From Amazon to Pepperfry, the eCommerce industry thrives in India, especially in B2C eCommerce companies. In fact, India is ranked first in the fastest-growing eCommerce market globally, with an estimated market value of $16.6 trillion by 2022.

B2C means business-to-consumer, which refers to the business model where the companies directly sell their products to consumers. The market offering B2C services has gained speed in recent years. According to the report by Grand View Research, the B2C eCommerce industry is set to reach a valuation of $7.65 trillion by the year 2028.

This brings us to the article’s primary content, top B2C eCommerce companies across India. So, let’s get started.

List of top B2C eCommerce companies in India

Amazon

Flipkart

FirstCry

Paytm Mall

Snapdeal

Myntra

1mg

LimeRoad

Shopclues

Pepperfry

BookMyShow

Nykaa

Amazon

| Founded | 2013 |

|---|---|

| Founders | Jeff Bezos |

| Headquarters | Seattle, Washington (USA) |

| Category | Ecommerce |

| Website | amazon.in |

When it comes to B2C eCommerce websites, Amazon tops the list. The company was initially started in the United States as an online bookstore and was later converted into a marketplace for other products. Initially, it was created as a platform where customers could purchase books on a wide range of subjects.

With time, Amazon grew into an eCommerce site with monthly visitors of over 322.54 million, as per the 2010 data. And it became widely popular in the Indian eCommerce industry. Today, the company reached out to a total of 89 percent of the Indian audience.

Flipkart

| Founded | 2007 |

|---|---|

| Founders | Sachin Bansal, Binny Bansal |

| Headquarters | Bengaluru, India |

| Category | Ecommerce |

| Website | flipkart.com |

Founded by two former Amazon employees, Binny Bansal, and Sachin Bansal, in 2007, Flipkart is a well-known privately hosted eCommerce website in India. After its highest acquisition of 16 billion in 2018 by Walmart, Flipkart now comes under the ownership of Walmart. The company owns 39.5 percent of the market share of the Indian eCommerce industry, with the most significant competition from none other than Amazon.

Flipkart gained massive popularity due to its Big Billion Days Sale, where it reached a large audience base by offering huge discounts on its merchandise of all categories. With a solid online presence, Flipkart is considered one of the best eCommerce websites following the B2C business model.

FirstCry

| Founded | 2010 |

|---|---|

| Founders | Amitava Saha and Supam Maheshwari |

| Headquarters | Pune, India |

| Category | Online Baby Products |

| Website | firstcry.com |

FirstCry is considered the best eCommerce platform for babies and children’s merchandise, following a B2C business model. The product quality and variety offered by FirstCry are excellent and worth all the praise. It provides more than 200,000 products from over 5,000 manufacturers. FirstCry was introduced in 2010 by Amitava Saha and Supam Maheshwari.

In addition to its eCommerce platform, Firstcry also operates physical stores across the country, which allows customers to experience its products before making a purchase.

The website has also launched its own private-label brands to offer quality products at affordable prices. FirstCry has over 400 outlets across India, covering cities like Hyderabad, Bangalore, Mumbai, Chennai, Kolkata, and many more.

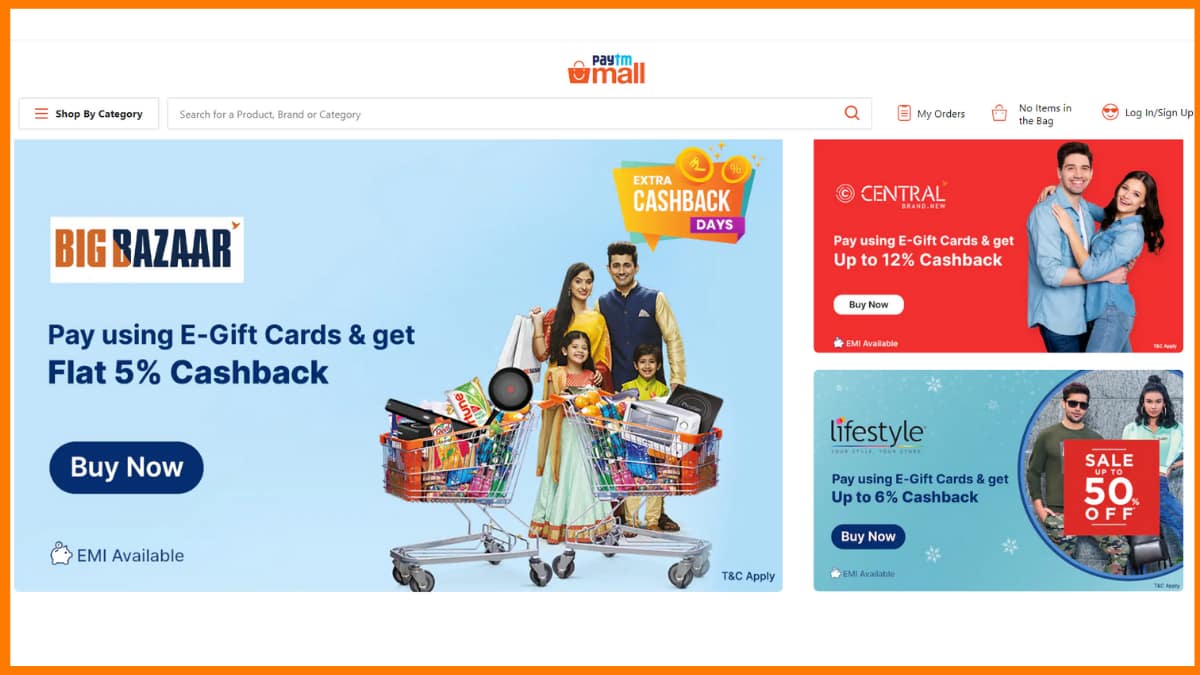

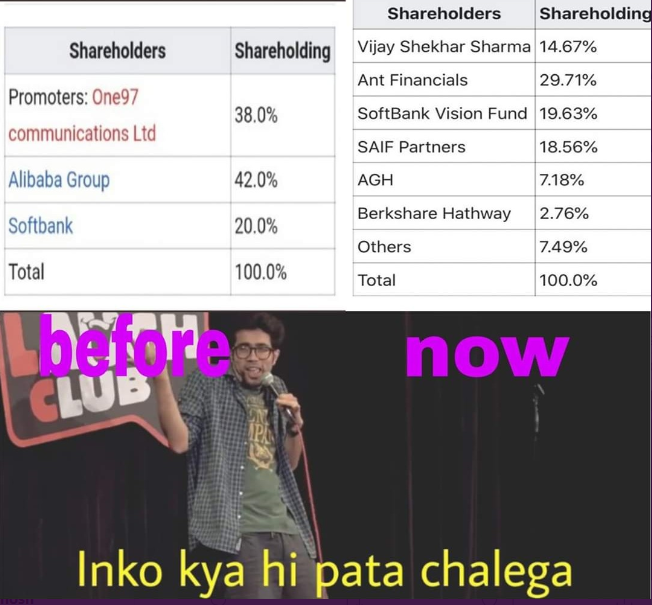

Paytm Mall

| Founded | 2016 |

|---|---|

| Founders | Vijay Shekhar Sharma |

| Headquarters | Bengaluru, India |

| Category | Ecommerce |

| Website | paytmmall.com |

Yes, you heard it right. Paytm isn’t limited to digital payments and financial services; it has also expanded to eCommerce. In 2016, Paytm introduced an online shopping platform based on the B2C business model, Paytm Mall.

From all kinds of clothing to exclusive gadgets to home furnishing, you can find everything at Paytm Mall. As per the reports published by findly, Paytm Mall is estimated to receive 60 million orders in a month.

Paytm Mall offers high-quality products at affordable pricing. Plus, you can use different coupons for discounts and cashback offered by Paytm Mall.

Snapdeal

| Founded | 2010 |

|---|---|

| Founders | Kunal Bahl, Rohit Bansal |

| Headquarters | Gurgaon, India |

| Category | Ecommerce |

| Website | snapdeal.com |

With an estimated monthly visitor count of 56.41 million, Snapdeal is considered an eCommerce giant with a B2C business model. It’s an online shopping platform with various products from different categories such as electronics, clothing, home decor, books, beauty, and many more. Among these, Snapdeal’s electronic category is the largest shopped one.

This eCommerce platform was launched in 2010 and has attracted top investors such as Softbank, Alibaba Group, and Foxconn.

Myntra

| Founded | 2007 |

|---|---|

| Founders | Mukesh Bansal, Ashutosh Lawania, Vineet Saxena, Sankar Bora, and Raveen Sastry |

| Headquarters | Bengaluru India |

| Category | Ecommerce |

| Website | myntra.com |

Myntra is among the premier fashion, lifestyle, and home eCommerce platforms with a B2C business model. It has around 48.03 million monthly visitors. It earned impressive profit and popularity after the acquisition of Jabong.com, its competitor in the market.

Myntra is known for its fantastic collection of high-end fashion from top brands all around the globe and as per 2012 data, Myntra added more than 350 Indian and Foreign brands to its manufacturer’s list. Plus, it has many private clothing labels, such as HRX and Moda Rapido, which are exempted from expansion vastly.

The website is also a fashion retailer with a wide range of products from international to local brands in all sections.

1mg

| Founded | 2013 |

|---|---|

| Founders | Prashant Tandon, Gaurav Agarwal, Vikas Chauhan |

| Headquarters | Gurugram, India |

| Category | Healthcare |

| Website | 1mg.com |

1mg is categorized as an Indian online pharmacy founded in 2015 by Prashant Tandon, Gaurav Agarwal, and Vikas Chauhan. 1mg offers a wide range of healthcare products including medicines, healthcare devices, health supplements, personal care products, and more. The website features products from over 3,000 brands and has over 2 lakh products available on its platform.

1mg also provides features such as online medicine ordering, diagnostic tests booking, and wellness package booking to provide a comprehensive healthcare experience to its customers. In addition to healthcare products and services, 1mg also provides health-related content through its blog and social media channels.

LimeRoad

| Founded | 2012 |

|---|---|

| Founders | Prashant Malik, Manish Saksena, Ankush Mehra, and Suchi Mukherjee |

| Headquarters | Gurugram, India |

| Category | Fashion Ecommerce |

| Website | limeroad.com |

Headquartered in Gurugram, LimeRoad is a pretty famous fashion and clothing eCommerce website following B2C business models. The company was founded in 2012 with the specification of online shopping. It was founded by Prashant Malik, Manish Saksena, Ankush Mehra, and Suchi Mukherjee.

In its initial three funding rounds, the company raised 50 million USD. LimeRoad is the first-ever women’s social shopping platform in India. It also offers a wide range of categories dealing with men, women, and kids.

Shopclues

| Founded | 2011 |

|---|---|

| Founders | Sandeep Aggarwal, Radhika Aggarwal and Sanjay Sethi |

| Headquarters | Gurugram, India |

| Category | Online Shopping |

| Website | shopclues.com |

Shopclues is another online shopping company based in Gurugram, Haryana, India, founded by Radhika Aggarwal, Sandeep Aggarwal, and Sanjay Sethi in 2011. With revenue of above $40 million and 1080+ employees, the company has established a strong image in the marketplace. It’s a privately owned company that specializes in online shopping.

ShopClues operates on a marketplace model where it connects buyers and sellers on its platform. The website has over 5 crore products from 9 lakh+ merchants across 3,300+ categories. Apart from the regular products, ShopClues also offers several exclusive features like Sunday Flea Market, Wholesale, and IndiMarket which showcase products from small and medium-sized businesses in India.

Pepperfry

| Founded | 2011 |

|---|---|

| Founders | Ambareesh Murty & Ashish Shah |

| Headquarters | Mumbai, India |

| Category | Home Decor and Furniture |

| Website | pepperfry.com |

Pepperfry is a popular eCommerce B2C website in India that primarily focuses on home decor and furniture. The website was launched in 2012 by Ashish Shah and Ambreesh Murthy. Pepperfry has become one of the leading online shopping destinations for furniture and home decor in India.

They offer products from over 10,000 sellers and has over 1.2 lakh products available on its platform. It also has more than 100 outlets across 57 cities in India. The website also has a feature called “Studio Pepperfry” which is a concept store where customers can get a hands-on experience with the products before making a purchase.

BookMyShow

| Founded | 2007 |

|---|---|

| Founders | Ashish Hemrajani, Parikshit Dar, and Rajesh Balpande |

| Headquarters | Mumbai, India |

| Category | Online Ticket Booking |

| Website | bookmyshow.com |

BookMyShow is a popular eCommerce B2C (business-to-consumer) website in India that primarily focuses on providing online ticket booking services for movies, events, and other entertainment activities. The website was launched in 2007 by Ashish Hemrajani, Parikshit Dar, and Rajesh Balpande.

BookMyShow offers a range of services including movie ticket booking, event ticket booking, sports event ticket booking, play and theater ticket booking, and more. The BookMyShow website features listings of events, movies, and activities happening in various cities across India. They also provide reviews and ratings of movies, events, and activities to help customers make informed decisions.

Nykaa

| Founded | 2012 |

|---|---|

| Founders | Falguni Nayar |

| Headquarters | Mumbai, India |

| Category | Cosmetics, Beauty, Personal Care |

| Website | nykaa.com |

Nykaa is a popular eCommerce B2C website in India that primarily provides beauty and wellness products to its customers. It was launched in 2012 by Falguni Nayar. Nykaa offers a wide range of beauty and wellness products including makeup, skincare, hair care, personal care, fragrance, wellness, and more.

The website features products from over 1,500 brands and has over 2 lakh products available on its platform. It also provides content related to beauty and wellness through its blog and social media channels.

Conclusion

In conclusion, with the massive adaptation of machine learning, consumers are getting more personalized services from B2C eCommerce companies. The best thing about B2C websites is the level of convenience and security they provide consumers.

It shows products based on the previous purchasing history of the users to fulfill their unique needs. These above-mentioned B2C eCommerce websites are truly extraordinary with their services and products. And because of this only, the competition within the eCommerce industry is relatively high, which is also the reason for its growth.

FAQs

Which is India’s number 1 eCommerce company?

Flipkart is considered India’s number 1 eCommerce company with 39.5% of the market share from the Indian eCommerce industry.

Is Zomato a B2C?

Yes, Zomato is a B2C company.

Who is the father of eCommerce in India?

K Vaitheeswaran is considered the father of eCommerce in India.

What are B2C website examples?

Some of the B2C website examples are Amazon, Flipkart, Myntra, LimeRoad, Pepperfry, Shopclues, 1mg, Snapdeal, Paytm Mall, Firstcry, etc.