Do you need an urgent cash loan without a salary slip? When money is an emergency need, then banks are not a good option. Bank loans come with a lot of paperwork. The increasing demand for instant loans is becoming evident, particularly for individuals lacking traditional salary documentation. Accessibility is crucial for these individuals to secure financial assistance. You can get an urgent cash loan without salary slip through various instant loan apps that offer quick approval and minimal documentation. This blog post aims to showcase the top instant loan applications available in India.

| S.No. | App Name | Key Features | Loan Amount Range |

|---|---|---|---|

| 1 | PaySense | No salary slip required, quick approval, flexible EMIs | INR 5,000 – INR 5,00,000 |

| 2 | MoneyTap | App-based credit line, instant approval, low interest rates | INR 3,000 – INR 5,00,000 |

| 3 | CASHe | Social profile-based credit scoring, fast disbursal | INR 7,000 – INR 3,00,000 |

| 4 | KreditBee | Minimal documentation, quick processing, direct bank transfer | INR 1,000 – INR 4,00,000 |

| 5 | Fibe | Instant personal loans, salary advance options | INR 5,000 – INR 5,00,000 |

| 6 | Indiabulls Dhani | Instant disbursal, health benefits, digital documentation | INR 1,000 – INR 15,00,000 |

| 7 | Nira | Credit line for salaried and self-employed, minimal documents | INR 3,000 – INR 1,00,000 |

| 8 | MoneyView | Instant personal loans, paperless process, flexible repayment options | INR 5,000 – INR 5,00,000 |

| 9 | Kissht | Easy EMI loans, quick KYC, shop now pay later options | INR 10,000 – INR 3,00,000 |

| 10 | Buddy Loan | Aggregator platform, connects with multiple lenders | INR 10,000 – INR 15,00,000 |

PaySense

| Website | www.gopaysense.com |

|---|---|

| Rating | 4.8 |

| Platform | Web, IOS/Android |

You can easily get an instant 10,000 loan without salary slip in India through trusted loan apps that require minimal documentation. PaySense is a financial application that offers a range of features and advantages tailored to meet the needs of its users. The platform provides various benefits, including a user-friendly interface, quick loan approval processes, and flexible repayment plans that cater to individual financial situations. To qualify for a loan through PaySense, applicants must meet specific eligibility requirements, which typically include a minimum income threshold and a satisfactory credit score.

The application allows users to access different loan amounts, enabling them to choose the sum that best fits their financial requirements, along with a variety of repayment options designed to accommodate diverse budgets and timelines.

MoneyTap

| Website | www.moneytap.com |

|---|---|

| Rating | 3.5 |

| Platform | Web, IOS/Android |

MoneyTap is a financial technology application that primarily offers personal loans and credit lines to users in India. The app allows users to access instant credit through a seamless digital platform, enabling them to meet their financial needs without the lengthy processes typically associated with traditional banking.

User feedback and ratings for MoneyTap have generally been positive, reflecting satisfaction with its services and features. Many users appreciate the straightforward application process and the user-friendly design of the app, which simplifies accessing credit. Users frequently highlight the speed at which funds are disbursed, often praising the instant approval feature that allows them to meet urgent financial needs.

CASHe

| Website | www.cashe.co.in |

|---|---|

| Rating | 4.3 |

| Platform | Web, IOS/Android |

CASHe is a financial service provider focused on young professionals seeking quick personal loans, offering various loan products with flexible repayment options. The loan application process at CASHe is streamlined and user-friendly, allowing online submissions with minimal documentation and swift approval, often disbursing funds within hours.

Key benefits of CASHe include competitive interest rates, no hidden fees, and a convenient digital platform for loan management, along with advanced technology for inclusive credit assessments.

KreditBee

| Website | www.kreditbee.in |

|---|---|

| Rating | 4.4 |

| Platform | Web, IOS/Android |

KreditBee offers a variety of loan options tailored to meet diverse financial needs, ensuring that customers can find a suitable product for their circumstances. To qualify for a loan, applicants must meet specific eligibility criteria and provide necessary documentation, which typically includes proof of identity, income verification, and other relevant financial information.

Customer feedback regarding KreditBee has been largely positive, with many users appreciating the streamlined application process and prompt disbursement of funds, although some have noted areas for improvement in customer service responsiveness.

Fibe

| Website | www.fibe.in |

|---|---|

| Rating | 3.3 |

| Platform | Web, IOS/Android |

This platform offers features specifically designed to cater to both salaried and non-salaried users, ensuring that a wide range of financial needs are met. It provides various loan limits along with competitive interest rates, allowing users to select options that best fit their financial circumstances. The overall user experience is prioritized, leading to high levels of satisfaction among clients who utilize the service for their financial requirements.

Indiabulls Dhani

| Website | www.dhaniloansandservices.com |

|---|---|

| Rating | 3.8 |

| Platform | Web, IOS/Android |

The Indiabulls Dhani application offers a comprehensive suite of financial services designed to cater to the diverse needs of its users. It provides functionalities such as instant personal loans, credit score monitoring, and investment options, all accessible through a user-friendly interface.

One of the standout features of this app is its ability to assist users who do not possess traditional salary slips, thereby broadening its appeal to a wider audience, including freelancers and self-employed individuals. In comparison to other financial applications in the market, Indiabulls Dhani distinguishes itself through its seamless loan approval process and competitive interest rates, making it a favorable choice for those seeking quick and reliable financial solutions.

Nira

| Website | www.nirafinance.com |

|---|---|

| Rating | 4.7 |

| Platform | Web, IOS/Android |

Nira is a financial technology application designed to provide users with seamless access to credit and financial management tools. Its distinctive characteristics include:

- User-Friendly Interface

- Instant Credit Access

- Personalized Financial Insights

- Flexible Repayment Options

- Secure Transactions

- Integration with Banking Services

The eligibility criteria for Nira is as below:

- Age: Applicant should be at least 18 year old

- Residency: Applicant should be a resident of India

- Income: A minimum income threshold may be required, which varies based on the type of loan being applied for.

- Credit History: Though Nira offers services to people with varying credit scores, a basic credit history check is conducted to assess risk.

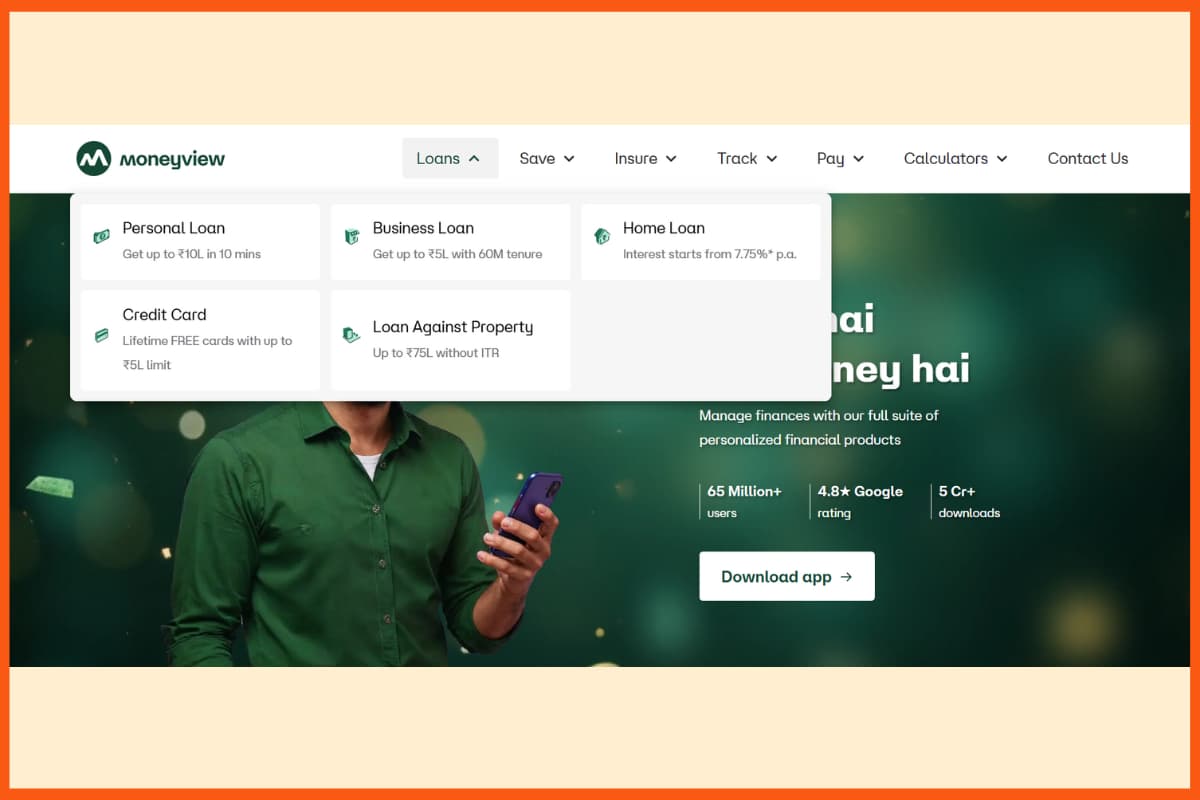

MoneyView

| Website | www.moneyview.in |

|---|---|

| Rating | 4.5 |

| Platform | Web, iOS/Android |

MoneyView is an instant loan app that uses its own credit rating system to decide how much loan you can get. You can check your loan eligibility in just two minutes by entering your mobile number and verifying with an OTP. The app considers other data, not just salary slips, to approve loans. After completing KYC, you can get personal loans up to INR 5 lakh at interest rates starting from 1.33% per month.

Kissht

| Website | www.kissht.com |

|---|---|

| Rating | 4.4 |

| Platform | Web, iOS/Android |

Kissht is a good option for people who want flexible repayment and a wide range of loan amounts. The whole process, from signing up to getting the money, takes about 5 minutes and is completely digital. Once approved, the loan amount is sent directly to your bank account. You can get personal loans up to INR 2 lakh with minimal documents, interest rates starting at 18% per year, and easy repayment plans of up to 24 months.

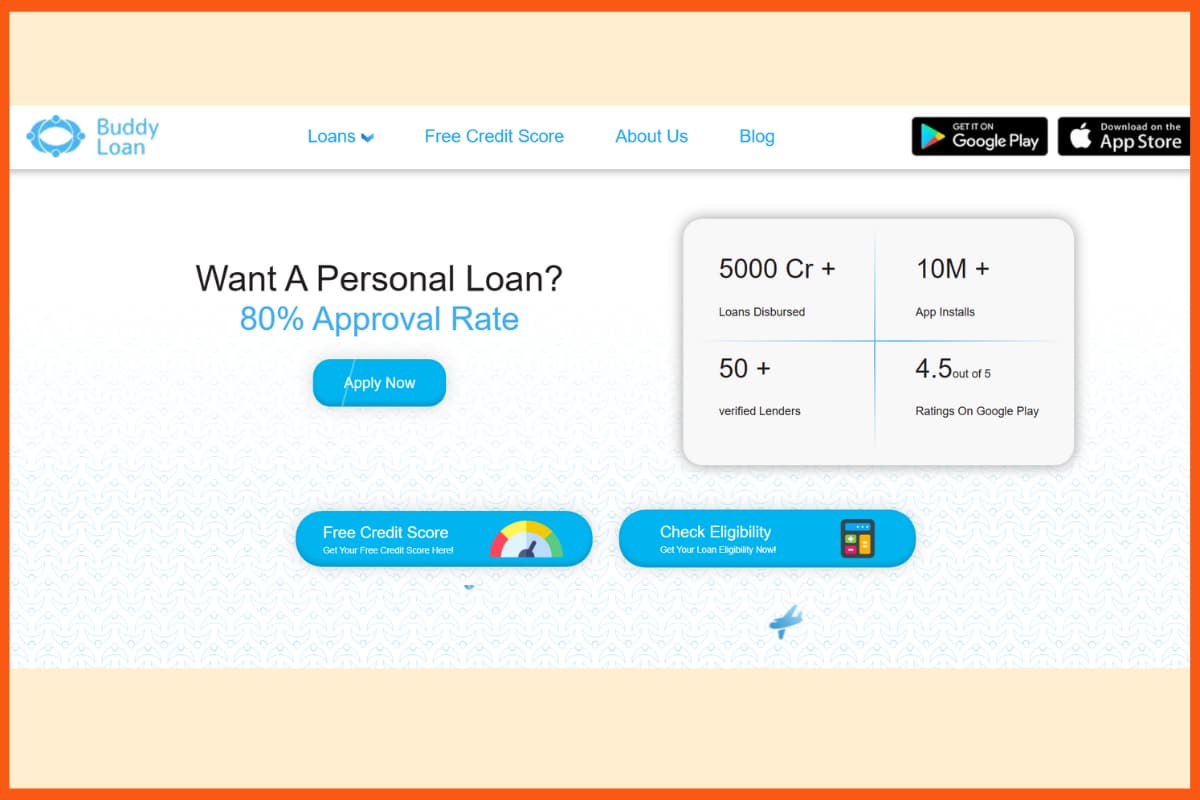

Buddy Loan

| Website | www.buddyloan.com |

|---|---|

| Rating | 4.6 |

| Platform | Web, iOS/Android |

Buddy Loan is easy to use and a good choice for people with low credit scores who may find it hard to get loans elsewhere. It offers instant personal loans from INR 5,000 to INR 15 lakh within minutes. The interest rate starts at 11.99% per year, and you can choose flexible repayment plans ranging from 6 months to 5 years.

Conclusion

In summary, the significance of instant loan applications that do not require salary slips cannot be overstated, as they provide a vital financial resource for individuals who may not have traditional income verification methods. It is essential for borrowers to make informed decisions that align with their specific financial circumstances and requirements, ensuring that they select options that best suit their needs. Looking ahead, the landscape of instant lending in India appears promising, with advancements in technology and evolving consumer demands likely to shape a more accessible and efficient borrowing experience for all.

FAQ

Can I get an instant loan without a salary slip?

Yes, you can get an instant loan in India without a salary slip. Many lending apps provide an instant 10,000 loan without salary slip with easy online application and quick disbursal. However, the terms and interest rates may vary. Always check with the lender for specific requirements.

Which app is best for loan without salary slip?

Here are some of the best apps for getting loans without a salary slip:

- PaySense

- MoneyTap

- CASHe

- KreditBee

- Fibe (Formerly EarlySalary)

- Indiabulls Dhani

- Nira

Are loan apps safe?

Loan apps in India can be safe if they are reputable and registered with the Reserve Bank of India (RBI). However, some unregulated apps may pose risks, so it’s essential to verify their credibility before using them.

I need 5000 rupees loan urgently without salary slip, how can I get it?

You can get a INR 5,000 loan urgently without a salary slip by using instant loan apps that offer small personal loans with minimal documents. Apps like KreditBee, Nira, MoneyView, and PaySense allow you to apply online by verifying your mobile number, completing KYC, and linking your bank account. Once approved, the money is usually credited to your account within minutes to a few hours.