Starting and growing a business in India is highly rewarding, but one challenge every entrepreneur faces is arranging adequate funds to keep things running smoothly. This is where India’s Micro, Small, and Medium Enterprises (MSMEs) step in as true game-changers.

With nearly 40 million MSMEs spread across both organized and unorganized sectors, they not only generate millions of jobs but also contribute close to 40% of the country’s GDP.

The Indian government has introduced various subsidies and loan schemes that make it easier for business owners to secure funds, expand operations, and be competitive. From easing the pressure of high-interest loans to providing financial support for growth, these schemes aim to address real challenges like unemployment and limited access to credit.

In this article, we will know some of the most government subsidy schemes in India. These initiatives can help entrepreneurs and small business owners turn their ideas into sustainable growth.

Why Government Schemes Are Crucial for Startups and MSMEs?

List of Major Government Subsidies to Boost Businesses in India

Why Government Schemes Are Crucial for Startups and MSMEs?

In the dynamic world of startups and Micro, Small, and Medium Enterprises (MSMEs), government schemes can often be the difference between survival and exponential growth. These initiatives are designed to empower entrepreneurs with resources that go beyond capital, offering a holistic support system to nurture innovation and competitiveness.

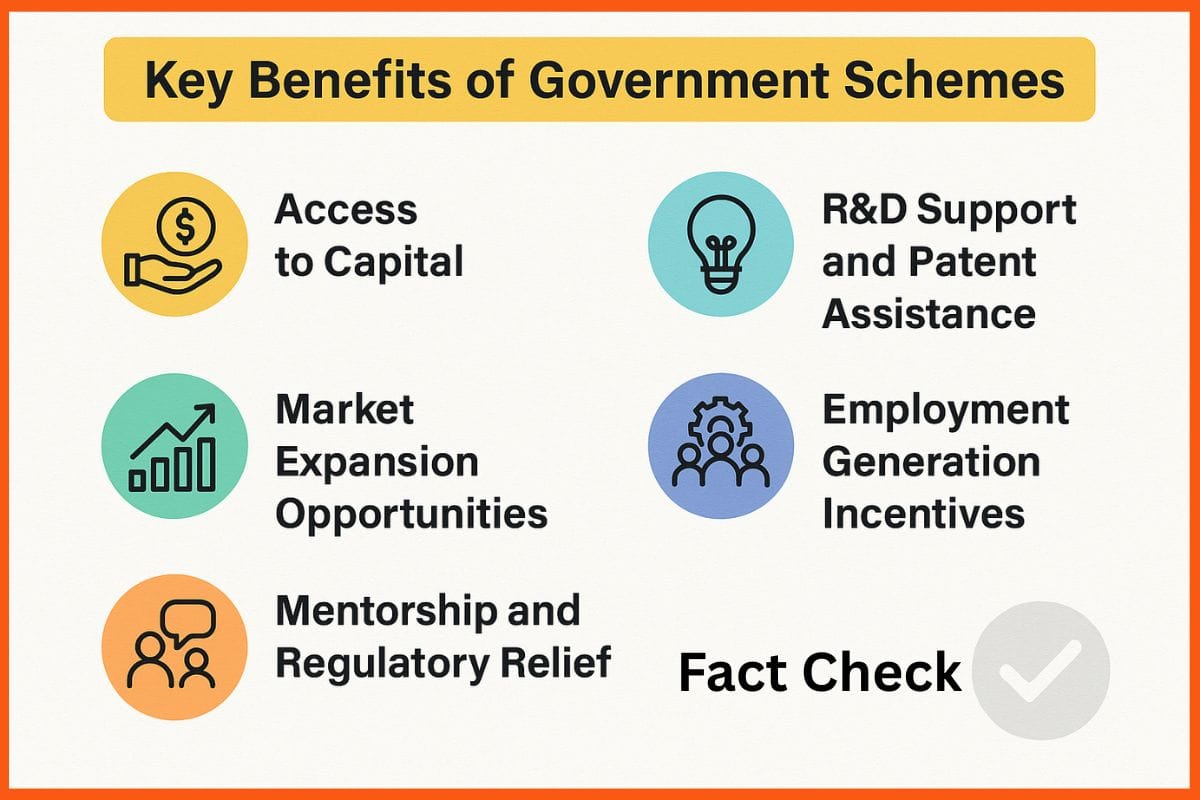

Key Benefits of Government Schemes:

- Access to Capital: Many schemes offer direct funding, low-interest loans, and credit guarantees, helping startups and MSMEs launch, expand, or pivot without the constant pressure of private financing.

- Market Expansion Opportunities: Through initiatives promoting domestic and international trade, startups gain huge market access, helping them reach new customers and scale globally.

- R&D Support and Patent Assistance: Schemes often include grants for research and development, along with patent filing support, enabling innovators to protect and commercialize their ideas effectively.

- Mentorship and Regulatory Relief: Government programs often offer guidance from industry experts and simplified regulatory processes, reducing the compliance burden and fostering informed business decisions.

- Employment Generation Incentives – Startups and MSMEs creating jobs can benefit from subsidies, tax rebates, and other incentives, aligning business growth with national economic development goals.

- Fact Check: India is currently the 3rd largest startup ecosystem in the world and aims to support over 1 million startups by 2035, reflecting a robust policy framework geared toward entrepreneurship and innovation.

List of Major Government Subsidies to Boost Businesses in India

India offers a range of government subsidies and support programs to help businesses grow, innovate, and compete in both domestic and global markets. These initiatives provide funding, tax benefits, and mentorship, making it easier for startups, MSMEs, and franchise owners to scale their operations efficiently.

1. Startup India Scheme

Best for: Early-stage startups

Key Benefits:

- 3-year income tax exemption to reduce the initial financial burden.

- Fast-track patent filing to protect innovative ideas quickly.

- Self-certification under 9 labor and environmental laws.

- Access to Startup India Seed Fund and Fund of Funds, providing crucial capital for growth.

Eligibility Criteria:

- Must be registered as a Private Limited Company, LLP, or Partnership.

- Turnover less than INR 100 crore.

- Business operational for less than 10 years.

- Should have an innovative and scalable business model.

2. MSME Business Loans in 59 Minutes

Best for: New and existing MSMEs seeking quick financial support

Key Benefits:

- Fast approval within 59 minutes, enabling businesses to access funds quickly.

- Loan amounts up to INR 1 crore, helping MSMEs expand operations or manage working capital.

- Interest rates start from 8.5%, depending on the business type.

- Process completion in 8–12 days, ensuring minimal delay for fund utilization.

Eligibility Requirements:

- GST verification to confirm business compliance.

- Income tax verification for financial transparency.

- Bank account statements for the last 6 months.

- Ownership-related documentation to establish legitimacy.

- KYC details of the business owner(s).

3. Credit Guarantee Scheme for Startups (CGSS)

Best for: Startups seeking credit without collateral

Key Benefits:

- Loans up to INR 5 crore through participating banks.

- Flexible financing options, including term loans, working capital loans, and purchase order financing.

- Up to 80% loan guarantee, reducing risk for both startups and banks.

- Low interest rates with extended repayment periods to ease cash flow pressures.

Eligibility Requirements:

- Must be registered as a Private Limited Company.

- Turnover up to INR 50 crore in the previous financial year.

- Operates in an innovative and scalable business domain.

4. Pradhan Mantri Mudra Yojana (PMMY)

Best for: Small and medium businesses outside the farm and corporate sectors

Loan Categories:

- Shishu: Loans up to INR 50,000 for startups in the initial phase

- Kishore: Loans ranging from INR 50,000 to INR 5 lakh for growing businesses

- Tarun: Loans ranging from INR 5 lakh to INR 10 lakh for well-established enterprises

Key Highlights:

- Over 29.55 crore loans disbursed worth INR 15.52 lakh crore since its launch in 2015

- Collateral-free loans designed to support entrepreneurship and promote financial inclusion

- Encourages small business growth and employment generation across India

5. Prime Minister Employment Generation Programme (PMEGP)

- Managed by: KVIC & Ministry of MSME

- Targets: New micro-enterprises in rural and urban areas

Key Benefits:

- Subsidy of 15–35% to reduce the initial investment burden

- Loans up to INR 25 lakh for manufacturing units and INR 10 lakh for service enterprises

- Strong focus on employment generation, supporting local economies

Highlights:

- Encourages entrepreneurship in both rural and urban regions

- Promotes sustainable growth and job creation for micro enterprises

6. Atal Innovation Mission (AIM)

Best for: Startups in healthcare, education, and agriculture

Key Benefits:

- Grants up to INR 10 crore for innovative projects

- Atal Tinkering Labs (ATL) and Atal Incubation Centers (AIC) support schools and startups

- Funding for prototype development, market research, and capacity building

Highlights:

- Promotes innovation and entrepreneurship across sectors

- Provides financial and mentorship support to scale ideas

7. Production Linked Incentive (PLI) Scheme

Best for: Manufacturers in electronics, technology, pharmaceuticals, and automotive sectors

Key Benefits:

- Financial incentives to boost domestic manufacturing

- Encourages “Make in India” by providing extra benefits for locally produced goods

- Government allocation of INR 1.97 lakh crore for promoting industrial growth

Highlights:

- Strengthens India’s manufacturing ecosystem

- Supports innovation, investment, and global competitiveness

8. Stand-Up India

Designed for: SC/ST and women entrepreneurs

Key Benefits:

- Loans from INR 10 lakh to INR 1 crore for new businesses focus on greenfield projects, encouraging fresh startups

- Up to 75% of the project cost is covered through financing

- Available via all commercial banks, making access easier

Highlights:

- Promotes inclusive entrepreneurship and supports underrepresented groups

- Helps startups overcome financial barriers to launch and scale

9. National Small Industries Corporation (NSIC) Subsidy

Best for: Small and medium-sized enterprises (SMEs)

Key Benefits:

- Promotion support to help businesses grow and reach new markets

- Credit assistance for loans at low interest rates

- Raw material support to ensure smooth production

- NSIC facilitated loans worth INR 236 crore for MSMEs in 2020–21

Highlights:

- Helps small businesses improve credit scores and access financing

- Supports overall growth and operational efficiency for MSMEs

10. Market Development Assistance (MDA) Scheme

Best for: MSMEs looking to expand into domestic and international markets

Key Benefits:

- Funding support for participation in trade shows, exhibitions, and buyer-seller meets

- Helps MSMEs showcase products and connect with global buyers

- Facilitates international shipments, boosting export potential

Highlights:

- Strengthens market presence for Indian MSMEs

- Supports growth and competitiveness in both domestic and global markets

Conclusion

In 2025, India’s startup and MSME ecosystem will be stronger and more supportive than ever, thanks to a range of government schemes designed to fuel entrepreneurship and innovation. From tax exemptions, collateral-free loans, and credit guarantees to funding for research, market development, and international expansion, the government is creating an environment where businesses can grow with reduced risk.

By strategically implementing these schemes, startups and MSMEs can accelerate growth, enhance competitiveness, and contribute to job creation and economic development, making the journey of entrepreneurship smoother, smarter, and more sustainable in India’s dynamic business landscape.

FAQs

Why are government schemes important for startups and MSMEs in India?

Government schemes provide financial assistance, mentorship, tax benefits, and easier access to credit.

What kind of financial help can entrepreneurs get from government schemes?

They can get low-interest loans, subsidies, tax exemptions, grants, and even collateral-free credit facilities.

What are the different categories of loans under the Pradhan Mantri Mudra Yojana (PMMY)?

PMMY offers three categories:

- Shishu: Up to INR 50,000 for new startups

- Kishore: INR 50,000–5 lakh for growing businesses

- Tarun: INR 5–10 lakh for established enterprises

Do government schemes support women entrepreneurs?

Yes, several schemes are designed specifically to encourage women entrepreneurs by providing easier access to funding and resources.