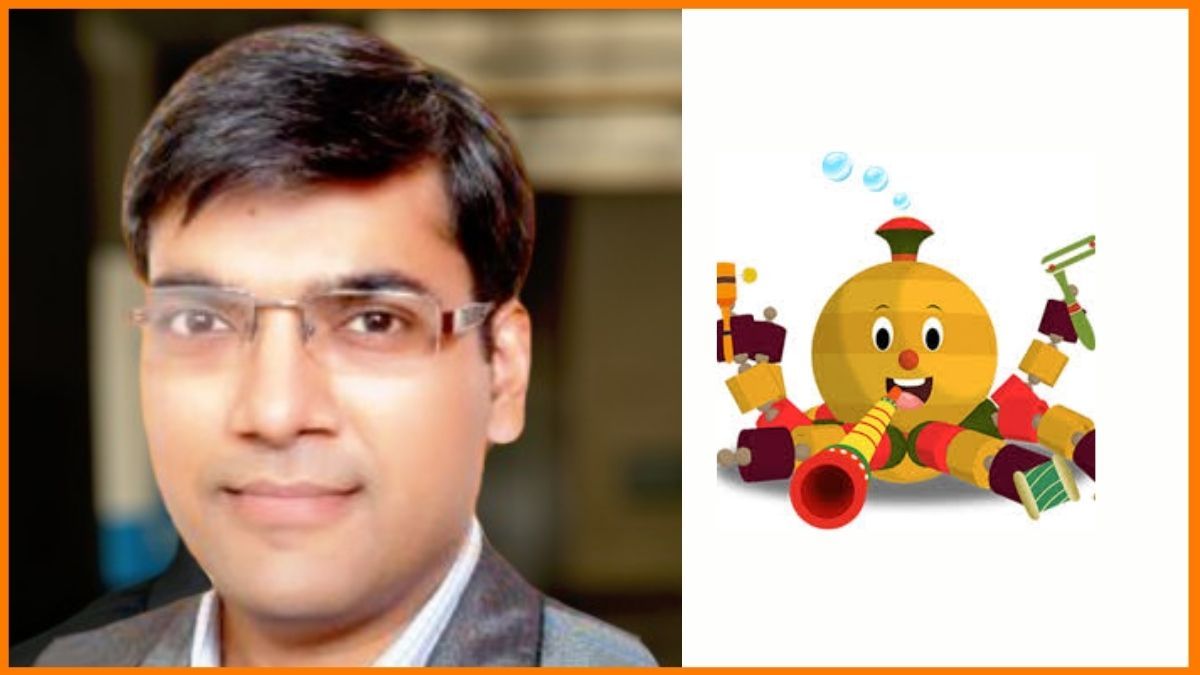

In this exclusive interaction with StartupTalky, Mr. Om Narayan Singh, the visionary founder of Digital Gramin Seva (DGS), discusses his mission to bridge the digital divide in rural India by bringing essential services and technology to underserved communities. He shares the challenges he has faced, the solutions he’s developed, and his vision for creating a more digitally connected and inclusive future for rural communities. Explore how Mr. Singh and his team are making a significant impact in rural areas through Digital Gramin Seva.

StartupTalky: What inspired you to start Digital Gramin Seva?

Mr. Singh: Digital Gramin Seva was inspired by the vision to empower rural communities in India by leveraging digital technology and providing essential services at their doorstep. The initiative aims to empower rural communities by bringing critical services such as banking, utility payments, and government schemes to their doorstep through digital platforms. This helps improve access to services, reduce hurdles, and enhance overall efficiency in service delivery, without having to travel long distances.

We want to make life easy for the population residing in rural India.

The rural population in India has challenges in their life regarding banking and other utility payments. We want to resolve this issue so we are starting Digital Gramin Seva as a platform to solve all these problems.

StartupTalky: What are the core services that DGS offers to rural populations?

Mr. Singh: Our Core Services to rural populations are as follows:

AEPS(Aadhar Enabled Payment System, Utility Bill payments, Cash Withdrawal, Money Transfer, Cash Deposit, Mobile/DTH Recharge, Insurance, IRCTC Agent ID, GST registration, Return Filing, Income Tax return Filing, Company registration, etc.

StartupTalky: How does DGS ensure accessibility for the millions of people in India who lack internet access?

Mr. Singh: Digital Gramin Seva (DGS) addresses the challenge of internet accessibility in rural India through Agent-assisted Services: DGS utilizes a network of local agents who act as intermediaries between the digital platform and the rural population. These agents are typically stationed in villages and are trained to operate the digital service platforms on behalf of rural residents who may not have internet access or digital literacy.

DGS initiatives also focus on digital literacy and awareness programs to educate rural residents about the benefits of digital services and how to access them, thereby increasing their comfort and capability to use digital platforms.

StartupTalky: What sets DGS apart from other digital service providers in rural India? Can you explain the DGS franchise model and its benefits for rural entrepreneurs?

Mr. Singh: Digital Gramin Seva (DGS) distinguishes itself from other digital service providers in rural India through several key aspects:

- Comprehensive Service Offering: DGS offers a wide array of essential digital services under one platform. These services typically include banking (such as account opening, deposits, and withdrawals), utility bill payments, mobile recharges, insurance services, government schemes (like Aadhaar enrolment), and more. This comprehensive approach ensures that rural residents can access multiple services conveniently through a single provider.

- Last-Mile Connectivity: By establishing a network of local, DGS enhances last-mile connectivity in rural areas. This means that residents do not have to travel long distances to access digital services; instead, they can utilise services provided by local entrepreneurs who understand the community’s needs and preferences.

- Focus on Rural Empowerment: DGS is focused on empowering rural communities economically and digitally. Through its merchant or franchise model, it creates opportunities for local entrepreneurs to generate income, promote financial inclusion, and contribute to local economic development. This approach not only bridges the digital divide but also fosters entrepreneurship and self-reliance in rural areas.

- Technology Integration: DGS leverages technology to ensure seamless service delivery despite many challenges. Users with varying levels of digital literacy and access to internet connectivity can use our platform with ease. We are always open to integrating new technologies with our platform to ensure seamless service delivery.

- Better Support: We have a top-notch support team composed of individuals who are highly knowledgeable about the product or service they support. They understand its intricacies and are adept at troubleshooting issues.

- Maximum Commission: DGS offers the highest commission to our merchant/agent for their use of services on our platform in rural India, Compared with other digital service providers in rural India we are far ahead of them in terms of providing maximum commission to merchant/agent.

- Franchise Model: DGS operates on a franchise model where local entrepreneurs, often from rural areas themselves, can become franchise holders. These entrepreneurs are provided with training, support, and access to digital service platforms, enabling them to offer a variety of services directly to their communities.

Here are the benefits of the DGS Franchise Model for Rural Entrepreneurs:

- Low Entry Barrier: Becoming a DGS franchisee typically requires a moderate initial investment, making it accessible to aspiring entrepreneurs in rural areas who may not have large capital resources.

- Training and Support: DGS provides comprehensive training to franchise holders on operating digital platforms, managing transactions, and providing customer support. This training equips entrepreneurs with the necessary skills to effectively run their businesses.

- Brand Association: Franchise holders benefit from the brand recognition and credibility of DGS, which enhances customer trust and attracts more business.

- Revenue Opportunities: Franchisees earn commissions on the transactions and services they provide through the DGS platform, thereby creating a sustainable revenue stream.

- Community Impact: By offering essential digital services locally, franchise holders contribute to the socio-economic development of their communities. They facilitate financial inclusion, promote digital literacy, and improve the overall quality of life in rural areas.

StartupTalky: What key challenges did you face while expanding DGS, and how did you overcome them?

Mr. Singh: Expanding Digital Gramin Seva (DGS) in rural India likely faced several key challenges, and overcoming them required strategic planning, adaptation, and collaboration:

- Infrastructure and Connectivity: One of the primary challenges was adequate infrastructure in rural areas. Many villages lacked basic infrastructure like electricity and internet connectivity, which are essential for digital service delivery. To overcome this DGS utilises a network of local agents who act as intermediaries between the digital platform and the rural population.

- Awareness and Education: There was a significant gap in awareness and understanding of digital services among the rural population. Many villagers were unfamiliar with digital transactions, online banking, and government schemes available to them. Therefore, extensive awareness campaigns and training programs were needed to educate and empower them to use these services effectively. We Educate villagers about the benefits of digital technology and encourage its adoption through community outreach programs.

- Trust and Security: Building trust in digital transactions and ensuring security were critical concerns. Many villagers were apprehensive about the security of their financial transactions and personal data.We have established robust security measures and gained trust through transparent operations to overcome these barriers.

- Regulatory and Compliance Issues: Integrating banking, government, and non-government services required navigating through various regulatory frameworks and compliance requirements. Ensuring adherence to legal norms while providing seamless services was a complex task, particularly in a diverse country like India with different state regulations. We have a dedicated team to resolve these types of issues.

- Partnerships and Collaboration: Collaboration with banks, government agencies, and NBFCs was crucial but challenging due to differing priorities, processes, and varying levels of digital readiness among partners. We make Collaborations and partnerships with multiple partners and agencies to provide seamless service to merchants and people in rural areas.

StartupTalky: How does the Aadhaar-Enabled Payment System (AEPS) work, and what impact has it had on rural banking?

Mr. Singh: How AEPS Works:

- Aadhaar Authentication: AEPS uses Aadhaar authentication to verify the identity of individuals conducting banking transactions. This authentication is done through biometric (fingerprint or iris scan) or demographic (Aadhaar number and OTP) means.

- Micro-ATMs: AEPS transactions are conducted using micro-ATMs, which are handheld devices operated by business correspondents (BCs) or agents in rural areas. These devices are equipped with fingerprint scanners and can connect to banks’ servers via GPRS or other networks.

- Types of Transactions: AEPS supports various types of transactions, including-

- Balance Enquiry: Users can check their account balance using AEPS Cash Withdrawal: Users can withdraw cash from their bank accounts by authenticating their identity through Aadhaar biometrics.

- Cash Deposit: Customers can deposit cash into their bank accounts.

- Fund Transfer: It allows for fund transfers between Aadhaar-linked bank accounts.

- Participating Banks: AEPS is implemented by banks that are enabled to offer Aadhaar-based banking services. These banks appoint BCs who operate micro-ATMs in rural areas, extending banking services to unbanked and underbanked populations.

- Security and Accessibility: AEPS transactions are secure due to Aadhaar authentication, which ensures that only authorized individuals can access their accounts. The use of biometric data adds a layer of security compared to traditional PIN-based systems.

Impact on Rural Banking:

- Financial Inclusion: AEPS has significantly contributed to financial inclusion by bringing banking services closer to rural populations. It has enabled millions of unbanked individuals to access basic banking services such as withdrawals, deposits, and fund transfers conveniently in their villages.

- Ease of Access: Rural residents no longer need to travel long distances to access a bank branch. Micro-ATMs operated by BCs provide banking services at the doorstep of villagers, saving time and effort.

- Reduction in Cash Dependency: AEPS promotes digital transactions and reduces dependency on cash in rural areas. This has positive implications for financial literacy and the formalisation of the economy.

- Empowerment of BCs: The deployment of micro-ATMs under AEPS has created employment opportunities for BCs in rural areas. These agents act as intermediaries between banks and customers, earning commissions on transactions conducted through micro-ATMs.

- Government Benefit Disbursement: AEPS has been instrumental in the direct transfer of government subsidies, pensions, and other benefits to beneficiaries’ bank accounts linked with Aadhaar. This has streamlined distribution processes, reduced leakages, and improved efficiency. In conclusion, the Aadhaar-Enabled Payment System (AEPS) has been a game-changer for rural banking in India, promoting financial inclusion, empowering rural communities, and facilitating economic growth by leveraging Aadhaar-based authentication and micro-ATM technology.

StartupTalky: Which of DGS’s digital services are most popular among customers, and why?

Mr. Singh: Digital Gramin Seva (DGS) offers a range of digital services tailored to meet the needs of rural customers in India. Some of the most popular services among customers typically include Banking Services, Utility Bill Payments, Mobile/DTH Recharges, and Insurance Premium Payment.

Reasons for Popularity:

- Highest Commission: DGS offers the highest commission to our merchant/agent for their use of services on our platform in rural India, Compared with other digital service providers in rural India we are far ahead of them in terms of providing maximum commission to merchant/agent.

- Convenience: DGS brings essential services directly to rural communities, eliminating the need for residents to travel long distances to access banking, utility payments, and other services. This convenience is highly valued by customers.

- Accessibility: By leveraging a network of local Merchants/ franchises and micro-ATMs, DGS ensures that even remote villages have access to digital services. This accessibility is crucial in areas with limited infrastructure and connectivity.

- Trust and Familiarity: Customers often prefer conducting transactions through local agents they know and trust, rather than through impersonal urban centres. DGS builds trust by empowering local entrepreneurs as merchant/franchise holders who understand community needs.

- Time-Saving: Rural customers save valuable time by using DGS for transactions that would otherwise require long journeys to town centres. This time-saving aspect is significant in rural contexts where agricultural and household chores are prioritised.

- Digital Literacy Support: DGS not only offers services but also invests in educating rural customers about digital literacy. This support helps customers feel more comfortable using digital platforms for their transactions.

StartupTalky: How does DGS ensure the security and privacy of its customers’ data?

Mr. Singh: Ensuring the security and privacy of customer’s data is paramount for Digital Gramin Seva (DGS) to maintain trust and compliance with regulatory standards. Here are several measures DGS implements to safeguard customer data:

- Data Encryption: DGS employs robust encryption techniques to protect data both in transit and at rest. Encryption ensures that sensitive information such as Aadhaar numbers, financial transactions, and personal details are unreadable to unauthorised individuals or cyber attackers.

- Secure Authentication: DGS uses secure authentication protocols to verify the identity of users accessing its platforms. This typically includes multi-factor authentication (MFA) and biometric authentication (such as fingerprint or iris scans) for accessing sensitive services.

- Access Control: Access to customer data within DGS systems is strictly controlled based on the principle of least privilege. Only authorized personnel and systems have access to specific data necessary for their roles or functions.

- Assessments: DGS conducts regular security audits, vulnerability assessments, and penetration testing of its systems and infrastructure. These tests help identify and address potential security weaknesses proactively.

- Compliance with Regulations: DGS adheres to data protection regulations and guidelines set forth by regulatory authorities such as the Reserve Bank of India (RBI) and the Unique Identification Authority of India (UIDAI). Compliance ensures that customer data handling practices meet legal requirements regarding privacy and security.

- Employee Training: Employees and franchise holders of DGS receive training on data security best practices and the importance of safeguarding customer information. This training helps prevent human errors and ensures that all stakeholders understand their roles in protecting customer data.

- Customer Awareness: DGS educates its customers about data security and privacy through awareness campaigns and customer communication. This empowers customers to make informed decisions about their interactions with DGS and helps them recognize potential security threats.

StartupTalky: What training and support do you offer to your retail partners and franchisees?

Mr. Singh: Training and Support for Retail Partners and Franchisees:

- Product and Service Training: Retail partners and franchisees receive comprehensive training on the range of digital services offered by DGS, including banking transactions, utility bill payments, mobile recharges, insurance services, etc.

- Technology Training: Training on how to operate micro-ATMs or other digital service delivery devices used by DGS. This includes technical aspects such as troubleshooting common issues, handling transactions, and ensuring data security.

- Standard Operating Procedures (SOPs): Retail partners and franchisees are provided with SOPs outlining step-by-step procedures for conducting various transactions, handling customer queries, and maintaining records.

- Customer Relationship Management (CRM): Training on building positive customer relationships, handling customer complaints, and providing excellent customer service.

- Access to Support Resources: Providing access to a dedicated helpdesk or support team that franchisees can contact for technical assistance, operational queries, or regulatory clarifications.

- Ongoing Support: Continuous support to address any operational challenges, software updates, or changes in service offerings.

StartupTalky: How has DGS contributed to job creation and entrepreneurship in rural areas?

Mr. Singh: Digital Gramin Seva (DGS) has significantly contributed to job creation and entrepreneurship in rural areas of India through several impactful initiatives:

- Franchise Model Empowerment: DGS operates on a franchise model, empowering local entrepreneurs to establish and operate digital service centers in their communities. These entrepreneurs become franchise holders and provide a range of essential services such as banking, utility payments, insurance services, and more. By becoming DGS franchisees, these individuals create their businesses and generate employment opportunities locally.

- Business Correspondents (BCs): DGS engages Business Correspondents (BCs) who act as intermediaries between banks and customers in rural areas. BCs typically operate micro-ATMs and provide banking services, earning commissions for transactions conducted. This role creates employment for BCs who often come from rural backgrounds and serve their communities.

- Direct Employment Opportunities: Beyond franchise owners and BCs, DGS contributes to direct employment by hiring staff members at franchise outlets. These staff members are trained to assist customers with various digital services, thereby creating jobs locally and contributing to household incomes.

- Skill Development and Training: DGS invests in training programs for franchisees, BCs, and local staff members. Training covers operational procedures, customer service, digital literacy, and compliance with regulatory standards. This enhances the employability and entrepreneurship skills of participants, enabling them to manage and grow their businesses effectively.

- Community Development: DGS initiatives contribute to overall community development by reducing dependency on urban centers for essential services, improving access to digital technologies, and enhancing the overall quality of life in rural areas.

StartupTalky: What role does technology play in DGS’s operations, and what recent advancements have you implemented?

Mr. Singh: Digital Gramin Seva (DGS) relies heavily on technology to streamline its operations, deliver digital services efficiently, and enhance customer experience in rural India. Here are the key roles that technology plays in DGS’s operations, along with recent advancements:

Roles of Technology in DGS’s Operations:

- Service Delivery Platforms: DGS uses robust digital platforms to offer a wide range of services such as banking transactions, utility bill payments, mobile recharges, insurance services, government schemes (like Aadhaar enrolment), and more. These platforms enable seamless service delivery across its network of franchises and micro-ATMs.

- Micro-ATMs and Digital Devices: DGS deploys micro-ATMs and handheld digital devices equipped with biometric scanners, card readers, and connectivity options (like GPRS) to facilitate banking and other transactions in remote areas. These devices play a crucial role in extending banking services to underserved populations.

- Data Security and Privacy: Technology safeguards customer data through encryption, secure authentication mechanisms (such as biometrics), and adherence to data protection regulations. This ensures the confidentiality and integrity of transactions conducted through DGS platforms.

- Training and Education: DGS uses technology for digital literacy training programs aimed at franchisees, BCs, and customers. These programs enhance understanding and usage of digital services, improving overall service adoption and customer satisfaction.

Recent Technological Advancements:

- Enhanced User Interfaces: DGS has improved user interface on its digital platforms and mobile applications to make them more intuitive and user-friendly, especially for customers with varying levels of digital literacy.

- Mobile App Development: DGS has developed and updated mobile applications that allow customers to access services conveniently from their smartphones. These apps support functionalities such as account management, transaction history, and service requests.

- Biometric Authentication Enhancements: DGS continues to refine biometric authentication technologies used in micro-ATMs and digital devices. This includes improving the accuracy, speed, and reliability of fingerprint or iris scan authentication for secure transactions.

- Digital Payments Integration: DGS has expanded integration with digital payment systems and e-wallets to offer more diverse payment options for customers. This supports cashless transactions and enhances financial inclusion efforts.

- QR Code Scanner: DGS has expanded integration with QR Code Scanner to offer more diverse payment options for customers. This supports cashless transactions and enhances financial inclusion efforts.

StartupTalky: How does DGS collaborate with governmental and non-governmental organisations to enhance its services?

Mr. Singh: Digital Gramin Seva (DGS) collaborates with governmental and non-governmental organisations (NGOs) to enhance its services and extend its reach in rural areas of India. These collaborations play a crucial role in leveraging resources, expertise, and infrastructure to deliver impactful services. Here’s how DGS collaborates with these entities:

- Financial Institutions: Partnerships with banks and financial institutions have been crucial in providing banking and financial services to rural communities. These collaborations enable villagers to open bank accounts, deposit and withdraw money, access loans, and use digital payment services conveniently through Digital Gramin Seva centres.

- Technology Providers: Collaborations with technology providers have enhanced the digital infrastructure of Digital Gramin Seva centres. This includes providing hardware as well as software solutions for managing transactions and customer interactions.

- Corporate Partners: Partnerships with corporate entities have facilitated rural development and employee development program technology advancement which contribute to the sustainability and expansion of Digital Gramin Seva’s operations.

Overall, DGS’s collaborations with governmental and non-governmental organisations are integral to its mission of promoting financial inclusion, fostering entrepreneurship, and driving socio-economic development in rural India. These partnerships strengthen its capacity to deliver impactful services and create lasting positive change in the communities it serves.

StartupTalky: What do recognitions like ‘Best Rural Banking Service Provider’ mean for you and your team?

Mr. Singh: For Digital Gramin Seva (DGS), receiving recognitions like ‘Best Rural Banking Service Provider’ holds significant meaning and serves as validation of the team’s efforts and achievements. Here’s what such recognitions typically mean for DGS and its team:

- Validation of Efforts: Being recognized as the best rural banking service provider validates the hard work, dedication, and innovation that DGS and its team have invested in serving rural communities. It acknowledges its commitment to delivering high-quality financial services and digital solutions tailored to the unique needs of rural populations.

- Credibility and Trust: Awards and recognitions enhance DGS’s credibility and reputation in the industry. They demonstrate to customers, stakeholders, and partners that DGS is a reliable and trustworthy organization capable of making a positive impact in rural areas.

- Motivation and Morale Boost: Recognition boosts team morale and motivation. It serves as encouragement for the team to continue striving for excellence, innovate further, and maintain high standards in service delivery and customer satisfaction.

- Enhanced Visibility and Brand Image: Awards raise DGS’s visibility within the industry and among potential customers. They reinforce the brand image as a leader in rural banking and digital services, potentially attracting new franchisees, customers, and partnerships.

- Customer Confidence: Recognitions reassure customers that they are choosing a reputable and distinguished service provider. This can increase customer confidence and loyalty, leading to greater adoption of DGS’s services and further expanding its impact in rural communities.

StartupTalky: Can you share any success stories or testimonials from rural communities you’ve served?

Mr. Singh: Success Story- Empowering Rural Entrepreneurship in a remote village in rural India, Digital Gramin Seva (DGS) established a franchise operated by Raja Trillonix, a resident passionate about improving access to digital services. Here’s Raja’s story: Raja had struggled to find steady employment in his village, often traveling to nearby towns for odd jobs.

When DGS introduced the opportunity to become a franchisee, Raja saw it as a chance to make a meaningful impact in his community while earning a livelihood. With support from DGS’s training programs, Raja quickly adapted to operating a micro-ATM and providing essential services such as banking transactions, utility bill payments, and mobile recharges. He became a trusted point of contact for villagers seeking reliable and convenient access to financial services.

Over time, Raja’s franchise became a hub for digital literacy workshops, where he taught fellow villagers how to use digital platforms for banking and utility payments. He also facilitated Aadhaar enrolment camps, helping hundreds of residents obtain their unique identity numbers and access government subsidies seamlessly.

Through his dedication and DGS’s support, Raja not only transformed his livelihood but also contributed to the economic empowerment of his community. The convenience of accessing essential services locally reduced travel expenses and saved valuable time for villagers, particularly women and elderly residents.

Testimonials from villagers highlighted Raja’s reliability, personalised service, and the positive impact of having a local franchise for their day-to-day financial needs. They expressed gratitude for the improved quality of life and newfound confidence in digital transactions. Raja’s success story underscores DGS’s commitment to fostering entrepreneurship, promoting financial inclusion, and empowering rural communities through innovative digital solutions.

StartupTalky: What are your plans for Digital Gramin Seva, including any new services or expansions?

Mr. Singh: Digital Gramin Seva aims to add new services and expand its impact and reach in rural India with several strategic goals and plans for the next few years:

- Expansion of Service Reach: Digital Gramin Seva plans to create more merchants in underserved and remote areas across India. This expansion will ensure broader access to essential digital services such as banking, government schemes, healthcare, and education.

- Enhanced Service Offerings: The platform intends to diversify and enhance its service offerings to meet evolving needs. This includes incorporating new digital services, QR Code Scanner, integrating emerging technologies like AI and blockchain for improved efficiency and security, and expanding partnerships with additional service providers.

- Technological Advancements: Digital Gramin Seva aims to upgrade its technological infrastructure continuously. upgrading hardware and software systems and adopting mobile and cloud-based solutions to enhance accessibility and scalability.

- Digital Literacy and Skill Development: Increasing emphasis will be placed on digital literacy programs and skill development initiatives in rural communities. Digital Gramin Seva plans to conduct rigorous impact assessments to measure its effectiveness in driving financial inclusion, enhancing livelihoods, improving access to services, and fostering overall socio-economic development in rural areas.

StartupTalky: What advice would you give to aspiring entrepreneurs in the digital services sector?

Mr. Singh: For aspiring entrepreneurs venturing into the digital services sector, especially in contexts like rural India, here are some key pieces of advice to consider:

- Understand Local Needs: Conduct thorough research to understand the specific needs and challenges of the community you aim to serve. Tailor your digital services to address these needs effectively, whether it’s banking, utility payments, government services, or other essential needs.

- Embrace Innovation: Leverage technology to innovate and differentiate your offerings. Explore opportunities to integrate advanced technologies like AI, IoT, or blockchain to enhance service delivery, security, and customer experience.

- Build Partnerships: Collaborate with governmental organisations, financial institutions, NGOs, and local community leaders to build trust, access resources, and expand your service network. Partnerships can also provide insights into regulatory requirements and market dynamics.

- Focus on Customer Experience: Prioritise customer satisfaction by offering user-friendly interfaces, reliable customer support, and personalised services. Listen to customer feedback and continuously improve your offerings based on their needs.

- Ensure Data Security: Implement robust data protection measures to safeguard customer information and build trust. Compliance with regulatory standards and regular security audits are crucial in maintaining the integrity of your digital services.

- Persistence and Resilience: Entrepreneurship can be challenging, especially in emerging markets. Stay persistent in pursuing your goals and resilient in overcoming obstacles. Learn from failures and iterate on your ideas to achieve long-term success.

By combining innovation, community engagement, customer-centricity, and resilience, aspiring entrepreneurs can create impactful ventures in the digital services sector, contributing to economic development and social empowerment in their communities.