The payment gateway allows the merchants to process credit, debit, and other alternative online payments. Using a payment gateway can help to lessen the frequency and severity of credit card fraud within e-commerce or any other kind of business. This gateway for payments acts as the go-between to make sure that customer data is encrypted and secure.

BillDesk is an Indian online payment gateway company based in Mumbai, Maharashtra, India. The company provides payment solutions for customers in e-commerce, financial services, retail, and other sectors. BillDesk is one of the oldest payment gateways in India and is responsible for powering 50%–60% of the online bill payments in the country as of August 2021.

Know the BillDesk Success Story, Founders, Business Model, Funding, Revenue, and more here with StartupTalky.

BillDesk – Company Highlights

| STARTUP NAME | BILLDESK |

|---|---|

| Headquarters | Mumbai, Maharashtra, India |

| Sector | Finance |

| Founders | M.N. Srinivasu, Ajay Kaushal and Karthik Ganapathy |

| Founded | 2000 |

| Website | billdesk.com |

BillDesk – About

BillDesk – Industry

BillDesk – Founders and Team

BillDesk – Startup Story

BillDesk – Mission and Vision

BillDesk – Name and Logo

BillDesk – Business Model

BillDesk – Revenue Model

BillDesk – Challenges Faced

BillDesk – Funding and Investors

BillDesk – Shareholding

BillDesk – Growth

BillDesk – Financials

BillDesk – Awards

BillDesk – Competitors

BillDesk – Future Plans

BillDesk – About

Founded in 2000 by a team of ex-Arthur Andersen professionals, BillDesk, an Indian online payment gateway company, continues to be at the forefront of digital payments’ evolution in India, creating Internet-based payment products that enable consumers to make payments online in a frictionless manner.

BillDesk, a product and service with about 20 years of market leadership, provides a reliable payment platform for enterprise-wide electronic payments and collections, related reconciliation and settlement operations, across multiple delivery channels, and using a wide range of payment methods.

BillDesk – Industry

The India Payment Gateway Market is anticipated to expand at a compound annual growth rate (CAGR) of 17.16% from USD 1.21 billion in 2024 to USD 2.66 billion by 2029, according to Mordor Intelligence. Factors like rising internet penetration and growing e-commerce in India are driving this growth.

BillDesk – Founders and Team

BillDesk was founded in 2000 by M.N. Srinivasu (Co-Founder and Director), Ajay Kaushal (Co-Founder and Director), and Karthik Ganapathy (C0-Founder).

M.N. Srinivasu

Srinivasu, the Co-Founder and Director of BillDesk, is a BCom Economics graduate who later completed a PGDM from IIM Ahmedabad. MN Srinivasu first started his professional career as the Manager of the Agri Business Group of ITC Limited. He then switched to ITC Zeneca Limited, where he served the role of Financial Controller, but it continued only for a year, after which he again switched to the Treasury (Financial Services) of ITC Limited, where he worked for a span of 4 years.

He then went on to manage Business Consulting at Andersen. This continued for another year, after which he co-founded BillDesk.

Ajay Kaushal

Ajay Kaushal is a Co-Founder and Director of BillDesk. who started as the Head of Securities Research at SBI Capital Markets Limited. He then became the Manager at Arthur Andersen, after which Kaushal served as the Trustee at CAF India. He managed this job role for around 6 years before he decided to co-found BillDesk. Ajay Kaushal has a BTech in Electrical and Electronic Engineering, and he topped it off with a PGDBM, MBA from IIM Lucknow.

Karthik Ganapathy

Karthik Ganapathy is the Co-Founder and VP of BillDesk. He is an IIT Bombay and IIM Bangalore alumnus who is regarded as the Chief Architect of the technology and operations that currently power BillDesk. Before founding BillDesk, Ganapathy worked with Arthur Andersen.

The BillDesk team operates with an employee strength of somewhere between 501 and 1000 employees.

BillDesk – Startup Story

The story of BillDesk’s founding is a classic example of creative problem-solving and entrepreneurial vision. The trip began when three people who had previously worked for the prestigious American accounting firm Arthur Andersen decided to leave their secure positions in order to follow their entrepreneurial dreams.

The daily inconvenience of consumers having to wait in line to pay for different bills—such as those for energy or phone services—was the source of their inspiration. The creators recognized a chance to completely change the payment environment by offering a more straightforward and simplified solution after realizing how painful this problem was.

BillDesk – Mission and Vision

The company’s mission on its websites states, “To make payments accessible and easy for all through market-leading solutions.”

BillDesk’s vision is to create a one-stop destination to make all payments.

“At BillDesk we are committed to this vision of implementing innovative solutions for simplifying payments and collections and translating the opportunities offered by the Internet into actual customer delight through efficient payment and collection services.”

BillDesk – Name and Logo

BillDesk parent company is “IndiaIdeas.com Ltd.”

related to unregulated gambling apps. According to CNBC – TV18, Google had

notified the developers by releasing a statement on September 18th regarding

this issue. Google said that, “we don’t allow online unregulated ga…

BillDesk – Business Model

BillDesk is a business-to-business (B2B) model that links banks with utilities and retailers to process payments without having to buy end users outright. Prepaid account sales (PINS and eTop up subscriptions) and transaction processing fees from electronic transactions on its network are the main sources of income.

The business also receives payment for additional supplementary and consultancy services as well as loyalty reward point management. BillDesk provides a platform for online and mobile payments through aggregator platforms in India, catering to telecom, insurance, e-commerce, financial services, charitable organizations, and entertainment providers, among other industries.

BillDesk – Revenue Model

The revenue model of BillDesk includes the following sources:

Fees for processing electronic transactions: BillDesk collects money by charging for the processing of electronic transactions conducted on its platform.

Sales of PINS (Personal Identification Numbers): PINS are used for a variety of digital transactions, including online bill payment, prepaid cellphone recharge, and other services. BillDesk makes money from the selling of PINS.

E-top subscriptions: In order to create recurring income, BillDesk provides consumers with access to premium features or expanded capability for electronic transactions through subscription-based services like e-top subscriptions.

BillDesk – Challenges Faced

BillDesk faced challenges in selling its business amid intense competition in the digital payments segment, where well-marketed startups like PayUmoney, Paytm, Citrus, and CC Avenue emerged. Utilizing its two-decade industry experience and devoted clients, BillDesk maintained its momentum and profitability despite challenges like the Reserve Bank of India’s reduction of commission rates.

In the face of tighter laws and rising demand, the company realized it needed a fully integrated payment system. It adjusted to developments in the market while putting the needs of its customers first. In the future, BillDesk hopes to use its momentum and stability to overcome obstacles and spur further expansion.

BillDesk – Funding and Investors

BillDesk has raised a total of $241.4 million in funding over 4 rounds.

Here are the funding details:

| Date | Round | Money | Lead Investor |

|---|---|---|---|

| Nov 16, 2018 | Corporate Round | $82.27 million | Visa |

| Mar 15, 2016 | Secondary Market | $150 million | General Atlantic |

| Apr 4, 2012 | Private Equity Round | – | TA Associates |

| Jun 22, 2006 | Venture Round | $7.5 million | Clearstone Venture Partners, State Bank of India |

BillDesk – Shareholding

BillDesk’s shareholding pattern as of March 2023, sourced from Tracxn:

| BillDesk Shareholders | Percentage |

|---|---|

| M N Srinivasu | 10.9% |

| Ajay Kaushal | 10.2% |

| Karthik Ganapathy | 8.5% |

| General Atlantic | 14.2% |

| Temasek | 8.5% |

| Clearstone Venture Partners | 6.4% |

| March Capital | 5.4% |

| Irani Children’s Trust of 2006 | 0.3% |

| Upton Investment | 0.1% |

| LionRock Capital | < 0.1% |

| SAF Capital | < 0.1% |

| ZAD Investment Company | < 0.1% |

| Elpis Investments | < 0.1% |

| FDI | 13.1% |

| Visa | 12.6% |

| Maverick Enterprises | 1.7% |

| Tsjpm | 0.6% |

| VT Partner LLC | 0.3% |

| Trojaninvestmentllc | 0.2% |

| Haqan | < 0.1% |

| Novel | < 0.1% |

| Angel | 0.8% |

| Other People | 1.9% |

| ESOP Pool | 3.9% |

| Total | 100.0% |

BillDesk – Growth

BillDesk’s growth highlights are:

- It does 4 billion+ transactions per year as of March FY24

- It has 150 million+ API calls per day as of March 2024

- It is available in 20+ categories as of March 2024

- The company has 70+ agents as of March 2024

- It has 20,000+ billers as of March 2024

- BillDesk has done Rs 10 trillion+ in payment volume in FY23

BillDesk – Financials

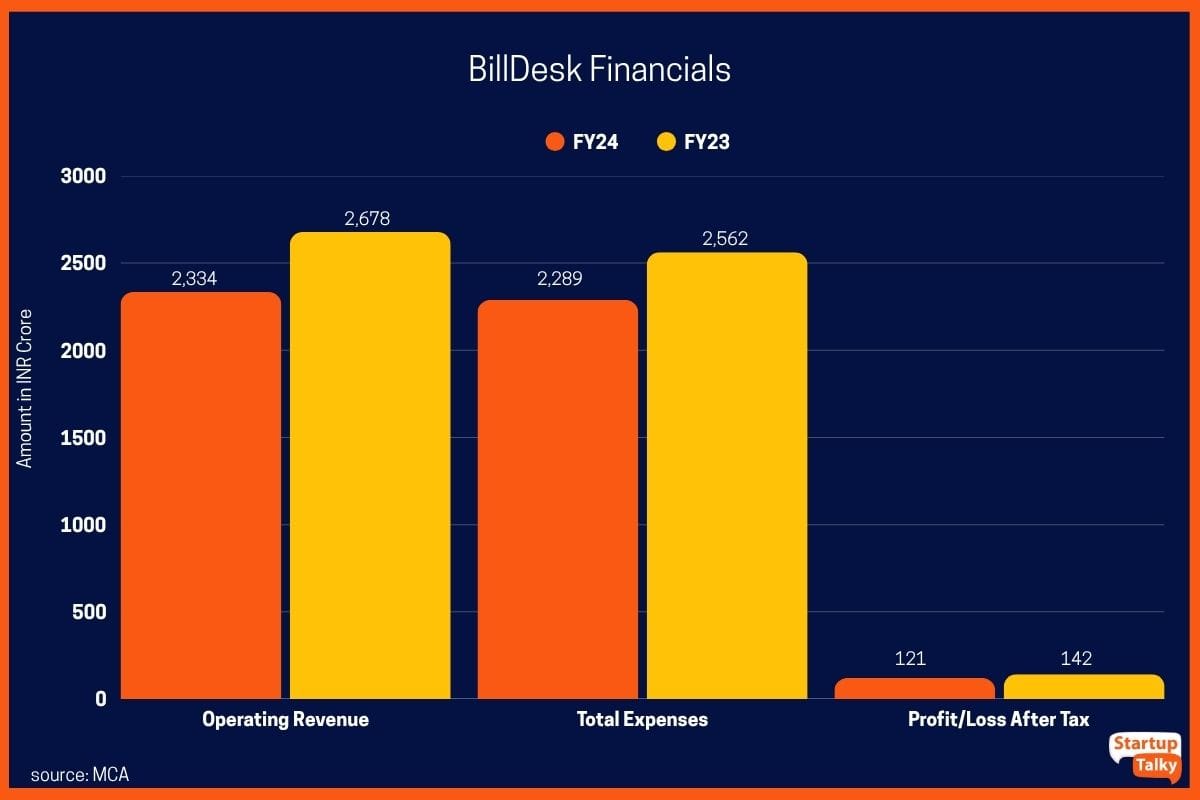

BillDesk has shown steady revenue growth over the years, with expenses also rising in parallel. While profitability has fluctuated, the company remains in a strong financial position.

| Particulars | FY24 | FY23 |

|---|---|---|

| Revenue | INR 2,334 crore | INR 2,678 crore |

| Expenses | INR 2,289 crore | INR 2,562 crore |

| Profit/Loss | INR 121 crore | INR 142 crore |

EBITDA

| BillDesk Financials | FY24 | FY23 |

|---|---|---|

| EBITDA Margin | 9.24% | 9.26% |

| Expense/INR of Op Revenue | INR 0.98 | INR 0.96 |

| ROCE | 5.77% | 7.78% |

payment and no worries about hunting for change every time you purchase

something probably is a major benefit of using a mobile wallet. While today many

international players are providing mobile wallet services in Indi…

BillDesk – Awards

Reiterating its position as a leader in the digital payment sector, BillDesk was recognized in 2023 with the esteemed Pay Excellence Champions Awards for its exceptional performance as the Best Online Payment Platform. This honor highlights BillDesk’s dedication to innovation and quality in offering its customers easy-to-use online payment alternatives.

BillDesk – Competitors

BillDesk’s competitors include –

- GooglePay

- Razorpay

- Paytm

- PhonePe

- TechProcess Payment Services

- Airpay

- Oxigen

- PayUbiz

- Instamojo

- CCAvenue

- Payworld

Google to power in app and tap to pay purchases on mobile devices. Google pay

enables its users to make payments with their android devices (phones, tablets

or watches), the users in United States can also iOS devices but…

BillDesk – Future Plans

BillDesk’s future plans include focusing on expanding their product and service offerings, adhering to high security standards, and potentially incorporating blockchain technologies to enhance transaction security. They aim to maintain their leadership position in the online payments space and continue to simplify payments for users. They are exploring the use of blockchain technologies to further enhance the security and transparency of transactions.

FAQs

What is BillDesk payment, what does BillDesk mean?

BillDesk, founded in 2000 is an Indian online payment gateway company based in Mumbai, Maharashtra, India.

Is BillDesk an Indian company?

Yes, BillDesk is an Indian online payment gateway company.

How does BillDesk make money?

Processing electronic transactions, such as charging fees to process payments online, brings in money for BillDesk. Its revenue sources are further enhanced by the sales of PINS (Personal Identification Numbers) and E-top subscriptions.

How does BillDesk payment gateway work?

BillDesk is a one-stop online payment provider that helps customers organize, pay and manage their regular and ongoing bills. Customers can receive, review and pay all the bills they receive from different providers in one place with BillDesk.

Who is BillDesk CEO?

BillDesk doesn’t have a CEO; now it has three Co-Founders.

Who are BillDesk founders?

M.N. Srinivasu, Ajay Kaushal, and Karthik Ganapathy are the founders or owners of BillDesk.