This article has been contributed by CA Sujatha G

Coined by Reid Hoffman (LinkedIn’s co-founder) and Chris Yeh, blitzscaling is a high-speed growth strategy described in their book Blitzscaling: The Lightning-Fast Path to Building Massively Valuable Companies. The term refers to prioritizing speed of growth over efficiency, even at the cost of higher risks and inefficiencies in the short term. With the right ingredients—huge markets, powerful network effects, and flawless execution—blitzscaling can transform ambitious startups into industry giants. But it is inherently high-risk, high-reward. Startups that attempt blitzscaling without product–market fit, governance discipline, or sufficient capital often reach a dead end, leaving behind cautionary lessons for both entrepreneurs and investors.

History offers many such cautionary tales like Theranos and WeWork to Indian examples such as Stayzilla, TinyOwl, and Byjus.

Investor Requirements From Start-Ups

Startups thrive on an ecosystem of trust — with investors, customers, employees, and vendors. When investors back a start-up, they’re betting on growth founded on trust. Transparency, therefore, is not a regulatory burden but the foundation upon which lasting investor relationships are built. The industry is strewn with examples of failed start-ups caused by a combination of blitzscaling and lack of transparency. The collapse of WeWork is an example of how absence of transparency across operations, finance, and governance can turn a promising enterprise into a cautionary tale.

Investors typically look at three dimensions of transparency

- Operational Transparency: It requires start-ups to provide a clear view of their unit economics, customer acquisition costs, per customer cost, and true picture of the larger market sold to the investors. While dashboards and management information systems have been used, investors often cannot rely on the curated narratives, and must find ways to track the real time performance of the company.

- Financial transparency: Investors expect accounts that comply with accepted standards such as GAAP or IFRS, not creative accounting designed to obscure the truth. Traditional reporting systems obscure more insightful SLA’s like cash burn, profitability timelines, and risky liabilities.

In contrast, in its IPO filings, WeWork offered a textbook case of financial opacity. Instead of presenting its losses plainly, the company relied on “Community Adjusted EBITDA” — a bespoke metric that excluded major expenses such as rent, sales, and marketing. This metric painted a distorted picture of profitability. Furthermore, WeWork had not adequately disclosed its massive lease obligations until those details were forced into the open by regulatory requirements during the IPO process. Once the real numbers started emerging, investor trust collapsed, and with it, WeWork’s $47 billion valuation.

- Governance Transparency: Governance transparency addresses how decisions are made and who is accountable. It requires clarity on the balance of power between founders and boards, full disclosure of related-party transactions, and adherence to fiduciary duties, and strict adherence to statutory prohibitions called for by company law or other statutes. Independent audits and compliance reviews reinforce this transparency.

Here too, WeWork failed dramatically. CEO Adam Neumann engaged leased out personally owned buildings to WeWork. WeWork, even paid its founder and CEO, Adam Neumann, $5.9 million for the trademark rights to the word “We” in 2019, exposing glaring governance deficiencies. Combined with his super-voting shares, which concentrated control in his hands, these actions created a situation that undermined investor faith. It provided the right climate where conflicts of interest and unrestricted founder ambitions superseded fiduciary responsibility.

Other Examples of Governance & Transparency Failures

The collapse of WeWork is not the only example. The landscape is filled with more such examples.

- Lack of transparency: Stayzilla began with a bold vision to create an “Airbnb for India” by connecting travelers with unique homestays across the country. Founded in 2005, the company expanded rapidly, boasting thousands of listings across tier-2 and tier-3 cities where global players had little reach. Investors, including Matrix Partners and Nexus Venture Partners, poured in millions to fuel its growth. Yet, by 2017, Stayzilla had collapsed, its co-founder arrested in a highly publicized vendor dispute. At the heart of this downfall was not just a flawed business model but a deeper issue: a lack of transparency in operations, finances, and governance that eroded trust.

Financial opacity played an even greater role in Stayzilla’s downfall. Despite raising over $30 million, the company struggled with unsustainable cash burn, vendor debts, and inconsistent revenue flows. Instead of openly reporting liabilities and negotiating settlements with vendors, Stayzilla delayed payments and allowed debts to accumulate. One of its vendors, Jigsaw claimed that Stayzilla owed them around Rs 1.7 crore for advertising and marketing services provided, while the company argued that many of Jigsaw’s charges were inflated,

The dispute escalated into criminal proceedings against the founders. Had Stayzilla maintained transparent accounts and proactively disclosed its financial stress to both investors and vendors, it might have secured structured workouts or bridge funding. Instead, opacity destroyed trust and pushed partners into adversarial positions.

Once celebrated as the world’s most valuable edtech startup, Byju’s has become a case study for how lack of governance standards can drag down unicorn startups from the stratosphere to the ground. Its collapse didn’t stem from a single failure but from layered opacity in financial disclosures, accounting practices, and fund management—revealing a culture of misreporting, delayed filings, and questionable fund transfers.

- Questionable Accounting Practices: Business today reported in its news article in October, 2023 titled “BYJU’s to file FY22 financials after more than a year’s delay”, that the start-up had used non-standard approach to capitalization of employee-related costs. Analysts pointed out that recording 60% of employee costs as capital expenditure instead of operational expense significantly understated losses had these costs been recognized correctly, FY2021 losses would have exceeded INR 5,000 crore.

Economic Times also reported in its article “Byju’s audited revenue may be lower than projected by edtech unicorn”in September 2022 about Byju’s adoption of the revised Indian Accounting Standard (Ind-AS 115) to change its accounting practices for revenue from multi-year streaming contracts. This change required the company to recognize revenue over the period of service, rather than upfront when the contract was signed, which resulted in a significantly lower reported income for that fiscal year.

Prior to the change, Byju’s recognized the entire revenue from multi-year contracts at the beginning of the contract period, even though the service would be delivered over several years. This practice inflated the company’s revenue and profits in the short term, giving the appearance of rapid growth and attracting investors

- Opaque or Oblique Unit Metrics : TinyOwl is an example of another issue – Hiding uncomfortable financials in creative metrics.

TinyOwl scaled rapidly by offering heavy discounts and subsidized deliveries, but it failed to disclose its unit economics — the cost of acquiring and retaining a customer versus the revenue per order. Times of India in its article ‘Rise and Fall of TinyOwl: paraphrases the lessons that startup founder Saurab Goyal learnt’ on how their fleet of 1000 delivery boys was not needed for the market they were required to serve. Internally, the company struggled with negative margins per transaction. This financial opaqueness meant that problems were noticed too late.

WeWork offered a textbook case of financial opacity. Instead of presenting its losses plainly, the company relied on “Community Adjusted EBITDA” — a bespoke metric that excluded major expenses such as rent, sales, and marketing.

Mechanisms to Strengthen Financial Governance in Startups

The spectacular collapse of WeWork underscored how weak governance, opaque financial reporting, and unchecked expansion can erode investor trust. Digital tools and technology-driven mechanisms can bridge the information and insight gap, create transparency, strengthen compliance, and enforce financial diligence. These technologies serve as guardrails, ensuring that enthusiasm for growth is grounded in accountability.

- Cloud-Based Accounting and ERP Systems: One of the central failures at WeWork was the lack of transparent, standardized financial reporting. Today, cloud-based accounting platforms such as Zoho Books, QuickBooks Online, and NetSuite ERP allow investors and boards to access real-time financial statements, expense tracking, and cash-flow forecasts. An article by Pierrick Ribes in The Entrepreneur, Middle East Edition titled “Why Startups Are Investing in ERP Systems Earlier than Ever”, captures the essence of this shifting winds. The article sums up the new trajectory with this paragraph quoted from the article

“For startups, these capabilities are game-changing. By analyzing both historical and real-time data, ERP systems allow companies to anticipate trends, forecast market shifts, and better understand customer behavior. Predictive analytics further enable startups to optimize operations by streamlining resource planning, improving demand forecasting, and even implementing proactive maintenance strategies to avoid costly disruptions. Additionally, AI-powered dashboards provide decision-makers with real-time metrics, empowering them to make faster, more informed choices that drive growth and operational efficiency.”

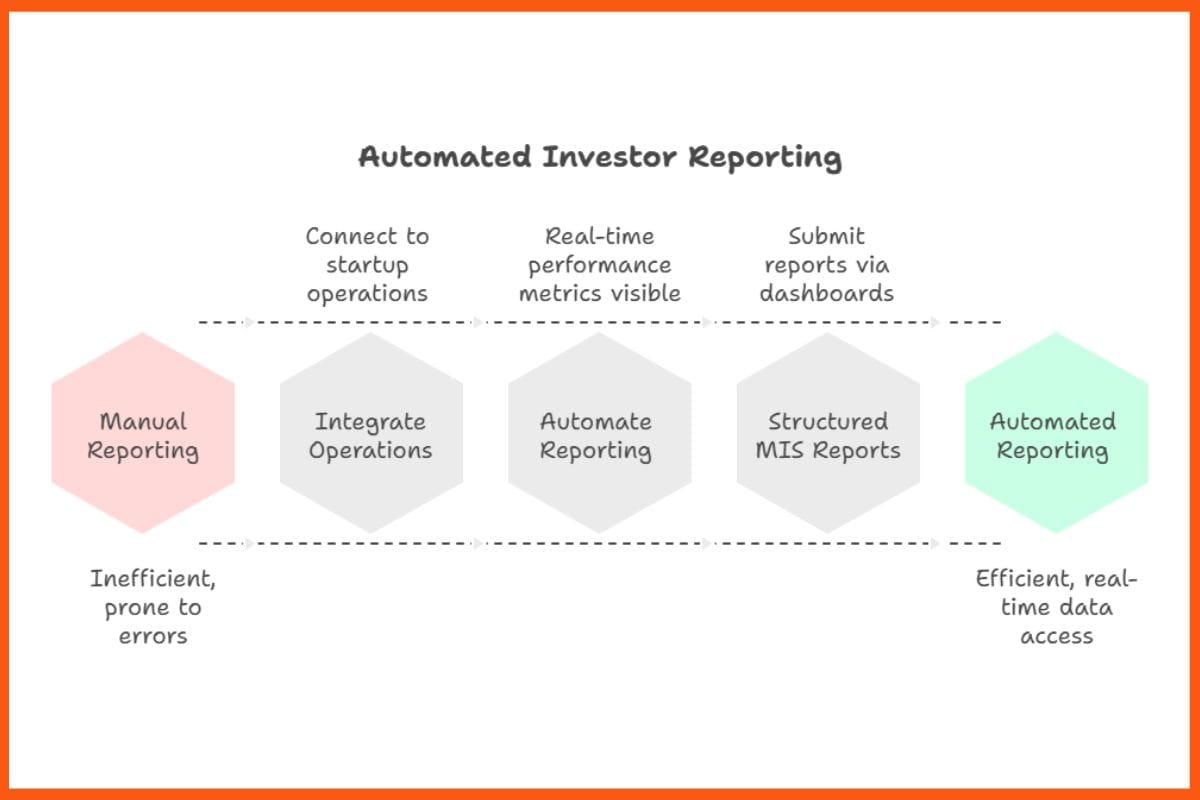

- Investor Dashboards and Data Rooms: Investors now demand automated reporting dashboards integrated with a start-up’s operations. Tools like Carta, Visible, and AngelList Stack allow start-ups to maintain investor portals where performance metrics, cap tables, and compliance updates are visible in real time. For example, Peak XV Partners, formerly known as Sequoia Capital India uses its own Sequoia Surge platform, which requires portfolio start-ups to submit structured MIS reports via digital dashboards. This ensures red flags (like unsustainable burn rates) are spotted early.

- Contract and Lease Management Systems: WeWork’s business model collapsed partly because it under-disclosed massive lease liabilities. Today, start-ups managing real estate or long-term commitments are expected to use contract management platforms (e.g., Icertis, Ironclad or Zoho Contract Lifecycle management) that track obligations digitally and link them to accounting systems. Real estate firms backed by PE funds now use AI-powered lease management software to ensure all liabilities are logged, visible, and linked to financial forecasting models.

- AI-Powered Compliance Monitoring: Corporate governance lapses like Adam Neumann’s self-dealing would be far harder to conceal today. Governance, Risk, and Compliance (GRC) platforms such as Diligent, MetricStream, and ComplyAdvantage automatically track related-party transactions, board resolutions, and conflict-of-interest disclosures. In the financial services sector, RegTech solutions flag unusual payments or self-dealing transactions in real time, creating automatic audit trails.

- Predictive Analytics and Scenario Planning: Investors now use financial analysis tools (e.g., Fathom, Cube, Mosaic Finance) that ingest live financial data and run stress-test scenarios, and some have added some AI modules as well. If WeWork’s liabilities and burn rate had been run through such models, the fragility of its business would have been obvious much earlier. Growth-stage funds in the U.S. mandate quarterly scenario modeling to test how start-ups would survive under downturn conditions — something WeWork never prepared for.

Conclusion

The collapse of WeWork and others shows that opacity in operations, finance, and governance can be fatal even for billion-dollar “unicorns.” Today, investors increasingly mandate the adoption of cloud accounting, investor dashboards, AI compliance systems, and predictive analytics to ensure startups remain transparent and accountable. While technology cannot eliminate all risk, it creates the digital guardrails that make another WeWork-style implosion far less likely.