This article has been contributed by Mr. Karan Shetty, Co-Founder, Claravest Technologies Pvt. Limited.

India’s real estate market is witnessing a fundamental shift in what homebuyers are seeking. The vintage mantra of “Roti, Kapda, Makan” is being forgotten as they are no longer looking for a simple roof over their head; instead, they are looking for an upgrade in lifestyle, a status symbol in society and an experience. To back this, we have data, which shows that the luxury housing sales jumped a whopping 85% YoY in H1 2025 across major metros like Delhi-NCR, Mumbai, Bangalore and Hyderabad. In this article, let us dive into the major forces behind this staggering shift.

The Shift to Aspirational Buying

Affordable housing (under Rs 45 lakhs), which was once the backbone of India, has been consistently shrinking. Developers are pushing back on this segment, citing smaller margins and increased raw material pricing, while buyers seem willing to stretch budgets that offer more than the basic. Indian homebuyers are no longer just associating affordability with their purchase but are also considering lifestyle and long-term appreciation.

The Role of Amenities and Sustainability

Apart from the decrease in the supply within the affordable housing segment, another major driver for the shift lies in the project offerings, which are slowly becoming a new standard. Gone are those days when a project that offered a swimming pool and gym was termed luxury; these days, buyers are looking for a 5-star clubhouse, co-working areas, wellness zones, pickleball courts, theatre and many more. In fact, some ultra-luxury projects provide services such as a private on-call chef, access to luxury brands within the premises and a private golf course, to name a few.

As people become more aware of the risks of global warming, they are also looking to invest in projects that offer a greener lifestyle. Estimates suggest that more than 30% of the residential projects will carry some form of green certification. Projects are being built with a focus on implementing rainwater harvesting facilities, solar panels, and energy-efficient fittings.

The Gen Z & Millennial Effect

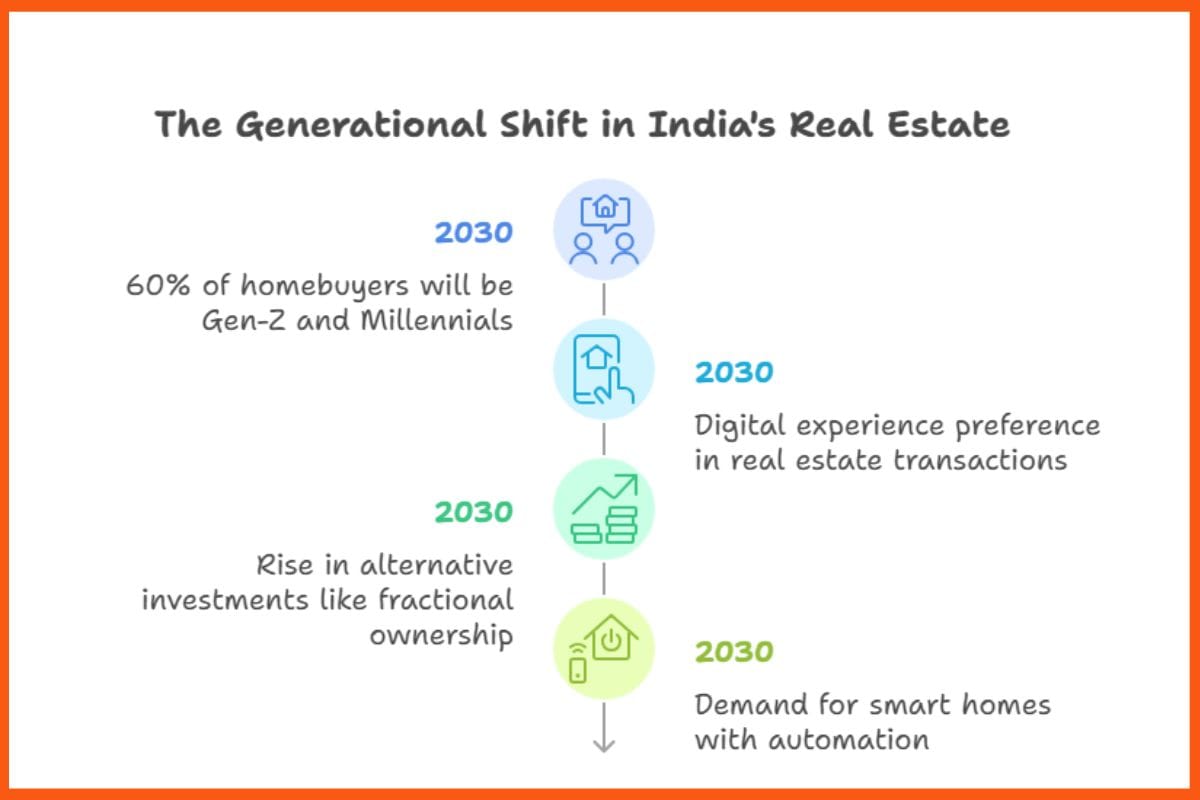

Perhaps one of the biggest drivers of this shift is the generational aspect. By 2030, we can expect 60% of homebuyers in India to fall into the Gen-Z and Millennial demographics. While the previous generations focused on affordability and security, the newer generation is willing to wait longer to invest in real estate that aligns with their personality and aspirations. These buyers are more tech-savvy and view things from a different perspective when it comes to buying and selling real estate. They prefer a more digital experience, from researching online to using digital platforms for mortgage applications. Moreover, with the rise in alternative investments such as fractional investments, they are also looking at platforms that provide them with a medium to invest smaller capitals in aspiration projects such as vacation homes, co-living spaces, resorts etc. They also have a different definition of ‘luxury’. It’s not just about opulent interiors; it’s about smart living. They want homes with automation for lighting, security systems, and IoT (Internet of Things) devices.

The Impact on Affordable Housing

Rising cost of land acquisition, construction, regulatory burdens and razor-thin margins are pushing many developers towards the mid to luxury housing segments. This trend has become a major concern, as middle- and lower-income buyers are being left behind, especially in Tier 2 and Tier 3 cities. Government initiatives, such as Pradhan Mantri Awas Yojana (PMAY) and increased lending to first-time buyers, are keeping the segment afloat. The developers have been vocal to the government about these risks and have been demanding additional support for this segment by way of decreasing government charges and increasing the price limit of apartments that fall under affordable housing.

To conclude, India’s housing story is at a turning point. Today’s homebuyers aren’t all about affordability; they’re about aspiration, lifestyle, tech assistance and status symbols. This is a positive sign as the country is progressing, both in terms of economy and development; however, it remains extremely critical to maintain a balance across all housing segments, from affordable to ultra-luxury, to keep the market healthy.