Vijay Vittal Mallya, popularly known as Vijay Mallya, is an Indian businessman and an ex-Member of Parliament (Rajya Sabha). He was born in Kolkata, on 18 December 1955. He can be commonly recalled as the former owner of the IPL cricket team of Royal Challengers Bangalore and the former owner of Kingfisher Airlines.

Furthermore, he is also the ex-chairman of the biggest spirits manufacturing company in India, United Spirits. Mallya still retains his post as the chairman of United Breweries Group.

He is also the face of one of the biggest financial scandals in India and is a subject of extradition efforts by the Indian Government. Let’s understand the complete story of Vijay Mallya.

Vijay Mallya – Latest News

Vijay Mallya – Family

Vijay Mallya – Education

Vijay Mallya History

Vijay Mallya – When and How Did the Bubble Burst?

How Banks Gave the Loan to Kingfisher?

Vijay Mallya Biography

| Name | Vijay Mallya |

|---|---|

| Born | 18 December 1955 |

| Birthplace | Bantwal, Mangalore, Karnataka, India |

| Nationality | Indian |

| Education | La Martinière Calcutta, St. Xavier’s College |

| Position | Founder and Former owner of Kingfisher Airlines, Ex-member of Rajya Sabha |

| Father | Vittal Mallya |

| Mother | Lalitha Ramaiah |

| Spouse | Samira Tyabjee Mallya (1986–1987), Rekha Mallya (m. 1993) |

Vijay Mallya – Latest News

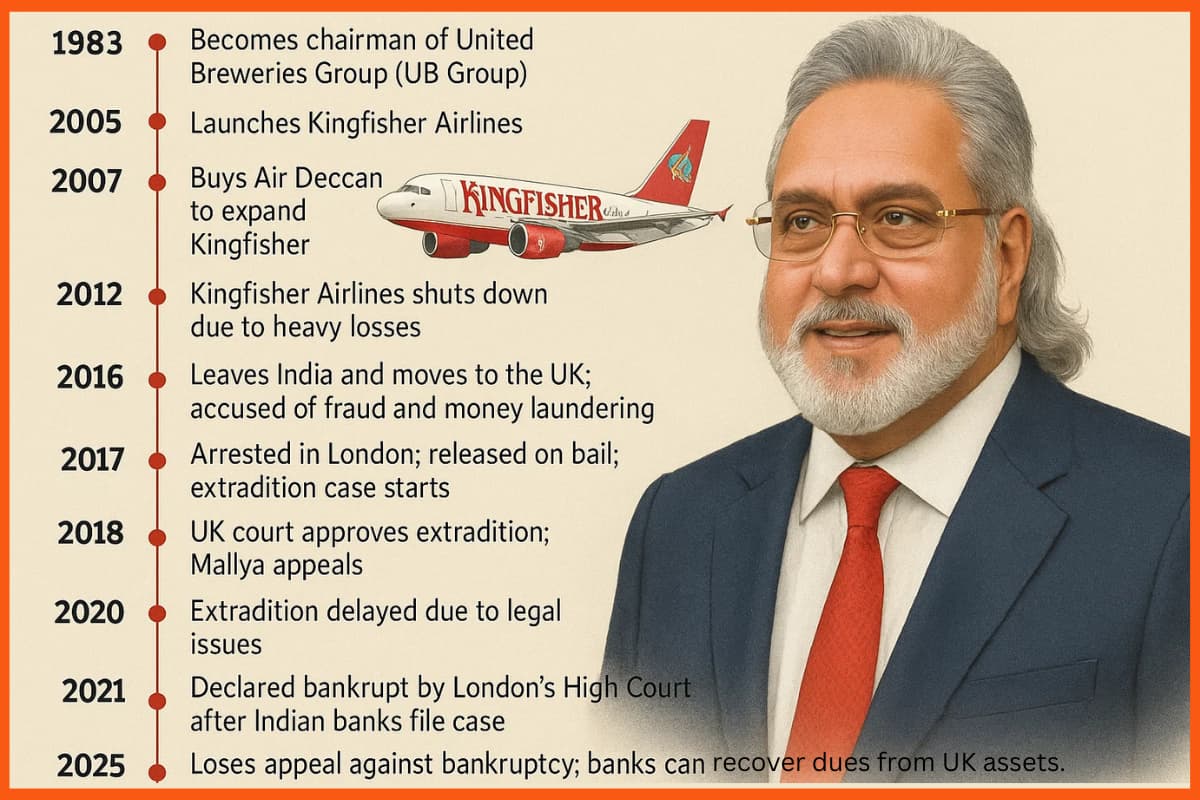

Vijay Mallya lost an appeal against bankruptcy in April 2025 in London’s High Court. The court had earlier declared him bankrupt because he owes more than 1 billion pounds (about $1.28 billion) to banks, including the State Bank of India.

Mallya, who now lives in the UK, has been fighting a long legal battle with the banks and the Indian government since his airline, Kingfisher Airlines, shut down in 2012.

Vijay Mallya – Family

Vijay Mallya was born to an affluent business family as a son of the former chairman of the United Breweries Group, Vittal Mallya and Lalitha Ramaiah. Soon after his father’s death, Mallya succeeded his father to become the chairman of the United Breweries Group at the early age of 28.

Vijay Mallya, now 69, married Sameera Sharma, an air hostess of Air India, in 1986, and their first son, Siddharth Mallya was born on May 7, 1987. However, his first marriage didn’t last long, and soon after they were divorced, Mallya married Rekha Mallya, who is his present wife, in June 1993. He adopted Rekha’s daughter, Leila during the time of his marriage and also has two daughters from his present wife, Leanne, and Tanya.

Vijay Mallya – Education

Mallya spent his school and college days in Kolkata. He was a student of La Martinière Calcutta, where he was appointed House Captain of Hastings house in the final year, following which, he went on to be admitted to St. Xavier’s College, Kolkata, where he graduated with an Honours in the Bachelor of Commerce degree in 1976.

He interned in his family’s businesses during his college days. Post-graduation, Mallya flew to the United States and joined as an intern at the American part of Hoechst AG.

Senior Exec of Oracle India and his wife for duping the clients through an

interior design company. In this article let’s look at the exact story of Meenu

Agarwal who is the wife of the head of Oracle and how she cheated her…

Vijay Mallya History

Though Vijay Mallya was born to humble parents, he never decided to settle for a quiet life like his father. He had soaring ambitions and a desire to exceed them. His journey started with United Breweries, which was already an MNC business conglomerate, comprising over 60 companies.

As soon as he joined the business, he worked hard to grow the business and managed to increase the overall turnover by around 64%, reaching US $ 11 billion in 1998-1999. He was already living a lifestyle of that of kings, being dubbed as the “King of Good Times” that eventually became the tagline of Kingfisher.

In the year 2005, Mallya launched his new airline company, Kingfisher Airlines to further diversify his business, which later on became the cause of his downfall.

Vijay Mallya – When and How Did the Bubble Burst?

Within a relatively short span of time, Vijay Mallya got what he aimed for but continued to dream bigger. Kingfisher Airlines was launched at the peak of his career when he was already living a lifestyle that most people cannot even dream of but after a brief spell of success and with skying debts, it was finally shut down in 2012.

Vijay Mallya’s success didn’t seem to last long not because of his ambitious dreams but due to his dishonest ways to achieve the same.

Kingfisher Airlines was a business built on a platform of losses, and as a result of which it has echoed losses ever since it was launched. Intending to overcome the financial burdens, which started to weigh heavy by then, Mallya decided to fly overseas. However, according to the rules, an airline company needs to run its local operations successfully before it can look forward to flying internationally.

Here, Mallya planned to rush things by acquiring another low-cost airline company, Air Deccan by paying over the odds but this viciously backfired Mallya, catalyzed by the rising loans and catapulted by the economic downturn of 2008 and 2009.

At the end of 2009, Kingfisher Airlines was already due for a massive sum of Rs 7,000 crores, a major part of which was siphoned by Mallya as loans from 17 Indian banks allegedly to shell companies in Britain, Switzerland, and Ireland. Furthermore, he also left staff underpaid and even unpaid when he couldn’t meet the due amount. Kingfisher Airlines finally crashed in 2012 with the aircraft seized.

How Banks Gave the Loan to Kingfisher?

Banks give loans based on the collateral of the same amount given in the loan. But these banks gave loans to Vijay Mallya on items like office stationery, boarding pass printers, folding chairs, computer screens, and wood tables as collateral. The bank’s willingness to provide loans based on current assets as capital created suspicions on the bank officials who passed their loans.

Also, the loans given by SBI were on the trademarks and Goodwill of Kingfisher airlines kept as collateral. SBI chairman OP Bhatt was involved in providing such fraud loans to him.

Banks lost their money because of the officials who granted and processed the loans, without checking all the collaterals and taking securities that were to be followed as per rules and regulations. They came under the pressure of their seniors who were bribed by Vijay Mallya. Also, he took the help of his political connections to process such big loans.

The loans taken on the name of Kingfisher Airlines and UB group weren’t used for its actual cause. Banks never knew that the loans taken by Vijay Mallya were laundered overseas to various tax havens. All this was done with the help of shell companies.

Mallya would have the bank loans moved to these shell firms, which were set up with sham directors for this reason. These companies did not have any source of income and weren’t active at all. The loans taken were only to further his agenda. The directors placed in the shell companies would act according to the command of Mallya. The money was transferred to seven different countries including the United Kingdom, the United States, Ireland, Switzerland, France, and South Africa.

Furthermore, Vijay Mallya diverted the money he got from the loans to fund his IPL team Royal Challengers Bangalore. He bought the most expensive IPL team RCB at INR 476 Crore with the money of public sector banks. Around 77 payments were done by the SBI bank account of Kingfisher Airlines to the IPL Vendors. He had spent massive amounts lavishly over cricketers from the borrowed money of the banks.

At first, this case seemed similar to those in businessmen getting unlucky. But a closer look reveals this is was a case of smart money laundering. As our Indian banking sector is still developing, there are many loopholes in the system. People like Vijay Mallya took the advantage of such loopholes and made their unhealthy marks on the economic system.

Here is a list of how much loan was taken from each bank:

| Rs 1,600 crore | State Bank of India |

|---|---|

| Rs 800 crore | PNB |

| Rs 800 crore | IDBI Bank |

| Rs 650 crore | Bank of India |

| Rs 550 crore | Bank of Baroda |

| Rs 430 crore | United Bank of India |

| Rs 410 crore | Central Bank of India |

| Rs 320 crore | UCO Bank |

| Rs 310 crore | Corporation Bank |

| Rs 140 crore | Indian Overseas Bank |

| Rs 90 crore | Federal Bank |

| Rs 60 crore | Punjab & Sind Bank |

| Rs 50 crore | Axis Bank |

| Rs 600 crore | 3 other Banks |

| Rs 150 crore | State Bank of Mysore |

The government of India despite its repeated attempts for extradition, is yet to arrest him from the UK, where he has fled post the issuance of the warrants against him.

“The evil that men do lives after them; the good is often interred with their bones.”

The Fugitive Economic Offenders Act was rolled out by the Indian government in 2018 and by this act, Vijay Mallya was labelled as the first fugitive economic offender of the nation. He is now remembered by the same.

for the charges of money laundering, criminal conspiracy, corruption, cheating and dishonesty. He is also accused in the PNB scam case. He is an Indian born

citizen who later took citizenship in Antigua and Barbuda in 20…

FAQ

How much bank money does Vijay Mallya owe?

Vijay Mallya fled India and moved to London in March 2016 while he owed Indian banks more than Rs 9,000 crore.

When did Mallya leave India?

He left India in March 2016 under the pretext of personal reasons and defrauded at least 17 Indian banks.

What is the full name of Vijay Mallya?

The full name of Vijay Mallya is Vijay Vittal Mallya.

What is the birthplace of Vijay Mallya ?

Vijay Mallya was born on 18 December 1955 in Kolkata.

How many children does Vijay Mallya have?

Vijay Mallya has 4 children, Siddharth Mallya, Laila Mallya, Tanya Mallya, Leanna Mallya.

Where is Vijay Mallya hometown?

The home state of Vijay Mallya is Karnataka.

What is Vijay Mallya education?

Vijay Mallya studied at La Martiniere School in Kolkata and later graduated with a degree in commerce from St. Xavier’s College, Kolkata. He was known for being a bright student and also actively participated in extracurricular activities during his college years.

Is Vijay Mallya still the owner of Kingfisher?

No, Vijay Mallya is no longer the owner of Kingfisher Airlines. The airline, which he founded in 2005, ceased operations in 2012 due to severe financial difficulties and accumulated debts. By 2013, Kingfisher Airlines had lost its license to operate, and Mallya had exited the airline business.

What is Kingfisher owner name?

Vijay Mallya was the founder and former owner of both Kingfisher Airlines and Kingfisher beer, he no longer holds ownership or control over either entity.

What is Vijay Mallya net worth?

In 2013, Forbes estimated Vijay Mallya’s net worth at approximately $750 million. By 2022, some reports suggested his net worth had rebounded to around $1.2 billion. As of March 2025, corporate filings indicate that Mallya holds public shares in three companies, with a combined value exceeding INR 4,683 crore (approximately $560 million).