This article has been contributed by Mr Sanjith Mukund, Co-Founder, JrnyOn

The tourism industry has perhaps never been as dynamic as it is today. Advances in technology, shifting population demographics, and changing values are redefining how people travel and what they seek in their travels. Likewise, the creator economy has matured into a multi-billion-dollar sector that can redefine how we consume content, how we discover products, and how trust is developed. Now, both forces are converging, resulting in a new model of tourism that is shaped by not only travel companies and governments, but by creators and communities based on their inspiration.

The Rise of the Creator Economy in Travel

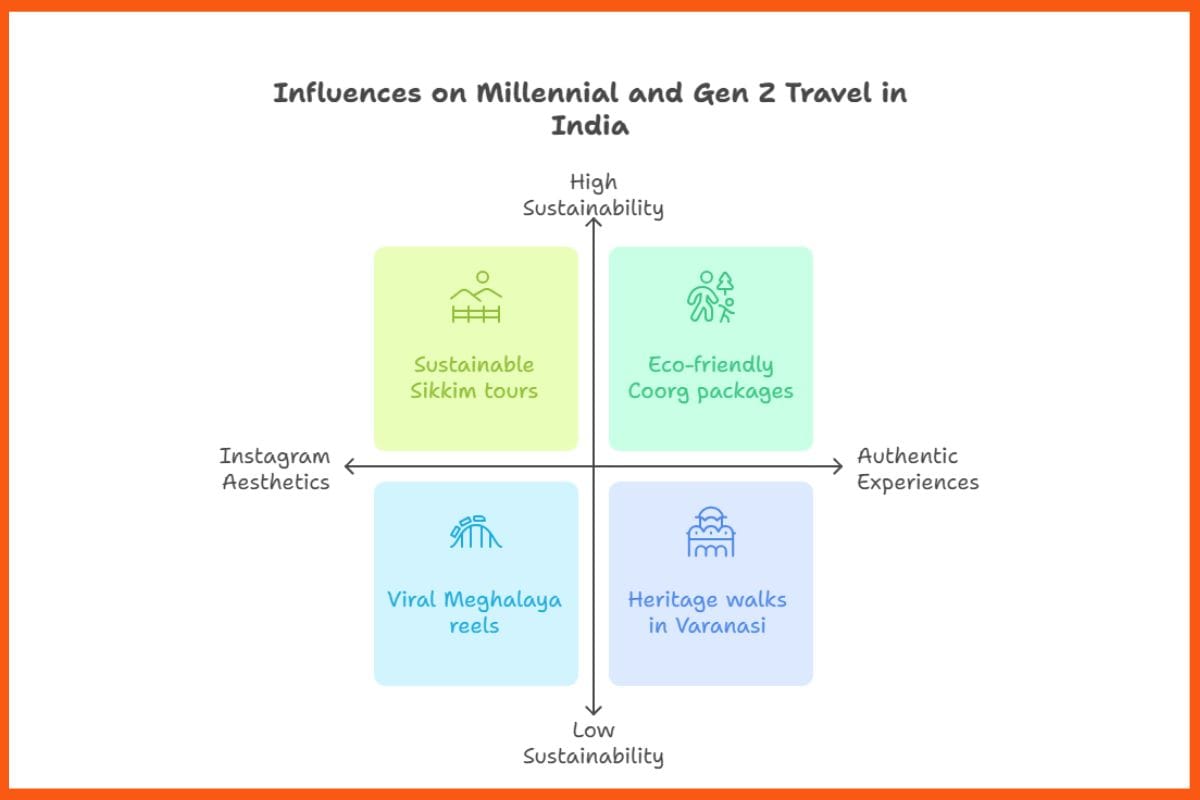

The creator economy is characterized by individuals monetizing their expertise, interests, and content through engaging directly with audiences. It’s impact in the travel space is undeniable. Platforms such as Instagram, TikTok, and YouTube are now the primary sources of travel inspiration for millennials and Gen Z, replacing guidebooks and brochures.

Now more than ever, authenticity is key in the age of AI-generative content. When algorithms can generate pristine imagery or create faux narratives for storytelling, the travel experience is seeking to find a source of authenticity. This is where creators’ reels, vlogs, and blogs provide a source to provide authentic moments and experiences, experiences full of little, unrefined, humane moments that artificial intelligence cannot replicate. Once those moments have been framed and shared, and the audience has found some sort of trust in that creator before the moment was created, the moment turns into a more powerful invitation to be present or leave the screen.

This shift has strength in its relatability. A 30-second video clip of a backpacking trek enhanced in a place like Kyrgyzstan, a blog story of a family-run homestay in Vietnam, creates curiosity bigger than any advertisement from the industry could. The audience more often than not feels connected to the creator, sometimes by following or consuming their content for several years; they have created trust, and trust has become new currency in tourism marketing.

Why Trust Matters More in Travel

Travel is an inherently high-consideration decision when compared to purchasing a new gadget or venturing to a new restaurant. Travel is a decision based on financial consideration, safety, and an unknown experience. It is in these instances where creator influence is valuable in a unique way. When a consumer sees a destination reflected through a creator, or someone they already trust, their sense of uncertainty is lowered. The creator is a proxy, someone who has been there before them.

In an era of content splice from AI is the true variable- trust. The audience can certainly tell the difference between scripted promotional content and an authentic experience. This is why creators, through their authenticity, continue to be important in determining “how” and “where” travel is taken.

From Inspiration to Action: Curated Experiences

The power of creators is going from inspiration to action. Travelers are seeing what their favorite creators see, and they want to go there with them, or through them. This has led to the development of creator-curated experiences: small group trips that are designed around the interest and expertise of a creator.

For example, a chef might curate a food experience in Tuscany, a photographer could curate a photography expedition to Borneo, or a wellness coach could curate a wellness retreat in the Himalayas. These are not itineraries for the mass market, but instead first-person experiences that reflect the personality and expertise of a creator. From a traveler’s perspective, the appeal has a dual benefit of access and connection. For many travelers, they gain access to unique and often niche experiences, and the value of sharing that experience with someone they feel connected to with the creator’s influence.

This also expands the accessibility of tourism design. Tourism design is no longer just for the large operators; up to this point, tourism design has been equitable to the notion of tourism selected only from large operators or companies. It expands new tourism experiences and destinations voices and offers experiences from micro-influencers with devoted niche audiences, to experts who are passionate to bring their knowledge to life in travel experiences.

Impact on Local Economies

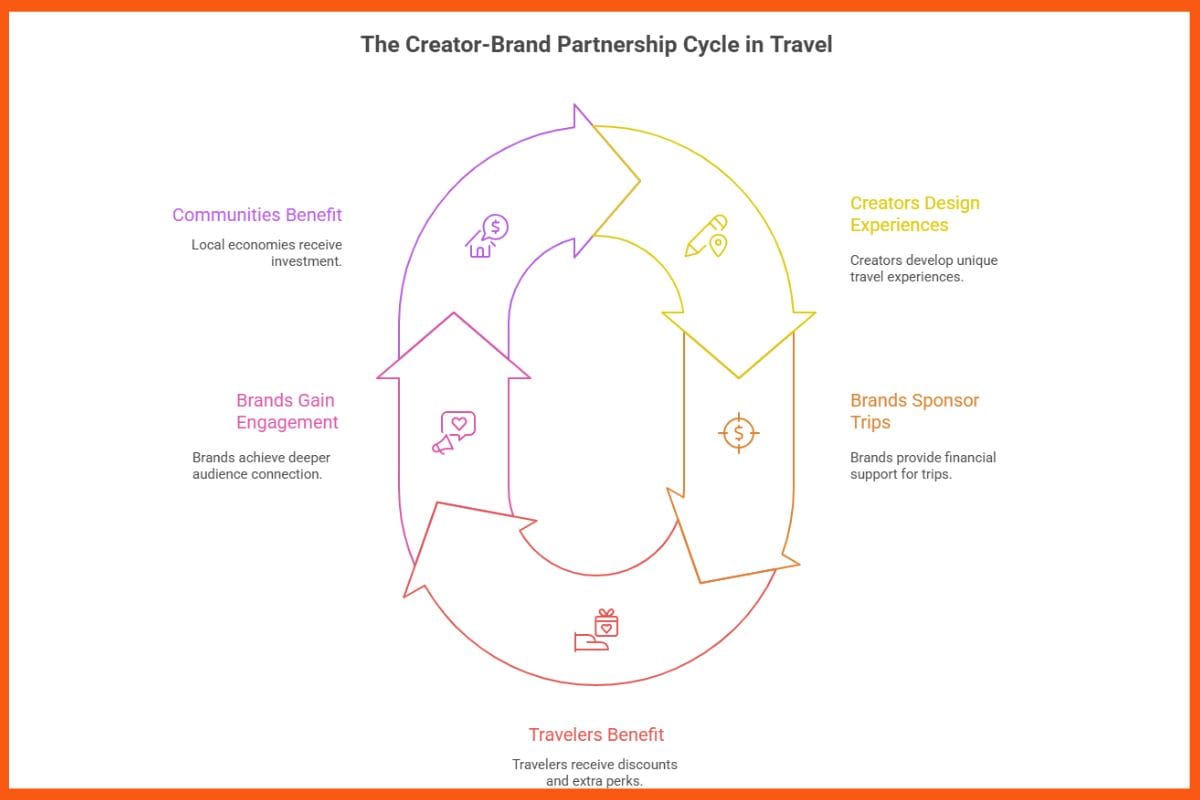

One of the most notable advantages of creator-curated travel is its direct effect on nearby economies. Traditional mass tourism directs the spending power toward large operators and global hotel chains, with little remaining for the surrounding community. Alternatively, small group-curated trips can result in patronizing local guides, lodging at family-run accommodations and staying at smaller restaurants and artisans.

By engaging travelers directly with local service providers, creators serve as micro-distributors of tourism demand. A single photography expedition to Mongolia may put thousands of dollars into the local community through transport providers, herder families, and local guesthouses. Over time, these niche experiences can help redistribute tourism from hot spots that are bursting at the seams, spreading the economic benefits while also dealing with overtourism.

For destinations attempting to rebuild after the crisis of a pandemic, it is a growth engine. Creator-driven demand cultivates sustainable, community centered economic development.

The Role of Brands in Creator-Curated Travel

A further aspect of this trend is the function of brands. Not only are creators designing and hosting travel experiences, they are also attracting the attention of consumer brands looking for genuine ways to connect with an audience. The act of brands partnering with creators to sponsor or co-sponsor trips adds another level of value. Travelers are also able to gain from a sponsorship partnership.

In practical terms, this could look like discounted packages, extra experiences, or even complimentary products and services integrated into the trip, which could include traveling gear, or local events funded by brand sponsorships. For brands, appreciation comes in the form of association with authentic storytelling and deeper engagement. For portable travel experiences, the experience becomes richer at a greater value and for local communities, it adds additional layers of investment into and around the tourism ecosystem.

Sustainability and Community Building

Smaller, niche groups are inherently more aligned with sustainability and slow travel. Instead of racing through multiple cities in a week, travelers spend longer periods in fewer places, providing an opportunity for more engaging cultural exchanges and lessening their footprint.

The impact is environmental, economic, and also social. In an age that has been described as a ‘loneliness pandemic’ curated group travel becomes a way for people to form true friendships. Digital community becomes a physical community and trips become platforms for long-lasting relationships. For many the most memorable aspects of these journeys aren’t even just the experience at the destinations; it’s the people with whom they experience it.

Challenges and Guardrails

As expected, this new model will have some challenges. As creator-curated travel increases, we may see signs of oversaturation, commodification, or unsatisfactory quality control. There is also the possibility of overtourism for destinations if demand is not appropriately managed. And while creators are experts in telling stories, they might not be experts in operations, logistics, or safety.

This is where frameworks and partnerships come in important ways. Tech platforms, sector bodies, and local government will need to develop frameworks, provide operational assistance and attribution, all to maintain creator-curated travel which is authentic, safe, and beneficial to all stakeholders.

The Future of Tourism: Co-Creation

The intersection of the creator economy and tourism marks the dawn of a new era for the industry. Once the space of travel companies and travel marketers, this is now being shaped by creators and their communities. The implications are monumental:

- For travelers, it means more authentic, passion-driven travel experiences.

- For destinations, it means new channels for demand and economic development at the local level.

- For brands, it terms engaging in real-life experiences and not just in a digital presence.

- For the industry, it means thinking about the creators not only as remuneration but as co-creators of the experience.

Tourism has always been about storytelling. In a time of AI-generated content, creators provide something that algorithms will never replace – authenticity. The co-authors of the future of travel will involve creators, brands, and the community that they inspire.