Alphabet’s market value plummeted by $150 billion on 21 October as a result of OpenAI’s release of ChatGPT Atlas, an AI-powered web browser. This was one of the biggest one-day market reactions to a tech product launch this year. A mysterious six-second movie showcasing browser tabs was uploaded to X to make the announcement.

CEO Sam Altman then said during a livestream that the browser is “a rare once-a-decade opportunity to rethink what a browser can be about.” Within hours following OpenAI’s statement, Alphabet shares dropped as much as 4.8% to $246.15, but they recovered considerably to settle down 2.4% at $250.46.

OpenAI Directly Locking Horns with Google

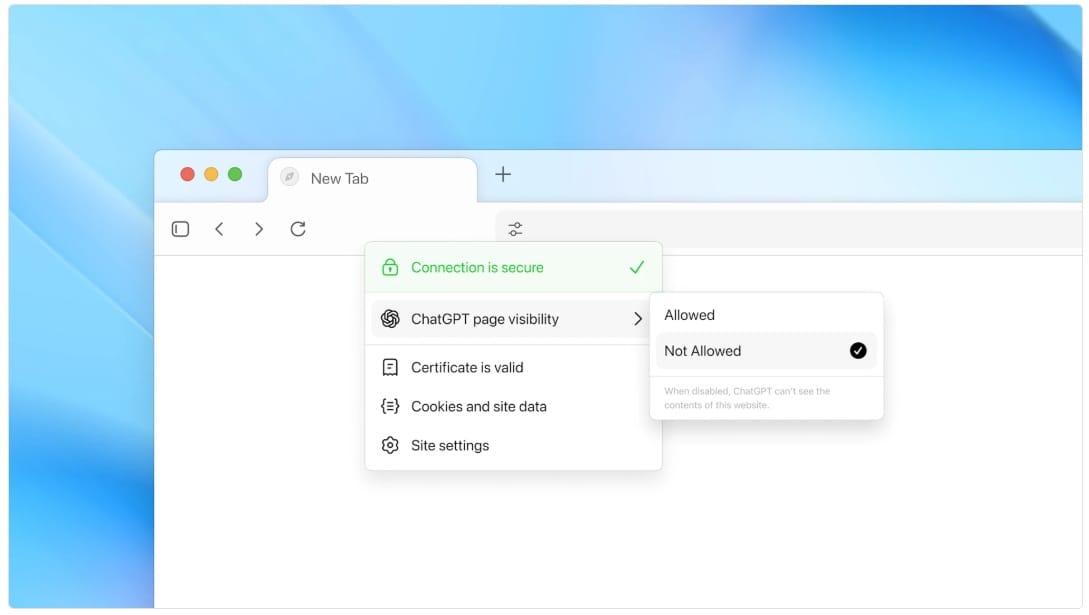

Sam Altman, CEO of OpenAI, positioned Atlas as more than just a rival to Chrome but as a revolutionary reinvention of web browsing. Nevertheless, it shares the Chromium core technology with Google Chrome. Atlas integrates ChatGPT directly into every webpage, removing the need for tab switching and copy-paste enquiries. It is now available on macOS, with mobile and Windows versions on the horizon.

The browser’s defining feature is “agent mode”, in which AI uses your keyboard and cursor to perform intricate tasks like researching things, booking flights, and even editing documents while you watch or move on. Although free users can still use the basic browser, this capability is initially only available to Plus and Pro members. During the broadcast, Altman said, “We think AI represents a rare once-a-decade opportunity to rethink what a browser can be,” with programmers who had previously worked on Chrome and Firefox at his sides.

Google Vs OpenAI Who will Dominate Web Browser Sector in Future?

Market share for browsers is just one aspect of the stakes. Since AI answer engines provide direct answers rather than ad-filled results pages, they pose a challenge to Google’s whole business model, which depends on search advertising for the majority of its revenue. OpenAI has a sizeable existing audience that is prepared to move, with 800 million weekly ChatGPT users. Google isn’t sitting still; last month, it just escaped a court-ordered split of Chrome after integrating Gemini AI across the browser. Investors will be examining if AI competition is already undermining Google’s search dominance as third-quarter earnings draw near on October 29.

|

Quick Shots |

|

•Alphabet’s •OpenAI •Sam •Alphabet •Atlas •Initially on macOS; mobile and |