This article has been contributed by Asma Shaikh – Co-founder & MD, Enthral.ai

For enterprises today, the real challenge with workforce capability building is not simply that skills are becoming outdated; it is that employees are often not role-ready when they are needed. On average workers can expect 39% of their skills to be transformed or outdated between 2025 and 2030. The skills that empowered employees for yesterday’s success may not ensure tomorrow’s success. This makes it critical for L&D leaders to anticipate future capability needs and pushes L&D leaders to evolve from support to strategic growth drivers in fast-scale enterprises and startups.

For example, a sales hire may complete onboarding but still take months before they can confidently close deals, or a newly promoted manager who has completed leadership training yet struggles to prepare for performance conversations. A compliance officer may pass an e-learning module yet struggle to apply regulations for daily operations. These are not just learning gaps; they are role readiness gaps.

The business consequences of these readiness gaps are significant. In a recent McKinsey Learning Trends Perspective 2025, 39% of skill sets are expected to become outdated by 2030, yet 61% of organizations only plan their workforce strategy one year out. Organizations thus face productivity loss when employees take longer than expected to ramp up. Revenue is delayed when customer-facing teams are unable to operate at full capacity, and increased compliance and operational risks arise when employees understand the policy but do not effectively apply it in practice. For L&D leaders, the mandate is shifting from delivering skills to ensuring role readiness, where learning directly translates into performance and outcomes.

Agentic AI: Powering role readiness and results

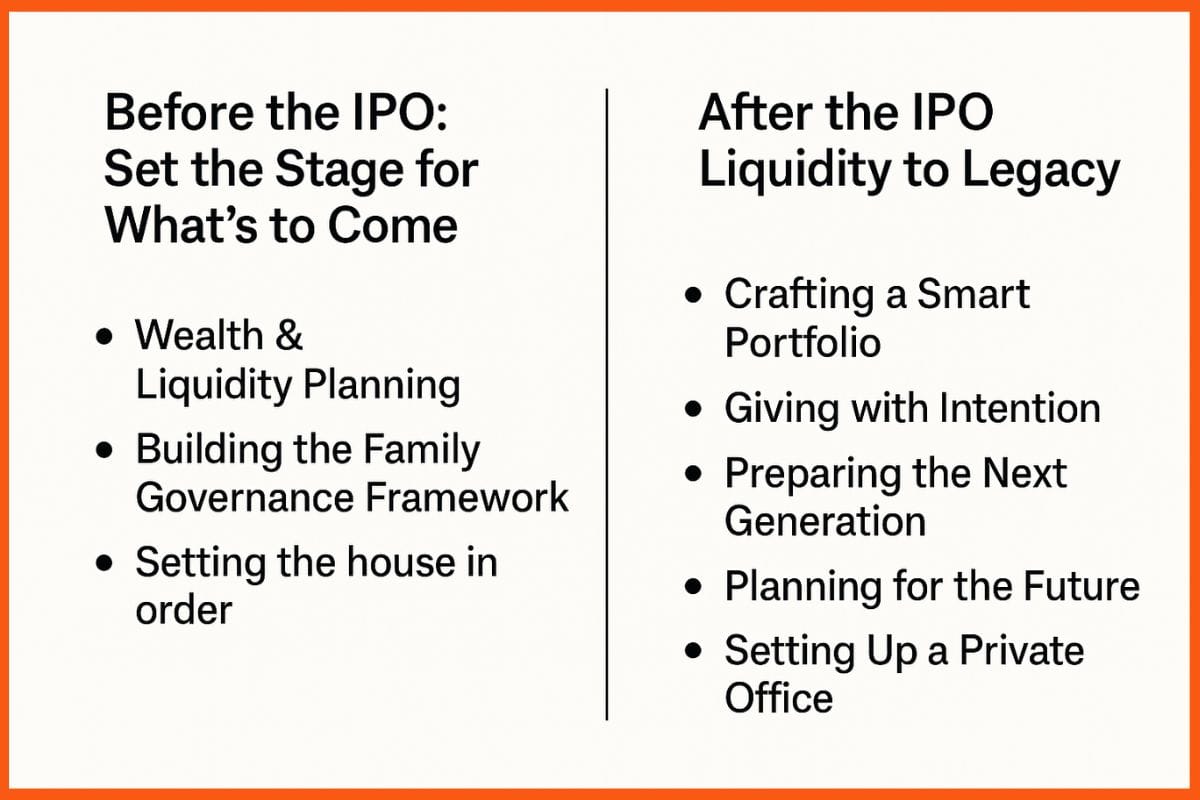

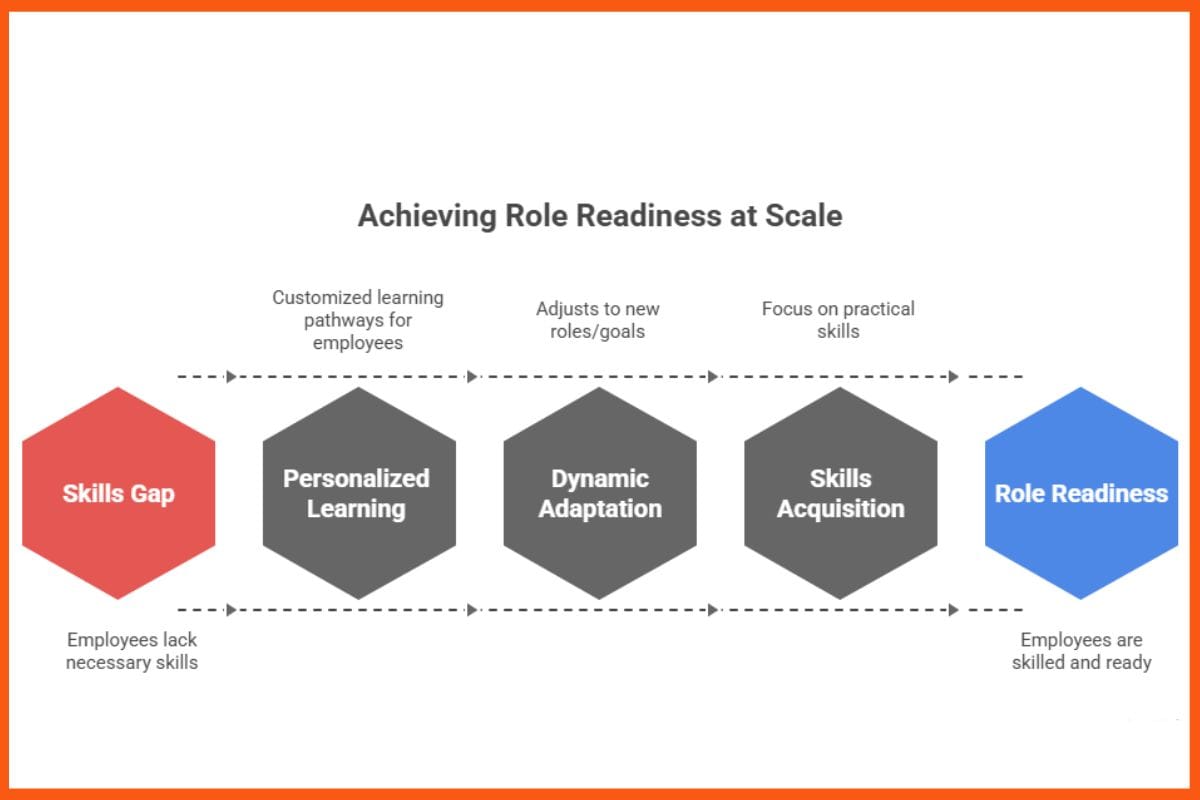

For L&D leaders the challenge is no more about just delivering skills but about ensuring employees are role-ready and able to perform effectively in their jobs. Traditional skilling models often fail to deliver real-world impact. One-size-fits-all approach lacks context and engagement, even though the 70-20-10 model shows that the majority of learning occurs through on the job experience. Modern workforces prefer blended, interactive methods, and static e-learning cannot keep up with their pace. This is where Agentic AI solves the problem by mapping role requirements to individual capabilities and skill gaps, and guiding learners through context-specific learning paths. The process enables L&D leaders to achieve their goal of moving from measuring learning progress to delivering actual business results. According to Gartner, by 2028, more than 20% of digital workplace applications will use AI-driven personalization algorithms to generate adaptive experiences for the worker. Agentic AI enables employees to reach role readiness through ongoing real-time skill assessments and personalized learning paths, which combine microlearning content with AI coaches, gamified modules, and real-time simulations.

The effect is impactful, and it goes beyond just completing training. Role readiness functions as an important factor that determines whether L&D leaders’ initiatives will transform into improved performance outcomes. Agentic AI makes role readiness possible at scale because learners do not just learn; they practice realistic scenarios perfectly and receive real-time data and actionable feedback that helps them develop immediate work readiness. The system produces faster employee onboarding, improved work accuracy, and better overall performance across positions, which traditional training methods fail to achieve.

Agentic AI systems generate learning progress data and employee role competencies and readiness results, which help organizations understand their workforce better. The system allows L&D leaders to track training completion status but also shows which employees have acquired the necessary skills for their job functions. It maps role capabilities and role readiness outcomes.

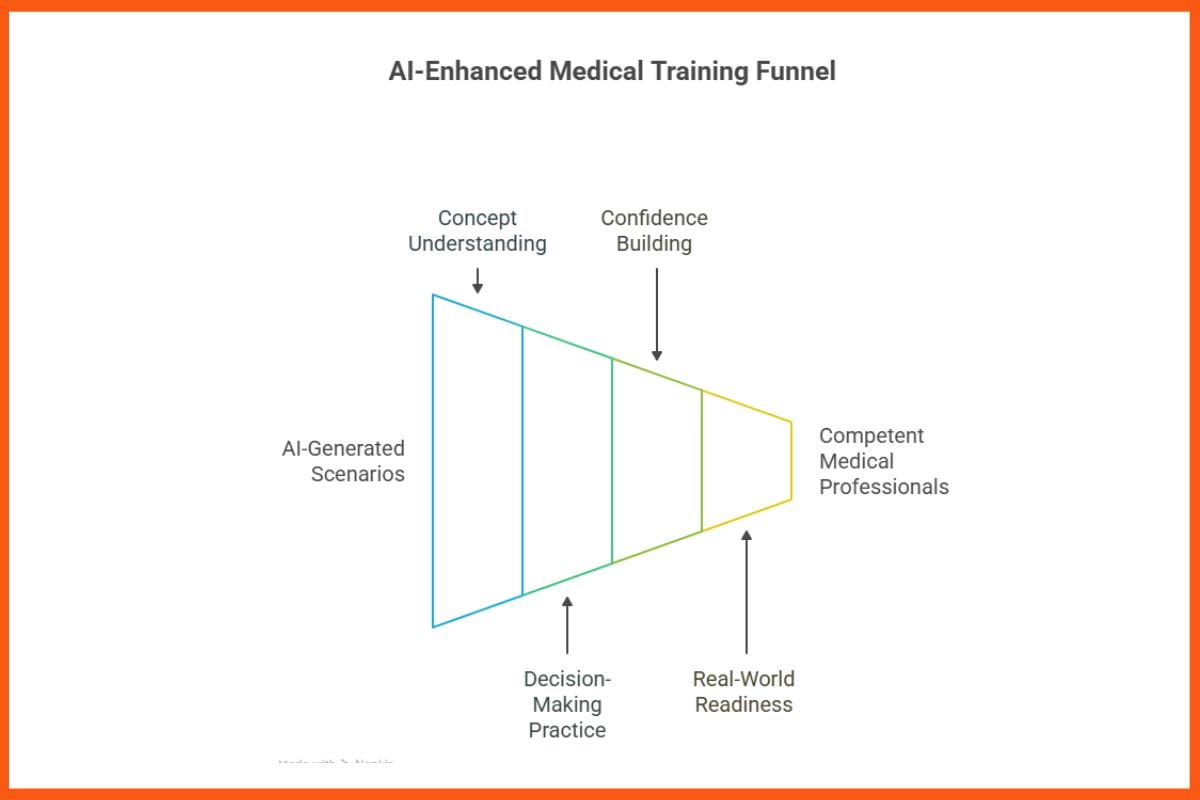

In simple words, with AI Agents, L&D leaders no longer need to manually design complex training journeys but can just instantly and intelligently skill. By easily defining the role, whether it is a sales advisor or marketing strategist, the system auto-generates a tailored, performance-focused learning path to drive readiness and outcomes. This learning journey is built around the show me, try me, test me approach, where learners first undergo role-specific training, then are given the opportunity to practice through AI-powered coaching and simulations, and finally are tested through assessments, ensuring employees are not just trained but truly role-ready before they face real-world situations. This cycle makes readiness measurable, repeatable, and directly tied to real-world performance.

Customization and Adaptive Learning at Scale

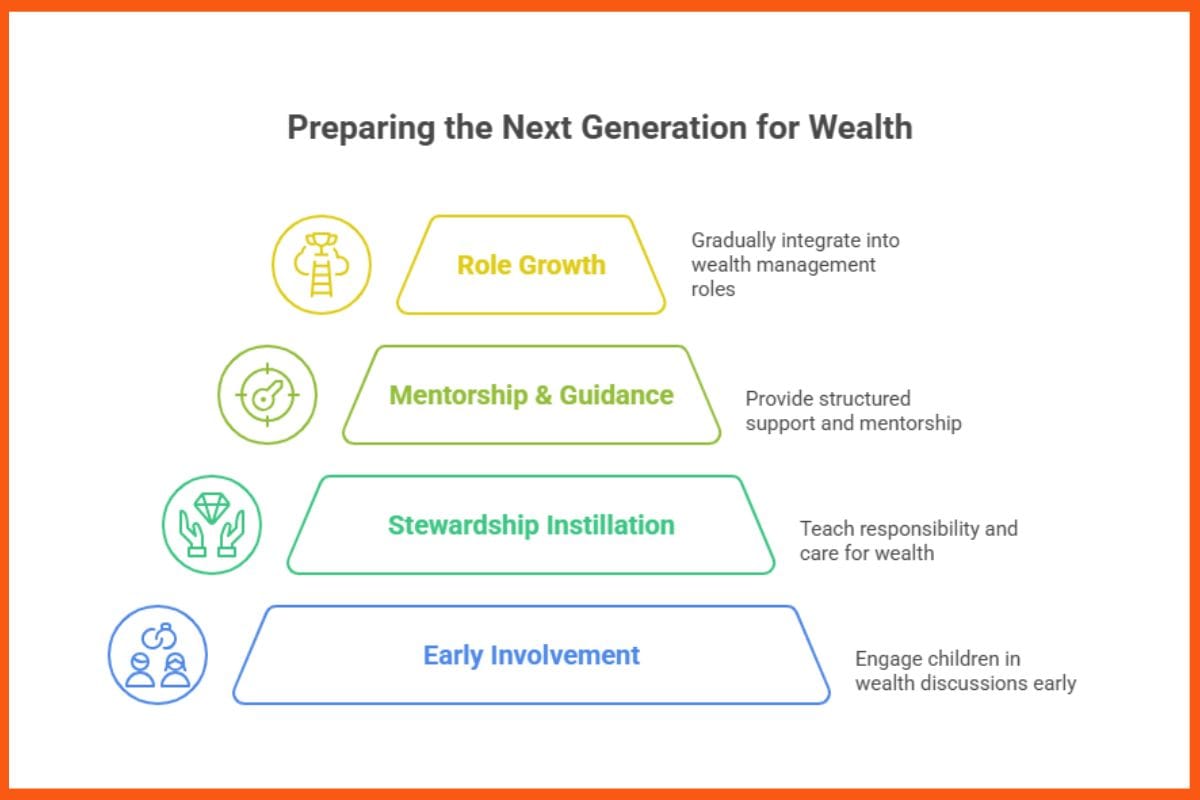

Agentic AI’s greatest contribution lies in its ability to drive role readiness at scale. Thousands of employees across the globe can now follow personalized learning journeys that adapt dynamically as the role emerges or business priorities change. The focus is not just on completing courses but also on ensuring each employee acquires the skills and knowledge needed to perform their role effectively from the start.

Agentic AI exists to support learners in creating role readiness at an accelerated pace. The global workforce now accesses customized learning pathways, which adjust automatically when new roles appear or business goals change. The focus is not just on completing courses but also on ensuring each employee acquires the skills and knowledge that will help them succeed in future work roles.

Content is delivered in ways that fit specific job roles and includes useful information through various methods like e-learning, live classes, hands-on practice, and simulations, ensuring each learner gets ready in the way they learn best. The training approach provides customized learning experiences that not only develop employee assurance but also reduce mistakes and shorten the time it takes for employees to reach full productivity.

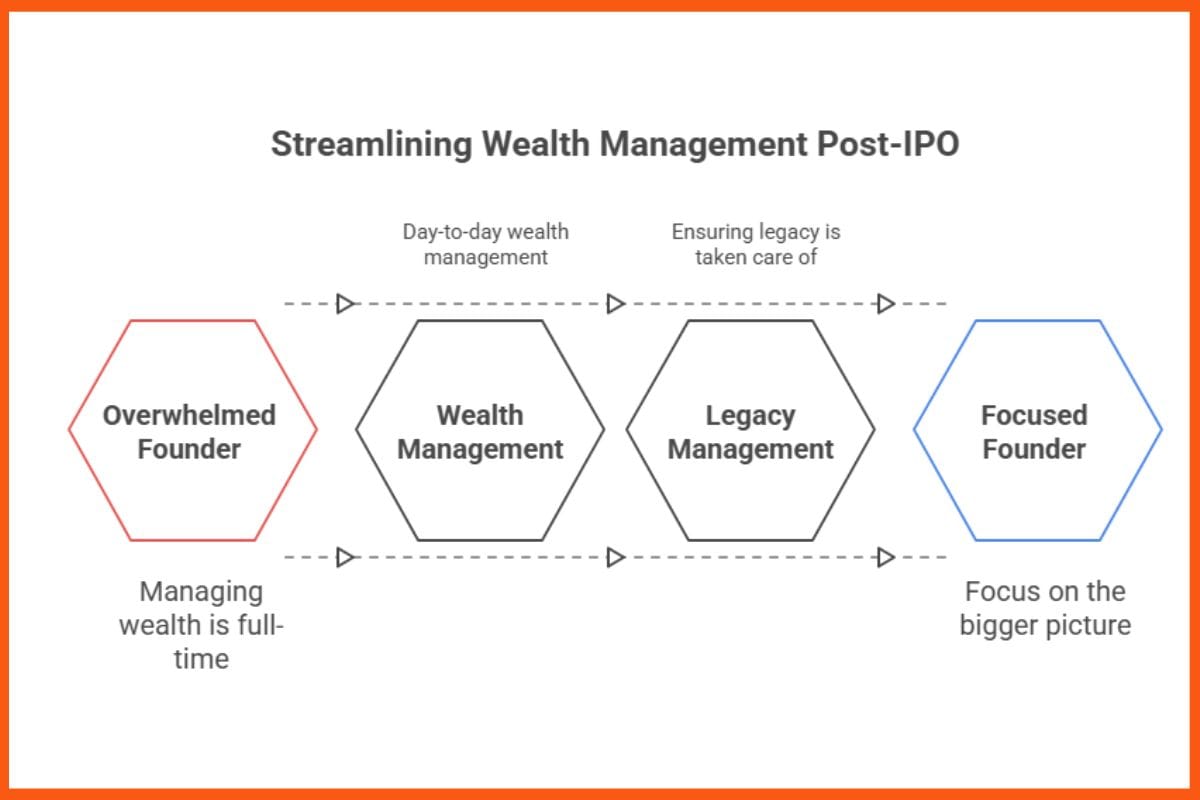

Despite the rise of AI features in LMS (Learning Management Systems) and LXP (Learning Experience Platforms), many L&D teams remain tied up with repetitive tasks, including course authoring, reminders, assessment tracking, and reporting. Agentic AI eliminates this bottleneck by automating end-to-end processes, from onboarding journeys and adaptive content creation to gamified nudges, real-time analytics dashboards, and offline-compatible delivery.

Instead of manually piecing together programs, HR and L&D leaders can delegate to intelligent agents that generate new materials, manage administration, and deliver just-in-time learning support across devices. This frees teams to focus on strategic enablement rather than logistics, while learners benefit from an engaging, accessible experience that is available on any device and always accessible.

Parting Thoughts

The implementation of Agentic AI establishes a learning system that goes beyond basic assistance to become a strategic tool for developing professional readiness. The system delivers personalized training through multiple learning approaches, which use data analytics to prepare employees for their work responsibilities at the exact moment they need them. Agentic AI stands out from standard AI systems because it tracks skill gaps and role readiness results and provides practical recommendations that connect learning activities directly to business goals and real-world performance expectations.

The outcome is measurable, scalable, and strategically impactful, building a workforce that is not only equipped for today but also prepared for improvements in productivity and revenue growth and compliance achievement.