If a seller wants to sell across India they need to register for GST. The GST is meant to replace a slew of indirect taxes with a federated tax. In the GST Regime, businesses whose turnover exceeds Rs. 40 lakhs* (Rs 10 lakhs for NE and hill states) is required to register as a normal taxable person. The registration process is entirely paperless which means that it will take place online or digitally. Registering for a GST might seem confusing but just follow our Step by Step guide on how to register for GST online easily.

How to Register For GST Online

To Register For GST Online

Documents Required To register For GST Online

Steps To Register For GST Online

Frequently Asked Questions About Online GST Registration

How to Register For GST Online

To Register For GST Online

There are two parts in registering for GST online,

Part A – Generate your GST Application form

Part B – Filling in your GST Application form

Documents Required To register For GST Online

- PAN of the Applicant

- Aadhaar card

- Proof of business registration or Incorporation certificate

- Identity and Address proof of Promoters/Director with Photographs

- Address proof of the place of business

- Bank Account statement/Cancelled cheque

- Digital Signature

- Letter of Authorization/Board Resolution for Authorized Signatory

Steps To Register For GST Online

Part 1: Generate Your GST Application Form

First you need to visit official GST portal – https://www.gst.gov.in/ and under the services tab, choose Services > Registration > New Registration.

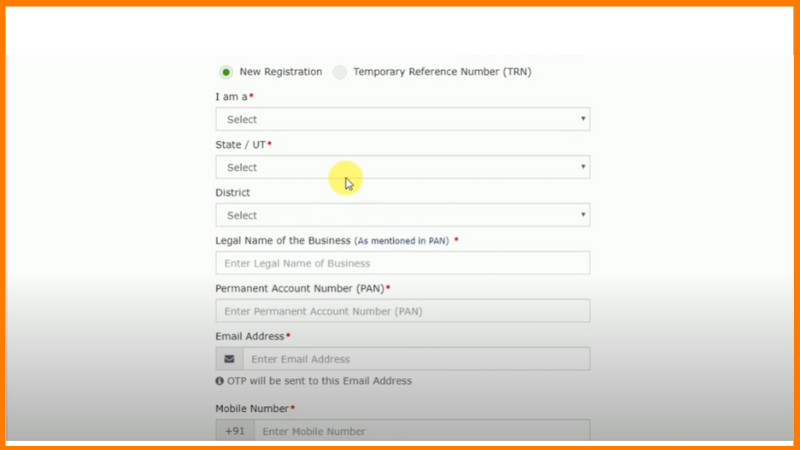

On the registration page, enter all the requested details (including your PAN number), email address and mobile number. You need to select the option I am a Taxpayer.

After entering the details click proceed. After that you’ll receive two different OTP on your phone and Email id for verifying the mobile number and the email id. OTP is valid only for 10 minutes. Enter the Received OTP and click proceed.

Once you click proceed your Temporary Reference number will be generated. Save and copy your TRN number it will be used for further filling of the form.

This was the complete Part A of Registering for GST online. If you want some Help with tax preparation and planning, do read it.

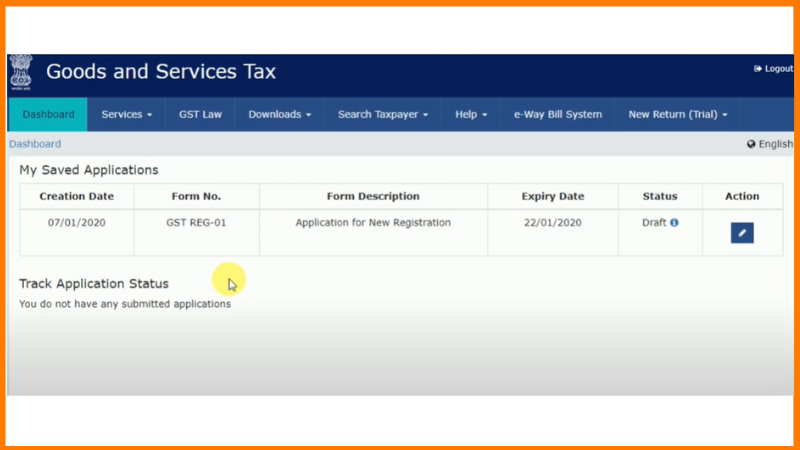

Now to use this TRN number, either click Proceed or Services > Registration > New Registration option and select the Temporary Reference Number (TRN).

Enter your TRN number and the captcha text as shown on your screen. Click proceed and you will be asked to verify OTP again. (This is different from the previous OTP generated), Same OTP will be received on your phone and email id.

Part 2: Filling Your Online GST Application Form

Now click on action button on top right to start filling your GST application form.

The form contains 9 sections,

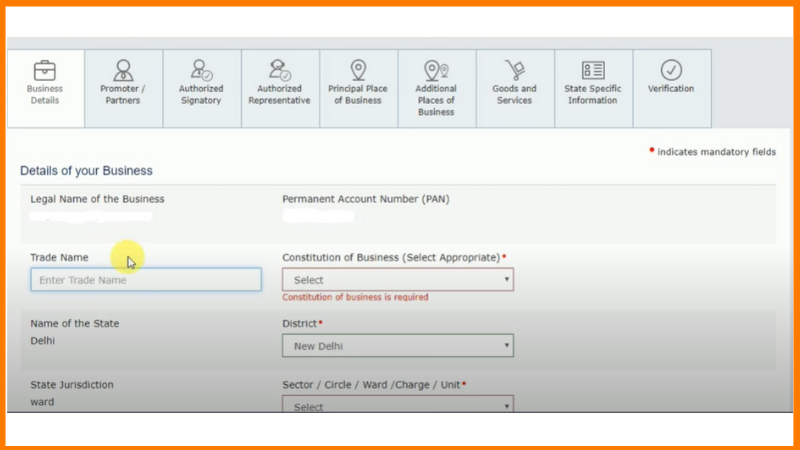

Your Business Details

Enter the details of your business. Enter the name of your shop under the Trade name and enter the constitution of business, private limited or partnership etc.

After you complete your registration click on save and continue to proceed further.

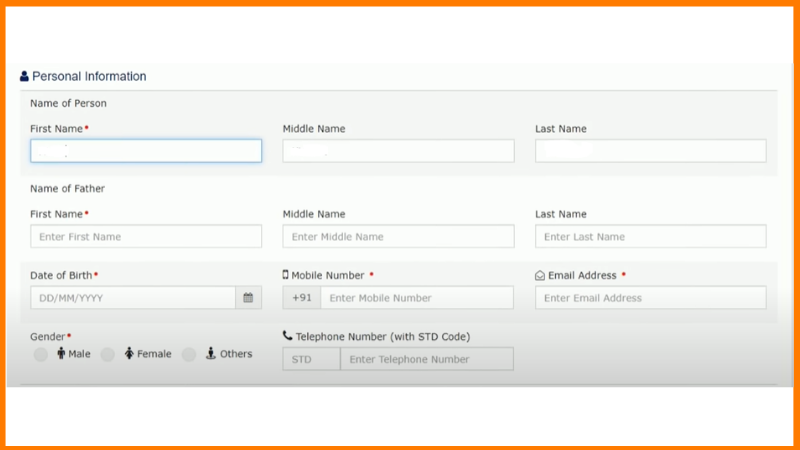

Personal Information

Enter the Required personal information and identity information. In identity information under designation, Add the designation of yourself. Suppose if you are proprietor add proprietor under that.

After you add all the details you have to upload your photograph, which should be in jpeg format of size maximum up to 100kb.

Authorized Signatory

If you are the proprietor of the company just click on primary authorized signatory and proceed further. If you are not the proprietor of the company then fill in the details of the proprietor of your company.

Authorized Representative

If you have an Authorized representative you have to fill in the details of your representative or else Click on save and continue to proceed further.

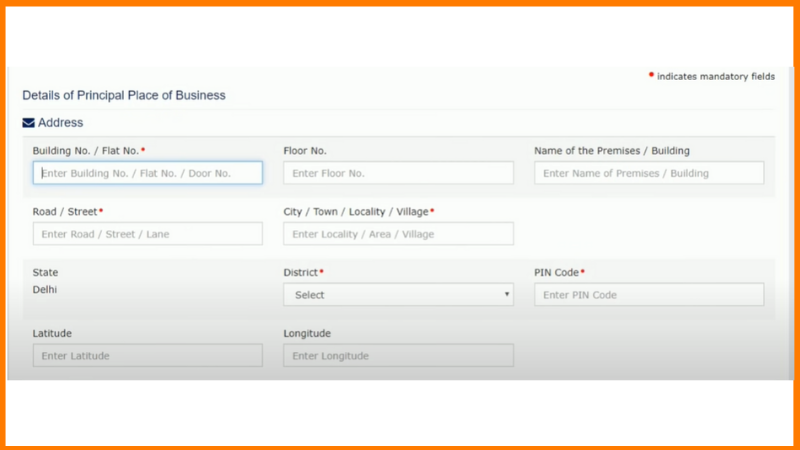

Principal Place of Business

Here, You have to add the details where your business is located, if your business is in Delhi then add the location details of your business.

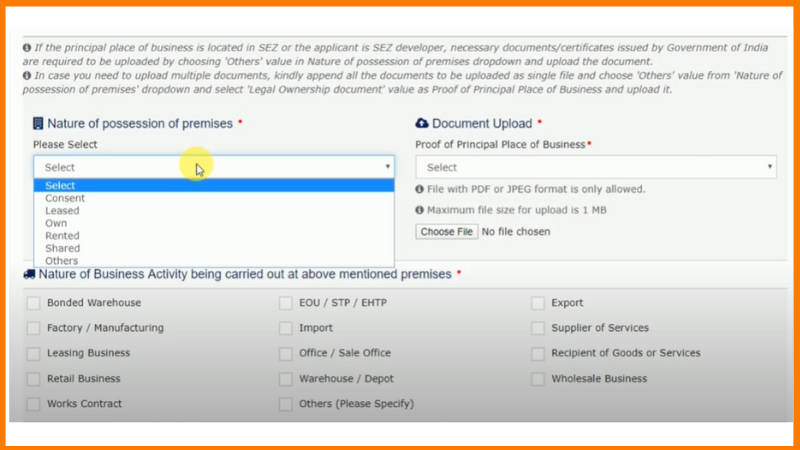

You also have to add nature of your business. Under the nature of possession of premises add the type of your business and provide the document proof of place of business. Suppose you have a Rented business so click on rented and provide the proof of rented agreement such as electricity bill.

Also add the nature of business activity and click on save and continue to proceed further.

Additional Places of Business

If you have Additional places of business you can Add it or click on continue to proceed further.

Goods And Services

Here you have to add if you are selling goods or services. If you are selling physical goods add the HSN code. (HSN is a six-digit code that classifies more than 5000 products, arranged in a legal and logical structure)

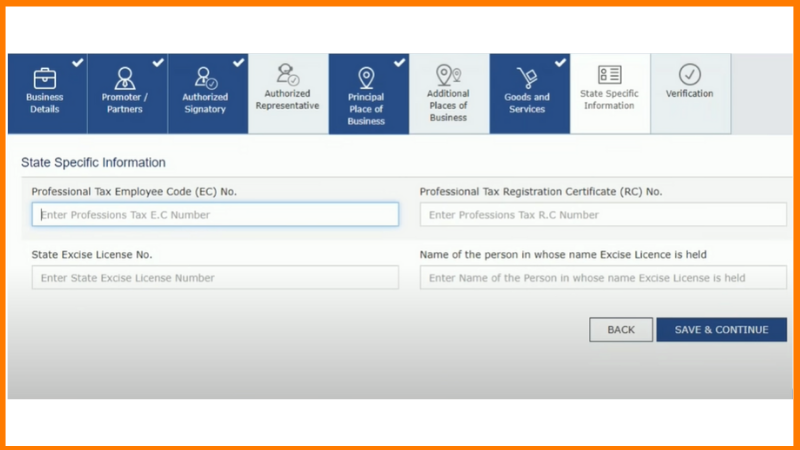

State Specific Information

Providing this information is up to you because it is not mandatory. Click on save and continue to proceed further.

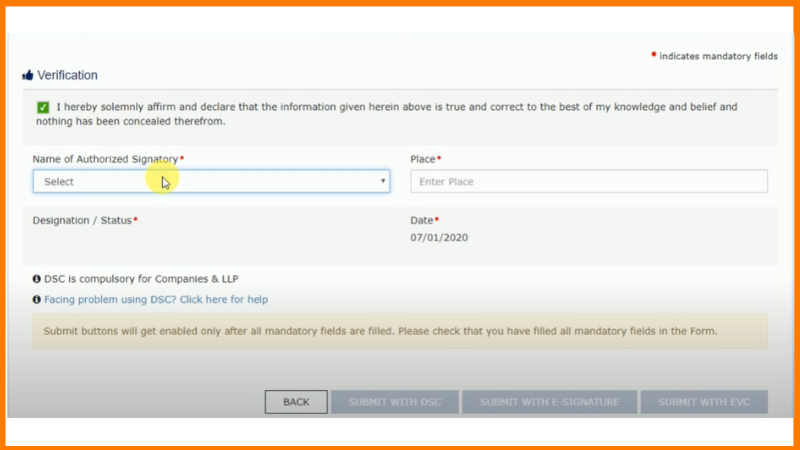

Final Verification

This is the final step of GST form. Once you fill the details you can choose to submit with EVC or DVC. If you select EVC you’ll receive same OTP on your mobile no. and email id. If you have a digital signature you can submit with DVC.

On completion, an Application Reference Number (ARN) will be generated and sent to your mobile number and email id. You can use this to track your application status (Services > Registration > Track Application).

This was the complete how to register for GST online step by step.

Frequently Asked Questions About Online GST Registration

How do I get a new GST number?

- Go to the official GST portal – https://www.gst.gov.in/ and under the services tab, choose services > Registration > New Registration.

- On the Registration page, enter all the requested details (including your PAN number), email address and mobile number.

- After entering the details, click proceed. You will receive two different OTPs on your mobile and on your email for verifying the mobile number and the email id. OTP is valid only for 10 minutes. If required, you can regenerate the OTP.

Your Temporary Reference number will be generated at the end of this process. - To use this number, either click Proceed or Services > Registration > New Registration option and select the Temporary Reference Number (TRN) radio button to login using the TRN.

- In the Temporary Reference Number (TRN) field, enter the TRN generated and enter the captcha text as shown on the screen.

- After this, you will be asked to verify OTP again. This is different from the previous OTP generated, please enter the new OTP received. The same OTP will be received on the verified mobile number and email id.

- This will take you to your “My Saved Application” page. You will have to fill in all the form details and submit them within 15 days. After this, your number and saved form will be deleted.

Is GST registration free?

The GST registration is absolutely free of cost. The registration process is entirely paperless which means that it will take place online or digitally. Registering for a GST might seem confusing but just follow our Step by Step guide on how to register for GST online easily.

Is GST applicable for online business?

It is a mandatory GST Registration for all Online Sellers. Under GST, all online sellers must register and pay GST. This means that even if you only bring in Rs 1 lakh, you must go online and get a GSTIN. In addition, you’re required to file monthly returns and pay taxes on all qualified sales.

How do I file GST online?

Registering for a GST might seem confusing but just follow our Step by Step guide on how to register for GST online easily.

- Go to the official GST portal – https://www.gst.gov.in/ and under the services tab, choose services > Registration > New Registration. You can also apply for GST online using our exclusive offer for Amazon by clicking here.

- On the Registration page, enter all the requested details (including your PAN number), email address and mobile number.

- After entering the details, click proceed. You will receive two different OTPs on your mobile and on your email for verifying the mobile number and the email id. OTP is valid only for 10 minutes. If required, you can regenerate the OTP.

Your Temporary Reference number will be generated at the end of this process. - To use this number, either click Proceed or Services > Registration > New Registration option and select the Temporary Reference Number (TRN) radio button to login using the TRN.

- In the Temporary Reference Number (TRN) field, enter the TRN generated and enter the captcha text as shown on the screen.

- After this you will be asked to verify OTP again. This is different from the previous OTP generated, please enter the new OTP received. The same OTP will be received on the verified mobile number and email id.

- This will take you to your “My Saved Application” page. You will have to fill in all the form details and submit them within 15 days. After this, your number and saved form will be deleted.

Can I sell on Amazon without GST?

Yes. if you are selling only GST exempted categories, then this may not be required. However, If you are listing taxable goods, GST details are required to sell online. You need to provide a GST number to Amazon at the time of registration.

Do I need a GST number for my small business in India?

If a seller wants to sell across India they need to register for GST. The GST is meant to replace a slew of indirect taxes with a federated tax. In the GST Regime, businesses whose turnover exceeds Rs. 40 lakhs* (Rs 10 lakhs for NE and hill states) is required to register as a normal taxable person.

What is EVC in GST?

In the GST portal, a person can authenticate the user using an OTP (One Time Password). The OTP is called the Electronic Verification Code (EVC) and a person who wants to do the user authentication using an OTP can select this method.

What are the documents required for GST registration?

To complete GST registration, you will be needing the documents like PAN, Aadhaar, business address proof, cancelled cheque, bank account statement, business registration proof or the incorporation certificate, digital signature, photograph, address proof and ID proof of the director or promoter, board resolution or letter of authorisation from the authorised signatory.