If you have a little bit of interest in the equity or stock market, you must have come across the name Zerodha. It is one of the dominant brokerage platforms that facilitates five million+ orders daily.

To be very honest, after the 2008 financial crisis, many big corporate houses have faced colossal losses. The stock market was at its worst, and many people lost their faith in investment.

The 2008 market collapse was the most significant single-day decrease in modern history. The fallout from this disastrous financial catastrophe washed away large portions of retirement savings and had a long-term impact on business, even after the share market had stabilized.

The recession was the black phase for every country, but then in 2009, the Kamath brothers came up with the idea of Zerodha, which is an online brokerage platform. At that instant, there were many share marketing platforms like Sharekhan and ICICI available in the market, and launching Zerodha seemed to be a foolish move. Because how can you beat the legends but with hope in their heart, they launched Zerodha in 2010 with a small budget of INR 10 lakhs.

Let’s know all about Zerodha and its marketing strategy in detail.

The Story Behind Zerodha

Zerodha Marketing Strategy

Zerodha’s Unique and Innovative Customer Acquistion Approach

Zerodha Success Factors

Why Doesn’t Zerodha Believe in Advertising?

Things That Make Zerodha Stand Out in the Market

The Story Behind Zerodha

Zerodha is a brokerage company situated in Bengaluru, Karnataka. Nitin Kamath created it on August 15, 2010. It is India’s first cheap broker, ushering in a new era in the brokerage sector. In India, Zerodha is the biggest and one of the finest stock brokers. The ultimate aim was to make investing barrier-free, which is why they came up with the name Zerodha.

The name “Zerodha” is an English-Sanskrit portmanteau word consisting of “Zero” in English and “Rodha” (Barriers or Obstructions) in Sanskrit, to sum up as “No Obstructions.” The name of the company directly signifies the birth of the challenge-free online stock-broking platform that Zerodha is!

The Zerodha logo features the numeral ‘0’ in a block format, cropped stylishly to form an upward-pointing arrow. This represents the successful path traders can expect when using Zerodha’s platform.

Do you know that both brothers are listed in the Forbes list of India’s 100 most prosperous 2020? You might be aware of that, but what makes us awe is how they became the most substantial brokerage company in India, with around 10 million users.

Before founding Zerodha, the company’s co-founder, “Nithin Kamath,” worked in customer service at night and traded during the day. He was exposed to the financial markets by a companion when he was 17 years old, and he has been investing ever since.

After working full-time for over ten years, he chose to be a broker because he felt the moment had come to offer a distinct type of structured finance service that he had never encountered throughout his trading career. When he initially considered creating Zerodha, he believed that digitalization and a user-friendly platform were highly required. Nithin Kamath further noted that the hefty brokerage costs imposed on trades are one of the reasons why young people are hesitant to begin trading. His goal was to be an internet broker who prioritized people before profits by utilizing cutting-edge technology. That’s the incarnation of Zerodha.

Zerodha Marketing Strategy

Coming to our next section, where we will shed light on how Zerodha became so popular among people and what their marketing strategy is. Zerodha was launched to give consumers technology-efficient and cost-effective services. Many young users were afraid to try stock investments because of the brokerage charges. Furthermore, the technology used was old and could be a bummer for many of us. Kamath’s brother knew that it was time to change and allure young minds with a service that didn’t require any technological expertise.

Not only this, he knew that to attract youthful consumers, he had to offer something out of the box. Many of the young customers were put off by hefty commission fees when it came to trading. He took advantage of it, and hence he introduced a zero brokerage strategy. The owners of the company believed that there was no better marketing than word of mouth. They didn’t spend huge chunks of money on the advertisement. Instead, they started focusing on building brand credibility. The next thing they started was educating millennials about trading.

Zerodha’s Unique and Innovative Customer Acquistion Approach

While many stockbrokers still use cold calls and ads to get clients, Zerodha took a different route. It focused on making trading easy, rewarding referrals, and educating users, leading to massive word-of-mouth growth.

India’s First Zero Brokerage Plan

Back when all brokers charged a fixed commission, Zerodha broke the norm. It became the first in India to offer zero brokerage on equity delivery trades. This bold move helped them stand out and quickly attract customers.

Growth Through Referrals

Instead of spending heavily on ads, Zerodha chose to reward its users. Through its referral program, existing clients earn bonuses for every new person they bring in. Today, more than 60% of Zerodha’s users have joined through referrals, saving the company a lot on marketing.

Educating Investor Communities

Zerodha created Varsity, a free learning platform that teaches everything from basic finance to advanced trading strategies. It’s become a trusted resource for anyone looking to learn, helping Zerodha build trust and credibility in the market.

Zerodha Marketing Success Factors

The critical factors involved in the success of Zerodha are mentioned below.

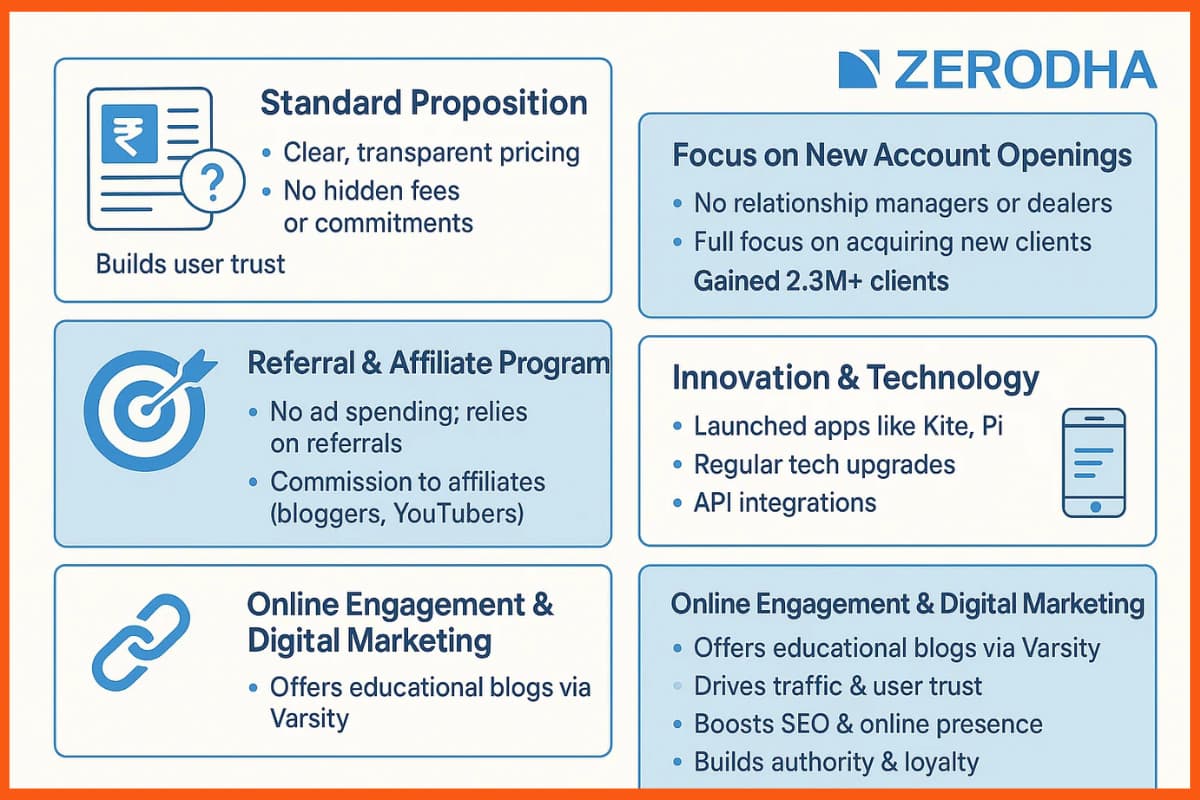

Standard Proposition

The very first marketing strategy was to be crystal clear about everything. Most users don’t trust brokerage services because they involve money. So they considered that thing by being clear about everything. When the company entered the market, many stockbrokers offered irrational prices and non-transparent pricing to clients. Then Zerodha came up with a standard proposition with zero commitments. This worked out well for the company. If you take a look at the FAQ section of the company, you will see the direct response and clear answers admired by most of their users. The company doesn’t believe in confusing its clients.

Concentrate on New Account Opening

The second reason for their vast success was putting their minds to bringing in more customers. They didn’t have any relationship managers or dealers. They started focusing on getting a new client. Today, the company has more than 2.3 million clients.

Referral Program and Business Affiliates

The strongest pillar of Zerodha marketing is the referral and affiliate programs. Rather than investing in an advertisement, they came up with the idea of giving a commission to their referrals. Many bloggers and YouTubers promote the services through affiliate programs on their platforms, and in return, they earn a commission on every purchase. The referral program helped Zerodha discover thousands of leads that too without any upfront cost.

Innovation and Technology

The company understands the importance of change and evolution for growth. They knew how important it is to take advantage of technology and offer something innovative to their client base—that’s why they keep launching applications like Kite, Pi, and much more. The platform was fundamental in the earlier days with minimal features, but then they added advanced features like API integrations, third-party applications, and much more. They keep adding new features so that their consumers won’t lose interest.

Online Engagement and Digital Marketing

Every business knows how important it is to gain an online presence and engagement. This is why they kept their users engaged on the platform by offering to educate them about blogs and much more. Varsity offers content that educates users, and it brings a chunk of traffic. The importance of digital marketing is that it provides a subscriber base and improves the authority of the domain in the eyes of Google. Also, clients find the service genuine when they gain something in return, such as learning about the stock market or trading.

Why Doesn’t Zerodha Believe in Advertising?

The reason for the same is that most users don’t make impulse purchases when it comes to stock marketing. Trading involves investment and the risk of losing money, so the users try to be very cautious and attentive. The following reason why most people prefer to invest in the stock market is because of greed. The greed to double their money. Zerodha analyzed their customer mentality, and they knew if stock marketing became an impulse, it wouldn’t benefit them. So they started shifting their focus to word-of-mouth marketing. Most of the users on Zerodha are recommended by others. Such users won’t lose interest in trading because they want to make the best out of it.

So, rather than focusing on an advertisement, they start investing in customers.

Things That Make Zerodha Stand Out in the Market

The reason why Zerodha is distinct from its users is its approach to educating its users first. Zerodha does not provide stock recommendations, unlike a full-fledged brokerage platform. When new traders enter the site, they first must learn the ropes of the trade. An engaged customer base would be driven by traders’ capacity to comprehend why they are going bankrupt or trade sensibly. In 2015, Zerodha Varsity was developed with the same goal in mind and a blog connection to build interest in the website. In 2019, the Varsity App was released, as well as material in Hindi.

Later, there were Finception and LearnApp. Finception concentrates on making financial material easy for its users, whereas LearnApp sells finance information to consumers for a fee, including videos handpicked by top fund institution specialists. They’ve been extending their educational goal by using current collaborations.

Furthermore, unlike the other companies, the Kamath siblings do not impose charges for distribution or trading. Instead, they retain a 10% portion of the earnings from the investment.

Conclusion

That’s all! Here we have mentioned all about the Zerodha marketing strategy. The business model of a company is promising. Their user base is young. The reason behind their success is exceptional products with transparent pricing. However, most of the users were not satisfied with the company’s uptime, and it has been news for the server down issue, but the brothers promised to make the platform more friendly each passing day. Not just this, there has also been news that soon the company will enter the advisory sector too. It would be fun to watch how well this would work out for Zerodha.

That’s all we have for now. In case we have missed something, please feel free to reach out to us in the comments section.

FAQs

Is Zerodha a unicorn?

Zerodha entered the unicorn club in June 2020 with a valuation of $1 billion.

Who is the owner of Zerodha?

Nithin Kamath and Nikhil Kamath are the owners of Zerodha.

How much does it cost to open a Zerodha account?

Zerodha charges Rs 200 for online accounts and Rs 400 for offline account opening.

What is Zerodha Pricing?

Zerodha Pricing are listed below:

- All equity delivery investments (NSE, BSE), are absolutely free.

- Flat Rs. 20 or 0.03% (whichever is lower) per executed order on intraday trades across equity, currency, and commodity trades.

- All direct mutual fund investments are absolutely free.

What is the number of active customers of Zerodha?

Zerodha has over 62.77 lakh active customers as of 2022.

What is Zerodha valuation?

Zerodha Valuation is $3.6 billion (2023).