India is the largest importer of Gold in the world. Gold is not only a material of great value that is closely tied to Indian culture and tradition, but it has also been a time-tested investment option, which is very common among Indian households. With the emergence of the internet and the digitalization of the day, gold and the investment in gold in India also took the digital route.

Yes, it is digital gold now in place of the physical gold that is growing in popularity. Furthermore, numerous gold investment companies and online platforms for purchasing gold are fueling the growing demand for digital gold, or e-gold, enabling investors to buy gold quickly, securely, and easily.

The Digital Gold can be bought online and will be stored in safe vaults until sold. Currently, three entities in India provide Digital Gold. You can use certain platforms to make digital gold purchases online, but these three companies would have to be associated with those platforms.

India’s digital gold market is growing fast and could become a $100 billion opportunity by 2025. This growth is happening because more people are using fintech apps, and young investors are now more aware that gold is a smart way to invest.

The three companies in India are Augmont Goldtech Pvt. Ltd., MMTC-PAMP India Pvt. Ltd., and Digital Gold India Pvt. Ltd., which is sold under the brand Safe Gold. These companies purchase the gold and store it safely in vaults on behalf of the platforms.

Advantages of E-Gold

- Gold rates on the NSE are based on Indian market rates.

- Investors can buy and sell gold in small denominations. E.g., 1gm, 2gm of gold.

- Transparency in pricing and seamless trading are one of the major advantages of this product.

- This product is high in liquidity. One can sell it at any point in time. No impurity risks.

Here is the list of gold trading apps that bring in fantastic gold investment options, or buying digital gold, which one can opt to invest in E-gold in India.

List of Best Platforms to Buy Digital Gold in India in 2025

| # | Brand Name | App Type / Category | Platform Availability | Main Use | Why Users Like It |

|---|---|---|---|---|---|

| 1 | Paytm | UPI & Wallet App | Android, iOS, Web | UPI payments, recharges, shopping | All-in-one app with fast payments and cashback |

| 2 | PhonePe | UPI Payment App | Android, iOS | UPI and bill payments | Simple interface and quick transactions |

| 3 | Google Pay | UPI Payment App | Android, iOS | UPI payments | Backed by Google, easy to use |

| 4 | Groww | Investment App | Android, iOS, Web | Stocks & mutual fund investment | Beginner-friendly with low fees |

| 5 | Jar | Gold Saving App | Android, iOS | Gold savings via spare change | Auto-saves small amounts daily into digital gold |

| 6 | Airtel Payments Bank | Digital Bank & Wallet | Android, iOS, Web | Digital banking & payments | Works well with Airtel ecosystem |

| 7 | Amazon Pay | UPI & Wallet App | Android, iOS, Web | Payments and shopping rewards | Smooth for Amazon users, cashback offers |

| 8 | HDFC Securities | Stock Trading Platform | Android, iOS, Web | Stock trading | Trusted banking brand with full trading tools |

| 9 | Motilal Oswal | Investment Platform | Android, iOS, Web | Investments & research | Strong advisory and research support |

| 10 | FinPlay | Learning & Budgeting App | Android, iOS | Financial learning app for teens | Makes money learning fun and interactive |

| 11 | Zerodha | Stock Trading Platform | Web, Android (via Kite) | Discount stock brokerage | Low brokerage fees and easy interface |

| 12 | Tanishq | Jewellery Shopping App | Android, iOS, Web | Gold and jewellery shopping | Trusted brand with high-quality jewellery |

| 13 | Spare8 | Micro-Investment App | Android, iOS | Save and invest spare change | Helps build habits through micro-investments |

| 14 | DigiGold | Digital Gold Platform | Android, iOS, Web | Buy & sell digital gold | Instant gold buying with real-time prices |

| 15 | Jupiter Money | Neobank | Android, iOS | Smart digital banking | Money tracking and spending insights |

| 16 | MMTC-PAMP | Gold Investment Platform | Android, iOS, Web | Digital gold and bullion buying | Government-authorized and safe |

| 17 | Gullak | Gold Saving App | Android, iOS | Auto-save & invest in gold | Daily auto-savings into gold |

| 18 | Pluto Money | Finance EdTech App | Android, iOS | Financial education for Gen Z | Gamified learning for young users |

| 19 | Plus Gold | Gold Investment App | Android, iOS | Gold saving and investment | Goal-based savings in gold |

| 20 | Dvara SmartGold | Gold Saving Platform | Android (mostly) | Rural-focused gold savings | Easy gold savings for underserved communities |

| 21 | Fiydaa | Budgeting App | Android, iOS | Budgeting & money management | Helps users plan, track, and save smarter |

| 22 | eBullion | Gold Investment Platform | Android, iOS, Web | Buy, sell & manage gold 24/7 | Offers full control, price alerts, and deep insights |

How to Invest in E-Gold?

Open a Demat Account

To purchase commodities in NSE, you must have a Demat account. One can keep a separate Demat account for equities and commodities or keep the same one. To open an account, one can submit all the required documentation to NSE.

Trading

Once your account is opened, you can log in and buy e-gold. You can trade from 10 a.m. to 11:30 p.m. on weekdays. Your gold units will get credited to your Demat account in T+2 days (date plus one days).

Physical Delivery

If you want, you can physically deliver gold at any time by redeeming e-gold units in your Demat account.

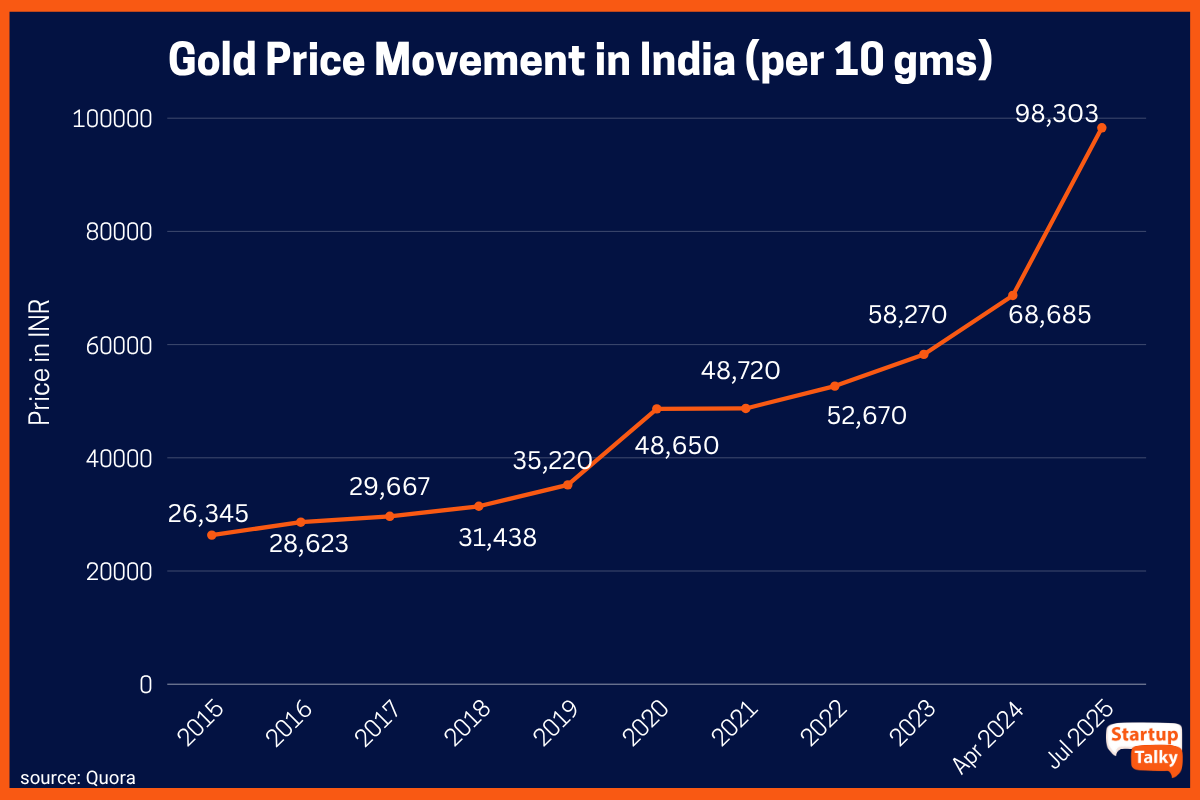

The graph shows the gold price movement in India per 10 grams from 2015 to 2025. The price of gold has been increasing over the past few years, and it is likely to continue to increase in the future.

The gold price started at around INR 26,345 per 10 grams in 2015 and reached INR 58,270 per 10 grams in 2023, an increase of over 100%, and INR 98,303 in July 2025. The main reasons for the increase in gold price are inflation, geopolitical uncertainty, and rising demand from India.

List of Digital Gold Investment Platforms

Paytm

| Name | Paytm |

|---|---|

| Founded | 2010 |

| Minimum Investment | INR 1 |

| Partnered with | MMTC-PAMP |

Paytm is an e-commerce payment system and a fintech company in India. It was founded in the year 2010 and has its headquarters located in Uttar Pradesh, India. Paytm provides an opportunity for Indians to invest or purchase 99.99% pure Gold for as low as INR 1.

The user can purchase gold through the Paytm app by choosing the stocks and wealth icon and then selecting the Paytm Gold icon, which lets you invest in Gold in terms of rupees or quantity. It is one of the most trustworthy and best gold investment app in India.

PhonePe

| Name | PhonePe |

|---|---|

| Founded | 2015 |

| Minimum Investment | INR 1 |

| Partnered with | MMTC-PAMP |

PhonePe is an Indian financial service and a digital payment platform. It was founded in the year 2015 and has its headquarters in Bangalore, India. The company is a subsidiary of Flipkart. Even PhonePe allows its users to invest or purchase 99.99% pure Gold for as low as INR 1. It is one of the best platform for the best digital gold investment in India.

PhonePe platform provides the promise of transparent pricing and assured quality, and is one of the best ways to buy gold online. In PhonePe, the users will have to log into their account and choose the Gold option available in the My Money section. With PhonePe, the users can invest in Gold in terms of rupees or quantity.

Google Pay

| Name | Google Pay |

|---|---|

| Founded | 2011 |

| Minimum Investment | INR 1 |

| Partnered with | MMTC-PAMP |

Google Pay is also a digital payment platform, which is powered by Google. It was launched in the year 2015. Google Pay also lets users invest or purchase 99.99% pure Gold for as low as INR 1.

The users can purchase the gold by using the Google Pay platform, which works similarly to the digital gold purchased through PhonePe and Paytm.

Groww

| Name | Groww |

|---|---|

| Founded | 2016 |

| Minimum Investment | INR 10 |

| Partnered with | Augmont Gold |

Groww is an Indian-based online investment platform. It provides services to customers to invest in mutual funds and stocks. The company was founded in the year 2016, is headquartered in Bangalore, and is one of the best platforms to buy digital gold in India.

Through Groww, the users will be able to purchase Gold in terms of grams from a starting price of INR 10. The purchase cannot be made through the Groww funds, and the users will have to purchase them through UPI, NEFT, net banking, IMPS, or RTGS. If it is net banking, then they will have to purchase for more than INR 100.

Jar

| Name | Jar |

|---|---|

| Founded | 2021 |

| Minimum Investment | Based on Digital Transaction Value |

| Partnered with | SafeGold |

The Jar App is a daily savings platform that rounds off spare change from your digital transactions and invests it in digital Gold, all of this with zero manual involvement. For example, if a person spends Rs. 23, Jar smartly rounds it off to the nearest ten and automatically invests Rs. 7 in digital gold on their behalf.

First of its kind, with Jar App, you can save while you spend. The entire process takes 45 seconds and can start right after.

Jar App enables its customers to save consistently with minimum hassle so that they are all prepared for the future.

Airtel Payments Bank

| Name | Airtel Payments Bank |

|---|---|

| Founded | 2016 |

| Minimum Investment | INR 1 |

| Partnered with | SafeGold |

Airtel Payments Bank is a financial service company that is a subsidiary of Bharti Airtel. It is the first company to receive a payments bank license from the RBI. Headquartered in New Delhi, India, Airtel Payments Bank was founded in the year 2017.

Airtel has launched a new platform, DigiGold. It is one of the best platforms to buy digital gold from. This platform will allow users to invest in digital gold. This feature can be used only by the savings account customers of Airtel Payments Bank.

Amazon Pay

| Name | Amazon Pay |

|---|---|

| Founded | 2007 |

| Minimum Investment | INR 5 |

| Partnered with | SafeGold |

Amazon is one of the largest e-commerce platforms in India. It is a US-based company that was founded in the year 1994. Launched in 2007, Amazon Pay uses the consumer base of Amazon.com and focuses on giving users the option to pay with their Amazon accounts on external merchant websites. If you are looking for how to buy gold online with Amazon, then that is easy, too.

The users can buy Digital Gold through the Amazon App on the Amazon Pay page, or they can search for it directly in the search bar. Once the users can log in, they can click on the gold vault icon and see the buy price at that time. The digital gold can be bought from the starting price of INR 5. The users can buy up to 30g of Gold without KYC.

HDFC Securities

| Name | HDFC Securities |

|---|---|

| Founded | 2000 |

| Minimum Investment | 1 gram of Gold |

| Partnered with | Augmont Gold |

HDFC is a financial securities company that is a subsidiary of HDFC Bank. HDFC Securities was founded in the year 2000, and its headquarters are located in Mumbai, India. HDFC Securities also allows its users to invest in digital gold.

Using HDFC securities, users can buy 24K Gold in terms of rupees as well as quantity. It is one of the best gold trading apps. You will be able to buy the top-quality Gold and store it safely in the digital locker, which can be accessed anytime and anywhere.

Motilal Oswal

| Name | Motilal Oswal |

|---|---|

| Founded | 1987 |

| Minimum Investment | 1 gram of Gold |

| Partnered with | MMTC-PAMP |

Motilal Oswal is an India-based diversified financial service company that also provides gold investment opportunities. The company was founded in the year 1987 and has its headquarters in Mumbai, India. Motilal Oswal allows users to purchase digital Gold at a starting price of INR 1,000. You can purchase 24k pure gold at the best price and keep it safe online.

FinPlay

| Name | FinPlay |

|---|---|

| Founded | 2021 |

| Minimum Investment | INR 1 |

| Partnered with | MMTC-PAMP |

FinPlay is a game-based investment platform that is designed to bring two exciting themes of fintech and gaming together, making it one of the best gold investment apps in India. Founded by two IITians, FinPlay allows users to play games and earn FinCash awards, which they can redeem to get financial products at discounted rates on the platform, along with other rewards like Amazon coupons and more. Recognized as one of the best apps for gold investment, FinPlay offers a user-friendly approach to investing in digital gold, making it the best place to buy digital gold.

FinPlay currently helps users with the opportunity to buy digital gold. FinPlay extends easy ways to invest in 24K, 99.99% Pure Gold, which is 100% safe and secure, and promises transparent pricing. The company also enables its customers and other investors to buy and invest in digital gold starting from Re 1, and is gearing up to become a major company that would let users invest in gold.

Zerodha

| Name | Zerodha |

|---|---|

| Founded | 2010 |

| Minimum Investment | 1 gram of Gold |

| Partnered with | Augmont Gold |

Zerodha is India’s largest retail stockbroker by active client base and trading volume. It is a discount broker, meaning it charges lower commissions than traditional brokers. Zerodha is known for its innovative trading platforms and its focus on customer service.

By expanding its reach into the e-hold trading industry, Zerodha has added another layer of innovation to its portfolio. It is a ground-breaking bargain brokerage. With a track record of disrupting the financial sector, it now provides a stable investment environment for digital gold. The platform’s commitment to customer satisfaction is reflected by the multitude of cutting-edge tools it provides, which equip users with the knowledge they need to make sound decisions and pave the way for an interesting and profitable e-gold investment experience.

Tanishq

| Name | Tanishq |

|---|---|

| Founded | 1994 |

| Minimum Investment | INR 100 |

| Partnered with | SafeGold |

Tanishq is a leading Indian jewelry brand in the Tata Group. It is known for its high-quality jewelry and its commitment to ethical sourcing. Tanishq has a wide range of jewelry products, including gold, diamond, and platinum, making it one of the best apps for gold investment.

Tanishq is also a pioneer in the digital gold space. It was the first jewelry brand in India to offer digital gold to its customers. Tanishq’s digital gold product, Tanishq e-gold, is powered by SafeGold, a digital gold provider regulated by the Securities and Exchange Board of India (SEBI).

You can sell or swap the gold at any of its 350+ outlets in India anytime. There are no additional fees for the app’s locker or transaction processing. It is one of the best platforms to invest in gold and one of the most reputable sites for purchasing gold in physical and digital forms because it is a Tata Group firm. Tanishq is a trusted brand with a long history of providing high-quality jewelry and ethical sourcing. Its digital gold product, Tanishq e-gold, is a convenient and affordable way for investors to invest in gold. Tanishq is considered as the safest and best app to buy digital gold.

Spare8

| Name | Spare8 |

|---|---|

| Founded | 2020 |

| Minimum Investment | INR 10 |

| Partnered with | Augmont & Paytm |

Founded in September 2021, FinPlay is currently led by Ganesh Kumar Anegondi (Co-founder and CEO) and is built to simplify long-term investing and is, therefore, great for first-time investors. The platform currently lists digital gold as the only asset, but is planning to launch mutual funds and stock baskets in the upcoming months. “Democratise finance and wealth management for millennials in India” is currently the mission of FinPlay. The startup further aims to emerge as the go-to wealth platform for millennials who are just starting their wealth creation journey. It is considered one of the best app for gold investment, as it offers a user-friendly approach to investing in digital gold.

DigiGold

| Name | DigiGold |

|---|---|

| Founded | 2020 |

| Minimum Investment | INR 1 |

| Partnered with | – |

DigiGold is an investment platform by Amrapali Gujarat, founded in 2020, with 40+ years of legacy in Bulk Gold and Silver. Accredited by NABL and BIS, and supported by GGC and SEQUEL, DigiGold is one of the best apps to buy digital gold and is one of the best digital gold companies in India. Gold purchased by the users is stored in Government-trusted vaults of BRINKS. The minimum amount of purchase starts from just INR 1. They also offer a no-lock-in-period SIP in Gold with a minimum amount of INR 500 through periodic installments. With DigiGold, you can buy and possess a portion of massive gold, silver, and platinum bars that are safely stored in The Vault. DigiGold is considered as the best place to buy digital gold.

Jupiter Money

| Name | Jupiter Money |

|---|---|

| Founded | 2019 |

| Minimum Investment | INR 10 |

| Partnered with | MMTC-PAMP |

Jupiter Money is a digital payment app powered by Federal Bank, founded by Jitendra Gupta and Vishnu Jerome in 2019, and headquartered in Mumbai. The Jupiter Money app allows investors to buy/sell digital gold or start a No-penalty SIP starting at INR 10. Jupiter Money and MMTC-PAMP have teamed up to provide digital gold on the platform. You can invest in 24K gold that is 99.99% pure through Jupiter Money. Gold can be purchased and sold at current market prices at any time of day. With the app, you may store gold in safe vaults.

MMTC-PAMP

| Name | MMTC-PAMP |

|---|---|

| Founded | 2008 |

| Minimum Investment | INR 1 |

| Partnered with | – |

MMTC-PAMP was founded in 2008 as a joint venture between MMTC Ltd. (a government of India undertaking and India’s largest public sector trading organization) and PAMP SA, a bullion brand based in Switzerland. Investors can redeem digital gold for 24K, 999.9 purest gold bars and coins from MMTC-PAMP. They can sell the digital gold back to MMTC-PAMP or gift/transfer the gold to a loved one using the platform.

Gullak

| Name | Gullak |

|---|---|

| Founded | 2022 |

| Minimum Investment | 0.5 gm of gold |

| Partnered with | Augmont |

Gullak is a savings and investment app founded by Manthan Shah, Dilip Jain, and Naimisha Rao in 2022. Recognized as the best digital gold investment app in India, Augmont and Gullak collaborated to create the leasing scheme known as Gullak’s Gold+. With the Gullak app, customers may safely lease their gold thanks to Gold+. Reputable, reliable, and established jewelers lease gold metal. Jewelers offer investment protection in the form of bank or corporate guarantees. The interest that these jewelers pay is expressed in grams of gold, and the users also benefit from this. The minimum quantity required to participate in Gold+ is 0.5 grams, and the maximum quantity is 250 grams.

Pluto Money

| Name | Pluto Money |

|---|---|

| Founded | 2023 |

| Minimum Investment | INR 100 |

| Partnered with | Augmont |

Pluto Money, a goal-based saving platform that assists users in creating a secure financial future, was founded by Danish and Reev. It is known as one of the best apps to invest in gold. It assists users in establishing a savings habit, making low-risk investments, and reaching their financial objectives. With Pluto Money, investors can buy 24K, 99.9% pure gold and convert digital gold to physical gold, with delivery to your doorstep. To invest in digital gold, download the app, register, choose your investment amount, and complete your purchase.

Plus Gold

| Name | Plus Gold |

|---|---|

| Founded | 2022 |

| Minimum Investment | INR 100 |

| Partnered with | Augmont |

Plus Gold is an Indian-based jewellery savings app that combines the simplicity of digital gold investment with the excitement of building a jewellery collection. Users can invest in gold through systematic investment plans (SIPs) or one-time purchases, with no lock-in period, allowing for easy redemption anytime. Purchases can be made using UPI, NEFT, net banking, IMPS, or RTGS, making it one of the best apps to buy digital gold.

With Plus Gold, users earn a 10% extra gold benefit, receiving 1 gram of additional gold on every 10 grams purchased. Trusted by over 300 verified jewellers and redeemable at 1,000+ stores in 520+ cities, Plus Gold offers a secure and flexible way to save in gold for the future.

Dvara SmartGold

| Name | Dvara SmartGOld |

|---|---|

| Founded | 2019 |

| Minimum Investment | INR 100 |

| Partnered with | Jana Small Finance Bank (SFB) |

Dvara SmartGold is a micro-savings platform that helps users build a financial safety net by investing in gold. Launched in 2019, it allows you to save in small, flexible installments through SIPs, and redeem your savings as cash, coins, or jewellery from trusted jewellers.

With no fees or commissions on SIPs and secure storage in BRINKS vaults, Dvara SmartGold offers a simple, safe, and affordable way to grow your gold savings for future needs.

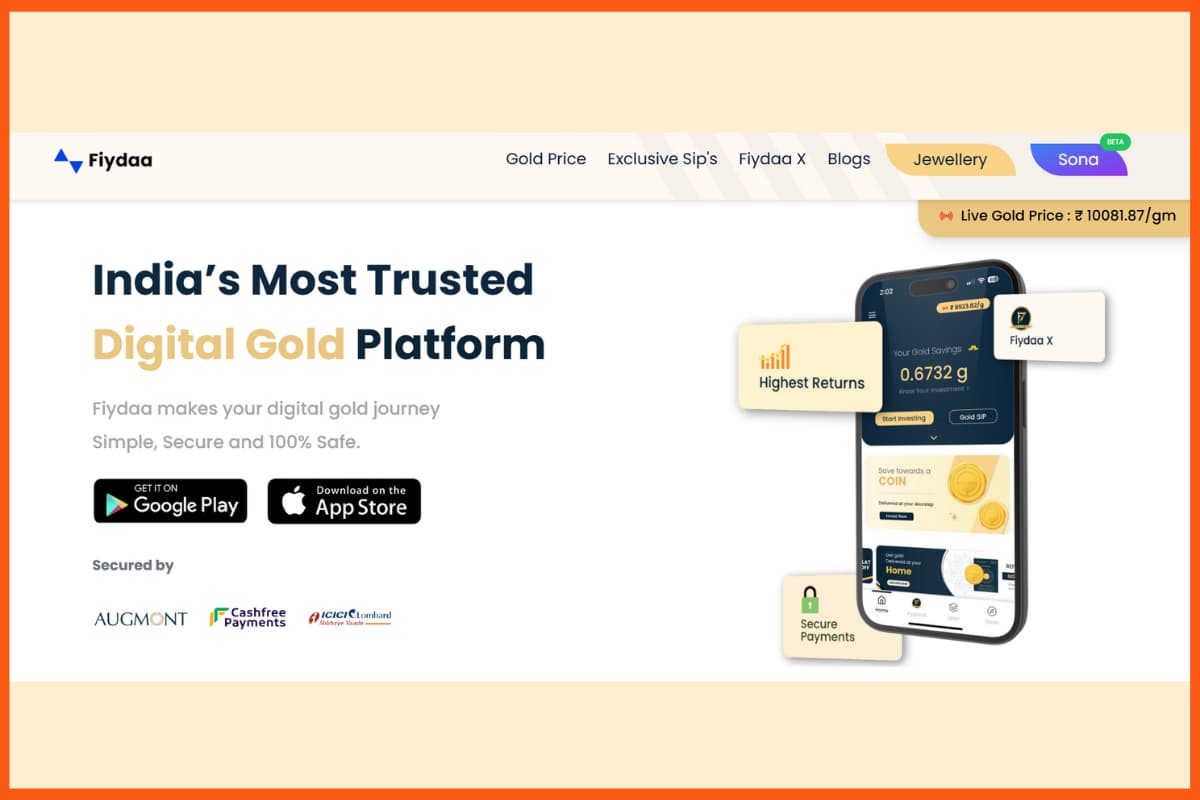

Fiydaa

| Name | Fiydaa |

|---|---|

| Founded | 2023 |

| Minimum Investment | INR 5 |

| Partnered with | Not publicly disclosed |

Fiydaa is a digital gold investment platform designed for middle-class savers, letting you start with as little as INR 5. It offers flexible SIP options like DigiGold SIP (from ₹100), Lease SIP (earn extra 4% monthly in grams), and Gold Coin SIP (redeem coins later). With Fiydaa X, users can lease gold to earn up to 6% annually. All gold is securely stored and can be redeemed anytime for cash or physical delivery. Fiydaa also offers its jewelry line, Elegance.

eBullion

| Name | eBullion |

|---|---|

| Founded | 2020 |

| Minimum Investment | Not disclosed |

| Partnered with | Not publicly disclosed |

eBullion is a complete digital gold investment platform that lets users buy, sell, and manage gold 24/7. It’s designed for both beginners and active investors who want full control and real-time insights. The platform offers live gold prices, smart price alerts, and detailed portfolio tracking. Users can set custom alerts to buy or sell at their preferred rates. All gold is 100% insured, stored in secure vaults, and can be redeemed anytime for cash or physical delivery. eBullion focuses on transparency, safety, and flexibility, making gold investing simple and convenient.

FAQs

Can people buy E-Gold in India?

Yes, you can buy digital gold in India through various digital gold investment platforms.

Is digital gold better than physical gold?

Digital gold is a better option than physical gold as it ensures safety and has no additional storage costs.

What is E-gold in India?

E-gold is held electronically in the demat form and can be freely converted into physical gold.

Which is the best country to buy gold?

If you are wondering about the best country to buy gold, it is Dubai, UAE.

What is digital gold?

Digital gold or e-gold is a virtual form of gold investment that one can make. The users can easily buy e-gold via the best gold investment apps available online and have it stored in secured vaults.

What is the best way to buy digital gold?

The best way to buy digital gold is through trusted apps like eBullion, Jar, or MMTC-PAMP that offer real-time prices, secure vault storage, and easy redemption.

Which are the best Digital Gold Investment platforms in India?

Some of the best Digital Gold Investment platforms in India are:

- Paytm

- Phonepe

- Google Pay

- Groww

- Jar

- Airtel Payments Bank

- Amazon

- HDFC Securities

- Motilal Oswal

- FinPlay

- Upstox

- Zerodha

- 5paisa

- Tanishq