Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations.

Anything that has to do with real estate, specifically as a purchaser has always been convoluted and annoying. The constant push from the sellers, nagging from the middlemen, lack of fluid communication, and running helter-skelter to get the paperwork done are some of the common horrors in the world of real estate. Was it meant to be this way?

Yes, many of us have pondered on the scene on several occasions but without any outcome. Akhil Gupta, Amit Agarwal, and Saurabh Garg also thought of improving this gloomy scenario and found a solution in the form of NoBroker. Founded in 2014, NoBroker is a Bangalore-based startup in the real estate search domain, that connects flat and property owners with tenants and buyers directly through their platform, thereby making buying, selling, and renting properties simpler, transparent, and affordable.

NoBroker claims to handle around $2 billion worth of transactions on its platform each year and saves INR 130 crores of brokerage monthly. The platform helped Indian real estate customers save around INR 1,100 crores worth of brokerage in 2020. The company further strives to help the Indians usher in a new era of smooth and easy real estate transactions minus the “brokers.” The startup became a unicorn on November 23, 2021.

StartupTalky interviewed Mr. Saurabh Garg, Co-Founder & CBO of NoBroker to get insights on the Startup Journey and the Growth Story of NoBroker. Read on to learn about NoBroker company, its owner, business model, revenue model, competitors, founders, revenue, funding & more.

NoBroker Company Details

| Startup Name | NoBroker |

|---|---|

| Headquarters | Bangalore |

| Founders | Amit Kumar Agarwal, Saurabh Garg, Akhil Gupta |

| Founded | 2014 |

| Sector | Proptech, Real Estate |

| Total Funding | $430.9 million (March 2023) |

| Website | nobroker.in |

| Registered Entity Name | NoBroker Technologies Solutions Private Limited |

About NoBroker

NoBroker – Real Estate Industry Details

NoBroker – Founders and Team

NoBroker – History and Startup Story

NoBroker – Products and Services

NoBroker – Name and Logo

NoBroker – Business Model and Revenue Model

NoBroker – Startup Challenges Faced

NoBroker – Funding and Investors

NoBroker – Shareholding

NoBroker – Growth and Revenue

NoBroker – Financials

NoBroker – ESOP

NoBroker – Acquisitions

NoBroker – Competitors

NoBroker – Awards and Recognition

NoBroker – Future Plans

About NoBroker

NoBroker is a disruptive force in the real estate sector that uses innovative technologies to connect property owners, buyers, and renters with the help of a single platform.

Here’s what NoBroker has to say about their mission:

Our mission is to lead India’s real estate industry towards an era of doing real estate transactions in a convenient and brokerage-free manner.

NoBroker – Real Estate Industry Details

India’s real estate market was worth $477 billion in 2022. It is projected to grow to $1 trillion by 2030 and $5.17 trillion by 2047. Furthermore, the market size of the real estate sector in India, which was estimated to be around US$ 120 billion in 2017, will be expected to grow to US$ 1 trillion by 2030 and will contribute nearly 13% to the country’s GDP by 2025.

In FY23, India’s residential real estate market experienced unprecedented growth, with home sales reaching a record high of INR 3.47 lakh crore ($42 billion), marking a substantial 48% year-on-year increase. This surge underscores the sector’s potential, with forecasts suggesting its contribution to India’s GDP could rise to 15.5% by 2047, expanding the real estate sector to a projected $5.8 trillion.

Besides, Indian firms are also expected to raise more than $48 billion with the help of infrastructure and real estate investment trusts in 2022 when compared to raised funds, which are worth $29 billion to date, according to ICRA.

NoBroker – Founders and Team

NoBroker company was founded by Amit Kumar Agarwal, Akhil Gupta, and Saurabh Garg.

“I first met Akhil when we were studying at IIT Bombay and Amit at IIM Ahmedabad. Convincing them was not tough, as we all had our fair share of hassle when looking for properties” says Saurabh Garg, Co-founder & CBO, NoBroker.

- Amit Kumar Agarwal: Co-founder and CEO of NoBroker

- Akhil Gupta: Co-founder, Chief Tech and Product Officer of NoBroker

- Saurabh Garg: Co-founder and CBO of NoBroker

NoBroker company currently operates with a team of 1000+ highly motivated individuals consistently working to offer better services to over 30 million registered users across Bangalore, Mumbai, Pune, Chennai, Hyderabad, and Delhi-NCR.

Amit Kumar Agarwal: Co-founder & CEO, NoBroker

Amit Agarwal is a banking and finance veteran, with over 15 years of experience in the banking and finance sector in management consulting and strategy. He had previously worked with leading global entities like PricewaterhouseCoopers, where he collaborated with numerous renowned Indian and foreign banks. Besides, he also garnered considerable experience of working with the top CXOs on several critical aspects, including the formulation of business strategy and the enhancement of on-ground profitability. He also displays a successful track record of guiding entry and portfolio strategy along with large-scale policy implementation and has won several industry accolades for his accomplishments.

In his role as the CEO of NoBroker.in, Amit spearheads the organization’s overall vision and direction and is responsible for defining and gilding its corporate strategies. Amit is an alumnus of the Indian Institute of Technology, Kanpur, and IIM, Ahmedabad.

Akhil Gupta: Co-founder & CTO, NoBroker

Akhil is the Co-founder and Chief Tech and Product Officer of NoBroker and has been instrumental in building the foundation for NoBroker’s spectacular growth. Akhil holds a dual degree (B.Tech & M.Tech) from the Indian Institute of Technology, Bombay.

He leads the entire tech vertical of the company and is responsible for building, scaling, and managing teams along with overseeing the business growth of NoBroker to promise a heightened customer experience. His commitment to efficiency and finding disruptive solutions to the most crucial business challenges has helped NoBroker offer some ground-breaking features like the AMP/PWA, and WhatsApp chat feature, along with the use of AI and ML to provide rent prediction and recommendations. These were some of the firsts in its league. Many of the products built at NoBroker serve as successful case studies at Google and Facebook.

Furthermore, Akhil also monitors the products of the company and is continuously engaged in making necessary amendments and improvements to them. Akhil had over a decade’s worth of experience before setting forth with NoBroker. He had previously worked with Oracle, where he had led several products in Siebel, Oracle Ebiz, and Oracle Sales Cloud, and was also responsible for filing a couple of patents for the same. He is currently associated with the world’s largest customer-to-customer real estate portal and is anticipating massive growth in the upcoming years.

Saurabh Garg: Co-founder & CBO, NoBroker

Saurabh Garg was also a student of IIT Bombay and IIM Ahmedabad and as soon as he finished his studies, he set out with Hindustan Unilever Limited as a fresh graduate. Saurabh worked for the Sales and Marketing team of HUL and left the company after 3 years. Next, he founded Four Fountains De-Stress Spa, which was his first entrepreneurial leap. Saurabh is still serving as the Co-founder and Director of the Four Fountains Spa, which he founded back in May 2007.

His experience with Hindustan Unilever and as an entrepreneur helped him gain considerable experience. This has further benefitted him in his role as the Chief Business Officer at NoBroker.in. Saurabh’s role in the revolutionary real-estate platform is mainly to pursue strategic alliances with real estate developers and corporates to bring high-quality supply and demand at a low cost, thereby expanding the revenue stream. Saurabh contributed largely to building the marketing team from scratch and empowered them to take on new challenges and try new and disruptive solutions without fearing failure. This freedom to experiment is one of the reasons why NoBroker.in has achieved over 1 million app downloads within the first 3 years with surprisingly less marketing costs. The platform also has the lowest customer acquisition costs in the competitive Indian real estate sector.

Amid mounting social media criticism from dissatisfied customers, Saurabh Garg stated that the company is actively addressing concerns and harnessing artificial intelligence to resolve issues efficiently.

NoBroker – History and Startup Story

Reminiscing the startup journey of NoBroker.in, Saurabh Garg (Co-founder & CBO of NoBroker) says:

“We established NoBroker.in when we realized that the real estate search and discovery process was fragmented, opaque, inefficient, and full of hassles for the customer. The idea first germinated after the awful experiences that we personally had with brokers while looking for a property. All the other online platforms are also marketing platforms for brokers and it is very difficult to contact the owner/seller directly. This dependence on the broker made the experience horrible for the customer. Brokers subject customers to biases, pressures, and manipulations”

He continued –

“Through NoBroker.in, we wanted to empower Indian home-seekers to find a home of their choice in a hassle free manner without paying a hefty brokerage. We did not have a prototype or a model to copy from as this was a solution built for a problem unique to Indian real estate. Brokerage has been an accepted norm for generations and therefore, penetrating the market with as disruptive a solution was not easy. The idea was simple yet bold but we knew that there was a huge scope for it. We launched the website in March 2014. Once the customer understood the unique proposition, there was no turning back for us”.

NoBroker – Products and Services

NoBroker.in addresses the gap of information asymmetry that the Indian homebuyers face in its real estate market. Its disruptive solution connects property seekers with property owners, a process that earlier used to cost as much as 1-2 months of rent or 4% of the transaction amount as brokerage. The platform also provides personalized recommendations and assists with decision-making based on real-time data.

“We are the only platform in the C2C space that directly connects tenants and buyers with owners and sellers” Saurabh mentioned.

The platform offers end-to-end one-stop solutions for property seekers including services such as rental agreements, movers & packers services, home loans, interiors, special packages for NRIs, relocation services for corporates, remote property management services, etc. It also facilitates online rent payment via credit cards, debit cards, net banking, and UPI wallets.

NoBroker also promises to be a one-stop-shop for processing the paperwork and documentation, associated with the lease agreement registration, bank franking, police verification, and society approvals.

NoBroker Home Services – Along with serving as an excellent solution for home buyers and renters, NoBroker also extends a list of useful services for homes, which are:

- Painting services

- Cleaning services

- Home sanitization services

- AC repair services

- Pest control services

- Carpentry services

- Plumbing services

NoBroker Furniture – NoBroker also offers a wide range of furniture to buy/rent and ease the process online. It helps in installing and free relocation of furniture, swapping old ones with new ones, and maintaining them.

The platform’s visitor and community management super app- NoBrokerHood is currently optimizing society living across 11,000 societies in Bangalore, Mumbai, Pune, Hyderabad, Chennai, Delhi-NCR, Kolkata, Ahmedabad, Nagpur, Jaipur, and Kochi.

CallZen

CallZen, a platform for conversational AI, has been introduced by NoBroker on October 12, 2023. The Bengaluru-based company has already ventured into other verticals, such as apartment management software, home services, and beauty, so this is an entirely new business line for NoBroker.

NoBroker – Name and Logo

“The name had to be simple, self-explanatory and direct. So, when I saw that name NoBroker.in is available I booked it immediately back in 2007” says Saurabh.

NoBroker – Business Model and Revenue Model

The business model of NoBroker acts as a digital peer-to-peer platform that allows homeowners/sellers and prospective tenants/buyers to connect directly without the involvement of a broker. It provides a subscription business model to customers who are looking to buy, sell, or rent a property.

NoBroker has 3 revenue models:

- Freemium model for tenants

- Freedom plan

- Relax plan

- MoneyBack plan

Apart from that, NoBroker also offers an array of home services like packers and movers, home cleaning, home painting, interiors, and a lot more. These are also among the notable sources of revenue for NoBroker.

NoBroker – Startup Challenges Faced

Real estate is a huge sector and a vastly unorganized one. For generations, it had relied on traditional processes, which involved a third party. The history of brokerage services can also be traced down to the earliest establishments of real estate. The team, therefore, focused on the most fundamental challenge faced by real estate customers: the service they were receiving was not commensurate with what the customer paid for it.

As there was information asymmetry, people had no option but to rely on broker services. Real estate platforms have been around for decades and have tried to solve the issue of information asymmetry. However, they couldn’t keep brokers away from the system. This led brokers to exploit the system to their benefit.

“When I – along with my Co-founders Amit and Akhil – formed NoBroker.in, we were determined to use technology to address the gaps in the property discovery creating a platform that was 100% brokerage free” Saurabh added.

Their approach differed from the other online real estate platforms in that they were essentially tying up with property brokers and getting them to list properties on their platforms. On the other hand, the team connected owners with sellers and tenants with buyers directly. Because of this approach, NoBroker’s value proposition found a favorable reception from the customers. NoBroker has the highest number of owner-listed properties.

It bootstrapped for quite a few months. Getting investors to believe in its proposition was a challenge because the team did not have an existing successful model to convince them to back it.

“But we were sure of our resolve and our solution, and the needle moved when we raised our first $20 million”, Saurabh exclaims proudly.

The pandemic ironically offered a shot in the arm as people could not use offline services and relied heavily on online platforms to search and finalize a house. One way or the other, the value-conscious Indian customer has realized and appreciated NoBroker’s unique proposition and helped it grow.

NoBroker – Funding and Investors

NoBroker has raised a total funding of $430.9 million to date. The company raised INR 400M from its Series-E funding led by Google, dated March 1, 2023. This has shot the valuation of the startup to over a billion dollars, thereby making it India’s first proptech (property tech) unicorn startup and the 38th Indian startup to be a unicorn in 2021.

It also raised $210 mn from its Series E funding led by General Atlantic and Tiger Global Management, dated November 23, 2021, where the US-based Moore Strategic Ventures also joined later on.

Paytm’s Vijay Shekhar Sharma and Anand Chandrashekharan, ex-Facebook are among the angel investors in the company. Google, Tiger Global, General Atlantic, and BEENEXT are some of the popular investors fueling the brand.

With the successful completion of the upcoming round, the company is estimated to be valued at over $1 billion. However, the startup managed to raise more than that and eventually emerged as a unicorn.

The Funding and Investors’ details of NoBroker are as follows –

| Date | Amount | Stage | Investors |

|---|---|---|---|

| March 1, 2023 | INR 400 million | Series E | |

| November 23, 2021 | INR 15.8 billion | Series E | General Atlantic, Tiger Global Management |

| April 16, 2020 | $30 million | Series D | General Atlantic |

| November 5, 2019 | $10 million | Venture Round | General Atlantic |

| October 1, 2019 | $50 million | Series D | Tiger Global |

| September 11, 2019 | $51 million | Venture Round | Tiger Global Management |

| June 5, 2019 | $51 million | Series C | General Atlantic |

| June 4, 2019 | $2.5 million | Debt Financing | Trifecta Capital Advisors |

| December 19, 2016 | $7 million | Series B | KTB Ventures |

| February 24, 2016 | $10 million | Series B | BEENEXT |

| February 23, 2015 | $3 million | Series A | Fulcrum Ventures India, SAIF Partners |

| March 1, 2014 | – | Angel Round | – |

NoBroker – Shareholding

NoBroker’s shareholding pattern as of July 2024, sourced from Tracxn:

| NoBroker Shareholders | Percentage |

|---|---|

| Amit Kumar Agarwal | 6.8% |

| Akhil Gupta | 6.8% |

| Saurabh Garg | 5.3% |

| General Atlantic | 31.1% |

| Tiger Global Management | 13.9% |

| Elevation Capital | 16.3% |

| Moore Ventures | 4.6% |

| Beenext | 4.4% |

| Beenos | 1.4% |

| DG Incubation | 1.3% |

| VD Investments | 0.9% |

| KTB Ventures | 1.6% |

| Rocketship | 0.5% |

| Qualgro | 0.4% |

| Youngmonk Trust | – |

| Fulcrum PE | – |

| DST Global | – |

| Trifecta Capital | – |

| 0.5% | |

| Angel | 1.2% |

| ESOP Pool | 3.0% |

| Total | 100.0% |

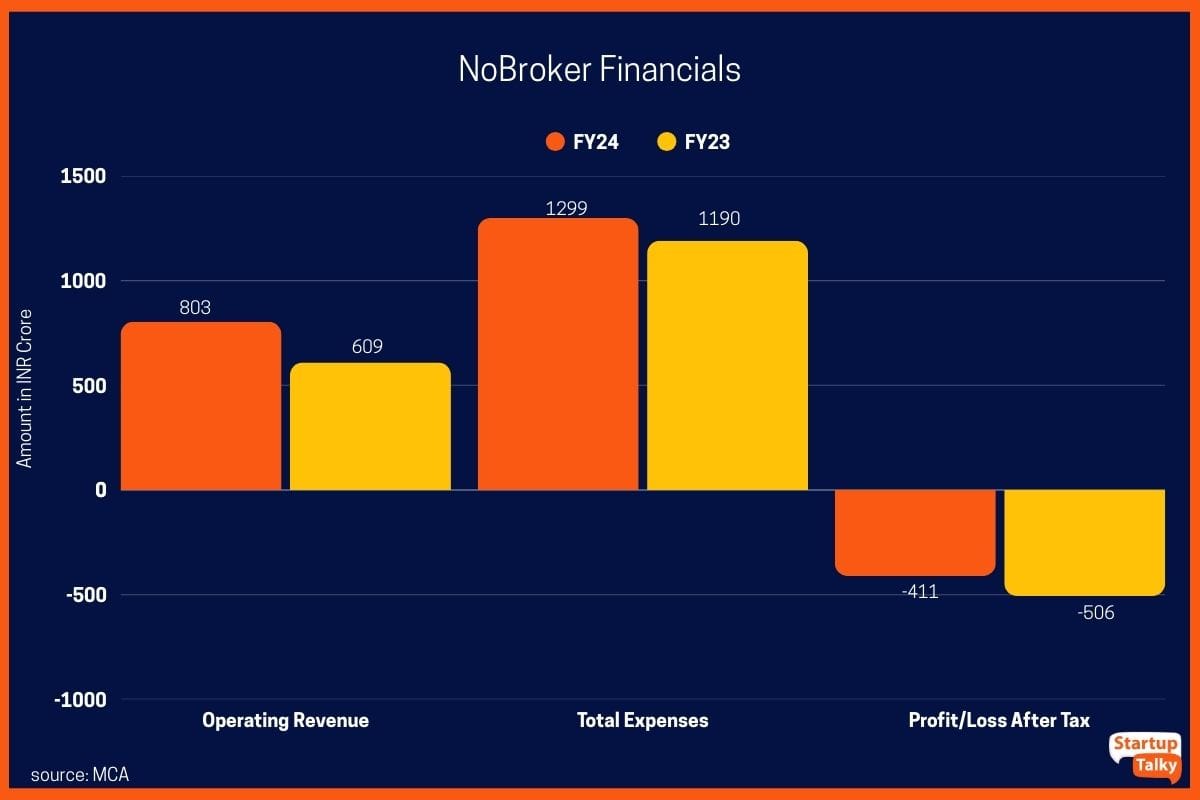

NoBroker – Financials

NoBroker has shown significant revenue growth over the years, but expenses have also increased, leading to continued losses. Below is a detailed financial breakdown from FY24 to FY20.

| Particulars | FY24 | FY23 |

|---|---|---|

| Revenue | INR 803 crore | INR 609 crore |

| Expenses | INR 1299 crore | INR 1190 crore |

| Profit/Loss | INR -411 crore | INR -506 crore |

NoBroker EBITDA

| NoBroker Financials | FY24 | FY23 |

|---|---|---|

| EBITDA Margin | -66.55% | -42.5% |

| Expense/INR of op Revenue | INR 1.62 | INR 1.95 |

| ROCE | -37.12% | -34.12% |

NoBroker – ESOP

NoBroker announced the completion of its employee buyback worth INR 32.2 crore in a report dated March 15, 2022. The buyback program of the proptech unicorn promises to allow 95 former and current employees of the company to liquidate their stock options, which make up for 57% of total employees with ESOPs.

takes a lot of effort. The construction industry especially is complex and

dynamic due to a lot of stakeholders involved. Moreover, the industry is marked

by a trust deficit making the process of engaging in the construction…

NoBroker – Acquisitions

NoBrokerHood acquired Society Connect on February 11, 2020, to integrate the financial module with its services on one single platform and make society’s living easy and hassle-free.

NoBroker – Competitors

“As mentioned above, what differentiates us from other online real estate platforms is that ours is the only platform that is 100% brokerage free. We are not just enabling property discovery. We are a transaction platform and provide end to end solution. In that sense, we don’t have competition” says Saurabh.

NoBroker – Awards and Recognition

NoBroker.in is a market leader in customer-to-customer real estate transactions and leading third-party endorsements have recognized the same,

- NoBroker.in was part of the elite ‘Champions of Change’ with the Prime Minister of India organized by the NITI Aayog.

- NoBroker.in has been recognized as the “Coolest Startup” by the India Today Group.

- The company was distinguished as the most promising startup for 2017, a recognition that it received from the Govt. of Gujarat.

- NoBroker was also recognized by Forbes Japan as one of the 20 hot startups in India.

- NoBroker was listed as one of the top 100 startups (36 on readers rating) with gravity-defying momentum to look up to in 2017 by YourStory.

- NoBroker bagged the Digital Marketer of the Year award by IAMAI in 2018.

- Most recently, the company received an award at the Emerging Awards by Tracxn where it was declared as one of the topmost companies in Real Estate Tech from across the globe.

- NoBroker won for Disintermediation of Real Estate Transactions in the category of Innovation in Real Estate at the 14th AGBA in April 2024.

We’re thrilled to announce that #NoBroker has been #awarded the Emerging Awards by Tracxn and has been recognized as one of the topmost companies in Real Estate Tech from across the globe. @AmitKumarA @Sgarg2408 @akhil10s #realestate #awards #proudmoment pic.twitter.com/fctwPCt1T1

— NoBroker.com (@nobrokercom) March 17, 2020

h

NoBroker – Future Plans

NoBroker plans to expand its presence significantly in the Indian real estate market. They aim to reach 50 cities within the next three years, moving from their current base of 6 cities. This expansion is driven by strong demand and a focus on improving services through technology. NoBroker is actively pursuing AI-driven B2B services to increase profitability and eventually consider an IPO.

FAQs

Who are the Founders of NoBroker?

NoBroker was founded by Amit Kumar Agarwal, Akhil Gupta, and Saurabh Garg.

What is NoBroker?

NoBroker is a Bangalore-based real estate search portal, which helps connect flat owners with tenants/buyers directly and makes the buying-selling of real estate simpler. NoBroker removes the need for brokers in real estate-related dealings.

When was NoBroker founded?

NoBroker was founded in 2014.

What is NoBroker net worth?

NoBroker net worth as of March 2023 is $954 million.

How does NoBroker make money? What is NoBroker revenue model?

Around 70% of NoBroker’s revenue comes from the subscription plans it offers on various packages. Advertisements from furniture start-ups also contribute significantly as NoBroker claims over 2.5 million users visit its website per month. NoBroker also earns revenue by offering services, such as connecting tenants with movers and packers, drafting rental agreements, and extending a wide range of home services.

What is NoBroker business model?

NoBroker follows a freemium model, offering broker-free real estate transactions. It earns revenue through subscription plans, advertising, home services, and financial products like rent payments and home loans. Its AI-driven platform connects buyers, sellers, tenants, and landlords directly, eliminating middlemen.

How NoBroker works?

NoBroker is a broker-free real estate platform that connects property owners with buyers or tenants directly. It uses AI-powered matching to suggest suitable listings and allows users to communicate without middlemen. The platform also offers value-added services like home loans, rent payments, legal help, and movers. It follows a freemium model, earning from subscriptions, ads, and services, while keeping basic property listings free.