When the online food delivery market is seeing a rise in the country, there is another related sector that is rapidly peeking its way into the market. Cloud Kitchen, as a name, sounds familiar and strange at the same time, is a new concept in our country that was introduced somewhere around 2010. The popularity and demand for Cloud Kitchens have started soaring up after the COVID pandemic.

Curefoods is one such Cloud Kitchen startup that was established to provide healthy and loving food to customers through its multiple brands. Utilizing the prevailing public admiration and anticipated future demand for Cloud Kitchens, Curefoods is marching on the path of growth and expansion.

Here is the story behind the Curefoods Founders, Startup Story, Mission and Vision, Business Model, Revenue Model, Products, Funding and Investors, Competitors, and more.

Curefoods – Company Highlights

| STARTUP NAME | CUREFOODS |

|---|---|

| Headquarters | Bangalore, Karnataka, India |

| Sector | Food and Beverage Services |

| Founder | Ankit Nagori |

| Founded | 2020 |

| Website | curefoods.in |

Curefoods – About

Curefoods – Industry

Curefoods – Founders and Team

Curefoods – Mission and Vision

Curefoods – Name and Logo

Curefoods – Business Model

Curefoods – Revenue Model

Curefoods – Funding and Investors

Curefoods – Shareholding

Curefoods – Financials

Curefoods – Mergers and Acquisitions

Curefoods – Competitors

Curefoods – Future Plans

Curefoods – About

Curefoods is an Indian Cloud Kitchen brand that was established in 2020. This startup was founded by Ankit Nagori and is headquartered in Bangalore. It aims at feeding people the food they love that remains nutritious and healthy at the same time. Curefoods has incorporated technology and modern solutions on all its fronts, like cooking, packaging, waste management, etc., to ensure its long-term sustainability in the market.

The company operates through various brands under its control and is continuously expanding its business through acquisitions, mergers and funding. After its merger with Maverix in January 2022, Curefoods became the second-largest Cloud Kitchen brand in India.

Curefoods – Industry

The Indian food and beverage market is expected to develop significantly in the coming years, according to Maximize Market Research’s report, which also shows that the market is expected to expand significantly in size. The market is expected to grow at a strong Compound Annual Growth Rate (CAGR) of 11.05% from 2023 to 2029, when it is expected to reach nearly US $622.67 billion by 2029. The enormous potential and profitable prospects in the Indian food and beverage industry are highlighted by this forecast.

The anticipated expansion highlights the nation’s shifting food patterns, rising levels of disposable income, and changing consumer tastes. With such bright futures, companies in this sector are well-positioned to benefit from India’s expanding need for a wide range of food and drink items.

Curefoods – Founders and Team

Ankit Nagori is the Founder of Curefoods.

Ankit Nagori

Ankit Nagori is the Founder of the Cloud Kitchen startup Curefoods. He was born in Bihar in October 1985 and holds a Bachelor’s degree from IIT Guwahati. Ankit founded another two startups namely, Youthpad.com and Simply Sport Foundation in 2007 and 2020 respectively. He is also a co-founder of Curefit. Earlier, between 2010 and 2016, he served as the Chief Business Officer of Flipkart.

Ankit Nagori – Founder of Curefoods

Curefoods – Mission and Vision

Curefoods runs with a mission: “to make honest food that customers love.” It wanted to provide quality and healthy foods that people love sustainably.

The company’s vision is to “build the ecosystem and grow with the suppliers.” For a sustainable operation, Curefoods believes in being eco-friendly and hence is working towards waste management and eco-friendly packaging techniques.

Curefoods – Name and Logo

The logo of Curefoods comes in a Deep Sapphire tint, where the name ‘Curefoods’ in all caps would be present in the middle.

Curefoods – Business Model

Curefoods follows the Thrasio-style model of business. Thrasio refers to the name of a company in the United States. This company acquires or collaborates with small and successful sellers on e-commerce platforms like Amazon and invests more in those companies to make them huge and well established under a single brand name.

Curefoods follows a similar pattern and has acquired a lot of small food startups across the country. The main idea behind this is to provide people with multiple options to choose their food based on their choices. Curefoods receives orders, cooks them, and delivers them to your doorstep.

Curefoods – Revenue Model

CureFoods generates revenue through two primary streams: the sale of products and advertising/promotional services.

Sales of Goods: CureFoods generates income through the sale of a wide variety of food and drink goods. These goods could be prepared meals, snacks, drinks, and ingredients for cooking.

Consumers can buy these products straight from CureFoods’ website or through partnerships with retail stores. CureFoods is able to realize the full value of its products through the selling of these items at a profit over their cost of production.

Advertising and Promotional Services: CureFoods uses its platform to provide food and beverage brands with advertising and promotional services in addition to product sales.

Curefoods – Funding and Investors

Curefoods raised $6.6 million in a debt financing round from BlackSoil, Binny Bansal, and Caspian Investments in March 2025.

The following contains the Curefoods funding in detail:

| Date | Stage | Amount | Investors |

|---|---|---|---|

| March 23, 2025 | Debt Financing | $6.6 million | BlackSoil, Binny Bansal and Caspian Investments |

| March 18, 2024 | Series D round | $25 million | Three State Ventures |

| April 6, 2023 | Venture Rounds | INR 300 crore | Three State Capital |

| April 6, 2023 | Debt Financing | – | Three State Capital |

| July 26, 2022 | – | – | Nora Fatehi |

| June 1, 2022 | Series C | $50 million | Chiratae Ventures, Alteria Capital, Accel India, NB Ventures, Iron Pillar, Winter Capital |

| April 6, 2022 | Venture Round | – | Varun Dhawan |

| January 12, 2022 | Venture Round | $49.3 million | Accel, Chiratae Ventures, Binny Bansal, Iron Pillar, Sixteenth Street Capital |

| January 12, 2022 | Debt Financing | $9.3 million | Trifecta Capital, Alteria Capital and BlackSoil |

| October 22, 2021 | Debt Financing | $10 million | Trifecta Capital and Alteria Capital |

| September 30, 2021 | Venture Round | $48.1 million | Trifecta Capital |

| August 24, 2021 | Series A | $12.2 million | Kunal Shah, Binny Bansal, Iron Pillar, Nordstar, Lydia Jett |

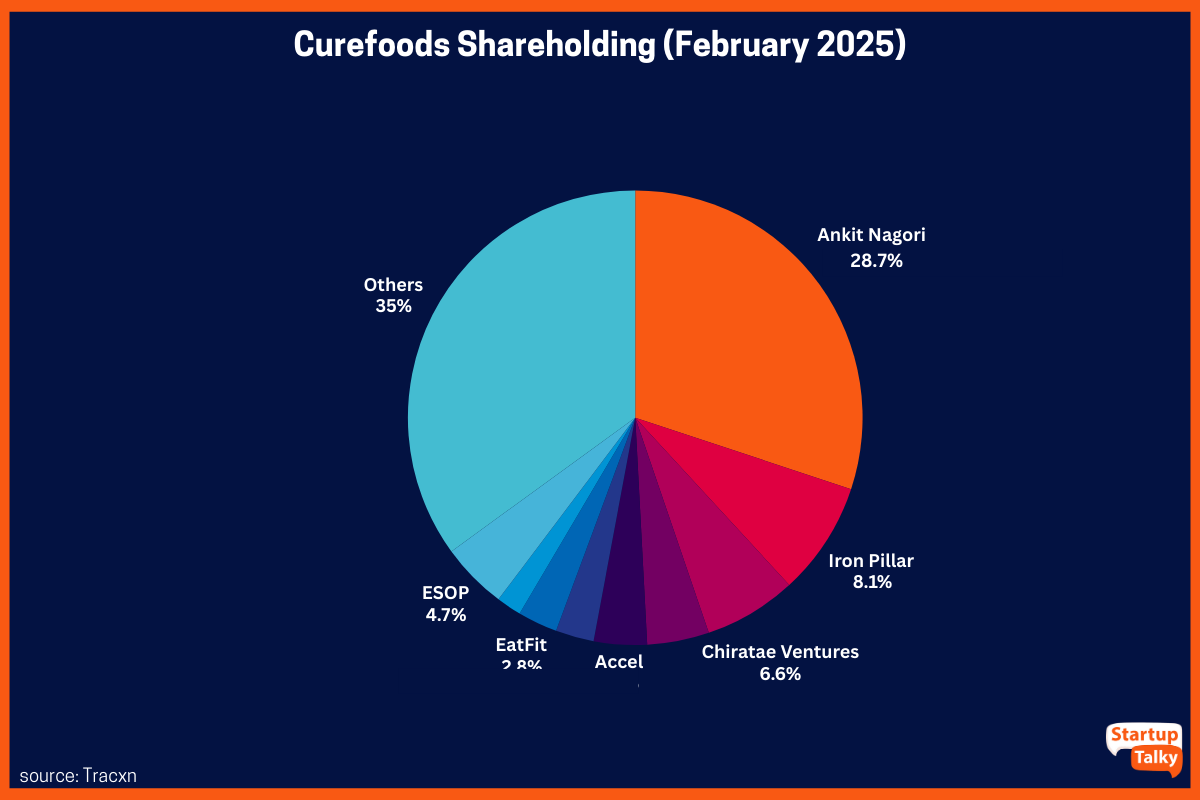

Curefoods – Shareholding

Curefood’s shareholding pattern as of February 2025, sourced from Tracxn:

| Curefoods Shareholders | Percentage |

|---|---|

| Ankit Nagori | 28.7% |

| Iron Pillar | 7.7% |

| Chiratae Ventures | 6.3% |

| Rockstone Ventures | 4.2% |

| Accel | 3.6% |

| Three State Capital | 2.6% |

| Global Ecommerce Consolidation Fund | 1.7% |

| RB Investments | 1.4% |

| Zephyr Peacock | 1.4% |

| Brand Capital | 0.8% |

| Sixteenth Street Capital | 0.6% |

| Alteria Capital | 0.5% |

| Shinhan Venture Investment | 0.4% |

| Nbventures | 0.3% |

| Rukam Capital | 0.2% |

| Rhodium Trust | 0.2% |

| Trifecta Capital | 0.2% |

| Singularity Ventures AMC | 0.1% |

| FPGA Family Foundation | 0.1% |

| LetsVenture | 0.1% |

| Curefoods Rulezero Angel Investors Trust | 0.1% |

| Pivot Investment Partners | < 0.1% |

| Qed Innovation | < 0.1% |

| Napatree Capital | < 0.1% |

| Potential Ventures | < 0.1% |

| Ananth Sankaranarayanan Family Trust | < 0.1% |

| BlackSoil | < 0.1% |

| EatFit | 2.7% |

| Horizon Techno | 0.3% |

| Allanasons | 0.1% |

| The Ski Bum | < 0.1% |

| Frigerio Conserva Allana | < 0.1% |

| Angel | 1.7% |

| Other People | 0.1% |

| ESOP Pool | 4.5% |

| Total | 70.9% |

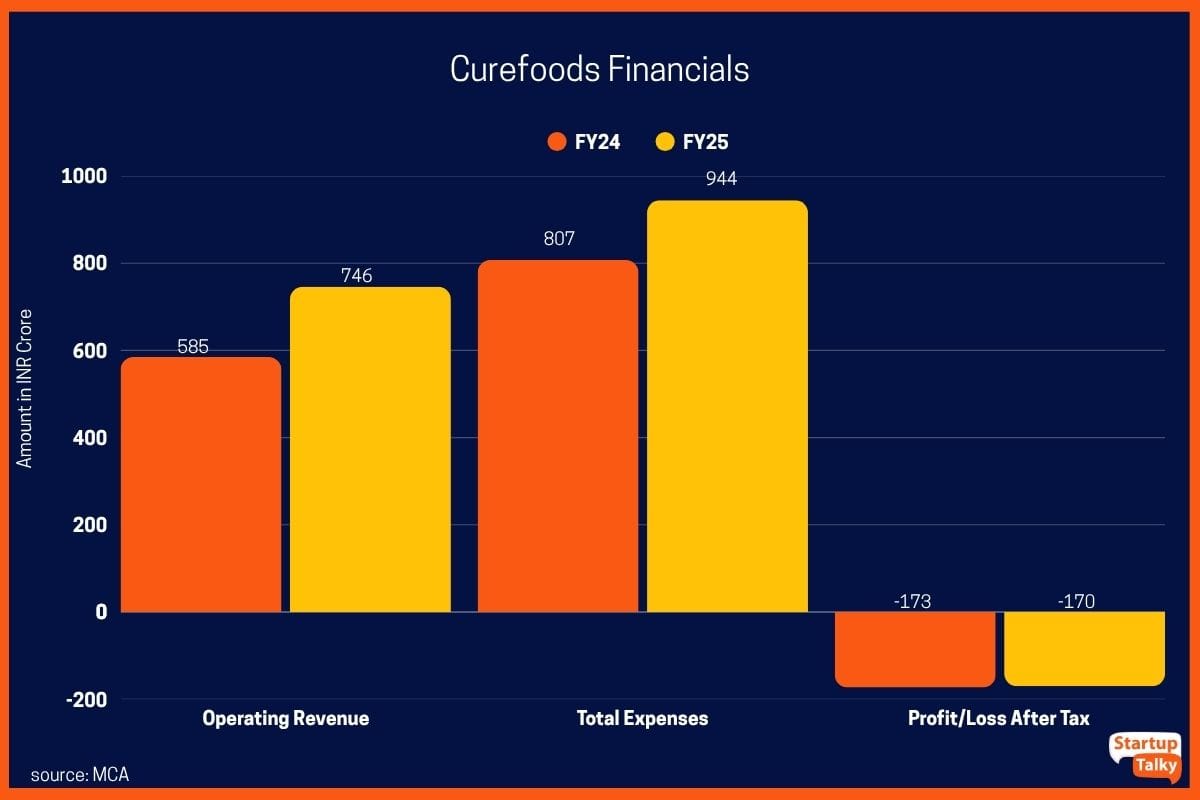

Curefoods – Financials

| Particulars | FY24 | FY25 |

|---|---|---|

| Revenue | INR 585 crore | INR 746 crore |

| Expenses | INR 807 crore | INR 944 crore |

| Profit/Loss | INR -173 crore | INR -170 crore |

EBITDA

| Particulars | FY24 | FY25 |

|---|---|---|

| EBITDA Margin | -12.91% | -7.48% |

| Expenses/INR of OP Revenue | INR -1.38 | INR 1.27 |

| ROCE | -23.34% | -18.6% |

Curefoods – Mergers and Acquisitions

Curefoods has acquired 6 companies to date.

Here are the details:

| Company Name | Date |

|---|---|

| Yumlane | Oct 30, 2023 |

| Frozen Bottle | Mar 10, 2022 |

| Fingerlix | Jan 27, 2022 |

| Ammi’s Biryani | Oct 22, 2021 |

| CakeZone | Oct 22, 2021 |

| Masalabox Food Networks | Oct 22, 2021 |

Curefoods – Investment

CureFoods has made strategic investments in two companies. During its Seed Round, CureFoods invested INR 10 crore in Hogr on December 18, 2023. CureFoods first took part in a Corporate Round investment in Millet Express on May 1, 2023.

With these investments, CureFoods is demonstrating its dedication to advancing innovation and growth in the food and beverage sector, as well as broadening its market presence.

Curefoods – Competitors

Curefoods has the following major competitors in the market:

Rebel Foods

Rebel Foods is considered to be the largest Cloud Kitchen brand in the world that does business in over 10 countries. Rebel Foods owns an online food delivery company, Faasos. This company excels in every aspect of its operation, like technology, branding, expansion, marketing strategies, etc. Rebel Foods has partnered with various international brands to firmly establish its business operations around the world.

Biryani by Kilo

Biryani By Kilo (BBK) is a biryani retail chain that is based in Gurgaon, Haryana. This startup is well-known for its aromatic biryani served in pots along with kebabs, korma, and the traditional phirni. BBK has expansion plans in and outside India.

SLAY Coffee

SLAY Coffee is a coffee chain that is the second-largest coffee brand in the country. This startup delivers its coffee through platforms like Swiggy and Zomato and is extremely well-rated among its customers.

Curefoods – Future Plans

Picking up a global QSR brand name at this scale of the business serves to send a signal to investors on growth ambitions, making it work has been anything but easy. Curefoods and its multi brand approach remains to be tested, especially with profits still distant, and H1 of FY 26 will probably be a good time to evaluate if the firm has discovered a path to profitability.

FAQs

When was Curefoods India founded?

Curefoods was founded in 2020.

Who is the Curefoods founder?

Ankit Nagori is the founder of Curefoods.

What is Curefoods valuation?

As sourced from Tracxn, Curefoods valuation is $451 million as of February 2025.

Who are the Competitors of Curefoods?

Top Competitors of Curefoods are:

- Rebel Foods

- Biryani By Kilo

- SLAY Coffee

How is Binny Bansal connected with Cure foods?

Binny Bansal is known as the Flipkart founder and a billionaire Indian investor and entrepreneur, who left the company in November 2018. Binny Bansal stands as an investor in Curefoods.

What is Curefoods business model?

Curefoods follows a cloud kitchen business model, operating multiple food brands under one roof. It acquires, builds, and scales food brands, leveraging a centralized kitchen network for cost efficiency. The company focuses on online food delivery, using digital platforms and strategic brand partnerships to drive growth.

What are Curefoods products?

Curefoods owns and operates multiple food brands in the cloud kitchen space, catering to various customer preferences. Its key brands include EatFit (healthy meals), Sharief Bhai Biryani and Aligarh House Biryani (biryani and Mughlai cuisine), MasalaBox (home-style meals), Yumlane (ready-to-eat pizzas), CakeZone (cakes and desserts), and Nomad Pizza (artisanal pizzas). These brands primarily focus on online food delivery through platforms like Swiggy and Zomato.

What are Curefoods locations?

Curefoods operates across major Indian cities, including Bengaluru (HQ), Delhi NCR, Mumbai, Hyderabad, Chennai, Pune, and Kolkata. It has expanded into Tier-1 and Tier-2 cities through a network of cloud kitchens, serving customers via online food delivery platforms.