After 75 years of independence from the British Raj, India has emerged as the fastest-growing and fifth-largest economy in the world. By the year 2020-2021, India’s per capita income has increased to INR 1.28 lakh. By August 2022, the country’s Foreign Exchange Reserves amounted to USD 572.97 billion and its GDP (Gross Domestic Product) rose to USD 3.5 trillion. India aspires to reach a USD 5 trillion economy by the year 2024-2025.

Economic History

Current Economic Status

Way To USD 5 Trillion Economy

Challenges & Obstacles

Conclusion

Economic History

At the end of the 1st millennium BC, India was one of the largest economies around the globe which ended around the beginning of British rule. Under British rule, India experienced decentralization as well as the cessation of various craft industries. This coupled with accelerated economic and population growth in the west led to a steep decline in India’s share and by independence, the country’s GDP had been reduced to a mere 4.2%. India’s global industrial output also reduced from a towering 25% in the 1700s to a mere 2% in just a little over 200 years. The British left India in dire straits, dealing with a collapsing economy, poverty, high inflation, and an utter state of confusion.

Post-independence, India adopted five-year plans concentrating on centralized economic and social growth programs. The first five-year plan focused on agriculture and irrigation and aimed to boost farm output and the second, launched in 1956 advocated rapid industrialization with a focus on heavy industries and capital goods. However, this caused the funds to be taken away from the agricultural sector leading to food shortages and inflation. In the 1960s Indian economy was worsened by the wars with China and Pakistan and the political instability within the country. This led to the devaluation of the Indian Rupee. Then, a little over two decades later came the oil crisis in 1991 resulting in a balance-of-payment crisis for the country. The global economic crisis of 2008 left the Indian economy deeply scathed and the country’s fiscal deficit rose to 6.4% of its GDP in 2009-2010.

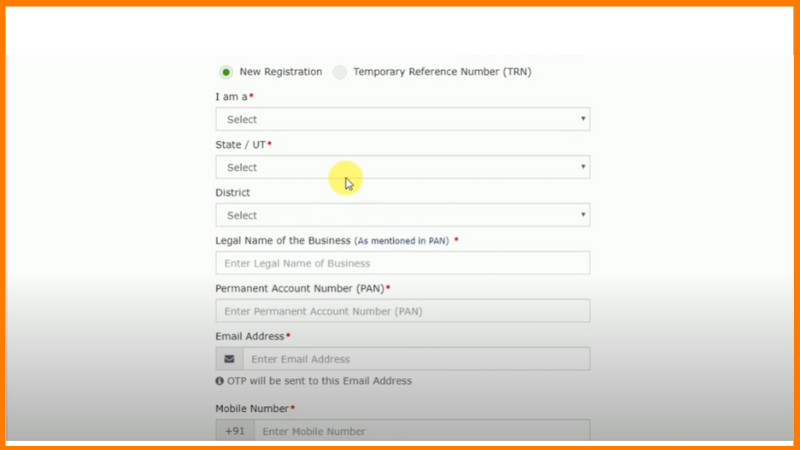

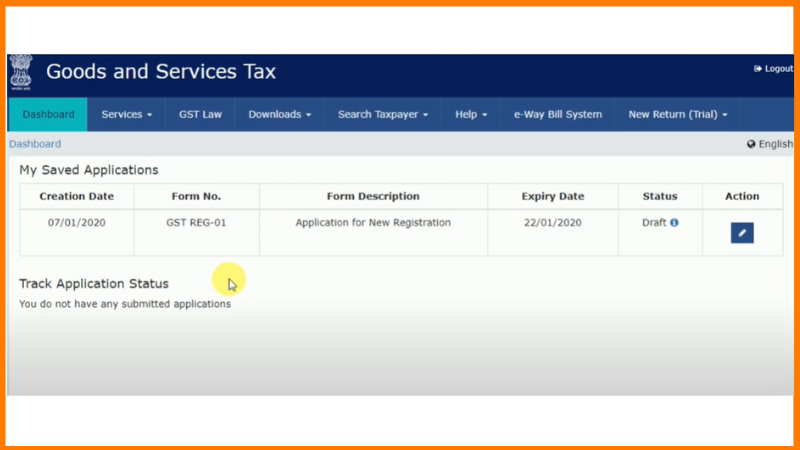

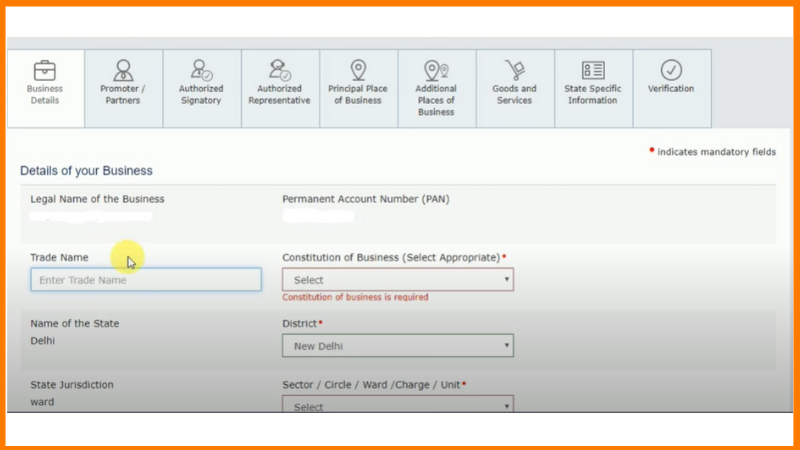

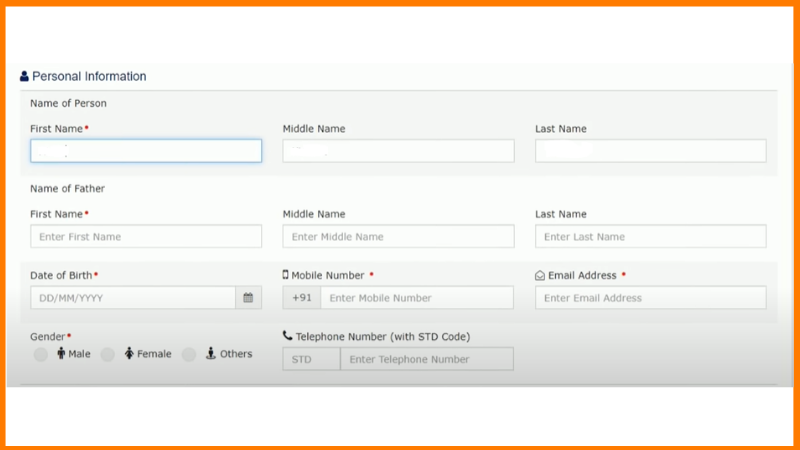

However, two economic events that have assured a place in history were the demonetization of 2016 and the implementation of the Goods & Services Tax (GST) in 2017. Demonetization was aimed at flushing out black money and striking out corruption and the introduction of GST introduced a uniform tax rate across all states paving the way for easier compliance.

Current Economic Status

Since the beginning of the 21st century, India’s annual average GDP growth has been around 6% to 7%. Between the years 2013 and 2018, India surpassed China and became the world’s fastest-growing economy. The country is the third largest unicorn base globally, being home to 100 unicorns that are collectively worth USD 335 billion. The country is also the third largest by PPP (Purchasing Power Parity) with an estimated USD 11.75 trillion.

Way To USD 5 Trillion Economy

The country currently has strong economic fundamentals and is well on the road to becoming a USD 5 trillion economy. Various factors are working in favor of the country. These factors are –

Diversified Economy

India enjoys strong trade relations with many other countries. Its economy is well-diversified with healthy roots.

New Technology Adoption

In the past few years, India has quickly adopted newer technologies, especially in the manufacturing and financial sectors. This has led to higher quality and reduced production costs driving profitability. It has also led to increased investment in innovation.

Increasing Off-Shore Opportunities

As devastating as the effects of the covid-19 pandemic were, it has favored India, as the working culture shifted to remote teams. This led to developed nations finding it more cost-effective to work with people living in India.

Young Average Age Population

India’s youth population is the largest globally at approximately 356 million. This represents a high 64% working population that contributes to the country’s growth in GDP and per capita income. It also presents a high consumer base for companies to thrive and grow.

Shift to Renewable Energy

India’s dependency on energy imports has lessened considerably with almost 40% of the country’s installed electricity capacity coming from non-fossil fuel sources. This has reduced operational costs for businesses and individuals.

Challenges & Obstacles

India’s fast growth has persisted even in the face of the globally crippling pandemic coronavirus. The country, however, is facing several challenges on the path to becoming a USD 5 trillion economy.

Supply Chain Bottlenecks

Developed economies resorted to distributing cash to households to combat the debilitating effects of the pandemic. The supply-chain bottlenecks resulting from the pandemic have also not eased. These have led to soaring inflation across the world, which is exacerbated by the ongoing Russia-Ukraine war.

Interest Rate Increase by the Federal Reserve

The Federal Reserve has increased the interest rates to combat rising inflation. However, these threaten economic growth and may cause ripple effects within India.

Strengthening Dollar to Indian Rupee

The US Dollar is consistently strengthening against the Indian Rupee adding to inflation and can have a negative impact as India purchases oil and other imports in this currency.

EU Energy Crisis

The ongoing war between Russia and Ukraine has led to a severe energy crisis in the European Union. This acts as a growth inhibitor.

China’s Covid Policy

At one time, leading the global economic growth, China has continued to announce restrictions due to its zero-covid policy making international trade difficult.

Conclusion

India’s growth is unprecedented and its march is strong and sure. However, challenges like generating employment, curbing inflation, increasing foreign direct investment into the country, and maintaining macroeconomic stability must be successfully dealt with to make a USD 5 trillion economy a reality.

FAQs

How does the Indian economy compare to other economies in the world?

India is the world’s fifth-largest economy by nominal GDP and the third-largest by PPP(Purchasing Power Parity).

What are the key policies and initiatives taken by the Indian government to boost economic growth?

The Indian government has implemented policies such as Make in India, Atmanirbhar Bharat, Digital India, Start-up India, GST, FDI liberalization, Pradhan Mantri Jan Dhan Yojana, and Swachh Bharat Abhiyan to boost economic growth and development.

What is the role of foreign investment in India’s economic development?

Foreign investment has significantly contributed to India’s economic growth by providing capital and technology, improving productivity, and creating jobs. The Indian government has implemented policies to attract foreign investment, which has increased exports and skills in various sectors.

What are the main sectors driving economic growth in India?

The main sectors driving economic growth in India are services, agriculture, and manufacturing.