AI applications for saving money will track spending, locate bargains, and automatically set budgets for users. These apps alert users about discounts and coupon suggestions, draw attention to unused subscriptions, and assist users in canceling them with ease. These apps usually learn the spending habits of their users and encourage smarter decisions with the option to compare prices and app information before making purchases. Some will assist in splitting bills with friends, while others help in tracking savings goals, making it easier to set something aside each month. A lot of tools offer just simple graphs of expenses and savings for easy catching of trends.

| App | Core Features | Platform Availability |

|---|---|---|

| Cleo | Chatbot-style budgeting, savings challenges, cash advance (up to $250), credit builder card | iOS, Android |

| Wally | Global expense tracking, 60+ currencies, visual dashboards, joint/group budgeting | iOS |

| Rocket Money | Subscription tracking & cancellation, bill negotiation, spending insights, auto-saving | iOS, Android, Web |

| Monarch Money | Unified tracking (bank, loans, investments), family collaboration, Sankey cash-flow charts | iOS, Android, Web |

| Plum | Auto-savings, round-ups, bill switching, pension consolidation, investment options | iOS, Android (UK/EU focus) |

| Acorns | Round-up investing, automated portfolios, retirement accounts, family/child accounts | iOS, Android |

| Trim | Subscription cancellation, bill negotiation, budgeting tools, finance concierge | Web (mobile-friendly) |

| PocketGuard | Expense tracking, “In My Pocket” leftover-cash view, bill negotiation, debt payoff planning | iOS, Android |

| YNAB Smart Planner | Zero-based budgeting, scenario planning, goal tracking, group budgeting (YNAB Together) | iOS, Android, Web |

Cleo

| Website | cleo.ai |

|---|---|

| Rating | 4.6 |

| Free Trial | Yes |

| Best For | Personal finance management with AI-powered budgeting, saving, and spending insights through a chatbot interface. |

AI-driven Cleo is an application that helps people save money by tracking spending, with budget tips, and suggestions for customized savings challenges. Feedback from the chatbot is in a fun chat style, with alerts for bills, and the emergency provision of cash advances of up to $250. Users can gain insights into their spending for a basic free service or upgrade for more extras like credit-building, overdraft alerts, and high-yield savings. This money management app lowers stress through active reminders and a flirtatious approach. Access to the Cleo learning algorithm tracks harmful spending patterns and encourages users to develop better habits using simple goal-setting and handy tools.

Pros

- Automated savings challenges and the categorization of expenditures

- Emergency cash advances of up to $250 Credit

- Builder card for raising credit scores

Cons

- Some features are behind paywalls

- Doesn’t offer direct bill payment

Pricing

Check Play Store/App Store

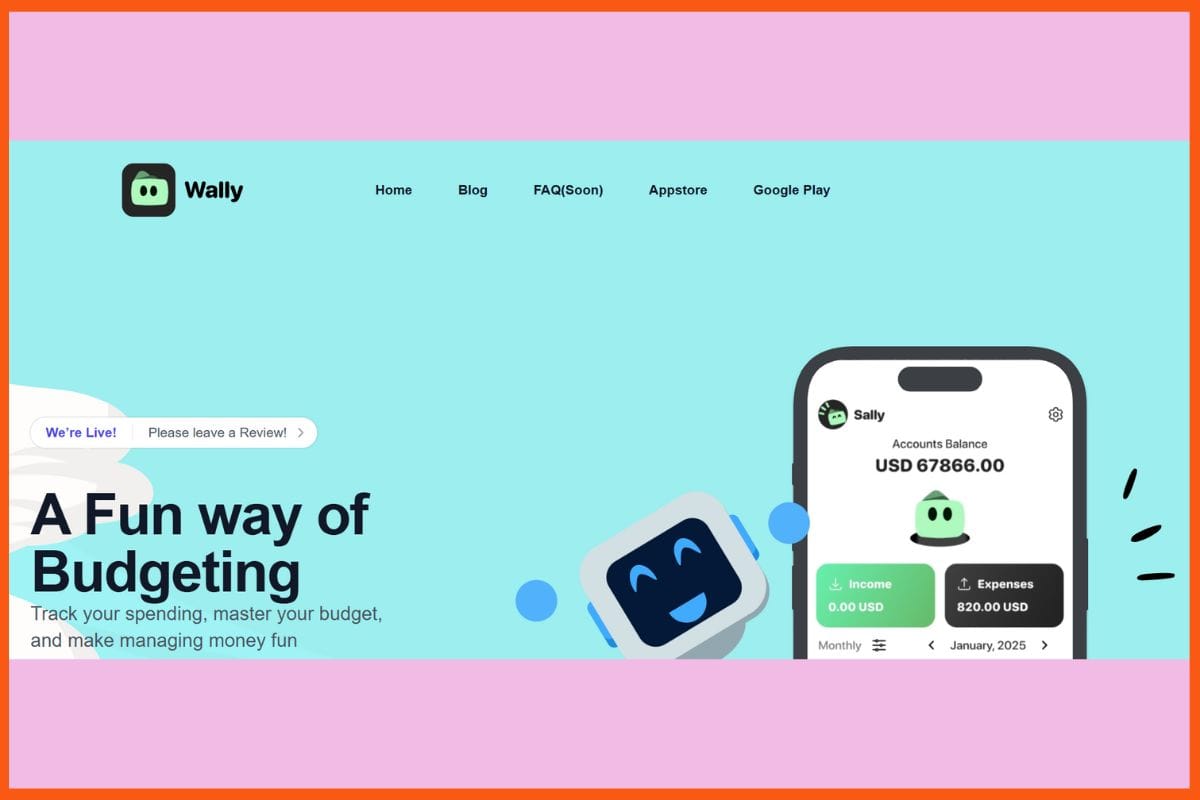

Wally

| Website | wally.me |

|---|---|

| Rating | 4.5 |

| Free Trial | Yes |

| Best For | Individuals seeking smart expense tracking, budgeting, and personal finance management with global currency support. |

Wally gives a helping hand to save money in AI by tracking spending, setting budgets, and organizing loans in one place. It connects to bank accounts worldwide, manages currencies, and presents easy-to-understand charts on every bill, budget, and goal. Users enjoy daily expense tracking, automatic updates, and smart reminders as to when to pay. The app is activated for families or individuals with highly secure syncing and group money-tracking features. Wally’s clean design is best suited for visual learners and keeps budgeting fun. The users can check out their financial health across all their accounts and gain key insights into where their money goes, helping them fine-tune their habits towards saving more.

Pros

- Connects with 15000 banks all over the world, from 70 countries.

- Cater to 60 currencies for a traveler or global user; has goal planning

- Visualized dash boards for tracking very easy for everyone.

Cons

- Limited to iOS only, with no Android edition.

- Not all joint budgets or unlimited accounts have appeared in the free version.

Pricing

Check Play Store/App Store

Rocket Money

| Website | rocketmoney.com |

|---|---|

| Rating | 4.4 |

| Free Trial | Yes |

| Best For | Users who want to manage subscriptions, track spending, lower bills, and improve savings with personalized finance tools. |

Rocket Money is an app powered by AI to track your spending, identify and delete unused subscriptions, and haggle with service providers on your behalf to save money. It links up to your bank, pinpoints repeat payments, and offers you simple-to-use displays, showing you how you’re doing against your budget. Smart reminders paired with automatic saving make managing money easy while premium features provide a credit report, net worth tracking, and unlimited budgets. The smooth design works easily on iOS, Android, and desktop for speedy access, thereby ensuring that financial health tools are just a click away. Rocket Money helps users to expose wastage and increase their savings almost effortlessly.

Pros

- Concierge fast subscription cancellation option

- Bill negotiation service that can effortlessly reduce expenses

- Visual spending snapshots for smart tracking

Cons

- The bill negotiation fee is 30-60% of first-year savings.

- No investment management or comprehensive financial planning.

Pricing

Check Play Store/App Store

Monarch Money

| Website | monarchmoney.com |

|---|---|

| Rating | 4.7 |

| Free Trial | Yes |

| Best For | Families and individuals seeking collaborative budgeting, financial tracking, and goal planning with bank sync and investment insights. |

Monarch Money comprises an advanced AI budgeting system that integrates bank accounts, credit cards, loans, real estate, and investments into one place, apart from tracking spending. It arranges all the transactions and identifies subscriptions that can be canceled easily. Each user can get specifically designed budgets, detailed charts, and investment analysis while tracking real-time statuses of their goals via a clear and easy-to-use design. Monarch incorporates family collaboration, supports bank-level security, and provides syncing with over 13,000 institutions. It is designed for iOS, Android, and web-based platforms, making intelligent budgeting and saving easy for individuals as well as households looking to maintain complete control of their finances.

Pros

- Consolidated dashboard overview for all accounts

- Profound investment and goal tracking

- Sankey diagram and advanced visualizations on the cash flow

Cons

- Premium pricing that is higher than most alternatives

- With certain banks, the syncing issue may arise randomly

Pricing

| Plan | Pricing |

|---|---|

| Monthly | $14.99 / month |

| Yearly | $8.33 / month |

Plum

| Website | withplum.com |

|---|---|

| Rating | 4.5 |

| Free Trial | Yes |

| Best For | Automated saving and investing app that helps users budget smarter, grow savings, and invest effortlessly using AI insights. |

Plum is an application powered by Artificial Intelligence that automatically saves money for its users after analyzing their expenditure and depositing small amounts into savings accounts. It also provides round-up facilities and custom savings modes, bill-switching to reduce utility costs, and invests for individuals into professionally managed funds or ISAs. Plum connects with UK banks, advises how to save, allows instant access to money held, reinforces helpful reminders, and provides finance breakdowns. Users grow wealth through smooth auto-deposits and could also keep track of their budgets, set goals, and consolidate pensions all in one secure, easy-to-use app. The simple and adaptive AI makes it seem effortless to save and helps users save without changing their routine.

Pros

- Habitual auto-saving that doesn’t stress you out

- Bill swapping gets you through a deal at breakneck speed

- Roundups increase the lift into savings by collecting spare change

Cons

- Only paid plans can feature investment tools.

- International access limitations apply.

Pricing

| Plan | Pricing |

|---|---|

| Plus | $5.39 / month |

| Boost | $10.79 / month |

| Max | $16.19 / month |

Acorns

| Website | acorns.com |

|---|---|

| Rating | 4.6 |

| Free Trial | Yes |

| Best For | Beginners looking to start investing easily through round-ups, automated portfolios, and long-term wealth-building tools. |

Acorns is hugely reliant on artificial intelligence to help with money savings and investment-aiding people. The extra amounts include the pennies rounded up from cash purchases and the difference allocated into portfolios made by experts for consumers. Thus, investment automation, finances gained through purchases, and fractional stock purchases are all made available within the application. This portfolio includes retirement accounts and opportunities for investing in a socially responsible way. Acorns Early is an account available to parents through which, through Acorns, they can manage their children’s accounts. It allows recurring contributions and saves simple lessons on money. It is, of course, safeguarded by very trusted custodians and with amazing safety.

Pros

- Round-up investing makes saving effortless.

- Start investing with little money.

- Cash-back rewards with select purchases.

Cons

- Fewer portfolios to choose from–no custom picks.

- No access to human advisors for individualized assistance.

Pricing

| Plan | Pricing |

|---|---|

| Acorns Bronze | $3 / month |

| Acorns Silver | $6 / month |

| Acorns Gold | $12 / month |

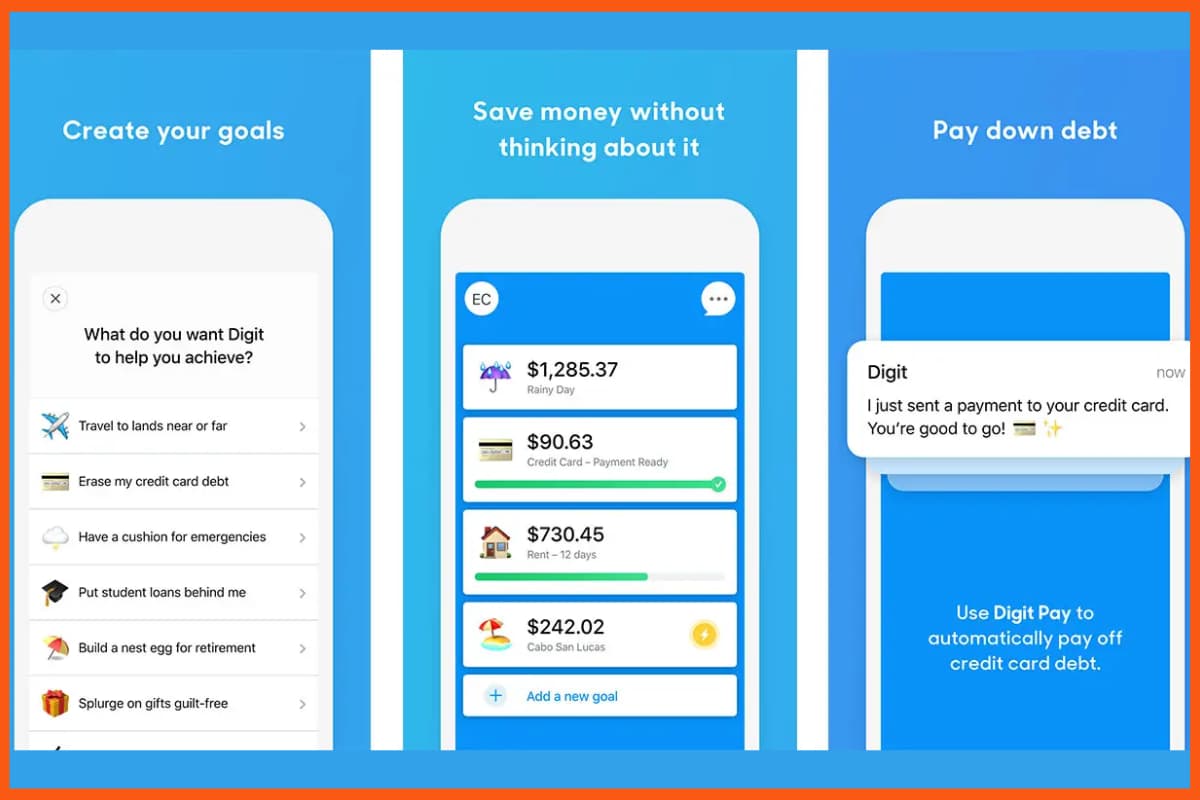

Digit

| Website | digit.co |

|---|---|

| Rating | 4.4 |

| Free Trial | Yes |

| Best For | Individuals seeking automated saving, budgeting, and investing tools that adapt to spending habits and financial goals. |

Digit is your financial app for savings powered completely by AI; depositing of cash is simplified, made absolutely effortless, eliminates all stress. It takes into consideration all the income, bills and spending, and then moves small amounts from checking to savings without needing any planning. The app can save automatically, pay bills, pay down debt, save small discretionary amounts, and even create retirement goals. It sends instant alerts each time a transfer is made and helps avoid an overdraft. You can also set up personal rules for getting to your savings target more quickly. Designed simply, with dashboards that are clear, it fits the busy person who wants to track his funds on the go.

Pros

- Savings are automatically adjusted to income and habits.

- Includes bill payment and debt paydown tools.

- No need for manual transfers—progressive saver.

Cons

- Some features limited to US-based accounts.

- Requires sharing bank login information to achieve full automation.

Pricing

| Plan | Pricing |

|---|---|

| Essentials | $65 / month |

| Core | $100 / month |

| Professional | Custom |

Trim

| Website | asktrim.com |

|---|---|

| Rating | 4.3 |

| Free Trial | Yes |

| Best For | Users wanting to cancel unwanted subscriptions, negotiate bills, track spending, and save automatically with AI-driven insights. |

Trim is an AI-powered app designed to help users save money and make managing their expenditures easier. It scans transactions for repeated charges and cancels unwanted subscriptions. Trim also negotiates reduced bills for cable, internet, and utilities, thereby allowing users to save without any hassle. The app includes a free budgeting tool that makes it very easy to track expenses and set goals. With bill negotiation, customers only pay a fee if savings are secured, making it a risk-free process. For further assistance, a finance concierge personally counsels the user on a pay-what-you-want basis. Trim is running on a secure, mobile-friendly website rather than a mobile app, so that anyone can get started quickly.

Pros

- Payments are required only if savings are secured.

- All users get free tracking and cancellation of subscription.

- It gives a fair opportunity for a personal finance coach.

Cons

- Budgeting tools are not a strong suit versus the top competitors.

- Success fees deducted at the inception can affect the expenses of the present month.

Pricing

Sign up

PocketGuard

| Website | pocketguard.com |

|---|---|

| Rating | 4.5 |

| Free Trial | Yes |

| Best For | Individuals who want to control spending, track bills, and optimize budgets with a simple “In My Pocket” money management view. |

PocketGuard is an AI budgeting app that helps people track expenses and save more easily. It links directly with bank accounts and credit cards, sorting spending and bills into one neat space. And since the app auto-categorizes transactions, it can find ways you might save money, and it uses its “In My Pocket” tool to show you just how much cash you’ve got left after your goals and payments. Users can set custom goals, build rollover budgets, and plan for debt payoff. Alerts in real-time warn against any out-of-the-ordinary spending, while bank-grade security stands watch to protect the user’s data.

Pros

- Free cash budgetary tracker just for “In My Pocket” use.

- Negotiates your bills with major providers.

- Live alerts and security features.

Cons

- Specific transactions require manual entry.

- Most features need premium

Pricing

| Plan | Pricing |

|---|---|

| Monthly Plan | $12.99 / month |

| Yearly Plan | $6.25 / month |

YNAB Smart Planner

| Website | ynab.com |

|---|---|

| Rating | 4.8 |

| Free Trial | Yes |

| Best For | Users seeking proactive budgeting with real-time tracking, goal planning, and debt payoff strategies using the YNAB method. |

YNAB Smart Planner is an artificial intelligence-driven budgeting application based on a zero-sum budget, so that every single rupee is accounted for: from bill payments to savings. It connects with bank accounts, categorizes expenses, and forecasts cash flow to keep the user one step ahead. Scenario tools allow users to prepare for risks or changes in their lives. An “age of money” report gives insight into financial health, while real-time goals with detailed breakdowns leave no doubt as to where one could cut back. YNAB Together allows groups of a maximum of five people to budget together. The app is available on mobile and desktop to give its users full control from anywhere.

Pros

- Unique Zero-based budgeting for maximum savings.

- Scenario planning and goal tracking using AI.

- Share budgets with a maximum of 5 users (YNAB Together).

Cons

- No automatic cancellation of subscriptions.

- Manual and time-consuming management of budgets.

Pricing

| Plan | Pricing |

|---|---|

| Monthly Plan | $14.99 / month |

| Annual Plan | $9.08 / month |

Conclusion

The apps help in saving money by letting people make intelligent choices easily. They keep a track of the expenses, identify the wasteful ones, and increase savings with little effort. Each of them has a simple dashboard and uses data to show where cash flows, so one can change his/her habits easily. With the assistance of bill alerts and budget tips, people get the required track to pursue. Some offer cash-back, round-ups, or even help with investments, so that to feel that growing wealth is automatic. Group plans make savings for the families easy, and reminders help avoid late fees. Using advanced security, these applications keep money safe while guiding smarter moves.

FAQs

How do AI money-saving apps work?

AI-powered finance apps track your spending, categorize expenses, locate bargains, suggest coupons, and even cancel unused subscriptions.

Are AI budgeting apps safe to use?

Yes, most leading apps use bank-level encryption and security measures.

Can AI finance apps help improve credit scores?

Yes, apps provide a Credit Builder card that helps users build or repair their credit history while also tracking spending and offering savings challenges.