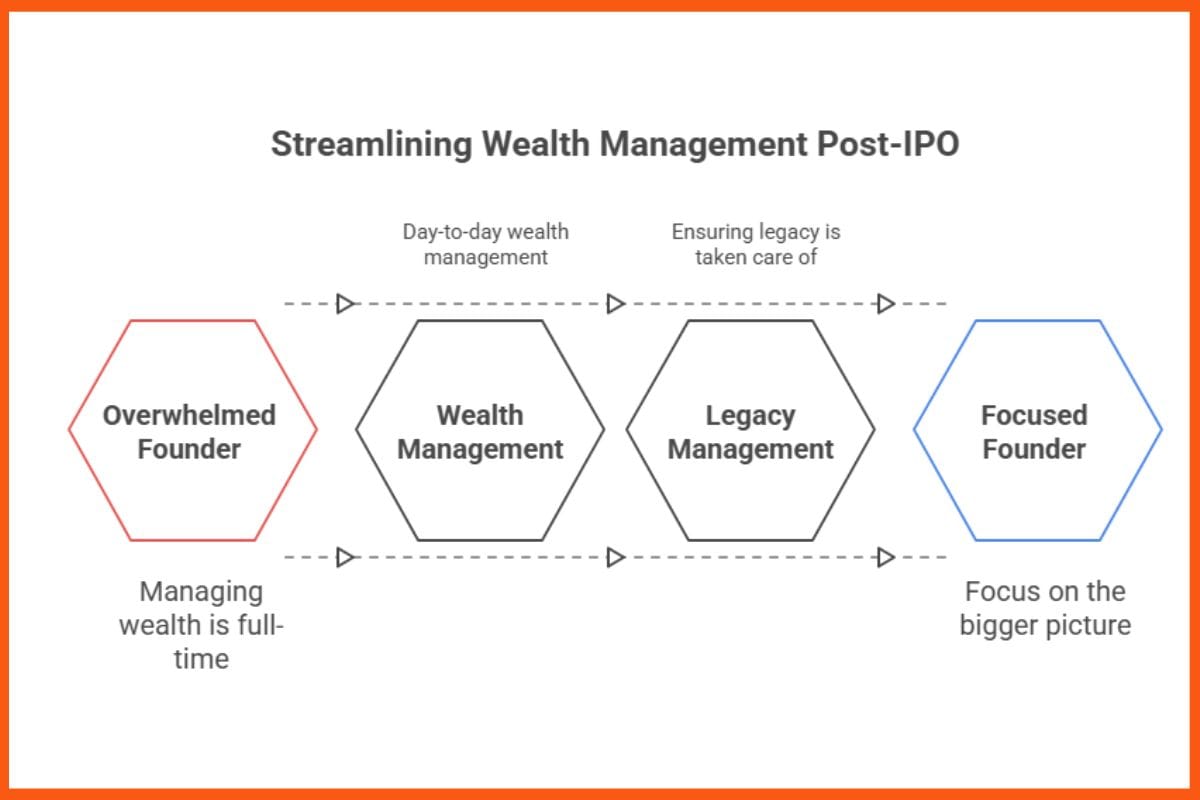

Setting Up a Private Office

Many founders come to realize that after going public, managing their wealth, philanthropy, family governance, and compliance can quickly turn into a full-time job. At this stage, establishing a private office or family office might make sense. This would ensure that the day to day management of wealth and legacy is taken care of, leaving the founder to focus on the bigger picture.

The Real Legacy Starts After the IPO

An IPO is a very important milestone, but it is the beginning of a crucial journey. By planning carefully and setting structures in place in order to protect and nurture their wealth and legacy, founders can ensure that this moment of success creates something lasting and meaningful.