The role of business consultants has evolved significantly in recent years, with increasing responsibilities and tasks that require them to juggle multiple priorities every single day. From prospecting for new clients to managing the needs of existing ones, the sheer volume of work can be overwhelming. Whether you are analyzing data, creating presentations, managing projects, or communicating with clients, having the right set of tools can help you work more efficiently and effectively.

With so many tools available, it is essential to make prudent choices that not only simplify work but also enhance client relationships and provide a competitive edge in a crowded industry. This article will explore some of the best tools that business consultants can use to streamline their work and deliver results for their clients. By the end of this post, you will have a better understanding of the tools you need to succeed as a business consultant in today’s competitive market.

| Sr. No. | Tool | Key Features | Rating |

|---|---|---|---|

| 1 | Capsule | Contact & Lead Management, Task & Sales Tracking | 4.3/5 |

| 2 | Keap | Automated Marketing, CRM & Sales Pipeline | 4.1/5 |

| 3 | Ring Central | VoIP & Phone System, Team Messaging & Meetings | 4.2/5 |

| 4 | Slack | Team Messaging & Channels, Integrations with Apps & Tools | 4.5/5 |

| 5 | Accelo | Project Management, Client Billing & Automation | 4.0/5 |

| 6 | Trello | Kanban Boards & Task Management, Team Collaboration & Workflow | 4.4/5 |

| 7 | Xero | Accounting & Invoicing, Bank Reconciliation | 4.3/5 |

| 8 | QuickBooks | Accounting & Tax Management, Expense & Payroll Tracking | 4.2/5 |

| 9 | Hootsuite | Social Media Scheduling, Analytics & Reporting | 4.4/5 |

| 10 | Sprout Social | Social Media Publishing, Engagement & Analytics | 4.2/5 |

Tools for Client Relationship Management

As a business consultant, maintaining strong relationships with your clients is crucial for success. To do so, you need to have effective Client Relationship Management (CRM) tools that can help you stay organized, track communication, and build stronger connections with your clients.

Here are some of the best CRM tools for business consultants:

Capsule

| Website | Capsulecrm.com |

|---|---|

| Free Trial | Available |

| Platforms supported | Web, Android, iPhone/iPad |

Client Relationship Management CRM is one of the most important aspects of business consulting. Keeping track of the client information, vendors, contacts, etc. Capsule is an excellent application used by both individuals and businesses. It is an all-in-one stop to maintain a record of deals, bids, proposals, and all other relevant information about the client.

It is designed specifically for growing businesses and thereby gives different levels of access to different kinds of clients. This feature becomes extremely useful when it comes to situations wherein different team members work on different phases of the respective project. The app is also mobile-friendly.

Pricing:

| Plan | Monthly Price |

|---|---|

| Enterprise | $54 USD / Per user, per month |

| Teams | $36 USD / Per user, per month |

| Professional | $18 USD / Per user, per month |

Try Capsule For Free

Keap

| Website | Keap.com |

|---|---|

| Free Trial | Available |

| Platforms supported | Web, Android, iPhone/iPad |

Keap provides a centralized system that is integrated to collect, assemble, and manage customer data. Along with the CRM facilities that it provides, Keap goes the extra mile by providing a platform for sales and marketing automation.

Additionally, email automation, appointment scheduling, sales pipelining, invoicing etc. are some other features that Keap offers. Thus, Keap becomes a single stop for a number of activities that would have otherwise required more than twenty apps.

Management Consultant Tools

Pricing:

| Plan | Yearly Price |

|---|---|

| Pro | $149 /month (Billed at $1788/year) |

| Max | $199 /month (Billed at $2388/year) |

| Max Classic | Custom Pricing |

Start Using Keap Now

By using these CRM tools, you can streamline your work and build stronger relationships with your clients. Whether you are a solo consultant or part of a team, these tools can help you stay organized, improve communication, and ultimately deliver better results for your clients.

Tools for Communication

As a business consultant, effective communication is key to building strong relationships with your clients and achieving your goals. Fortunately, there are many communication tools available that can help you streamline your communication and collaborate more effectively.

Here are some of the best communication tools for business consultants:

Ring Central

| Website | www.ringcentral.com |

|---|---|

| Free Trial | Available |

| Platforms supported | Web, Android, iPhone/iPad |

Communication with clients in a professional setup goes beyond emails. Today, with the hyper-integration of technology into our daily lives, instantaneous responses have become a basic norm that the client expects the business consultancy to follow.

RingCentral is a multifunctional collaboration tool that helps the client gain access to the respective consultancy in any manner. The best part is that you don’t have to ask the client to download any app since it can be accessed via browser as well. It helps you share your screen, shift from different forms of calls and so on. They have designed their services to be compatible with both iOS and Android so that the team members can work from their personal devices.

Pricing:

| Plan | Yearly Price |

|---|---|

| Essentials | $19.99/user/month |

| Standard | $27.99/user/month |

| Premium | $34.99/user/month |

| Ultimate | $49.99/user/month |

Slack

| Website | Slack.com |

|---|---|

| Free Trial | Available |

| Platforms supported | Web, Android, iPhone/iPad |

Slack is a communication platform that helps you send instant messages to your team through a messenger. It helps you create specific groups for different purposes of communication between the group members.

They have specially curated archives that keep an eye on every detail of the discussion that has ever been made through the platform. With more than a thousand app integrations, Slack is an excellent platform that helps you streamline your business communications and progress.

Pricing:

| Plan | Monthly Price |

|---|---|

| Free | ₹0/month |

| Pro | ₹218/month* |

| Business+ | ₹375.20/month* |

| Enterprise Grid | Custom Price |

By using these communication tools, you can stay connected with your team and clients, collaborate more effectively, and ultimately achieve better results. Whether you are working remotely or in an office, these tools can help you communicate more efficiently and build stronger relationships with your clients.

Tools for Project Management

As a business consultant, managing multiple projects can be challenging, but having the right project management tools can make a big difference. These tools can help you stay organized, track progress, and collaborate with your team and clients.

Here are some of the best project management tools for business consultants:

Accelo

| Website | www.accelo.com |

|---|---|

| Free Trial | Available |

| Platforms supported | Web, Android, iPhone/iPad |

Managing a project and delivering it to the client at the right time without exceeding the budget is what sustains and attracts more clients to the business. Accelo adds value to this vision by helping the consultancies to manage time through automation of various tasks that would otherwise need manual inputs.

It has the additional facility to integrate the functionalities of already existing apps like Gmail, Microsoft Office, etc. into its domain. They also generate automatic invoices by making use of projects and timesheets. Based on the client’s requirements, the app lets you collaborate with their respective products and thereby keep track of the progress of the same.

Pricing:

| Plan | Monthly Price |

|---|---|

| Plus | $30/product/user/month |

| Premium | $49/product/user/month |

Trello

| Website | Trello.com |

|---|---|

| Free Trial | Available |

| Platforms supported | Web, Android, iPhone/iPad |

Project Management, being a cumbersome task, demands an efficient app to keep track of the progress of the project. Trello is an excellent project management tool in that regard. It has a very user-friendly interface that provides a number of options for customization.

It helps in managing, organizing, and capturing details of the project to completion. To further increase the efficiency of the work done through the app, Trello has also integrated itself with many other apps.

Pricing:

| Plan | Yearly Price |

|---|---|

| Free | $0 |

| Standard | $5/user/month |

| Premium | $10/user/month |

| Enterprise | $17.50/user/month |

By using these project management tools, you can stay organized, track progress, and collaborate more effectively with your team and clients. Whether you are working on multiple projects at once or managing a large team, these tools can help you stay on top of your work and deliver results for your clients.

Tools for Finance

As a business consultant, having a good understanding of finance is essential to providing valuable insights to your clients. Fortunately, there are many finance tools available that can help you analyze data, create financial models, and make informed decisions.

Here are some of the best finance tools for business consultants:

Xero

| Website | www.xero.com |

|---|---|

| Free Trial | Available |

| Platforms supported | Web, Android, iPhone/iPad |

Tracking account details, reviewing bills that are to be received and payable, payroll management, etc., are important activities that should be managed properly for all your efforts to bear fruit.

Xero is an excellent accounting software that is made for business consultants. It gives you an exemplary dashboard view of all your finances that comes along with various features for expense management.

They have designed the app in such a way that it is capable of handling international businesses at a multi-currency level. By automatically tracking payments and backing up relevant data, Xero has gained the attention and interest of business consultants over a short span of time.

Pricing:

| Plan | Monthly Price |

|---|---|

| Starter | $25 USD per month |

| Standard | $40 USD per month |

| Premium | $54 USD per month |

QuickBooks

| Website | Quickbooks.intuit.com |

|---|---|

| Free Trial | Available |

| Platforms supported | Web, Android, iPhone/iPad |

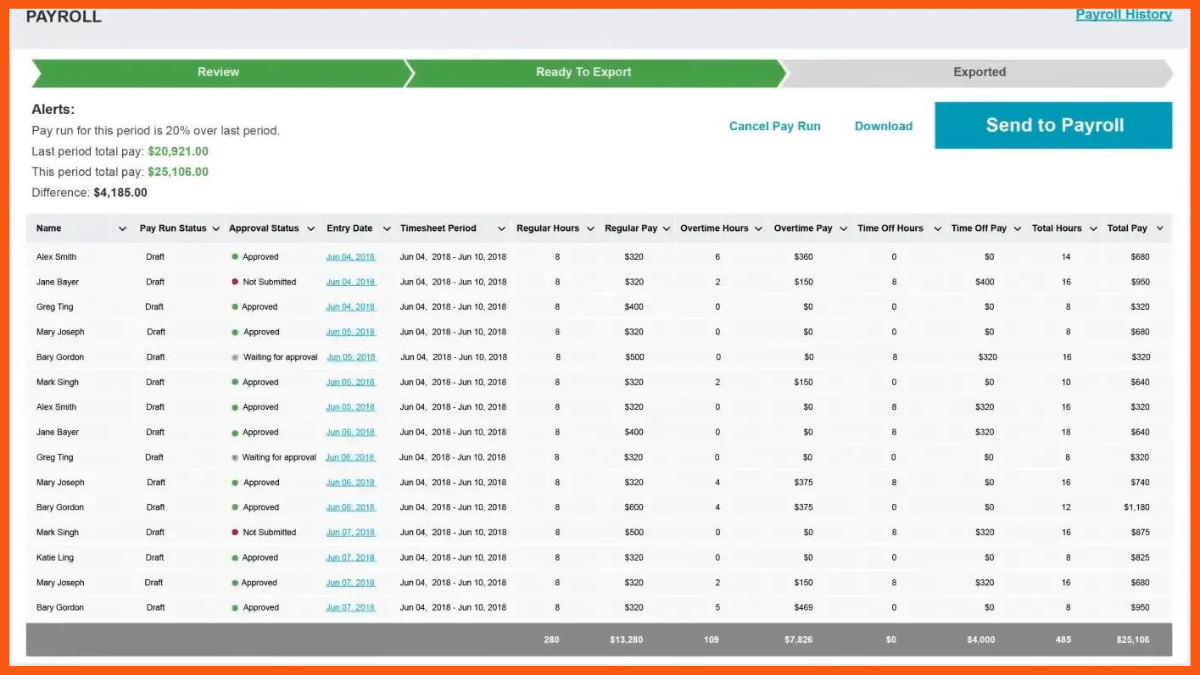

QuickBooks is a popular accounting software developed and marketed by Intuit. It is designed to help small and medium-sized businesses manage their financial operations, including invoicing, payments, payroll, inventory, and reporting. QuickBooks is available in both online and desktop versions, and offers a range of features and integrations to help businesses automate and streamline their accounting processes.

It is a single space where you can manage money and expenses. Very similar to Xero, it allows you to track your expenses, create invoices, and keep track of the inflow and outflow of money.

Pricing:

| Plan | Monthly Price |

|---|---|

| Simple Start | $15 per month |

| Essentials | $27.50 per month |

| Plus | $42.50 per month |

| Advanced | $100 per month |

Try QuickBooks Now

By using these finance tools, you can gain a better understanding of your clients’ financial data, create accurate financial models, and provide valuable insights that can help them make informed decisions. Whether you are managing finances for your own business or providing consulting services to clients, these tools can help you achieve better results.

Tools for Social Media Scheduling

Social media is an essential aspect of any modern business, and as a business consultant, it is crucial to help your clients manage their social media presence. One of the most effective ways to do this is by using social media scheduling tools. These tools allow you to plan, create, and schedule posts in advance, so you can ensure a consistent and engaging presence on social media.

Here are some of the best social media scheduling tools for business consultants:

Hootsuite

| Website | www.hootsuite.com |

|---|---|

| Free Trial | Available |

| Platforms supported | Web, Android, iPhone/iPad |

Social media marketing has evolved as one of the primary factors for brand building and publicity. An app like Hootsuite steps in to understand and adapt to the nuances of the industry.

It helps you maintain all your social media marketing in a single place. The users can create content and share it across whichever social media platform they choose. Considering the fact that a firm will need multiple accounts on various platforms, an app like Hootsuite will be handy.

By using these social media scheduling tools, you can help your clients stay organized, consistent, and engaging on social media. Whether you are managing social media for your own business or providing consulting services to clients, these tools can help you achieve better results and make the most of your social media efforts.

Pricing:

| Plan | Monthly Price |

|---|---|

| Professional | $49 per month |

| Team | $129 per month |

| Business | $599/month per month |

| Enterprise | Custom Pricing |

Sprout Social

| Website | www.sproutsocial.com |

|---|---|

| Free Trial | Available |

| Platforms supported | Web, Android, iPhone/iPad |

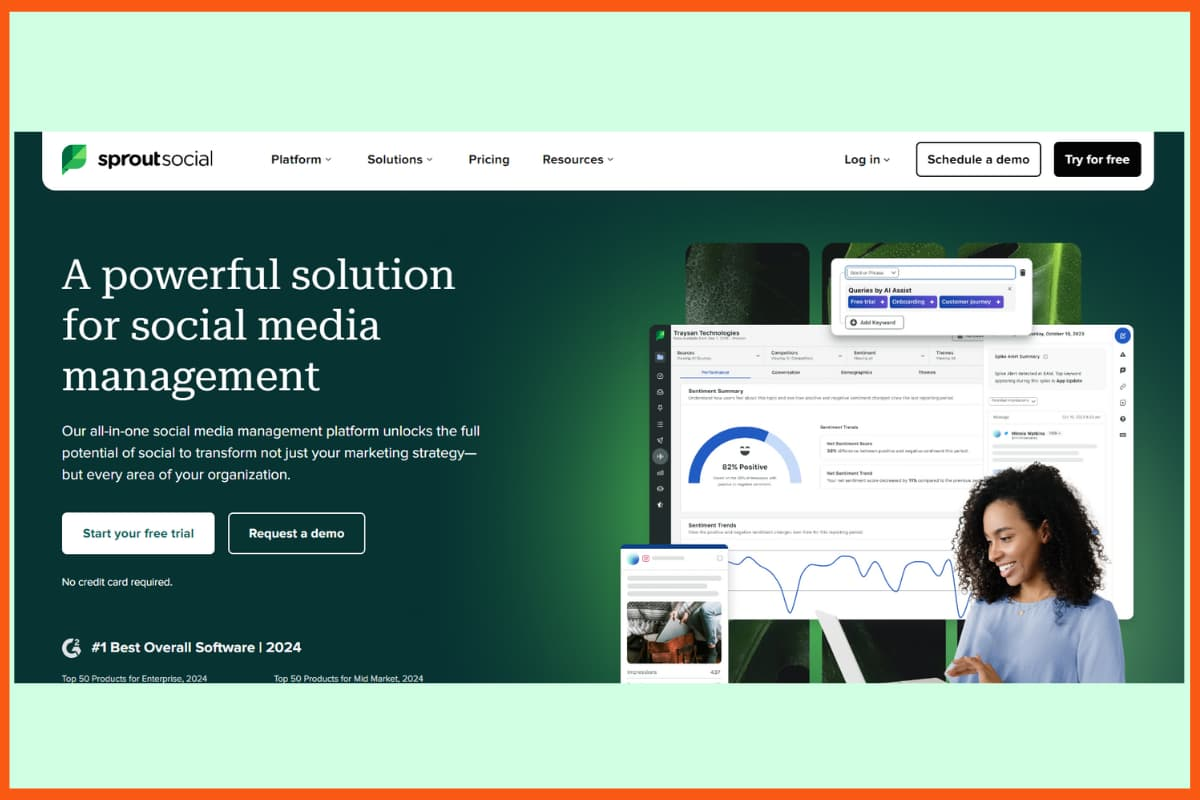

Sprout Social is a powerful platform that streamlines social media management for businesses and individuals. It offers robust features like content publishing across multiple networks, AI-assisted post ideas, and scheduling, as well as engagement tools such as a unified inbox and real-time brand monitoring. Its analytics help track performance, identify the best times to post, and benchmark against industry standards, while social listening tools monitor trends, mentions, and hashtags with AI-powered summaries. The employee advocacy feature boosts brand awareness by enabling team members to share authentic content. Though it requires investment in cost and learning, Sprout Social delivers significant value, especially for agencies or larger organisations managing complex social media needs.

Pricing:

| Plan | Monthly Price |

|---|---|

| Professional | $249 per month |

| Advanced | $399 per month |

| Premium | $499 per month |

| Enterprise | Custom Pricing |

Conclusion

As a business consultant, you need to be vigilant and mindful of the details to ensure the quality of work remains high and technical mistakes are avoided. While the right tools can undoubtedly make your work easier, it’s vital to understand that they should be viewed as supplements to your skills, rather than replacements.

In essence, being a business consultant is no easy feat. It requires a combination of skills, experience, and tools to be successful. By leveraging the right tools at the right time and maintaining a hands-on approach to your work, you can provide value to your clients and establish yourself as a reliable and trustworthy consultant. However, by exploring some of the best tools available in each category, you can gain a better understanding of what’s available and make an informed decision. Ultimately, it’s the perfect balance of technology and human intervention that will enable you to thrive in the business consulting industry.

FAQs

What are some popular tools that business consultants can use?

Trello, Slack, Keap, Capsule, and Hootsuite are some of the best consultant tools to provide valuable insights and deliver results for your clients.

What work does a business consultant do?

A business consultant works with clients to help them improve their business operations and achieve their goals. They analyze the client’s current business practices, identify areas for improvement, and provide recommendations for change. Business consultants may also assist with project management, financial analysis, marketing strategies, and other aspects of the client’s business.

What Types of Tools Does a Business Consultant Need?

A business consultant needs a variety of tools to effectively manage their work, including communication tools, project management software, financial analysis tools, CRM software, time tracking tools, survey tools, social media scheduling tools, and more.

How do I select the best tools for my business consulting needs?

Selecting the best tools for your business consulting needs requires careful consideration of your specific requirements, budget, and preferred features. It’s important to research and compare multiple tools before making a final decision and to take advantage of free trials and demos whenever possible.

Why client relationship management (CRM) is important for business consultants?

For business consultants, CRM is critical for maintaining strong relationships with clients, keeping track of client communications and data, and identifying opportunities to provide additional value to clients.

Why project management is important for business consultants?

For business consultants, project management is essential for managing multiple clients, keeping track of project timelines and deliverables, and ensuring that all tasks are completed efficiently and effectively.