FirstCry is a multi-channel retailer that has a wide variety of items for mothers, children, and infants. With a wide range of products including diapers, feeding, skincare, toys, apparel, footwear, and more, FirstCry.com was born out of a desire to help the millions of Indian parents who struggle to find high-quality baby care items. Diapering, feeding and nursing, skin and health care, toys, clothing, footwear, fashion accessories, and an array of other product categories are all contributors to Firstcry’s success story.

About FirstCry

In 2010, Supam Maheshwari and Amitava Saha founded FirstCry, an innovative online store that specializes in baby care items. For parents in particular, the site opened a new era of internet buying. Thanks to its hardworking staff, FirstCry has grown significantly, overcoming obstacles, and has raised significant capital.

There is a wide variety of high-quality products available at FirstCry.com, thanks to their extensive inventory of 90,000 products from 1,200 foreign and Indian companies. With its headquarters located in Pune, the company’s mission is to provide all parents with easy access to parenting needs by providing an outstanding online shopping experience that includes affordable prices, dependable delivery services, and responsive customer support.

FirstCry Business Model

One of the ways that FirstCry conducts its business is through a hybrid approach that blends online and offline locations. In addition to its extensive presence on the Internet, the company operates more than 400 retail locations in India, including 350 franchise stores. Additionally, FirstCry has a one-of-a-kind program in which it sends out a “FirstCry Box” to more than seventy thousand mothers and fathers every single month. The purpose of this campaign is to deliver gift boxes to new parents in 6,000 hospitals around the country as a way of expressing congratulations on the birth of their kid. The present consists of necessities like diapers, baby lotion, and baby oil, all of which are manufactured by well-known companies like Mamy Poko and Libero respectively. For the time being, FirstCry has been able to communicate with millions of parents in India through this endeavor. The promotion of FirstCry is carried out through various social media outlets. Initially, FirstCry began to incorporate retailers into its platform and made it possible for local businesses to put their products for sale on the Internet.

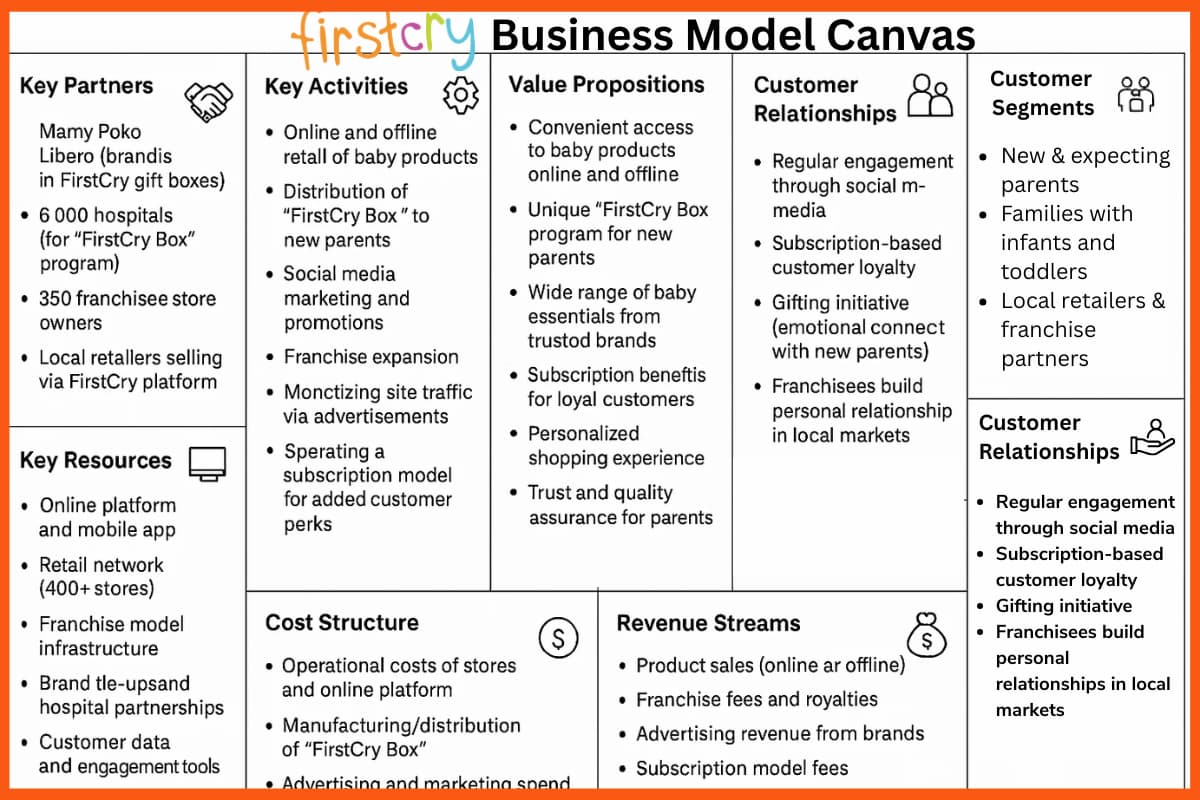

FirstCry Business Model Canvas

FirstCry follows a unique hybrid business model that combines online sales with a strong offline presence through franchise stores and innovative outreach programs.

Here is the Business Model Canvas of FirstCry:

1. Key Partners

- Mamy Poko, Libero (brands in FirstCry gift boxes)

- 6,000 hospitals (for “FirstCry Box” program)

- Franchise store owners (350 franchisees)

- Local retailers selling via the FirstCry platform

2. Key Activities

- Online and offline retail of baby products

- Distribution of “FirstCry Box” to new parents

- Social media marketing and promotions

- Franchise expansion

- Monetizing site traffic via advertisements

- Operating a subscription model for added customer perks

3. Key Resources

- Online platform and mobile app

- Retail network (400+ stores)

- Franchise model infrastructure

- Brand tie-ups and hospital partnerships

- Customer data and engagement tools

4. Value Propositions

- Convenient access to baby products online and offline

- Unique “FirstCry Box” program for new parents

- Wide range of baby essentials from trusted brands

- Subscription benefits for loyal customers

- Personalized shopping experience

- Trust and quality assurance for parents

5. Customer Relationships

- Regular engagement through social media

- Subscription-based customer loyalty

- Gifting initiative (emotional connect with new parents)

- Franchisees build personal relationships in local markets

6. Channels

- FirstCry website and mobile app

- Physical retail stores and franchises

- Social media platforms

- Hospitals via gift box distribution

7. Customer Segments

- New and expecting parents

- Families with infants and toddlers

- Local retailers and franchise partners

8. Cost Structure

- Operational costs of stores and the online platform

- Manufacturing/distribution of “FirstCry Box”

- Advertising and marketing spend

- Franchise management and support

9. Revenue Streams

- Product sales (online and offline)

- Franchise fees and royalties

- Advertising revenue from brands

- Subscription model fees

How FirstCry Makes Money

FirstCry Financials

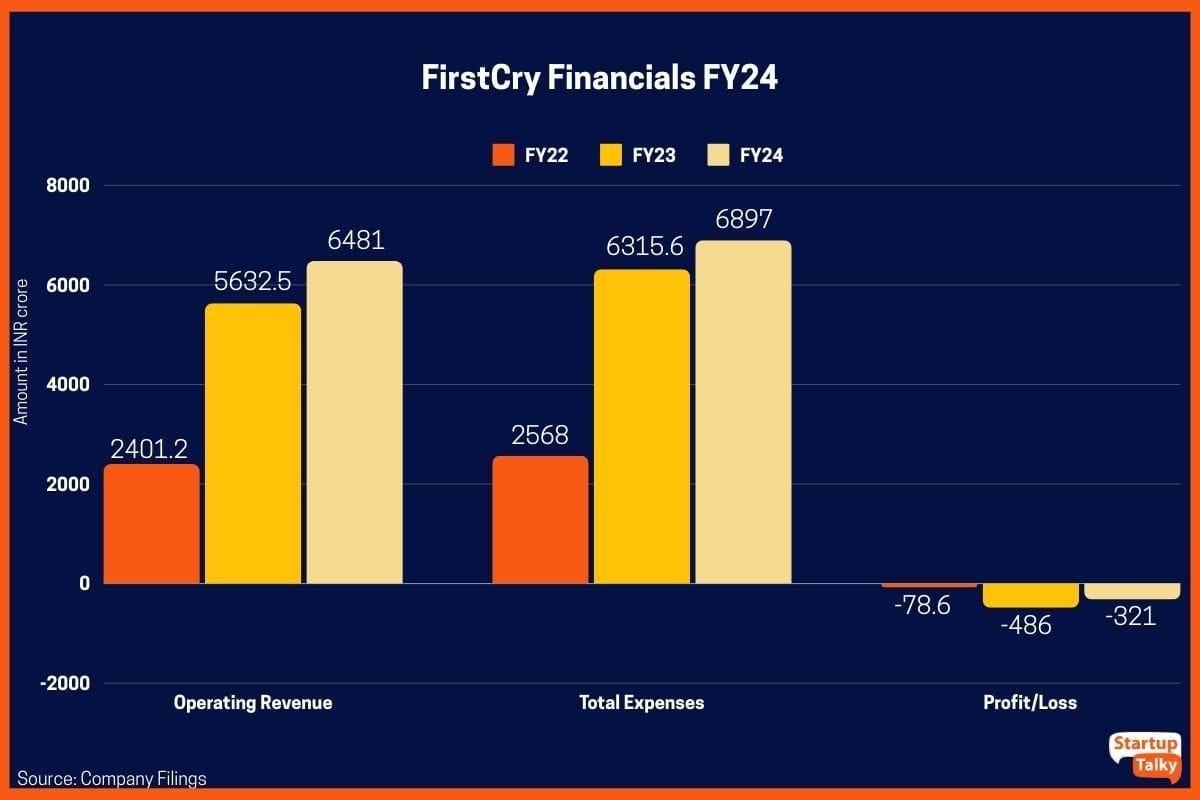

| Particulars | FY24 | FY23 |

|---|---|---|

| Revenue | INR 6,575.1 crore | INR 5,731.3 crore |

| Expenses | INR 6,896.6 crore | INR 6,315.7 crore |

| Profit/Loss for the year | INR -321.5 crore | INR -486.1 crore |

FirstCry saw a 15% increase in total revenue in FY24 over FY23, driven by stronger operating revenue. FY24, the company’s operating revenue significantly increased to INR 6481 crore as opposed to the lower INR 5632.5 crore in FY23. However, total expenses also rose to INR 6897 crore in FY24, which is higher than the previous INR 6315 crore in FY23. Thanks to steady growth and managed expenses, FirstCry reduced its losses by 34% in FY24, bringing them down to INR 321 crore from INR 486 crore in FY23.

FirstCry Revenue FY24

| Revenue Type | FY24 | FY23 |

|---|---|---|

| Revenue from operations | INR 6,480.9 crore | INR 5,632.5 crore |

| Other income | INR 94.2 crore | INR 98.7 crore |

| Total Revenue | INR 6,575.1 crore | INR 5,731.3 crore |

BrainBees Solutions, the parent company of FirstCry, reported a 47.4% reduction in quarterly losses to INR 62.8 crore in Q2 FY25, driven by 26.4% growth in revenue, which reached INR 1,936 crore. Since its stock market debut at INR 446, the company’s share price has climbed to INR 519.8, with a market capitalization of INR 26,987 crore.

Through the use of a defined franchise model, the corporation can increase the amount of money it generates. Additionally, FirstCry produces revenue through advertisements that are displayed on its website. To accomplish this, the company charges brands a fee for advertisements. Apart from that, the company also runs a subscription model which provides additional benefits to its subscribers.

The Supam Maheshwari-led firm flourished from the financials of the fiscal year 2021 onward, even though the company’s revenue undoubtedly increased yearly. This kids’ marketplace managed to generate a profit of INR 215.94 crore in April 2022. This is in contrast to the loss of INR 190.8 crore that the company had during the same period in the previous year. The total amount of the company’s consolidated revenues increased to INR 1740 crore this year, representing a boost of 141.3%.

USP of FirstCry

In light of the fact that the Indian market for these items was so severely restricted, one could claim that FirstCry was the first company to cross the gap, and they accomplished so in a remarkable manner. Now, the brand has practically become synonymous with the market sector for baby-brand products, and it is one of the largest players in the industry that offers such an elite service for parents and their children. The combined online and offline approach that they used captured the market and satisfied the demands of customers by catering to their requirements in a manner that was both convenient and guaranteed to be of high quality.

The corporation has been able to eliminate all direct forms of rivalry in this particular market area as a result of this strategy; nevertheless, this does not mean that they do not face competitors regularly. Even though FirstCry is still a very young firm, it has managed to establish a strong presence in both the online and offline spheres.

FirstCry SWOT Analysis

FirstCry Strength

- It is one of the biggest online marketplaces for children’s and infant goods in Asia.

- There are over 90,000 goods from over 1,200 brands.

- Its subscription offerings are an excellent method of keeping customers coming back.

- Customer acquisition is aided by concepts such as the “gift boxes” that it distributes to new moms in partnership with hospitals.

FirstCry Weakness

- Its potential size is constrained by its serving a particular group of people.

- In a world where giants of online shopping like Amazon and Flipkart run aggressive marketing campaigns, depending too much on word-of-mouth publicity might backfire.

FirstCry Opportunities

- It can opt to explore international markets to expand its reach further.

- Exploring new product lines, including those for the home, accessories for sports, etc.

FirstCry Threats

- Mom and Me and other brick-and-mortar retailers pose a threat. Mom and Me’s parent company, Mahindra Group, has bought out BabyOye, a competitor.

- Investors such as Helion Venture Partners and Velos Capital Partners are putting money into online competitors like BabyOye and Hopscotch.

Conclusion

Due to its well-known reputation, FirstCry is the undisputed leader in the infant care industry. Although it faces competition from online platforms such as Amazon and Myntra, its traditional stores also have to deal with local sellers. The diverse offers and strong brand presence of FirstCry enable it to overcome these obstacles and stand out in the industry.

FAQs

What is FirstCry?

FirstCry, established in 2010 and headquartered in Pune, is a prominent Indian eCommerce company specializing in baby products retailing.

Who are the owners of FirstCry?

Supam Maheshwari and Amitava Saha founded FirstCry in 2010.

What are the strengths of FirsCry?

The strengths of FirstCry are it is the top kids’ marketplace in Asia, has 90,000+ kids products from 1,200+ brands, its subscription offerings boost customer loyalty, and the gift boxes for new moms drive strong customer acquisition.

What is the business model of FirstCry?

FirstCry follows an omnichannel business model, combining online sales with over 400 offline stores (mostly franchises). It earns revenue through product sales, franchise fees, advertising, and a subscription model, while also promoting its brand via the “FirstCry Box” program for new parents in hospitals.

Who are FirstCry competitors in India?

FirstCry’s main competitors include Hopscotch, Mamaearth, and Amazon in the baby products space. These brands compete in categories like baby care, clothing, toys, and maternity products, both online and offline.

Is FirstCry profitable?

No, FirstCry is not yet profitable.

What is the Firstcry franchise cost?

The cost to open a FirstCry franchise in India typically ranges from INR 20 to INR 50 lakhs, depending on the store size and location. This includes a franchise fee of INR 2–5 lakhs, setup and interiors (INR 8–15 lakhs), and initial inventory (INR 8–20 lakhs). The store space required is around 1,000–2,000 sq ft, and FirstCry usually charges a 5–10% royalty on sales. The franchise agreement is valid for 5 years, with the option to renew.