The number of startups grew by 8971% from FY 2016-17 to 2021-22 with 65,861 startups in 2022, mentioned Commerce and Industry Minister Piyush Goyal. But are all these profitable? Nearly 95% of these startups are loss-making and significantly burning a lot of cash. Yet, there is something surprising about them. Many of these loss-making startups were able to raise funds and become an IPO.

Earlier SEBI didn’t allow loss-making companies to go public and raise funds to save investors. It traces back to companies that were making losses, raised funds, and ran away leaving investors dismal. However, this drove these companies to go public in other countries.

The government did not want these startups with future potential to move out of the nation. So, they enabled unprofitable companies to raise funds limiting them to only 10% of share capital. However, why would investors invest in loss-making startups? They are neither generating any tangible or intangible assets nor do they have guaranteed future profits. What do investors bet on?

In July 2021, Zomato became an IPO whilst it had losses of ₹63.2 crores. There are many other companies like Paytm and Flipkart that were able to raise money even though they had losses in crores.

In fact, the well-known eCommerce platform Amazon was in losses for the longest time and sustained solely on investments and raised capital. It was only until the last two decades that it became profitable and is now one of the top 10 biggest companies in the world. The bigger concern is why so many startups fail before or after raising the investments? Let us look into that first.

Why So Many Startups Fail and Incur Losses?

How Do Investors Valuate Loss-Making Startups?

What Attracts Investors to Invest in Loss-Making Startups?

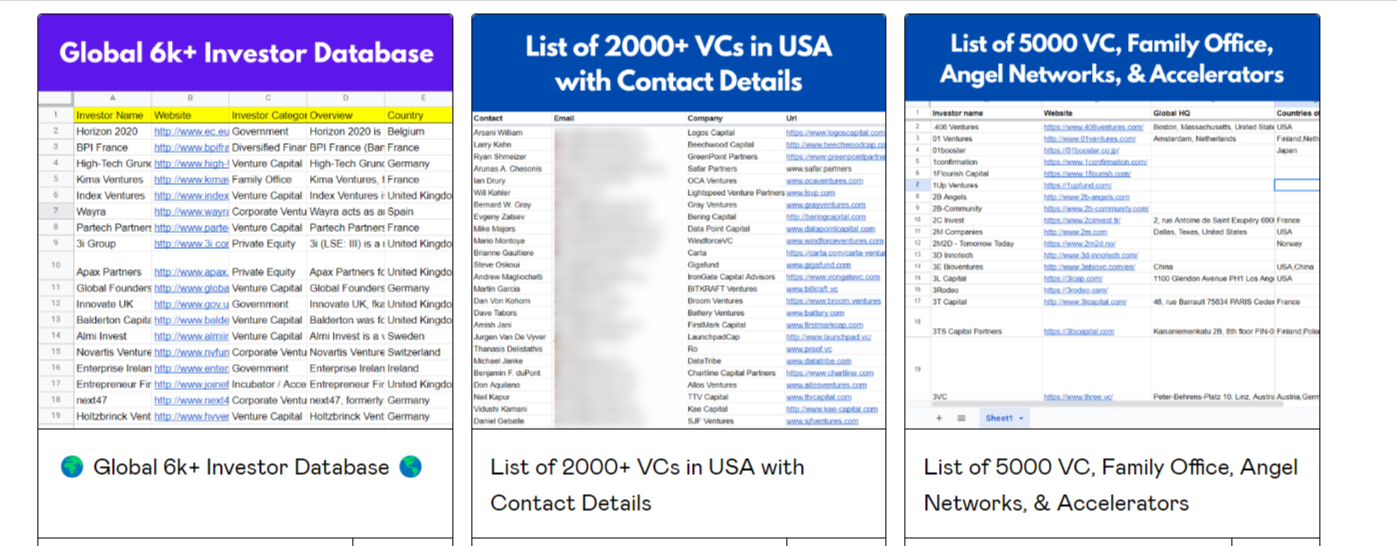

Unlock Your Startup’s Potential with Our Exclusive Investor Lists and Resources

Supercharge your startup’s success with our comprehensive resources. Access investor lists, pitch decks, KPIs, and fundraising guides. Connect with pre-seed investors, angel networks, and family offices, while mastering VC pitches. Ignite your entrepreneurial dreams today!

Why So Many Startups Fail and Incur Losses?

A startup tends to burn initially for any reason; but what keeps it flunking year after year? It could be any of the following reasons:

Talent Acquisition Cost

A startup needs people to build the product and run the business. Generally, it is difficult to attract and retain them due to competitive salary standards in the industry. As a result, businesses often burn their pockets while acquiring employees.

Marketing Cost

Startups invest a lot in marketing to build a customer base. Again this leads to negative cash flow and thus leads to losses. Zomato itself spends nearly 9 crores on advertising.

Acquiring Technical Competent Tools

Startups invest a lot to automate and streamline processes with tech stacks. Again it adds up to the recurring costs for the business. Oftentimes, businesses do not assess the usability of these products and end up wasting more money as well.

Not Targeting Customer Needs

Many startups are coming every day with the hope to make millions of dollars and exiting. Unfortunately, they do not cater to any specific need and end up creating a product with null demand. As a result, they have a hard time getting users.

An issue in Business Model

Many young entrepreneurs jump in to start a startup without assessing the environment and building the right business model. It leads to many issues and friction amongst the teams.

There could be many other reasons for a startup to be in losses for a longer duration. Initially, every startup makes losses, which is normal, especially for SaaS or tech startups. But if they continue to incur losses repetitively then they need to look for the reason. But the question arises that when these startups are already in losses; how do investors evaluate the worthiness or their valuation?

How Do Investors Valuate Loss-Making Startups?

Investors need to assess the company’s valuation before investing. Generally, a company is evaluated based on profits generated. However, when the company is not making profits investors generally look for other key metrics while investing.

Customer Base

The first metric is “customer base”. Investors look into the current customer base and estimate the growth thereon. The user must be dependent on the product to generate consistent profits or monetize them. If the user is not mentally invested, it is hard for a business to become profitable.

So, investors generally invest in the growth potential of the startup and not the profits per se. They look into customer retention rates and other criterions such as CAC and LTV of the business. This gives them clarity regarding business growth potential in the true sense.

Marketing spend return

The next important indicator is marketing spend return. Is the company able to generate back the marketing cost? Generally, business investors study the startup market, environment, future growth prospects, and other indicators to understand the true valuation of the company.

Business management and Moat

Lastly, investors look into business management and moat. Is business management efficient, suitable, and sustainable? Does the business have a moat to leverage? There are 100s of startups targeting similar problems with identical products.

Investors generally put their money on the ones that distinguish themselves. But what exactly drives investors to invest in unprofitable startups? Why do they spend millions on a startup that is in losses for years? Why do investors at times end up buying loss-making units? There could be several reasons. Let us dive right into them.

What Attracts Investors to Invest in Loss-Making Startups?

Startups today raise funding even with losses by selling their organization’s goal. They aim to scale the business instead of restricting themselves to minimal profits. Investors bet on the company’s vision and future growth possibilities when they are at their loss-making stage.

Amazon is one of the biggest trendsetters to bring this revolution. Also, the fact that 70% of investors today are below the age of 30 justifies the risk appetite. Now quickly look into the scenarios and reasons why these investors invest in loss-generating businesses.

Future Growth Promise

Many investors don’t find other options such as mutual funds and savings accounts lucrative and move to other options with higher return opportunities. Generally, these startups offer the potential for the future even though they are in losses. Hence, they attract young or big investors to invest with the promise of future growth.

Recovering Money

Many big investors invest in loss-making startups because they can recover their money even if any one of the loss-making startups blows up. It is more like gambling intended to back the net investment gains.

Vision and Mission

Other sets of investors wish to invest in the business’s vision and mission instead of looking for profitability. In fact, many investors are driven to invest in tech startups to promote ‘Digital India’. Also, many startups, especially tech startups, are hopeful for success based on innovation. So, If they resonate with the business idea and see opportunities, they do not shy away from putting their money into the startup.

Brand Value

Often investors look for brands that are making losses but still raising money. They bet their money on the brand value instead of other metrics. One of the biggest examples of the same could be Paytm, Zomato. These loss-making companies raised funds only due to brand image.

Exiting with Profit

In some cases, instead of investing, investors directly purchase a startup even with the losses. Why? They speculate on opportunities such as mergers and acquisitions with a big player to exit with immense profits. Alternatively, oftentimes they purchase these units to create a profitable alliance.

India’s best fintech entrepreneurs & a stock market expert, Mr. Vivek Bajaj once quoted that

“Valuation is not a reflection of the earning, it is the reflection of future potential earning”.

Investors run by this rule and focus on growth and scalability instead of immediate profits.

FAQs

Why do VCs invest in loss-making startups?

VCs invest in loss-making startups in the hope of a profitable future, even though the startup is in loss but it might turn profitable in future.

Should you invest in loss-making companies?

Investing in loss-making companies is like gambling either you’ll lose all your money or will exit with huge profits.