A few years ago, selling online in India meant figuring out Amazon or Flipkart and hoping for the best. Today, things look very different. Small businesses, local shopkeepers, even individual resellers now have dozens of platforms to choose from; some built for specific niches like fashion or electronics, others open to just about everything.

That variety is both exciting and overwhelming. A platform that works for one seller may not be right for another. Fees, the kind of buyers you want to reach, and even the delivery network can decide whether your online shop struggles or takes off.

This article walks you through the most reliable online selling platforms in India right now, explains what each one is best at, and gives you a few tips on how to pick the one that fits your products.

How to Choose the Right Online Selling Platform?

Where to Sell Online in India: List of the Best Platforms for Business Growth

How to Choose the Right Online Selling Platform?

Searching the right online marketplace is a crucial step because it can make or break your business growth. Each platform comes with its key features, so the ultimate decision depends on what you sell, who your buyer is, and how much you are ready to invest.

- Know your requirements: If you are an individual creator or a new brand, choose a marketplace that aligns with your long-term goals and provides the right tools to scale.

- Check the costs: Every platform has its own fee model. Factor in listing fees, commissions, logistics costs, and hidden charges before you commit.

- Match your products: Choose your marketplace wisely because it should be a natural fit for what you sell. For example, handcrafted items perform best on Etsy, while baby products are a better choice for FirstCry.

Where to Sell Online in India: List of the Best Platforms for Business Growth

| Platform | Best For | Key Benefits | Customer Base / Reach | Fees & Policies |

|---|---|---|---|---|

| Amazon India | All categories (electronics, fashion, etc.) | FBA logistics, Seller Central tools, secure payments, wide trust factor | ~76% of Indian shoppers | Transparent pricing, weekly payouts |

| Flipkart | Fashion, electronics, home appliances | Free product listings, COD/UPI support, wide marketplace | 400M+ registered users | Commission-based |

| eBay | Resale, collectibles, second-hand items | Global reach, auction listings, Global Shipping Program | Buyers in 180+ countries, 1.7B+ listings | Listing + commission fees |

| Myntra | Fashion, lifestyle, beauty | Niche-focused audience, seller control, dedicated customer support | 60M+ active users | Commission-based, category-specific |

| Meesho | Small businesses, resellers, budget items | Zero commission, no penalties, smart recommendations | 140M+ (14 crore+) Indian customers | Zero commission (except ads GSTIN req.) |

| Nykaa | Beauty, wellness, cosmetics, fashion | Targeted beauty-focused buyers, influencer marketing, logistics support | Loyal beauty/wellness audience | Commission + logistics charges |

| Facebook Marketplace | General products, testing new products | Easy mobile setup, AI-driven recommendations, Messenger chats, ad support | 2.7B global users, growing in India | No listing fee (ads are paid) |

| FirstCry | Baby, kids, maternity products | Targeted parent audience, large child/maternity catalog | India’s biggest baby products base | Commission-based |

| WhatsApp (Biz + API) | Small sellers, D2C brands, direct engagement | Free app with catalog, API for automation, CRM/chatbot integration, bulk messages | 500M+ users in India (2B+ global) | Free app; API is paid |

| AJIO | Fashion, accessories, home, beauty | Reliance network reach, easy interface, affordable to luxury range | 10M+ customers | Commission-based |

Amazon India

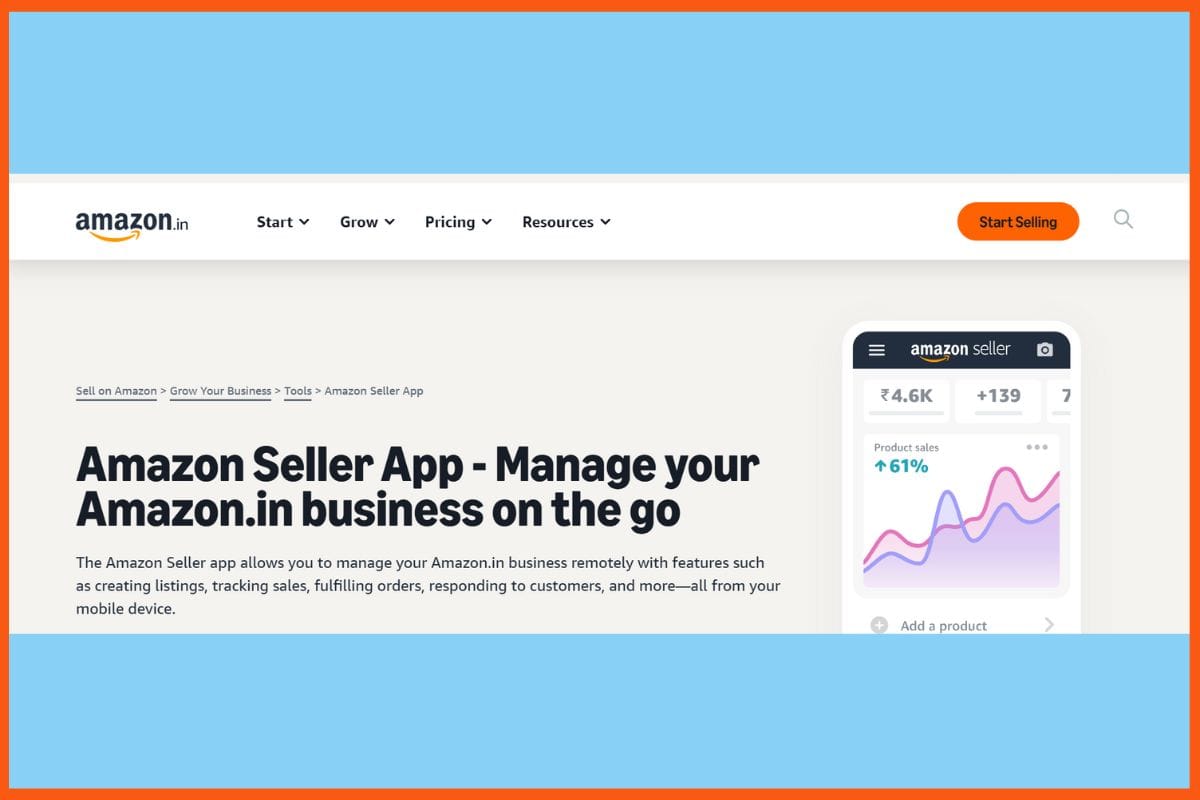

Amazon is still the biggest name in Indian e-commerce, which is trusted by around 76% of shoppers. Amazon India holds the top-most preferred online marketplace, trusted by approx 76% of shoppers. Beyond its reach, the real value lies in how easy it makes selling online.

- Amazon Seller App: Useful for managing orders, pricing, and customer queries.

- Amazon Seller Central: A dashboard to list products, track inventory, advertise, and access support.

- Fulfillment by Amazon (FBA): Store products in Amazon warehouses while handling packaging, shipping, and delivery.

- Transparent Pricing & Secure Payments: Clearly defined fees and payouts directly to your bank every 7 days, including Cash-on-Delivery orders.

Additionally, other advantages include inventory management, real-time sales tracking, customer feedback monitoring, and access to exclusive seller programs.

Flipkart

Flipkart is also popular for being India’s second-largest online marketplace with a huge customer base of over 400 million registered users. It offers more than 150 million products across 80+ categories, making it an ideal platform for fashion, electronics, and home appliances.

Benefits of selling on Flipkart:

- List your products without paying any extra charge.

- Reach millions of shoppers across India instantly.

- Offer convenience to buyers with COD, UPI, cards, and wallets.

eBay

eBay is one of the original giants of online marketplaces and is still a favorite for resellers worldwide. From vintage collectibles to second-hand electronics, eBay gives sellers access to 1.7 billion+ active listings and buyers across 180+ countries. It’s the perfect platform whether you’re a casual seller or building a global resale business.

Benefits of selling on eBay:

- Global reach: Sell across international markets with ease.

- Auction-style listings: Stand out with competitive bidding and higher chances of profit.

- Global Shipping Program: eBay handles international shipping, making cross-border selling hassle-free.

Myntra

Myntra is one of India’s top destinations for fashion and lifestyle, specializing in clothing, activewear, kids’ products, home & living, and beauty. Myntra has up to 60 million active users, making it a powerful channel for sellers in the fashion space.

Benefits of selling on Myntra:

- Full control over product listings and inventory management.

- Dedicated customer service to handle buyer queries and returns.

- Niche-focused audience, ensuring higher conversions for fashion and lifestyle brands.

Meesho

Meesho has quickly grown into India’s largest online reselling and shopping platform, attracting over 14 crore+ customers across the country. With 700+ categories, it’s a favorite among small businesses and first-time sellers looking to start with zero upfront costs.

Benefits of selling on Meesho:

- Zero commission fees: Keep 100% of your profits.

- No penalty charges: Seller-friendly policies with minimal risk.

- Smart recommendations: Product and price suggestions to boost growth.

To advertise on Meesho, sellers must provide a valid GSTIN. With its low entry barriers and huge customer base, Meesho is one of the best platforms for new entrepreneurs to begin selling online.

Nykaa

Nykaa is a leading marketplace for beauty, cosmetics, wellness, and fashion, with a strong online presence and 100+ offline stores across India. It has become a trusted brand for premium and affordable beauty products, attracting a loyal customer base that values quality and variety.

Benefits of selling on Nykaa:

- Targeted customer base with a strong focus on beauty and wellness.

- Marketing & promotions through influencer collaborations and campaigns.

- End-to-end logistics, including warehousing, packaging, and shipping support.

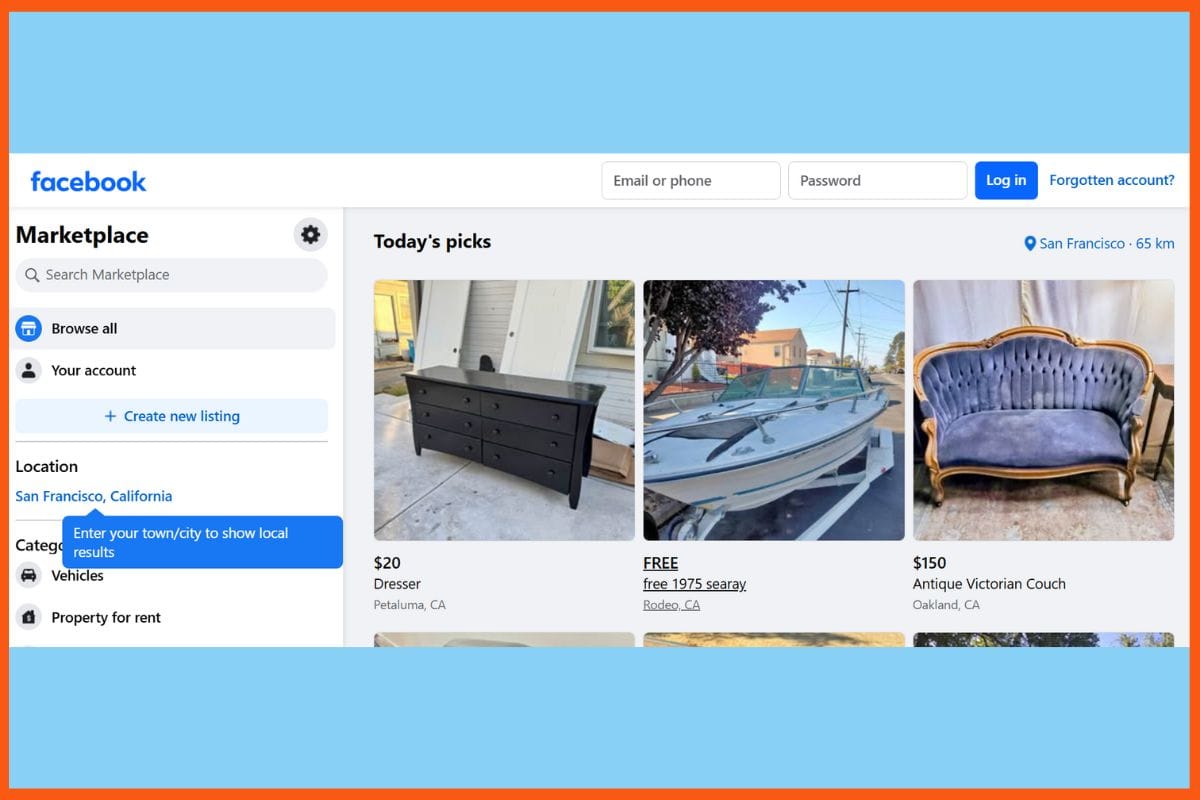

Facebook Marketplace

Facebook Marketplace offers one of the biggest opportunities to sell products online, with 2.7 billion monthly users worldwide. In India, its popularity is growing fast, thanks to its ease of use and integration with social networks.

Benefits of selling on Facebook Marketplace:

- Mobile-friendly and easy to use for both buyers and sellers.

- Personalized shopping experience with AI-driven recommendations.

- Direct communication with customers via Messenger.

- Test new products quickly without heavy investment.

- Targeted ad support through Facebook’s powerful algorithm.

Anyone 18 years and above can shop or sell here, and sellers can list almost anything since there are fewer restrictions compared to other platforms.

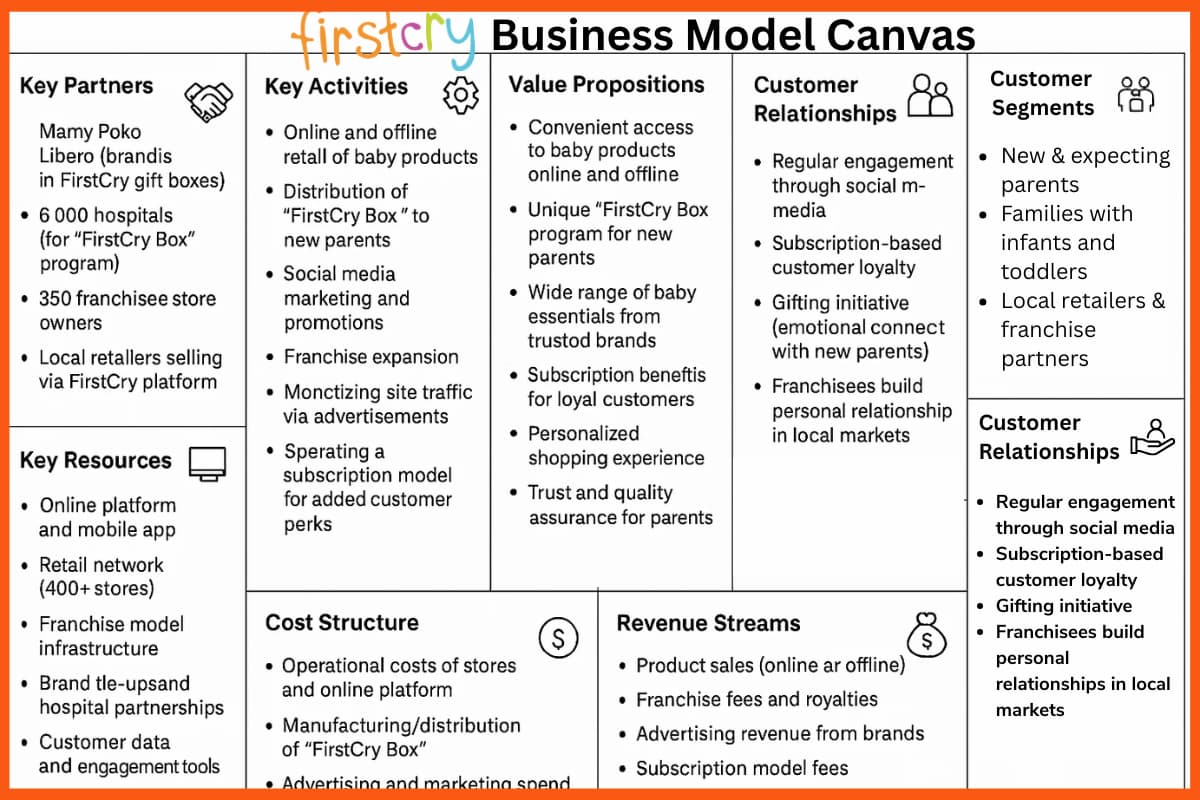

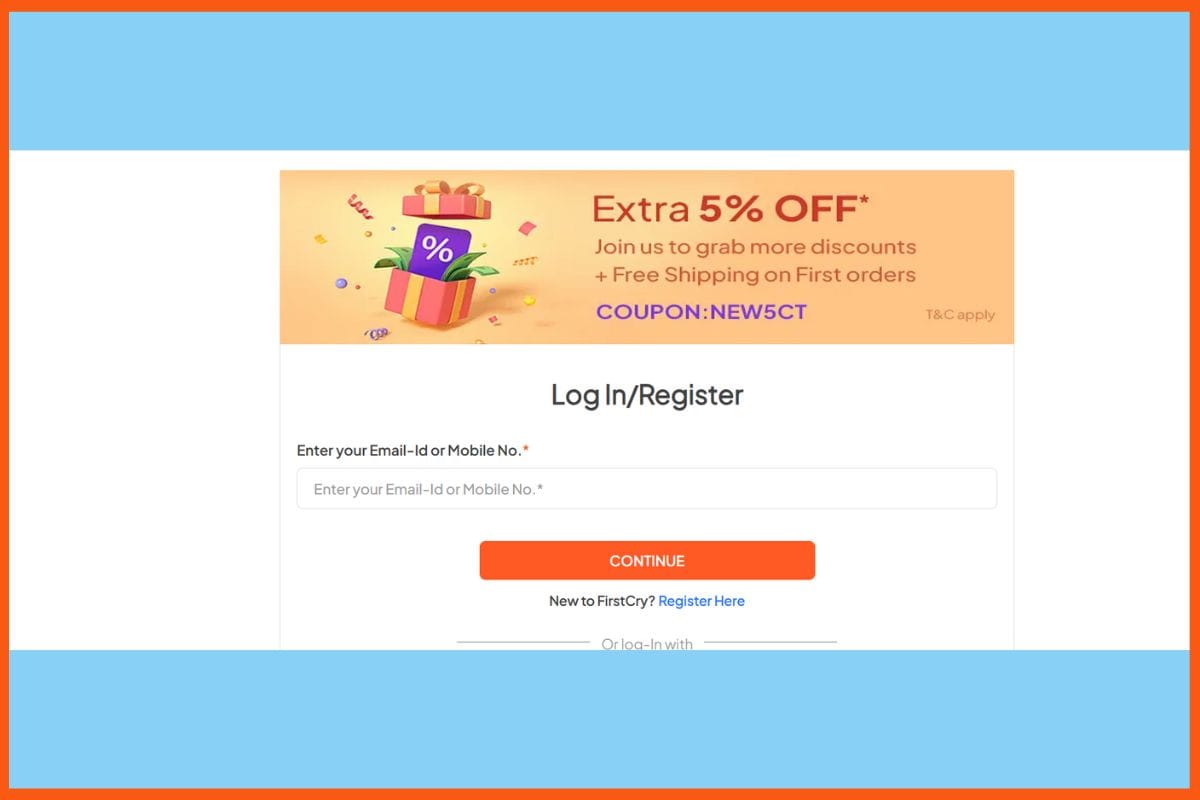

FirstCry

FirstCry is India’s largest online marketplace dedicated to newborns, babies, and kids. It caters specifically to parents looking for trusted products for their little ones. From baby essentials to kids’ fashion, toys, and maternity needs, FirstCry provides sellers with a highly targeted audience already searching for child-focused products.

Benefits of selling on FirstCry:

- Reach parents and families actively shopping for baby and kids’ items.

- Sell clothes, footwear, toys, diapers, maternity essentials, and more.

- India’s biggest platform for child and maternity categories.

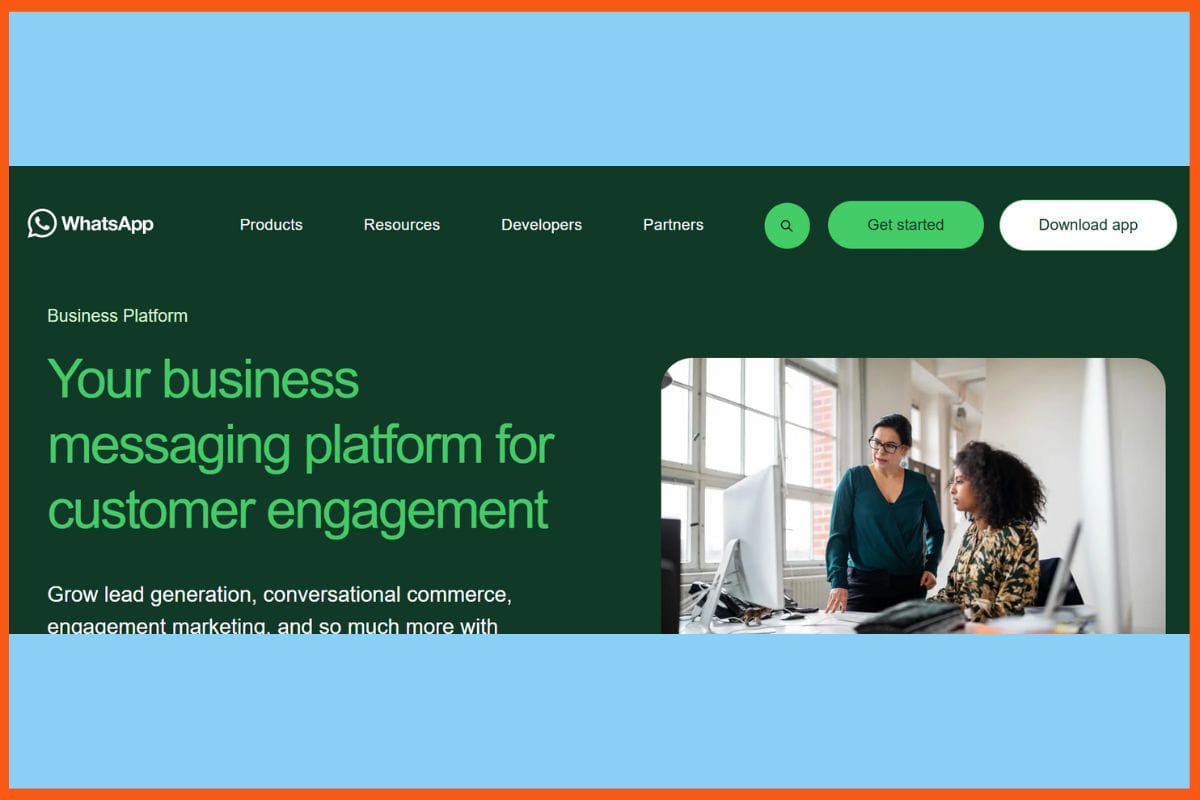

WhatsApp (Business + API)

WhatsApp has become a powerful sales channel for businesses of all sizes. It offers a direct, mobile-first, and personal way to engage customers and drive sales.

WhatsApp Business App (Free):

- Set up a profile & product catalog

- Use quick replies, labels, and auto-replies

- Best for small businesses and solo sellers

WhatsApp Business API (Paid):

- Automate order updates & customer support

- Send bulk offers and marketing broadcasts

- Integrate with CRMs and chatbots for scale

From product inquiries to purchases, everything happens in chat, making WhatsApp one of the most affordable, high-engagement marketplaces today.

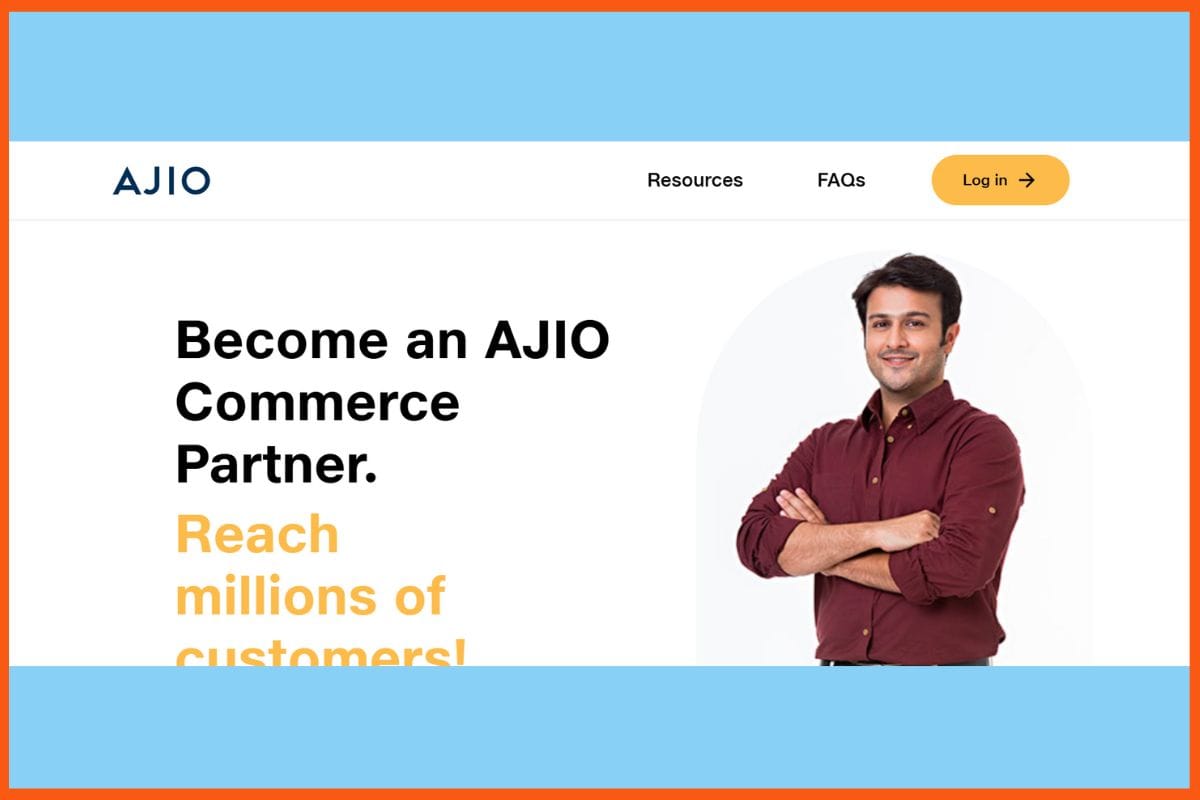

AJIO

Ajio is one of India’s fastest-growing online retail platforms, which includes fashion, accessories, beauty, footwear, and home essentials. With access to 10M+ customers through the Reliance network, it gives sellers a strong competitive edge.

Benefits of selling on Ajio:

- Wide reach powered by Reliance’s ecosystem.

- Easy listing & order management with a user-friendly interface.

- A diverse product range from affordable styles to premium and luxury brands.

Conclusion

In a nutshell, it is better to say that the purpose of every online platform serves different needs. Some of these online platforms will work best if you are selling fashion or beauty, while others are better for electronics or home products. Moreover, you need to stay updated and adapt quickly, you will always have an advantage. So, whether you are planning to go digital or already selling and want to scale up, the right platform can make things a lot smoother and help you reach more customers without too much hassle.

FAQs

What are some Top Online Selling Platforms in India?

Some Top Online Selling Platforms in India are:

- Amazon India

- Flipkart

- eBay

- Myntra

- Meesho

- Nykaa

- Facebook Marketplace

- FirstCry

- WhatsApp (Business + API)

- AJIO

How do I choose the right platform to sell products online in India?

You should consider factors like what you sell (fashion, electronics, beauty, etc.), your target audience, the platform’s fees, delivery options, and the tools provided for sellers.

Is it possible to sell internationally from India using these platforms?

Yes, some platforms allow Indian sellers to reach international buyers.