Company Profile is an initiative by StartupTalky to publish verified information on different startups and organisations. The content in this post has been approved by CoinDCX.

A massive increase in the number of internet users has reactivated virtual world concepts and spawned a new market phenomenon known as cryptocurrency to enable financial transactions such as purchasing, selling, and trading.

Cryptocurrencies are digital representations of precious and intangible objects that can be used in a variety of applications and networks, including online social networks, online social games, virtual worlds, and peer-to-peer networks.

In recent years, virtual currency has been widely used in a variety of schemes. It’s clear that cryptocurrencies are an important and rising element in today’s digital economy.

CoinDCX is a cryptocurrency trading site, which is famous as one of India’s biggest cryptocurrency exchanges. The company earned the unicorn status by raising $90 million on August 10, 2021, and turned into India’s first unicorn crypto startup.

Here we will delve deep into the CoinDCX company, where you will find all about CoinDCX, CoinDCX Founders, its Funding, Investors, Mission, Vision, Business and Revenue Model, Challenges Faced, Future Plans, and more. So, stay glued.

CoinDCX – Company Highlights

| Company Name | CoinDCX |

|---|---|

| Headquarters | Mumbai, Maharashtra, India |

| Industry | Cryptocurrency, Software |

| Founded | April 2018 |

| Founders | Sumit Gupta and Neeraj Khandelwal |

| Valuation | $2 billion |

| Website | www.coindcx.com |

About CoinDCX and How it Works?

CoinDCX – Industry

CoinDCX – Founders and Team

CoinDCX – Startup Story

CoinDCX – Mission and Vision

CoinDCX – Name, Logo and Tagline

CoinDCX – Business and Revenue Model

CoinDCX – Growth and Revenue

CoinDCX – Funding and Investors

CoinDCX – Partnerships and Campaigns

CoinDCX – Achievements

CoinDCX- LayOffs

CoinDCX – Competitors

CoinDCX – Challenges Faced

CoinDCX – Future Plans

About CoinDCX and How it Works?

Billed as India’s largest and safest cryptocurrency exchange platform, CoinDCX allows users to legally exchange various cryptocurrencies. It is built for all types of traders, taking into account their trading background, risk tolerance, and trading frequency, allowing customers to trade their crypto assets according to their requirements.

CoinDCX is a company that is working on a cryptocurrency trading network. The business is focused on developing cross-border financial services that ensure a smooth and continuous flow of resources. The trading experience is quick, reliable, and effortless thanks to its liquidity, powerful wallet, and impenetrable protection. CoinDCX has given its traders access to a variety of industry-first products that enable them to trade using exchange liquidity.

Currently, CoinDCX Go offers a range of tokens in INR pairs such as Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Binance Coin (BNB), Chainlink (LINK), EOS (EOS), Tether (USDT), Cardano (ADA), Stellar Lumens (XLM), Ripple (XRP), Basic Attention Token (BAT), Matic Network (MATIC), Tron (TRX) etc.

CoinDCX announced its 3rd birthday on April 7, 2021. Three years ago, CoinDCX has begun an exciting journey of providing cryptocurrency trading and exchange services to the general public. The Reserve Bank of India (RBI) declared a banking ban for cryptocurrency and related entities around the same time. In addition, India’s crypto industry was in desperate need of a shake-up. It was enough to keep the momentum going, and CoinDCX began with a single goal in mind: ‘Cryptocurrency Adoption.‘

The services of CoinDCX are tailored to fit all styles of traders, taking into account their trading history, risk tolerance, and frequency of trading. The company’s mission is to democratise finance and make investing more accessible to the general public.

CoinDCX announced the launch of CoinDCX Go app on January 20, 2021. A future Bitcoin app that allows users to legally purchase Bitcoin and other common cryptocurrencies with a single click, CoinDCX Go stands as a simple, safe, and secure method to invest in cryptocurrencies.

CoinDCX – Industry

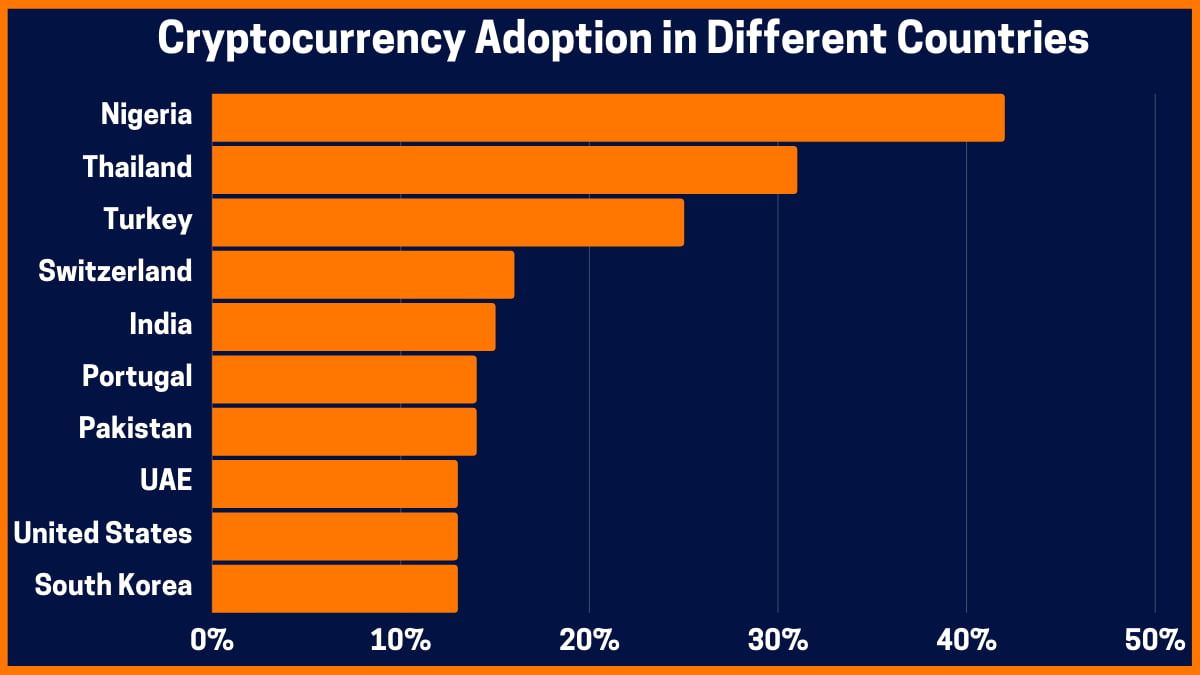

CoinDCX is a part of the cryptocurrency industry, which is growing at an unimaginable pace across the globe. Looking at the global cryptocurrency industry, we can discover that it reached a valuation of $1,782 billion in 2021. The same sector is predicted to grow at a CAGR of 58.4% and will reach $32,420 billion by 2027. While looking at the growth of cryptocurrency in India, the same industry is inching to touch a valuation of $241 million by 2030, as of December 2021.

CoinDCX – Founders and Team

CoinDCX was founded by Sumit Gupta and Neeraj Khandelwal in April 2018.

Sumit Gupta

Sumit Gupta is known as the Co-founder and CEO of CoinDCX. Sumit holds a B.Tech in Electrical and Electronics, and an MTech degree in Electronics and Signal Processing, from IIT Bombay. He served as a Data Research Analyst at Columbia Business School before joining Sony as a Software Engineer. However, he left the role after a little more than a year and co-founded ListUp before leaving it too and founding CoinDCX.

Neeraj Khandelwal

Neeraj Khandelwal is another Co-founder of CoinDCX, who also serves as CTO of the company. Khandelwal also is an alumnus of IIT Bombay, who completed his graduation in Electrical Engineering from the same university. It is Khandelwal who leads the technical development of the CoinDCX products.

The CoinDCX team created the entire platform from the ground up. Full-stack developers, blockchain developers, machine learning engineers, app developers, software engineers, and data scientists make up the 100+ members team, giving them the expertise to incorporate any innovative logic or functionality in our market. CoinDCX plans to have a workforce consisting of 200+ members soon.

CoinDCX – Startup Story

Sumit Gupta first learned about distributed ledger technology when Bitcoin mining was gaining popularity. This is when the concept of putting together different decentralised marketplaces and cryptocurrencies, which serve as the marketplace medium of exchange, stayed with him.

He then reached out to his friend Neeraj Khandelwal, with whom he worked to bridge the crucial market gaps between this emerging technology and global consumers. The duo realised that blockchain traders, who could keep track of thousands of crypto trades every second, lacked a single trading network. In April 2018, the IIT-Bombay graduates launched CoinDCX as a result of this.

The startup claims to have had a daily trading volume of more than $10M and a monthly trading volume of $400M since its launch. After researching the industry and the potential of crypto technology, they launched the DCX journey with a cryptocurrency exchange in 2018.

CoinDCX – Mission and Vision

CoinDCX mission and vision statement says,

“CoinDCX envisions to enable global financial inclusion of billions of people around the planet with a crypto-based financial services. We aim to make decentralized financial services accessible to the common man on their palms and tips.“

CoinDCX – Name, Logo and Tagline

DCX is a company based in Singapore that specialises in crypto-enabled financial services, and so the name ‘Coin’ DCX is a fitting add-on to let the company ooze of uniqueness.

CoinDCX’ s tagline is, “Your Gateway to Crypto.“

CoinDCX – Business and Revenue Model

The CoinDCX business model has established single-point access to trade all cryptocurrency instruments available in over 500 markets, according to the founders. It claims to have developed a highly scalable trade machine engine capable of processing one million transactions per second. Any transaction or exchange on CoinDCX incurs a transaction fee. Deposit fees (charged on exchanging currencies), withdrawal fees, trading commissions (0.01 percent of the overall transaction is normal on any exchange), and listing fees are how CoinDCX makes money, just like any other cryptocurrency exchange.

The trader will convert INR to Cryptos and vice versa on DCXInsta, gain by lending their holdings with DCXlend, and leverage trades with DCXmargin on DCXtrade’s 500+ markets. CoinDCX aspires to be the world’s best cryptocurrency exchange. Its patented liquidity aggregation model gives users access to liquidity from the world’s leading cryptocurrency exchanges.

CoinDCX – Growth and Revenue

CoinDCX is popularly hailed as India’s first crypto unicorn. Founded in 2018, CoinDCX brings easy investing and trading solutions for cryptocurrency-based products for all. This ISO-certified crypto platform, which is insured by BitGo, provides an array of products like CoinDCX, CoinDCX Pro, DCX Learn, Cosmex, and more. It is the only crypto startup in India that has raised 3 CoinDCX funding rounds in less than a year.

CoinDCX witnessed a 45.78% growth in its installed users between October and November 2021 alone. The growth of CoinDCX definitely depends on the innovative ideas on which CoinDCX was founded, its ability to battle with the challenges thrown in, the funding rounds it has witnessed, and the innovative and interesting marketing strategies that CoinDCX executes.

Some more growth highlights of CoinDCX are:

- CoinDCX became the first crypto unicorn in India valued at $1.1 billion as of August 10, 2021, with the latest funding round where the former Facebook co-founder, Eduardo Saverin’s B Capital Group took part along with a bunch of the company’s existing investors – Coinbase Ventures, Polychain Capital, Block.one and more. CoinDCX was valued at $2.15+ bn last in April 2022.

- CoinDCX has grown its user base from 150K to 400K in just 15 months and currently over 1.4 crores users.

- The quarterly trading volume of CoinDCX is over 16,500 users.

- CoinDCX has already crossed $10 billion in trading volume in February 2021

- It has witnessed a 4X growth Q-o-Q in daily active users

- It has listed 500+ coins and 1000+ trading pairs

CoinDCX Revenue, Financials and More

CoinDCX’s Indian business, Neblio Technologies, witnessed a remarkable growth in its net profit in FY21, which rose 9X YoY to become Rs 4.4 crore from Rs 45.6 lakh in FY20.

All of it started with the Supreme Court verdict of March 2020, which lifted the banking ban on the trade of cryptocurrency in India. CoinDCX started seeing quite a growth starting from August 2020 onwards. It noticed a 38% month-on-month (MoM) growth since its inception in 2018. This is due to the fact that more and more Indians started to show interest to participate in the global crypto economy.

The CoinDCX operating revenue surged by more than 527% YoY from Rs 6.2 crore in FY20 to Rs 38.9 crore in FY21.

The expenses also ballooned by more than 7X, which increased from Rs 5.7 crore in FY20 to Rs 40.7 crore in FY21.

CoinDCX Ventures

CoinDCX launched CoinDCX Ventures with an aim to establish its own venture investment arm on May 10, 2022. The venture investment arm of the Indian crypto-exchange unicorn, CoinDCX Ventures will help the company invest in early and late-stage crypto and blockchain startups. Rohit Jain, a Harvard Business School alum has been appointed by the startup as the Senior Vice President and the Head of Ventures and Investments to lead the CoinDCX Ventures which is designed to strengthen the digital asset ecosystem of India and give a push to the country’s digital economy. According to the Co-founder and CEO of CoinDCX, Sumit Gupta, CoinDCX Ventures is nothing short of a “great milestone”, and that the crypto exchange has plans to invest around Rs 100 crores in CoinDCX Ventures within the next 12 months.

CoinDCX “Earn” Crypto Yield Initiative

CoinDCX has announced the launch of its new initiative on May 26, 2022. This “Earn” crypto yield initiative that CoinDCX launched, will allow the crypto asset holders to earn interests on their crypto assets.

The platform will deploy the assets under ‘Earn’ among the wide array of yield generating options like lending, margin trading, and staking, in order to create returns. This new opportunity to yield income promises no lock-in periods and withdrawals at any moment, thereby offering the customers full flexibility and control over their cryptocurrency assets. However, the tenor must be of seven days.

CoinDCX grew considerably even during the pandemic, speaking about which, Sumit Gupta, the CEO and Co-founder of CoinDCX said in a statement, “This has been the most exciting year for CoinDCX. While the pandemic forced everyone indoors, CoinDCX scaled up exponentially and continues to do so. Our team tripled in number from 30 in March to 90 in December, and we are continuing to hire aggressively.”

If more investors looked into these emerging liquidity alternatives as a result of the global pandemic, interest in digital assets grew steadily. As institutional and individual investors adopt these emerging asset classes to diversify their portfolios, this trend is expected to intensify exponentially, according to analysts.

India is regarded as a developing market for cryptocurrencies, with retail investors aged 25 to 40 spending millions of dollars every day on cryptocurrency trading in the nation. In the April-June quarter of 2020, the exchange says it saw a 3X increase in total volume traded and a 4X increase in daily active users.

“In the end of 2020, interest in digital assets was growing consistently as more investors explored these new liquidity options. With the global events this year, we’re seeing this trend accelerate exponentially, as both institutional and individual investors embrace these new asset classes to diversify their portfolios,” Block.one’s CEO Brendan Blumer said.

CoinDCX – Funding and Investors

CoinDCX has raised around $245 million over 8 Coindcx funding rounds that the company has seen. The last (Series D) round of funding came in on April 19, 2022, and helped CoinDCX raise $135 mn. Pantera Capital and Steadview Capital led this CoinDCX funding round, which helped the crypto unicorn raise its valuation to around $2 billion. The previous round of funding helped the company raise $90 million, which turned the company into an Indian unicorn startup at a valuation of $1.1 billion on August 10, 2021.

The CoinDCX funding till date is as follows:

| Date | Round | Amount | Lead Investors |

|---|---|---|---|

| April 19, 2022 | Series D | $135M | Steadview Capital and Pantera Capital |

| August 10, 2021 | Series C | $90M | B Capital Group, Coinbase Ventures, Polychain Capital and others |

| Dec 22, 2020 | Series B | $13.43M | Block.one |

| May 26, 2020 | Series A | $2.5M | Polychain |

| Mar 23, 2020 | Series A | $3M | 100x Ventures, Bain Capital Ventures, Polychain |

| Mar 20, 2019 | Seed Round | – | Bain Capital Ventures |

| January 7, 2019 | Secondary Market | – | – |

| March 30, 2018 | Seed Round | – | – |

CoinDCX has been funded to date by some of the famous venture capitals in the world of startups like Steadview Capital, Pantera Capital, B Capital Group, Polychain Capital, Bain Capital Ventures, and more, which have led to elevating CoinDCX to the position of the first crypto unicorn of India. However, little was known about the shareholding pattern of CoinDCX until now. This is why we have taken a dive into the shareholding pattern of the company.

Here goes CoinDCX shareholding pattern, as of April 29, 2022:

| Owning Company/Individual | Percentage of Stakes |

|---|---|

| Polychain Ventures | 19.40% |

| Block One Investments | 18.52% |

| Neeraj Khandelwal | 14.36% |

| Sumit Gupta | 14.36% |

| Bain Capital | 7.13% |

| Others | 6.43% |

| Jump Capital | 3.73% |

| B Capital | 2.96% |

| Cadenza Capital | 2.79% |

| Steadview Capital | 2.38% |

| Coinbase | 2.34% |

| Uncorelated fund | 2.01% |

| Pantera Blockchain fund | 1.46% |

| Choi Sung Ho | 1.11% |

| Vivek Nagpal | 1.01% |

The shareholding status of CoinDCX shows that Polychain Ventures owns the highest stakes in the company whereas the co-founders of CoinDCX – Neeraj Khandelwal and Sumit Gupta, have 14.36% of stakes each. Reports say that the collective valuation of the co-founder is over $590 mn.

CoinDCX – Partnerships and Campaigns

CoinDCX Makes Amitabh Bachchan its Brand Ambassador

CoinDCX has seen quite some partnerships that involved Bollywood actors and more. The company didn’t see any brand ambassadors until it partnered with the veteran actor Amitabh Bachchan, who became the first brand ambassador of the brand according to the reports dated October 4, 2021. With this agreement, CoinDCX aims to boost the overall knowledge of crypto and popularise the currency as an emerging asset class. Furthermore, Bachchan is also deemed to be the new face of the latest campaign by CoinDCX.

According to CoinDCX, Bachchan’s personality matches the brand’s values. Amitabh Bachchan, who is always forward in his league, whether it is in movies or anything else, is the paragon of wisdom, which will help the company add more credibility. Besides, the veteran actor has been a crypto investor himself and has already been successful in launching his own NFT (Non-fungible token), thereby gathering a considerable amount of knowledge of the crypto space. “His knowledge will prove valuable in building trust and credibility amongst new users. We are certain that his association with CoinDCX will help bring greater visibility to the world of crypto and develop a strong brand recall for us,” mentioned Sumit Gupta, Co-founder, and CEO of the brand.

CoinDCX is yet to proceed with its ad campaign with Amitabh Bachchan as of October 15, 2021. The company has reportedly put the advertisement campaigns with the legendary actor due to the lack of clarity on the regulation and policy framework. On the other hand, Amitabh has also disclosed in a recent blog post that he will be reconsidering the advertisement campaign signed with the crypto trading major. He had also mentioned that he would be revoking his endorsement with the pan masala brand Kamala Pasand on the same blog.

CoinDCX Ropes in Ayushmann Khurana

The crypto unicorn has roped in celebrated actor Ayushmann Khurana for its new campaign titled “Future Yahi Hain” on October 18, 2021. This CoinDCX campaign is designed to address concerns surrounding crypto investments of Indian audiences.

#BitcoinLiyaKya Campaign

CoinDCX has launched a digital campaign titled #BitcoinLiyaKya, which is a humorous take on the inclusion of cryptocurrencies like bitcoins. This campaign aims to drive more audiences to use bitcoins via companies like CoinDCX.

HAPPY DAY REWARDS Campaign

CoinDCX launched the “HAPPY DAY REWARDS” campaign to fuel its crypto awareness campaign across the country and present crypto as a dominating asset class.

The campaign, which started on 19th September 2021 and ended on October 15, 2021, brought opportunities for numerous eligible new users to win up to Rs 1 lakh worth of Bitcoin (BTC) every day.

Some other partnerships that CoinDCX saw are:

- The unicorn crypto startup partnered with BITS Pilani on March 8, 2022, to foster research, development, and innovation in crypto among the students in India.

- CoinDCX partnered with Solidus Labs on February 19, 2022. This collaboration is aimed to enhance anti-money laundering protection.

- Partnership with Onfido – CoinDCX partnered with Onfido. The UK-based company that has its headquarters in London, is recognised as a world leader in AI for identity verification and authentication and was partnered with by CoinDCX to help the company figure out whether the user identities of the users’ identity documents are authentic.

- Partnership with BitGo – CoinDCX collaborated with BitGo in May 2020 to secure Indian crypto trader funds.

- CoinDcx partnered with Cryptocurrency Exchange OKEx, with over 50 million users worldwide, OKX is a global spot and derivatives exchange for cryptocurrencies and the second-largest exchange by trading volume.

CoinDCX – Achievements

CoinDcx is rewarded with the following recognitions from industry leaders:

• Great Place to Work Award 2021 & 2022.

• Tech Start-up of the Year Entrepreneur Awards.

• Elite list of Unicorns in India 2021 by Tracxn.

• Next Hottest Product by Amplitude Award.

CoinDCX- LayOffs

According to reports, CoinDcx has decided to direct the company’s growth in the direction of profitability and sustainability; they have let go of 12% (or about 70 employees) of the total workforce. According to Sumit Gupta, CEO of CoinDcx, “…Today, some of our incredibly talented team members will be parting ways with the organization. We are deeply sorry for that and we want to share our thoughts and reasons for the same,”.

Additionally, he added, “As you all know, startups and businesses globally are going through challenging times due to tough macro conditions, more so in crypto because of the prolonged bear market and impact of TDS on domestic exchanges. These factors had a significant impact on our volumes and thus revenues. To adapt, we undertook several proactive measures, including direct cost optimization and investment in automation to drive efficiency and productivity”

CoinDcx underwent internal reorganisation earlier in January, but it denied that any employees were laid off as a result of the process.

CoinDCX – Challenges Faced

CoinDCX was launched in 2018, and in the same year, RBI announced a banking ban on the transactions of cryptocurrencies. This ensured the shutdown of cryptocurrency startups in many parts of India, however, CoinDCX was one of the exceptional players who contested this ban, which finally, in March 2020, was invalidated by the Supreme Court of India. This lifting of the ban helped CoinDCX grow its user base from 150K to 400K investors on its exchange.

As the price of Bitcoin, the world’s leading cryptocurrency, dropped dramatically to a multi-month low, Indian cryptocurrency exchanges WazirX and CoinDCX experienced hour-long outages. Bitcoin’s price fell 30% in a few hours to $31,000 on May 19th, 2021. Many investors tried to sell their crypto assets to prevent large losses when the price fell, but they were unable to do so because WazirX and CoinDCX’s servers crashed, denying those trades.

Other investors attempted to purchase cryptocurrencies when the price was low, but their purchases were unsuccessful, resulting in a loss of valuable time before Bitcoin’s price rebounded to $40,000. Several investors converted their cryptocurrencies to Indian rupees and requested withdrawals, but stated that the funds were withdrawn from their crypto wallets but not reflected in their bank accounts.

Due to high user traffic we are aware some of our users like yourself might be experiencing issues related to services on our website and our Apps.

We are thankful for your patience and regret any inconvenience this may cause to you.https://t.co/W6oS8yz55v

— CoinDCX: Making Crypto Accessible to Indians (@CoinDCX) May 19, 2021

Following an informal advisory from the Reserve Bank of India, many Indian banks have stopped providing services to Indian crypto companies (RBI). Despite the Supreme Court’s decision in March 2020 to overturn the RBI’s 2018 circular prohibiting banks from offering services to crypto exchanges, this is still the case.

The current accounts of crypto companies have been suspended by ICICI Bank, one of the last few large lenders to provide services to them. Payment gateways for merchants buying or selling cryptocurrencies have reportedly been told by the private sector lender to turn off its net banking services.

CoinDCX was Questioned by ED in Relation to FEMA

The Enforcement Directorate (ED) has been working on an ongoing Foreign Exchange Management Act (FEMA) to verify whether or not the Indian cryptocurrency companies are engaged in foreign currency offences. CoinSwitch Kuber has also been notified by ED in relation to the same. The ED has already questioned Sumit Gupta, the founder of CoinDCX, at its headquarters in Bengaluru. His statements were also videotaped, as far as the reports go.

CoinDCX – Competitors

Top Competitors of CoinDCX are as follows:

- CoinSwitch Kuber

- Binance

- Zebpay

- Unocoin

- UPHOLD

- Coinbase

- Poloniex

- LocalBitcoins

- HitBTC

- Kucoin

- C-Cex

- Bitso

CoinDCX – Future Plans

- Aims to get 50 million Indians into the cryptocurrency bandwagon this year.

- Aims for widespread adoption among new crypto enthusiasts, especially millennials and Generation Z.

- Strives to spread awareness about cryptocurrencies.

- Looks forward to improve the company’s existing array of products.

- Aims to strengthen customer retention campaigns.

Speaking from a development perspective of the app, Neeraj Khandelwal, Co-founder, CoinDCX said, “Most of the app users are in the age group 22 to 45. This app has been introduced to serve a simple purpose; remove the fear of technology, make the market numbers more understandable and provide the ability to make informed decisions in the crypto universe. A smart investor will regularly invest at least 1 percent of his disposable income for Bitcoins in his investment portfolio. People having faith in the future of technology should do the same. The app just makes the induction easy. Buying Bitcoin on CoinDCX Go will be as easy as using any of the popular apps such as WhatsApp, Instagram, Amazon, or booking your cab through Uber.”

The company invested $1.3 million in TryCrypto, its own project aimed at making blockchain and cryptocurrency more available to mainstream consumers, in yet another effort to accelerate mass acceptance of cryptocurrencies.

FAQs

How does CoinDCX work? What does it do?

CoinDCX is a platform that allows users to legally exchange various cryptocurrencies. It is built for all types of traders, taking into account their trading background, risk tolerance, and trading frequency, allowing customers to trade their crypto assets according to their requirements.

Who founded CoinDCX?

CoinDCX was founded by Sumit Gupta and Neeraj Khandelwal in March 2018.

Which companies do CoinDCX compete with?

Top Competitors of CoinDCX are UPHOLD, Binance, Coinbase, Poloniex, LocalBitcoins, HitBTC, Kucoin, C-Cex, Bitso, and WazirX.

How does CoinDCX make money?

Deposit fees (charged on exchanging currencies), withdrawal fees, trading commissions (0.01 percent of the overall transaction is normal on any exchange), and listing fees are how CoinDCX makes money, just like any other cryptocurrency exchange.

How is the CoinDCX funding?

CoinDCX funding is impressive. In fact, CoinDCX is also hailed as the only crypto startup in India to have raised three funding rounds in less than a year.

What is the CoinDCX transaction fees?

If you are wondering about the CoinDCX transaction fees, then you need to know that CoinDCX charges 0.10% commission from both the takers and makers.