In today’s world, almost all educators, majorly in developing nations, work on improving the quality of education via various means like infrastructure expansion, digital & innovative Edtech developments & partnerships, different facilities & faculties, etc. But with quality, the price point of education also increases. Due to this price point, only children from wealthy families can access this education. These wealth backed children would anyway get exposure and access to quality education facilities, even outside local schooling. But what about the children at the bottom of the pyramid? They constitute the mass of the population in a developing nation! Due to the price point, this mass does not get access to quality education. To cater to this audience, Rohit Gajbhiye, Naveesh Reddy, Sunit Gajbhiye and Debi Prasad Baral launched Financepeer in 2017.

It is only when this mass has access to Quality Education, will there be a real impact of education on society! This is Financepeer’s firm belief and area of operation.

| Startup Name | Financepeer |

|---|---|

| Headquarter | Mumbai |

| Sector | Fintech |

| Founders | Rohit Gajbhiye |

| Founded | 2017 |

| Website | financepeer.com |

Financepeer – About and how it works

Financepeer – Founders and Team

Financepeer – How did it start?

Financepeer – Startup Launch

Financepeer – Business Model and Revenue Model

Financepeer – Competitors

Financepeer – Advisors and Mentors

Financepeer – Growth

Financepeer – About and how it works

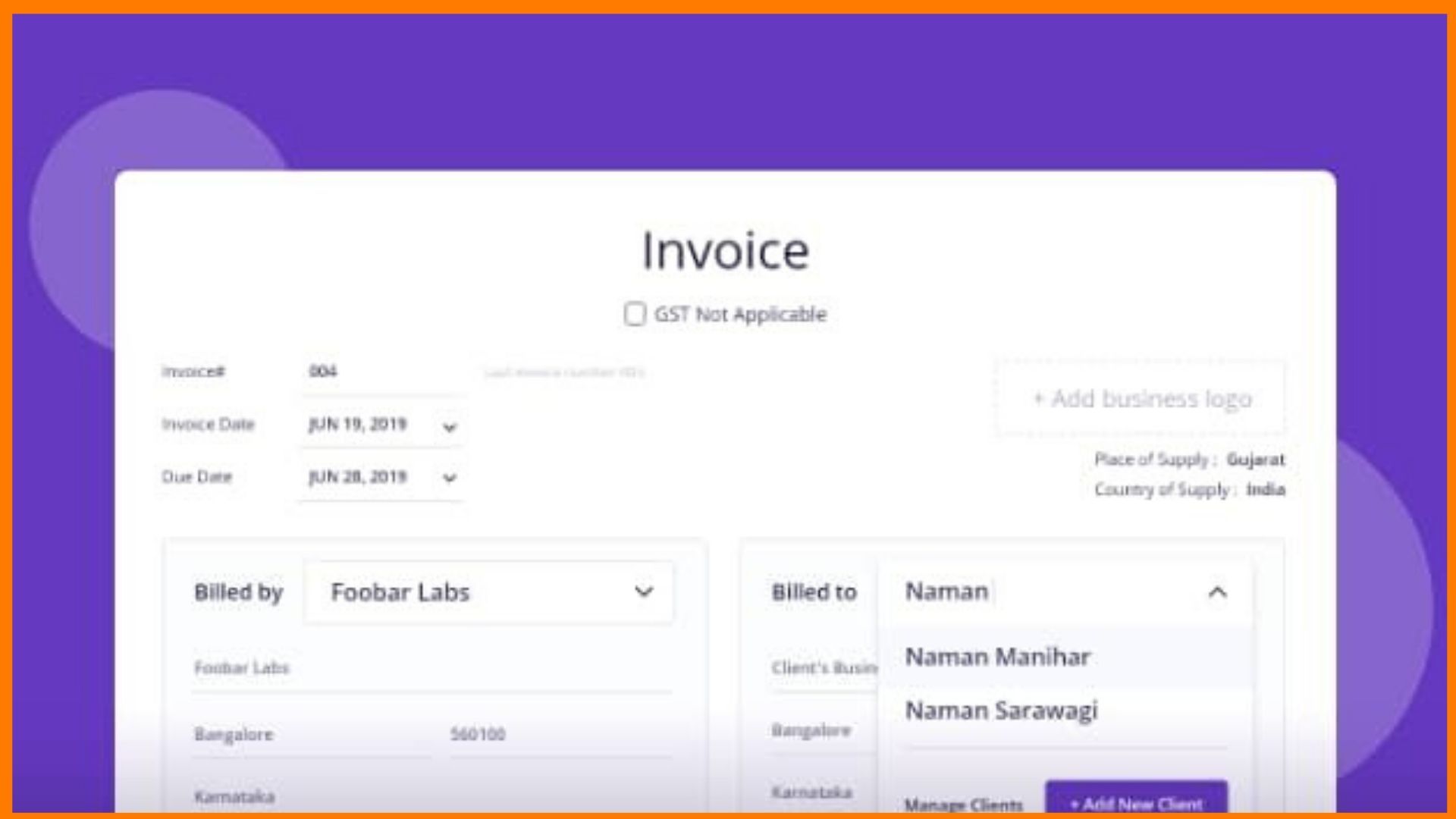

Financepeer is a Google incubated School (K-12) Fee Financing Company that helps to pay the entire year fees upfront to the School in one installment and collects fees in 3 to 12 monthly installments from parents that too at Zero Interest & Zero Cost.

Financepeer – Founders and Team

The Co-founders of Financepeer are Rohit Gajbhiye, Naveesh Reddy, Sunit Gajbhiye and Debi Prasad Baral.

- Rohit Gajbhiye, CEO of Financepeer has a BTech-MTech from IIT Bombay. He worked at DBS Bank, Singapore for 4 years in the Consumer Credit Space. Post entrepreneurship studies from Stanford University, he started & failed in his 1st startup, left work & built Financepeer via his domain expertise.

- Naveesh Reddy, COO of Financepeer also has a BTech -MTech from IITB, Naveesh was a Data Scientist in Cognizant India and Japan for more than 4 years. His expertise was in developing machine learning algorithms for Sentiment Analysis and Fraud detection.

- Debiprasad Baral, CTO of Financepeer is BIT’s, IIMA Vs Stanford alumnus (Rohit’s class), Debi has 15yrs of experience in software product development, via Salesforce & Microsoft. He was Lead architect for developing multiple Schooling Softwares Lending Systems in multiple NBFCs.

- Sunit Gajbhiye, CPO of Financepeer is an IIM and VJTI alumnus, he has 10 years of experience in Business Operations and Product Management via Samsung and Edgeverve. He has expertise in product development in School Eco- System & Finacle core banking system in India.

Currently, Financepeer is having a strength of odd 90 employees across India with 7 offices. Financepeer has a bunch of young minds full of ambition, dedication, and innovative minds. Work flexibility and encouragement by mentors at Financepeer allows the employees to give 110%.

Financepeer – How did it start?

All of this started with a survey, that was created in the early days to understand the pain point of parents who were not able to pay the entire fees upfront. When asked for an opinion, the majority of parents wanted to have the EMI option for school fees or any other curricular activity. Education for children, being the priority for all parents, it is necessary to have timely payments. Since the category of the mass are people who do not have enough savings to pay School Fees upfront in 1 or 2 installments, but they can afford to pay fees from their monthly income in EMI’s.

Financepeer – Startup Launch

Financepeer started with Mussoorie International School in Dehradun. Zero Interest on fee had already convinced the parents at an early stage during the promotional activities. A lot many people had already reached out to us before the admissions itself. Constant interactions with parents was important to gain trust.

Financepeer acquired its first 100 customers in a time span of not more than 3 months. Financepeer team had boarded a few schools and were trying their best for the response. Fortunately, the team met people who were always welcoming. Might be from school or any other partnerships. This allowed them to function in the best way. The maintained relationships with the school and the parents have helped them to retain the customers over this period.

Financepeer – Business Model and Revenue Model

The Financepeer business model is simple – it provides Zero Cost, Zero Interest monthly installments to parents to pay their school fees. At the same time, on behalf of the parent, Financepeer pays the entire year fees to the School on Day 1. This way, the School does not face any collection issue and continues improving the quality of education. At the same time, the masses are also able to avail of such quality education.

Financepeer – Competitors

Quite a few competitors are out there trying to provide quality education to all the kids in the country. Some of them include GrayQuest, Bajaj Finance to only name a few.

Financepeer – Advisors and Mentors

The advisors and mentors of Financepeer are:

- Ashish Mittal – 30+ years experience in Finance Industry, Lotus Eduservices Private Limited

- Vivek Anand Oberoi – Educationist, Handling Project Devi, and Vrindavan Charity, Philanthropist

- Balajee Shrikant – Executive Director, DBS Singapore; 25+ years experience in Fintech Industries

Financepeer – Growth

Financepeer is working with 601+ schools and impacting the lives of 3,50,000+ kids across 37+ cities in India. It is planning to work with 2600+ schools in the year 2020-2021. Financepeer is exploring synergies with education institutes outside India.

Financepeer – Awards and Recognition

Over the years, Financepeer gained the following recognitions:

- Google Incubated

- Startup Award

- Associated with the T-Hub

Frequently Asked Questions – FAQs

What is Financepeer?

Financepeer is a Google incubated School (K-12) Fee Financing Company that helps to pay the entire year fees upfront to the School in one installment and collects fees in 3 to 12 monthly installments from parents that too at Zero Interest & Zero Cost.

Who are the Founders of Financepeer?

The Financepeer Founders are Rohit Gajbhiye, Naveesh Reddy, Sunit Gajbhiye and Debi Prasad Baral.

Who are the Grayquest competitors?

Financepeer is a competitor to Grayquest.