Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations.

Businesses in the financial services sector, known for their strict regulations and cautious nature, are often slow to embrace groundbreaking technologies. However, when they do, it’s a clear sign that a broader shift is happening across industries and regions. This raises a crucial question: how will this acceptance evolve into widespread adoption that delivers real value? The banking and insurance sectors may hold the key, offering valuable lessons for other industries looking to advance their own GenAI strategies.

Fractal Analytics also examines how one global financial institution is already seeing the benefits—teams are making smarter decisions and boosting productivity thanks to a new tool that automates complex data analysis.

In this article, we will highlight the various GenAI use cases in financial services. Here’s learning about Fractal Analytics, its Founders, Startup Story, Business Model, Revenue Model, Funding, Acquisitions, Growth, Competitors, and more.

Fractal Analytics – Company Highlights

| Name | Fractal Analytics |

|---|---|

| Headquarters | Mumbai and New York City |

| Sector | Artificial Intelligence |

| Founded | 2000 |

| Founders | Pranay Agrawal and Srikanth Velamakanni |

| Website | Fractal.ai |

Fractal Analytics – About

Fractal Analytics – Industry

Fractal Analytics – Founders

Fractal Analytics – Startup Story

Fractal Analytics – Mission and Vision

Fractal Analytics – Name, Tagline and Logo

Fractal Analytics – Business Model

Fractal Analytics – Revenue Model

Fractal Analytics – Employees

Fractal Analytics – Challenges Faced

Fractal Analytics – Funding and Investors

Fractal Analytics – Mergers & Acquisitions

Fractal Analytics – Financials

Fractal Analytics – Advertisements and Social Media Campaigns

Fractal Analytics – Awards and Achievements

Fractal Analytics – Competitors

Fractal Analytics – Future Plans

Fractal Analytics – About

Fractal Analytics is a global leader in AI and analytics, helping businesses leverage data to make smarter, more informed decisions. With expertise across multiple industries—ranging from consumer goods and healthcare to insurance, life sciences, retail, and financial services—Fractal is at the forefront of transforming businesses through data.

Fractal’s approach is grounded in predictive analytics and visual storytelling, enabling companies to not only understand but act on insights for a competitive edge.

With offices in over 15 countries, including key locations like the United States, United Kingdom, Ukraine, and India, Fractal operates from dual headquarters in Mumbai and New York. The company’s impact and innovation have earned it recognition from industry analysts, including mentions as a “Cool Vendor” and a “Vendor to Watch” by Gartner.

Fractal continues to push the boundaries of artificial intelligence, delivering tailored solutions that drive growth and operational excellence across sectors.

Fractal Analytics – Industry

AI is shaping up to be a game-changer for global development, with experts predicting it could add a staggering $15.7 trillion to the world economy by 2030—more than the combined GDP of India and China today. But what about India’s role in this AI boom? Well, the country is emerging as a powerhouse, boasting the third-largest pool of AI talent globally. Investments in India’s AI capabilities are on the rise, growing at an impressive CAGR of 30.8%, hitting approximately $881 million in 2023 alone.

What’s fueling this surge? A big part of it is India’s growing semiconductor industry, which is set to become the backbone of AI innovations here. By 2025, India’s AI market could be worth $7.8 billion, with a massive 60% of AI’s contribution to India’s GDP coming from four key sectors: Industrials & Automotive, Healthcare, Retail and Consumer Packaged Goods (CPG). But that’s not all—BFSI (Banking, Financial Services, and Insurance) and Agri-tech are also rapidly emerging as exciting spaces for AI-driven solutions.

India is gearing up to be a key player in the global AI revolution.

Fractal Analytics – Founders

Pranay Agrawal

Pranay Agrawal serves as the Co-founder and CEO of Fractal, bringing a wealth of expertise in both finance and data science. He is a certified Financial Risk Manager through the Global Association of Risk Professionals and was recognized as one of the Top 20 CEOs of Data Science Service Providers in 2023 by Analytics India Magazine.

Before joining Fractal, Pranay worked with prominent financial institutions, including ICICI Bank and ANZ Grindlays Bank. His accomplishments have been widely acknowledged, including the prestigious Young Alumni Achiever’s Award from IIM Ahmedabad in 2018-19.

Pranay holds a Bachelor of Commerce degree from Bangalore University and a postgraduate diploma in management from IIM Ahmedabad. As CEO, his focus is on expanding Fractal’s presence in the U.S. and Europe while developing capabilities that keep pace with the evolving needs of clients.

“Our goal is to power every human decision within enterprises through analytics, AI and technology. This approach allows us to provide comprehensive support to our clients,” Pranay shared.

Srikanth Velamakanni

Srikanth Velamakanni is the Co-founder, Group Chief Executive, and Vice-Chairman of Fractal Analytics, one of India’s top analytics firms.

A graduate of IIT Delhi with a degree in engineering and an MBA from IIM Ahmedabad, Velamakanni joined ANZ Investment Bank, where he worked in the structured debt department. Reflecting on his time there, he found the role engaging, working with high-profile clients like Enron and handling sectors such as aircraft finance.

That’s not all – Mr. Velamakanni is also a Co-founder and Trustee of Plaksha University, which emphasizes core engineering, AI/ML, and mathematics, fostering interdisciplinary learning that blends science with the liberal arts. As part of NASSCOM’s Executive Council, he contributes as a data and AI expert.

Fractal Analytics – Startup Story

Fractal Analytics kicked off its journey in 2000 in Mumbai, thanks to the vision of co-founders Srikanth Velamakanni, Pranay Agrawal, Nirmal Palaparthi, Pradeep Suryanarayan and Ramakrishna Reddy. (While Srikanth and Pranay continue to lead Fractal today, the other three co-founders have since moved on.)

The beginning of a great partnership began when Velamakanni transitioned to ICICI Bank’s structured products group, where he collaborated with Pranay Agarwal, a future co-founder of Fractal, to pioneer India’s first collateralized bond obligation (CBO) in 1999. This is where they saw the potential of using math to improve business outcomes, particularly in banking.

In 2000, as the internet was booming, it was the perfect time for Fractal Analytics to take shape. The founders seized the opportunity to build algorithms that could track sentiment analysis, capitalizing on the vast amount of data generated by rapidly growing websites. This laid the groundwork for their innovative analytics-as-a-service business, allowing companies to make more informed, data-driven decisions. This insight eventually led to the creation of Fractal Analytics.

In 2016, Pranay Agrawal stepped up as CEO, succeeding Srikanth Velamakanni, who transitioned to the Group Chief Executive and Executive Vice-Chairman role.

The company hit a major milestone in January 2022, achieving unicorn status after raising $360 million from private equity firm TPG. This accomplishment has solidified Fractal’s position as a powerhouse in the AI and analytics landscape, poised for even greater success in the future!

Fractal Analytics – Mission and Vision

Fractal Analytics is on a mission to leverage AI in ways that make a real difference in the world.

Vision: Imagine a future where every decision made in businesses is fueled by AI. Fractal believes in this future, where human creativity can flourish, opening doors to exciting new possibilities that can change lives and industries around the globe.

Mission: Fractal is dedicated to transforming the business landscape by harnessing advanced science and data-driven tools. Their mission is to simplify decision-making, liberating individuals from mundane tasks so they can channel their energy into innovation and creative thinking, driving progress and inspiring new ideas.

Fractal Analytics – Name, Tagline and Logo

At its core, the logo represents the concept of “fractals,” which are irregular, fractional, and fragmented objects. This design choice reflects the company’s focus on complex systems that are often disordered and multifaceted. Just as fractals can reveal intricate patterns within chaos, Fractal Analytics aims to uncover valuable insights from vast amounts of data, helping businesses navigate the complexities of the modern world.

This connection between the logo and the company’s mission highlights Fractal’s commitment to transforming disorder into clarity, allowing organizations to harness the potential of their data in a meaningful way.

Fractal Analytics – Business Model

Fractal Analytics operates with a robust business model tailored for consumer-facing companies that handle high-volume transactions.

The company focuses on two primary objectives:

- Deeply understanding consumers to enhance engagement & loyalty.

- improving operational efficiency through data-informed decision-making.

Their flagship solution, Customer Genomics, exemplifies this approach by providing a comprehensive view of each customer’s behavior and attitudes. This enables businesses to create personalized marketing strategies that resonate with their target audience.

By utilizing proprietary pattern recognition and machine learning algorithms, Fractal learns from every customer interaction, including insights from social media, empowering organizations to act on previously undiscovered patterns in their data.

With a specialization in sectors such as consumer goods, financial services, insurance, retail, and technology, Fractal leverages its extensive experience across over 100 countries to deliver 40 productized services designed to enhance customer understanding and drive business success.

Fractal Analytics – Revenue Model

Fractal Analytics generates revenue primarily through its subscription-based and project-based analytics services.

The company’s diverse offerings encompass artificial intelligence (AI), business intelligence (BI), and customer intelligence (CI), providing clients with a comprehensive analytics toolkit to navigate the complexities of big data.

By offering a suite of tailored solutions that integrate scientific decision-making into the operations of their clients, Fractal helps organizations improve business process efficiency and customer experience, ultimately leading to higher market share and profitability.

Fractal Analytics – Employees

Fractal Analytics offers a range of benefits designed to enhance employee satisfaction and well-being, scoring an impressive average of 81 out of 100 in perks and benefits. Notable offerings include free food, a flexible work-from-home policy, and a performance bonus. In addition to these, Fractal provides several unique benefits across categories like Health & Wellness and Paid Time Off, fostering a supportive and enriching workplace environment.

At Fractal, employees, affectionately known as Fractalites, are encouraged to remain curious and continually challenge their capabilities. To support this mindset, the company provides training programs through the Fractal Analytics Academy (FAA). This academy features a comprehensive onboarding program for every new Fractalite, ensuring a smooth transition into the organization. The FAA is committed to ongoing skill and knowledge development, helping employees advance their careers while nurturing a culture where imagination and creativity thrive.

Fractal Analytics – Challenges Faced

Fractal Analytics leverages its experience in solving business analytics challenges across industries like consumer packaged goods (CPG), financial services, and retail.

- Transition from analytics to AI: First, the company had to anticipate client needs years in advance, prompting a significant increase in research and development investment, from 3-4% of revenue to 12.5%. Second, the shift required a change in talent strategy, prioritizing a learning-oriented mindset over specific skills. To address this, Fractal invested heavily in training and development programs, ensuring employees could adapt to evolving AI technologies. Despite these adjustments, the overall transition was relatively smooth, with the core business questions remaining constant.

- Building a risk model: The lack of sufficient data, posed significant risks, especially in the financial sector where errors could cost banks a fortune. For instance, while developing a personal loan cross-sell model for ICICI’s credit card customers, they encountered thin data for price sensitivity analysis, a relatively new area at the time. To overcome this, Fractal conducted extensive research and wrote a paper on the subject, which they presented to the bank. This built credibility and allowed them to confidently offer their services to other major clients like Citibank and Hindustan Lever.

- Keeping up with the fast-evolving world of analytics: At Fractal Analytics, the industry changes so quickly that knowledge becomes outdated in just three years. To tackle this, they established the Fractal Academy, a dynamic learning hub designed to keep employees ahead of the curve. By partnering with platforms like eDX and Coursera, Fractal encourages its team to continuously upgrade their skills. Employees can earn credits for completing relevant courses, ensuring they stay sharp and ready to handle the industry’s rapid advancements while maintaining a culture of continuous growth.

Fractal Analytics – Funding and Investors

Fractal has raised around $855 million to date including a $360 million round, where the Srikanth Velamakanni and Pranay Agrawal-led company turned unicorn.

| Date of Funding | Funding Amount | Round Name | Investors |

|---|---|---|---|

| July 15, 2025 | $170 million | Secondary share sale | |

| January 5, 2022 | $360 million | Series E | TPG |

| January 17, 2019 | $200 million | Series D | Apax |

| May 10, 2016 | $100 million | Series C | Khazanah Nasional Berhad |

| August 13, 2014 | Undisclosed | Series B | Aimia |

| January 24, 2013 | $25 million | Series A | TA |

Fractal Analytics – Mergers & Acquisitions

Fractal Analytics has made several acquisitions across three countries, with the majority concentrated in India and the United States. Most of these acquisitions have been focused on AI services and IT services, with two acquisitions in each of these areas. These strategic moves have strengthened Fractal’s capabilities in delivering advanced AI-driven solutions and expanding its footprint in key global markets.

| Acquired On | Acquired Company |

|---|---|

| January 11, 2022 | Neal Analytics |

| June 22, 2021 | Samya.ai |

| January 15, 2021 | Zerogons |

| January 15, 2021 | XStreams |

| March 14, 2018 | Finalmile Consulting |

| June 2017 | 4i Inc. |

- Fractal Analytics partnered with Final Mile to integrate data science with behavioral science in September 2017.

- Fractal Announces Merger with Eugenie.ai (June 24, 2024)

- Fractal Partners with QiCAP.Ai (June 4, 2024)

- Acquisition of Imagna Analytics (2015)

- Fractal Analytics has also acquired Mobius Innovations, a Singapore-based startup specializing in mobile-based, context-aware Big Data solutions for an undisclosed sum.

Fractal Analytics – Financials

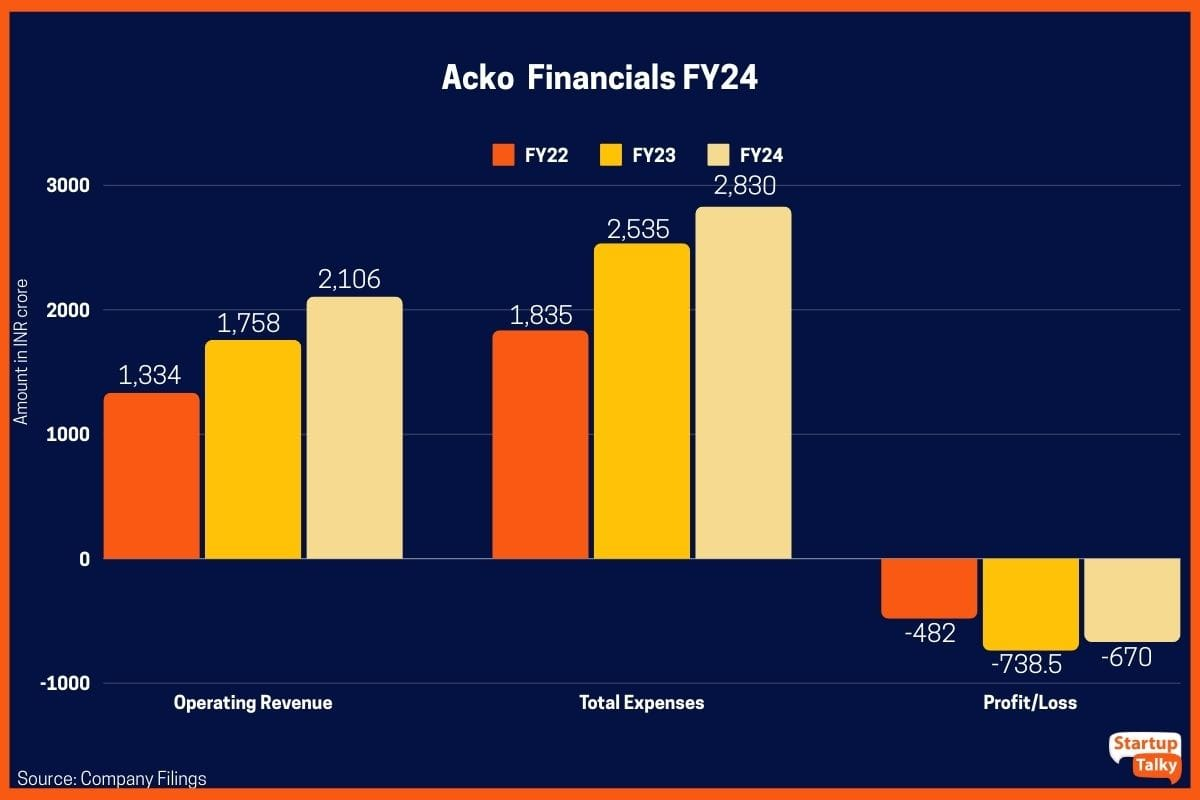

| Fractal Financials | FY24 | FY25 |

|---|---|---|

| Operating Revenue | INR 2196 crore | INR 2765 crore |

| Total Expenses | INR 2250 crore | INR 2575 crore |

| Net Loss/Profit | INR -55 crore | INR 221 crore |

Fractal Analytics – Advertisements and Social Media Campaigns

Fractal Analytics allocated under $100 million for print advertising over the past year, strategically investing in premium ad units. The company advertised across fewer than 50 different media properties, utilizing a variety of formats to reach its audience. In addition to its advertising efforts, Fractal launched and promoted a new product called MarshallGoldsmith.ai in the last twelve months. MediaRadar, a platform that tracks creative runs on leading websites, magazines, and national television for over 3 million brands, captures Fractal’s advertising presence. Recently, the company has placed several advertisements through its subsidiaries, showcasing its commitment to effective media engagement.

Fractal Analytics – Awards and Achievements

Fractal has received the following awards:

- Best Places to Work in New York 2023

- Fast 50 Asian American Business: Honored by the US Pan Asian American Chamber of Commerce (USPAACC).

- Innovation Award: Fractal Analytics received the prestigious Innovation Award at the Direct Marketing Association’s (DMA) annual Analytics Challenge during the DMA2013 Conference & Exhibition held in Chicago.

- Best in Business for ‘AI and Data’: Best in Business Awards 2023, featured in the Winter issue of Inc. magazine.

Fractal Analytics – Competitors

The main competitors of Fractal include:

- Alteryx

- Microsoft

- Qlik

- ThoughtSpot

- Altair Engineering

- AWS

- BDB

- Salesforce (Tableau)

Fractal Analytics – Future Plans

Fractal prepares for an IPO to raise $400–$500 million at a valuation of around $3 billion. The company has appointed Morgan Stanley, Kotak Securities, and Axis Securities as its IPO bankers and is preparing to file its draft red herring prospectus (DRHP).

FAQs

What does Fractal Analytics do?

Fractal Analytics is an artificial intelligence company offering services across various industries, including consumer packaged goods, insurance, healthcare, life sciences, retail, technology, and finance.

Who is the CEO of Fractal Analytics?

Pranay Agrawal is the CEO of Fractal Analytics.

When was Fractal Analytics founded?

Fractal Analytics was founded in 2000 by Srikanth Velamakanni, Pranay Agrawal, Nirmal Palaparthi, Pradeep Suryanarayan and Ramakrishna Reddy.

Who are the competitors of Fractal Analytics?

The main competitors of Fractal Analytics include Alteryx, Microsoft, Qlik, ThoughtSpot, Altair Engineering, AWS, BDB, Salesforce (Tableau) and others.