When it comes to managing expenses and bills, especially when one has low funds. This becomes really pressurizing and people start looking for sources to lend money from. In such situations, borrowing from friends and family could be embarrassing and hectic. And depending upon banks could cost major interests. So where should we look?

Well by acknowledging these situations and deals, online money lending apps are developed. These provide the facility to lend money through digital platforms without any further issues.

Multiple companies are providing the facility of offering loads immediately with minimal competitive interest rates and required tenure durations. These companies facilitate the loan very easily and quickly as compared to usual bank loans.

With keeping such progress in mind, India has developed numerous digital lending companies whose finances can manage smoothly. India is evolving to a great extent in the digital sector and financial inclusion. The country has cash for transactions. But with the evolving method of development and modernization, India is shifting toward a cashless economy. To understand its development more prominently, let’s look at the top 10 digital lending platforms in India.

| S.No | Company Name | Products/Services | Key Features |

|---|---|---|---|

| 1. | Lendingkart | Digital MSME Loans | Fast loan approval, flexible tenure |

| 2. | Pine Labs | POS & Payment Solutions | Seamless payments, merchant financing |

| 3. | MobiKwik | Digital Wallet, Instant Loans | Quick loans, ZIP EMI options |

| 4. | Shiksha Finance | MSME & School Loans | Secured & unsecured loans, flexible repayment |

| 5. | MoneyTap | Personal Loans, Credit Line | Flexible credit line, paperless process |

| 6. | Paytm | Payments, Personal Loans | Wide acceptance, easy application |

| 7. | PolicyBazaar | Insurance & Loan Marketplace | Compare policies, loan options |

| 8. | Capital Float | SME Loans, Working Capital | Quick disbursal, flexible repayments |

| 9. | Faircent | P2P Personal Loans | Peer-to-peer lending, flexible terms |

| 10. | KreditBee | Instant Personal Loans | Quick approval, minimal documentation |

1. Lendingkart

| Lending Platform | Lendingkart |

|---|---|

| Loan Amount | Upto ₹1 Crore |

| Loan Tenure | 36 Months |

The prominent digital lending platform, Lendingkart was founded in 2014. It works by offering different capital loans and company loans vary from small to medium-sized businesses across India. They are widely famous for providing capital completely through an online platform and require minimum documentation for the procedure to begin.

For young entrepreneurs, managing their finances becomes quite hectic and it deviates them from focusing on their business growth. That’s why Lendingkart has taken the initiative to make capital funding easily available for entrepreneurs so they don’t have to worry about the cash-flow gaps. Lendingkart is a company established in Ahmedabad, Mumbai and Bangalore. But, its services are accessible throughout the whole of India.

2. Pine Labs

| Lending Platform | Pine Labs |

|---|---|

| Loan Amount | From ₹25,000 to ₹5 Lakhs |

| Loan Tenure | 90 Days |

Pine Labs is one of the leading fintech companies in India established in 1998 that provides digital lending services. The company is quite famous for its incredible facility of transforming the mobile NFC into a card machine and activating the service of accepting all types of payment digitally which also includes the ‘Tap n Pay’ card as well.

Pine Labs have brought tons of services for the retailers including multi-channel, different payment options, brand offerings, risk assessments, analytics, and many more.

It provides working capital loans for small to medium businesses. Their loan application process is quite simple and you can apply for a business loan through their website or their app myPlutus.

Pine Labs’ services and technologies are widely preferred and used by more than 100,00 merchants all across India and also, many Asian companies. According to the estimations, PineLabs’ cloud-based technology has the power of over 350,000 PoS terminals; that too in more than 3,700 cities.

3. MobiKwik

| Lending Platform | Mobikwik |

|---|---|

| Loan Amount | Upto ₹5,00,000 |

| Loan Tenure | 6 to 36 Months |

MobiKwik is a very prominent mobile payment company that works by connecting the consumers together with the merchants and many online sellers. The company is established in Gurgaon, Haryana, India.

Mobikwik is a private company that has more than 550 employees. Since the establishment of this company, the company has raised a total of 118 million USD from over 8 funding rounds.

Mobiwik provides instant personal loans. You can download its app and once the loan is approved it will be credited to your wallet.

4. Shiksha Finance

| Details | Information |

|---|---|

| Loan Amount | ₹1 Lakh to ₹15 Lakhs (unsecured) or up to ₹2.5 Crores (secured) |

| Loan Tenure | 6 to 48 Months (unsecured), Up to 84 Months (secured) |

One of the biggest lending companies, Shiksha Finance, is an education-based finance firm. Shiksha Finance provides the services of funding parents for school fees by reducing the school drop-out rates. It also offers capital to educational institutions for the development of buildings, properties and working capital.

Shiksha Finance has loans that range from INR 10,000 to INR 50,000 with a return duration of 6 to 10 months. The loans which Shiksha Finance provides can be utilized for educational based purposes such as school fees, tuition, luggage and stationary.

5. MoneyTap

| Lending Platform | MoneyTap |

|---|---|

| Loan Amount | Upto ₹5,00,000 |

| Loan Tenure | 36 Months |

The Bengaluru based lending company, MoneyTap is known for its huge service of offering credit lines for the consumers as their loans, with the partnership with RBL Bank. MoneyTap is now counted among the leading lending businesses. Recently, the company received the license of NBFC for co-lending space together with their lending partners.

MoneyTap has offered many great features among which, the minimal documentation procedure for a personal loan is the most special one. Moreover, its app version also provides the facilities for tracking down your borrowing records.

6. Paytm

| Lending Platform | Paytm |

|---|---|

| Loan Amount | Upto ₹2,00,000 |

| Loan Tenure | 6 to 36 Months |

The biggest digital lending wallet company Paytm is wildly famous in the minds of Indians. The company is established in Noida, Uttar Pradesh. Paytm has grown to a great extent and now, millions of downloads have been made.

The development the company has received is breathtaking. It employs more than 9000 people and has a revenue of a total of $118 million. Paytm is highly specialised in online shopping as well.

The company was founded in the year 2010 by Vijay Shekar Sharma.

7. PolicyBazaar

| Lending Platform | PolicyBazaar |

|---|---|

| Loan Amount | ₹40,00,000 |

| Loan Tenure | Upto 7 Years |

The company is counted among the top leading online insurance companies, PolicyBazaar was established in the year 2008 and headquartered in Gurgaon, Haryana, India.

It is online life insurance as well as a general insurance aggregator company. PolicyBazaar is very popular among Indians for its incredible services and holdings. It employs over 2500 people and has an annual revenue of $21 million (as estimated in 2017-18).

The current CEO of PolicyBazaar is Yashish Dahiya who is also one of the founders of this company. It has raised around US$ 346 million through 7 funding rounds.

8. Capital Float

| Lending Platform | Capital Float |

|---|---|

| Loan Amount | ₹50,00,000 |

| Loan Tenure | Upto 36 Months |

Capital Float is one of the leading lending companies in India. It is acquired by CapFloat Financial Services. Capital Float is popular for its amazing service of specialised financial loans and business credits.

Capital Float has a partnership with some prominent companies such as Shopclues, Paytm and Uber. The company lends the potential borrower through its system of proprietary loans. Capital Float is now targeting established store owners and small merchants.

9. Faircent

| Details | Information |

|---|---|

| Loan Amount | ₹5,00,000 |

| Loan Tenure | 6 to 36 Months |

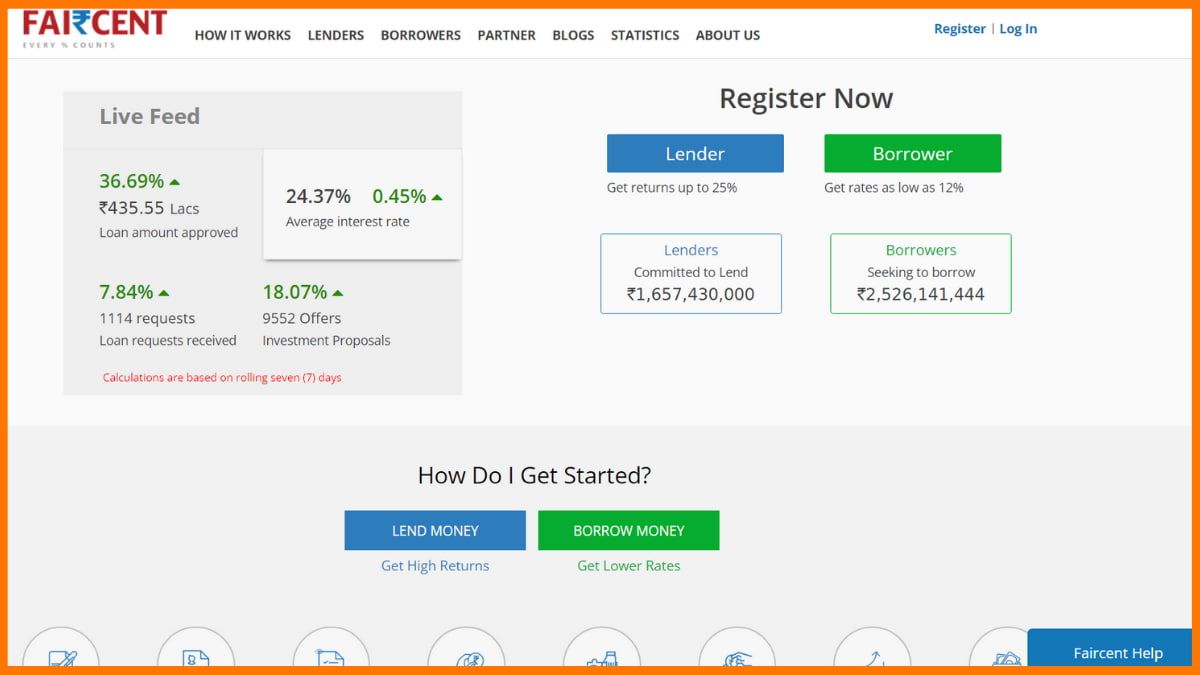

The largest and first Indian peer-to-peer digital lending platform, Faircent is known to be absolutely amazing. It is officially registered by the RBI. It provides a safe marketplace for people to loan money to a borrower. Faircent facilitates the credit to organizations and individuals who are interested in lending money.

Faircent provides the absolutely convenient procedure of lending the required money to those who need it, at reasonable interest rates.

10. KreditBee

| Lending Platform | KreditBee |

|---|---|

| Loan Amount | ₹5,00,000 |

| Loan Tenure | 6 to 36 Months |

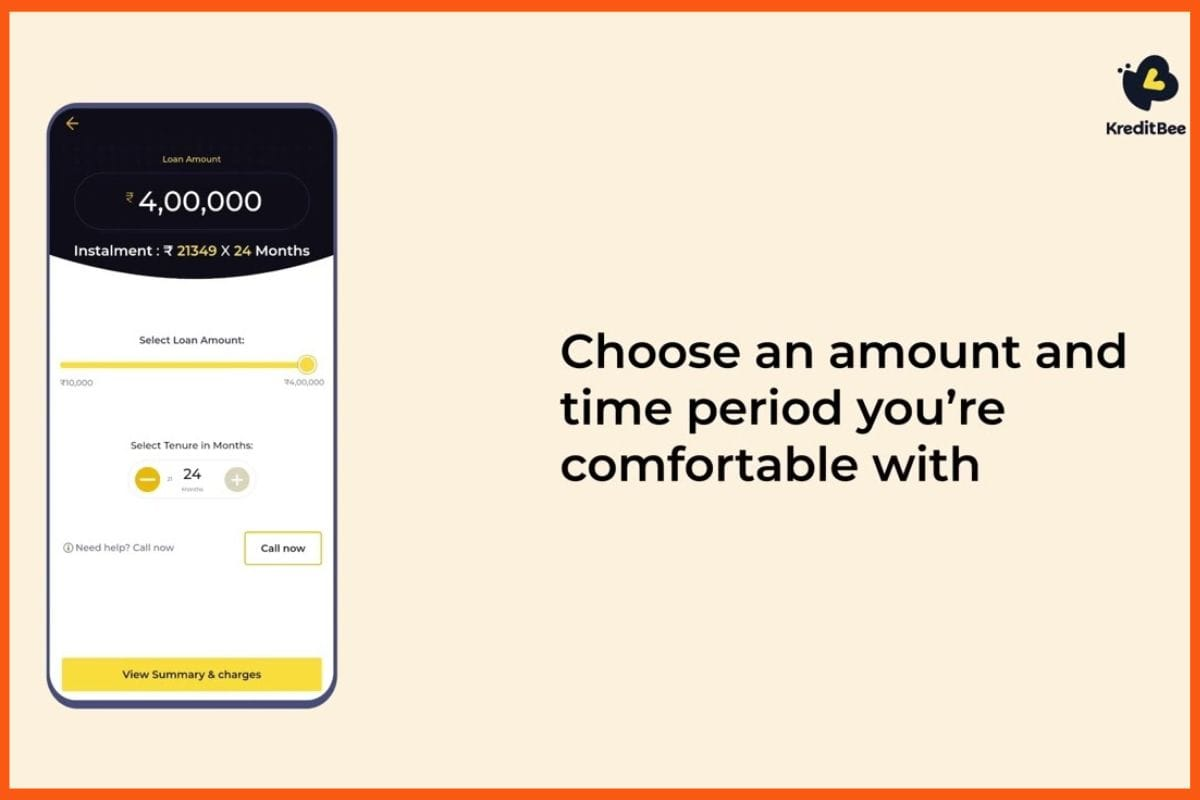

KreditBee is a Bangalore-based fintech that offers quick personal loans up to INR 2,00,000 for working professionals. Using easy online KYC, the loan process is fast and simple. KreditBee is one of the top lending companies in India.

Backed by trusted investors like ICICI Bank and supported by banks like AU Small Finance, KreditBee serves over 5 million customers.

The process is mostly paperless, sign up on the app, and within 15 minutes, approved loans are transferred instantly to your bank account.

Conclusion

In India, there are many fintech companies that are providing the service of digitally lending money very easily with the minimal documentation procedure. Today, many apps have been developed by these companies to make the transaction of money absolutely susceptible. And for those who require a personal loan or business loan, can easily get one. That’s why we listed these top digital lending companies in India.

FAQs

What are some of the top digital lending companies in India?

Lendingkart, Pinelabs, Mobiwik, Policybazaar, and Paytm are some of the top digital lending companies in India.

How does a lending company work?

Lending companies provide loans to an entity, which is then expected to repay its debt.

How many fintech companies are there in India?

There are around 2,000 fintech companies in India.