Well, life is full of unpredictable situations, and technology on the other hand keeps us at ease. With digitalization booming all across the world, now everything is possible with a click. Earlier, social media platforms were only quite popular forms of digitalization.

But now, every facility availed by a common man has also turned digital which is why it is now accessible to everyone. One of the time-saving and lengthy processes of insurance has also been turned digital and it has become possible only through Acko General Insurance. Here, we will look into the business model of Acko that is helping the brand to reach heights:

About Acko

Target Audience of Acko

Products and Services of Acko

Business Model of Acko

What Is Unique About the Business Model of Acko?

How Does Acko Make Money | Acko Revenue Model

The Cost Structure of Acko

About Acko

Acko is a general insurance company founded in 2016 by Varun Dua. It has become one of India’s tremendously booming digital insurance policy providers with all of its services offered through digital platforms. It has got its license from the Insurance Regulatory and Development Authority of India (IRDAI).

The company has been backed by investors like Amazon, Elevation Capital, RPS Ventures, Accel Partners, and others.

Tie-Ups With Major Players

The company also has tie-ups with different renowned players like Ola, OYO, Zomato, RedBus, and Urban Company. Acko General Insurance has partnered with Ola Cabs and launched an in-trip insurance program in more than 110 cities in India. Amazon Pay also partnered with Acko in July 2020 to provide an auto insurance policy to its customers.

Target Audience of Acko

The retail consumers who are pretty techno-friendly are the ones who are primarily focused on Acko.

- Individual Consumers: Acko provides digital insurance products including car, bike, gadget, and health insurance policies. Their target market seeks convenience, price-sensitivity, and transparency.

- Corporate Customers: Acko collaborates with e-commerce giants such as Amazon, ride-hailing service providers like Ola, food delivery platforms like Zomato, and others, to offer bespoke insurance solutions to their customers and employees.

- E-commerce and Online Service Providers: Acko has partnered with e-commerce platforms and online service providers to offer insurance products as value-added services to their customers. This customer segment is looking for innovative insurance solutions to enhance their experience.

Products and Services of Acko

With multiple services offered digitally, the services vary in size and quality, and they are:

Acko Car Insurance

- Comprehensive Car Insurance

- Third-Party Car Insurance

- Commercial Car Insurance

Acko Bike Insurance

- Comprehensive Bike Insurance

- Third-Party bike Insurance

Acko Health insurance

- Health Insurance

- Aarogya Sanjeevani

- Group Medical Cover

Acko Electronics Insurance

- Mobile Protection

- Appliance Protection

Business Model of Acko

Well, the company goes with a very witty approach of business to consumer (B2C). The business model of Acko clearly states that the brand reaches the customers directly and sometimes also through brand partnerships. It has a good record of insuring more than 20,000 cars and provides car insurance to customers in less time, with no paperwork in the purchase, claim, or renewal.

It means no stress and no hassle for insurance-related work. Acko also provides General insurance, mobile insurance, and bike insurance. Apart from that, the company also works with third parties to offer micro-insurance for the services of other brands.

What Is Unique About the Business Model of Acko?

Acko is not just making you stress-free along with offering better services but also is providing you comfort with micro-insurance services.

- Affordability: Acko’s approach, which is driven by technology, helps them reduce operational costs. This, in turn, enables them to offer insurance products at competitive prices.

- Convenience: Acko simplifies insurance by providing an online platform for purchasing policies, managing claims, and accessing customer support via their website or mobile app.

- Customization: Acko uses data to create personalized insurance products and pricing based on individual risk profiles, achieving a more efficient and fair pricing model.

- Digital: Well gone are the traditional days because now you can buy insurance digitally anywhere at any point in time, and that too without any paperwork in less time Car insurance that is too digital is like an added advantage for the consumers.

- Innovation: The products are innovative and the technology added to them has a unique offering such as trip insurance, electronic cover, and hotel-stay insurance with the association of digital partners.

- Customer-friendly: The brand focuses on the convenience of the customers and offers products that are customer-friendly.

Just imagine your vehicle got damaged, and you get to avail yourself of Acko’s services. You call Acko support, and your damaged vehicle will be picked up within an hour. The vehicle will be repaired in 3 days, or they will also provide you with cab services. Isn’t it amazing? No other brands offer these facilities and an easy car insurance process. So, the customer stays satisfied as they live with ease and do not worry about problems.

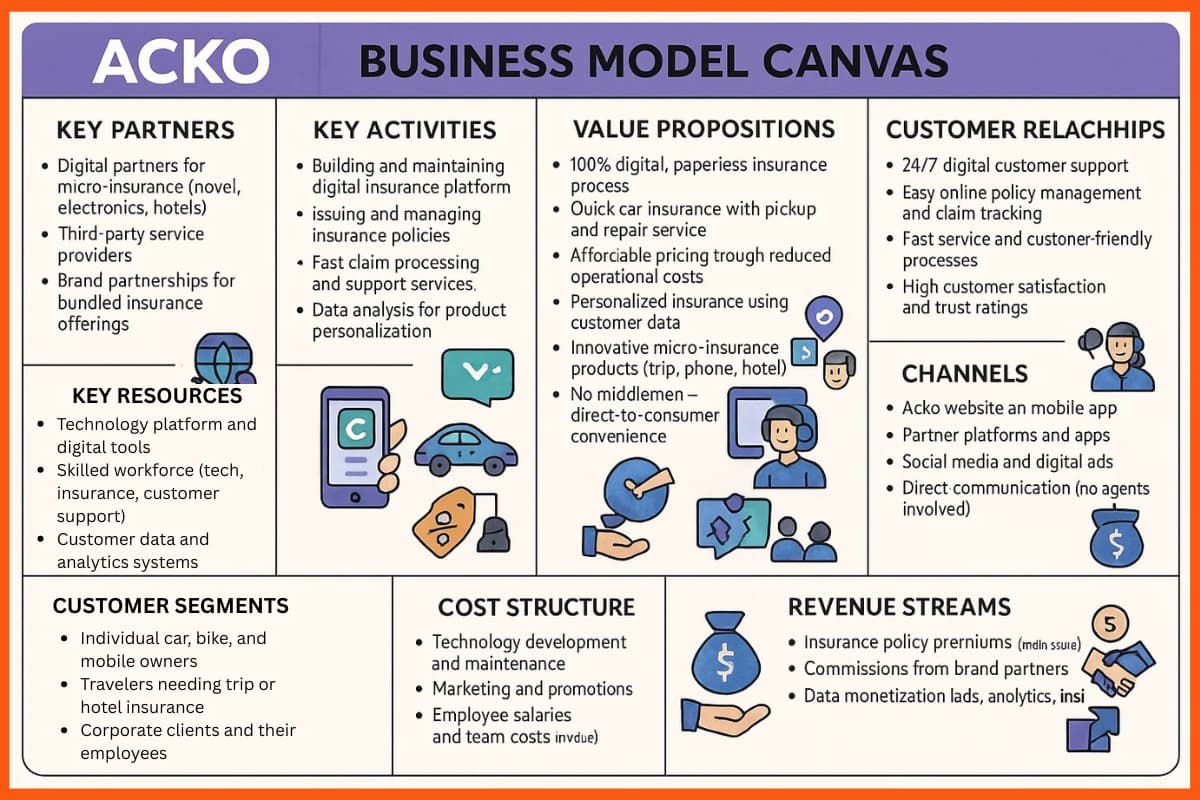

Acko Business Model Canvas

Acko is a fully digital insurance company that operates on a direct-to-consumer (B2C) model, eliminating the need for intermediaries. Its business model is driven by technology, enabling fast, affordable, and hassle-free insurance services. Here’s a breakdown of Acko’s business model using the Business Model Canvas:

1. Key Partners

- Digital partners for micro-insurance (travel, electronics, hotels)

- Car service providers and garages

- Third-party service providers

- Brand partnerships for bundled insurance offerings

2. Key Activities

- Building and maintaining digital insurance platform

- Issuing and managing insurance policies

- Fast claim processing and support services

- Data analysis for product personalization

- Marketing and customer acquisition

3. Value Propositions

- 100% digital, paperless insurance process

- Quick car insurance with pickup and repair service

- Affordable pricing through reduced operational costs

- Personalized insurance using customer data

- Innovative micro-insurance products (trip, phone, hotel stay)

- No middlemen — direct-to-consumer convenience

4. Customer Relationships

- 24/7 digital customer support

- Easy online policy management and claim tracking

- Fast service and customer-friendly processes

- High customer satisfaction and trust ratings

5. Customer Segments

- Individual car, bike, and mobile owners

- Travelers needing trip or hotel insurance

- Corporate clients and their employees

- E-commerce consumers needing quick cover

6. Key Resources

- Technology platform and digital tools

- Skilled workforce (tech, insurance, customer support)

- Customer data and analytics systems

- Licenses and regulatory approvals

- Brand reputation and trust

7. Channels

- Acko website and mobile app

- Partner platforms and apps

- Social media and digital ads

- Direct communication (no agents involved)

8. Cost Structure

- Technology development and maintenance

- Marketing and promotions

- Employee salaries and team costs

- Compliance and licensing expenses

9. Revenue Streams

- Insurance policy premiums (main source)

- Commissions from brand partners

- Data monetization (ads, analytics, insights)

Acko Advertisement

How Does Acko Make Money | Acko Revenue Model

Acko also has several customer-friendly schemes, which is the way the company is making money. As a digital insurance platform, it provides services that are cost-effective and of better quality than other brands. Also, when it comes to the direct-to-consumer approach, there happen to be no middlemen, which eventually makes a way to make extra profit.

The company has also gained the trust of its customers and has received high ratings from them. The customer support facility provided by Acko has also assisted in getting more appreciation from the customers and ratings too, eventually paving the way for more money acquisition and revenue. The revenue streams of Acko are:

- Premiums: Acko generates its primary revenue from selling insurance policies to individual and corporate customers.

- Commissions: Acko earns commissions from partner companies for selling insurance products as value-added services to their customers or employees.

- Data monetization: Acko’s data-driven approach allows for the collection of valuable customer data, which can be used for targeted marketing, advertising, and analytics services.

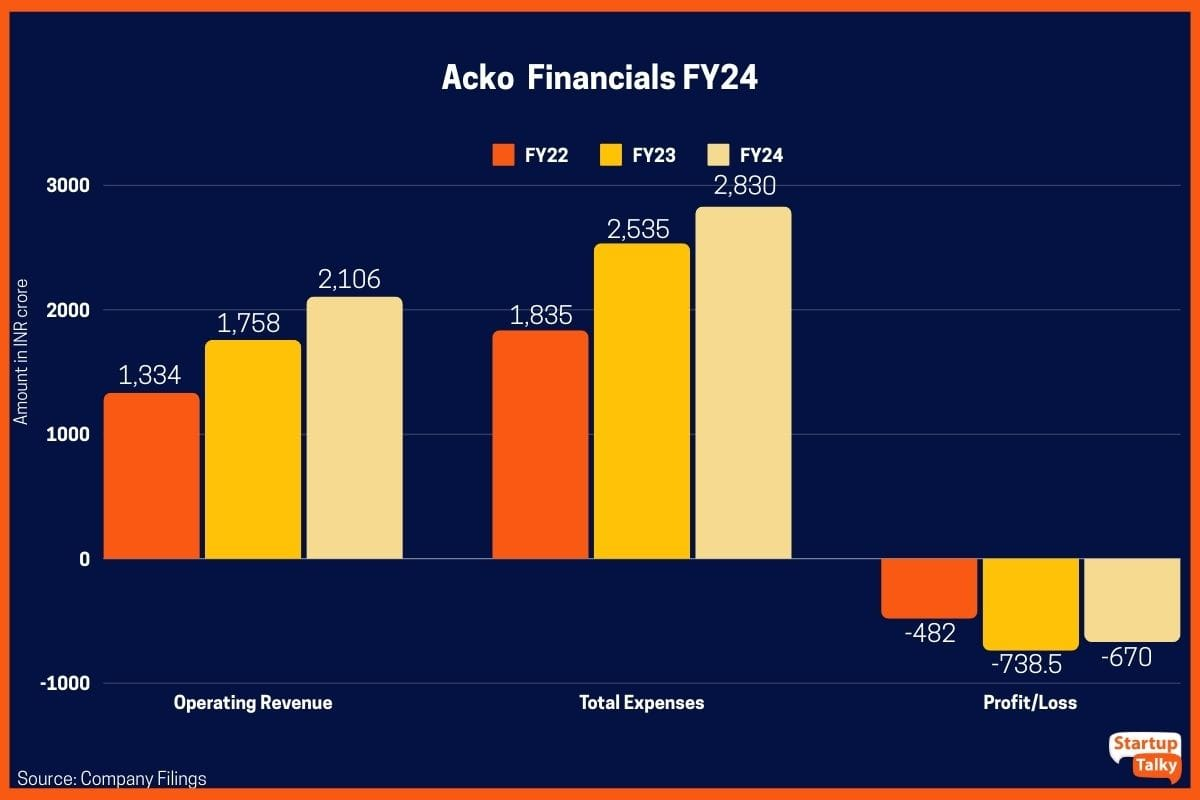

Acko’s operating revenue has shown consistent growth, rising from INR 1,334 crore in FY22 to INR 2,106 crore in FY24. However, its total expenses have also increased, from ₹1,835 crore in FY22 to INR 2,830 crore in FY24. As a result, the company has continued to report losses, INR 482 crore in FY22, INR 738.5 crore in FY23, and INR 670 crore in FY24. Despite narrowing its losses in FY24, Acko remains in the red while focusing on expansion and digital innovation.

The Cost Structure of Acko

In the dynamic landscape of the insurance industry, Acko emerges as a formidable contender, driven by a multifaceted approach to business operations. The cost structure of Aco is:

- A significant portion of Acko’s costs is dedicated to developing, maintaining, and enhancing its technology infrastructure.

- Acko invests in marketing and promotional activities to acquire new customers and build brand awareness.

- Acko’s expenses include salaries and benefits for its team of professionals, such as engineers, data scientists, insurance experts, and customer support staff.

- Acko incurs costs associated with regulatory compliance and maintaining necessary licenses to operate in the insurance industry.

Conclusion

Acko, because of its services and perfect business model, is rising high in the insurance industry. The company has presented a record of providing insurance policies to 62+ million customers and has also issued 800 million insurance policies. The innovative products and the unique technology-based offerings are making Acko stand out from the crowd of insurance service providers.

FAQs

Who is Acko owner?

Varun Dua is the founder of Acko.

How does Acko make money?

Acko makes money through its various insurance schemes.

What is Acko insurance business model?

Acko operates as a digital insurance provider, offering policies directly to consumers through its online platform. Leveraging technology and data-driven insights, it aims to streamline the insurance process, providing convenient and affordable coverage options.

Is Acko profitable?

No, Acko is not currently profitable. Despite increasing revenue, the company has reported significant losses in recent years.

What are the various marketing strategy of acko general insurance?

Acko General Insurance employs digital marketing tactics such as targeted online advertising and social media campaigns to reach its audience effectively. Additionally, it utilizes partnerships with digital platforms and influencers to expand its brand presence and customer acquisition efforts.