Millions of Indians rely on MobiKwik, a financial technology pioneer, to streamline and improve their digital payment experience. Debit cards, credit cards, net banking, and even cash deposits are just a few of the ways customers may easily load money into their digital wallet with MobiKwik, an all-inclusive mobile payments network. With the use of this flexible platform, consumers can easily pay for a variety of services, including entertainment costs, electricity bills, insurance premiums, and cell recharges. Peer-to-peer transfers are another feature that MobiKwik offers in addition to consumer transactions, making it simple for users to send money to friends and relatives.

Let’s take a fascinating look at the various elements of the MobiKwik business model to inspire would-be young entrepreneurs to research similar challenging prospects.

About MobiKwik

MobiKwik Business Model

How MobiKwik Makes Money | MobiKwik Revenue Model

USP of MobiKwik

SWOT Analysis of MobiKwik

About MobiKwik

Upasana Taku and Bipin Preet Singh founded MobiKwik in 2009, and since 2021, it has transformed itself into one of the major players in its domain. It began as a digital wallet before evolving into a full-featured horizontal finance platform. The fintech firm, which now has over 140 million customers and 3.7 million merchants, broadened its product line in 2018 to include a variety of financial services, such as mutual funds, credit, insurance, and digital gold. Its current services, including bill payment, payment gateway, and digital payment solutions, were supplemented by this growth.

MobiKwik Business Model

The core of MobiKwik’s creative business strategy is building an extensive ecosystem that connects customers with a wide variety of merchants and service providers. Customers can perform transactions at physical retail locations and on e-commerce platforms thanks to the platform’s strong connectivity with both online and offline payment infrastructures.

A loyalty rewards programme that delivers discounts and cashback is part of MobiKwik’s user-centric strategy, which encourages regular use and improves consumer engagement. In order to meet customers’ short-term cash needs, the platform also incorporates microlending services, which provide users with small, immediate loans based on their credit profile and transaction history.

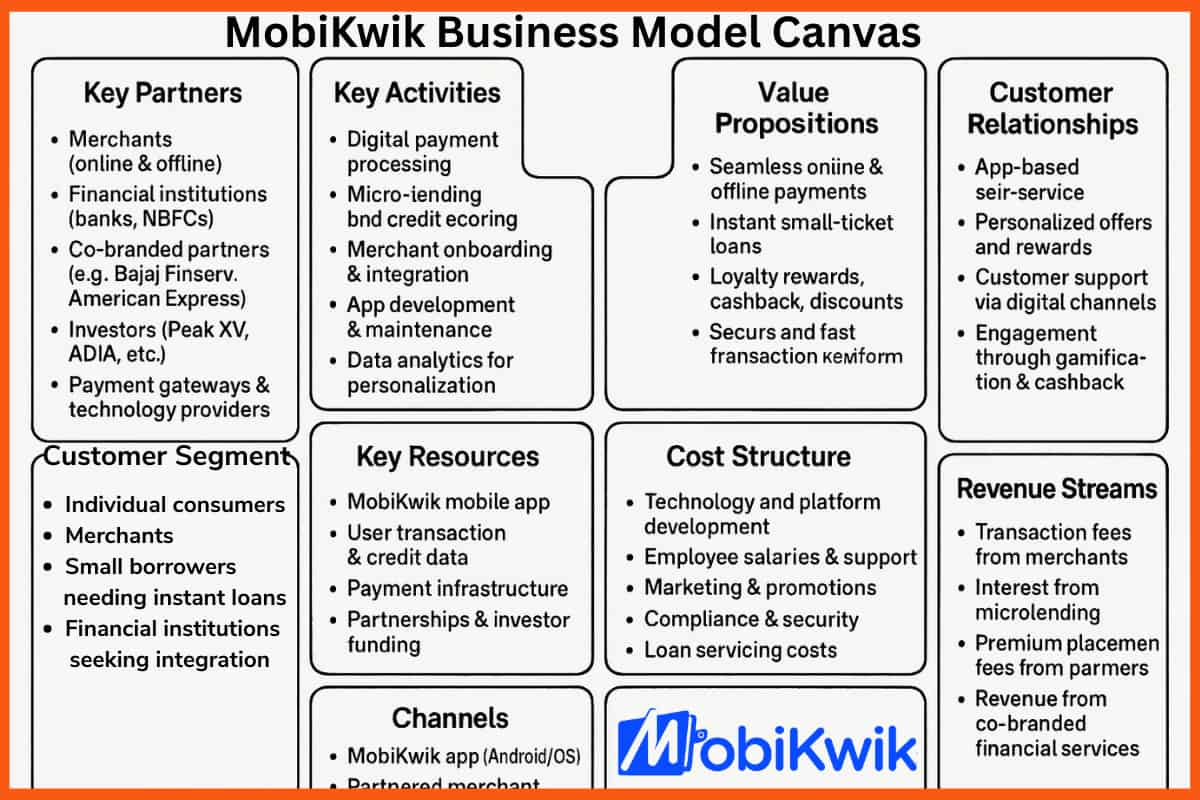

MobiKwik Business Model Canvas

MobiKwik is a leading Indian fintech company that offers a digital wallet, payment gateway, and financial services like loans and insurance. The business model of MobiKwik focuses on creating a connected ecosystem for users and merchants, enabling seamless transactions and value-added services.

1. Key Partners

- Merchants (online & offline)

- Financial institutions (banks, NBFCs)

- Co-branded partners (e.g., Bajaj Finserv, American Express)

- Investors (Peak XV, ADIA, etc.)

- Payment gateways & technology providers

2. Key Activities

- Digital payment processing

- Micro-lending and credit scoring

- Merchant onboarding & integration

- App development & maintenance

- Data analytics for personalization

- Customer service & fraud prevention

3. Value Propositions

- Seamless online & offline payments

- Instant small-ticket loans

- Loyalty rewards, cashback, discounts

- Secure and fast transaction platform

- Financial services via app integration

4. Customer Relationships

- App-based self-service

- Personalized offers and rewards

- Customer support via digital channels

- Engagement through gamification & cashback

5. Customer Segments

- Individual consumers (urban digital users)

- Merchants (retailers, e-commerce sellers)

- Small borrowers needing instant loans

- Financial institutions seeking integration

6. Key Resources

- MobiKwik mobile app

- User transaction & credit data

- Payment infrastructure

- Partnerships & investor funding

- Technology & analytics systems

7. Channels

- MobiKwik app (Android/iOS)

- Partnered merchant websites/apps

- Retail QR code-based payments

- Digital marketing and referrals

8. Cost Structure

- Technology and platform development

- Employee salaries & support

- Marketing & promotions

- Compliance & security

- Loan servicing costs

9. Revenue Streams

- Transaction fees from merchants

- Interest in microlending

- Premium placement fees from partners

- Revenue from co-branded financial services

- Commissions from value-added services

How MobiKwik Makes Money | MobiKwik Revenue Model

MobiKwik’s revenue model is intricate and intended to support long-term expansion. The company’s primary source of revenue is the transaction fees that merchants pay to facilitate payments through the MobiKwik network.

Revenue through premium placement options

MobiKwik makes money by providing premium placement choices to companies that want to increase their app visibility.

Revenue through interest on small loans

By charging interest on user-issued modest loans, the microlending service generates another sizable revenue source.

Revenue through co-branded partnerships and financial service

The platform benefits from financial service integrations and co-branded alliances, which increase revenue and user acquisition.

By striking a balance between various sources of income, MobiKwik maintains a steady and varied flow of money, establishing itself as a flexible and robust participant in the ever-changing digital payments market.

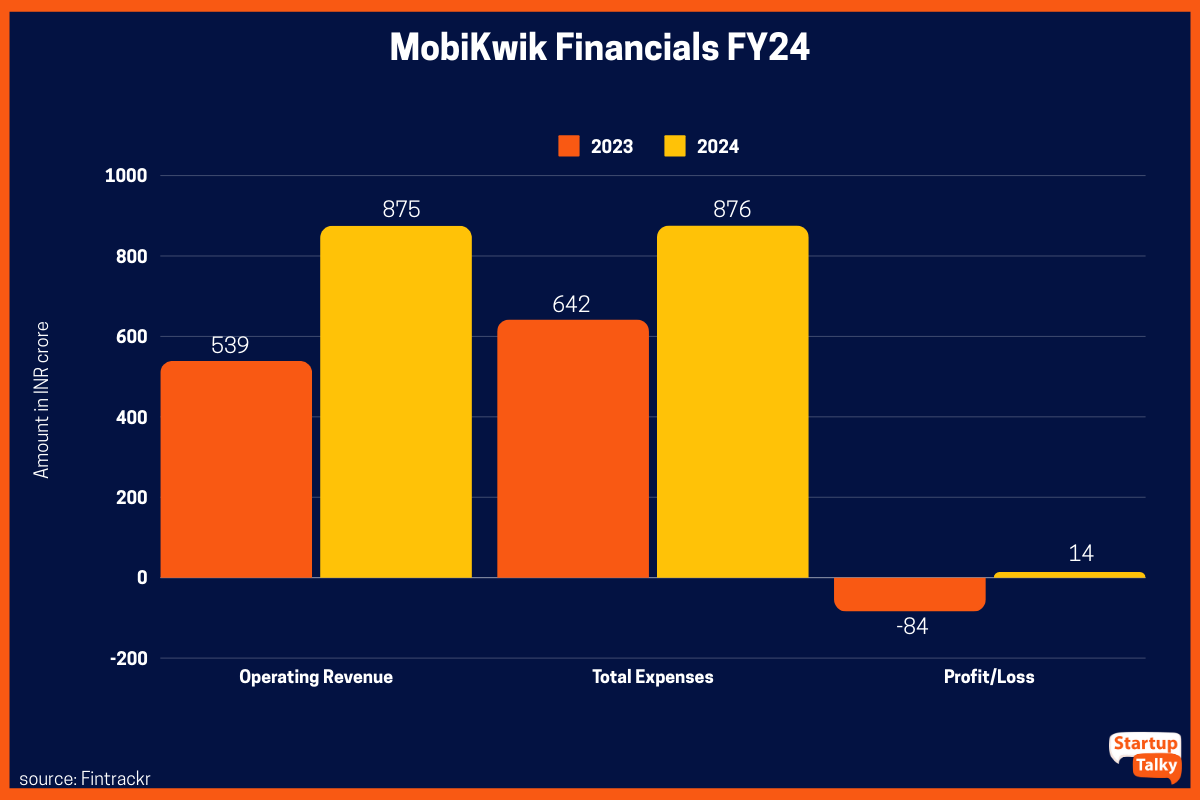

MobiKwik reported a loss of INR 55.2 crore in Q3 FY25, after making a profit of INR 5.27 crore in Q3 FY24. In the previous quarter (Q2 FY25), the loss was INR 3.59 crore.

In FY24, MobiKwik achieved a profit of INR 14.1 crore, a significant turnaround from the loss of INR 83.8 crore in FY23. This positive shift underscores the company’s effective cost management and revenue enhancement strategies.

The revenue from operations surged by approximately 62% from INR 539.5 crore in FY23 to INR 875.0 crore in FY24, highlighting the company’s robust business growth.

USP of MobiKwik

Like the majority of its competitors, MobiKwik has shifted its focus over the last few years to lending, which might not be sufficient on its own. The situation has altered dramatically from 2021, when there were no benchmarks for fledgling tech stocks, leaving investors and startups in the dark regarding pricing. Since Paytm, Zomato, Nykaa, and other tech stocks have been listed in recent years, their performance has been useful in setting standards.

In the long run, MobiKwik’s rationalisation of its IPO pricing and value would benefit its current shareholders. From companies including Peak XV Partners, Orios Venture Partners, Cisco Investments, NET1, Abu Dhabi Investment Authority, Bajaj Finserv, and American Express Ventures, among others, MobiKwik has raised about $180 million in debt and equity capital so far. After some employees exercised their ESOPs, the firm became a unicorn in October 2021.

SWOT Analysis of MobiKwik

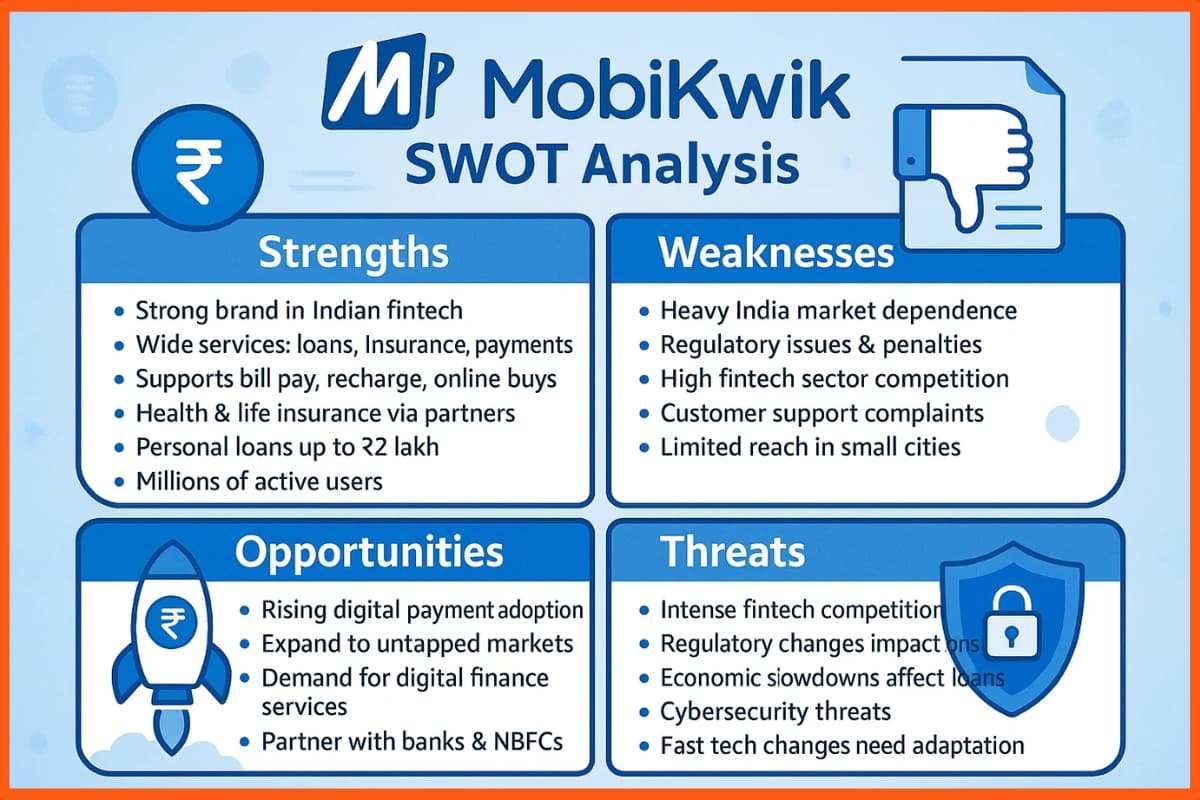

Strength

- Strong brand awareness in the fintech sector in India.

- Wide range of services, such as loans, insurance, and payments.

- Payments Support for bill payment, recharge services, and online transactions.

- Coverage Goods for health and life insurance through alliances with insurers.

- Personal loans with adjustable payback plans up to INR 2 lakh.

- A big consumer base with millions of users.

Weakness

- Reliance on the Indian market restricts international growth.

- Issues with regulations in the fintech sector.

- Regulatory Penalties (INR) and Compliance Expenses (INR) by Year

- Fierce rivalry between banks and alternative payment systems.

- Problems with customer support that people have mentioned.

- Restricted reach in tier-2 and tier-3 cities, in contrast to more established rivals.

Opportunities

- India’s growing use of digital payments

- Possibility of growing into under-represented markets

- Growing consumer demand for digital financial services

- Possibilities for innovation with cutting-edge technologies like blockchain

- Forming strategic partnerships with financial institutions and banks to improve services

Threats

- Fierce rivalry between long-standing firms and recent arrivals in the fintech industry.

- Modifications to regulations that may have an effect on business operations or profitability.

- Economic downturns have an impact on loan repayments and consumer expenditure.

- Risks to cybersecurity that could erode user confidence.

- Rapid advancements in technology necessitate ongoing adaptation.

Conclusion

With a solid base characterised by high brand recognition and a wide range of services, MobiKwik is at a critical juncture. It must, however, overcome obstacles including fierce competition and legal restrictions. Growth opportunities are promising, particularly given the growing use of digital payments and new technology, but the business needs to be on the lookout for cybersecurity risks and changes in the market. MobiKwik can strategically position itself to take advantage of new opportunities in the constantly changing fintech ecosystem by utilising its strengths and correcting its deficiencies.

FAQ

How MobiKwik earn money?

Here are a few ways Mobikwik earns money:

- Revenue through premium placement options

- Revenue through interest on small loans

- Revenue through co-branded partnerships and financial service

Is MobiKwik RBI approved?

Yes, MobiKwik is RBI-approved as a Prepaid Payment Instrument (PPI) issuer and Bharat Bill Payment Operating Unit (BBPOU).

Is MobiKwik a unicorn?

Yes, MobiKwik became a unicorn in 2021.

Which company made MobiKwik and what does MobiKwik do?

MobiKwik, founded by One MobiKwik Systems Pvt. Ltd. in 2009, is a leading Indian fintech company started by Bipin Preet Singh and Upasana Taku. It offers a digital wallet, bill payments, recharges, Buy Now Pay Later (BNPL), small personal loans, insurance, and investment options. MobiKwik connects users and merchants, enabling fast, secure, and convenient financial transactions across India.

What are MobiKwik features and services?

MobiKwik offers features like mobile wallet, bill payments, recharges, UPI, and QR-based payments. Its services include Buy Now Pay Later (BNPL), instant personal loans, insurance, and mutual fund investments, all through a single easy-to-use app.

Evaluate the financial technology company Mobikwik on how to do peer to peer money transfer online in India?

MobiKwik enables peer-to-peer (P2P) money transfers in India through its UPI-based platform, allowing users to send or receive money instantly using mobile numbers or UPI IDs. The process is secure, fast, and integrated within the MobiKwik app, making digital payments simple and convenient.