Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations.

The concept of credit is not new. People have been opting for credit since time immemorial. Credit is crucial when our capital cannot support certain investments, and credit cards have certainly made them easy to avail. However, paying the credit card bills is a priority and equally difficult to manage. This is why CRED decided to come forth with the unique idea of a platform that will help Indians pay their credit card bills on time and also offer them instant offers and rewards for the same.

CRED is a fintech company headquartered in Bengaluru, which allows its users to make credit card payments through its app and get exclusive offers and other benefits online. Furthermore, CRED has also introduced house rent payment options, Rent Pay; flexible credit lines, CRED Cash; and CRED Mint, with which the lenders can lend their idle money to borrowers who exhibit decent credit scores at interests of around 9% per annum.

Learn more about the CRED startup story, its founder, history, tagline, logo, business model, revenue model, funding, competitors, and more.

CRED Company Details

| Startup Name | CRED |

|---|---|

| Headquarters | Bengaluru, Karnataka, India |

| Sector | Financial Services |

| Founder | Kunal Shah |

| Founded | 2018 |

| Website | cred.club |

About CRED

CRED – Startup Story

CRED – Founder and Team

CRED – Tagline and Logo

CRED – Business Model

CRED – Revenue Model

CRED – Funding and Investors

CRED – Shareholding

CRED – Acquisitions

CRED – Growth and Revenue

CRED – Financials

CRED – Products and Features

CRED – Partnerships

CRED – Competitors

About CRED

CRED allows credit card users to pay their credit card bills through its platform and extends rewards for each transaction. The fintech platform also lets users make their house rent payments and avail all the benefits of the short-term credit lines that the app now offers. The CRED headquarters is in Bangalore.

The company takes the utmost care in protecting the data and user information. Hence, the app is completely safe and secure. Kunal Shah is the founder of CRED. He founded the company in 2018 and often describes CRED as a TrustTech company, not a Fintech. This is because his initial motivation to start CRED came from solving trust issues in Indian society, which, according to him, is the key to economic prosperity. The CRED founder, Kunal Shah, is a well-known face in the startup ecosystem who has already funded numerous startups.

CRED – Startup Story

The Cred story was very simple. The goal was to create a platform where life could be made better and systematic. Kunal Shah wanted to offer more privileges and benefits to people with good credit scores. Therefore, creating a flywheel effect for more people was important to improve the scores.

Everybody, from the startups to the government, has focused on the masses. The founder of the company wanted to focus specifically on the people, the responsible citizens who pay taxes on time. He felt that nobody had solved their problems earlier.

‘If you look at history, nobody has been rewarded for paying back on time. We want to fix that.’

Therefore, CRED was founded primarily to solve the problems of the taxpayers and reward them with attractive rewards in return.

CRED – Founder and Team

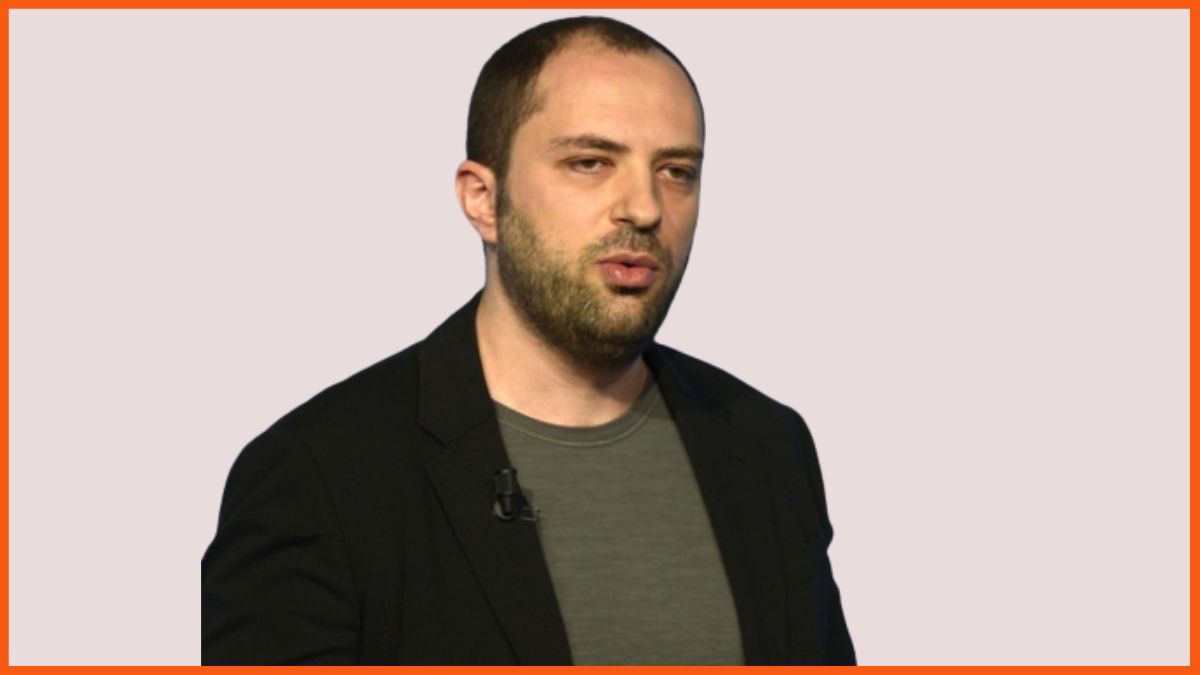

Kunal Shah

Kunal Shah is the founder and CEO of CRED. He is an Indian entrepreneur who is credited for launching new ventures for a second time. Kunal was a Philosophy graduate from Wilson College and later went on to pursue an MBA from the Narsee Monjee Institute of Management Studies, but he dropped the course midway to chase his dreams as an entrepreneur.

Kunal started his entrepreneurial journey with PaisaBack, a website for cashback, coupons, and other offers for users, along with Sandeep Tandon. However, he eventually shut down its operations in order to found FreeCharge, which the duo founded in 2010.

FreeCharge was acquired by Snapdeal in April 2015, but the company still continued as an independent entity led by Shah. CRED was founded in 2018 and successfully turned unicorn on April 6, 2021. FreeCharge, on the other hand, was acquired by Axis Bank in July 2017. Here’s looking at the FreeCharge business model and how it makes money through it.

Kunal Shah was born in Mumbai in 1983. His hobbies include playing chess and poker. He loves munching on chips and guacamole. He loves the ideology of Socrates and the plays of G.B. Shaw.

CRED – Tagline and Logo

CRED’s tagline is ‘Suraksha Aur Bharosa Dono.’

CRED – Business Model

The business model of CRED consists of four parts :

CRED app – The CRED app is a neat-looking, beautifully designed app that users can visit if they want to go through the offers that are available after they pay their credit card bills. They can easily sign up on the app and view all the offers that they can avail of.

Businesses that provide offers on the app – The users of CRED can also find a wide range of offers from numerous businesses. For this, CRED brings businesses on board and collaborates with them. Along with benefitting CRED and its customers, who can avail of the exclusive offers provided by the businesses, it is also a win-win situation for the companies. This is because they also hugely benefit from the visibility they get.

Users who pay their credit card bills – CRED also serves as a smooth and rewarding platform for the users who use it to pay their credit card bills. In comparison to banking or other apps, end-users can choose CRED as an app to pay their credit card bills and get numerous offers and benefits. On the other hand, the users who like the app also share CRED with their family and friends.

CRED Mint – CRED disclosed its new feature, CRED Mint, on August 20, 2021, which is designed as a peer-to-peer lending platform that will help CRED users lend their idle money to creditworthy members. It is a rather transparent process that only allows the trustworthy CRED members boasting of a minimal credit score of 750 or higher to be the borrowers. Furthermore, the lenders can also withdraw their money whenever they want, with the interest that they have accumulated for the period.

CRED – Revenue Model

There are 2 prominent ways via which CRED makes money,

Listing products and offers – CRED, as we know, lists an array of products and offers that benefit its users from a range of businesses. These businesses, in turn, pay CRED a fee for their visibility. Every time a user avails of the offers, CRED generates an income through it.

Using the financial data of the users, CRED accumulates the financial data from the users who use the platform for paying their bills and more. Along with providing CRED with the opportunity to introduce more offers to their users using these data, CRED also has other banks and financial institutions that pay them a fee for accessing these data. These companies, banks, and financial institutions would eventually approach the potential customers with their own set of products aligned to their tastes.

CRED has revealed that it does not charge any fees for the credit card payment options that it offers via its app. The company instead earns its revenues from the ancillary services it provides with the help of its technology and distribution platform.

CRED – Funding and Investors

Here’s a look at the CRED funding rounds:

| Date | Transaction Name | Money Raised | Lead Investors |

|---|---|---|---|

| June 9, 2025 | $72 million | Lathe Investment, RTP Global, Sofina Ventures, QED Innovation Labs | |

| June 9, 2022 | Series F | $80 million | GIC, Sofina, Alpha Wave and DF International |

| April 8, 2022 | Venture Round | $200 million | GIC |

| October 19, 2021 | Series E | $251 million | Tiger GLobal and Falcon Edge |

| April 6, 2021 | Series D | $215 million | Coatue, Falcon Edge Capital and others |

| January 1, 2021 | Post-IPO Secondary Round | – | – |

| November 30, 2020 | Series C | $81 million | DST Global |

| July 26, 2019 | Series B | $120 million | Gemini Investments, Ribbit Capital and Sequoia Capital India |

| April 16, 2019 | Series A | $24 million | – |

| January 1, 2019 | Seed Round | – | Rainmatter Technology |

| November 6, 2018 | Seed Round | $30 million | Sequoia Capital India |

CRED – Shareholding

Here is CRED’s shareholding pattern as of March 2025, sourced from Tracxn:

| CRED Shareholders | Percentage |

|---|---|

| Kunal Shah | 10.8% |

| QED Innovation Labs | 9.6% |

| Sequoia Capital | 9.3% |

| Ribbit Capital | 8.1% |

| Tiger Global Management | 5.8% |

| Gemini Investment Management | 4.8% |

| DST Global | 4.5% |

| Alpha Wave Global | 4.7% |

| Coatue | 4.0% |

| Hillhouse Capital Group | 2.0% |

| RTP Global | 2.5% |

| General Catalyst | 1.6% |

| Sofina | 1.5% |

| Greenoaks | 1.5% |

| GIC | 0.9% |

| Prime Venture Partners | 0.8% |

| Dragoneer Investment Group | 0.8% |

| Insight Luxembourg | 0.5% |

| Axiom Asia | 0.2% |

| Marshall Wace | 0.2% |

| Kalaari Capital | 0.2% |

| Dream Duo | 0.2% |

| Rise Global Capital | 0.2% |

| Matrix Partners India | 0.2% |

| SciFi | 0.1% |

| Whiteboard Capital | < 0.1% |

| Rainmatter | < 0.1% |

| Greyhound Capital Management | < 0.1% |

| Bharat Innovation Fund | < 0.1% |

| Reddy Futures | < 0.1% |

| Venture Highway | < 0.1% |

| Future Shape | < 0.1% |

| Rajaram Family Trust | < 0.1% |

| Zarringhalam Ventures | < 0.1% |

| Mission Holdings | < 0.1% |

| Meridian Fund | < 0.1% |

| Cupola Venture Opportunites l | < 0.1% |

| Alteria Capital | < 0.1% |

| Valiant Capital Partners | – |

| ReDefine Capital Partners | – |

| Credence Partners | – |

| Ganesh Ventures | – |

| eWTP Capital | – |

| The Chatterjee Family Revocable Trust | – |

| AME Cloud Ventures | – |

| CRED | 0.8% |

| Anxa Holding | 0.6% |

| MVision | 0.6% |

| GRACE software | 0.3% |

| SFSPVI | 0.2% |

| Stak3 International | 0.2% |

| Spenny | < 0.1% |

| Strategic Asset Management | < 0.1% |

| Ra Hospitality | < 0.1% |

| Kuber Technologes | – |

| SF Roofdeck Capital | – |

| Angel | 0.2% |

| Other People | 1.3% |

| ESOP Pool | 20.4% |

| Total | 100.0% |

CRED – Acquisitions

CRED has acquired five companies to date: Hipbar, Happay, smallcase, and Spenny. The recent acquisition is of Spenny on June 23, 2023.

| Company Acquired | Date | Deal Value |

|---|---|---|

| Kuvera | February 6, 2024 | – |

| Spenny | June 23, 2023 | – |

| smallcase | August 2, 2022 | $400 million |

| Happay | December 1, 2021 | $180 million |

| HipBar | October 21, 2021 | – |

CRED – Growth and Revenue

CRED has shown steady growth throughout the years. Being a startup that was founded in 2018, it successfully joined the unicorn club on April 6, 2021, closing its Series D round where the company had mopped up $215 million. CRED controls “22% of all credit card payments in India every month,” said Kunal Shah in his statement released in April 2021. CRED’s valuation reached $6.5 billion in 2022 after a $200 million funding round.

Kunal Shah further took to his LinkedIn profile on July 10, 2021, and shared highlights of the milestones reached by CRED in June:

CRED Financials

CRED saw its operating revenue grow by 71% to INR 2,397 crore in FY24, up from INR 1,400 crore the previous year.

Including other income, CRED’s total revenue increased by 66%, reaching INR 2,473 crore in FY24, compared to INR 1,484 crore in FY23.

However, despite the rise in revenue, the company’s net loss expanded by 22%, reaching INR 1,644 crore in FY24, up from INR 1,347 crore the previous year. CRED noted that its operating loss decreased by 41%, dropping to INR 609 crore from INR 1,024 crore in FY23. The company’s total operating expenditure, including one-time costs, amounted to INR 3,082 crore in FY24.

Whereas, CRED’s operating revenue has increased from INR 393.5 crore in FY22 to INR 1,400.6 crore in FY23. In terms of profit and loss, company losses increased from INR 1,279.5 crore in FY22 to INR 1,347 crore in FY23.

CRED Revenue Breakdown

| Particulars | FY23 | FY22 |

|---|---|---|

| Revenue from Operations | INR 1,400.3 crore | INR 394.4 crore |

| Other Income | INR 84.4 crore | INR 28.2 crore |

| Total Revenue | INR 1,484.6 crore | INR 422.6 crore |

Revenue more than tripled in FY23, led by a sharp increase in operational revenue from INR 394.4 crore to INR 1,400.3 crore.

CRED Profit/Loss

Losses remained high and consistent, increasing slightly from INR 1,279.6 crore in FY22 to INR 1,347.5 crore in FY23.

CRED Expenses Breakdown

The company’s total expenses rose from INR 1,702 crore in FY22 to INR 2,832 crore in FY23.

| Particulars | FY23 | FY22 |

|---|---|---|

| Employee Benefit Expense | INR 788.9 crore | INR 307.6 crore |

| Finance Costs | INR 3.5 crore | INR 2.4 crore |

| Amortization & Depreciation | INR 59.4 crore | INR 14.3 crore |

| Other Expenses | INR 1,980.2 crore | INR 1,377.7 crore |

| Total Expenses | INR 2,832 crore | INR 1,702.1 crore |

EBITDA

With a huge increase in EBITDA margin from -299.24% in FY22 to -86.42% in FY23, the company showed remarkable financial improvement. The ROCE increased from -42.66% in FY22 to -31.95% in FY23, demonstrating good improvement. These adjustments imply that the company’s financial performance is on the upswing.

| EBITDA FY22-FY23 | FY22 | FY23 |

|---|---|---|

| EBITDA Margin | -299.24% | -86.42% |

| Expense/₹ of Op Revenue | ₹4.33 | ₹2.02 |

| Roce | -42.66% | -31.95% |

Quick Summary: Comparative Insights (FY23 vs FY22)

- Revenue Growth: Revenue surged 251%, highlighting strong traction in core services.

- Expense Surge: Expenses rose by 66%, indicating significant operational scale-up.

- Losses Sustained: Losses stayed high despite revenue growth due to steep cost increases.

CRED – Products and Features

CRED Mint

CRED introduced CRED Mint on August 20, 2021, which will serve as a peer-to-peer lending feature that can be used by the customers of CRED. CRED Mint was launched by CRED in collaboration with RBI-approved P2P Non-Banking Financial Company (NBFC), Liquiloans.

CRED Cash

CRED launched CRED Cash, a flexible credit line, in 2020. CRED Cash considers its members pre-approved for an active credit line of up to INR 5 lakhs without any documents, phone calls, forms, or physical visits.

Rent Pay

CRED launched Rent Pay in April 2020, which enables users to pay their monthly rent via credit cards.

CRED Store

CRED launched CRED Store, an eCommerce platform, which is deemed as a haven for customers with over 500 premium brands across a wide range of categories to shop from.

CRED, which was famous as a credit card bill manager, is now up with some more offerings, including mobile, DTH, and FASTtag recharge options. As per the latest reports dated April 1, 2022, the Kunal Shah-led company has launched its utility bill payments segment, with the help of which the users can now pay their utility bills, including electricity, water bills, and municipal tax, via the CRED app.

Tap to Pay Feature

With the Tap to Pay feature Android users with NFC capabilities can pay without physical cards or wallets by tapping their smartphones on merchant terminals. CRED launched this feature in February 2022.

BidBlast

BidBlast is a thrilling bidding game that CRED members can only play, and it was launched in December 2022. This will give the CRED members the excitement of bidding without using actual money by using CRED coins.

CRED Flash

CRED launched CRED flash in February 2023; with this launch, customers can make payments using BNPL products within the app and across more than 500 partner merchants.

CRED Escapes

The launch of CRED Escapes in March 2023 will provide a painstakingly designed platform with premium privileges, exclusive events, and lodging. This is consistent with CRED’s cutting-edge strategy, which offers members benefits like spa credits, hotel upgrades, and theme park admission.

P2P Payments

CRED launched a P2P payment feature in April 2023. With this feature, customers of CRED will be able to send money to other users via UPI IDs or contact numbers using P2P payment.

RuPay Credit card-based payments

In August 2023, CRED, in collaboration with NPCI in August 2023, launched Rupay credit card- based payment, and now customers can make UPI payments using their credit cards. This partnership benefits banks and merchants by increasing spending and credit sector inclusion.

Fourth Edition of AWP program

CRED launched its fourth version of the AWP (Accelerated Wealth Program), giving staff members the opportunity to purchase more ESOPs (Employee Stock Ownership Plans) with a quicker vesting period.

According to a March 15, 2024, report, this program gives employees the option to choose to have up to 50% of their pay come from special grant ESOPs. With this initiative, CRED hopes to encourage employee ownership and alignment with the company’s long-term growth trajectory while also rewarding and incentivizing staff members.

CRED – Competitors

CRED’s top competitors are Paytm, PhonePe, Google Pay, Amazon Pay, Freecharge, and MobiKwik.

- Paytm is the top competitor of CRED. It is a fintech app and payments platform that is headquartered in Noida, Uttar Pradesh, India, and was founded in 2010.

- PhonePe is another notable competitor of CRED. It is also a digital payment and financial services platform headquartered in Bangalore, India, and was founded in 2015. This app has the largest market share of 50% as of December 2022.

- Being a UPI platform that is a mass-volume player, Google Pay is another competitor of CRED. This digital payments platform was developed by the Search engine giant Google itself.

- Amazon Pay is also a rival of CRED, which is now all set to provide diverse payment options. The online payments processing app was launched by Amazon and founded in 2007.

- MobiKwik is yet another fintech company, that supports digital payment options and is a rival of CRED at the same time. It is headquartered in Gurugram, Haryana, India, and was founded in 2009.

- Freecharge is also a company that CRED competes with, after the launch of its mobile bills and utility bill payment services. Originally founded by Kunal Shah and Sandeep Tandon, Freecharge is now owned by Axis Bank.

on different startups and organizations. The content in this post has been

approved by the organization it is based on. Using a Mobile Wallet has now turned out to be a habit of many. Easy hassle-free

payment and no wo…

FAQs

What is CRED company?

CRED allows credit card users to pay their bills through its platform and extends rewards for each transaction. The fintech platform also lets the users make their house rent payments, and also avail all the benefits of the short-term credit lines that the app now offers.

Who is CRED founder and CRED CEO?

Kunal Shah is the founder and CEO of CRED.

CRED started in which year?

Kunal Shah founded CRED in 2018.

Is CRED a fintech company?

Yes, CRED is a fintech company founded by Kunal Shah and headquartered in Bangalore.

Is CRED an Indian company?

Yes, CRED is an Indian fintech company.

How does CRED make money?

CRED earns money from listing fees that businesses pay to display their products and offers on its app – CRED collects your financial data as you use the app and continues to pay your bills to offer you better offers in the future. To gain access to this data, banks and credit card companies pay CRED.

Is CRED profitable?

CRED saw its operating revenue grow by 71% to INR 2,397 crore in FY24, up from INR 1,400 crore the previous year. Despite the rise in revenue, the company’s net loss expanded by 22%, reaching INR 1,644 crore in FY24, up from INR 1,347 crore the previous year.

How much is CRED revenue?

CRED saw its operating revenue grow by 71% to INR 2,397 crore in FY24, up from INR 1,400 crore the previous year.

What is CRED tagline?

The tagline of CRED company is Suraksha Aur Bharosa Dono.

Which is CRED parent company?

CRED doesn’t have a parent company. It is an independent fintech platform.