Entrepreneur Steve Blank created one of the most well-known definitions of a startup. According to him, “a startup is a temporary organization searching for a repeatable and scalable business.” Such businesses operate with limited resources trying to fulfill a market gap with products that have an uncertain demand. Startup businesses rely on external funding for growth and expansion. These businesses operate at three different levels –

- Operational Level – launching and testing a new product within a limited market

- Tactical Level – fulfilling commitments made to investors and also raising new funds

- Strategic Level – finding a suitable and scalable business model

Types of Startups

Features of Startups

Investors in Startup Businesses

Conclusion

Types of Startups

There are a few different types of startup businesses operating in different niches and market spaces.

Scalable Startups

Essentially, these are businesses that operate within the technology field with a high potential for growth and expansion that can span a global reach.

Small Businesses

With little outside and market pressure to grow and expand, such businesses operate at their own pace and have access to very few resources. These businesses are self-financed by an independent team and are also called self-starters.

Lifestyle Startups

Needless to mention, these businesses work in the lifestyle space, be they products or services. Such businesses are often created out of passion

Buyable Startups

The name itself categorizes such businesses as being created with the eventual aim to sell to bigger players within the industry

Large Company Startups

These startup businesses are sprung from large conglomerates and use limitless resources and technology available to them

Social Startups

Such businesses are more focused on the social aspect of business rather than on the bottom line

Features of Startups

As different as startup businesses can be, playing in different markets and niches, they share a few common features –

Innovation

Most startup businesses work with new products that answer an existing market need.

Technology

Startup businesses are usually looking for a competitive advantage. They use AI and other technological solutions to build innovative products or services.

Scalability

These businesses grow into scalable and repeatable business models.

Expansion

Startup businesses are expected to have quick and high growth and expansion.

Higher Risk

New businesses operate in uncertainty within all spheres and they are risk-takers. However, it is this risk-taking that eventually leads them to success.

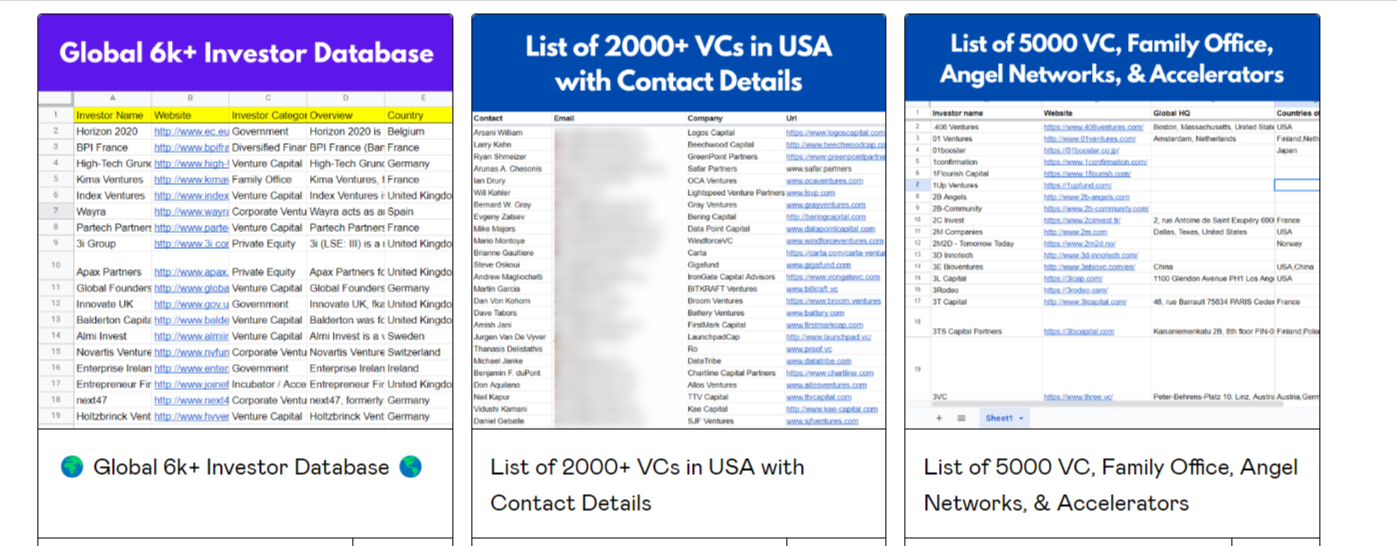

Investors in Startup Businesses

Investors that invest in startup businesses have one goal. That is to earn a strong profit. Whether investment happens through an angel investor, a venture capital firm, or equity crowdfunding platforms the final aim is for the business to succeed and earn a profit. This is the main reason that investors conduct a thorough check of the startup business before investing. There are a few important criteria that startup businesses need to meet for receiving funds through investments.

The Startup Team

What makes a business operational is the team that works around the business idea. Hence, it becomes important to evaluate if the team has a competitive edge within the industry. Also, it is essential to validate the suitability of their skill set for the startup operation. The primary question is also to assess if the startup is built around a genuine problem that they have encountered.

Target Audience Identification

As with any business idea, it is important to clearly articulate the target market and the target customers. The startup must have clarity on the target audience who will become the early adopters of their products. Also, the founders of the business must address the worst-case scenario and the ways to handle it.

Is the Business Offering a Genuine Solution

This is probably the most important question for the startup business. Is there a genuine need for the product? How did the idea take shape? Will the business idea hold relevancy in the long term? Also, what is the benefit of the product that is offered in terms of quality, cost, convenience, and efficiency?

Competitive Advantage in the Market

Startup businesses must be constantly aware of their direct and indirect competitors within the market that they are operating. They must also question the position of the startup business in the future in comparison to their competition.

Building an Effective Business Strategy

A startup business must have an effective business strategy that details the ways in which it will acquire and build its customer base. This means that the business must strategize and create marketing initiatives that ensure a deep market reach. Secondly, the business must plan an effective strategy for future cost reduction that affects the company’s bottom line.

Conclusion

There are many startup businesses that build enormously successful enterprises and there is an almost equal number of startups that fail and fold within a short span of time. It remains upon the investor to conduct a thorough check to ascertain the health and future prospects of a startup business to ensure that the business grows to earn profits for itself and its investors.

FAQs

What are the levels at which startup businesses operate?

The startup businesses operate at three different levels –

- Operational Level

- Tactical Level

- Strategic Level

What are the various types of startups?

There are a few different types of startup businesses operating in different niches and market spaces.

- Scalable Startups

- Small Businesses

- Lifestyle Startups

- Buyable Startups

- Large Company Startups

- Social Startups

What do investors look for before investing in a startup business?

There are a few important criteria that startup businesses need to meet for receiving funds through investments.

- The Startup Team

- The Target Audience Identification

- Is the Business Offering a Genuine Solution

- Competitive Advantage in the Market

- Building an Effective Business Strategy