StartupTalky is thrilled to have Mr. Bhavik Vasa, Founder and CEO, of GetVantage as our guest, for a captivating discussion on critical topics. Given the growth potential of the economy, today’s discussion focuses on how GetVantage plays a crucial role in addressing the credit deficit in the SME market. A recent industry report published by GetVantage, in collaboration with Redseer, sheds light on a $500 billion credit opportunity in the SME sector.

Bhavik Vasa’s expert insights along with GetVantage’s mission to simplify venture finance will undoubtedly enhance our understanding of this ever-changing landscape. Additionally, we will explore government policies, the crucial aspect of data protection, and the hypothetical possibility of data as collateral during our conversation.

StartupTalky: Today, we have with us the Founder and CEO of GetVantage, Mr. Bhavik Vasa. Good evening Bhavik. Welcome to StartupTalky. It is a pleasure for us to have you with us today.

So, today we’ll be discussing various topics related to data protection and government policies in the context of Indian startups, in addition to the credit report published by GetVantage in collaboration with Redseer. I hope that it will be a very insightful conversation and that our audience will be highly enlightened about the market.

Bhavik Vasa: Yes, thank you. A pleasure to be here and talking and sharing insights from what vantage point we have on the growth that the Indian economy is going to be seeing.

StartupTalky: Sure, let us jump right in with my first question for you. How do you envision GetVantage’s role in addressing the credit deficit? According to a recent report, there is a potential credit deficit of 220 billion in the digitized MSME sector, with an opportunity of about 500 billion in the sector. How do you foresee GetVantage capitalizing on this market?

Bhavik Vasa: I believe the industry report we recently published further underscores an opportunity that we all recognize within the Indian economy. As of now, India boasts a $3 trillion economy. To realize the ambition of reaching a $5 trillion economy in the next five to seven years, a substantial infusion of capital is essential to fuel this growth.

India has traditionally thrived on its small businesses, and to attain the targeted GDP growth, we must foster the growth of these enterprises by facilitating access to capital. And I think that is what truly our passion and mission at GetVantage is – How do we make sure that this sector, which has always been a priority sector, gets access to capital that is more frictionless, simpler for every small business and startup out there that is growing month on month, quarter on quarter.

The only way to really do this right is by using the power of technology and data. If we can use the power of the fintech platform that we have built and the amount of real-time data we can pull on a business, we can quickly evaluate the business and create a complete journey to onboard a business, evaluate them, and get money to them as quickly as possible. That is where tech and data, along with AI and Machine Learning-driven analysis, will come into play to get access to capital that is more democratized.

StartupTalky: That is a very insightful perspective, Bhavik. Since you talked about what needs to be done, I would like to ask what GetVantage is doing to address this issue.

Bhavik Vasa: The way we put it is that a lot of fintech companies say that they’re disrupting something. We actually say we are not disrupting anything; we are simplifying venture finance. That is the simplest way I can put it. We are probably the country’s first truly digital platform, where right from the onboarding journey, to the application journey, we have simplified the process.

For years, small businesses have struggled to provide so much data and paperwork to qualify for a small business loan or financing. With our proprietary technology platform, driven by APIs and AI and ML-driven credit engines, we have created a frictionless and simple journey. Small business owners and startup founders can come online to our portal, GetVantage.co, and quickly start their process by connecting a few data points like their PAN, GST numbers, bank accounts, and real-time online platforms. From that application journey to quick evaluation, we can evaluate and disburse money to a business in 48 to 72 hours.

Our goal is to make finance paperless and funding performance-driven, making it accessible to businesses from metro cities to small Tier 2 towns. We want to ensure businesses can quickly access financing ranging from Rs 5 lakh to Rs 5 crore in just a few days by connecting their data and completing an online application with GetVantage.

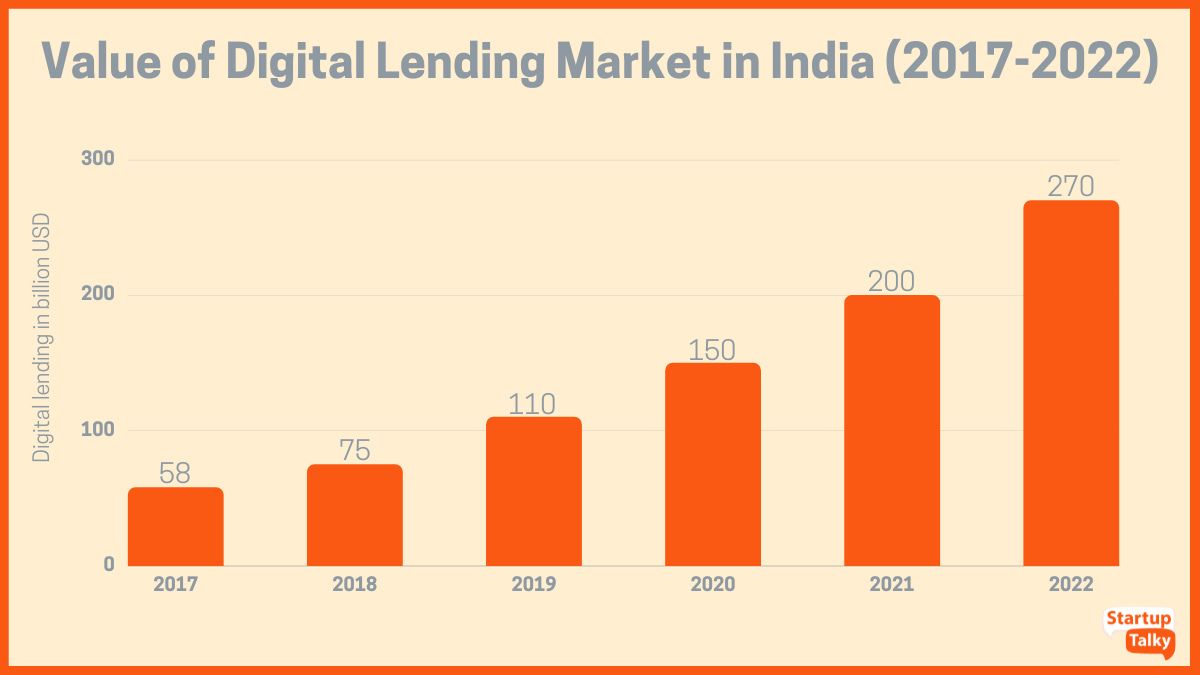

StaryupTalky: Maybe that is one of the main reasons why the concept of digital lending came into effect. Earlier, there was a lot of bureaucracy and longer processing times for traditional lending institutions to disburse loans and credit. So, definitely, the development of this sector has streamlined the process for businesses.

Bhavik Vasa: Absolutely, Sayantan. The digital lending space has transformed access to capital for businesses and made the process significantly more efficient and accessible.

StartupTalky: So, moving on to government policies, what is the government doing to facilitate the growth of lending institutions and the MSME market so that there is a smooth flow of capital?

Bhavik Vasa: The government is currently at an inflection point in terms of fostering the growth of small businesses and MSMEs. These sectors have always been a priority for lending, and the government recognizes their importance for the overall economy.

In recent budget sessions, the government has allocated substantial capital for priority sector lending and introduced corporate guarantee schemes to fuel the growth of small businesses. There is a strong awareness of the need to support these sectors to achieve the goal of becoming a $5 trillion economy. This involves identifying the importance of these sectors at the government and Finance Ministry levels, along with the active participation of industry players. The government’s efforts are aligning well with the growing importance of small businesses and startups in India, and there is a significant amount of capital earmarked for these sectors.

Now the challenge is to ensure that this capital reaches small businesses efficiently, which is the role of industry players like GetVantage. We need to innovate and leverage technology to make the entire process more seamless and provide quick access to various forms of capital.

StartupTalky: Indeed, it is a pivotal time for the government, regulatory bodies, and industry players to collaborate and ensure the smooth flow of capital to small businesses and startups.

Now, moving on to startups, they play a crucial role in the economy. How do you see the startup initiative, especially the G20 Summit, helping the growth of Indian MSMEs? Will they be endangered by foreign competition or be able to prosper more in the global market?

Bhavik Vasa: There could not be a better time to launch a new brand, business, or startup than in India right now. The market dynamics are playing out favorably for startups and small businesses.

Startups are essentially emerging brands across various sectors, and GetVantage has backed over 500 emerging brands and startups in 18 different sectors. These startups are representing the local consumption trend, and “local for local” is becoming increasingly popular. Indian consumers are opting for Indian brands, and this trend is being further boosted by equity capital and foreign investments pouring into local startups and brands.

The game is just getting started, and as we get more forms of capital into the hands of small businesses and brands, there is no stopping them from achieving their growth potential and competing effectively, whether it is against other local players or international ones.

StartupTalky: Absolutely, the support for startups and the growth of Indian brands is a promising sign for the economy. Now, let us dive into the importance of data.

Given the recent Digital Personal Data Protection Act of 2023, what measures is your company taking to ensure data protection for customers and businesses that are engaged with GetVantage?

Bhavik Vasa: Data is indeed crucial, and it is not only about data protection but also about secure access and utilization of data. Accessing data is the first step, and we start by making sure that accessing this data is seamless and secure. We aim to create a paperless and digital journey for small businesses, reducing the risk of data leaks and misuse. We follow strict security measures, including ISO standards and Infosec certifications, to ensure that data is accessed and handled securely.

Additionally, our technology platform allows us to monitor a business’s health in real-time through live connectors and APIs, adding another layer of security. This monitoring ensures that data remains secure and provides early warning signals if something goes awry. Data security and compliance are integral to our operations.

StartupTalky: It is reassuring to hear that data security is a top priority for GetVantage.

Now, let us explore the hypothetical concept of data as collateral. There already exists the practice of putting commodities in a warehouse as collateral. Now, do you see a future where businesses use their data as collateral to access credit? Also, how can such data be secured if it is used as collateral?

Bhavik Vasa: It is not a hypothetical scenario; it is happening in real time. Data is becoming a valuable collateral asset for businesses. Using technology and APIs, we access data directly from the source, ensuring there is no misrepresentation. This access to real-time data not only allows us to evaluate a business but also provides a live monitoring system throughout the financing tenure. It acts like an ECG for the business, giving us insights into its health and performance. This new form of collateral, live data monitoring, de-risks the lending model significantly and represents the real-time health of the business. It is a secure way to provide financing while continuously monitoring the business’s performance.

StartupTalky: That is indeed an innovative approach to collateral, utilizing real-time data to assess and monitor a business’s health. Bhavik, it has been really a highly informative and insightful conversation. Our audience will certainly gain a better understanding of the market and the role of GetVantage in it.

Bhavik Vasa: Thank you, Sayantan. It has been a pleasure discussing these important topics with you.