IPO is a term that many of us are hearing nowadays. The ones who know about businesses and share markets are familiar with it. But few still don’t know what IPO is.

It is simply a process that makes a private company become public. Investing in IPOs can be a lucrative option to earn great financials in the future.

IPO investing does seem a good idea to almost everyone. However, it might not always be successful. It is important that you are a well-informed investor who knows about this world.

IPO has a way of working in India. The entire process gets monitored by SEBI (The Securities and Exchange Board of India).

About IPO

How IPO works in India?

How Does IPO Price is Decided in India?

Top IPO Listings and Funding India 2021

- Zomato

- Nykaa

- Paytm

- MTAR Technologies Limited

- Easy Trip Planners Limited

- Paras Defence and Space Technologies Limited

- Nureca Limited

- Clean Science and Technology Limited

- Latent View Analytics Limited

- Laxmi Organic Industries Limited

About IPO

IPO stands for Initial Public Offerings. As the name suggests it is a process that makes a company available to the public so that they can buy a share of it.

Any company with any type of business, size, or time of existence can get itself listed for being public. IPO simply helps a company to earn funding through public.

The company shares gets available to the public after initial public offerings. Investment banks help the company with the IPO process. The money raised through IPO enables a business to grow further. This in turn helps the shareholders to gain profits.

How IPO works in India?

When a private company needs huge capital which is way beyond its reach to raise, it resorts to other measures. One of the best and lucrative options is to ask the public for investment through IPO.

A company can sell the shares itself, but this makes the process highly taxing. So, companies tend to hire investment banks to take care of the entire process.

The process of IPO in India involves the following steps:

Step 1

At first, the company creates an agreement with the investment bank. This includes the aimed amount to be raised, security issues, and other details about the process.

Step 2

Then they register a statement to the Securities and Exchange Board of India. The statement is then approved by SEBI after proper examination.

Step 3

After the approval, the company finalizes the shares to be sold to the public. It also finalizes the price for it.

IPOs are available in two issues. These are fixed price and book building. In the former, the company creates a fixed price for each share to be sold. In book building, the company provides a range of prices. The people then place their bids within the range to get a share.

Step 4

After the price fixations, the shares are available for the public. The interested people then submit their applications for the shares. Then after scrutinizing the applications, the company’s share allotment begins.

Step 5

The final step is the listing in the stock market. When the public investors receive their share, they are then listed in the secondary market.

How Does IPO Price is Decided in India?

In simple words, it is decided by dividing the entire value of the company by the number of shares in the listing.

The total number of orders received for shares and maximization of the trades to be executed at the time of stock exchange launch makes for the listing price.

Top IPO Listings and Funding India 2021

Zomato

The online food delivery company, Zomato gained huge popularity with its IPO listing. The date of listing was 23RD July 2021. The issue price was Rs.73. The current BSE and NSE prices are Rs.132.70 and Rs.133.70.

Public offerings helped Zomato raise Rs. 9,375 crores. Its debut in the share market turned various heads around.

Nykaa

Another popular IPO listing of the year 2021 is Nykaa. The beauty and wellness e-commerce company was listed on 10th November 2021. The issue price was Rs. 1,125. The current BSE and NSE prices are Rs. 2,063 and Rs. 2,018.

The company raised funding of Rs. 5,352 crores through the public offerings.

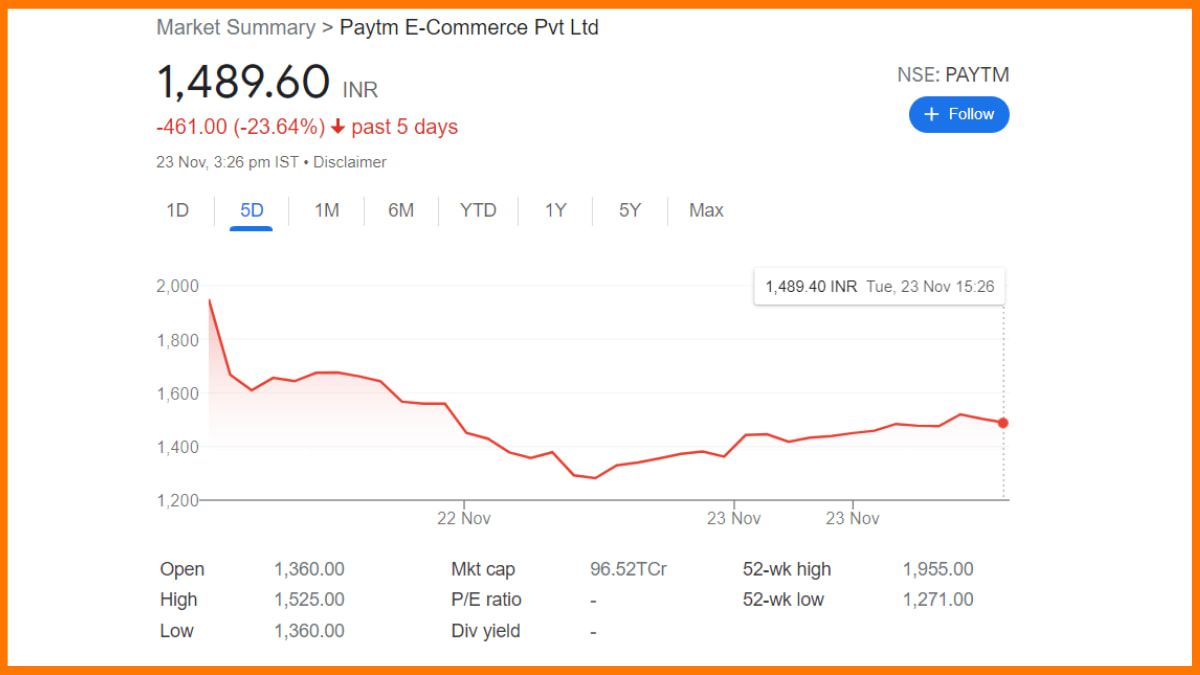

Paytm

The Indian digital payments and technology platform’s IPO listing date was 18th November 2021. The issue price was Rs. 2,150. The BSE and NSE prices are Rs. 1,955 and Rs. 1950.

Paytm raised Rs. 8,300 crores through initial public offerings.

MTAR Technologies Limited

MTAR Technologies, the engineering solutions company’s listing date was the 15th of March 2021. The issue price for the share was Rs.575. The current price at BSE (Bombay Stock Exchange) stands at Rs. 2236.95 and NSE (National Stock Exchange) current price is Rs. 2237.95.

After the sales of shares, the company gained Rs. 179 Crores through IPO.

Easy Trip Planners Limited

Easy Trip Planners or EasyMyTrip is the online Indian travel company found in the year 2008. EaseMyTrip got listed on 19th of March 2021. The issue price of the share was Rs.187. The current BSE price stands at Rs. 520.25 and NSE price is Rs. 593.85.

The company got the funding of Rs. 229 Crores after selling the shares to the public.

Paras Defence and Space Technologies Limited

Paras Defence and Space Technologies Limited deals in engineering products and solutions. The listing date for the company was 1st October 2021. The issue price was Rs. 175. The current BSE and NSE price stands at Rs. 732.4 and Rs. 732.9 respectively.

The company earned funding of Rs. 51 crores through IPO.

Nureca Limited

NURECA, the health and wellness products company’s listing date was 25TH February 2021. The issue price was Rs.400. The BSE and NSE current prices stand at Rs. 1390 and Rs. 1390.4.

The company received funding of Rs. 44.55 Crores through initial public offerings.

Clean Science and Technology Limited

The company uses the latest technologies to manufacture specific chemicals. The listing date for the company was 19th July 2021. The issue price was Rs. 900. The BSE current price is Rs. 2481.65 and NSE current price is Rs. 2476.15.

Through IPO the company collected a capital of Rs. 464 Crores.

Latent View Analytics Limited

Latent View Company helps with the processes related to digital consumers. It got listed on 23rd November 2021. The issue price was Rs. 197. The current BSE and NSE price of the company is Rs. 491.55 and Rs. 491.3.

The company received the funding of Rs. 267 Crores through IPO.

Laxmi Organic Industries Limited

Laxmi Organic Industries Ltd. is the chemical manufacturing company. The company was listed on 25th March 2021. The issue price was Rs. 130. The BSE current price is Rs. 396.45 and the current NSE price is Rs. 396.5.

IPO listing helped the company to raise funding of Rs.180 Crores.

Conclusion

The IPO market in the year 2021 has seen a great amount of growth. Many startups like Zomato, Nykaa, Paytm have entered the unicorn club through IPO this year.

IPO investing has two sides. It can be super flourishing but also a doorway to loss. So, it is necessary to do proper research about the company and the market before investing. IPO is a lucrative way that makes for company growth by making it available to the public.

FAQs

How many IPO are there in 2021 in India?

As per data by BSE, a total of 63 Indian companies went for IPO in 2021.

Which IPO is the biggest IPO in India?

The listing of LIC is considered to be India’s biggest ever IPO.

What are the top IPO funding in 2021?

Some of the top IPO Listings and Funding in India in 2021 are:

- MTAR Technologies Limited

- Easy Trip Planners Limited

- Paras Defence and Space Technologies Limited

- Nureca Limited

- Clean Science and Technology Limited

- Latent View Analytics Limited

- Laxmi Organic Industries Limited

- Zomato

- Nykaa

- Paytm