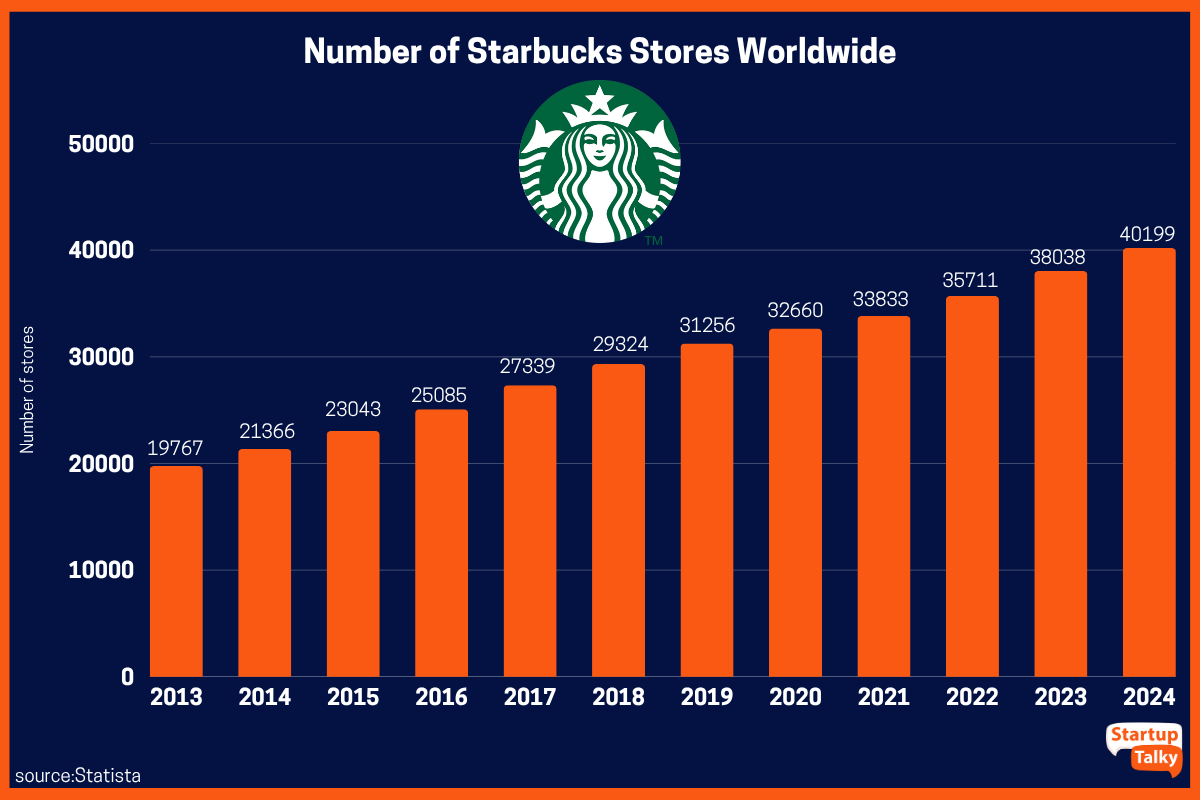

Starbucks Corporation is an American coffee chain that was established in 1971 in Seattle, Washington. By 2023, the organization had a presence in over 38,000 areas around the world. Starbucks has been depicted as the fundamental delegate of “second wave espresso,” a reflectively-named development that advanced high-quality espresso and specially simmered coffee. Starbucks now uses robotized coffee machines for proficiency and well-being.

Starbucks serves hot and cold beverages, entire bean espresso, micro-ground moment espresso known as VIA, coffee, caffe latte, full-and free leaf teas such as Teavana tea products, Evolution Fresh squeezes, Frappuccino refreshments, La Boulange baked goods, and bites (for example, chips and wafers); some offerings such as the Pumpkin Spice Latte are explicit to the territory of the store. Numerous Starbucks outlets sell pre-bundled nourishment items, sweltering and cold sandwiches, and drinkware such as cups and tumblers. Furthermore, there are Select “Starbucks Evenings” areas that offer brew, wine, and appetizers.

Starbucks first ended up productive in Seattle in the mid-1980s. Despite an underlying financial downturn with its venture into the Midwest and British Columbia in the late 1980s, the organization experienced rejuvenated success with its entrance into California in the mid-1990s. Starbucks opened an average of two new stores every day between 1987 and 2007.

Brian Niccol is the current CEO of Starbucks, a role which he started on September 9, 2024. Before Niccol, Indian-American Laxman Narasimhan served as the CEO of Starbucks.

This article is a case study of Starbucks with Starbucks Startup Story, its presence in India, business strategy, future plans, and more.

Starbucks – Company Highlights

| Startup Name | Starbucks |

|---|---|

| Headquarters | Seattle, Washington, United States |

| Sector | Food and Beverage, Hospitality |

| Founders | Gordon Bowker, Jerry Baldwin, Zev Siegl |

| Founded | 1971 |

| Valuation | $108.84 billion (September 2024) |

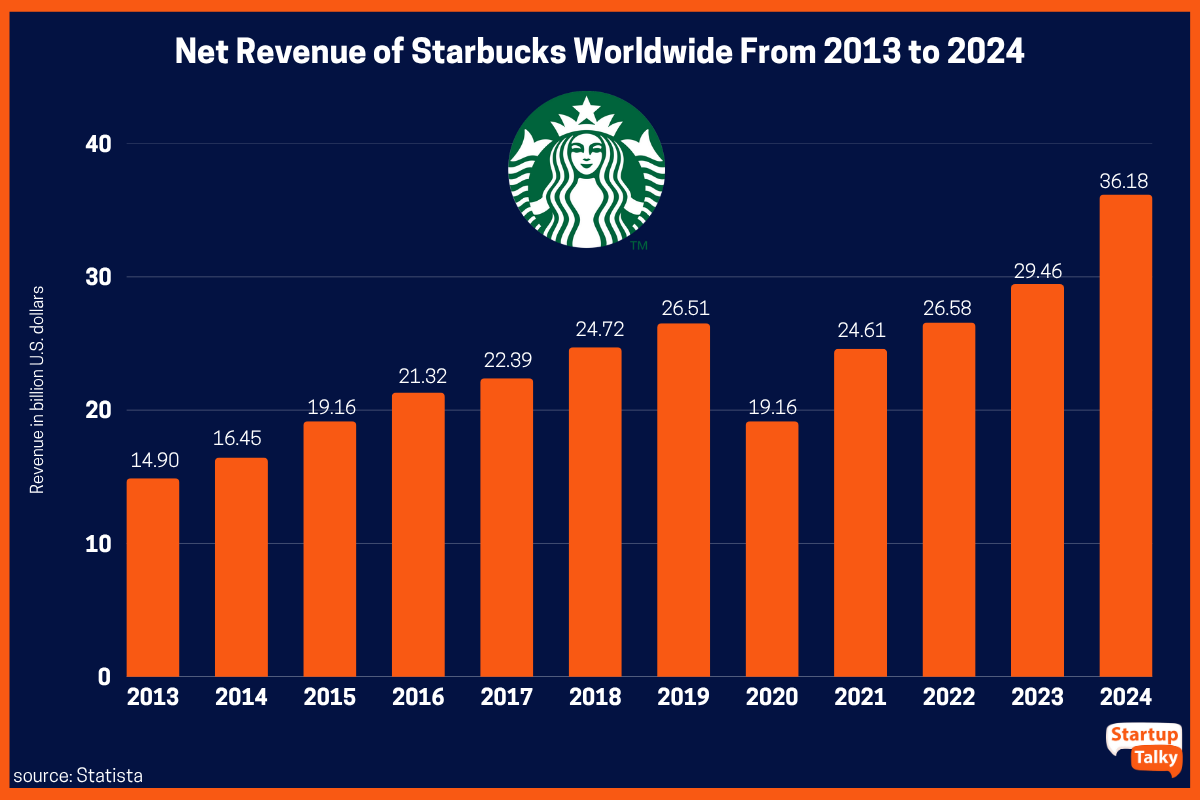

| Revenue | $35.98 billion (FY23) |

| Parent Organization | Joint Venture Company of Tata Consumer Products and Starbucks Corporation |

| Website | starbucks.com |

Starbucks – Startup Story

Starbucks – History

Starbucks – Name and Logo

Starbucks – Expansion Journey

Starbucks – India

Starbucks – Business Strategy in India

Starbucks – Products

Starbucks – Business Growth

Starbucks – Future Plans

Case Study of Starbucks

Starbucks – Startup Story

If you are wondering how did Starbucks start? Then, the story of Starbucks started when the company was a roaster and retailer of whole bean and ground coffee, tea, and spices with a single store in Seattle’s Pike Place Market. Gordon Bowker, Jerry Baldwin, and Zev Siegl founded Starbucks in 1971.

Zev Siegl stated that at that time he knew the coffee industry inside and out, he was well-versed, especially with the gourmet end of the industry. Besides, he was also known as the most educated coffee guy in the country at that time. So, the three college friends – Zev Siegl, Jerry Baldwin, and Gordon, started with their coffee bean shop and roastery at Seattle’s famous Pike Place Market in 1971. Eventually, they found a mentor in Alfred Peet, who was the founder of Peet’s Coffee and the man responsible for bringing custom coffee roasting to the U.S., and started with the coffee business in full swing. Starbucks initially began by selling coffee beans that were roasted by Peet’s, a gourmet coffee company in Berkeley, California, and later on, started roasting on their own.

Starbucks – History

The first Starbucks store was initiated in 1971 in Washington by 3 individuals who met while they were studying at the University of San Francisco: English educator Hun Baldwin, history educator Zev Siegl, and author Gordon Bowker. The trio was encouraged to sell top-notch espresso beans and hardware after businessman Alfred Peet showed them his style of simmering beans.

During this time, the organization sold simmered, entire espresso beans. During its first year of activity, Starbucks bought green espresso beans from Peet’s and then started purchasing legitimately from producers.

Starbucks – Name and Logo

Bowker reviews that Terry Heckler, with whom Bowker claimed a publicizing office, thought words starting with “st” were ground-breaking. The organizers conceptualized a rundown of words starting with “st” and in the long run arrived at “Strabo,” a mining town in the Cascade Range. The team then finalized “Starbucks,” the name of the young chief mate in the book “Moby-Dick”.

Starbucks has given too many slogans/taglines already among which the most popular one is – “Brewed for those who love coffee”.

Starbucks – Expansion Journey

In 1984, the first proprietors of Starbucks, driven by Jerry Baldwin, acquired Peet’s. During the 1980s, all-out offers of espresso in the US were falling. However, offers of strength espresso expanded, shaping 10% of the market in 1989; it stood at just 3% in terms of market share in 1983. By 1986, the organization worked six stores in Seattle and had just barely started to sell coffee.

In 1987, the first proprietors sold the Starbucks chain to the previous manager Howard Schultz, who rebranded his II Giornale espresso outlets as Starbucks and immediately extended. Starbucks then launched its outlets outside Seattle at Waterfront Station in Vancouver, British Columbia, and Chicago, Illinois. By 1989, 46 stores existed over the Northwest and Midwest, and every year Starbucks was simmering more than 2,000,000 pounds (907,185 kg) of coffee. At the hour of its first sale of stock (IPO) on the financial exchange in June 1992, Starbucks had 140 outlets with an income of $73.5 million, up from $1.3 million in 1987.

The organization’s fairly estimated worth was $271 million at this point. The 12% segment of the organization that was sold raised around $25 million for the organization, which encouraged a multiplying of the number of stores throughout the following two years. By September 1992, Starbucks’ offer cost had ascended by 70% to more than multiple times the income per portion of the past year. In July 2013, over 10% of in-store buys were made on the client’s cell phones utilizing the Starbucks app.

The organization used the versatile social media stage when it propelled the “Tweet-a-Coffee” campaign in October 2013. People had the option to buy a $5 gift voucher for a companion by entering both “@tweetacoffee” and the companion’s handle in a tweet. Research firm Keyhole observed the advancement of the event and a media article from December 2013 detailed that Starbucks had discovered that 27,000 individuals had taken an interest and $180,000 of buys were made to date.

As of 2023, Starbucks is positioned 137th on the Fortune 500 rundown of the biggest United States organizations by revenue.

In July 2019, Starbucks announced a “monetary second from last quarter total compensation of $1.37 billion, or $1.12 per share, up from $852.5 million, or 61 pennies for each offer, a year sooner.” The organization’s fairly estimated worth of $110.2 billion expanded by 41% in the middle of 2019. The income per share in quarter three was recorded at 78 pennies, considerably more than the estimate of 72 cents.

Starbucks – India

In January 2011, Starbucks Corporation and Tata Coffee reported designs to start opening Starbucks outlets in India. Despite a bogus beginning in 2007, in January 2012, Starbucks declared a 50:50 joint endeavor with Tata Global Beverages, called Tata Starbucks Ltd., which would possess and work outlets marked “Starbucks, A Tata Alliance”. Starbucks endeavored to enter the Indian market in 2007. However, it didn’t provide any explanation behind its withdrawal of it.

It was on October 19, 2012, that Starbucks opened its first store, a 4,500 sq ft store in Elphinstone Building, Horniman Circle, Mumbai. Starbucks opened its first cooking and bundling plant in Coorg, Karnataka in 2013 to supply its Indian outlets. The company extended its reach to Delhi on 24 January 2013 by opening 2 outlets. Tata Global Beverages declared in 2013 that they would have 50 areas before the end of the year, with a venture of INR 4 billion. The organization did open its 50th store in India on July 8, 2014.

The third city in India to get a Starbucks outlet was Pune, where the organization opened an outlet at Koregaon Park on 8 September 2013. Starbucks opened a 3,000-square-foot lead store at Koramangala, Bangalore on 22 November 2013, making it the fourth city to have an outlet. Starbucks opened the biggest espresso-forward store in the nation at Vittal Mallya Road, Bangalore on 18 March 2019. The store is estimated at 3,000 sq ft and is Starbucks’ 140th outlet in India.

Tata Starbucks opened 25 stores between 2017 and 2018, which went up to 30 during 2018-19. On 21 February 2019, CEO Navin Gurnaney reported that Tata Starbucks would use only compostable and recyclable bundling materials over the entirety of its stores from June 2020.

Starbucks reported its entrance in Gujarat on 7 August 2019. The organization opened five stores in Surat and Ahmedabad the following day. Starbucks’ leader store in the state is situated at Prahlad Nagar, Ahmedabad, and offers more vegan alternatives than other Indian outlets.

Starbucks currently has over 450 stores across 70 cities in India and is planning to reach 1000 stores by 2028.

Starbucks – Business Strategy in India

Starbucks’ strategies for business in India seemed rock-solid but the brand wasn’t completely immune still. In any case, the world’s biggest bistro chain is building its position cautiously via a progression of well-picked steps. Numerous worldwide brands have entered India since the 1990s, being pulled in by its developing and optimistic customer base. Yet, not all have succeeded. The Starbucks case analysis highlights how strategic partnerships and localized approaches helped the brand succeed in the Indian market.

Starbucks isn’t the primary contestant in India’s composed espresso showcase; so it doesn’t have any first-participant advantage. Cafe Coffee Day (CCD) is the market head while Barista Lavazza was the main espresso chain to open for business. Both are valued by the white-collar class. Costa Coffee, Coffee Bean and Tea Leaf (CBTL), and Gloria Jean are valued by the rich group in India.

India is customarily a tea-drinking nation, so espresso chains have concentrated on giving a feel where individuals can unwind and invest energy with one another. This setup implies higher capital expenses. It is different from the US, where the vast majority have a liking for espresso. The Indian buyer base has likewise advanced in the recent decade. What can worldwide brands like Starbucks do to augment their odds of achievement in India?

Picking a Local Partner

Worldwide brands face the difficult choice of either going solo or tying up with a nearby accomplice. Starbucks’ choice to team up with India’s TATA Global Beverages demonstrates attention to utilizing different advantages. The TATA Group is one of India’s morally determined brands, an observation passed on about Starbucks India too.

Given that India produces espresso beans in just a couple of spots, the other sourcing alternative was bringing in the beans. Be that as it may, this would have raised costs fundamentally.

Tata’s espresso plant in Karnataka has been contracted to supply beans to Starbucks universally, making common cooperative energies. It has contracted to take into account TATA’s TAJ SATS, which supplies TATA’s top-notch lodging network – TAJ. The TATAs are put into the retail part with store brands like Westside, Tanishq, Croma, Star Bazaar, and so forth. Starbucks can use them for information sharing on Indian land, territory points of interest, and handling land administrations. This would enable its very own development to outline. This strategy gives scope for store-in-store deals.

Consistency in Store Arrangements

This keeps up the one-of-a-kind selling purpose of customer experience and allows to pick up economies of scale on CAPEX. Starbucks plans to have a similar store group crosswise over India. However, the size can change depending on financial matters. This is how it works all around. Starbucks wants to provide an agreeable ‘café’ experience. Having a similar organization gives clients the solace of accepting the equivalent ‘Starbucks’ vibe in any place they go throughout the world.

Keeping the store designs steady means it needs to pick and open new areas stringently, to such an extent that the area can yield a throughput by the venture. Its methodology in-store arrangement is different from CCD, which has picked various configurations to tap the potential interest in any region. CCD has opened a couple of premium outlets dependent on the area’s customer profile. It has additionally gone for non-store organizations like takeaway booths and candy machines. Be that as it may, Starbucks may expect that such non-store configurations may weaken its image esteem.

Estimating the Pace of Expansion

India is the place where an inability to screen primary concerns has tossed numerous organizations out of the rigging. So, a top-line just approach doesn’t work here. Since Starbucks needs to pick new areas stringently by its equivalent configuration approach, it has decided on a deliberate pace of extension. It is concentrating on the budgetary feasibility of every outlet, as opposed to going for an aggressive development plan which may have brought about rehashed calls for capital.

This operational process is different from its system in the USA and China where it has fabricated scale by opening stores in pretty much every area – being the main port-of-call for espresso by basically being all over the place. CCD’s methodology behind adaptable store organizations was to guarantee there is a CCD bistro at a simple reach. It is intriguing to check its normal store gainfulness given its scale.

Guaranteeing Top-Authority Backing and Responsibility

Top initiative responsibility from the two sides of the organization, Tata and Starbucks, has been plentifully clear. Starbucks took as much time as was needed to enter the market (6 years), recognizing that India was a mind-boggling market and required cautious passage arranging. The two sides have spoken finally about their dedication and shared their plans to give their business a new direction toward growth.

Altering Contributions to Suit Indian Market and Client Needs

Being adjusted to Indian culture, tastes, and inclinations conveyed at a suitable “esteem” guarantees customer importance, construct, and continued utilization. Starbucks mirrors this comprehension – as observed through a blend of Western staples, a wide scope of intriguing Indian tidbits similar to confined refreshments on the idea. Since its experience ( and item as well, however to a lesser degree) is its image guarantee, its test lies in conveying an all-around steady, yet locally significant brand experience.

The stores, or the “third spot” as Starbucks calls them, have been altered likewise. The stores don’t pursue the worldwide layout and appear to have been planned with consideration, with neighborhood contacts consolidated. Stores in various urban communities have been structured unexpectedly, mirroring the neighborhood culture – e.g., New Delhi’s store has ropes and chat on the dividers and henna designs on the floor, though the Pune store has a rich showcase of collectibles and copper.

There appears to be sufficient utilization of shading – something missing in the US. The stores have been intended to convey a particular, premium café experience, predictable, and in a state of harmony with the one conveyed over the rest of the world.

Making Inventive and Restricted Plan of Action

Starbucks appears to have made a confined plan of action, planned for conveying a universally reliable item and involvement with locally-focused costs. The Tata group conveys a major sourcing advantage (attributable to its quality over the generation chain, developing, broiling, and exchanging espresso), yet it has just gone past that to develop and support associations with nearby espresso cultivators – putting resources into structure economical cultivating rehearses. All of Starbucks’ espresso is sourced locally, a first-ever for the organization.

Scaling up using Arrangements and Organizations

The Tata organization is the genuine overthrow in the Starbucks passage story. Having Tata as an accomplice is gigantically profitable, not due to the validity and strength it offers, or because it coordinates the scale and stature of Starbucks as an organization.

It offers numerous advantages catalyzing pretty much every market section achievement variable – for example, The Tata group has involvement in the retail business, a solid reputation in advancing new pursuits, gives a sourcing advantage through Tata espresso, offers access to high-traffic areas using its lodgings and other retail outlets, guarantees excellent nourishment and refreshment supply through its F&B business and so forth.

Furthermore, the potential for an effective organization is amazingly high given Starbucks’ and Tata’s mutual qualities – the two of them have a solid social inner voice and are resolved to “give back” to the general public and network.

Influencing India for Worldwide Items

Not long after it finished its first year, Starbucks reported that it was serving top-quality Indian Arabica espresso as “Indian coffee” in different markets. Another world-class office for cooking and bundling has just been initiated in Coorg, Karnataka; the results of which are to be analyzed in India and abroad.

Overseeing Discernment and Guidelines

This viewpoint is tied in with structure, a solid positive observation, and a picture for the business and brand crosswise over key outer partners and crowds – incorporating the administration, corporate accomplices, networks inside the eco-framework, and customers on the loose. Given what Starbucks has figured out how to accomplish in a year and a half since dispatch, it appears to be genuinely evident that its thought combined with the Tata advantage (critical reach and impact) has helped in developing solid connections and a positive picture with key outside partners and voting demographics.

Engage Nearby Association

Starbucks is by all accounts constructing a nation-explicit activity with nearby individuals in charge and overall unmistakable customer interface focuses, giving them the necessary position to coordinate and work. There is overwhelming interest in enlisting the perfect individuals and giving the essential preparation – to install and instill the organization’s culture and administration models.

Along these lines, how has Starbucks fared against the McKinsey spread out variables for long-haul India achievement? Its accomplishments against the scorecard look noteworthy. With thorough vigorous passage arranging and brilliant and quick execution, the multi-month-old endeavor appears to have impressive force, making purchaser and network-driven ventures and focused on sustaining its center business and brand. It appears to be very much set to “win” in India.

Whether Starbucks will collect a huge piece of the overall industry and accomplish its objective of India being among its best 5 markets over the long haul is not yet clear. It’s still early days, yet for the organization, this appears to be an incredible beginning and a great globalization model for multinationals looking for an India section.

Starbucks – Products

Aside from the typical items offered globally, Starbucks in India has some Indian-style item contributions, for example, Tandoori Paneer Roll, Chocolate Rossomalai Mousse, Malai Chom Tiramisu, Elaichi Mewa Croissant, Chicken Kathi Roll, and Murg Tikka Panini to suit Indian customers. All coffees sold in Indian outlets are produced using Indian broiled espressos by Tata Coffee. Starbucks additionally sells Himalayan packaged mineral water. Free Wi-Fi is accessible at all Starbucks stores.

In January 2017, Tata Starbucks presented Starbucks’ tea image “Teavana”. Teavana offers 18 unique assortments of tea in India. One of the assortments called the India Spice Majesty Blend was explicitly created for the Indian market and is only accessible in India. India Spice Majesty Blend is a mix of full-leaf Assam dark tea injected with entire cinnamon, cardamom, cloves, pepper, star anise, and ginger. On 15 June 2015, Tata Starbucks reported that it was suspending the utilization of fixings that had not been affirmed by the Food Safety and Standards Authority of India (FSSAI).

The organization didn’t indicate what the fixings were or which items they were utilized in. The organization additionally expressed that it was applying for FSSAI endorsement for these ingredients.

As per the Latte Index positioning of the expense of a tall hot latte at Starbucks in 44 nations, India was the fifth most costly nation to buy the drink depending on January 2016 costs. The record distributed by US-based buyer research firm ValuePenguin found that a tall hot latte cost $7.99 in India, far higher than the $2.75 it costs in the least expensive nation, the United States, yet much lower than the $12.32 in the most costly nation, Russia.

Tata Starbucks propelled the Starbucks Delivers program in mid-2019. The administration offers home conveyance from Starbucks outlets through an organization with Swiggy. The administration was first propelled in Mumbai, with designs to turn it out to other cities.

In its menu, the Tata Starbucks company has launched ice-creams as their new products. The frozen delights are available even in flavours like java chip and caramel macchiato among others and will come in takeaway tubs and single scoops. The ice-creams are now available in 50-60% of the Starbucks stores.

Starbucks – Business Growth

Tata Starbucks, a joint venture between Tata Consumer Products Limited (TCPL) and the American coffee chain Starbucks, reported a loss of INR 81 crore in the 2024 fiscal year, according to TCPL’s annual report. This is a bigger loss compared to the INR 23.9 crore loss in the previous year, FY23. Despite this, the company’s revenue from operations grew by 12% in FY24.

In FY24, Tata Consumer Products invested INR 25 crore into the coffee chain, which also opened the most new stores in India since starting the joint venture in 2012. However, the coffee chain faced challenges in profitability due to weak demand for quick service restaurants (QSRs) in general. Tata Starbucks, which is hoping to make back the initial investment in the current money, has opened 380 stores to date.

Tata Starbucks, a 50:50 joint endeavor between Tata Global Beverages and Starbucks Coffee of the US, has announced a 30% top-line development in financial 2018-19, driven by new store openings and improved execution. Tata Starbucks announced “twofold digit top-line development – 30% for the entire year, driven by new stores and improved store execution,” Tata Global Beverages Ltd (TGBL) said in a financial specialists’ introduction. Tata Starbucks’s income for 2018-19 is required to be approximately INR 450 crores.

TGBL said Tata Starbucks opened 30 outlets in the past financial year, out of which 15 new stores were opened during the last quarter of the money-related year. The organization claimed detailed benefits at the store level; all urban areas were likewise productive and additionally saw an ascend in nourishment share in general deals.

The Starbucks company added around 40 stores in FY21 but the company had recorded a 33% Y-O-Y fall in its revenues during the same fiscal. According to Sushant Dash, CEO of Tata Starbucks, the recovery that the company has seen after the second wave of COVID-19 was better than what it saw after the first wave of the deadly pandemic. The quarterly growth after Q2 FY22 was 120% more than what it saw during the same period in the previous fiscal. The company has hugely focused on home deliveries ever since the pandemic broke out. It has already addressed concerns associated with the spillage and other challenges about home delivery, which contributed to over 18% of the total sales that the company witnessed this fiscal, as per the reports in November 2021. Furthermore, the company has also added ice-creams to its menu in flavors like java chip and caramel macchiato. The Sanjeev Kapoor menu is another thing that has been freshly launched by Tata Starbucks. Besides, the company also launched a one-litre freshly brewed beverage and at-home coffee.

Starbucks – Future Plans

As per reports on 26 May 2025, Starbucks is starting self-service kiosks in Korea and Japan for the first time, allowing customers to place orders without talking to staff. Starbucks Korea said it will set up kiosks in about 10 stores this week. These stores are in busy areas like Seoul and Jeju Island, especially where many tourists visit.

The first kiosks will be placed in two stores in Seoul’s Myeong-dong area, which is popular with foreign visitors. People will be able to use the kiosks from early next month.

A Starbucks Korea spokesperson said the kiosks were made to help tourists who have trouble communicating due to language barriers. The goal is to make ordering easier and attract more visitors in tourist areas.

Tata Starbucks plans to operate 1000 stores in India by 2028. To reach its goal of having 1,000 stores by 2028, Tata Starbucks plans to double its workforce to around 8,600 employees. The company aims to expand into Tier 2 and 3 cities in India, increase the number of drive-thru locations, open more stores in airports, and add more 24-hour stores to better serve customers wherever they are.

Tata Starbucks Pvt. Ltd. is looking to forcefully grow its impression in the Indian market with its eyes on the quickly spreading “espresso culture” among the twenty to thirty-year-olds and upwardly versatile customers. Tata Starbucks, a JV between US-based Starbucks Coffee Company and Tata Global Beverages Ltd, hopes to set up altogether more number stores this monetary than it did previously.

With per-store venture prerequisites being evaluated at INR 1.7-2 crores, the complete CAPEX plan by the organization works out in an overabundance of INR 50 crores during current monetary on the off chance that it opens more stores than a year ago.

The organization is likewise open to different open doors for development including inorganic development through acquisitions. Be that as it may, when tested about any probability of a venture plan in the espresso chain Cafe Coffe Day (CCD), Gurnaney denied estimating any discussions for securing.

With an end goal to upgrade the client experience, Starbucks is presenting new nourishment things, taking into account all client needs including breakfast and lunch. The income share from nourishment things is right now around 25%, even as it keeps on developing with new things to meet the client’s needs.

FAQs

Who founded Starbucks?

Starbucks was started by Hun Baldwin, Zev Siegl, and Gordon Bowker in 1971.

Where was the first Starbucks started?

Starbucks was started in Pike Place Market, Seattle, Washington, United States.

When was Starbucks started in India?

Starbucks was launched in India in 2012.

What is the revenue of Starbucks?

Starbucks revenue was recorded at $35.98 billion in 2023.

How many Starbucks stores are there worldwide?

There are over 38000 Starbucks stores in the world as of 2023.