This article has been contributed by Gaurav Lekhrajani, CEO and Co-Founder of DavaNinja.

India is about to experience a demographic change that will reshape its consumers for decades to come. The talk of India’s growth story has centered on its youth dividend, while a quieter, but equally seismic, phenomenon is quietly emerging: the rapid rise of India’s senior citizen population. By 2050, there will be nearly one in five Indians over the age of 60 (more than 300 million). This increase is more than a figure – it points to a huge, untouched market called the Silver Economy. Earlier generations of retirees relied almost exclusively on extended family for care and support. Today’s and tomorrow’s retirees are living longer, more independent lives. Many have higher amounts of discretionary or spending power, with different aspirations and without as many dependent needs to care for. Still, the products, services, and solutions available to seniors remain very limited. The imbalance between need and availability represents an opportunity for startups to come in and innovate, disrupt, and capture a market that will only become more important with age.

The Demographic Boom: A Market Service

India’s elderly population is not a monolithic population. The India Ageing Report 2023, prepared by UNFPA, predicts that by 2050, the elderly population will represent close to 21% of the population, with the oldest 80+ age cohort growing fastest. Within this cohort are many different realities: urban and rural, rich and poor, dependent and independent seniors. The Longitudinal Ageing Study in India (LASI) survey of over 72,000 adults highlighted just how many differences in their health, financial, and social situations. To startups, this diversity illustrates, once again, the importance of segmentation – think about solutions that recognize aging and why people are experiencing it differently, and factors in income, family support systems, and where the person lives. The scale of demand is obvious, but so are the nuances.

A Market of Unmet Demand

There is a significant unmet demand gap in the area of senior living and care. In developed markets, the ecosystem of retirement communities, assisted living and care ecosystems, and more specialized health care delivery is vibrant. The Indian eco-system for senior living is really just beginning. Industry estimates have the senior housing market, currently at approximately $2–3 billion value, growing four times, to hit $12 billion by 2030. However, supply continues to lag demand for options in middle-market models that balance affordability and service quality. Care services like home health care, geriatric rehabilitation, and chronic disease management services will all also experience double-digit growth opportunities. This growth pathway signals to startups clearly that they can provide solutions to serve the everyday needs of India’s elderly community.

Healthtech: From Episodic Care to Continuous Care

The health of India’s seniors is an urgent problem. Research from LASI shows that many more of our elderly experience undiagnosed chronic diseases like diabetes and hypertension and that more broadly, chronic illness rates remain high with conditions like anaemia inflicting large swathes of the elderly population. Tele-consultation startups are likely to overlook the more severe plight of our seniors; our elderly need longitudinal care that is continuous and ideally encompasses proactive screening, remote physiological monitoring, medication adherence, and caregiver follow-up. The field of healthtech seniors will need remote-patient monitoring devices, vernacular health coaching, and family caregiver dashboards that offer great opportunities for innovation and growth potential.

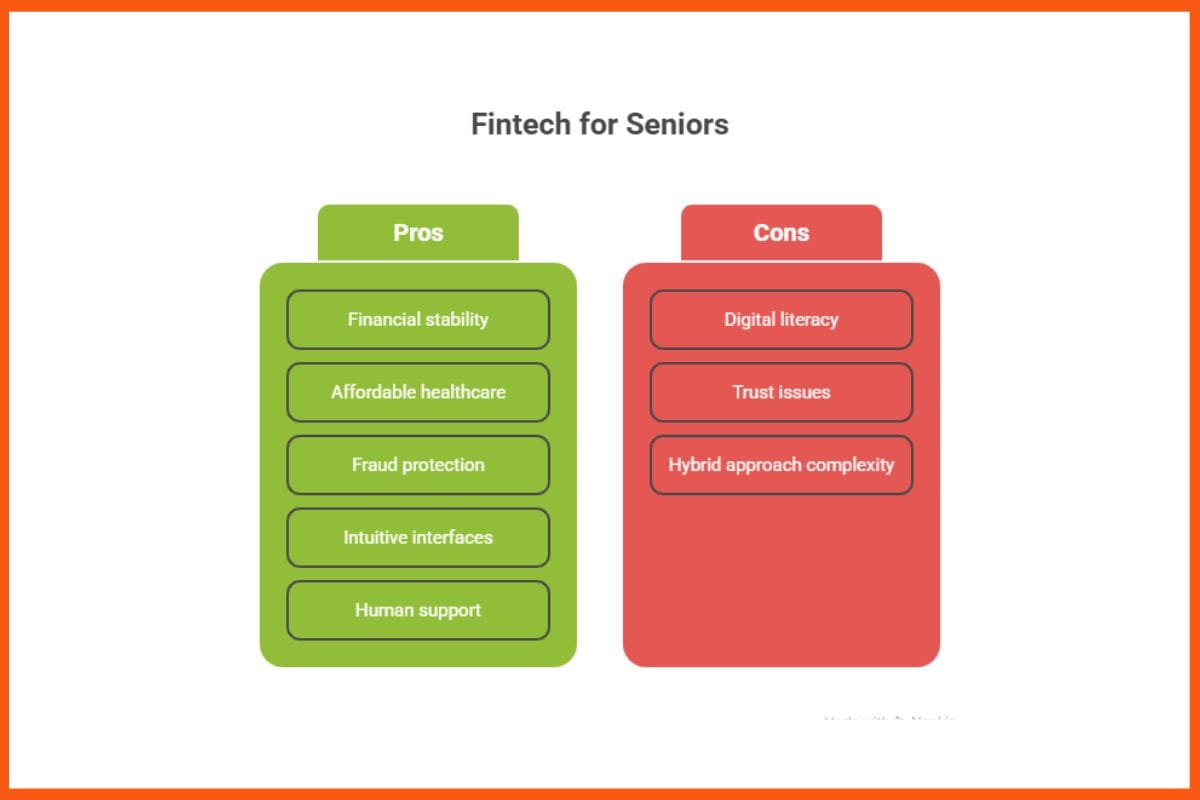

Seniors’ Financial Security and the Case for Seniors Focused Fintech

The personal finance dimensions of older Indians are equally complicated. Some retirees enjoy the stability of a pension or savings but the majority exist and live their life on the cusp of financial insecurity, especially with healthcare costs rising and life expectancy lengthening. There is an opening for fintech products that focus on safetytech (not feartech), simplicity, and trust. Products designed specifically for seniors could range from income smoothing (annuity) products to affordably priced (short-term) health insurance, to safe (that is, fraud-proof) digital payments, and bank accounts with built-in fraudulent monitoring linked to a caregiver. Due to clear digital literacy and adoption issues among seniors, fintech solutions targeting seniors will need intuitive (preferably voice-first) interfaces with assisted journeys, touchpoints, or hybrid approaches that marry digital convenience (access and control) with the support of human-assisted.

Loneliness: The Silent Epidemic

Beyond the financial and medical realities lies a more personal challenge—loneliness. This is an opportunity for startups to reinvent their models to solve for confidence and companionship. The answer could be curated social pods, volunteering opportunities, inter-generational programming, or digital platforms that connect seniors through shared common interests. Chances are the solution will combine a tech-enabled approach with personal and in-person contact and make sure that older adults are not only healthy, but socially and emotionally connected.

Design with Dignity at the Forefront

As startups seek to innovate for older adults, the biggest thing they must commit to is dignity. Products and services with empathy, simplicity, and respect must characterize our lives. This means user interfaces that use larger fonts and high contrast colors, pricing that is transparent and comprehensible, wrapped up in features that are caregiver-friendly, and they should be intuitive, not intimidating. The goal is to move seniors to feel empowered rather than patronized so seniors feel comfortable, have their independence, and can have enhanced lives through technology and innovation.

India’s silver economy is not a fad, but a transformation that will not go away in the short or even medium term; it will grow as longevity increases, and family structure continues to evolve. The market is massive, the needs are acute, and the gaps are glaring. Startups that move quickly- thoughtfully segmenting, innovating with dignity, and demonstrating impact- will create category-defining businesses and be in the position to not only support this important demographic, but help solve one of the biggest social transitions of our time.

As we developed DavaNinja, we deliberately included the voices of India’s seniors in product decisions – an important user group with specific health needs, not as an afterthought. The app is built around the vision to convert fragmented health and social care into a continuous support system and help seniors to receive care with dignity: easy-to-read interfaces to care for low-digital literacy users, ordering renewals and easy delivery to your doorstep removed daily access barriers. For digital solutions to truly succeed in the silver economy, they must be designed with seniors in mind – using larger fonts, high-contrast visuals, and simplified navigation – so that ease of use becomes a gateway to adoption rather than a barrier.

Everything we have built is based on one guiding principle: health solutions for seniors must maintain independence and dignity. Trust remains the cornerstone of adoption in the silver economy. Seniors and their families often look for services that don’t just deliver a product but provide step-by-step support, reassurance, and a human touch throughout the process. This is the reason we have married technology with human touch- so that older adults have access to continuity of care, preventive health advice, and convenience in their everyday lives and live life more healthily and confidently.

More so, families abroad are increasingly seeking reliable, tech-enabled ways to care for their parents. NRIs living out of the country can use the app and access and order medicines for their elderly parents in Mumbai.