Chaayos is a vibrant and creative brand of Indian tea cafes that aims to give the traditional tea-drinking culture a contemporary spin. Chaayos has quickly expanded to become a well-known brand in the Indian cafe business by placing a strong focus on quality, customer experience, and innovation. The company ensures the authenticity and depth of flavors by using premium tea leaves sourced from all around India. Every location also prioritizes creating a welcoming atmosphere that serves as the ideal escape from the bustle of the city.

About Chaayos

Chaayos was established in 2012 by Nitin Saluja and Raghav Verma to provide tea lovers with a distinctive and enjoyable chai experience by providing them with freshly brewed, customized drinks. By providing a range of carefully and precisely created tea blends, the brand expresses the rich and varied flavors of India. Customers may rest, unwind, and enjoy their favorite tea along with delicious snacks and small meals at Chaayos locations because of their warm and inviting atmosphere.

Chaayos Business Model

Chaayos’s business strategy revolves around giving its clients a remarkable, personalized chai experience. Chaayos guarantees the authenticity and depth of its products by utilizing a strong supply chain that procures premium tea leaves and components from various regions of India. To accommodate a wide range of tastes and preferences, the brand combines traditional and modern components, enabling customers to customize their chai in over 80,000 unique ways. With a significant presence in high-traffic places including malls, business parks, and airports, Chaayos operates through a network of carefully placed locations in tier-1 towns and metropolitan cities. To meet the diverse needs of contemporary customers, the company employs an omnichannel strategy that provides delivery, takeaway, and dine-in options.

How Chaayos Makes Money | Chaayos Revenue Model

Chaayos’s revenue model is based on several sources that guarantee consistent and long-term growth.

- Generating Revenue Through Various Outlets: The main source of income for its stores is the sale of tea and related foods. Through a well-planned menu that offers small meals, snacks, and desserts to go with the tea, the business places a major emphasis on upselling.

- Generating Revenue by Forming Partnerships with Food Delivery Platforms: Furthermore, Chaayos has embraced the digital era by collaborating with well-known food delivery services, which has greatly increased their sales outside of their physical locations.

- Generating Revenue Through Packaged Tea and Other Accessories: In order to enable clients to replicate the Chaayos experience at home, Chaayos now sells packaged tea mixes and accessories.

- Generating Revenue Through Various Programmes and Collaborations: Additional revenue streams include special promotions, loyalty plans, and partnerships with corporate clients for catering and bulk orders, which establish Chaayos as more than just a café but a full-fledged tea brand.

Chaayos Financials

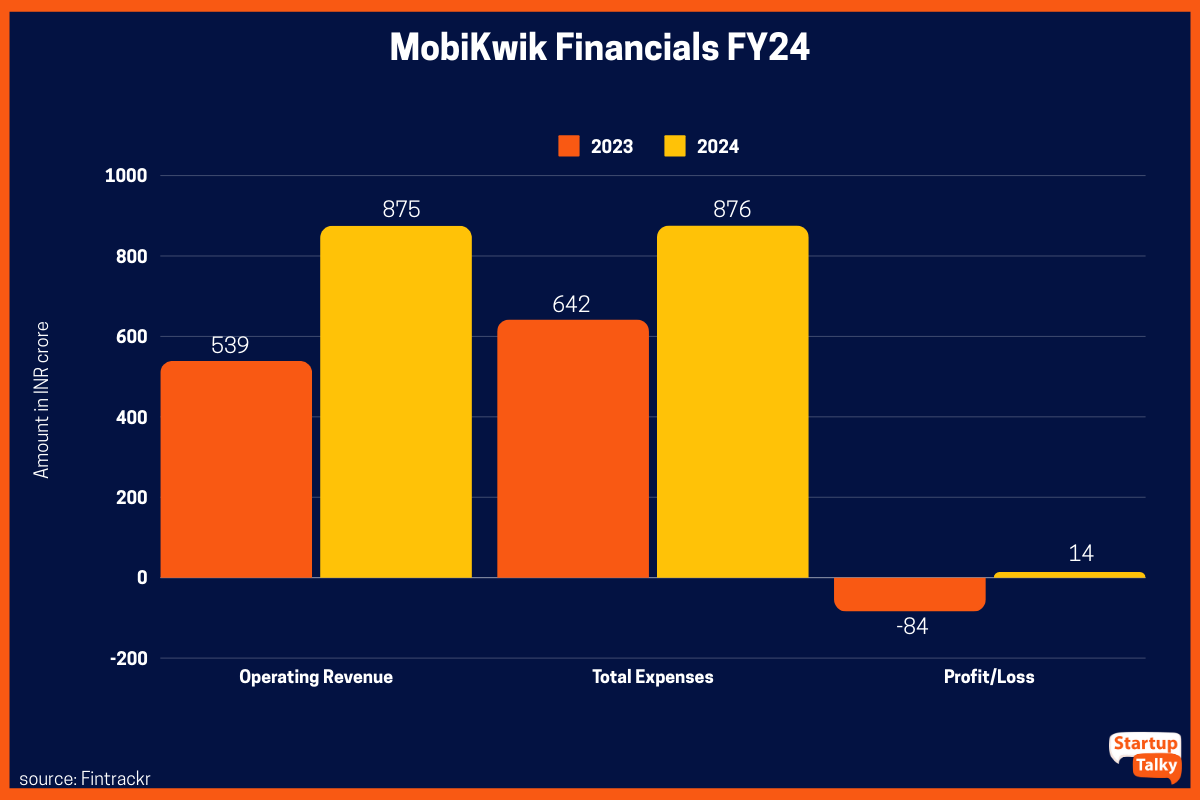

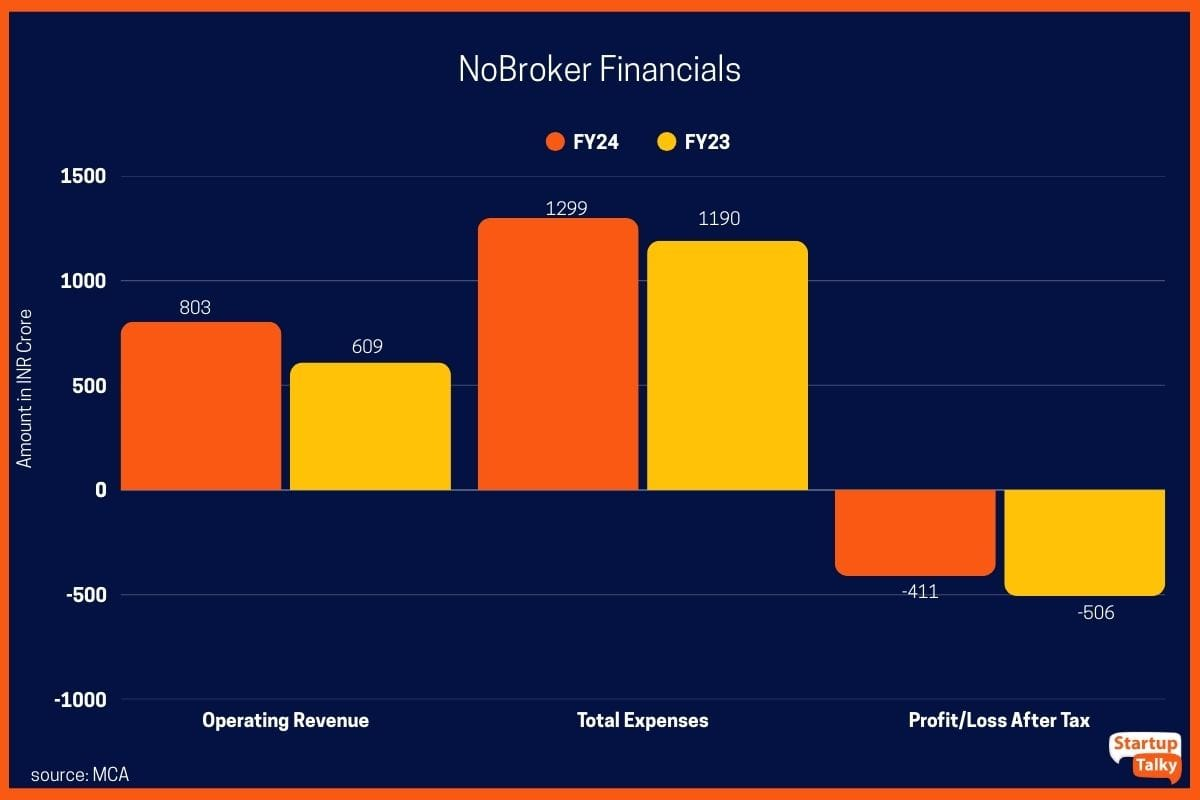

Chaayos made most of its money (95.32%) from selling its own products like tea, earning INR 236.87 crore in FY24, a 3.1% increase from last year. It also earned INR 10.74 crore from selling other items like snacks and tea leaves, which nearly doubled. Service income dropped to INR 0.89 crore.

In total, including INR 22.7 crore from non-operating sources, Chaayos earned INR 271.2 crore in FY24.

On the cost side, employee salaries rose to INR 81.15 crore, while raw material costs fell to INR 76.54 crore. Depreciation stayed around INR 51.83 crore, commissions fell to INR 26 crore, and other expenses were INR 89.69 crore.

Overall, Chaayos managed to cut its total expenses by 11% to INR 325.21 crore in FY24, compared to INR 365.68 crore in FY23.

USP of Chaayos

Offering customized tea experiences is one of Chaayos’ most distinctive features. Chaayos gives something as basic as chai a personalized touch by giving clients the option to select from more than 80,000 different tea blends.

SWOT Analysis of Chaayos

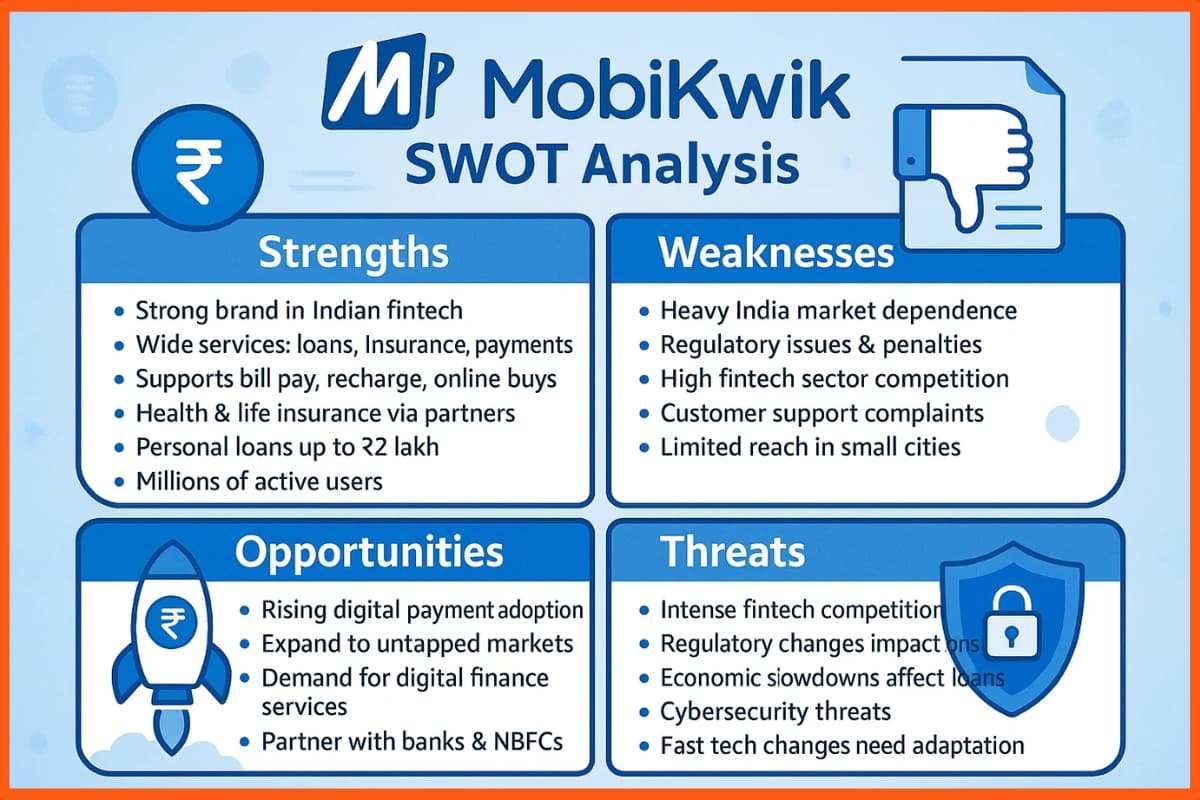

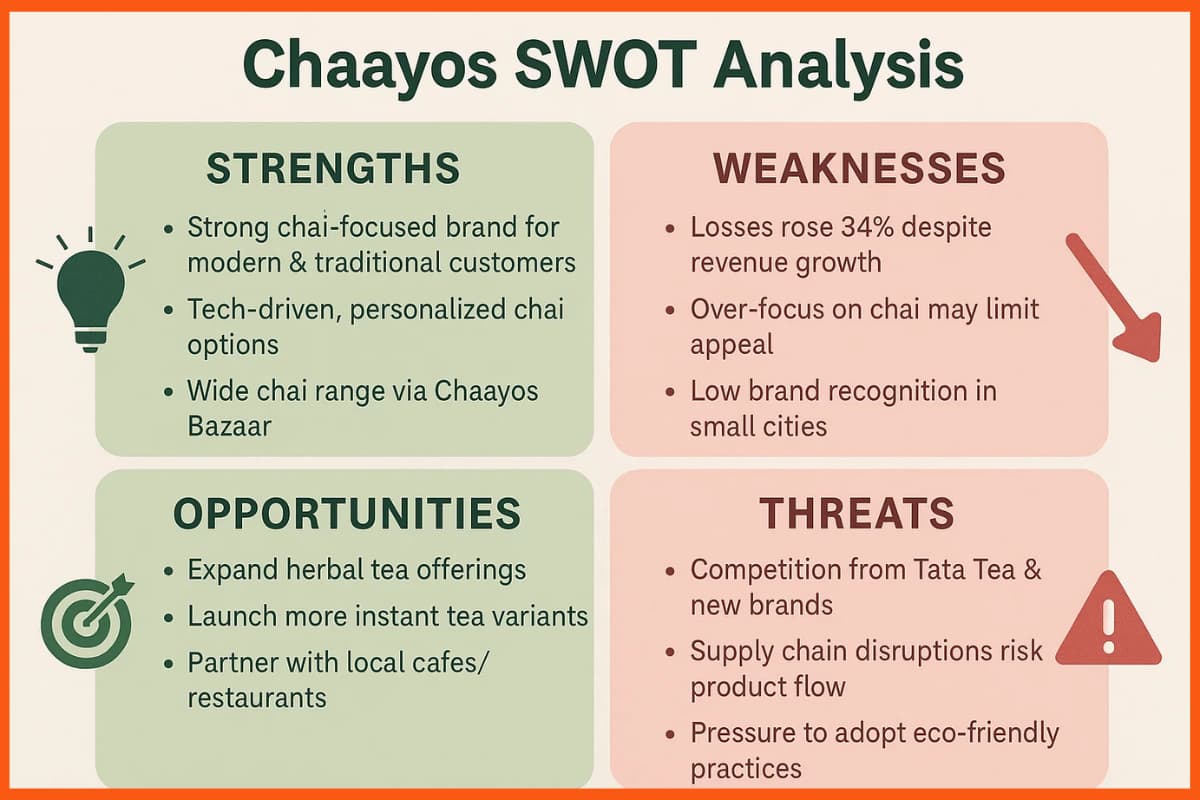

Chaayos Strengths

- In the chai business, Chaayos has developed a strong brand identity that appeals to both conventional and contemporary customers.

- The business uses technology to improve client involvement by providing customized chai-making alternatives.

- With a large selection of chai goods, including snacks and instant teas, Chaayos Bazaar can satisfy a variety of customer tastes.

Chaayos Weaknesses

- The stated 34% increase in losses despite revenue growth suggests possible operational inefficiencies or excessive administrative expenses.

- Particularly as the business launches a new coffee menu, the emphasis on chai may reduce market attractiveness and weaken brand identity.

- Expansion efforts into smaller markets may be hampered by a lack of brand recognition outside of major cities.

Chaayos Opportunities

- There is a chance to increase the range of herbal tea products due to the growing trend of health-conscious consumers.

- By launching additional instant tea flavors, Chaayos can take advantage of the growing demand for quick, ready-to-drink tea options.

- Partnerships with nearby eateries or cafes could increase brand awareness and expand the audience.

Chaayos Threats

- Market share may be eroded by fierce rivalry from well-known companies like Tata Tea as well as fresh competitors in the chai and herbal tea industries.

- Disruptions to the supply chain may have an impact on the availability and cost of products, especially when it comes to obtaining high-quality tea leaves and components.

- Chaayos may be under pressure to implement more environmentally friendly practices due to the growing sustainability movement, which could necessitate a significant financial outlay.

Conclusion

Every journey has its share of difficulties, and for Chaayos, scaling quickly without sacrificing consistency and quality is a major obstacle. As a result, being quick on one’s feet and creative is essential for success in India’s rapidly developing cafe scene. But Chaayos’ future is bright. With aspirations to enter new markets and expand geographically, Chaayos is well-positioned to solidify its position. It will be essential to prioritize digital growth, particularly in improving their web presence and mobile app. Chaayos continues to brew its way to success by utilizing a thorough blend of creative marketing, operational efficiency, and customer-centric initiatives. As it stands, Chaayos is a prime example of how a conventional idea may be updated to provide a distinctive and long-lasting company plan.

FAQs

What is Chaayos?

Chaayos is an Indian café chain known for customizable chai, snacks, and a tech-enabled tea experience, blending tradition with modern flavors.

What is Chaayos business model?

Chaayos follows a café-retail model, earning mainly from dine-in, takeaway, and online tea/snack sales, along with ready-to-drink and instant tea products.

How does Chaayos make money?

Chaayos makes money by selling chai, snacks, and instant tea products through its cafés, website, and delivery platforms.