Juspay is a leading Indian fintech infrastructure company that specializes in payment orchestration solutions. Known for its innovative products like Safe, HyperSDK, and Express Checkout, Juspay enables businesses to integrate secure and seamless payment systems across various platforms. With a customer-centric approach, the company has built a strong reputation for processing high volumes of transactions daily, serving over 1,200 major digital businesses. Juspay is also known for its flexibility, allowing clients to tailor payment processes according to their specific needs, making it a preferred partner for many in India’s rapidly growing digital payment ecosystem.

Learn more about Juspay, its founders, business and revenue model, startup story, growth, revenue, funding, challenges, and more.

Juspay – Company Highlights

| Name | JUSPAY |

|---|---|

| Headquarters | Bengaluru, India |

| Founder | Vimal Kumar, Ramanathan RV |

| Founded | 2012 |

| Sector | software company and fintech |

| Website | Juspay.io/in |

Juspay – About

Juspay – Industry

Juspay – Founders and Team

Juspay – Startup Story

Juspay – Mission and Vision

Juspay – Name, Tagline and Logo

Juspay – Business Model

Juspay – Revenue Model

Juspay – Shareholding

Juspay – Challenges Faced

Juspay – Funding and Investors

Juspay – Mergers and Acquisitions

Juspay – Financials

Juspay – Awards and Achievements

Juspay – Competitors

Juspay – Future Plans

Juspay – About

Juspay is the go-to platform for businesses looking to simplify payments, maximize conversions and cut down fraud. Trusted by top enterprises worldwide, they make transactions smoother, faster and more reliable—so customers enjoy a seamless experience every time. Juspay Technologies is a pioneer in India’s fintech space, providing cutting-edge solutions that streamline digital payments. Their suite of products includes a powerful payments stack, advanced checkout APIs and a widely adopted two-factor authentication (2FA) SDK.

- Payment Processing: They handle transactions for major brands like Amazon, Ola, Vodafone and Jio.

- 2FA SDK: Their security framework is one of the most widely used in India.

- BHIM App: They played a key role in developing BHIM 1.0, which now processes over INR 5 billion monthly.

- UPI Development: Their team has been instrumental in shaping India’s Unified Payments Interface (UPI).

How Juspay Makes Payments Smarter

- Optimized Transaction Routing: Lower costs and increase revenue by directing payments efficiently.

- Unified Payment Integration: Bring all payment methods under one system for easy management.

- Seamless API Compatibility: Works smoothly with major payment providers.

- Smart Infrastructure:

- Multi-cell architecture ensures zero downtime

- Fully isolated stacks with autonomous recovery keep operations running

- Automated failover and real-time monitoring enhance reliability

- Intelligent auto-scaling adapts to traffic spikes effortlessly

Juspay – Industry

India’s FinTech sector is on a meteoric rise. Valued at $584 billion in 2022, it’s expected to skyrocket to $1.5 trillion by 2025. Nowhere is this growth more evident than in digital payments, with transaction volumes projected to hit $100 trillion and generate $50 billion in revenue by 2030.

But it’s not just payments that are transforming. Digital lending, worth $270 billion in 2022 climbed around $350 billion by 2023. FinTech innovations—like alternative credit scoring and seamless digital loan approvals—are bridging India’s credit gap, making financial services more accessible than ever before.

Juspay – Founders and Team

Vimal Kumar

Vimal Kumar is the Founder and CEO of Juspay. Vimal Kumar is a seasoned technology leader with a strong background in software engineering and innovation. He earned his Bachelor of Engineering in Computer Science from the College of Engineering, Guindy, Chennai and achieved notable recognition by securing 5th place in Asia at the ACM International Collegiate Programming Contest (ICPC) 2001 held at IIT Kanpur.

His professional journey includes serving as the Chief Information Officer (CIO) at BankBazaar.com, where he played a key role in shaping the company’s tech strategy. Before that, he was a Tech Lead at Amazon.com and a Software Development Engineer at Amazon India, contributing to scalable and high-impact technology solutions. He began his career as an Associate at Trilogy, gaining valuable experience in software development. With deep expertise in building cutting-edge financial and e-commerce platforms, Vimal continues to drive innovation in the industry.

Nishant Sameer

Nishant Sameer is the VP, Product Strategy at Juspay. Nishant Sameer is an experienced technology and product leader with a strong background in engineering and innovation. He holds an MS in Electrical Engineering from Stanford University (2002-2004) and a BE in Computer Science from the Indian Institute of Technology, Roorkee (1993-1997).

Currently, Nishant serves as the Vice President of Product Strategy at Juspay, leading initiatives in Bangalore and San Francisco since January 2021. Previously, he was the Co-Founder and Chief Product Officer at Rizort, focusing on innovative travel solutions. He also held leadership roles as General Manager of Open Innovation at Samsung Electronics and General Manager of Sales & Marketing for Asia & Japan at Ittiam Systems Pvt Ltd. Additionally, he founded Eduflix, a platform aimed at enhancing digital education.

With a career spanning cutting-edge technology, product strategy and business development, Nishant continues to drive innovation in the fintech and tech industries.

Sheetal Lalwani

Sheetal Lalwani is the Co-founder and COO of Juspay. He joined the company in 2014.

Juspay – Startup Story

Juspay was founded in 2012 by Vimal Kumar and Ramanathan RV, with a vision to simplify digital payments. Over the years, the company has evolved into a leading player in the fintech space. In January 2023, Ramanathan RV moved on from his role at Juspay to launch Hyperface.co, a startup focused on issuing co-branded credit cards and providing a white-labeled Buy Now, Pay Later (BNPL) stack for businesses.

Juspay’s journey began with Card Vault, its first product designed to securely store user card details for seamless transactions. With the Reserve Bank of India’s (RBI) card tokenization mandate, which took effect on January 1, 2022, Juspay transitioned its card storage service to a tokenization-based model, reinforcing security while maintaining ease of transactions.

Juspay – Mission and Vision

Vision

Juspay envisions a future where digital payments are seamless, secure and accessible to a billion Indians. By building innovative and scalable solutions, the company aims to remove friction in online transactions, ensuring a smooth and intuitive experience for both businesses and consumers.

Mission & Core Values

At the core of Juspay’s mission is a commitment to innovation, efficiency and empowerment. The company believes in maximizing value creation by fostering a culture of innovation, optimizing resources and always doing the right thing. Juspay is dedicated to enabling people to unlock their full potential, cultivating a depth-seeking culture that promotes personal and professional growth. Taking big, courageous moves in the right direction is a fundamental part of its ethos, embracing uncertainty and taking calculated risks to drive transformative change.

Juspay – Name, Tagline and Logo

Juspay operates with the tagline “Payments designed for global outcomes,” reflecting its mission to create seamless, scalable and innovative payment solutions that transcend geographical boundaries.

Juspay – Business Model

Juspay’s business model is centered around providing technology-as-a-service, enabling merchants to seamlessly integrate payment solutions into their existing systems. By leveraging its proprietary technologies, Juspay offers flexible and highly customizable solutions that allow businesses to tailor payment processes to their unique needs. Beyond just integration, the company provides end-to-end support, including consultancy services to help clients optimize workflows, enhance security and reduce fraud. This client-focused approach fosters long-term partnerships, ensuring that businesses not only adopt Juspay’s solutions but continue to rely on them as they scale.

Juspay – Revenue Model

Juspay’s revenue model is primarily driven by transaction-based fees, where the company earns a small percentage from every payment proRacessed through its platform. This structure aligns its success with that of its clients, creating a mutually beneficial growth cycle. Additionally, Juspay generates revenue through custom implementations and consultancy services, offering businesses expert guidance on optimizing their payment infrastructure. This diversified revenue stream ensures sustainability while also fueling ongoing innovation, allowing Juspay to expand its product offerings and maintain its leadership in the digital payments ecosystem.

Juspay – Shareholding

Juspay’s shareholding pattern as of November 2024 as sourced from Tracxn:

| JusPay Shareholders | Percentage |

|---|---|

| Vimal Kumar | 20.3% |

| Ramanathan Rv | 16.1% |

| Sheetal Lalwani | 2.1% |

| Nishant Sameer | < 0.1% |

| Accel | 12.3% |

| SoftBank Vision Fund | 10.9% |

| VEF | 10.2% |

| Wellington | 5.2% |

| Aigi | 2.2% |

| Avendus | 1.7% |

| QED Innovation | < 0.1% |

| Raghupathi Ramakrishnan | 2.8% |

| Rajesh Balpande | < 0.1% |

| Parikshit Dar | < 0.1% |

| Ashish Hemrajani | < 0.1% |

| Anupama Sharma | – |

| ESOP Pool | 16.0% |

| Total | 100.0% |

Juspay – Challenges Faced

Scalability and High Transaction Volumes

Juspay operates in a fast-paced digital payments ecosystem where handling peak traffic during shopping seasons and major events is crucial. The platform must maintain a robust infrastructure capable of processing millions of transactions per second without disruptions, ensuring seamless payments even during high-demand periods.

Integration with Multiple Payment Methods

With India’s diverse payment landscape, Juspay must integrate a wide range of payment options, including UPI, credit and debit cards, net banking, wallets and emerging digital payment solutions. Ensuring smooth compatibility across multiple platforms while delivering a seamless user experience is a continuous challenge.

Fraud Prevention and Security

As digital payments grow, so do fraud risks. Juspay must implement advanced fraud detection algorithms to prevent unauthorized transactions while minimizing false positives that could impact genuine customers. Striking a balance between security and frictionless transactions is key to maintaining trust.

Regulatory Compliance and Legal Adaptation

The Indian financial sector is constantly evolving with new regulations, including KYC (Know Your Customer) and AML (Anti-Money Laundering) guidelines. Juspay must stay ahead of these regulatory changes, ensuring compliance across all its payment channels to avoid legal risks and maintain operational efficiency.

Data Protection and Cybersecurity

Protecting sensitive customer payment information is a top priority. Juspay must continuously enhance its encryption techniques, secure data storage methods and overall cybersecurity framework to safeguard user data against breaches and cyber threats.

User Experience Optimization

A seamless and intuitive checkout experience is critical for increasing conversions. Juspay needs to design frictionless payment interfaces across various devices and platforms, reducing checkout abandonment and enhancing customer satisfaction.

Network Stability and Connectivity Issues

Ensuring reliable connectivity with multiple banks and payment gateways across India is a constant challenge. Juspay must optimize its infrastructure to handle network fluctuations, reducing transaction failures and improving overall system reliability.

Adapting to Local Market Dynamics

India’s payment ecosystem is highly diverse, with varying consumer preferences and regional regulations. Juspay must continuously adapt its solutions to cater to different market segments, providing localized payment options while ensuring compliance with state and national policies.

Juspay – Funding and Investors

JUSPAY has raised a total of $ 147.42 million across four funding rounds. Below are the details of each round

| Announced Date | Transaction Name | Money Raised | Lead Investors |

|---|---|---|---|

| April 7, 2025 | Series D – JUSPAY | $60 million | Kedaara Capital |

| Dec 15, 2021 | Series C – JUSPAY | $60 million | SoftBank Vision Fund |

| Mar 31, 2020 | Series B – JUSPAY | $21.6 million | VEF |

| Feb 25, 2016 | Venture Round – JUSPAY | $5.8 million | Accel |

Juspay – Mergers and Acquisitions

Juspay has acquired LotusPay in Feb 2024 in an all-cash deal.

Juspay – Financials

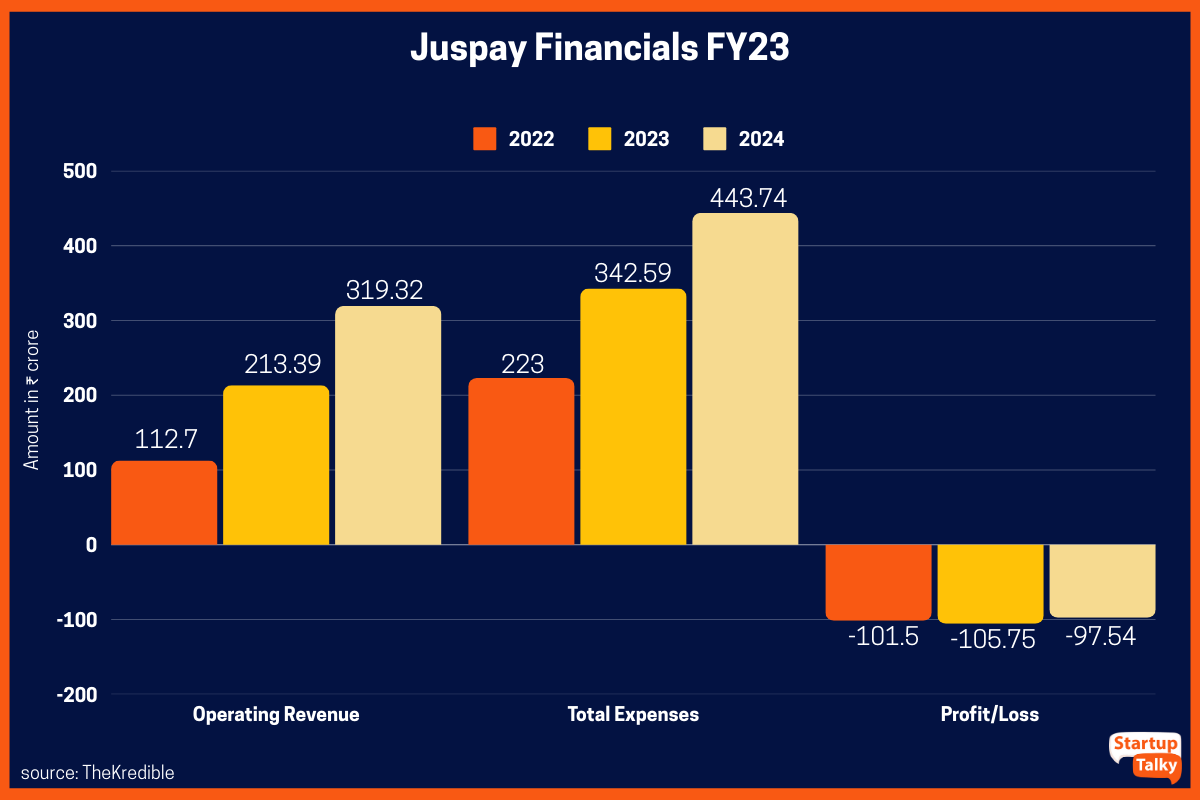

| Fiscal Year | Operating Revenue | Total Expenses | Profit/Loss |

|---|---|---|---|

| FY22 | INR 112.7 crore | INR 223 crore | INR -101.5 crore |

| FY23 | INR 213.39 crore | INR 342.59 crore | INR -105.75 crore |

| FY24 | INR 319.32 crore | INR 443.74 crore | INR -97.54 crore |

Juspay’s operating revenue saw a steady rise from INR 112.7 crore in FY22 to INR 319.32 crore in FY24, marking a 49.6% YoY growth in FY24. Despite increasing expenses, the company managed to reduce its net loss from INR 105.75 crore in FY23 to INR 97.54 crore in FY24.

Juspay – Awards and Achievements

Juspay won the “Best B2C Payment Experience Award” at the APAC Payments Excellence Awards, recognizing its innovative and seamless payment solutions for consumers across the Asia-Pacific region.

Juspay – Competitors

Juspay operates in a highly competitive fintech landscape, facing competition from established payment gateways and digital transaction platforms each offering unique solutions in the digital payments ecosystem, such as:

Juspay – Future Plans

With the fresh funding from Kedaara Capital, Juspay plans to deepen its investments in artificial intelligence to enhance workforce productivity and improve the merchant experience, the company said in a press release.

The funding comes at a time when several payments platforms — including Paytm, PhonePe, Cashfree, and Razorpay — have ended their partnerships with Juspay as a third-party orchestration provider.

Launched in 2012, Juspay provides full-stack orchestration, checkout experience, 3DS authentication, tokenisation, unified analytics, and value-added services for enterprise merchants, as well as end-to-end payments acceptance and real-time payments infrastructure for leading banks

The company claims to process more than 200 million transactions daily at 99.999% reliability, with over $900 billion in annual total processed volume.

Besides India, Juspay has extened its services to Asia-Pacific, Latin America, Europe, the UK, and North America.

FAQs

What is Juspay?

Juspay is a leading payments technology company that provides solutions to simplify digital payments for businesses and consumers.

Who are Juspay founders?

Juspay was founded in 2012 by Vimal Kumar and Ramanathan RV.

Who are Juspay competitors?

Main competitors of Juspay include Paypal, CCAvenue, Razorpay, Instantmojo, and more.

What is Juspay business model?

Business Model of Juspay revolves around providing payment solutions for businesses through payment gateways, one-click checkout, and fraud prevention tools. It earns revenue by charging transaction fees and offering customized payment products to e-commerce platforms, fintech companies, and other digital businesses.