At present, the world has experienced huge growth in online payments, and with the Covid-19 presence, people preferred to use online payment methods for almost everything as it is safe and secure. More and more people are opting for a cashless way to transfer money. Here, comes the work of the payment gateway. A payment gateway is basically a merchant service that connects the users’ bank accounts with the platform where the users need to transfer their money. A bank may provide a payment gateway to its customers, there is also a specialized financial service provider such as a payment service provider which provides it as a separate service.

Whether you are a small business or you have an established E-commerce business, good payment service is an essential factor for it. An online payment gateway is a secure and convenient way for a website or online business to accept payments from customers. When a customer makes a purchase on an e-commerce website, they enter their payment information, which is then processed by the payment gateway. The payment gateway verifies the information, checks to see if the customer has the funds available, and then transfers the funds from the customer’s account to the business’s account.

A payment gateway platform gives authority to the users to conduct an online transaction through various payment modes such as net banking, credit card, debit card, UPI, and other online payment apps. It is a third-party platform that provides the ability for the user to securely transfer their money to the merchant’s payment portal. In this era of the digital world, E-commerce is leading the market. As times are changing fast online businesses are also moving. So, it is important to know about the payment gateways in India.

In order to use an online payment gateway, you will need to sign up for an account and integrate the payment gateway into your website or online store. This typically involves adding a few lines of code to your website and may also require you to obtain a merchant account.

There are many different online payment gateways available, each with its own set of features and fees. In this article, we will talk about the top payment gateways in India that allow customers to make payments online. So, let’s take a look at them.

| S.No. | Payment Gateway | Key Features | Transaction Fees |

|---|---|---|---|

| 1 | Razorpay | Easy integration, supports multiple payment modes, instant settlements | 2% per transaction |

| 2 | Instamojo | No setup fee, user-friendly dashboard, quick payouts | 2% + ₹3 per transaction |

| 3 | Paytm | Large user base, supports UPI/wallet/cards, instant refunds | 1.99% + taxes |

| 4 | CCAvenue | Multiple currency support, advanced fraud detection, recurring billing | 2% per transaction |

| 5 | Payflow | Easy integration for businesses, seamless checkout experience | Varies by plan |

| 6 | Cashfree | Instant settlements, API friendly, supports international payments | 1.75% onwards |

| 7 | BillDesk | Reliable for utility and recurring payments, strong security | 1.5% onwards |

| 8 | Atom | Supports 100+ payment options, secure and scalable | 1.99% onwards |

| 9 | HDFC | Bank-backed, secure transactions, easy reconciliation | 2% per transaction |

| 10 | PayKun | No setup or maintenance fee, multiple payment modes | 1.75% per transaction |

| 11 | PayU | Easy checkout, supports international cards, fast settlements | 2% per transaction |

| 12 | MobiKwik | Popular wallet-based gateway, supports UPI, cards, EMI, and Buy Now Pay Later options | 1.75% onwards |

Razorpay

| Mobile Applications | Google Play Store |

|---|---|

| Accepted Payment Methods | Domestic and International Credit & Debit cards, EMIs ( Credit/Debit Cards & Cardless), PayLater, Netbanking from 58 banks, UPI and 8 mobile wallets |

Razorpay is one of the best payment gateways in India for your business. It was started in 2014. Many entrepreneurs who use Razorpay for their business, have seen some increase in their conversion rate. Razorpay has helped businesses to solve the problem of digital payments. It is due to their smooth user experience. Also, the refund process is easy and automated. If your customer applies for a refund, Razorpay will automatically get the refund, if you set it to, without any extra widget or code. You can use Razorpay Subscriptions to execute the automated recurring transactions on various payment modes, through a platform that’s built for automation.

Razorpay Features

- You can improve your business sales as Razorpay provides cashback and discounts to your customers

- Payment modes include credit cards, debit cards, net banking, payments through UPI, and popular wallets.

- Razorpay allows you to accept international payments from over 100 countries.

- Manage your marketplace, automate bank transfers, collect recurring payments, share invoices, and avail working capital loans.

Instamojo

| Mobile Applications | Google Play |

|---|---|

| Accepted Payment Methods | 170+ payment methods including RTGS/Bank Transfer/NEFT/EMI |

Instamojo is one of the top-rated payment gateways in India. It allows businesses to create a business account instantly and the account can also be activated within a few minutes to collect online payments. This is a Bangalore-based company and the target of Instamojo is selling digital goods and collecting payments online. You can enroll yourself at Instamojo with a bank account and start your online selling business. You can also collect payments for physical goods and workshops or events.

Instamojo Features

- To set up the payment gateway, no extra payment is needed.

- Different types of payment methods are available.

- Special care is being taken for the security of the server.

- Businesses can create discount codes for their products.

Paytm

| Mobile Applications | Google Play and App Store |

|---|---|

| Accepted Payment Methods | UPI, Debit Card, Credit Card, NetBanking, AMEX/International |

Paytm has emerged as a leading payment gateway in India due to its online customer base with the very popular Paytm wallet. It supports domestic credit cards like Visa, MasterCard, Maestro, Amex, Discover, and Diners. With Paytm online transactions can be made anytime and from anywhere. It is the best payment gateway solution provider in India which has served some biggest eCommerce companies.

Some of the most popular companies which use Paytm are Jabong, OLA, Cleartrips, Redbus, GoIbibo, Zomato, etc.

How to Create Payment Links from the Paytm Business Dashboard

Paytm Features

- The latest technologies are used for secure online transactions.

- It has the feature of saved cards, where a customer doesn’t have to put their card details again and again.

- Paytm is not only available as a desktop application but also supports smartphones and tablets.

CCAvenue

| Mobile Applications | Not Available |

|---|---|

| Accepted Payment Methods | 200+ payment methods including EMI options |

CCAvenue is an authorized payment gateway provider by Indian Financial Institutions and is known as the most secure and best payment gateway to transact money for online shopping. Customers can make online transactions via Credit Cards, Debit Cards, Net Banking, Digital and Mobile Wallets, Mobile Payment, and Cash Card modes. It offers smooth, fast, and secure transactions to its customers. Currently, CCAvenue powers more than 85% of businesses in India.

CCAvenue Features

- CCAvenue provides “Smart Analytics” by which you can see a real-time comprehensive statistical online report and a transparent history of all your transactions.

- It has a ‘Mobile Checkout Page’ which supports all mobile operating systems.

- CCAvenue also has CCAvenue In-built Advanced Shopping Cart’, CCAvenue S.N.I.P. ( Social Network In-stream Payments), it is one of India’s first genuine Social Commerce facilities.

Payflow

| Mobile Applications | App Store and Google Play |

|---|---|

| Accepted Payment Methods | Accept all major debit and credit cards supported by their processor, including Visa, Mastercard®, American Express, Discover, JCB, and Diners Club. Payflow Gateway also supports L2/L3 purchase cards, prepaid cards, foreign currencies, TeleCheck, and ACH. |

Payflow is offered by PayPal. It is known for being a secure and open gateway for payments. Payflow accepts all major credit and debit cards. It adds over 173 million customers regularly and supports more than 100 currencies. In India, it is used by Merchants for receiving international payments.

Payflow Features

- It accepts and offers different payment methods.

- The checkout process is customized with the help of APIs.

- It supports fraud protection services and allows you to install it for an additional fee.

Cashfree

| Mobile Applications | Google Play Store |

|---|---|

| Accepted Payment Methods | UPI, EMI, digital wallets, Debit/Credit cards, and 100+ other payment options |

Cashfree is a low-cost and popular payment gateway in India. Cashfree helps businesses in India to accept payments online from various payment channels. The best thing about Cashfree is that it has direct integration with multiple banks which makes Cashfree a fast and reliable payment gateway. It is the only payment gateway in India that provides a wide range of payment options such as Visa, MasterCard, Maestro, Rupay, and Amex, including 70+ more net banking options. Cashfree also supports UPI, NEFT, IMPS, and PayPal. TDR is the transaction discount rate that every payment gateway charges from the merchants for processing the transactions to their bank account.

Cashfree Features

- The setup cost is not needed.

- Cashfree also supports online wallets like Paytm, PhonePe, and GooglePay.

- Cashfree is the fastest settlement cycle of 24 hours to 48 hours and also offers popup, iframe and seamless checkout modes

BillDesk

| Mobile Applications | Google Play Store |

|---|---|

| Accepted Payment Methods | 120+ Credit cards, Debit cards, Banks, Net Banking, Wallets |

BillDesk is an Indian online payment gateway company based in Mumbai, India. BillDesk provides bill payment and settlement services to large billers like electricity, water, insurance, and other service providers. BillDesk also provides the ability to customers to decide how and when to make payments. BillDesk is a one-stop solution for customers through which customers can make all their payments at any time and from anywhere.

BillDesk Features

- The integration is developer friendly and is quite easy and flexible..

- BillDesk offers various payment methods.

- Customers can also receive payment reminders or alerts.

Atom

| Mobile Applications | Google Play Store |

|---|---|

| Accepted Payment Methods | Visa, Mastercard, Discover and American Express plus Amazon Pay, Apple Pay, Google Pay, PayPal, and Venmo |

Atom consists of various payment options which accept payment through all major debit cards and credit cards. Atom has completed over 15 million transactions and is used by thousands of merchants across the country. Atom is completely secured as it is backed with PCI DSS version 3.2 and 256-bit encryption which ensures a safe and secure transaction.

Atom Features

- Atom provides multiple payment methods.

- The integration is quite simple and easy.

- Atom provides invoices after every payment.

HDFC

| Mobile Applications | App Store and Google Play Store |

|---|---|

| Accepted Payment Methods | All major credit, debit cards and net banking in India, including Visa, MasterCard, Visa Electron, Diners, Rupay, Discover or Maestro |

HDFC is one of the largest banks in India that offers a payment gateway service for merchants and businesses to accept online payments from their customers. Many organizations like VSNL, Sify, and IRCTC use HDFC. If you want to use HDFC on your website or mobile app, you need to use their EPI payment gateway services. The HDFC Payment Gateway allows merchants to securely accept a wide range of payment options, including credit and debit cards, net banking, and UPI payments. The advantages of the HDFC payment gateway are instant settlement, a 100% chargeback facility, the facility to accept payment in 15 international currencies, easy integration with existing applications, and support for various shopping cart applications.

HDFC Features

- The HDFC Payment Gateway supports a wide range of payment options, including Visa, Mastercard, American Express, and Rupay credit and debit cards, as well as net banking and UPI payments.

- The HDFC Payment Gateway uses 128-bit SSL encryption to secure your transactions and protect your financial information.

- The HDFC Payment Gateway can be easily integrated with your website or mobile app, allowing you to customize the payment experience for your customers.

- The HDFC Payment Gateway provides detailed transaction reports and reconciliation tools to help you manage and track your payments.

- It accepts 15 types of international currencies.

- It provides 24×7 customer service.

PayKun

| Mobile Applications | Not Available |

|---|---|

| Accepted Payment Methods | UPI wallet payments, subscription payments, Debit/Credit cards, Master Card, diners club card, net banking, wallets, UPI/BHIM |

PayKun is an easy solution for online payments for all types of businesses including small businesses, and medium to large. Any kind of merchant including a freelancer, a YouTuber, a blogger, from an eCommerce website or mobile app, an offline and online seller at the shop or showroom, or an individual, every type needs to have an easy hand on the modern technology for the collection of digital payments. It provides free plugins and SDKs readily available on the internet to integrate with all the major platforms of websites and mobile applications.

PayKun Features

- Paykun has zero setup fees and zero maintenance fees.

- It provides different types of payment methods.

- The server is safe enough to use.

PayU

| Mobile Applications | Google Play and App Store |

|---|---|

| Accepted Payment Methods | 100 different payment methods are supported, including EMI, UPI, net banking, cards, wallets, Buy Now Pay Later, etc. |

PayU (formerly known as PayU Money) is one of the best multi-currency payment gateways to accept online payments. The PayU payment gateway is designed to be secure, reliable, and easy to use for both merchants and customers.

To use the PayU payment gateway, merchants need to sign up for an account and integrate the payment gateway into their online store or website. This can typically be done through the use of a software development kit (SDK) or by integrating with a payment processor or shopping cart platform. Once the integration is complete, merchants can start accepting payments from customers through the PayU payment gateway.

You can start accepting payments securely and seamlessly within your iOS, Android, or Windows app, within minutes, with its 100% online hassle-free onboarding process.

PayU Payment Gateway: What is a payment gateway and how does it work?

PayU Features

- PayUMoney supports multi-currency transactions and international credit cards.

- PayU provides over 100+ payment methods

- The transaction history is available through PayU.

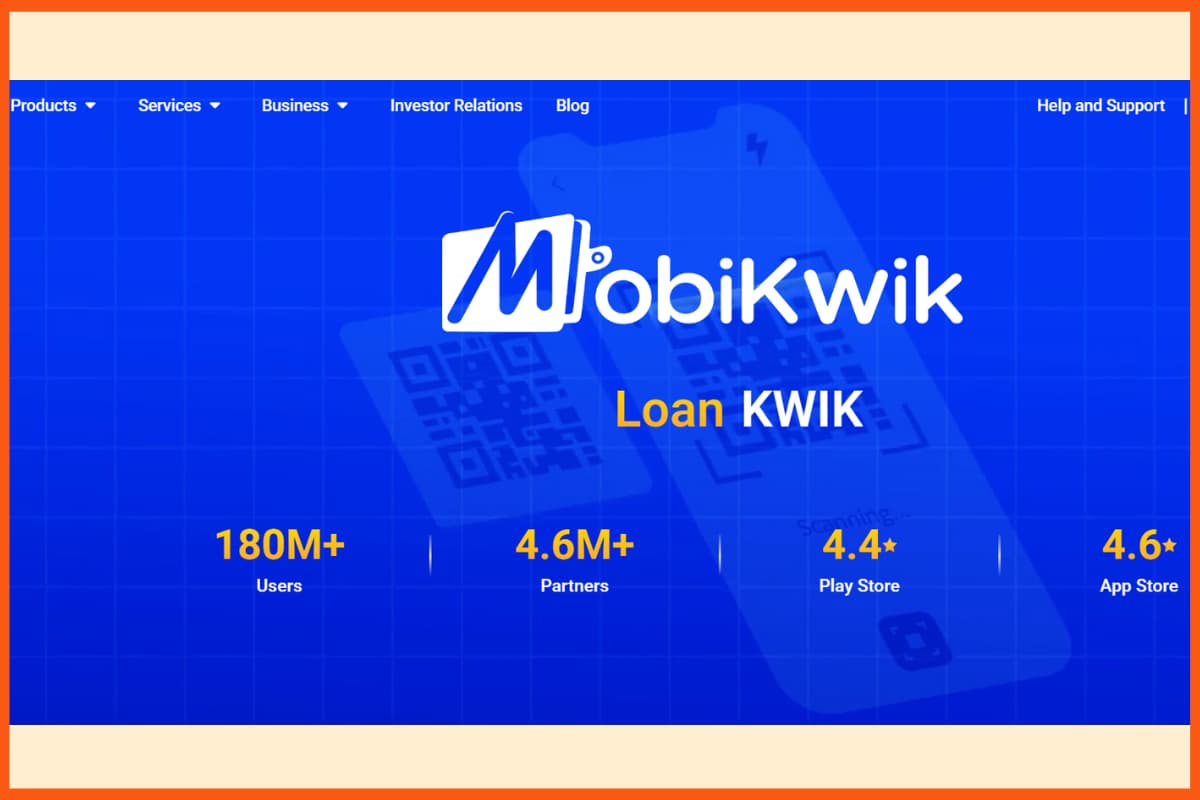

Mobikwik

| Mobile Applications | Google Play and App Store |

|---|---|

| Accepted Payment Methods | Supports UPI, MobiKwik wallet, credit/debit cards, net banking, EMI, and Buy Now Pay Later options. |

MobiKwik (earlier called Zaakpay) is one of the fastest-growing eCommerce payment gateways, helping businesses run smoothly. It focuses on giving users an easy experience by automatically detecting OTP (One Time Password) during payments.

Some well-known clients include Business World, BlueDart, Uber, and Zomato. Businesses can also integrate this gateway into their website or app with the help of eCommerce development companies.

Mobikwik Features:

- Strong PCI DSS security to keep transaction data safe

- Website analytics to track payment data

- Supports credit/debit cards, wallets, international cards, UPI, and EMI options

Conclusion

The payment gateway has become the most important part of the world of increasing eCommerce businesses. If a business provides a good payment service, it automatically creates a good impression in front of its customers. With the increase of E-commerce businesses in the world, the need for proper payment gateways is also increasing.

FAQs

What is a Payment Gateway?

A payment gateway platform gives authority to the users to conduct an online transaction through various payment modes such as net banking, credit card, debit card, UPI, and other online payment apps.

Where payment gateways are used?

Payment Gateways are used mostly used by E-commerce businesses.

What are some top 5 Payment Gateways?

The top 5 payments gateways are:

- Razorpay

- Instamojo

- BillDesk

- Paytm

- Payflow

Which is better, Paytm or PayPal?

The choice between Paytm and PayPal will depend on your specific needs and preferences. It may be helpful to consider factors such as geographical availability, payment methods, fees, and security when deciding which platform is right for you.

Who regulates payment gateways in India?

In India, payment gateways are regulated by the Reserve Bank of India (RBI), which is the central bank of the country.

Which is the cheapest payment gateway in India?

Cashfree Payment gateway is as of now, one of the cheapest payment gateways in India.

Is UPI available only in India?

UPI is not limited to India and has been adopted by some financial institutions and payment service providers in other countries as well such as Bhutan, Nepal, UAE, and the UK.

Which is better, Razorpay vs Billdesk?

Razorpay is better for startups and online businesses because it offers easy integration, many payment options, and instant settlements. BillDesk is more suited for large enterprises and utility bill payments due to its reliability and strong security.

Which is better, HDFC Payment Gateway vs Razorpay?

Razorpay is better for startups and developers due to its easy setup, modern features, and instant settlements, while HDFC Payment Gateway is ideal for established businesses needing a bank-backed, secure solution.

Which is the best payment gateway for startups in India?

The best payment gateway for startups in India is Razorpay because it offers easy integration, multiple payment options, fast settlements, and low setup hassle.

Which are the payment gateway for website in India?

Razorpay, PayU, and Cashfree are top payment gateways for websites in India, offering easy integration and fast payments.

Which is the best payment gateway for online business?

The best payment gateway for online business in India is Razorpay due to its seamless integration, wide payment options, and quick settlements.